Mercado de hidrolisados proteicos do Médio Oriente e África, por tipo (leite, carne, marinho, vegetal, ovos e outros), fonte (animais, plantas e micróbios), forma (líquido e pó), processo (hidrólise enzimática e hidrólise ácida), aplicação ( Ração animal , nutrição infantil, nutrição clínica, nutrição desportiva, suplementos alimentares e outros), país (África do Sul, Egito, Arábia Saudita, Emirados Árabes Unidos, Israel e resto do Médio Oriente e África), tendências e previsões do setor até 2029.

Análise de Mercado e Insights : Mercado de Hidrolisados de Proteínas do Médio Oriente e África

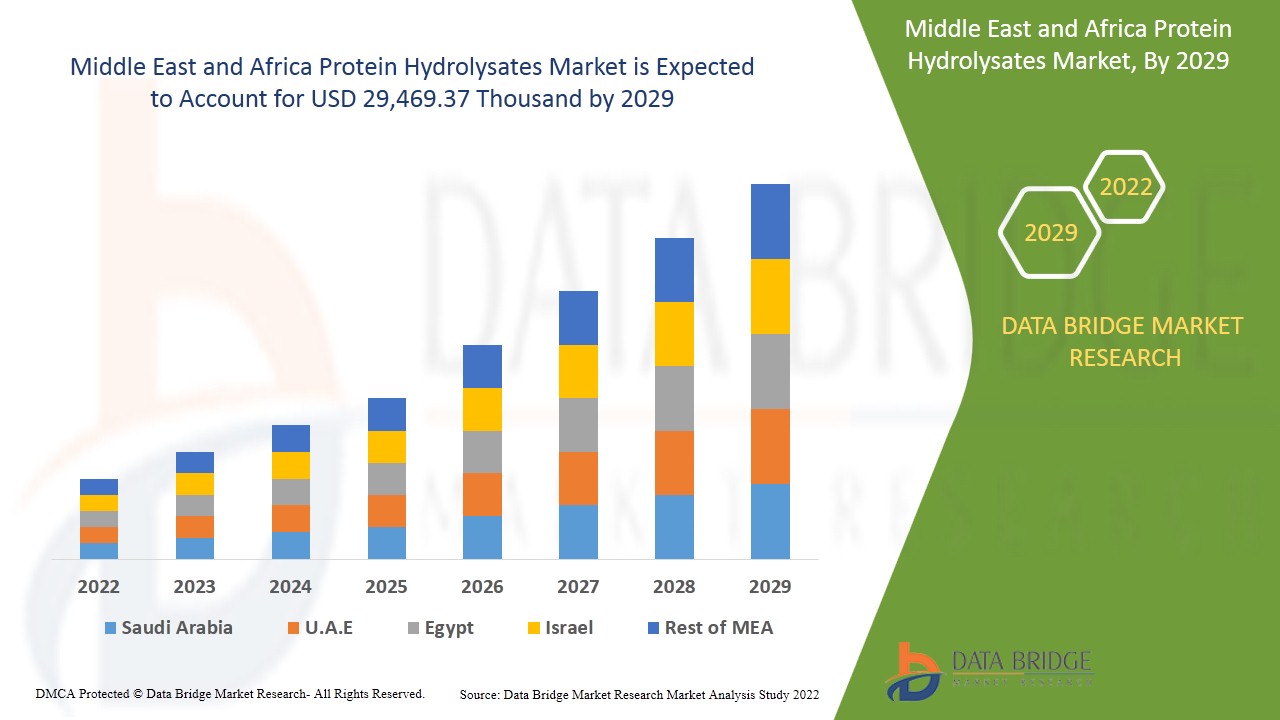

Espera-se que o mercado de hidrolisados proteicos do Médio Oriente e África ganhe crescimento de mercado no período previsto de 2022 a 2029. A Data Bridge Market Research analisa que o mercado está a crescer a um CAGR de 3,0% no período previsto de 2022 a 2029 e prevê-se que atinja os 29.469,37 mil dólares até 2029.

