Middle East And Africa Medical Device Outsourcing Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

8.43 Billion

USD

21.47 Billion

2025

2033

USD

8.43 Billion

USD

21.47 Billion

2025

2033

| 2026 –2033 | |

| USD 8.43 Billion | |

| USD 21.47 Billion | |

|

|

|

|

Mercado de outsourcing de dispositivos médicos do Médio Oriente e África, por serviços (garantia de qualidade, serviços de assuntos regulamentares, serviços de design e desenvolvimento de produtos, serviços de teste e esterilização de produtos, serviços de implementação de produtos, serviços de atualização de produtos, serviços de manutenção de produtos, serviços de matérias-primas, equipamentos elétricos médicos Serviços, Fabrico por contrato, Materiais e caracterização química), Produto (produtos acabados, eletrónica, matérias-primas), Tipo de dispositivo (Classe I, Classe II , Classe III), Aplicação (Cardiologia, Diagnóstico por imagem, Ortopédico, DIV, Oftálmico, Geral e Cirurgia plástica, administração de medicamentos, medicina dentária, endoscopia, cuidados com a diabetes e outros), utilizador final (pequena empresa de dispositivos médicos, média empresa de dispositivos médicos, grande empresa de dispositivos médicos e outros), país (África do Sul, Arábia Saudita, Emirados Árabes Unidos, Israel, Egito & Resto do Médio Oriente e África) Tendências e previsões do setor até 2028.

Análise de mercado e insights: mercado de outsourcing de dispositivos médicos no Médio Oriente e em África

Análise de mercado e insights: mercado de outsourcing de dispositivos médicos no Médio Oriente e em África

