Middle East And Africa Omega 3 For Food Application Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

43.26 Million

USD

80.86 Million

2025

2033

USD

43.26 Million

USD

80.86 Million

2025

2033

| 2026 –2033 | |

| USD 43.26 Million | |

| USD 80.86 Million | |

|

|

|

|

Segmentação do mercado de ômega-3 para aplicações alimentares no Oriente Médio e África, por tipo ( ácido alfa-linolênico (ALA), ácido eicosapentaenoico (EPA), ácido docosahexaenoico (DHA) e ácido eicosapentaenoico (EPA) + ácido docosahexaenoico (DHA)), fonte (de origem marinha, de algas e de origem vegetal), forma (óleo e pó), aplicação ( alimentos funcionais , produtos de confeitaria e chocolate, nutrição esportiva, suplementos alimentares , fórmulas infantis e outros), função (fortificação de alimentos, saúde óssea e articular, saúde da pele, saúde capilar, saúde das unhas e outras) - Tendências e previsões do setor até 2033.

Qual é o tamanho e a taxa de crescimento do mercado de ômega-3 para aplicações alimentares no Oriente Médio e na África?

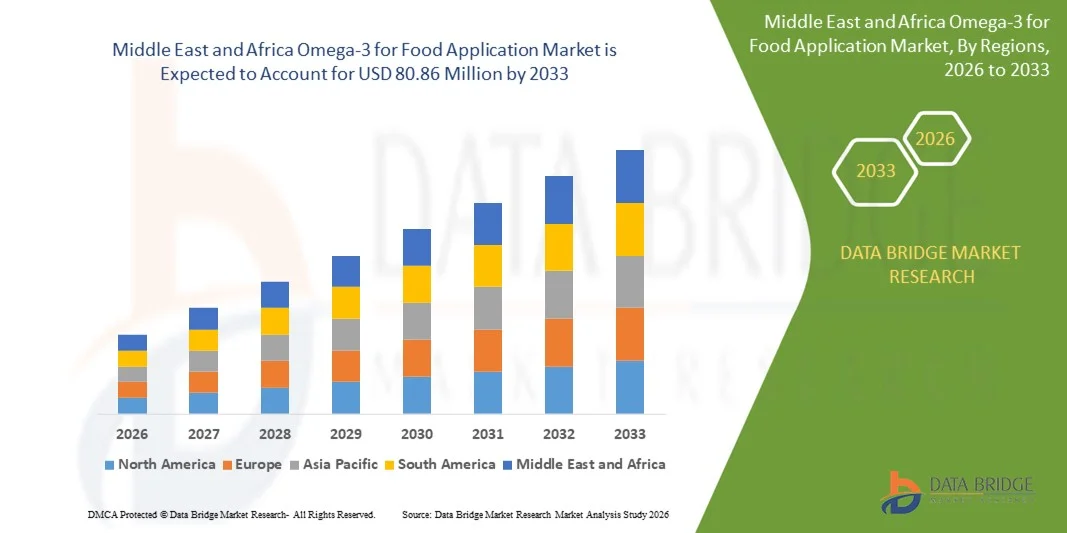

- O mercado de ômega-3 para aplicação alimentar no Oriente Médio e na África foi avaliado em US$ 43,26 milhões em 2025 e deverá atingir US$ 80,86 milhões até 2033 , com uma taxa de crescimento anual composta (CAGR) de 8,0% durante o período de previsão.

- A crescente demanda do consumidor por alimentos funcionais, fortificados e focados na saúde está impulsionando o crescimento do mercado de ômega-3 para aplicações alimentares. A maior conscientização sobre os benefícios dos ácidos graxos ômega-3 para a saúde cardiovascular, o suporte cognitivo e a ação anti-inflamatória está incentivando os fabricantes a incorporar esses ingredientes em produtos de panificação, laticínios, bebidas e snacks.

- A crescente preferência por produtos alimentares naturais e orgânicos, aliada às preocupações com o consumo de açúcar, a obesidade e a diabetes, está a impulsionar ainda mais a adoção de alimentos fortificados com ómega-3. Benefícios funcionais como ação anti-inflamatória, cardioprotetora e suporte à saúde cerebral estão a reforçar o seu apelo de mercado no Médio Oriente e em África.

Quais são os principais destaques do mercado de ômega-3 para aplicações alimentares?

- A crescente preocupação dos consumidores com a saúde, o aumento da renda disponível e a evolução das preferências alimentares são fatores-chave que impactam positivamente o mercado de ômega-3 para aplicações alimentares. Além disso, inovações de produtos e novas estratégias de formulação representam oportunidades lucrativas para os participantes do mercado.

