Middle East And Africa Ice Cream Freezers Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

313.70 Million

USD

519.18 Million

2025

2033

USD

313.70 Million

USD

519.18 Million

2025

2033

| 2026 –2033 | |

| USD 313.70 Million | |

| USD 519.18 Million | |

|

|

|

|

Segmentação do mercado de freezers para sorvete no Oriente Médio e África, por tipo (freezers horizontais/verticais, freezers verticais, freezers de gaveta, freezers portáteis, freezers expositores, freezers frost free, freezers contínuos e freezers de lote), componentes (compressor, condensador, filtro secador, válvula de expansão, evaporador, acumulador, motor do ventilador e outros), capacidade (menos de 70 litros, 70-150 litros, 150-300 litros, 300-500 litros, 500-700 litros e mais de 700 litros), tecnologia (manual, semiautomática e totalmente automatizada), canal de distribuição (online, lojas especializadas, pontos de venda, distribuidores/revendedores, lojas de eletrônicos, supermercados/hipermercados e outros), usuário final (residencial e comercial) - tendências e previsões do setor. até 2033

Tamanho do mercado de congeladores de sorvete no Oriente Médio e na África

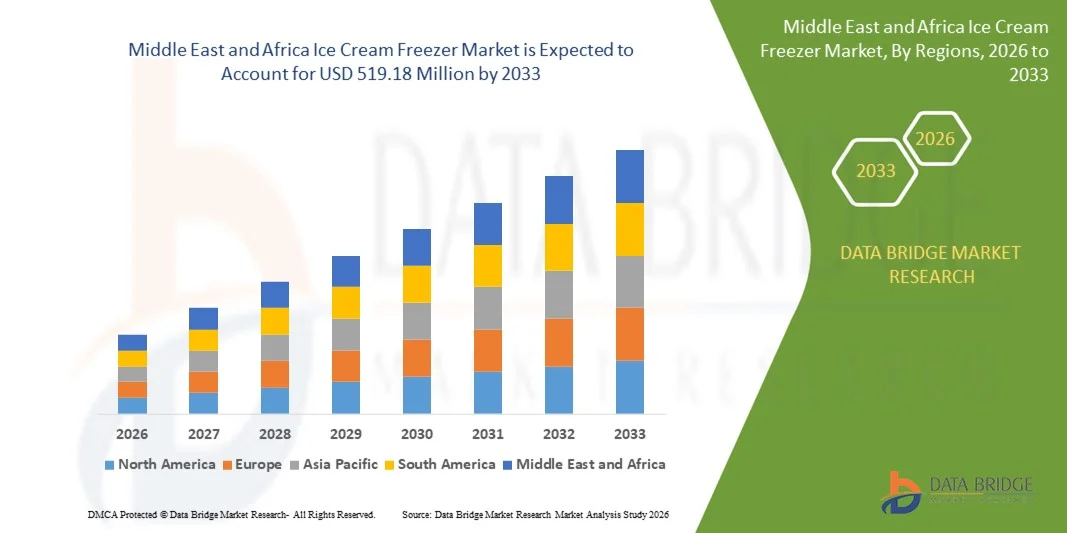

- O mercado de máquinas de sorvete no Oriente Médio e na África foi avaliado em US$ 313,70 milhões em 2025 e deverá atingir US$ 519,18 milhões até 2033 , com uma taxa de crescimento anual composta (CAGR) de 6,5% durante o período de previsão.

- O crescimento do mercado é impulsionado principalmente pela crescente demanda por soluções de congelamento confiáveis, energeticamente eficientes e de alto desempenho, tanto em ambientes residenciais quanto comerciais, sustentada pela rápida expansão de sorveterias, redes de restaurantes de serviço rápido e formatos de varejo modernos.

- Além disso, a crescente adoção de tecnologias avançadas para congeladores, como sistemas de isolamento aprimorados, compressores otimizados e refrigerantes ecológicos, está impulsionando a expansão do mercado, uma vez que os usuários finais priorizam o controle consistente da temperatura e a redução dos custos operacionais, acelerando, em última análise, a adoção de congeladores para sorvete nos mercados globais.