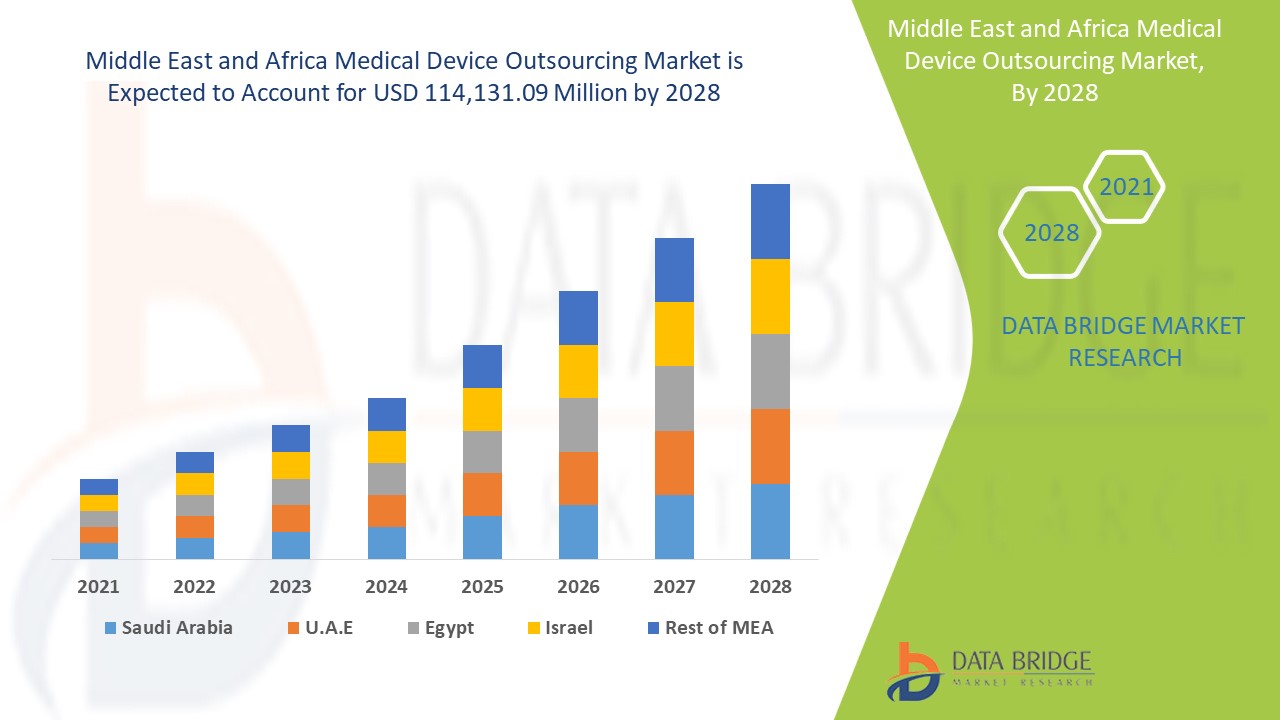

Espera-se que o mercado de outsourcing de dispositivos médicos ganhe crescimento de mercado no período previsto de 2020 a 2028. A Data Bridge Market Research analisa que o mercado está a crescer com um CAGR de 12,4% no período previsto de 2021 a 2028 e deverá atingir os 114.131,09 milhões de USD até 2028, face aos 46.676,11 milhões de dólares em 2020. A crescente incidência de infeções crónicas, a aceitação do uso de dispositivos não invasivos e o aumento dos gastos com a saúde serão provavelmente os principais impulsionadores da procura do mercado no período previsto.

A crescente necessidade de serviços de saúde de qualidade é impulsionada pelo mercado global de outsourcing de dispositivos médicos. O fabrico sob contrato de dispositivos médicos é a montagem terceirizada de um dispositivo médico para o mercado médico. Para realizar o fabrico recorrente, os parceiros de fabrico contratados podem ser utilizados pelas empresas de dispositivos médicos e beneficiar de eficiências de custos, cadeia de fornecimento simplificada, alinhamento logístico e muito mais, tudo isto para garantir que todos os requisitos da indústria são cumpridos, permitindo-lhes entregar produtos comerciais para o mercado.

Como os ciclos de vida dos produtos são curtos, os fabricantes de dispositivos médicos dependem profundamente da inovação e de tecnologias avançadas para crescer no mercado das supertendências. Algumas das inovações nos mercados de outsourcing de dispositivos médicos incluem I&D de dispositivos médicos em outsourcing, dispositivos médicos wearable, abordagem centrada no paciente, check-ups robóticos e cirurgia robótica, o que geralmente leva a uma maior eficácia, melhoria do rendimento, qualidade melhorada e redução de WIP (work in progress). O mercado de outsourcing de dispositivos médicos cresceu rapidamente, o que resultou numa melhoria da eficácia organizacional, ciclos de desenvolvimento de produtos mais curtos e maior acesso à alta tecnologia.

No entanto, fatores como as alterações na International Standards Organization (ISO): 13485, a estrutura regulamentar rigorosa e as interrupções na gestão da cadeia de abastecimento devido a uma pandemia dificultam o crescimento do mercado global de outsourcing de dispositivos médicos. Por outro lado, o aumento da população geriátrica e o aumento da utilização de Dispositivos Médicos de Intervenção (DMIs) atuam como oportunidades para o crescimento do mercado global de outsourcing de dispositivos médicos. O aumento das alternativas de serviços e os problemas de conformidade com o outsourcing são os desafios enfrentados no mercado global de outsourcing de dispositivos médicos.

O relatório de mercado de outsourcing de dispositivos médicos fornece detalhes sobre a quota de mercado, novos desenvolvimentos e análise do pipeline de produtos, impacto dos participantes do mercado nacional e localizado, analisa as oportunidades em termos de bolsas de receitas emergentes, alterações nas regulamentações do mercado, aprovações de produtos, decisões estratégicas, lançamentos de produtos , expansões geográficas e inovações tecnológicas no mercado. Para compreender a análise e o cenário de mercado, contacte-nos para um Briefing de Analista.

Âmbito e dimensão do mercado de outsourcing de dispositivos médicos no Médio Oriente e África

Âmbito e dimensão do mercado de outsourcing de dispositivos médicos no Médio Oriente e África

