Middle East And Africa Refractories Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

1.99 Billion

USD

2.60 Billion

2025

2033

USD

1.99 Billion

USD

2.60 Billion

2025

2033

| 2026 –2033 | |

| USD 1.99 Billion | |

| USD 2.60 Billion | |

|

|

|

|

Segmentação do mercado de refratários no Oriente Médio e África, por alcalinidade (refratários ácidos e neutros e carbono), tipo de forma (tijolos, monolíticos e outros), tipo de produto (argila e não argila), temperatura de fusão (refratário normal (1580-1780 °C), refratário de alta resistência (1780-2000 °C) e super refratário (2000 °C)), aplicação (ferro e aço, cimento e cal, energia e produtos químicos, vidro, metais não ferrosos e outros), tecnologia (isostáticos e válvulas deslizantes) - Tendências e previsões do setor até 2033.

Qual é o tamanho e a taxa de crescimento do mercado de refratários no Oriente Médio e na África?

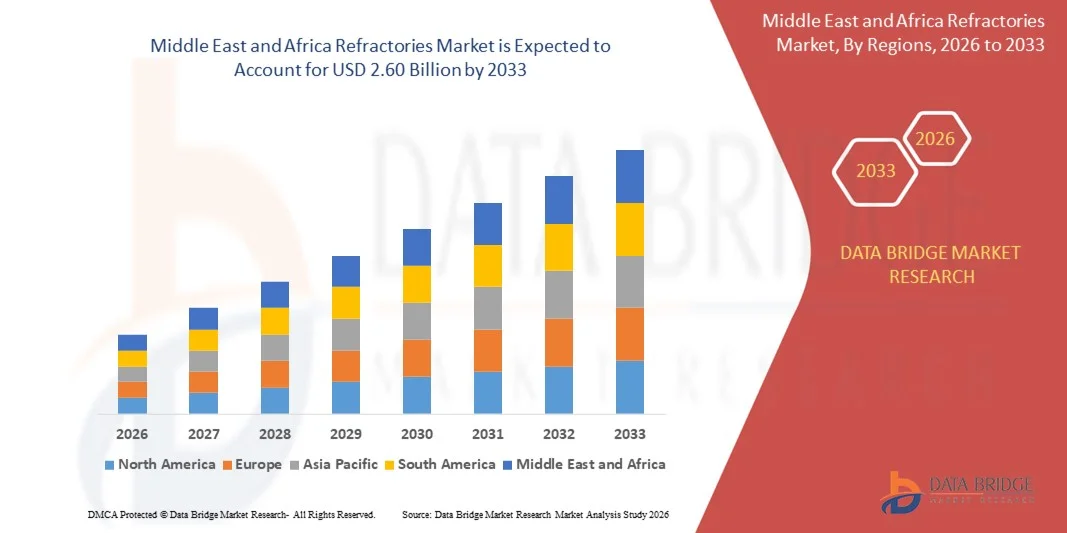

- O mercado de refratários no Oriente Médio e na África foi avaliado em US$ 1,99 bilhão em 2025 e deverá atingir US$ 2,60 bilhões até 2033 , com uma taxa de crescimento anual composta (CAGR) de 3,60% durante o período de previsão.

- Os materiais refratários estão disponíveis em todos os formatos e tamanhos. Os tijolos são uma das formas tradicionais de refratários e representaram a maior parte da produção no passado, mas atualmente os refratários monolíticos são amplamente utilizados devido ao baixo custo, durabilidade e facilidade de instalação. O mercado de refratários tem ampla aplicação em indústrias como a de ferro e aço, cimento e cerâmica, metais não ferrosos e outras.

Quais são os principais pontos a serem considerados no mercado de refratários?

- A crescente importância da indústria de minerais não metálicos, o aumento da infraestrutura em países emergentes e a demanda por refratários da indústria siderúrgica são fatores que impulsionarão o mercado de refratários.

- Algumas empresas estão expandindo suas capacidades de produção em diferentes regiões para ampliar seu mercado para esses produtos. No entanto, a corrosibilidade dos metais ferrosos em condições ambientais está restringindo o crescimento do mercado.

- A Arábia Saudita dominou o mercado de refratários com uma participação estimada de 36,9% da receita em 2025, impulsionada pela forte demanda da produção de aço, fabricação de cimento, processamento de vidro e indústrias de alto consumo energético em toda a região.

