Middle East And Africa Pharmaceutical Vials Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

17.23 Billion

USD

29.39 Billion

2025

2033

USD

17.23 Billion

USD

29.39 Billion

2025

2033

| 2026 –2033 | |

| USD 17.23 Billion | |

| USD 29.39 Billion | |

|

|

|

|

Segmentação do mercado de frascos farmacêuticos no Oriente Médio e África, por material (vidro, plástico e outros), tipo de gargalo (rosca, crimpagem, câmara dupla, tampa flip-top e outros), tamanho da tampa (13-425 mm, 15-425 mm, 18-400 mm, 22-350 mm, 24-400 mm, 8-425 mm, 9 mm e outros), canal de distribuição (vendas diretas, farmácias/drogarias, comércio eletrônico e outros), capacidade (1 ml, 2 ml, 3 ml, 4 ml, 8 ml, 10 ml, 20 ml, 30 ml, 50 ml e outros), tipo de medicamento (injetável e não injetável), aplicação (oral, nasal, injetável e outras), usuário final (empresas farmacêuticas, empresas biofarmacêuticas, empresas de desenvolvimento e fabricação por contrato, farmácias de manipulação e outros), mercado (parenteral, gastrointestinal, otorrinolaringológico e outros). Tendências e Previsões do Setor até 2033

Tamanho do mercado de frascos farmacêuticos no Oriente Médio e na África

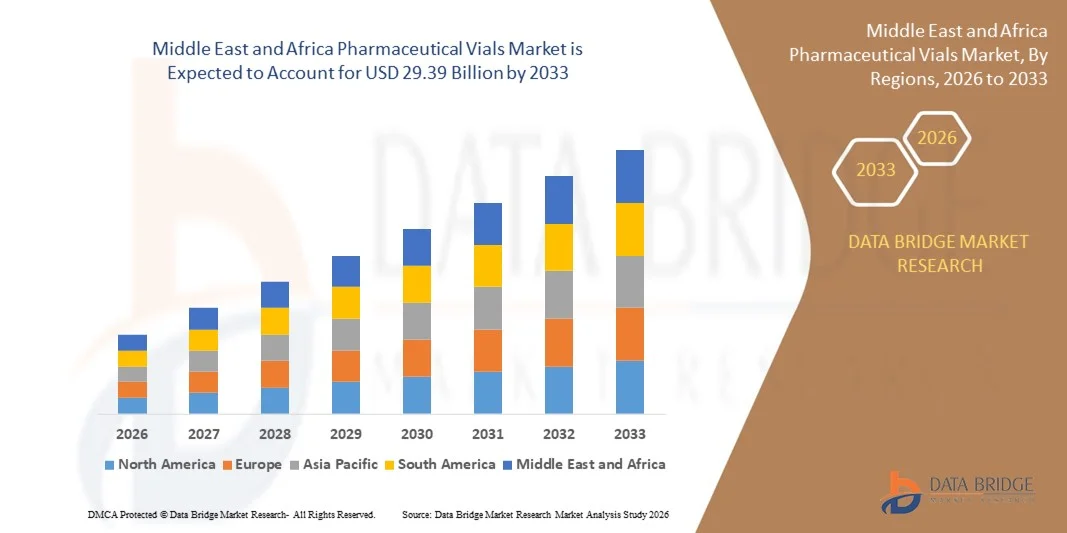

- O mercado global de frascos farmacêuticos no Oriente Médio e na África foi avaliado em US$ 17,23 bilhões em 2025 e deverá atingir US$ 29,39 bilhões até 2033 , com uma taxa de crescimento anual composta (CAGR) de 6,90% durante o período de previsão.

- O crescimento do mercado é impulsionado principalmente pela crescente demanda por soluções de embalagens de medicamentos seguras e eficientes, juntamente com o aumento da produção farmacêutica e da distribuição de vacinas em toda a região.

- Além disso, os avanços tecnológicos na fabricação de frascos, como o envase automatizado e as técnicas aprimoradas de esterilização, estão melhorando a qualidade do produto e a eficiência operacional, impulsionando ainda mais a expansão do mercado. Esses fatores, em conjunto, estão acelerando a adoção de frascos farmacêuticos, aumentando significativamente o crescimento do setor.

Análise do mercado de frascos farmacêuticos no Oriente Médio e na África

- Os frascos farmacêuticos, utilizados para armazenar e transportar medicamentos, vacinas e produtos biológicos, são componentes cada vez mais vitais da cadeia de suprimentos da área da saúde e farmacêutica, tanto em ambientes clínicos quanto comerciais, devido à sua esterilidade, durabilidade e compatibilidade com sistemas avançados de administração de medicamentos.

