Middle East And Africa Nut Oil Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

7.13 Billion

USD

13.69 Billion

2025

2033

USD

7.13 Billion

USD

13.69 Billion

2025

2033

| 2026 –2033 | |

| USD 7.13 Billion | |

| USD 13.69 Billion | |

|

|

|

|

Segmentação do mercado de óleos de nozes no Oriente Médio e na África, por tipo de produto (óleo de avelã, óleo de amêndoa, óleo de argan, óleo de macadâmia, óleo de marula, óleo de mongongo, óleo de noz-pecã, óleo de pistache, óleo de pinhão, óleo de noz e outros), uso final (processamento de alimentos, cosméticos e cuidados pessoais, aromaterapia, tintas e vernizes, produtos domésticos e outros), origem (orgânico e convencional), canal de distribuição (B2B e B2C), tipo de embalagem (potes, garrafas, sachês e outros) - Tendências e previsões do setor até 2033.

Qual é o tamanho e a taxa de crescimento do mercado de óleo de nozes no Oriente Médio e na África?

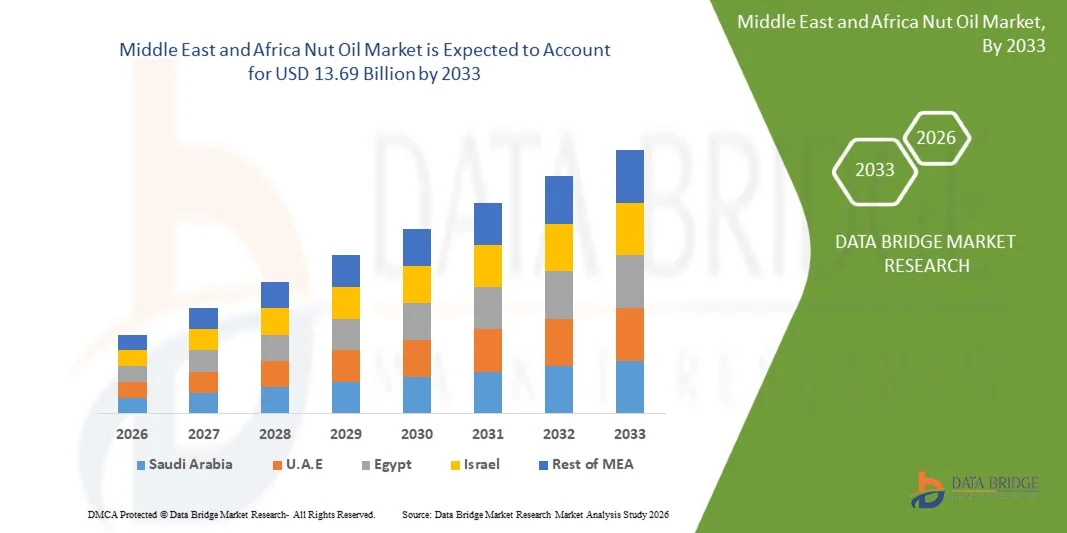

- O mercado de óleo de nozes no Oriente Médio e na África foi avaliado em US$ 7,13 bilhões em 2025 e deverá atingir US$ 13,69 bilhões até 2033 , com uma taxa de crescimento anual composta (CAGR) de 8,5% durante o período de previsão.

- O aumento da preocupação dos consumidores com a saúde, especialmente em relação à culinária saudável, é um fator crucial para o crescimento do mercado. Além disso, o aumento do uso de subprodutos do óleo de amendoim na indústria alimentícia, a crescente conscientização sobre os diversos benefícios dos óleos de nozes para a saúde, como o controle de peso e a melhora da saúde cardiovascular e óssea, e a presença de uma alta concentração de vitaminas e antioxidantes, são outros fatores importantes que impulsionam o mercado de óleos de nozes no Oriente Médio e na África. O uso do óleo de nozes como limpador, tônico facial, hidratante e sabonete líquido também são fatores importantes.