Os hidrolisados proteicos são produzidos a partir de fontes proteicas purificadas pela adição de enzimas proteolíticas, seguida de procedimentos de purificação. Cada hidrolisado proteico é uma mistura complexa de péptidos de diferentes comprimentos de cadeia e aminoácidos livres que podem ser definidos por um valor do Médio Oriente e de África conhecido como grau de hidrólise, que é a fracção de ligações peptídicas que foram clivadas na proteína inicial . Estas preparações fornecem o equivalente nutritivo do material original nos seus aminoácidos constituintes e são utilizadas como reposição de nutrientes e fluidos em dietas especiais ou para doentes que não podem ingerir proteínas alimentares comuns. Oferece inúmeros benefícios para a saúde, como ajudar o organismo a absorver os aminoácidos mais rapidamente do que as proteínas intactas, maximizando assim o fornecimento de nutrientes e tendo diversas aplicações na indústria alimentar e das bebidas. A aplicação de hidrolisados proteicos tem especial aplicação na medicina desportiva, uma vez que os aminoácidos presentes nos hidrolisados proteicos são mais facilmente absorvidos pelo organismo do que as proteínas intactas, o que aumenta o fornecimento de nutrientes aos músculos. Também é utilizado na indústria de biotecnologia para suplementar culturas celulares.

O aumento da procura de fórmulas infantis em várias regiões impulsionou o crescimento do mercado de hidrolisados proteicos. O consumo de fórmulas, que consistem num hidrolisado proteico, é considerado mais benéfico do que a fórmula de leite de vaca, uma vez que os hidrolisados proteicos podem ser facilmente digeridos pelos bebés, ao contrário dos produtos à base de leite, que são amplamente esperados que impulsionem o crescimento das proteínas no Médio Oriente e em África.

A procura significativa de produtos de controlo de peso para a nutrição infantil e desportiva e a crescente consciencialização da saúde entre os consumidores, levando ao consumo de alimentos funcionais e nutritivos, são os impulsionadores do mercado de hidrolisados proteicos do Médio Oriente e de África . No entanto, espera-se que a disponibilidade de alternativas, como os isolados, restrinja o crescimento do mercado.

O aumento da população vegan em todo o mundo pode trazer oportunidades para o mercado de hidrolisados proteicos do Médio Oriente e África crescer no futuro

O elevado custo de processamento da proteína hidrolisada deverá desafiar o mercado de hidrolisados proteicos do Médio Oriente e África a crescer num futuro próximo

Este relatório de mercado de hidrolisados proteicos do Médio Oriente e África fornece detalhes sobre a quota de mercado, novos desenvolvimentos e análise de pipeline de produtos, o impacto dos participantes do mercado doméstico e localizado, analisa as oportunidades em termos de bolsas de receitas emergentes , alterações nas regulamentações de mercado, aprovações de produtos, estratégias decisões, lançamentos de produtos, expansões geográficas e inovações tecnológicas no mercado. Para compreender a análise e o cenário de mercado, contacte-nos para um Analista Briefing; a nossa equipa irá ajudá-lo a criar uma solução de impacto na receita para atingir a sua meta desejada.

Âmbito e dimensão do mercado de hidrolisados proteicos do Médio Oriente e África

O mercado de hidrolisados proteicos do Médio Oriente e África está segmentado em cinco segmentos com base no tipo, fonte, forma, processo e aplicação. O crescimento entre segmentos ajuda-o a analisar os nichos de crescimento e as estratégias para abordar o mercado e determinar as suas principais áreas de aplicação e a diferença nos seus mercados-alvo.

- Com base no tipo, o mercado de hidrolisados proteicos do Médio Oriente e África está segmentado em leite, carne, marisco, vegetais, ovos e outros. Em 2022, prevê-se que o segmento dos hidrolisados proteicos do leite domine o mercado dos hidrolisados proteicos do Médio Oriente e África, uma vez que possui efeitos anti-hipertensivos, antioxidantes, anti-inflamatórios e hipocolesterolémicos notáveis .

- Com base na origem, o mercado de hidrolisados proteicos do Médio Oriente e África está segmentado em animais, vegetais e micróbios. Em 2022, prevê-se que o segmento animal domine o mercado de hidrolisados proteicos do Médio Oriente e de África devido à presença de um elevado teor proteico nas fontes de origem animal em comparação com os seus equivalentes.