- Prevê-se que os Emirados Árabes Unidos registem a taxa de crescimento anual composta (CAGR) mais rápida, de 7,36%, entre 2026 e 2033, impulsionada pelo rápido desenvolvimento industrial, pelo crescimento do processamento de alumínio e aço e pelos investimentos em energia, construção e manufatura avançada. A crescente adoção de refratários monolíticos e de alto desempenho contribui para a aceleração da expansão do mercado.

- O segmento de refratários ácidos e neutros dominou o mercado com uma participação estimada em 58,6% em 2025, impulsionado por seu uso extensivo nas indústrias de aço, vidro, cimento e metais não ferrosos.

Escopo do relatório e segmentação do mercado de refratários

|

Atributos |

Principais informações de mercado sobre materiais refratários |

|

Segmentos abrangidos |

|

|

Países abrangidos |

Oriente Médio e África

|

|

Principais participantes do mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor agregado |

Além das informações sobre cenários de mercado, como valor de mercado, taxa de crescimento, segmentação, cobertura geográfica e principais participantes, os relatórios de mercado elaborados pela Data Bridge Market Research também incluem análises aprofundadas de especialistas, análises de preços, análises de participação de marcas, pesquisas com consumidores, análises demográficas, análises da cadeia de suprimentos, análises da cadeia de valor, visão geral de matérias-primas/insumos, critérios de seleção de fornecedores, análise PESTLE, análise de Porter e estrutura regulatória. |

Qual é a principal tendência no mercado de refratários?

Crescente tendência em direção a soluções refratárias de alto desempenho, energeticamente eficientes e específicas para cada aplicação.

- O mercado de refratários está testemunhando uma forte mudança em direção a materiais refratários de alta pureza, baixo teor de impurezas e específicos para cada aplicação, visando atender às crescentes exigências de desempenho e durabilidade em ambientes industriais de temperaturas extremas.

- Os fabricantes estão desenvolvendo cada vez mais refratários energeticamente eficientes, leves e com maior vida útil, incluindo soluções refratárias de baixo carbono, à base de alumina, à base de magnésia e sem óxidos.

- A crescente ênfase na eficiência térmica, na redução do tempo de inatividade e no aumento da vida útil dos fornos está impulsionando a adoção dessa tecnologia nos setores de aço, cimento, vidro e metais não ferrosos.

- Por exemplo, empresas como RHI Magnesita, Vesuvius, Imerys, Morgan Advanced Materials e Saint-Gobain estão investindo em formulações refratárias avançadas, refratários monolíticos e soluções de revestimento otimizadas digitalmente.

- A crescente demanda por refratários projetados sob medida para fornos, estufas e reatores específicos está acelerando a inovação.

- À medida que os processos industriais se tornam mais intensivos em energia e focados na sustentabilidade, os materiais refratários continuam sendo essenciais para a eficiência operacional e a proteção de ativos.

Quais são os principais fatores que impulsionam o mercado de refratários?

- A crescente demanda por materiais de revestimento resistentes a altas temperaturas nas indústrias de aço, cimento, vidro, petroquímica e geração de energia impulsiona o desenvolvimento de materiais para revestimento.

- Por exemplo, durante o período de 2024–2025, empresas líderes como a RHI Magnesita, a Vesuvius e a Saint-Gobain expandiram suas capacidades de produção e introduziram soluções refratárias de baixo carbono para apoiar a descarbonização industrial.

- O crescimento no desenvolvimento de infraestrutura, urbanização e produção industrial na região Ásia-Pacífico, Oriente Médio e América Latina está impulsionando o consumo de materiais refratários.

- Os avanços em matérias-primas refratárias, sistemas de ligação e tecnologias monolíticas melhoraram a resistência ao choque térmico e a vida útil.

- O aumento da demanda por peças de reposição devido ao desgaste, corrosão e condições operacionais extremas sustenta a demanda recorrente do mercado.

- Impulsionado pela expansão industrial e pela modernização de fornos e estufas, o mercado de refratários deverá apresentar um crescimento estável a longo prazo.

Que fator está desafiando o crescimento do mercado de refratários?

- A volatilidade nos preços das matérias-primas, particularmente magnésia, bauxita e alumina, aumenta os custos de produção e impacta as margens de lucro.

- Por exemplo, durante o período de 2024–2025, as flutuações nos preços da energia, as restrições à mineração e as interrupções logísticas afetaram as cadeias de suprimentos de materiais refratários em todo o mundo.