Quais são os principais destaques do mercado de óleo de nozes?

- O aumento da população vegana, o crescimento das atividades de pesquisa e desenvolvimento e a modernização dos novos produtos oferecidos no mercado criarão novas oportunidades para o mercado de óleos vegetais no Oriente Médio e na África.

- No entanto, o aumento dos problemas relacionados ao armazenamento de matérias-primas é o principal fator, entre outros, que atua como restritivo e representará um desafio adicional para o mercado de óleo de nozes do Oriente Médio e da África no período previsto.

- A Arábia Saudita dominou o mercado de óleos vegetais do Oriente Médio e da África, com uma participação de 32,4% na receita em 2025, impulsionada pelo forte consumo de óleos de amêndoa, argan e noz em alimentos, cosméticos e produtos de higiene pessoal.

- Prevê-se que a Índia registre a taxa de crescimento anual composta (CAGR) mais rápida, de 8,4%, entre 2026 e 2033, impulsionada pelo crescente consumo de óleos de amêndoa, argan e macadâmia em aplicações culinárias, de cuidados pessoais e de aromaterapia.

- O segmento de óleo de amêndoa dominou o mercado com uma participação de 29,4% na receita em 2025, devido ao seu alto valor nutricional, versatilidade em aplicações culinárias e popularidade em cosméticos e produtos para a pele.

Escopo do relatório e segmentação do mercado de óleo de nozes

|

Atributos |

Principais informações sobre o mercado de óleo de nozes |

|

Segmentos abrangidos |

|

|

Países abrangidos |

Oriente Médio e África

|

|

Principais participantes do mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor agregado |

Além das informações sobre cenários de mercado, como valor de mercado, taxa de crescimento, segmentação, cobertura geográfica e principais participantes, os relatórios de mercado elaborados pela Data Bridge Market Research também incluem análises aprofundadas de especialistas, análises de preços, análises de participação de marcas, pesquisas com consumidores, análises demográficas, análises da cadeia de suprimentos, análises da cadeia de valor, visão geral de matérias-primas/insumos, critérios de seleção de fornecedores, análise PESTLE, análise de Porter e estrutura regulatória. |

Qual é a principal tendência no mercado de óleos vegetais?

“ Crescente demanda por produtos de óleo de nozes sustentáveis e de alta qualidade ”

- O mercado de óleos vegetais está testemunhando uma tendência importante: a crescente adoção de óleos sustentáveis, de alta qualidade e ricos em nutrientes, derivados de nozes como amêndoas, nozes e macadâmia. Essa tendência é impulsionada pela crescente conscientização do consumidor em relação à saúde, bem-estar e produtos com rótulos limpos, principalmente na América do Norte e na Europa.

- Por exemplo, empresas como a Wilmar International, a ADM e a Cargill estão expandindo sua oferta de óleos de nozes prensados a frio e orgânicos para atender à crescente demanda por opções alimentares saudáveis para o coração e à base de plantas.

- A crescente preferência por óleos funcionais enriquecidos com antioxidantes, ácidos graxos ômega e vitaminas está acelerando a adoção pelo mercado.

- Os fabricantes estão integrando técnicas avançadas de extração, como prensagem a frio, processamento sem solventes e sistemas de alta pressão, para melhorar o rendimento, a qualidade e a vida útil do produto.

- O aumento dos investimentos em pesquisa e desenvolvimento para retenção de sabor, estabilidade nutricional e embalagens ecológicas está impulsionando a inovação de produtos.

- À medida que os consumidores continuam a priorizar o bem-estar, a sustentabilidade e os óleos comestíveis de alta qualidade, espera-se que os óleos de nozes premium permaneçam um foco central no cenário global de óleos comestíveis.

Quais são os principais fatores que impulsionam o mercado de óleo de nozes?

- A crescente ênfase dos consumidores na saúde cardiovascular, imunidade e dietas à base de plantas é um dos principais impulsionadores da expansão do mercado.