- Com base na forma, o mercado de hidrolisados proteicos do Médio Oriente e África está segmentado em líquido e em pó. Em 2022, prevê-se que o segmento dos hidrolisados de proteína em pó domine o mercado dos hidrolisados de proteína do Médio Oriente e de África, uma vez que é mais facilmente absorvido e utilizado pelo organismo, tornando a recuperação pós-treino mais eficiente e rápida. Além disso, os pós de proteína hidrolisada têm menos probabilidade de causar dores de estômago e problemas intestinais e oferecem vários benefícios para a saúde, o que ajuda a aumentar a sua procura no ano previsto.

- Com base no processo, o mercado de hidrolisados proteicos do Médio Oriente e África está segmentado em hidrólise enzimática e hidrólise ácida. Em 2022, prevê-se que a hidrólise enzimática domine o mercado dos hidrolisados proteicos do Médio Oriente e de África porque a extensão do tratamento pode ser controlada devido à sua especificidade inerente de várias proteases.

- Com base na aplicação, o mercado de hidrolisados proteicos do Médio Oriente e África está segmentado em rações para animais, nutrição infantil, nutrição clínica, nutrição desportiva , suplementos alimentares e outros. Em 2022, prevê-se que o segmento dos suplementos alimentares domine o mercado dos hidrolisados proteicos do Médio Oriente e de África, uma vez que fornecem uma nutrição completa ou parcial aos indivíduos que não conseguem ingerir uma quantidade adequada de alimentos na forma convencional.

Análise do mercado de hidrolisados proteicos no Médio Oriente e África a nível de país

O mercado do Médio Oriente e África é analisado, e a informação sobre o tamanho do mercado é fornecida por tipo, fonte, forma, processo e aplicação.

Os países abrangidos no relatório de mercado de hidrolisados proteicos do Médio Oriente e África estão segmentados na África do Sul, Egito, Arábia Saudita, Emirados Árabes Unidos, Israel e Resto do Médio Oriente e África.

- Em 2022, prevê-se que os EAU dominem o mercado de hidrolisados proteicos do Médio Oriente e de África devido ao elevado rendimento disponível dos consumidores.

A secção de países do relatório também fornece fatores individuais que impactam o mercado e alterações na regulamentação do mercado que impactam as tendências atuais e futuras do mercado. Pontos de dados como novas vendas, vendas de reposição, demografia do país, atos regulamentares e tarifas de importação e exportação são alguns dos principais indicadores utilizados para prever o cenário de mercado para países individuais. Além disso, a presença e a disponibilidade de marcas do Médio Oriente e de África e os desafios enfrentados devido à grande ou escassa concorrência das marcas locais e nacionais, bem como o impacto dos canais de venda, são considerados quando se fornece uma análise de previsão dos dados do país.

Médio Oriente e África no Mercado de Hidrolisados de Proteínas do Médio Oriente e África

O mercado de hidrolisados proteicos do Médio Oriente e África também fornece uma análise detalhada do mercado para o crescimento de cada país na base instalada de diferentes tipos de produtos para o mercado, o impacto da tecnologia utilizando curvas de linha de vida e alterações nos cenários regulatórios dos hidrolisados proteicos e o seu impacto no mercado dos hidrolisados proteicos. Os dados estão disponíveis para o período histórico de 2010 a 2020.

Análise do cenário competitivo e da quota de mercado dos hidrolisados proteicos no Médio Oriente e em África

O panorama competitivo do mercado de hidrolisados proteicos do Médio Oriente e África fornece detalhes do concorrente. Os detalhes incluídos são a visão geral da empresa, finanças da empresa, receitas geradas, potencial de mercado, investimento em investigação e desenvolvimento, novas iniciativas de mercado, presença no Médio Oriente e África, localizações e instalações de produção, pontos fortes e fracos da empresa , lançamento de produto, pipelines de ensaios clínicos, análise de marca , aprovações de produtos, patentes, amplitude e abrangência do produto, domínio da aplicação, curva de vida da tecnologia. Os pontos de dados fornecidos acima estão apenas relacionados com o foco da empresa no mercado de hidrolisados proteicos do Médio Oriente e África.

Alguns dos principais participantes abordados no relatório são a BRF Middle East and Africa, Novozymes, Azelis, Scanbio Marine Group AS, Bioiberica SAU, Kemin Industries Inc., Copalis, Bio-marine Ingredients Ireland, Titan Biotech, ZXCHEM USA INC., SUBONEYO Chemicals Farmacêuticos P Limited, New Alliance Dye Chem Pvt. Ltd., Janatha Fish Meals & Oil Products, NAN Group e SAMPI, entre outros.

