Middle East And Africa Mobility As A Service Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

29.01 Billion

USD

259.46 Billion

2025

2033

USD

29.01 Billion

USD

259.46 Billion

2025

2033

| 2026 –2033 | |

| USD 29.01 Billion | |

| USD 259.46 Billion | |

|

|

|

|

Segmentação do mercado de Mobilidade como Serviço (MaaS) no Oriente Médio e África, por tipo de serviço (compartilhamento de carros, compartilhamento de ônibus, trem, transporte por aplicativo, compartilhamento de bicicletas, carros autônomos e outros), solução (soluções de navegação, soluções de bilhetagem, plataformas tecnológicas, serviços de seguros, provedores de conectividade de telecomunicações e motores de pagamento), tipo de transporte (público e privado), tipo de veículo (carros, ônibus, trem e micromobilidade), plataforma de aplicativo (iOS, Android e outras), tipo de necessidade (conectividade de primeira e última milha, deslocamento fora do horário de pico e em turnos, deslocamento diário, viagens para aeroporto ou estações de transporte público, viagens interurbanas e outras), porte da organização (grandes empresas e pequenas e médias empresas (PMEs)), uso (comercial e pessoal) - Tendências e previsões do setor até 2033.

Tamanho do mercado de Mobilidade como Serviço no Oriente Médio e na África

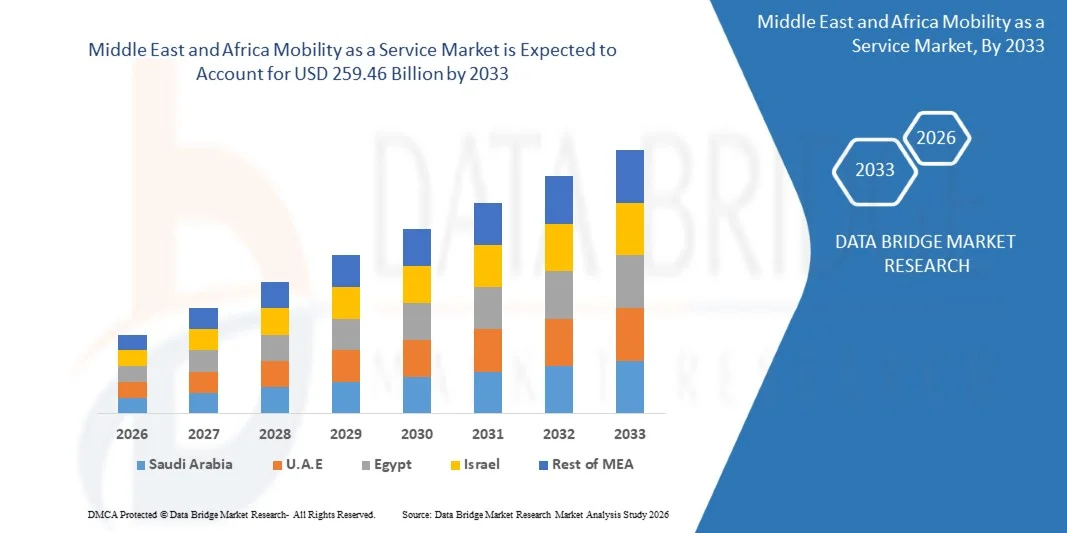

- O mercado de Mobilidade como Serviço (MaaS) no Oriente Médio e na África foi avaliado em US$ 29,01 bilhões em 2025 e deverá atingir US$ 259,46 bilhões até 2033 , com uma taxa de crescimento anual composta (CAGR) de 31,50% durante o período de previsão.

- O crescimento do mercado é impulsionado principalmente pela crescente urbanização, pela maior penetração de smartphones e pelos avanços nas tecnologias de IA e IoT, que estão facilitando soluções de mobilidade integradas, sob demanda e sem interrupções em toda a região.

- Além disso, a crescente preferência do consumidor por opções de transporte econômicas, flexíveis e sustentáveis está incentivando a adoção de plataformas MaaS, acelerando ainda mais a expansão do mercado e posicionando a região como um polo fundamental para soluções inovadoras de mobilidade.

