Middle East And Africa Oil Field Specialty Chemicals Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

192.61 Million

USD

273.92 Million

2025

2033

USD

192.61 Million

USD

273.92 Million

2025

2033

| 2026 –2033 | |

| USD 192.61 Million | |

| USD 273.92 Million | |

|

|

|

|

Segmentação do mercado de especialidades químicas para campos petrolíferos no Oriente Médio e na África, por tipo ( surfactantesdesemulsificantes , inibidores, biocidas , aditivos, ácidos, deformantes, polímeros, redutores de atrito, emulsificantes, agentes de controle de ferro, dispersantes, viscosificantes, agentes umectantes, retardadores e outros), localização (em terra e no mar), aplicação (perfuração, estimulação, produção, recuperação avançada de petróleo (EOR), cimentação, intervenção e completação de poços e outros) - Tendências e previsões do setor até 2032.

Qual é o tamanho e a taxa de crescimento do mercado de produtos químicos especiais para campos petrolíferos no Oriente Médio e na África?

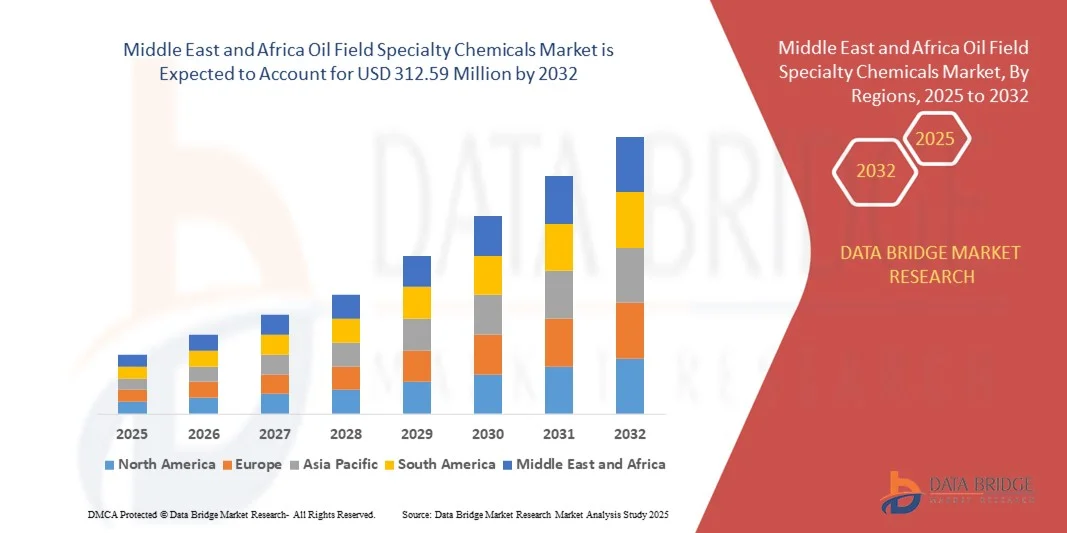

- O mercado de especialidades químicas para campos petrolíferos no Oriente Médio e na África foi avaliado em US$ 219,81 milhões em 2024 e deverá atingir US$ 312,59 milhões até 2032 , com uma taxa de crescimento anual composta (CAGR) de 4,5% durante o período de previsão.

- Os principais fatores que impulsionam o crescimento do mercado incluem o aumento da demanda da indústria da construção civil no Oriente Médio, na África e globalmente. Além disso, a adoção de sistemas de revestimento ecologicamente corretos para prevenir a corrosão e a ferrugem em peças metálicas, como cercas, tanques, radiadores e móveis de metal, deverá contribuir significativamente para a expansão do mercado.

- A crescente necessidade de revestimentos de alto desempenho, duráveis e ecologicamente corretos, que ofereçam estética aprimorada e confiabilidade a longo prazo, deverá impulsionar ainda mais o crescimento do mercado de produtos químicos especiais para campos petrolíferos.

Quais são os principais pontos a serem destacados no mercado de produtos químicos especiais para campos petrolíferos?