Os analistas do DBMR compreendem os pontos fortes competitivos e fornecem análises competitivas para cada concorrente em separado.

Por exemplo,

- Em outubro de 2021, o Instituto BRF, associação privada que direciona estrategicamente os investimentos sociais da Empresa, concluiu a terceira ronda de seleção do Aviso do Fundo Nossa Parte Pelo Todo. A iniciativa recebeu mais de 370 candidaturas, das quais foram selecionadas 50 iniciativas, num total de 1,8 milhões de investimentos em diferentes frentes com foco na Geração de Emprego e Rendimento, Saúde e Ações de Emergência, Segurança Alimentar e Proteção Social.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Índice

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST & AFRICA PROTEIN HYDROLYSATES MARKET

1.4 LIMITATION

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 TYPE LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 DBMR VENDOR SHARE ANALYSIS

2.13 IMPORT-EXPORT DATA

2.14 SECONDARY SOURCES

2.15 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 SIGNIFICANT DEMAND IN WEIGHT MANAGEMENT PRODUCTS FOR INFANT AND SPORTS NUTRITION

5.1.2 INCREASING HEALTH AWARENESS AMONG CONSUMERS LEADING TO CONSUMPTION OF FUNCTIONAL AND NUTRITIONAL FOODS

5.1.3 RISING DEMAND ACROSS A DIVERSE RANGE OF APPLICATIONS

5.1.4 INCREASED USAGE OF FISH PROTEIN HYDROLYSATE IN AQUAFEED

5.2 RESTRAINTS

5.2.1 HEALTH ISSUES RELATED TO HIGH AND LONG TERM CONSUMPTION OF PROTEIN-BASED DIET

5.2.2 STRINGENT GOVERNMENT REGULATIONS

5.2.3 AVAILABILITY OF ALTERNATIVES SUCH AS ISOLATES AND CONCENTRATES

5.3 OPPORTUNITIES

5.3.1 INCREASING VEGAN POPULATION ACROSS THE GLOBE

5.3.2 HIGH DEMAND FOR ORGANIC FOOD INGREDIENTS

5.4 CHALLENGES

5.4.1 HIGH PRODUCTION COST OF HYDROLYZED PROTEIN

5.4.2 LACK OF AWARENESS IN DEVELOPING COUNTRIES

6 COVID-19 IMPACT ON MIDDLE EAST & AFRICA PROTEIN HYDROLYSATES MARKET

6.1 ANALYSIS ON IMPACT OF COVID-19 ON MIDDLE EAST & AFRICA PROTEIN HYDROLYSATES MARKET

6.2 AFTERMATH OF COVID-19 AND GOVERNMENT INITIATIVE TO BOOST MIDDLE EAST & AFRICA PROTEIN HYDROLYSATES MARKET

6.3 STRATEGIC DECISIONS FOR MANUFACTURERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

6.4 PRICE IMPACT

6.5 IMPACT ON DEMAND

6.6 IMPACT ON SUPPLY CHAIN

6.7 CONCLUSION

7 MIDDLE EAST & AFRICA PROTEIN HYDROLYSATES MARKET, BY TYPE

7.1 OVERVIEW

7.2 MILK

7.2.1 MILK, BY TYPE

7.2.1.1 WHEY

7.2.1.2 CASEIN

7.3 MEAT

7.3.1 MEAT, BY TYPE

7.3.1.1 BOVINE

7.3.1.2 POULTRY

7.3.1.3 SWINE

7.4 PLANT

7.4.1 PLANT, BY TYPE

7.4.1.1 SOY

7.4.1.2 WHEAT

7.4.1.3 OTHERS

7.5 EGGS

7.6 MARINE

7.6.1 MARINE, BY TYPE

7.6.1.1 FISH

7.6.1.1.1 FISH, BY TYPE

7.6.1.1.1.1 TUNA

7.6.1.1.1.2 SALMON

7.6.1.1.1.3 OTHERS

7.6.1.2 ALGAE

7.7 OTHERS

8 MIDDLE EAST & AFRICA PROTEIN HYDROLYSATES MARKET, BY SOURCE

8.1 OVERVIEW

8.2 ANIMALS

8.3 PLANTS

8.4 MICROBES

9 MIDDLE EAST & AFRICA PROTEIN HYDROLYSATES MARKET, BY FORM