Análise do Mercado de Mobilidade como Serviço no Oriente Médio e na África

- A Mobilidade como Serviço (MaaS), que oferece soluções de transporte integradas, sob demanda e multimodais, está se tornando um componente essencial da mobilidade urbana nos setores público e privado devido à sua conveniência, acessibilidade em tempo real e integração perfeita com plataformas digitais.

- A crescente demanda por MaaS é impulsionada principalmente pelo aumento da urbanização, pela crescente penetração de smartphones, pelas preocupações ambientais e por uma mudança em direção a opções de transporte econômicas e sustentáveis.

- Os Emirados Árabes Unidos dominaram o mercado de Mobilidade como Serviço (MaaS) no Oriente Médio e na África, com a maior participação na receita, de 32,5% em 2025, impulsionados pela adoção precoce de soluções de mobilidade digital, altas rendas disponíveis e forte presença de importantes players do setor. Já os EUA testemunharam um crescimento significativo em plataformas de compartilhamento de viagens via aplicativo e mobilidade integrada, impulsionado por inovações tanto de provedores de mobilidade consolidados quanto de startups de tecnologia.

- Prevê-se que a Arábia Saudita seja a região de crescimento mais rápido no mercado de Mobilidade como Serviço (MaaS) do Oriente Médio e da África durante o período de previsão, devido à rápida urbanização, à expansão das redes de transporte público e ao aumento da renda disponível.

- O segmento de transporte por aplicativo dominou o mercado com a maior participação na receita, de 38,6% em 2025, impulsionado pela ampla adoção de smartphones, pelos desafios do congestionamento urbano e pela conveniência das viagens sob demanda.

Escopo do relatório e segmentação do mercado de Mobilidade como Serviço no Oriente Médio e na África

|

Atributos |

Principais insights de mercado sobre Mobilidade como Serviço |

|

Segmentos abrangidos |

|

|

Países abrangidos |

Oriente Médio e África

|

|

Principais participantes do mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor agregado |

Além de informações de mercado como valor de mercado, taxa de crescimento, segmentos de mercado, cobertura geográfica, participantes do mercado e cenário de mercado, o relatório de mercado elaborado pela equipe da Data Bridge Market Research inclui análises aprofundadas de especialistas, análises de importação/exportação, análises de preços, análises de produção e consumo e análises PESTEL. |

Tendências do mercado de Mobilidade como Serviço no Oriente Médio e na África

“Maior comodidade por meio de IA e mobilidade preditiva”

- Uma tendência significativa e crescente no mercado de Mobilidade como Serviço (MaaS) do Oriente Médio e da África é a integração cada vez maior de inteligência artificial (IA) e análise preditiva em plataformas MaaS, aprimorando a conveniência do usuário, a personalização e a eficiência operacional.

- Por exemplo, aplicativos como Careem e Bolt utilizam roteamento baseado em IA e algoritmos preditivos de demanda para otimizar a alocação de viagens, reduzir o tempo de espera e melhorar a eficiência das viagens, oferecendo uma experiência de mobilidade perfeita e altamente responsiva.

- A integração da IA no MaaS possibilita funcionalidades como o aprendizado dos padrões de deslocamento do usuário para sugerir rotas otimizadas, o fornecimento de notificações inteligentes sobre atrasos ou interrupções e o ajuste dinâmico de preços e disponibilidade de veículos. Por exemplo, o Moovit utiliza IA para fornecer recomendações de transporte multimodal em tempo real com base nos hábitos do usuário, nas condições de tráfego e nas interrupções do serviço.

- A integração perfeita das plataformas MaaS com assistentes de voz e ecossistemas digitais permite que os usuários planejem, reservem e gerenciem viagens multimodais por meio de uma única interface, incluindo opções de transporte por aplicativo, transporte público e micromobilidade. Esse controle unificado aumenta a conveniência e incentiva uma adoção mais ampla dos serviços MaaS.

- Essa tendência em direção a soluções de mobilidade mais inteligentes, preditivas e interconectadas está remodelando fundamentalmente as expectativas dos usuários em relação ao transporte urbano. Consequentemente, empresas como Uber e JoRide estão desenvolvendo recursos com inteligência artificial, incluindo previsão de disponibilidade de viagens, sugestões inteligentes de rotas e gerenciamento de viagens por voz através de plataformas como Google Assistente e Amazon Alexa.