- Prevê-se que regulamentações governamentais rigorosas que limitam o uso de certos produtos químicos emissores de COVs (Compostos Orgânicos Voláteis) restrinjam o crescimento do mercado durante o período de previsão.

- Os investimentos em economias emergentes e a crescente adoção de soluções de revestimento ecológicas devem proporcionar oportunidades de crescimento. No entanto, as preocupações ambientais persistentes e os desafios de sustentabilidade podem impedir a expansão do mercado no curto prazo.

- A Arábia Saudita dominou o mercado de especialidades químicas para campos petrolíferos no Oriente Médio e na África, com a maior participação de receita, de 38,7% em 2024, impulsionada por investimentos substanciais em operações de exploração e produção e refino de petróleo e gás.

- O mercado de especialidades químicas para campos petrolíferos nos Emirados Árabes Unidos está experimentando um crescimento robusto, com uma taxa de crescimento anual composta (CAGR) de 10,2%, impulsionado por projetos de grande escala em campos petrolíferos e investimentos em técnicas de recuperação avançada de petróleo (EOR). A demanda é particularmente forte em operações de perfuração offshore e petroquímicas, onde aditivos de alto desempenho, redutores de atrito e desemulsificantes são essenciais.

- O segmento de surfactantes dominou o mercado com uma participação de 28,5% na receita em 2024, impulsionado por seu papel crucial na redução da tensão interfacial, no aumento da recuperação de petróleo e na estabilização de emulsões nos processos de perfuração e produção.

Escopo do relatório e segmentação do mercado de produtos químicos especiais para campos petrolíferos

|

Atributos |

Principais informações de mercado sobre produtos químicos especiais para campos petrolíferos |

|

Segmentos abrangidos |

|

|

Países abrangidos |

Oriente Médio e África

|

|

Principais participantes do mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor agregado |

Além das informações sobre cenários de mercado, como valor de mercado, taxa de crescimento, segmentação, cobertura geográfica e principais participantes, os relatórios de mercado elaborados pela Data Bridge Market Research também incluem análises aprofundadas de especialistas, análises de preços, análises de participação de marcas, pesquisas com consumidores, análises demográficas, análises da cadeia de suprimentos, análises da cadeia de valor, visão geral de matérias-primas/insumos, critérios de seleção de fornecedores, análise PESTLE, análise de Porter e estrutura regulatória. |

Qual é a principal tendência no mercado de produtos químicos especiais para campos petrolíferos?

Liderança em Sustentabilidade e Conformidade Ambiental

- Uma tendência proeminente no mercado de especialidades químicas para campos petrolíferos no Oriente Médio e na África é a adoção acelerada de formulações químicas ecológicas, com baixo teor de COVs (Compostos Orgânicos Voláteis) e de base biológica, impulsionada por regulamentações ambientais rigorosas e metas de sustentabilidade em toda a região. Os fabricantes estão implementando cada vez mais revestimentos à base de água e em pó para reduzir as emissões de carbono e o impacto ambiental.

- Empresas como a BASF SE (Alemanha) e a Akzo Nobel NV (Países Baixos) estão na vanguarda com soluções químicas baseadas em matérias-primas recicláveis, energeticamente eficientes e renováveis, refletindo o forte compromisso do Oriente Médio e da África com a economia circular.

- As inovações em nanotecnologia e revestimentos inteligentes estão aprimorando o desempenho, incluindo maior estabilidade química, resistência aos raios UV e propriedades de autolimpeza, garantindo, ao mesmo tempo, a conformidade com os padrões ambientais.

- Os marcos regulatórios no Oriente Médio e na União Africana, incluindo limites de emissão de COVs e metas de neutralidade de carbono, estão impulsionando a adoção de especialidades químicas verdes e sustentáveis em diversos setores.

- Essa tendência está incentivando o investimento em biorresinas, aglutinantes renováveis e alternativas de baixo carbono, consolidando o Oriente Médio e a África como líderes globais em soluções químicas sustentáveis.

- A preferência do consumidor por produtos ambientalmente responsáveis e os compromissos corporativos com certificações como LEED e BREEAM estão estimulando ainda mais a demanda por produtos químicos especiais sustentáveis para campos petrolíferos no Oriente Médio e na África.