- A crescente demanda por frascos farmacêuticos é impulsionada principalmente pelo aumento da produção de vacinas e produtos biológicos, pela crescente prevalência de doenças crônicas e pelo foco cada vez maior em soluções de embalagem de medicamentos seguras e eficientes.

- Os Emirados Árabes Unidos dominaram o mercado de frascos farmacêuticos no Oriente Médio e na África, com a maior participação na receita, de 32,5% em 2025, caracterizado por infraestrutura farmacêutica avançada, alto investimento em P&D e forte presença de importantes players do setor. Os EUA, por sua vez, apresentaram crescimento substancial no consumo de frascos, impulsionado pela produção de vacinas, soluções inovadoras de embalagem e padrões de conformidade regulatória.

- Prevê-se que a Arábia Saudita seja a região de crescimento mais rápido no mercado de frascos farmacêuticos do Oriente Médio e da África durante o período de previsão, devido ao aumento da produção farmacêutica, à expansão da infraestrutura de saúde e ao aumento das iniciativas governamentais para imunização e acesso à saúde.

- O segmento de vidro dominou o mercado com uma participação de 61,5% na receita em 2025, impulsionado por sua resistência química superior, estabilidade térmica e compatibilidade com medicamentos injetáveis e vacinas.

Escopo do relatório e segmentação do mercado de frascos farmacêuticos no Oriente Médio e na África.

|

Atributos |

Principais informações de mercado sobre frascos farmacêuticos |

|

Segmentos abrangidos |

|

|

Países abrangidos |

Oriente Médio e África

|

|

Principais participantes do mercado |

• Gerresheimer AG (Alemanha) |

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor agregado |

Além das informações sobre cenários de mercado, como valor de mercado, taxa de crescimento, segmentação, cobertura geográfica e principais participantes, os relatórios de mercado elaborados pela Data Bridge Market Research também incluem análise de importação e exportação, visão geral da capacidade de produção, análise de produção e consumo, análise de tendências de preços, cenário de mudanças climáticas, análise da cadeia de suprimentos, análise da cadeia de valor, visão geral de matérias-primas/insumos, critérios de seleção de fornecedores, análise PESTLE, análise de Porter e estrutura regulatória. |

Tendências do mercado de frascos farmacêuticos no Oriente Médio e na África

Maior eficiência por meio de automação avançada e integração digital.

- Uma tendência significativa e crescente no mercado global de frascos farmacêuticos no Oriente Médio e na África é a adoção cada vez maior de automação avançada e tecnologias digitais na produção, envase e embalagem de frascos. Essas inovações estão aprimorando significativamente a eficiência operacional, a qualidade do produto e a rastreabilidade em toda a cadeia de suprimentos farmacêutica.

- Por exemplo, sistemas totalmente automatizados de enchimento e selagem de frascos podem lidar com produção em grande volume com mínima intervenção humana, garantindo esterilização consistente e reduzindo o risco de contaminação. Da mesma forma, sistemas de inspeção por visão integrados à robótica melhoram o controle de qualidade, detectando defeitos em frascos de vidro ou selagens inadequadas em tempo real.

- A integração digital na fabricação de frascos permite recursos como monitoramento em tempo real dos parâmetros de produção, manutenção preditiva de equipamentos e rastreamento em nível de lote para conformidade regulatória. Por exemplo, alguns sistemas utilizam sensores de IoT e análises baseadas em IA para otimizar a precisão do envase e detectar anomalias antes que elas afetem a produção.

- A integração perfeita de linhas de produção automatizadas com sistemas de planejamento de recursos empresariais (ERP) e de gerenciamento de armazéns permite que os fabricantes coordenem a produção, o estoque e a distribuição a partir de uma única interface. Isso cria um fluxo de trabalho altamente simplificado e rastreável que aumenta a eficiência da cadeia de suprimentos e minimiza o desperdício.

- Essa tendência em direção a processos de fabricação mais inteligentes, automatizados e conectados digitalmente está remodelando fundamentalmente as expectativas da indústria para a produção de frascos farmacêuticos. Consequentemente, empresas como Schott, Gerresheimer e Stevanato Group estão desenvolvendo soluções de produção de frascos totalmente automatizadas e assistidas por IA, com recursos de monitoramento em tempo real, detecção de defeitos e rastreabilidade digital.