- A demanda por plataformas MaaS que oferecem otimização contínua baseada em IA e controle por voz está crescendo rapidamente nos setores de transporte público e privado, à medida que os consumidores priorizam cada vez mais a conveniência, a eficiência e as soluções integradas de mobilidade urbana.

Dinâmica do mercado de Mobilidade como Serviço no Oriente Médio e na África

Motorista

“Crescente necessidade devido à urbanização, preocupações ambientais e adoção digital”

- Os crescentes desafios do congestionamento urbano, a maior conscientização ambiental e a adoção acelerada de plataformas digitais de transporte são fatores importantes que impulsionam a crescente demanda por Mobilidade como Serviço (MaaS) no Oriente Médio e na África.

- Por exemplo, no início de 2025, a Careem lançou um sistema preditivo de alocação de viagens baseado em inteligência artificial em diversas cidades dos Emirados Árabes Unidos, com o objetivo de reduzir o congestionamento do trânsito e otimizar a utilização da frota. Espera-se que estratégias como essa, adotadas por empresas líderes, impulsionem o crescimento do mercado de MaaS (Mobilidade como Serviço) durante o período de previsão.

- À medida que os consumidores buscam alternativas econômicas, flexíveis e ecológicas à posse de carros particulares, as plataformas MaaS oferecem recursos avançados, como rastreamento de viagens em tempo real, planejamento de rotas multimodais e preços dinâmicos, proporcionando uma melhoria significativa em relação às opções de transporte tradicionais.

- Além disso, a crescente popularidade de aplicativos de mobilidade baseados em smartphones e ecossistemas digitais integrados está tornando o MaaS um componente essencial do transporte urbano, oferecendo conectividade perfeita com transporte público, serviços de transporte por aplicativo e micromobilidade.

- A conveniência de reservas sob demanda, pagamentos sem dinheiro em espécie, planejamento de viagens multimodais e a possibilidade de acessar serviços por meio de aplicativos móveis são fatores-chave que impulsionam a adoção do MaaS (Mobilidade como Serviço) nos setores de transporte pessoal e corporativo. A tendência de gerenciamento de viagens via aplicativos e a crescente disponibilidade de plataformas fáceis de usar contribuem ainda mais para a expansão do mercado.

Restrição/Desafio

“Preocupações relativas à privacidade de dados, segurança cibernética e limitações de infraestrutura”

- Preocupações relacionadas à privacidade de dados, segurança cibernética e infraestrutura de transporte inconsistente representam desafios significativos para a adoção mais ampla do MaaS (Mobilidade como Serviço). Como as plataformas MaaS dependem de conectividade digital e dados do usuário, elas são suscetíveis a ataques cibernéticos e violações de dados, aumentando a ansiedade dos consumidores em relação à segurança de suas informações pessoais e de pagamento.

- Por exemplo, relatos de vulnerabilidades em aplicativos de transporte por aplicativo ou em plataformas de integração de transporte público fizeram com que alguns usuários hesitassem em adotar soluções de mobilidade totalmente digitais.

- Abordar essas preocupações por meio de criptografia segura, protocolos de autenticação robustos e atualizações regulares do sistema é crucial para construir a confiança do consumidor. Empresas como Uber e Bolt enfatizam suas medidas de segurança cibernética e recursos de proteção de dados para tranquilizar os usuários. Além disso, redes de transporte público inconsistentes, infraestrutura digital limitada em certas regiões e altos custos iniciais de assinaturas baseadas em aplicativos podem ser barreiras à adoção, principalmente em áreas em desenvolvimento.

- Embora as plataformas MaaS estejam se tornando mais acessíveis e econômicas, problemas de confiabilidade percebidos ou preocupações com a cobertura do serviço ainda podem dificultar a adoção em larga escala, especialmente entre usuários iniciantes ou consumidores sensíveis ao preço.

- Superar esses desafios por meio de maior segurança cibernética, investimento em infraestrutura digital, apoio governamental à mobilidade integrada e educação do consumidor sobre segurança de aplicativos será vital para o crescimento sustentado do mercado na região.