Quais são os principais fatores que impulsionam o mercado de produtos químicos especiais para campos petrolíferos?

- A expansão de projetos de construção e infraestrutura sustentáveis no Oriente Médio e na África está impulsionando a demanda por produtos químicos especiais de proteção, decoração e durabilidade.

- Em 2024, a Sherwin-Williams expandiu sua linha de revestimentos com baixo teor de VOC na Alemanha, França e Reino Unido, atendendo a construtoras ecologicamente conscientes e reforçando a transição para soluções químicas sustentáveis.

- A rápida urbanização e o crescimento industrial em países como Alemanha, França e Reino Unido estão impulsionando o uso de revestimentos econômicos e resistentes às intempéries para aplicações industriais e comerciais.

- A crescente demanda por acabamentos premium e soluções químicas personalizadas para aplicações internas e externas está impulsionando a inovação e a diferenciação de produtos nos mercados do Oriente Médio e da África.

- Os avanços tecnológicos em formulações à base de água e curáveis por UV estão melhorando a eficiência da aplicação, o tempo de secagem e a conformidade com as normas, impulsionando ainda mais o crescimento do mercado.

Qual fator está desafiando o crescimento do mercado de produtos químicos especiais para campos petrolíferos?

- A flutuação dos custos das matérias-primas, particularmente do dióxido de titânio, das resinas e das matérias-primas renováveis, pressiona os custos de produção e as margens de lucro.

- Regulamentações ambientais rigorosas sobre revestimentos à base de solventes obrigam os fabricantes a adotar alternativas ecológicas de alto custo, impactando as estruturas de preços em geral.

- A disponibilidade limitada e os altos custos das matérias-primas sustentáveis, aliados à necessidade de processos de produção especializados, restringem a adoção em alguns mercados do Oriente Médio e da África.

- As incertezas econômicas e as flutuações na atividade da construção civil, devido à inflação ou à instabilidade do mercado imobiliário, restringem a demanda em países-chave do Oriente Médio e da África.

- Para superar esses desafios, os fabricantes do Oriente Médio e da África estão investindo em P&D, otimizando as cadeias de suprimentos e aprimorando as iniciativas de reciclagem para melhorar a sustentabilidade, a eficiência de custos e a resiliência do mercado a longo prazo.

Como é segmentado o mercado de produtos químicos especiais para campos petrolíferos?

O mercado está segmentado com base no tipo, localização e aplicação.

- Por tipo

Com base no tipo, o mercado de especialidades químicas para campos petrolíferos é segmentado em surfactantes, desemulsificantes, inibidores, biocidas, aditivos, ácidos, deformantes, polímeros, redutores de atrito, emulsificantes, agentes de controle de ferro, dispersantes, viscosificantes, agentes umectantes, retardadores e outros. O segmento de surfactantes dominou o mercado com uma participação de 28,5% da receita em 2024, impulsionado por seu papel crucial na redução da tensão interfacial, no aumento da recuperação de petróleo e na estabilização de emulsões em processos de perfuração e produção. Os surfactantes são amplamente utilizados devido à sua versatilidade em diversas operações de campos petrolíferos, incluindo estimulação, cimentação e recuperação avançada de petróleo (EOR).

Prevê-se que o segmento de biocidas apresente a taxa de crescimento anual composta (CAGR) mais rápida, de 7,2%, durante o período de 2025 a 2032, impulsionado pela crescente necessidade de prevenir o crescimento microbiano em fluidos de campos petrolíferos, proteger equipamentos e manter a eficiência da produção. O aumento das regulamentações sobre contaminação microbiana em reservatórios e dutos fortalece ainda mais a demanda global por biocidas de alto desempenho.

- Por localização

Com base na localização, o mercado de especialidades químicas para campos petrolíferos é segmentado em onshore e offshore. O segmento onshore dominou o mercado com uma participação de 62,3% da receita em 2024, impulsionado pelo maior número de campos petrolíferos em terra, facilidade logística e custos operacionais relativamente menores. As operações onshore dependem fortemente de especialidades químicas para perfuração, estimulação e produção, o que gera uma demanda constante.