9.1 OVERVIEW

9.2 POWDER

9.3 LIQUID

10 MIDDLE EAST & AFRICA PROTEIN HYDROLYSATES MARKET, BY PROCESS

10.1 OVERVIEW

10.2 ENZYMATIC HYDROLYSIS

10.3 ACID HYDROLYSIS

11 MIDDLE EAST & AFRICA PROTEIN HYDROLYSATES MARKET, BY APPLICATION

11.1 OVERVIEW

11.2 DIETARY SUPPLEMENTS

11.3 INFANT NUTRITION

11.4 SPORTS NUTRITION

11.5 ANIMAL FEED

11.6 CLINICAL NUTRITION

11.7 OTHERS

12 MIDDLE EAST & AFRICA PROTEIN HYDROLYSATES MARKET, BY REGION

12.1 MIDDLE EAST AND AFRICA

12.1.1 U.A.E.

12.1.2 SAUDI ARABIA

12.1.3 SOUTH AFRICA

12.1.4 EGYPT

12.1.5 ISRAEL

12.1.6 REST OF MIDDLE EAST AND AFRICA

13 MIDDLE EAST & AFRICA PROTEIN HYDROLYSATES MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

13.2 MERGERS & ACQUISITIONS

13.3 EXPANSIONS

13.4 NEW PRODUCT DEVELOPMENTS

13.5 PARTNERSHIPS

14 SWOT ANALYSIS

15 COMPANY PROFILE

15.1 BRF MIDDLE EAST & AFRICA

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT UPDATES

15.2 NOVOZYMES

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT UPDATES

15.3 AZELIS

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 COMPANY SHARE ANALYSIS

15.3.4 PRODUCT PORTFOLIO

15.3.5 RECENT UPDATES

15.4 SCANBIO MARINE GROUP AS

15.4.1 COMPANY SNAPSHOT

15.4.2 COMPANY SHARE ANALYSIS

15.4.3 PRODUCT PORTFOLIO

15.4.4 RECENT UPDATE

15.5 BIOIBERICA S.A.U

15.5.1 COMPANY SNAPSHOT

15.5.2 PRODUCT PORTFOLIO

15.5.3 RECENT UPDATES

15.6 KEMIN INDUSTRIES, INC.

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT UPDATES

15.7 COPALIS

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT UPDATES

15.8 BIO-MARINE INGREDIENTS IRELAND

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT UPDATES

15.9 JANATHA FISH MEAL & OIL PRODUCTS

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT UPDATE

15.1 NAN GROUP

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT UPDATE

15.11 NEW ALLIANCE DYE CHEM PVT. LTD.

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT UPDATE

15.12 SAMPI

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT UPDATE

15.13 SUBONEYO CHEMICAL PHARMACEUTICALS P LIMITED

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT UPDATE

15.14 TITAN BIOTECH

15.14.1 COMPANY SNAPSHOT

15.14.2 REVENUE ANALYSIS

15.14.3 PRODUCT PORTFOLIO

15.14.4 RECENT UPDATES

15.15 ZXCHEM USA INC.

15.15.1 COMPANY SNAPSHOT

15.15.2 PRODUCT PORTFOLIO

15.15.3 RECENT UPDATES

16 QUESTIONNAIRE

17 RELATED REPORTS

Lista de Tabela

TABLE 1 IMPORT DATA OF PEPTONES AND THEIR DERIVATIVES; OTHER ALBUMINOUS SUBSTANCES AND THEIR DERIVATIVES; HS CODE - 350400 (USD THOUSAND)

TABLE 2 EXPORT DATA OF PEPTONES AND THEIR DERIVATIVES; OTHER ALBUMINOUS SUBSTANCES AND THEIR DERIVATIVES; HS CODE – 350400 (USD THOUSAND)

TABLE 3 MIDDLE EAST & AFRICA PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 4 MIDDLE EAST & AFRICA PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (TONNE)