- Por exemplo, em 2025, a Wilmar International e a Cargill lançaram óleos de nozes premium prensados a frio e fortificados, direcionados a consumidores preocupados com a saúde em todo o mundo.

- A crescente conscientização sobre óleos orgânicos, não transgênicos e com rótulo limpo está impulsionando sua adoção na América do Norte, Europa, Oriente Médio e África.

- Os avanços tecnológicos na extração de óleo, filtração e preservação de nutrientes estão aprimorando a qualidade do produto e o seu apelo junto ao consumidor.

- A crescente integração de práticas de fornecimento sustentável, sistemas de rastreabilidade e embalagens ecológicas está fortalecendo o crescimento do mercado.

- Com investimentos contínuos em P&D, desenvolvimento de produtos funcionais e educação do consumidor, espera-se que o mercado de óleos vegetais mantenha um forte ritmo de crescimento nos próximos anos.

Que fator está desafiando o crescimento do mercado de óleo de nozes?

- Os elevados custos de produção associados à seleção de nozes premium, à extração por prensagem a frio e aos testes de qualidade limitam a acessibilidade, principalmente em mercados sensíveis a preços.

- Por exemplo, durante o período de 2024–2025, as flutuações nos preços das matérias-primas de nozes, nos custos de energia e nos componentes de embalagem afetaram os volumes de produção e os preços das principais empresas do setor.

- A conformidade com as normas regulamentares de segurança alimentar, rotulagem e certificações orgânicas aumenta a complexidade operacional e os custos.

- O baixo nível de conhecimento do consumidor em mercados emergentes sobre óleos de nozes funcionais e premium restringe a adoção em massa.

- A concorrência de óleos comestíveis tradicionais, óleos mistos e alternativas de baixo custo cria pressão sobre os preços e afeta a penetração no mercado.

- Para enfrentar esses desafios, as empresas estão se concentrando em fornecimento sustentável, métodos de extração com boa relação custo-benefício, linhas de produtos fortificadas e programas de educação do consumidor para oferecer óleos de nozes de alta qualidade, nutritivos e premium.

Como o mercado de óleo de nozes é segmentado?

O mercado é segmentado com base no tipo de produto, uso final, natureza, canal de distribuição e tipo de embalagem .

• Por tipo de produto

Com base no tipo de produto, o mercado de óleos vegetais é segmentado em óleo de avelã, óleo de amêndoa, óleo de argan, óleo de macadâmia, óleo de marula, óleo de mongongo, óleo de noz-pecã, óleo de pistache, óleo de pinhão, óleo de noz e outros. O segmento de óleo de amêndoa dominou o mercado com uma participação de 29,4% da receita em 2025, devido ao seu alto valor nutricional, versatilidade em aplicações culinárias e popularidade em cosméticos e produtos para a pele.

Prevê-se que o óleo de macadâmia apresente o crescimento anual composto mais rápido entre 2026 e 2033, impulsionado pela crescente demanda por óleos especiais em culinária gourmet, produtos de cuidados com a pele de alta qualidade e formulações cosméticas antienvelhecimento.

• Por uso final

Com base no uso final, o mercado é segmentado em Processamento de Alimentos, Cosméticos e Cuidados Pessoais, Aromaterapia, Tintas e Vernizes, Produtos Domésticos e Outros. O segmento de Processamento de Alimentos dominou o mercado com uma participação de 34,6% na receita em 2025, impulsionado pela crescente preferência do consumidor por óleos de cozinha saudáveis, ricos em gorduras insaturadas e ácidos graxos ômega.

Prevê-se que o segmento de Cosméticos e Cuidados Pessoais apresente o crescimento anual composto mais rápido entre 2026 e 2033, impulsionado pelo aumento de produtos de beleza naturais e à base de plantas que incorporam óleos de nozes para hidratação da pele e benefícios antienvelhecimento.