Prevê-se que o segmento Offshore apresente a taxa de crescimento anual composta (CAGR) mais rápida, de 6,8%, durante o período de 2025 a 2032, impulsionado pelo aumento das atividades de exploração em águas profundas e ultraprofundas, pelos avanços tecnológicos na extração offshore e pela necessidade de inibidores de corrosão, produtos químicos para controle de incrustações e fluidos de recuperação aprimorada de petróleo para manter a eficiência operacional em ambientes marinhos agressivos.

- Por meio de aplicação

Com base na aplicação, o mercado de especialidades químicas para campos petrolíferos é segmentado em Perfuração, Estimulação, Produção, Recuperação Avançada de Petróleo (EOR), Cimentação, Intervenção e Completação e Outros. O segmento de Produção dominou o mercado com uma participação de receita de 31,7% em 2024, devido ao uso contínuo de produtos químicos para otimizar a extração, melhorar o fluxo e prolongar a vida útil dos equipamentos em poços existentes. Os produtos químicos utilizados na produção, como inibidores de corrosão, inibidores de incrustação e desemulsificantes, são essenciais para maximizar a produção e a eficiência operacional.

Prevê-se que o segmento de recuperação avançada de petróleo (EOR) apresente a taxa de crescimento anual composta (CAGR) mais rápida, de 7,5%, durante o período de 2025 a 2032, impulsionado pelos crescentes desafios de esgotamento dos campos petrolíferos e pela adoção de técnicas avançadas de injeção de produtos químicos. O foco crescente na maximização das taxas de recuperação e na melhoria do desempenho dos reservatórios está impulsionando a adoção de produtos químicos para EOR em campos petrolíferos maduros e em processo de envelhecimento em todo o mundo.

Qual região detém a maior participação no mercado de produtos químicos especiais para campos petrolíferos?

- A Arábia Saudita dominou o mercado de especialidades químicas para campos petrolíferos no Oriente Médio e na África, com a maior participação de receita, de 38,7% em 2024, impulsionada por investimentos substanciais em operações de exploração e produção e refino de petróleo e gás.

- O foco do país na expansão da capacidade de produção de petróleo, aliado às iniciativas governamentais para modernizar refinarias e plantas petroquímicas, está impulsionando a demanda por produtos químicos especiais. Fabricantes locais e internacionais, como a SABIC (Arábia Saudita) e a Clariant (Suíça), estão inovando em surfactantes, biocidas e inibidores de corrosão para aumentar a eficiência e a sustentabilidade.

- As iniciativas em curso da Visão 2030 da Arábia Saudita, com ênfase na diversificação industrial e em pesquisa e desenvolvimento tecnológico, consolidam sua posição como um centro regional para inovação e crescimento das exportações de produtos químicos especiais para campos petrolíferos no Oriente Médio e na África.

Análise do Mercado de Produtos Químicos Especiais para Campos Petrolíferos nos Emirados Árabes Unidos

O mercado de especialidades químicas para campos petrolíferos nos Emirados Árabes Unidos está experimentando um crescimento robusto, com uma taxa de crescimento anual composta (CAGR) de 10,2%, impulsionado por projetos de grande escala e investimentos em técnicas de recuperação aprimorada de petróleo (EOR). A demanda é particularmente forte em operações de perfuração offshore e petroquímicas, onde aditivos de alto desempenho, redutores de atrito e desemulsificantes são essenciais. Zonas industriais e zonas francas apoiadas pelo governo estão atraindo fabricantes multinacionais de produtos químicos, fomentando a inovação em formulações ambientalmente compatíveis e de alta eficiência. A localização estratégica e a infraestrutura logística dos Emirados Árabes Unidos também contribuem para a expansão do mercado em toda a região.

Análise do Mercado de Produtos Químicos Especiais para Campos Petrolíferos na Nigéria

O mercado de especialidades químicas para campos petrolíferos na Nigéria está em constante expansão, impulsionado pelo crescimento das atividades de exploração e produção de petróleo na região do Delta do Níger. A crescente demanda por inibidores, biocidas e polímeros para aumentar a eficiência da produção está impulsionando a adoção do mercado. Os incentivos governamentais para o desenvolvimento de conteúdo local, combinados com os investimentos contínuos em infraestrutura de refino e dutos, estão criando oportunidades para os fabricantes. A Nigéria está emergindo como um mercado-chave na África Ocidental para soluções químicas de alto desempenho e custo-benefício para campos petrolíferos.