- Regulamentações ambientais rigorosas e normas de emissão de carbono aumentam os custos de conformidade para os fabricantes.

- A escassez de mão de obra qualificada e a alta complexidade de instalação podem aumentar os custos operacionais para os usuários finais.

- A concorrência de fabricantes regionais de baixo custo, especialmente em mercados emergentes, cria pressão sobre os preços.

- Para enfrentar esses desafios, as empresas estão se concentrando em fornecimento sustentável, reciclagem de materiais refratários, monitoramento digital e soluções refratárias de valor agregado para aumentar a competitividade.

Como o mercado de refratários é segmentado?

O mercado é segmentado com base na alcalinidade, tipo de produto, tipo de forma, temperatura de fusão, aplicação e tecnologia .

- Por alcalinidade

Com base na alcalinidade, o mercado de refratários é segmentado em Refratários Ácidos e Neutros e Refratários de Carbono. O segmento de Refratários Ácidos e Neutros dominou o mercado com uma participação estimada em 58,6% em 2025, impulsionado pelo seu uso extensivo nas indústrias de aço, vidro, cimento e metais não ferrosos. Esses refratários, incluindo materiais à base de sílica, alumina e argila refratária, oferecem alta estabilidade térmica, resistência à corrosão e compatibilidade com uma ampla gama de escórias industriais. Sua relação custo-benefício e versatilidade os tornam a escolha preferencial para fornos, estufas e reatores que operam em condições neutras ou ácidas.

O segmento de refratários de carbono deverá apresentar o maior crescimento anual composto (CAGR) entre 2026 e 2033, impulsionado pela crescente demanda em altos-fornos, fornos elétricos a arco e aplicações de siderurgia em altas temperaturas. A resistência superior ao choque térmico, a baixa molhabilidade e a maior vida útil estão acelerando a adoção de refratários à base de carbono em processos metalúrgicos avançados.

- Por tipo de formulário

Com base no tipo de forma, o mercado de refratários é segmentado em tijolos, monolíticos e outros. O segmento de tijolos dominou o mercado com uma participação de 54,2% em 2025, devido às suas formas padronizadas, alta resistência mecânica e uso consolidado em fornos e estufas industriais. Os tijolos refratários são amplamente utilizados em panelas de aço, fornos de cimento, fornos de vidro e usinas de energia devido à sua durabilidade e facilidade de substituição durante os ciclos de manutenção.

Prevê-se que o segmento de materiais monolíticos apresente o crescimento anual composto mais rápido entre 2026 e 2033, impulsionado pela crescente preferência por concretos refratários moldáveis, misturas para projeção e massas de apiloamento. Os refratários monolíticos oferecem instalação mais rápida, menor tempo de inatividade, revestimentos sem juntas e melhor eficiência térmica. A crescente adoção em operações contínuas e geometrias complexas de fornos está acelerando a transição para soluções monolíticas em diversos setores.

- Por tipo de produto

Com base no tipo de produto, o mercado de refratários é segmentado em refratários de argila e refratários sem argila. O segmento de refratários sem argila dominou o mercado com uma participação estimada em 61,7% em 2025, impulsionado pela crescente demanda por materiais de alto desempenho, como alumina, magnésia, zircônia e refratários à base de carbono. Esses materiais oferecem resistência superior a altas temperaturas, corrosão química e tensões mecânicas, tornando-os essenciais para a siderurgia moderna e aplicações industriais de ponta.

O segmento de refratários de argila deverá apresentar o maior crescimento anual composto (CAGR) entre 2026 e 2033, impulsionado por vantagens de custo, fácil disponibilidade e uso crescente em fornos industriais de pequeno e médio porte. Os refratários de argila refratária continuam a encontrar aplicações em fornos tradicionais, caldeiras e revestimentos de apoio, especialmente em economias emergentes com bases de manufatura em expansão.

- Por temperatura de fusão

Com base na temperatura de fusão, o mercado é segmentado em Refratários Normais (1580–1780 °C), Refratários de Alta Resistência (1780–2000 °C) e Super Refratários (>2000 °C). O segmento de Refratários de Alta Resistência dominou o mercado com uma participação de 46,9% em 2025, impulsionado por seu uso generalizado em fornos de aço, fornos de cimento e unidades de fusão de vidro que exigem resistência sustentada a altas temperaturas. Esses refratários oferecem um equilíbrio entre desempenho e custo, tornando-os adequados para a maioria das operações industriais pesadas.