Escopo do mercado de Mobilidade como Serviço no Oriente Médio e na África

O mercado de mobilidade como serviço é segmentado com base no tipo de serviço, solução, tipo de transporte, tipo de veículo, plataforma de aplicação, tipo de requisito, tamanho da organização e utilização.

- Por tipo de serviço

Com base no tipo de serviço, o mercado de Mobilidade como Serviço (MaaS) no Oriente Médio e na África é segmentado em compartilhamento de carros, compartilhamento de ônibus, trens, transporte por aplicativo, compartilhamento de bicicletas, carros autônomos e outros. O segmento de transporte por aplicativo dominou o mercado com a maior participação na receita, de 38,6% em 2025, impulsionado pela ampla adoção de smartphones, pelos desafios do congestionamento urbano e pela conveniência das viagens sob demanda. Os consumidores preferem cada vez mais o transporte por aplicativo para deslocamentos de curta e média distância devido à sua acessibilidade, economia de tempo e serviço porta a porta.

O segmento de compartilhamento de bicicletas deverá apresentar a taxa de crescimento anual composta (CAGR) mais rápida, de 22,4%, entre 2026 e 2033, impulsionado pela crescente conscientização ambiental, iniciativas governamentais que promovem a mobilidade sustentável e investimentos cada vez maiores em infraestrutura de micromobilidade. A expansão dos serviços de mobilidade compartilhada em áreas urbanas, aliada a políticas de apoio e à crescente demanda por transporte ecológico, está impulsionando a rápida adoção de soluções de compartilhamento de bicicletas em toda a região.

- Por solução

Com base na solução, o mercado de Mobilidade como Serviço (MaaS) no Oriente Médio e na África é segmentado em soluções de navegação, soluções de bilhetagem, plataformas tecnológicas, serviços de seguros, provedores de conectividade de telecomunicações e motores de pagamento. As plataformas tecnológicas dominaram o mercado com a maior participação na receita, de 41,3% em 2025, pois fornecem a infraestrutura essencial para as operações de MaaS, incluindo gerenciamento de viagens, integração multimodal e rastreamento em tempo real.

Prevê-se que os motores de pagamento apresentem a taxa de crescimento anual composta (CAGR) mais rápida, de 20,8%, durante o período de previsão, impulsionados pela crescente demanda por transações sem dinheiro físico e pela integração com carteiras digitais. A rápida adoção de pagamentos sem contato e a expansão de soluções de pagamento baseadas em smartphones em toda a região estão proporcionando experiências de usuário mais fluidas, fomentando o crescimento da adoção de MaaS (Mobilidade como Serviço) e incentivando parcerias entre operadoras de mobilidade e provedores de fintech.

- Por tipo de transporte

Com base no tipo de transporte, o mercado de Mobilidade como Serviço (MaaS) no Oriente Médio e na África é segmentado em transporte público e privado. O segmento de transporte privado dominou o mercado com a maior participação na receita, de 57,2% em 2025, principalmente devido à popularidade dos serviços de transporte por aplicativo, plataformas de compartilhamento de carros e serviços de táxi via aplicativo que oferecem viagens flexíveis e convenientes.

Prevê-se que o transporte público apresente a taxa de crescimento anual composta (CAGR) mais rápida, de 18,9%, durante o período de previsão, impulsionado por iniciativas governamentais para modernizar os sistemas de transporte urbano, integração com plataformas de Mobilidade como Serviço (MaaS) e aumento da densidade populacional urbana. Os investimentos em bilhetagem digital, rastreamento em tempo real e aplicativos de transporte multimodal estão permitindo que as operadoras de transporte público aprimorem a acessibilidade e a conveniência, acelerando a adoção da MaaS entre os passageiros que dependem de ônibus, trens e metrô.

- Por tipo de veículo

Com base no tipo de veículo, o mercado de Mobilidade como Serviço (MaaS) no Oriente Médio e na África é segmentado em veículos de quatro rodas, ônibus, trens e veículos de micromobilidade. Os veículos de quatro rodas dominaram o mercado com a maior participação na receita, de 52,5% em 2025, impulsionados pela prevalência de aluguel de carros por aplicativo, serviços de transporte por demanda e soluções de mobilidade corporativa.