- A demanda por frascos farmacêuticos produzidos com sistemas automatizados e integrados digitalmente está crescendo rapidamente nos setores de vacinas e produtos biológicos, à medida que os fabricantes priorizam cada vez mais a eficiência, a segurança do produto e a conformidade regulatória.

Dinâmica do mercado de frascos farmacêuticos no Oriente Médio e na África

Motorista

Necessidade crescente devido ao aumento da demanda por produtos farmacêuticos e à distribuição de vacinas.

- A crescente prevalência de doenças crônicas, aliada à produção e distribuição aceleradas de vacinas e produtos biológicos, é um fator significativo para o aumento da demanda por frascos farmacêuticos.

- Por exemplo, no início de 2025, a Gerresheimer AG anunciou a expansão de suas linhas de produção automatizadas de frascos para atender às crescentes necessidades de fabricação de vacinas no Oriente Médio e na África. Espera-se que essas iniciativas estratégicas de empresas importantes impulsionem o crescimento do mercado durante o período de previsão.

- À medida que os profissionais de saúde e os fabricantes de produtos farmacêuticos priorizam embalagens seguras e estéreis, os frascos oferecem recursos avançados, como lacres invioláveis, alta resistência química e compatibilidade com sistemas avançados de administração de medicamentos, representando uma melhoria significativa em relação aos recipientes tradicionais.

- Além disso, o crescente foco em programas de imunização, produtos biológicos e terapias injetáveis está tornando os frascos farmacêuticos um componente indispensável das cadeias de suprimentos da área da saúde, garantindo o armazenamento e a distribuição seguros e eficientes de medicamentos sensíveis.

- A necessidade de frascos padronizados e de alta qualidade, soluções rápidas de envase e selagem, e sistemas de embalagem rastreáveis são fatores-chave que impulsionam a adoção tanto na fabricação farmacêutica em larga escala quanto em ambientes clínicos menores. A tendência em direção a linhas de envase automatizadas e soluções de embalagem fáceis de usar contribui ainda mais para o crescimento do mercado.

Restrição/Desafio

Conformidade regulatória e altos custos de produção

- Normas regulatórias rigorosas e requisitos de conformidade para embalagens farmacêuticas representam um desafio significativo para a expansão do mercado em geral. Os frascos devem atender a regulamentações rigorosas de qualidade, esterilidade e segurança, o que pode aumentar a complexidade e os custos de fabricação.

- Por exemplo, o não cumprimento das normas da FDA, da EMA ou das regulamentações locais pode resultar em recalls ou atrasos no lançamento de produtos, gerando hesitação entre os fabricantes em aumentar rapidamente a produção.

- Enfrentar esses desafios regulatórios por meio de sistemas robustos de garantia da qualidade, métodos de esterilização validados e adesão às Boas Práticas de Fabricação (BPF) é crucial para construir confiança com os clientes. Empresas como a Schott AG e o Grupo Stevanato enfatizam suas capacidades de conformidade e certificações em seu marketing e comunicações com os clientes para tranquilizar os compradores.

- Além disso, o custo relativamente alto de produção de frascos especializados, como frascos de vidro com esterilização de precisão ou superfícies revestidas, pode ser uma barreira à adoção, principalmente para fabricantes farmacêuticos menores em regiões em desenvolvimento. Embora alguns frascos padrão tenham se tornado mais acessíveis, os frascos premium com recursos avançados geralmente têm um preço mais elevado.

- Superar esses desafios por meio da otimização de processos, inovação em métodos de produção com boa relação custo-benefício e suporte regulatório contínuo será vital para o crescimento sustentado do mercado no setor de frascos farmacêuticos no Oriente Médio e na África.

Escopo do mercado de frascos farmacêuticos no Oriente Médio e na África

O mercado de frascos farmacêuticos é segmentado com base no material, tipo de gargalo, tamanho da tampa, canal de distribuição, capacidade, tipo de medicamento, aplicação, usuário final e mercado.

- Por material

Com base no material, o mercado de frascos farmacêuticos no Oriente Médio e na África é segmentado em vidro, plástico e outros. O segmento de vidro dominou o mercado com uma participação de 61,5% da receita em 2025, impulsionado por sua resistência química superior, estabilidade térmica e compatibilidade com medicamentos injetáveis e vacinas. Os frascos de vidro são amplamente preferidos para formulações estéreis, garantindo a estabilidade do medicamento a longo prazo e a conformidade com os rigorosos padrões regulatórios. Eles são particularmente vantajosos em aplicações biológicas e parenterais de alto valor agregado, onde a prevenção da contaminação é fundamental.