TABLE 5 MIDDLE EAST & AFRICA MILK IN PROTEIN HYDROLYSATES MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 6 MIDDLE EAST & AFRICA MILK IN PROTEIN HYDROLYSATES MARKET, BY REGION, 2020-2029 (TONNE)

TABLE 7 MIDDLE EAST & AFRICA MILK IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 8 MIDDLE EAST & AFRICA MEAT IN PROTEIN HYDROLYSATES MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 9 MIDDLE EAST & AFRICA MEAT IN PROTEIN HYDROLYSATES MARKET, BY REGION, 2020-2029 (TONNE)

TABLE 10 MIDDLE EAST & AFRICA MEAT IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 11 MIDDLE EAST & AFRICA PLANT IN PROTEIN HYDROLYSATES MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 12 MIDDLE EAST & AFRICA PLANT IN PROTEIN HYDROLYSATES MARKET, BY REGION, 2020-2029 (TONNE)

TABLE 13 MIDDLE EAST & AFRICA PLANT IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 14 MIDDLE EAST & AFRICA EGGS IN PROTEIN HYDROLYSATES MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 15 MIDDLE EAST & AFRICA EGGS IN PROTEIN HYDROLYSATES MARKET, BY REGION, 2020-2029 (TONNE)

TABLE 16 MIDDLE EAST & AFRICA MARINE IN PROTEIN HYDROLYSATES MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 17 MIDDLE EAST & AFRICA MARINE IN PROTEIN HYDROLYSATES MARKET, BY REGION, 2020-2029 (TONNE)

TABLE 18 MIDDLE EAST & AFRICA MARINE IN PROTEIN HYDROLYSATESMARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 19 MIDDLE EAST & AFRICA FISH IN PROTEIN HYDROLYSATESMARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 20 MIDDLE EAST & AFRICA OTHERS IN PROTEIN HYDROLYSATESMARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 21 MIDDLE EAST & AFRICA OTHERS IN PROTEIN HYDROLYSATESMARKET, BY REGION, 2020-2029 (TONNE)

TABLE 22 MIDDLE EAST & AFRICA PROTEIN HYDROLYSATES MARKET, BY SOURCE, 2020-2029 (USD THOUSAND)

TABLE 23 MIDDLE EAST & AFRICA ANIMALS IN PROTEIN HYDROLYSATES MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 24 MIDDLE EAST & AFRICA PLANTS IN PROTEIN HYDROLYSATES MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 25 MIDDLE EAST & AFRICA MICROBES IN PROTEIN HYDROLYSATES MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 26 MIDDLE EAST & AFRICA PROTEIN HYDROLYSATES MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 27 MIDDLE EAST & AFRICA POWDER IN PROTEIN HYDROLYSATES MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 28 MIDDLE EAST & AFRICA LIQUID IN PROTEIN HYDROLYSATES MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 29 MIDDLE EAST & AFRICA PROTEIN HYDROLYSATES MARKET, BY PROCESS, 2020-2029 (USD THOUSAND)

TABLE 30 MIDDLE EAST & AFRICA ENZYMATIC HYDROLYSIS IN PROTEIN HYDROLYSATES MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 31 MIDDLE EAST & AFRICA ACID HYDROLYSIS IN PROTEIN HYDROLYSATES MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 32 MIDDLE EAST & AFRICA PROTEIN HYDROLYSATES MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 33 MIDDLE EAST & AFRICA DIETARY SUPPLEMENTS IN PROTEIN HYDROLYSATES MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 34 MIDDLE EAST & AFRICA INFANT NUTRITION IN PROTEIN HYDROLYSATES MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 35 MIDDLE EAST & AFRICA SPORTS NUTRITION IN PROTEIN HYDROLYSATES MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 36 MIDDLE EAST & AFRICA ANIMAL FEED IN PROTEIN HYDROLYSATES MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 37 MIDDLE EAST & AFRICA CLINICAL NUTRITION IN PROTEIN HYDROLYSATES MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 38 MIDDLE EAST & AFRICA CLINICAL NUTRITION IN PROTEIN HYDROLYSATES MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 39 MIDDLE EAST AND AFRICA PROTEIN HYDROLYSATES MARKET, BY COUNTRY, 2020-2029 (USD THOUSAND)