Prevê-se que os veículos de micromobilidade, incluindo trotinetes e bicicletas elétricas, registarão a taxa de crescimento anual composta (CAGR) mais rápida, de 23,1%, entre 2026 e 2033, impulsionados pela crescente consciencialização ambiental, pelo apoio governamental ao transporte sustentável e pelo aumento do congestionamento urbano. A adoção de soluções de micromobilidade está a expandir-se rapidamente em cidades com tráfego intenso, oferecendo conectividade flexível para o último quilómetro e complementando as redes de transporte público e privado existentes.

- Por plataforma de aplicativos

Com base na plataforma de aplicação, o mercado de Mobilidade como Serviço (MaaS) no Oriente Médio e na África é segmentado em iOS, Android e outros. O segmento Android dominou o mercado com a maior participação na receita, de 63,4% em 2025, impulsionado pela maior penetração de smartphones Android em toda a região, particularmente em países em desenvolvimento.

Espera-se que o segmento iOS apresente a taxa de crescimento anual composta (CAGR) mais rápida, de 19,7%, durante o período de previsão, impulsionado pela crescente adoção entre usuários de smartphones premium e pela integração com aplicativos avançados de MaaS (Mobilidade como Serviço). A compatibilidade multiplataforma e interfaces amigáveis são essenciais para a adoção do MaaS, permitindo que os usuários acessem serviços de transporte por aplicativo, emissão de bilhetes e planejamento multimodal de forma integrada em seus dispositivos preferidos.

- Por tipo de requisito

Com base no tipo de necessidade, o mercado de Mobilidade como Serviço (MaaS) no Oriente Médio e na África é segmentado em conectividade de primeira e última milha, deslocamento fora do horário de pico e para trabalhadores em turnos, deslocamento diário, viagens para aeroportos ou estações de transporte público, viagens interurbanas e outros. As viagens diárias dominaram o mercado, com a maior participação na receita, de 44,1% em 2025, impulsionadas pela necessidade de soluções confiáveis, econômicas e flexíveis para o deslocamento urbano rotineiro.

A conectividade do primeiro e do último quilômetro deverá apresentar a taxa de crescimento anual composta (CAGR) mais rápida, de 21,5%, durante o período de previsão, impulsionada pela expansão das redes de micromobilidade, pelos programas de compartilhamento de bicicletas e pela integração com os centros de transporte público. Este segmento é crucial para aumentar a conveniência dos passageiros e garantir experiências de viagem multimodais perfeitas.

- Por tamanho da organização

Com base no porte da organização, o mercado de Mobilidade como Serviço (MaaS) no Oriente Médio e na África é segmentado em grandes empresas e pequenas e médias empresas (PMEs). As grandes empresas dominaram o mercado, com a maior participação na receita, de 59,3% em 2025, impulsionadas por programas de mobilidade corporativa, soluções de transporte para funcionários e serviços de gestão de frotas que aumentam a eficiência operacional.

Prevê-se que as PMEs apresentem a taxa de crescimento anual composta (CAGR) mais rápida, de 22,0%, durante o período de previsão, impulsionadas pela crescente adoção de serviços de mobilidade flexíveis, soluções econômicas e plataformas digitais que ajudam as organizações menores a gerenciar suas necessidades de transporte com eficiência. A crescente disponibilidade de soluções de Mobilidade como Serviço (MaaS) escaláveis e personalizadas para PMEs está acelerando a penetração no mercado em diversos segmentos de negócios.

- Por uso

Com base no uso, o mercado de Mobilidade como Serviço (MaaS) no Oriente Médio e na África é segmentado em comercial e pessoal. O uso pessoal dominou o mercado, com a maior participação na receita, de 54,6% em 2025, impulsionado pela ampla adoção de soluções de transporte por aplicativo, compartilhamento de carros e micromobilidade para deslocamentos individuais.