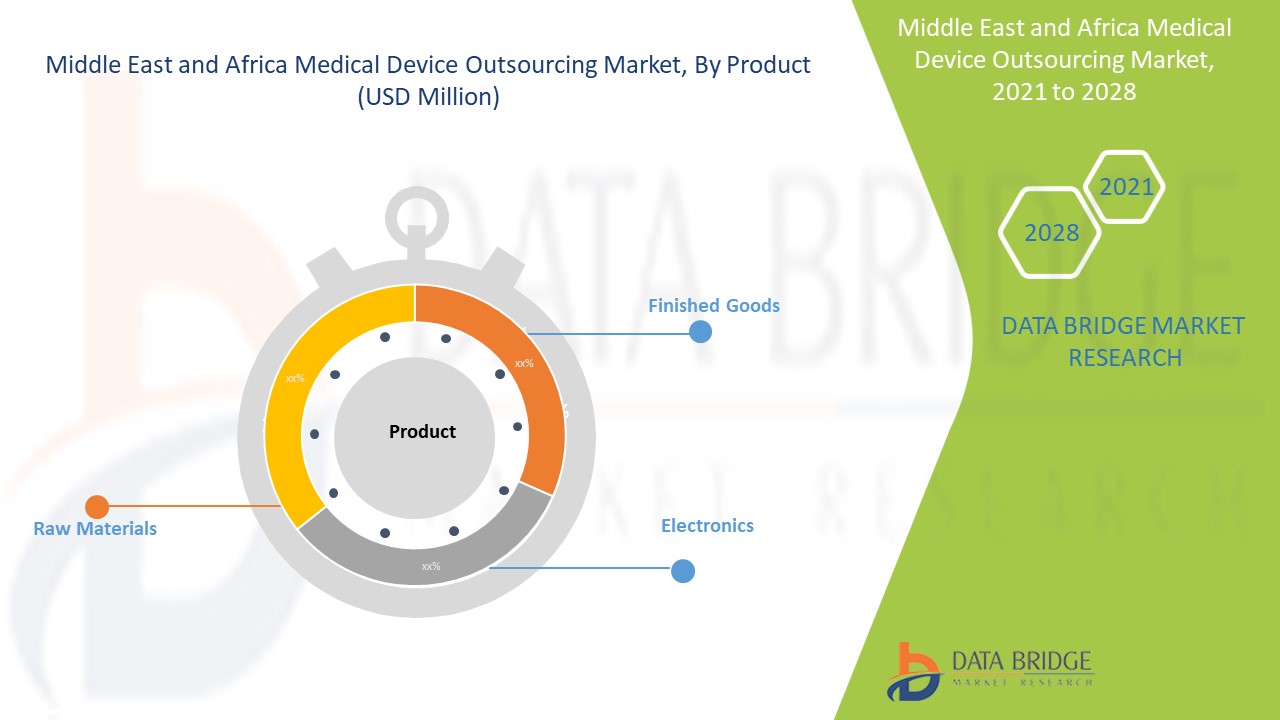

O mercado de outsourcing de dispositivos médicos está segmentado com base nos serviços, produto, tipo de dispositivo, aplicação e utilizador final. O crescimento entre segmentos ajuda-o a analisar os nichos de crescimento e as estratégias para abordar o mercado e determinar as suas principais áreas de aplicação e a diferença nos seus mercados-alvo.

- Com base nos serviços, o mercado de outsourcing de dispositivos médicos está segmentado em garantia de qualidade, serviços de assuntos regulamentares, serviços de design e desenvolvimento de produtos, serviços de teste e esterilização de produtos, serviços de implementação de produtos, serviços de atualização de produtos, serviços de manutenção de produtos, serviços de matérias-primas, serviços médicos. Em 2021, prevê-se que o segmento de fabrico por contrato domine o mercado global de outsourcing de dispositivos médicos devido à indisponibilidade de máquinas, mão-de-obra, instalações e elevados gastos para o fabrico de dispositivos médicos em diferentes regiões do mundo.

- Com base no produto, o mercado de outsourcing de dispositivos médicos está segmentado em produtos acabados, eletrónicos e matérias-primas. Em 2021, prevê-se que o segmento de produtos acabados domine o mercado global de outsourcing de dispositivos médicos devido à crescente procura de dispositivos médicos em todo o mundo para tratar os doentes.

- Com base no tipo de dispositivo, o mercado de outsourcing de dispositivos médicos está segmentado em classe I, classe II e classe III. Em 2021, prevê-se que o segmento de classe I domine o mercado global de outsourcing de dispositivos médicos devido à crescente procura de dispositivos médicos em todo o mundo para tratar doentes com doenças crónicas.

- Com base na aplicação, o mercado de outsourcing de dispositivos médicos está segmentado em cardiologia, diagnóstico por imagem, ortopedia, DIV, oftalmologia, cirurgia geral e plástica, administração de medicamentos, medicina dentária, endoscopia, tratamento da diabetes e outros. Em 2021, espera-se que o segmento da cardiologia domine o mercado global de outsourcing de dispositivos médicos devido à crescente procura de dispositivos médicos de cardiologia em todo o mundo para tratar doentes com DCV.

- Com base no utilizador final, o mercado de outsourcing de dispositivos médicos está segmentado em pequenas empresas de dispositivos médicos, médias empresas de dispositivos médicos e grandes empresas de dispositivos médicos, entre outras. Em 2021, prevê-se que o segmento das pequenas empresas de dispositivos médicos domine o mercado global de outsourcing de dispositivos médicos devido ao número crescente de pequenas empresas de dispositivos médicos nos países em desenvolvimento.