TABLE 40 MIDDLE EAST AND AFRICA PROTEIN HYDROLYSATES MARKET, BY COUNTRY, 2020-2029 (TONNE)

TABLE 41 MIDDLE EAST AND AFRICA PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 42 MIDDLE EAST AND AFRICA PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (TONNE)

TABLE 43 MIDDLE EAST AND AFRICA MILK IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 44 MIDDLE EAST AND AFRICA MEAT IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 45 MIDDLE EAST AND AFRICA MARINE IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 46 MIDDLE EAST AND AFRICA FISH IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 47 MIDDLE EAST AND AFRICA PLANT IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 48 MIDDLE EAST AND AFRICA PROTEIN HYDROLYSATES MARKET, BY SOURCE, 2020-2029 (USD THOUSAND)

TABLE 49 MIDDLE EAST AND AFRICA PROTEIN HYDROLYSATES MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 50 MIDDLE EAST AND AFRICA PROTEIN HYDROLYSATES MARKET, BY PROCESS, 2020-2029 (USD THOUSAND)

TABLE 51 MIDDLE EAST AND AFRICA PROTEIN HYDROLYSATES MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 52 U.A.E. PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 53 U.A.E. PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (TONNE)

TABLE 54 U.A.E. MILK IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 55 U.A.E. MEAT IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 56 U.A.E. MARINE IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 57 U.A.E. FISH IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 58 U.A.E. PLANT IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 59 U.A.E. PROTEIN HYDROLYSATES MARKET, BY SOURCE, 2020-2029 (USD THOUSAND)

TABLE 60 U.A.E. PROTEIN HYDROLYSATES MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 61 U.A.E. PROTEIN HYDROLYSATES MARKET, BY PROCESS, 2020-2029 (USD THOUSAND)

TABLE 62 U.A.E. PROTEIN HYDROLYSATES MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 63 SAUDI ARABIA PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 64 SAUDI ARABIA PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (TONNE)

TABLE 65 SAUDI ARABIA MILK IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 66 SAUDI ARABIA MEAT IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 67 SAUDI ARABIA MARINE IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 68 SAUDI ARABIA FISH IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 69 SAUDI ARABIA PLANT IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 70 SAUDI ARABIA PROTEIN HYDROLYSATES MARKET, BY SOURCE, 2020-2029 (USD THOUSAND)

TABLE 71 SAUDI ARABIA PROTEIN HYDROLYSATES MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 72 SAUDI ARABIA PROTEIN HYDROLYSATES MARKET, BY PROCESS, 2020-2029 (USD THOUSAND)

TABLE 73 SAUDI ARABIA PROTEIN HYDROLYSATES MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 74 SOUTH AFRICA PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 75 SOUTH AFRICA PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (TONNE)

TABLE 76 SOUTH AFRICA MILK IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 77 SOUTH AFRICA MEAT IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 78 SOUTH AFRICA MARINE IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 79 SOUTH AFRICA FISH IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 80 SOUTH AFRICA PLANT IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 81 SOUTH AFRICA PROTEIN HYDROLYSATES MARKET, BY SOURCE, 2020-2029 (USD THOUSAND)

TABLE 82 SOUTH AFRICA PROTEIN HYDROLYSATES MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 83 SOUTH AFRICA PROTEIN HYDROLYSATES MARKET, BY PROCESS, 2020-2029 (USD THOUSAND)

TABLE 84 SOUTH AFRICA PROTEIN HYDROLYSATES MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 85 EGYPT PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 86 EGYPT PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (TONNE)

TABLE 87 EGYPT MILK IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 88 EGYPT MEAT IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 89 EGYPT MARINE IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 90 EGYPT FISH IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 91 EGYPT PLANT IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 92 EGYPT PROTEIN HYDROLYSATES MARKET, BY SOURCE, 2020-2029 (USD THOUSAND)

TABLE 93 EGYPT PROTEIN HYDROLYSATES MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 94 EGYPT PROTEIN HYDROLYSATES MARKET, BY PROCESS, 2020-2029 (USD THOUSAND)

TABLE 95 EGYPT PROTEIN HYDROLYSATES MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 96 ISRAEL PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 97 ISRAEL PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (TONNE)