Prevê-se que o uso comercial apresente a taxa de crescimento anual composta (CAGR) mais rápida, de 20,9%, entre 2026 e 2033, impulsionado pela crescente demanda por transporte de funcionários, gestão de frotas corporativas e soluções logísticas. As empresas estão cada vez mais utilizando plataformas de MaaS (Mobilidade como Serviço) para otimizar custos, melhorar a satisfação dos funcionários e integrar o planejamento de transporte em estratégias operacionais mais amplas, o que sustenta um crescimento robusto no segmento comercial.

Análise Regional do Mercado de Mobilidade como Serviço no Oriente Médio e África

- Os Emirados Árabes Unidos dominaram o mercado de Mobilidade como Serviço (MaaS) no Oriente Médio e na África, com a maior participação na receita, de 32,5% em 2025, impulsionados pela crescente adoção de soluções de mobilidade digital, alta urbanização e maior conhecimento de plataformas de transporte baseadas em aplicativos.

- Os consumidores da região valorizam muito a conveniência, o rastreamento em tempo real e a integração perfeita oferecida pelas plataformas MaaS com outros serviços digitais, como aplicativos de navegação, soluções de pagamento e horários de transporte público.

- Essa ampla adoção é ainda mais impulsionada pela alta renda disponível, uma população com conhecimento tecnológico e uma preferência por opções de transporte flexíveis, econômicas e sustentáveis, estabelecendo o MaaS como uma solução de mobilidade preferida tanto para usuários individuais quanto corporativos.

Análise do Mercado de MaaS na Arábia Saudita

O mercado de Mobilidade como Serviço (MaaS) na Arábia Saudita está experimentando um crescimento significativo, impulsionado pela rápida urbanização, iniciativas governamentais para modernizar a infraestrutura de transporte e crescente penetração de smartphones. Os consumidores estão adotando cada vez mais soluções de transporte multimodal, como aplicativos de transporte por aplicativo, compartilhamento de carros e outras plataformas, para se locomover em áreas urbanas congestionadas. O mercado é ainda mais impulsionado pelo plano Visão 2030, que enfatiza o desenvolvimento de cidades inteligentes, a mobilidade sustentável e a digitalização do transporte. Programas de mobilidade corporativa e investimentos em plataformas integradas de MaaS também estão impulsionando a adoção nos setores comercial e residencial.

Análise do mercado de MaaS nos Emirados Árabes Unidos

O mercado de Mobilidade como Serviço (MaaS) dos Emirados Árabes Unidos está em forte expansão, impulsionado por uma população com conhecimento tecnológico, alta renda disponível e o uso generalizado de smartphones. A popularidade dos serviços de transporte por aplicativo, combinada com investimentos governamentais em iniciativas de cidades inteligentes e integração com o transporte público, está impulsionando a adoção do MaaS. Dubai e Abu Dhabi são polos líderes em soluções de mobilidade baseadas em aplicativos, oferecendo integração perfeita com táxis, metrô e ônibus. A adoção de recursos com inteligência artificial, navegação em tempo real e pagamentos sem dinheiro aumenta ainda mais a conveniência, incentivando tanto moradores quanto empresas a utilizarem plataformas de MaaS.

Análise do Mercado de MaaS na África do Sul

O mercado de Mobilidade como Serviço (MaaS) na África do Sul está crescendo de forma constante, impulsionado pela crescente urbanização, pela necessidade cada vez maior de opções flexíveis de deslocamento e pela expansão de serviços de transporte por aplicativo e compartilhamento de carros. Os consumidores priorizam soluções de mobilidade acessíveis, convenientes e confiáveis, principalmente em grandes centros urbanos como Joanesburgo e Cidade do Cabo. O mercado também é impulsionado pela adoção de plataformas de pagamento móvel, pela integração com o transporte público e pela crescente conscientização sobre alternativas de transporte ecologicamente corretas. A demanda também está aumentando entre clientes corporativos que buscam soluções para gestão de frotas e deslocamento de funcionários.