- O alto custo dos ingredientes ômega-3 em comparação com as alternativas convencionais, aliado à presença de opções de fortificação artificial mais baratas, pode dificultar o crescimento. A baixa conscientização do consumidor em regiões emergentes sobre os benefícios do ômega-3 para a saúde deverá representar um desafio para a adoção em larga escala.

- Apesar dos desafios, espera-se que os investimentos contínuos em P&D, a diversificação de produtos e as iniciativas de marketing sustentem o crescimento a longo prazo do mercado de ômega-3 para aplicações alimentares no Oriente Médio e na África.

- A Arábia Saudita dominou o mercado de ômega-3 para aplicações alimentares no Oriente Médio e na África, com uma participação de 41,2% na receita em 2025, impulsionada pela crescente conscientização do consumidor sobre saúde cardiovascular, desenvolvimento cerebral e nutrição preventiva em países-chave como Arábia Saudita, África do Sul e Egito.

- Prevê-se que a África do Sul registre a taxa de crescimento anual composta (CAGR) mais rápida, de 9,64%, entre 2026 e 2033, impulsionada pela crescente conscientização sobre saúde cardiovascular, função cognitiva e suplementação alimentar. Bebidas enriquecidas com ômega-3, laticínios e lanches fortificados estão ganhando popularidade.

- O segmento de DHA dominou o mercado com uma participação de 51,6% na receita em 2025, impulsionado por seu uso extensivo em fórmulas infantis, laticínios fortificados, bebidas para a saúde cerebral e suplementos nutricionais.

Escopo do relatório e segmentação do mercado de ômega-3 para aplicações alimentares.

|

Atributos |

Ômega-3 para Aplicação Alimentar: Principais Análises de Mercado |

|

Segmentos abrangidos |

|

|

Países abrangidos |

Oriente Médio e África

|

|

Principais participantes do mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor agregado |

Além das informações sobre cenários de mercado, como valor de mercado, taxa de crescimento, segmentação, cobertura geográfica e principais participantes, os relatórios de mercado elaborados pela Data Bridge Market Research também incluem análises aprofundadas de especialistas, análises de preços, análises de participação de marcas, pesquisas com consumidores, análises demográficas, análises da cadeia de suprimentos, análises da cadeia de valor, visão geral de matérias-primas/insumos, critérios de seleção de fornecedores, análise PESTLE, análise de Porter e estrutura regulatória. |

Qual é a principal tendência no mercado de ômega-3 para aplicações alimentares?

Crescente demanda por ingredientes alimentares enriquecidos com nutrientes e múltiplos ômega-3.

- O mercado de ômega-3 para aplicações alimentares está testemunhando um crescimento significativo em direção a formulações enriquecidas com nutrientes, multifuncionais e com rótulo limpo, incluindo misturas com óleos vegetais, extratos de algas e fibras alimentares para melhorar o valor nutricional, o sabor e os benefícios funcionais.

- Os fabricantes estão desenvolvendo soluções multifuncionais de ômega-3 que promovem a saúde cardiovascular, a função cognitiva, possuem propriedades anti-inflamatórias e oferecem aplicações mais amplas em produtos de panificação, laticínios, bebidas e nutrição infantil.

- Os consumidores estão cada vez mais buscando ingredientes ômega-3 naturais, seguros e funcionais em vez de alternativas sintéticas, impulsionando a adoção em categorias de alimentos, bebidas e nutracêuticos.

- Por exemplo, empresas como DSM, BASF, Croda, ADM e Aker BioMarine expandiram seus portfólios de produtos ômega-3, introduzindo óleos microencapsulados, em pó e misturados, adequados para alimentos e bebidas fortificados.

- A crescente conscientização sobre saúde cardiovascular, nutrição infantil e consumo de produtos com rótulo limpo está acelerando a adoção dessas práticas nos mercados do Oriente Médio e da África.

- Com o crescente foco do consumidor em saúde, funcionalidade e ingredientes naturais, espera-se que o ômega-3 para aplicações alimentares continue sendo fundamental para a inovação de produtos nas indústrias alimentícia e nutracêutica.

Quais são os principais fatores que impulsionam o mercado de ômega-3 para aplicações alimentares?

- A crescente demanda por ingredientes funcionais de ômega-3 de origem vegetal e marinha está impulsionando a forte adoção do ômega-3 em aplicações alimentares no Oriente Médio e na África.