Análise de mercado de outsourcing de dispositivos médicos a nível de país

O mercado de outsourcing de dispositivos médicos é analisado e são fornecidas informações sobre o tamanho do mercado por país, serviços, produto, tipo de dispositivo, aplicação e utilizador final.

Os países abrangidos pelo relatório de mercado de outsourcing de dispositivos médicos são a África do Sul, Arábia Saudita, Emirados Árabes Unidos, Israel, Egito, Kuwait e resto do Médio Oriente.

Prevê-se que a África do Sul domine o mercado do Médio Oriente e de África devido à crescente incidência de infecções crónicas e ao aumento dos gastos em cuidados de saúde.

A secção do relatório sobre os países também fornece fatores individuais que impactam o mercado e alterações na regulamentação do mercado nacional que impactam as tendências atuais e futuras do mercado. Pontos de dados como novas vendas, vendas de reposição, demografia do país, atos regulamentares e tarifas de importação e exportação são alguns dos principais indicadores utilizados para prever o cenário de mercado para países individuais. Além disso, a presença e a disponibilidade de marcas globais e os desafios enfrentados devido à grande ou escassa concorrência de marcas locais e nacionais, bem como o impacto dos canais de vendas, são considerados ao fornecer uma análise de previsão dos dados do país.

O potencial de crescimento para a externalização de dispositivos médicos em economias emergentes e as iniciativas estratégicas dos participantes do mercado estão a criar novas oportunidades no mercado de externalização de dispositivos médicos

O mercado de outsourcing de dispositivos médicos também fornece análises de mercado detalhadas para o crescimento de cada país num setor específico, com vendas de dispositivos de desbridamento de feridas, impacto do avanço no outsourcing de dispositivos médicos e mudanças nos cenários regulamentares com o seu apoio ao mercado de outsourcing de dispositivos médicos. Os dados estão disponíveis para o período histórico de 2011 a 2020.

Análise do cenário competitivo e da quota de mercado de outsourcing de dispositivos médicos

O panorama competitivo do mercado de outsourcing de dispositivos médicos fornece detalhes por concorrente. Os detalhes incluídos são a visão geral da empresa, finanças da empresa, receitas geradas, potencial de mercado, investimento em investigação e desenvolvimento, novas iniciativas de mercado, localizações e instalações de produção, pontos fortes e fracos da empresa, lançamento de produtos, pipelines de testes de produto, aprovações de produto, patentes, largura do produto e respiração, domínio da aplicação, curva de salvação da tecnologia. Os pontos de dados fornecidos acima estão apenas relacionados com o foco da empresa no mercado de outsourcing de dispositivos médicos.

As principais empresas que lidam com o outsourcing de dispositivos médicos são a SGS SA, TOXIKON, Pace Analytical, Intertek Group plc, WuXi AppTec, North American Science Associates, Inc., American Preclinical Services, LLC., Sterigenics US, LLC – Uma empresa da Sotera Health, Charles River Laboratories, Celestica Inc., Creganna, FLEX LTD., Heraeus Holding, Integer Holdings Corporation, Nortech Systems, Inc., Plexus Corp., Sanmina Corporation, EUROFINS SCIENTIFIC, TE Connectivity, ICON plc, Parexel International Corporation, Labcorp Drug Development , Tecomet, Inc., IQVIA, Jabil Inc. Syneos Health, PROVIDIEN LLC., Cekindo Business International East/West Industries, Inc., TÜV SÜD entre outros.

Muitos desenvolvimentos de produtos são também iniciados por empresas de todo o mundo, o que também está a acelerar o crescimento do mercado de outsourcing de dispositivos médicos.

Por exemplo,

- Em julho de 2021, a BREATHE e a IQVIA colaboraram para acelerar o diagnóstico precoce e o tratamento de doenças respiratórias. Esta etapa estratégica de trabalhar em conjunto para melhorar os resultados de saúde e a qualidade de vida das pessoas que vivem com problemas respiratórios no Reino Unido impulsionaria o mercado.

A colaboração, as joint ventures e outras estratégias dos participantes do mercado estão a fortalecer a empresa no mercado de outsourcing de dispositivos médicos, o que também traz o benefício para a organização melhorar a sua oferta de produtos de tratamento.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.