TABLE 98 ISRAEL MILK IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 99 ISRAEL MEAT IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 100 ISRAEL MARINE IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 101 ISRAEL FISH IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 102 ISRAEL PLANT IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 103 ISRAEL PROTEIN HYDROLYSATES MARKET, BY SOURCE, 2020-2029 (USD THOUSAND)

TABLE 104 ISRAEL PROTEIN HYDROLYSATES MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 105 ISRAEL PROTEIN HYDROLYSATES MARKET, BY PROCESS, 2020-2029 (USD THOUSAND)

TABLE 106 ISRAEL PROTEIN HYDROLYSATES MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 107 REST OF MIDDLE EAST AND AFRICA PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 108 REST OF MIDDLE EAST AND AFRICA PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (TONNE)

Lista de Figura

FIGURE 1 MIDDLE EAST & AFRICA PROTEIN HYDROLYSATES MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST & AFRICA PROTEIN HYDROLYSATES MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA PROTEIN HYDROLYSATES MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA PROTEIN HYDROLYSATES MARKET: MIDDLE EAST & AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA PROTEIN HYDROLYSATES MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA PROTEIN HYDROLYSATES MARKET: TYPE LIFE LINE CURVE

FIGURE 7 MIDDLE EAST & AFRICA PROTEIN HYDROLYSATES MARKET: MULTIVARIATE MODELLING

FIGURE 8 MIDDLE EAST & AFRICA PROTEIN HYDROLYSATES MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 MIDDLE EAST & AFRICA PROTEIN HYDROLYSATES MARKET: DBMR MARKET POSITION GRID

FIGURE 10 MIDDLE EAST & AFRICA PROTEIN HYDROLYSATES MARKET: APPLICATION COVERAGE GRID

FIGURE 11 MIDDLE EAST & AFRICA PROTEIN HYDROLYSATES MARKET: CHALLENGE MATRIX

FIGURE 12 MIDDLE EAST & AFRICA PROTEIN HYDROLYSATES MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 MIDDLE EAST & AFRICA PROTEIN HYDROLYSATES MARKET: SEGMENTATION

FIGURE 14 NORTH AMERICA IS EXPECTED TO DOMINATE THE MIDDLE EAST & AFRICA PROTEIN HYDROLYSATES MARKET, WHILE ASIA-PACIFIC IS EXPECTED TO GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 15 INCREASED DEMAND FOR INFANT NUTRITION AND SPORTS NUTRITION IS EXPECTED TO DRIVE THE MIDDLE EAST & AFRICA PROTEIN HYDROLYSATES MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 16 MILK SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST & AFRICA PROTEIN HYDROLYSATES MARKET IN 2022 & 2029

FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF MIDDLE EAST & AFRICA PROTEIN HYDROLYSATES MARKET

FIGURE 18 WORLD CAPTURE FISHERIES FROM 1950 TO 2018

FIGURE 19 MIDDLE EAST & AFRICA PROTEIN HYDROLYSATES, BY TYPE, 2021

FIGURE 20 MIDDLE EAST & AFRICA PROTEIN HYDROLYSATES, BY SOURCE, 2021

FIGURE 21 MIDDLE EAST & AFRICA PROTEIN HYDROLYSATES, BY FORM, 2021

FIGURE 22 MIDDLE EAST & AFRICA PROTEIN HYDROLYSATES, BY PROCESS, 2021

FIGURE 23 MIDDLE EAST & AFRICA PROTEIN HYDROLYSATES, BY APPLICATION, 2021

FIGURE 24 MIDDLE EAST AND AFRICA PROTEIN HYDROLYSATES MARKET: SNAPSHOT (2021)

FIGURE 25 MIDDLE EAST AND AFRICA PROTEIN HYDROLYSATES MARKET: BY COUNTRY (2021)

FIGURE 26 MIDDLE EAST AND AFRICA PROTEIN HYDROLYSATES MARKET: BY COUNTRY (2022 & 2029)

FIGURE 27 MIDDLE EAST AND AFRICA PROTEIN HYDROLYSATES MARKET: BY COUNTRY (2021 & 2029)

FIGURE 28 MIDDLE EAST AND AFRICA PROTEIN HYDROLYSATES MARKET: BY TYPE (2022-2029)

FIGURE 29 MIDDLE EAST & AFRICA PROTEIN HYDROLYSATES MARKET: COMPANY SHARE 2021 (%)

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.