- Por exemplo, em 2025, a DSM, a BASF e a Croda expandiram a linha de produtos de ômega-3 microencapsulados e em pó para aplicações em laticínios fortificados, bebidas e nutrição infantil.

- A crescente conscientização sobre saúde cardiovascular, desenvolvimento cerebral infantil, benefícios anti-inflamatórios e suporte cognitivo está impulsionando a demanda nos EUA, Oriente Médio e África.

- Os avanços nas técnicas de microencapsulação, extração e mistura melhoraram a estabilidade, a camuflagem do sabor e a versatilidade de aplicação em uma ampla gama de alimentos.

- A crescente preferência por produtos alimentícios orgânicos, não transgênicos e com rótulos limpos impulsiona ainda mais a expansão do mercado, motivada por consumidores preocupados com a saúde e o meio ambiente.

- Com pesquisa e desenvolvimento contínuos, lançamentos de novos produtos, colaborações e expansão da distribuição no Oriente Médio e na África, espera-se que o mercado de ômega-3 para aplicações alimentares mantenha um forte crescimento durante o período de previsão.

Qual fator está dificultando o crescimento do mercado de ômega-3 para aplicações alimentares?

- Os elevados custos de extração, purificação e estabilização associados aos óleos ômega-3 de origem marinha e vegetal limitam a sua acessibilidade em regiões sensíveis a preços.

- Por exemplo, durante o período de 2024–2025, as flutuações na produção de óleo de peixe e algas, na disponibilidade de matéria-prima e nos custos de energia impactaram os volumes de produção de diversas empresas.

- Requisitos regulamentares rigorosos para aprovações de novos alimentos, segurança alimentar e conformidade com a rotulagem adicionam complexidades operacionais.

- O baixo nível de conhecimento dos consumidores em mercados emergentes sobre os benefícios do ômega-3, incluindo suporte cardiovascular, cognitivo e nutricional infantil, restringe a sua adoção.

- A concorrência de alternativas mais baratas, como o óleo de linhaça, o óleo de chia e outros óleos vegetais, exerce pressão sobre os preços e a diferenciação.

- As empresas estão enfrentando esses desafios concentrando-se na extração com custo-benefício, formulações estáveis, conformidade regulatória e educação do consumidor para expandir a adoção de ômega-3 de alta qualidade para aplicações alimentares no Oriente Médio e na África.

Como está segmentado o mercado de ômega-3 para aplicações alimentares?

O mercado está segmentado com base no tipo, origem, forma, aplicações e função .

- Por tipo

O mercado de ômega-3 para aplicações alimentares é segmentado em ácido alfa-linolênico (ALA), ácido eicosapentaenoico (EPA), ácido docosahexaenoico (DHA) e EPA+DHA. O segmento de DHA dominou o mercado com uma participação de 51,6% da receita em 2025, impulsionado por seu amplo uso em fórmulas infantis, laticínios fortificados, bebidas para a saúde cerebral e suplementos nutricionais. O DHA é amplamente preferido devido aos seus benefícios comprovados para o desenvolvimento cognitivo, saúde ocular e suporte neurológico. Sua alta estabilidade em formatos microencapsulados e compatibilidade com formulações de panificação, bebidas e em pó ampliam ainda mais a adoção industrial.

Prevê-se que o segmento EPA+DHA apresente o crescimento anual composto mais rápido entre 2026 e 2033, impulsionado pela crescente demanda por misturas sinérgicas em alimentos funcionais para a saúde cardiovascular, nutrição esportiva e formulações anti-inflamatórias. A crescente conscientização sobre nutrição preventiva, o aumento da incidência de doenças cardiovasculares e a inovação de produtos a partir de fontes marinhas e de algas continuarão a acelerar a demanda nos mercados do Oriente Médio e da África.

- Por Fonte

O mercado de ômega-3 para aplicações alimentares é segmentado em ômega-3 de origem marinha, de origem vegetal e de origem em algas. O segmento de origem marinha detinha a maior participação, com 58,3% em 2025, impulsionado pela forte disponibilidade de óleo de peixe, óleo de krill e triglicerídeos marinhos concentrados, utilizados em bebidas fortificadas, laticínios, pastas para barrar e suplementos alimentares. Os ômega-3 de origem marinha continuam sendo a fonte mais consolidada devido ao alto teor de EPA e DHA e à ampla aceitação regulatória nas indústrias alimentícias do Oriente Médio e da África.