Prevê-se que o segmento de superrefratários apresente o crescimento mais rápido em termos de CAGR (Taxa de Crescimento Anual Composta) entre 2026 e 2033, impulsionado pela crescente demanda de processos metalúrgicos avançados, produção de materiais aeroespaciais e fabricação de produtos químicos de alta pureza. O foco crescente em aplicações de temperaturas extremas e em tecnologias de fornos de última geração está impulsionando a adoção de materiais refratários para temperaturas ultra-altas.

- Por meio de aplicação

Com base na aplicação, o mercado de refratários é segmentado em Ferro e Aço, Cimento e Cal, Energia e Produtos Químicos, Vidro, Metais Não Ferrosos e Outros. O segmento de Ferro e Aço dominou o mercado com uma participação estimada em 38,4% em 2025, devido ao uso extensivo de refratários em altos-fornos, fornos de oxigênio básico, fornos elétricos a arco e panelas de fundição. A produção contínua de aço e a necessidade frequente de substituição do revestimento garantem uma demanda sustentada.

O segmento de Energia e Produtos Químicos deverá apresentar o maior crescimento anual composto (CAGR) entre 2026 e 2033, impulsionado pela expansão de plantas petroquímicas, refinarias, instalações de conversão de resíduos em energia e unidades de produção de hidrogênio. A alta resistência a ciclos térmicos e ataques químicos está acelerando a adoção de materiais refratários em ambientes de processamento com alto consumo de energia.

- Por meio da tecnologia

Com base na tecnologia, o mercado de refratários é segmentado em Isostáticos e Refratores com Comporta Deslizante. O segmento de Isostáticos dominou o mercado com uma participação de 55,1% em 2025, impulsionado por sua capacidade de produzir componentes refratários de alta densidade, uniformidade e alta resistência. A prensagem isostática garante integridade superior do material, tornando-a ideal para revestimentos críticos de fornos e aplicações de alta tensão.

Prevê-se que o segmento de comportas deslizantes apresente o crescimento mais rápido em termos de taxa composta de crescimento anual (CAGR) entre 2026 e 2033, impulsionado pela crescente demanda por controle preciso do fluxo de metal fundido em operações de siderurgia e lingotamento contínuo. A melhoria da segurança, da eficiência e da automação de processos está acelerando a adoção de sistemas refratários avançados para comportas deslizantes em instalações metalúrgicas modernas.

Qual região detém a maior participação no mercado de refratários?

- A Arábia Saudita dominou o mercado de refratários com uma participação estimada de 36,9% da receita em 2025, impulsionada pela forte demanda da produção de aço, fabricação de cimento, processamento de vidro e indústrias de alto consumo energético em toda a região.

- Os principais fabricantes de refratários da Arábia Saudita estão investindo em materiais avançados, soluções refratárias de alta pureza e instalações de produção locais, fortalecendo as cadeias de suprimentos regionais e reduzindo a dependência de importações.

- Programas de diversificação industrial liderados pelo governo, investimentos em infraestrutura e expansão do setor energético em importantes economias do Oriente Médio e África continuam a consolidar a posição dominante do país no mercado global de refratários.

Análise do Mercado de Refratários nos Emirados Árabes Unidos

Prevê-se que os Emirados Árabes Unidos registrem a taxa de crescimento anual composta (CAGR) mais rápida, de 7,36%, entre 2026 e 2033, impulsionada pelo rápido desenvolvimento industrial, pelo crescimento do processamento de alumínio e aço e pelos investimentos em energia, construção e manufatura avançada. A crescente adoção de refratários monolíticos e de alto desempenho também contribui para a aceleração da expansão do mercado.

Análise do Mercado de Refratários na África do Sul

A África do Sul contribui significativamente devido à forte demanda das indústrias de mineração, ferro e aço, cimento e metais não ferrosos. A infraestrutura metalúrgica consolidada e os projetos de modernização de fornos em andamento sustentam um consumo constante de refratários.

Quais são as principais empresas no mercado de refratários?

O setor de refratários é liderado principalmente por empresas consolidadas, incluindo:

- Saint-Gobain Cerâmicas e Refratários de Alto Desempenho (PCR) (França)

- Morgan Advanced Materials (Reino Unido)

- Vesúvio (Reino Unido)

- Imerys (França)

- RHI Magnesita GmbH (Áustria)

- Grupo de Refratários Puyang Co., Ltd (China)

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.