• Por natureza

Com base na natureza, o mercado de óleo de nozes é segmentado em orgânico e convencional. O segmento convencional dominou com 61,2% da participação na receita em 2025, devido à sua ampla disponibilidade, custo acessível e uso nas indústrias alimentícia e cosmética.

Prevê-se que os óleos vegetais orgânicos apresentem o crescimento anual composto mais rápido entre 2026 e 2033, impulsionados pela crescente conscientização do consumidor sobre óleos livres de produtos químicos e de origem sustentável, bem como pela demanda por produtos com rótulos limpos.

• Por canal de distribuição

Com base no canal de distribuição, o mercado é segmentado em B2B e B2C. O segmento B2B dominou com 53,5% da receita em 2025, impulsionado por compras em larga escala por fabricantes de alimentos, marcas de cosméticos e empresas nutracêuticas que buscam a aquisição de óleos de nozes em grandes quantidades.

Prevê-se que o segmento B2C apresente o crescimento mais rápido em termos de CAGR (Taxa de Crescimento Anual Composta) entre 2026 e 2033, impulsionado pela expansão das plataformas de comércio eletrônico, vendas diretas ao consumidor e entregas por assinatura de óleos de nozes especiais e orgânicos.

• Por tipo de embalagem

Com base no tipo de embalagem, o mercado de óleo de nozes é segmentado em potes, garrafas, sachês e outros. O segmento de garrafas dominou o mercado com 47,8% da receita em 2025, devido à facilidade de armazenamento, ampla aceitação do consumidor e adequação tanto para aplicações de varejo quanto industriais.

Prevê-se que as embalagens tipo pouch apresentem o crescimento anual composto mais rápido entre 2026 e 2033, impulsionadas por soluções de embalagem leves, ecológicas e práticas, que atendem aos consumidores modernos e às iniciativas de produtos sustentáveis.

Qual região detém a maior participação no mercado de óleo de nozes?

- A Arábia Saudita dominou o mercado de óleos vegetais do Oriente Médio e da África, com uma participação de 32,4% na receita em 2025, impulsionada pelo forte consumo de óleos de amêndoa, argan e noz em alimentos, cosméticos e produtos de higiene pessoal.

- A crescente preocupação com a saúde, a preferência por óleos vegetais e orgânicos e os investimentos em instalações modernas de extração e embalagem fortalecem a liderança de mercado. A urbanização, o aumento da renda disponível e a demanda por óleos funcionais e com rótulos limpos aceleram ainda mais a adoção.

Análise do Mercado de Óleo de Nozes nos Emirados Árabes Unidos

Prevê-se que os Emirados Árabes Unidos registrem a taxa de crescimento anual composta (CAGR) mais rápida, de 7,9%, entre 2026 e 2033, impulsionada por óleos de nozes premium, como macadâmia, argan e pistache, utilizados em cosméticos, alimentos e aromaterapia. A expansão dos canais de varejo, a crescente adoção do comércio eletrônico e a maior conscientização sobre saúde contribuem para o crescimento do mercado. Investimentos em tecnologia de prensagem a frio, embalagens sustentáveis e óleos importados de alta qualidade aumentam a penetração no mercado e atendem à crescente demanda por óleos de nozes naturais e funcionais.

Análise do Mercado de Óleo de Nozes na África do Sul

A África do Sul contribui de forma constante para o crescimento regional, impulsionada pela crescente demanda por óleos de noz, marula e amêndoa em alimentos e produtos de higiene pessoal. Os consumidores preferem cada vez mais óleos orgânicos e funcionais, incentivando os fabricantes a investir em formulações de valor agregado, embalagens premium e fornecimento sustentável. O crescimento da população urbana e a crescente preocupação com a saúde também contribuem para essa adoção. Parcerias estratégicas e oportunidades de exportação de óleos de nozes de alta qualidade devem fortalecer a posição do país no mercado do Oriente Médio e da África.