O segmento de produtos à base de algas deverá registrar a taxa de crescimento anual composta (CAGR) mais rápida de 2026 a 2033, impulsionado pela crescente preferência por alternativas de origem vegetal, sustentáveis, não transgênicas e veganas, adequadas para fórmulas infantis, bebidas funcionais, alimentos com rótulo limpo e produtos nutricionais premium. Investimentos crescentes em fermentação de microalgas, produção com custo-benefício e sustentabilidade ambiental fortalecem ainda mais a adoção nos EUA, Oriente Médio e África.

- Por formulário

O mercado está segmentado em óleos e pós. O segmento de óleos dominou o mercado com uma participação de 67,2% da receita em 2025, devido à sua alta utilização em bebidas fortificadas, laticínios, fórmulas infantis e aplicações culinárias. Os óleos oferecem absorção superior, altos níveis de pureza e maior aplicabilidade em sistemas alimentares tradicionais. Os óleos ômega-3 de origem marinha e de algas continuam sendo o padrão da indústria para fortificação com EPA e DHA, principalmente em alimentos premium e nutracêuticos.

Prevê-se que o segmento de ômega-3 em pó apresente o crescimento mais rápido entre 2026 e 2033, impulsionado pela crescente adoção em produtos de panificação, gomas, confeitaria, misturas secas, substitutos de refeição e bebidas em pó. O ômega-3 em pó oferece maior estabilidade, mascaramento de sabor, maior prazo de validade e facilidade de mistura, tornando-o ideal para uso industrial em larga escala e para fabricantes de alimentos à base de plantas.

- Por meio de aplicativos

O mercado de ômega-3 para aplicações alimentares é segmentado em alimentos funcionais, produtos de confeitaria e chocolate, nutrição esportiva, suplementos alimentares, fórmulas infantis e outros. O segmento de alimentos funcionais liderou o mercado com uma participação de 36,4% da receita em 2025, impulsionado pela crescente demanda por alimentos que promovem a saúde cardiovascular, bebidas que estimulam a função cerebral, alternativas lácteas fortificadas, pastas para barrar, cereais e barras de cereais. A crescente preferência do consumidor por nutrição preventiva e baseada em estilo de vida sustenta a expansão contínua do mercado.

Prevê-se que o segmento de Nutrição Esportiva apresente o crescimento anual composto mais rápido entre 2026 e 2033, devido ao crescente interesse nos benefícios anti-inflamatórios, na recuperação muscular, na melhoria da resistência e no suporte à saúde articular. O aumento do consumo de proteínas em pó, géis, bebidas hidratantes e alimentos de desempenho enriquecidos com ômega-3 está impulsionando o rápido crescimento na América do Norte, Oriente Médio e África.

- Por função

O mercado está segmentado em Fortificação de Alimentos, Saúde Óssea e Articular, Saúde da Pele, Saúde Capilar, Saúde das Unhas e Outros. O segmento de Fortificação de Alimentos dominou o mercado com uma participação de 44,8% da receita em 2025, impulsionado pela crescente incorporação de ômega-3 em laticínios, bebidas, produtos de panificação, fórmulas infantis, cereais e snacks nutricionais. O crescente foco governamental no aprimoramento nutricional, em formulações com rótulos limpos e em saúde preventiva impulsiona a ampla adoção industrial.

Prevê-se que o segmento de Saúde da Pele apresente o crescimento anual composto mais rápido entre 2026 e 2033, impulsionado pela crescente demanda por produtos que promovem a beleza de dentro para fora, alimentos funcionais antienvelhecimento, misturas de colágeno e nutrição com respaldo dermatológico. O papel do Ômega-3 na hidratação, redução da inflamação e reparação da barreira cutânea acelera sua integração em snacks, bebidas e confeitaria funcionais fortificados.

Qual região detém a maior participação no mercado de ômega-3 para aplicações alimentares?

- A Arábia Saudita dominou o mercado de ômega-3 para aplicações alimentares no Oriente Médio e na África, com uma participação de 41,2% na receita em 2025, impulsionada pela crescente conscientização do consumidor sobre saúde cardiovascular, desenvolvimento cerebral e nutrição preventiva em países-chave como Arábia Saudita, África do Sul e Egito.

- A forte adoção de alimentos fortificados, suplementos alimentares, bebidas funcionais e nutrição infantil impulsiona a inclusão de ômega-3 em laticínios, cereais, barras de cereais e formulações de nutrição esportiva.

- O aumento da renda disponível, a urbanização e a expansão do varejo organizado e dos canais de comércio eletrônico continuam a acelerar a adoção em diversas categorias de alimentos.