O segmento de plásticos deverá apresentar a taxa de crescimento anual composta (CAGR) mais rápida entre 2026 e 2033, impulsionado pela crescente demanda por alternativas leves, resistentes a quebras e com melhor custo-benefício em sistemas de administração de medicamentos pré-carregados e descartáveis. Os frascos plásticos estão ganhando espaço em mercados emergentes devido à facilidade de transporte, menor risco de quebra e adaptabilidade à produção em larga escala. A crescente inovação em formulações de polímeros com alta resistência química está impulsionando ainda mais a sua adoção.

- Por tipo de pescoço

Com base no tipo de gargalo, o mercado de frascos farmacêuticos do Oriente Médio e da África é segmentado em gargalo de rosca, gargalo de crimpagem, câmara dupla, tampa flip-top e outros. O segmento de gargalo de rosca dominou o mercado com uma participação de 45,3% da receita em 2025, devido à sua facilidade de vedação, compatibilidade com linhas de envase automatizadas e adequação tanto para formulações injetáveis quanto orais. Os frascos com gargalo de rosca são amplamente utilizados em hospitais, farmácias e laboratórios de pesquisa por seus sistemas de fechamento padronizados e custo-benefício.

Espera-se que o segmento de tampas de rosca com crimpagem apresente a taxa de crescimento anual composta (CAGR) mais rápida de 2026 a 2033, impulsionado por suas capacidades aprimoradas de vedação, adequação para produtos liofilizados e preferência na produção de vacinas em grande volume. O design da tampa de rosca com crimpagem garante risco mínimo de contaminação, posicionamento confiável da rolha e conformidade com os rigorosos padrões de Boas Práticas de Fabricação (BPF), tornando-se a escolha preferencial para formulações críticas de medicamentos injetáveis.

- Por tamanho da tampa

Com base no tamanho da tampa, o mercado de frascos farmacêuticos do Oriente Médio e da África é segmentado em 13-425 mm, 15-425 mm, 18-400 mm, 22-350 mm, 24-400 mm, 8-425 mm, 9 mm e outros. O segmento de 13-425 mm dominou o mercado com uma participação de 38,7% da receita em 2025, impulsionado por seu uso generalizado em formulações injetáveis e pela padronização em linhas de produção farmacêutica. Esse tamanho de tampa é preferido devido à compatibilidade com máquinas automatizadas de envase e selagem e à sua prevalência tanto em aplicações hospitalares quanto no varejo.

O segmento de 18 a 400 mm deverá apresentar a taxa de crescimento anual composta (CAGR) mais rápida entre 2026 e 2033, impulsionado pela crescente adoção em embalagens de vacinas e na fabricação de produtos biológicos em larga escala. O crescimento do segmento é sustentado por inovações em tecnologia de vedação, maior compatibilidade com rolhas de borracha e pela crescente tendência de frascos multidose para campanhas de imunização em massa.

- Por canal de distribuição

Com base no canal de distribuição, o mercado de frascos farmacêuticos no Oriente Médio e na África é segmentado em vendas diretas, farmácias/drogarias, comércio eletrônico e outros. O segmento de vendas diretas dominou o mercado com uma participação de 52,1% da receita em 2025, impulsionado pela aquisição direta de fabricantes por empresas farmacêuticas e biofarmacêuticas, garantindo fornecimento em grande escala, pedidos personalizados e rigoroso controle de qualidade.

Espera-se que o segmento de comércio eletrônico apresente a taxa de crescimento anual composta (CAGR) mais rápida de 2026 a 2033, impulsionado pela crescente digitalização na aquisição de produtos de saúde, pela conveniência dos pedidos online e pela crescente aceitação entre pequenas farmácias e laboratórios de pesquisa. As plataformas de comércio eletrônico facilitam o acesso rápido a tamanhos de frascos, materiais e tipos de tampas padronizados, principalmente para necessidades urgentes ou específicas, apoiando assim a rápida adoção de canais online na cadeia de suprimentos farmacêutica.

- Por capacidade

Com base na capacidade, o mercado de frascos farmacêuticos do Oriente Médio e da África é segmentado em 1 ml, 2 ml, 3 ml, 4 ml, 8 ml, 10 ml, 20 ml, 30 ml, 50 ml e outros. O segmento de 10 ml dominou o mercado com uma participação de 35,9% da receita em 2025, devido à sua versatilidade para vacinas, produtos biológicos e medicamentos injetáveis comumente usados em hospitais e clínicas. O tamanho do frasco de 10 ml é compatível com sistemas automatizados de envase, inspeção e rotulagem, oferecendo eficiência e consistência na produção farmacêutica em larga escala.