Análise do Mercado de MaaS no Egito

O mercado de Mobilidade como Serviço (MaaS) no Egito está preparado para um rápido crescimento devido ao aumento da população urbana, aos desafios do congestionamento de tráfego e à crescente penetração de smartphones. Os consumidores estão adotando serviços de transporte por aplicativo, compartilhamento de ônibus e transporte multimodal para se locomover em cidades congestionadas como Cairo e Alexandria. O incentivo do governo a iniciativas de cidades inteligentes, o investimento em infraestrutura de transporte público e as soluções de pagamento digital estão impulsionando ainda mais o mercado. A integração do planejamento de rotas em tempo real, bilhetagem multimodal e serviços de frota baseados em aplicativos aumenta a conveniência tanto para usuários individuais quanto comerciais, impulsionando a adoção generalizada do MaaS em todo o país.

Participação de mercado de Mobilidade como Serviço no Oriente Médio e na África

O setor de Mobilidade como Serviço é liderado principalmente por empresas consolidadas, incluindo:

- Uber (EUA)

- Careem (Emirados Árabes Unidos)

- Parafuso (Estônia)

- Olá (Índia)

- Didi Chuxing (China)

- Moovit (Israel)

- Grátis agora (Alemanha)

- Via (EUA)

- BlaBlaCar (França)

- LeCab (França)

- MAX (África do Sul)

- Karhoo (Reino Unido)

- CleverShuttle (Alemanha)

- Heetch (França)

- Trânsito (EUA)

- JoRide (EAU)

- Yango (Rússia)

- Grab (Singapura)

- Terra Mobilidade (África do Sul)

- Swvl (Egito)

Quais são os desenvolvimentos recentes no mercado de Mobilidade como Serviço (MaaS) no Oriente Médio e na África?

- Em abril de 2025, a Careem, plataforma líder em transporte por aplicativo no Oriente Médio, lançou um sistema preditivo de alocação de viagens baseado em inteligência artificial em Riad, na Arábia Saudita, com o objetivo de reduzir o congestionamento do trânsito e melhorar a eficiência da mobilidade urbana. Essa iniciativa reforça o compromisso da Careem em oferecer soluções de transporte inovadoras e orientadas por dados, personalizadas para as necessidades dos usuários locais, consolidando sua liderança no mercado de Mobilidade como Serviço (MaaS) em rápido crescimento no Oriente Médio e na África.

- Em março de 2025, a Uber lançou sua integração multimodal de Mobilidade como Serviço (MaaS) em Dubai, permitindo que os usuários planejem viagens combinando serviços de transporte por aplicativo, metrô e ônibus. O recurso aumenta a conveniência dos passageiros, oferecendo otimização de rotas em tempo real, comparação de tarifas e opções de pagamento unificadas. Esse lançamento destaca o foco da Uber em fornecer soluções de mobilidade abrangentes, alinhadas às iniciativas de cidades inteligentes nos Emirados Árabes Unidos.

- Em março de 2025, a Bolt expandiu suas operações na Cidade do Cabo, África do Sul, implantando frotas de veículos elétricos e integrando serviços de transporte por aplicativo sustentáveis à sua plataforma. Essa expansão reforça o compromisso da Bolt com soluções de transporte urbano ecologicamente corretas, promovendo uma mobilidade mais verde e apoiando os esforços regionais para reduzir as emissões de carbono.

- Em fevereiro de 2025, a JoRide, provedora de Mobilidade como Serviço (MaaS) dos Emirados Árabes Unidos, firmou parceria com a Autoridade de Estradas e Transportes de Dubai (RTA) para oferecer soluções de conectividade de primeira e última milha, integrando bicicletas, patinetes elétricos e opções de mobilidade compartilhada ao transporte público. Essa colaboração demonstra o foco da JoRide em criar experiências de mobilidade urbana multimodal e integradas, ao mesmo tempo que aprimora a acessibilidade para os usuários.

- Em janeiro de 2025, a Moovit, plataforma israelense de tecnologia MaaS (Mobilidade como Serviço), lançou uma solução unificada de bilhetagem e navegação nas principais cidades do Egito, permitindo que os usuários acessem ônibus, metrô e serviços de transporte por aplicativo por meio de um único aplicativo móvel. A iniciativa reforça o compromisso da Moovit em utilizar tecnologia de ponta para sistemas de transporte urbano eficientes, fáceis de usar e interconectados no Oriente Médio e na África.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.