Análise de mercado de ômega-3 para aplicações alimentares nos Emirados Árabes Unidos

Os Emirados Árabes Unidos demonstram um crescimento constante devido à forte demanda por alimentos fortificados premium, bebidas funcionais e nutrição infantil. A alta renda disponível, o estilo de vida urbano e o crescente interesse em saúde preventiva estão impulsionando a integração do ômega-3 em bebidas lácteas, barras nutricionais e bebidas prontas para consumo. A inovação contínua em sabor, estabilidade e biodisponibilidade dos produtos está contribuindo para uma ampla penetração no mercado.

Análise de mercado de ômega-3 para aplicações alimentares na África do Sul

Prevê-se que a África do Sul registre a taxa de crescimento anual composta (CAGR) mais rápida, de 9,64%, entre 2026 e 2033, impulsionada pela crescente conscientização sobre saúde cardiovascular, função cognitiva e suplementação alimentar. Bebidas enriquecidas com ômega-3, laticínios e snacks fortificados estão ganhando popularidade. A expansão das plataformas de comércio eletrônico, a disponibilidade no varejo e o foco do consumidor em ingredientes naturais e com rótulo limpo contribuem para a rápida adoção em regiões urbanas e semiurbanas.

Análise de mercado de ômega-3 para aplicações alimentares no Egito

O Egito contribui significativamente para o crescimento regional, impulsionado pelo crescente interesse em nutrição funcional, fórmulas infantis e alimentos fortificados. A crescente preocupação com a saúde, a demanda por suporte cognitivo e cardiovascular e a adoção de suplementos alimentares estão incentivando um maior consumo de ômega-3. Os fabricantes estão enfatizando soluções de EPA e DHA à base de plantas e algas, perfis de sabor aprimorados e conformidade com os padrões de segurança e qualidade alimentar para expandir seu alcance de mercado.

Quais são as principais empresas no mercado de ômega-3 para aplicações alimentares?

O setor de ômega-3 para aplicações alimentares é liderado principalmente por empresas consolidadas, incluindo:

- DSM (Países Baixos)

- BASF SE (Alemanha)

- Croda International Plc (Reino Unido)

- Aker BioMarine (Noruega)

- ADM (Archer Daniels Midland Company) (EUA)

- Cellana Inc. (EUA)

- HUTAI Biopharm Resource Co. Ltd (China)

- AlaskaOmega (EUA)

- KinOmega Biopharm Inc. (EUA)

- Pharma Marine AS (Noruega)

- GC Rieber VivoMega AS (Noruega)

- Sanmark LLC (EUA)

- Arjuna Natural Pvt Ltd (Índia)

- ConnOils LLC (EUA)

- Kingdomway Nutrition, Inc. (China)

- Polaris Inc. (EUA)

- Biosearch Life (Espanha)

Quais são os desenvolvimentos recentes no mercado de ômega-3 para aplicações alimentares no Oriente Médio e na África?

- Em março de 2025, a Natac lançou seu produto Omega-3 Star, fabricado com óleo de peixe de alta qualidade e formulado para aplicações nas indústrias alimentícia, nutracêutica e de nutrição animal. Este lançamento fortalece a posição da empresa no crescente mercado de soluções de ômega-3.

- Em outubro de 2023, a dsm-firmenich lançou o life's OMEGA O3020 no mercado norte-americano, apresentando o primeiro ômega-3 de origem algal de fonte única que corresponde à proporção natural de EPA para DHA do óleo de peixe padrão, oferecendo, ao mesmo tempo, eficácia superior. Espera-se que este produto acelere a adoção de alternativas de ômega-3 à base de plantas.

- Em maio de 2023, a Nuseed Oriente Médio e África lançou o Nuseed Nutriterra, um óleo vegetal enriquecido com ômega-3, desenvolvido especificamente para atender às necessidades em constante evolução dos setores de nutrição humana e suplementos alimentares. Essa inovação amplia a disponibilidade de fontes sustentáveis de ômega-3 não marinhas.

- Em março de 2023, a Epax investiu US$ 40 milhões em tecnologias de destilação molecular com o objetivo de aprimorar a produção e a pureza de ingredientes ômega-3 altamente concentrados. Esse investimento reforça o compromisso da empresa com o desenvolvimento de soluções de ômega-3 de alta qualidade.

- Em outubro de 2022, a Nature's Bounty lançou um novo suplemento alimentar de ômega-3 à base de plantas, formulado com 1.000 mg de óleo de algas vegetal para promover a saúde do coração, das articulações e da pele. O lançamento deste produto destaca a crescente demanda dos consumidores por opções de ômega-3 com rótulo limpo e veganas.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.