Espera-se que o segmento de 2 ml apresente a taxa de crescimento anual composta (CAGR) mais rápida de 2026 a 2033, impulsionado pela crescente demanda por seringas pré-carregadas, formulações pediátricas e aplicações em escala laboratorial. Frascos de menor capacidade proporcionam dosagem precisa e reduzem o desperdício de medicamentos, atendendo às necessidades da medicina personalizada e de terapias injetáveis de pequeno volume.

Análise Regional do Mercado de Frascos Farmacêuticos no Oriente Médio e África

- Os Emirados Árabes Unidos dominaram o mercado de frascos farmacêuticos do Oriente Médio e da África, com a maior participação na receita, de 32,5% em 2025, impulsionados pela crescente demanda por vacinas, produtos biológicos e embalagens seguras para medicamentos injetáveis, bem como pela infraestrutura avançada de fabricação farmacêutica.

- Fabricantes e profissionais de saúde da região valorizam muito a confiabilidade, a esterilidade e a conformidade com as normas regulamentares oferecidas por frascos farmacêuticos de alta qualidade, garantindo o armazenamento e o transporte seguros de medicamentos e vacinas sensíveis.

- Essa ampla adoção é ainda mais sustentada por uma sólida pesquisa e desenvolvimento farmacêutico, altos investimentos em instalações de produção e um foco crescente em automação e garantia de qualidade, estabelecendo os frascos farmacêuticos como uma solução indispensável tanto para aplicações clínicas quanto comerciais na área da saúde.

Análise do Mercado de Frascos Farmacêuticos na Arábia Saudita

O mercado de frascos farmacêuticos da Arábia Saudita detinha uma participação significativa na receita em 2025, impulsionado pela expansão da infraestrutura de saúde do país, pelo crescimento da produção farmacêutica e pela crescente demanda por vacinas e produtos biológicos. Iniciativas governamentais de apoio à produção local de medicamentos e programas de vacinação estão impulsionando o crescimento do mercado. A adoção de tecnologias automatizadas de envase e esterilização avançadas está aprimorando ainda mais a eficiência da produção e a qualidade dos produtos nos setores clínico e comercial.

Análise do Mercado de Frascos Farmacêuticos nos Emirados Árabes Unidos

Prevê-se que o mercado de frascos farmacêuticos dos Emirados Árabes Unidos cresça a uma taxa composta de crescimento anual (CAGR) substancial durante o período de previsão, impulsionado principalmente pela crescente presença de instalações de fabricação farmacêutica e pela necessidade cada vez maior de embalagens estéreis para injetáveis. O investimento da região em inovação na área da saúde, juntamente com um foco crescente na distribuição de vacinas e produtos biológicos, está impulsionando a adoção. Fabricantes locais e internacionais estão expandindo suas capacidades de produção para atender à demanda de hospitais, clínicas e mercados de exportação.

Análise do Mercado de Frascos Farmacêuticos na África do Sul

O mercado de frascos farmacêuticos na África do Sul deverá expandir a uma taxa de crescimento anual composta (CAGR) notável, impulsionado pelo aumento dos gastos com saúde, pela expansão dos programas de vacinação e pela crescente conscientização sobre práticas seguras de armazenamento de medicamentos. O crescimento do mercado é sustentado por melhorias na infraestrutura da cadeia de suprimentos e pela adoção de soluções avançadas de embalagem para garantir a integridade de medicamentos e produtos biológicos sensíveis em ambientes de saúde urbanos e rurais.

Análise do Mercado de Frascos Farmacêuticos no Egito

O mercado egípcio de frascos farmacêuticos está preparado para um crescimento constante durante o período de previsão, impulsionado pela expansão do setor de fabricação farmacêutica do país, pela crescente demanda por vacinas e por iniciativas governamentais na área da saúde. O aumento do investimento em tecnologias de embalagens estéreis para medicamentos e em medidas de controle de qualidade está aprimorando a produção de frascos de alta qualidade para distribuição local e regional. A adoção de sistemas automatizados de envase e inspeção também está ganhando força, melhorando a eficiência e a segurança do produto.