Análise do Mercado de Óleo de Noz Egípcia

O Egito está emergindo como um mercado-chave, impulsionado pelos setores culinário, cosmético e nutracêutico. A crescente conscientização sobre óleos saudáveis e o aumento das importações de óleos de amêndoa, macadâmia e pistache impulsionam o consumo. A expansão do varejo, lojas especializadas e a penetração do comércio eletrônico facilitam o acesso a óleos premium e funcionais. Os consumidores estão migrando para óleos orgânicos, vegetais e prensados a frio, o que impulsiona a demanda por produtos de alta qualidade. Espera-se que os investimentos em infraestrutura de processamento sustentem o crescimento sustentável do mercado na região.

Análise do Mercado de Óleo de Noz de Marrocos

Marrocos é um importante contribuinte, especialmente para os óleos de argan e amêndoa utilizados em aplicações cosméticas e culinárias. Investimentos em cultivo sustentável, extração moderna de óleo e produção voltada para a exportação aumentam a capacidade do mercado. A crescente urbanização, o aumento da renda disponível e a preferência por óleos vegetais, orgânicos e funcionais impulsionam a adoção desses produtos. O apoio governamental à produção local e ao comércio internacional contribui para expandir o alcance do mercado. O posicionamento premium dos óleos de argan e amêndoa nos mercados globais fortalece o papel de Marrocos na indústria de óleos vegetais do Oriente Médio e da África.

Quais são as principais empresas no mercado de óleo de nozes?

O setor de óleos vegetais é liderado principalmente por empresas consolidadas, incluindo:

- Caloy Company, LP (EUA)

- Wilmar International Ltd (Singapura)

- Comércio Justo Internacional (Alemanha)

- ADM (Archer Daniels Midland) (EUA)

- Bunge Limited (Suíça)

- FUJI OIL CO., LTD. (Japão)

- Gustav Heess Oleochemische Erzeugnisse GmbH (Alemanha)

- Óleos Naturais Internacionais Inc (EUA)

- Cargill, Incorporated (EUA)

- CHS Inc. (EUA)

- Mazola (EUA)

- Biofinest (EUA)

- Natural Sourcing, LLC (EUA)

- Liberty Vegetable Oil Company (EUA)

Quais são os desenvolvimentos recentes no mercado de óleo de nozes no Oriente Médio e na África?

- Em outubro de 2024, a Texas A&M Agri Life Research, uma das maiores agências de pesquisa e desenvolvimento tecnológico do Texas, anunciou o desenvolvimento de uma variedade de amendoim com alto teor de óleo para aumentar a produção desse fruto, marcando um passo significativo na inovação agrícola.

- Em setembro de 2024, a Fassoum Peanut Oil, uma empresa nigeriana de óleos e derivados, aderiu ao programa LaunchUp da FasterCapital, uma empresa de capital de risco sediada em Dubai, com o objetivo de apoiar startups, aprimorar suas operações e fortalecer sua presença global, contribuindo para o crescimento da indústria de óleo de amendoim.

- Em maio de 2023, Singireddy Niranjan Reddy, Ministro da Agricultura de Telangana, lançou o óleo de amendoim da marca Vijaya com a participação do Presidente da Federação do Óleo e outras autoridades, promovendo o óleo de amendoim de alta qualidade produzido localmente.

- Em abril de 2022, a Gemini Edibles and Fats India Ltd. (GEF India) lançou um frasco de cinco litros de óleo de amendoim sob sua marca Freedom, oferecendo um sabor de nozes preferido para o preparo de picles em toda a Índia, reforçando a escolha do consumidor por óleos de cozinha tradicionais.

- Em março de 2020, a Dhara, uma popular marca indiana de óleo de cozinha, lançou a campanha “Moído na Índia” para incentivar os consumidores a escolherem óleos filtrados produzidos localmente, como o óleo de amendoim Kachi Ghani e o óleo de mostarda, destacando a importância dos óleos produzidos na Índia.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.