Análise do Mercado de Produtos Químicos Especiais para Campos Petrolíferos no Egito

O mercado egípcio de especialidades químicas para campos petrolíferos deverá crescer a uma taxa composta de crescimento anual (CAGR) de 9,1%, impulsionado pelo aumento da exploração de petróleo e gás no Deserto Ocidental e nas bacias offshore do Mediterrâneo. Especialidades químicas, incluindo surfactantes, desemulsificantes e modificadores de viscosidade, são muito procuradas para aplicações de perfuração e produção. O apoio regulatório do Egito ao uso sustentável e eficiente de produtos químicos, juntamente com o crescente investimento estrangeiro direto em infraestrutura de petróleo e gás, está impulsionando o crescimento do mercado. O país está se posicionando como um centro regional de fabricação e distribuição de produtos químicos para campos petrolíferos no Norte da África.

Análise do Mercado de Produtos Químicos Especiais para Campos Petrolíferos na Argélia

O mercado de especialidades químicas para campos petrolíferos na Argélia deverá expandir-se de forma consistente, com uma taxa de crescimento anual composta (CAGR) de 8,3% entre 2025 e 2032, impulsionado pela modernização dos campos de petróleo e gás e pelo crescente investimento em tecnologias de recuperação aprimorada de petróleo (EOR). O foco do governo na eficiência energética e no cumprimento das normas ambientais está acelerando a adoção de produtos químicos biodegradáveis e de baixa toxicidade. O aumento das atividades de exploração offshore e onshore está criando oportunidades para fornecedores de produtos químicos, com ênfase em aditivos de alto desempenho e inibidores de corrosão. A Argélia continua sendo um ator estratégico no cenário de especialidades químicas para campos petrolíferos no Norte da África.

Quais são as principais empresas no mercado de produtos químicos especiais para campos petrolíferos?

A indústria de especialidades químicas para campos petrolíferos é liderada principalmente por empresas consolidadas, incluindo:

- BASF SE (Alemanha)

- Solvay (Bélgica)

- DOW (EUA)

- Empresa Baker Hughes (EUA)

- Clariant (Suíça)

- Evonik Industries AG (Alemanha)

- Kemira (Finlândia)

- Thermax Limited (Índia)

- Huntsman International LLC (EUA)

- Zirax (EUA)

- Innospec (EUA)

- Empresa Stepan (EUA)

- Chevron Phillips Chemical Company LLC (EUA)

- Kraton Corporation (EUA)

- Jiaxing Midas Oilfield Chemical Mfg Co., Ltd (China)

- Versalis SpA (Itália)

- Halliburton (EUA)

- Corporação Albemarle (EUA)

Quais são os desenvolvimentos recentes no mercado de produtos químicos especiais para campos petrolíferos no Oriente Médio e na África?

- Em outubro de 2023, a Lubrizol Corporation anunciou um novo acordo de distribuição com o IMCD Group, um dos principais distribuidores e desenvolvedores globais de especialidades químicas e ingredientes, com o objetivo de expandir seu alcance de mercado e fortalecer sua cadeia de suprimentos no setor de produtos químicos para campos petrolíferos, aprimorando, assim, a disponibilidade de serviços e produtos para clientes em todo o mundo.

- Em julho de 2022, a Solvay firmou uma parceria com o Bank of America para otimizar suas operações de vendas de produtos químicos para campos petrolíferos, uma medida estratégica que deverá fortalecer sua posição no mercado e melhorar a eficiência operacional em mercados globais, reforçando, em última análise, a vantagem competitiva da empresa.

- Em setembro de 2021, a Neftegas Limited (ENL), operadora do projeto de petróleo e gás Sakhalin-1, na Rússia, anunciou planos de investir US$ 5 bilhões nos próximos cinco anos para conter o declínio da produção de petróleo, demonstrando seu compromisso com a sustentabilidade da produção e o apoio à segurança energética de longo prazo na região.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.