Análise do Mercado de Frascos Farmacêuticos em Israel

O mercado israelense de frascos farmacêuticos está ganhando impulso devido ao forte ecossistema de P&D farmacêutica do país, à crescente produção de produtos biológicos e vacinas e às avançadas capacidades de fabricação. A integração de sistemas digitais e automatizados de produção de frascos, juntamente com a rigorosa conformidade regulatória, está impulsionando a eficiência e garantindo a alta qualidade do produto. O foco de Israel em inovação e na fabricação farmacêutica voltada para a exportação está impulsionando ainda mais o crescimento do mercado nos setores clínico e comercial.

Participação de mercado de frascos farmacêuticos no Oriente Médio e na África

O setor de frascos farmacêuticos é liderado principalmente por empresas consolidadas, incluindo:

• Gerresheimer AG (Alemanha)

• SCHOTT AG (Alemanha)

• Grupo Stevanato (Itália)

• Vetter Pharma-Fertigung GmbH & Co. KG (Alemanha)

• BD (Becton, Dickinson and Company) (EUA)

• Nipro Corporation (Japão)

• Catalent, Inc. (EUA)

• AptarGroup, Inc. (EUA)

• Pfizer Packaging Solutions (EUA)

• Sartorius AG (Alemanha)

• Ompi (SGD Pharma) (França)

• Rexam (agora parte da Ball Corporation) (Reino Unido)

• Aseptic Technologies (França)

• Alpha Pro Tech (Canadá)

• Grupo Rommelag (Alemanha)

• Gerresheimer Regensburg GmbH (Alemanha)

• Thermo Fisher Scientific (EUA)

• SCHOTT Kaisha Ltd. (Japão)

• Pfizer Glass & Vial Solutions (EUA)

• Grupo Spartek (Reino Unido)

Quais são os desenvolvimentos recentes no mercado de frascos farmacêuticos no Oriente Médio e na África?

- Em abril de 2024, a Schott AG, líder global em vidros especiais e embalagens farmacêuticas, expandiu sua capacidade de produção nos Emirados Árabes Unidos para atender à crescente demanda por frascos farmacêuticos estéreis. Essa iniciativa reforça o compromisso da empresa em fornecer soluções de embalagem confiáveis e de alta qualidade, adaptadas aos mercados farmacêuticos e de vacinas em expansão da região. Ao alavancar sua experiência global e tecnologias de fabricação avançadas, a Schott está atendendo às necessidades regionais de saúde, ao mesmo tempo que fortalece sua presença no mercado de frascos farmacêuticos do Oriente Médio e da África.

- Em março de 2024, a Gerresheimer AG, empresa alemã de embalagens farmacêuticas, lançou na Arábia Saudita uma nova linha automatizada de envase de frascos para produtos biológicos e medicamentos injetáveis. O sistema avançado aumenta a eficiência da produção, garante a esterilidade e permite a rápida expansão da fabricação de vacinas e medicamentos. Esse desenvolvimento destaca a dedicação da Gerresheimer à inovação em embalagens farmacêuticas e seu papel no fortalecimento da infraestrutura de saúde regional.

- Em março de 2024, o Grupo Stevanato implementou com sucesso um sistema de inspeção e serialização de última geração em sua unidade egípcia, visando aprimorar o controle de qualidade e a conformidade regulatória de frascos farmacêuticos. Essa iniciativa utiliza soluções avançadas de automação e rastreabilidade digital para garantir a segurança e a integridade do produto, refletindo o compromisso do Grupo Stevanato em fornecer soluções de embalagem de alta qualidade na região do Oriente Médio e da África.

- Em fevereiro de 2024, a Catalent, Inc., líder global no fornecimento de soluções para o desenvolvimento e fabricação de medicamentos, firmou parceria com empresas farmacêuticas locais na África do Sul para expandir a produção de frascos para vacinas e terapias injetáveis. A colaboração visa aprimorar as capacidades de fabricação locais, melhorar a resiliência da cadeia de suprimentos e fornecer acesso confiável a medicamentos essenciais, reforçando o foco da Catalent em inovação e eficiência operacional no mercado farmacêutico regional.

- Em janeiro de 2024, a Vetter Pharma International GmbH lançou em Israel uma linha de envase e selagem de frascos totalmente automatizada, capaz de lidar com a produção em larga escala de medicamentos injetáveis estéreis. O sistema integra controle de qualidade avançado, monitoramento em tempo real e processos em conformidade com as normas regulatórias, demonstrando o compromisso da Vetter Pharma em combinar inovação tecnológica com excelência operacional para atender às crescentes demandas do mercado de frascos farmacêuticos do Oriente Médio e da África.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.