Análise do mercado de congeladores de sorvete no Oriente Médio e na África

- As câmaras frigoríficas para sorvetes, projetadas para manter temperaturas ultrabaixas e estáveis, essenciais para preservar a textura e a qualidade do sorvete, tornaram-se um componente crucial para o varejo, serviços de alimentação e operadores da cadeia de frio, devido à sua capacidade de garantir o frescor do produto, armazenamento de longa duração e desempenho confiável em diversas condições de demanda.

- A crescente necessidade de sistemas de congelamento eficientes é reforçada pelo aumento do consumo de sorvetes e sobremesas congeladas, pela expansão do varejo organizado e pela preferência cada vez maior por eletrodomésticos com baixo consumo de energia, que reduzem os custos operacionais para empresas comerciais e, ao mesmo tempo, oferecem capacidade de congelamento confiável para usuários residenciais.

- A Arábia Saudita dominou o mercado de congeladores para sorvetes em 2025, devido à rápida expansão de formatos de varejo modernos, redes de restaurantes de serviço rápido e lojas especializadas em sobremesas que exigem equipamentos de congelamento confiáveis e com baixo consumo de energia para armazenamento e exposição em grande volume.

- Prevê-se que os Emirados Árabes Unidos sejam o país com o crescimento mais rápido no mercado de congeladores para sorvetes durante o período de previsão, devido à expansão do setor de hotelaria, à crescente cultura de cafés e ao número cada vez maior de marcas premium de sorvetes e gelatos.

- O segmento de congeladores horizontais/congeladores verticais dominou o mercado com uma participação de 38,9% em 2025, devido à sua alta eficiência de isolamento e capacidade de manter temperaturas consistentes, essenciais para a conservação de sorvetes. Esses congeladores suportam armazenamento em grande escala e refrigeração de longa duração, tornando-os adequados para sorveterias, lojas de varejo e pontos de distribuição. Suas baixas necessidades de manutenção e design com eficiência energética ajudam a reduzir os custos operacionais para pequenas e médias empresas. A versatilidade dos congeladores horizontais permite armazenar diversos SKUs sem a necessidade de descongelamento frequente. A ampla adoção em regiões desenvolvidas e emergentes reforça sua posição de liderança.

Escopo do relatório e segmentação do mercado de congeladores de sorvete

|

Atributos |

Principais informações de mercado sobre freezers para sorvete |

|

Segmentos abrangidos |

|

|

Países abrangidos |

Oriente Médio e África

|

|

Principais participantes do mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor agregado |

Além das informações sobre cenários de mercado, como valor de mercado, taxa de crescimento, segmentação, cobertura geográfica e principais participantes, os relatórios de mercado elaborados pela Data Bridge Market Research também incluem análises aprofundadas de especialistas, análises de preços, análises de participação de marcas, pesquisas com consumidores, análises demográficas, análises da cadeia de suprimentos, análises da cadeia de valor, visão geral de matérias-primas/insumos, critérios de seleção de fornecedores, análise PESTLE, análise de Porter e estrutura regulatória. |

Tendências do mercado de congeladores de sorvete no Oriente Médio e na África

Crescente demanda por congeladores com eficiência energética

- Uma das principais tendências no mercado de congeladores para sorvetes é a crescente demanda por sistemas de congelamento com eficiência energética, impulsionada pela necessidade de reduzir custos operacionais e atender às expectativas de sustentabilidade em ambientes comerciais e de varejo. Essa mudança está fortalecendo a adoção de congeladores projetados com isolamento aprimorado, compressores otimizados e refrigerantes ecológicos que ajudam a manter temperaturas baixas e constantes, reduzindo o consumo de energia elétrica.

- Por exemplo, a Blue Star e a Haier continuam a expandir seus portfólios de congeladores de alta eficiência energética que ajudam varejistas e operadores de serviços de alimentação a manter a qualidade do sorvete em condições de temperatura estáveis. Essas soluções proporcionam economia de custos a longo prazo e aumentam a confiabilidade do armazenamento em locais de alta demanda.

- A demanda por congeladores com foco em eficiência energética está se acelerando devido ao crescente número de estabelecimentos de varejo modernos, sorveterias e redes de fast-food que exigem armazenamento refrigerado contínuo, estável e econômico. Isso está impulsionando os fabricantes a desenvolver congeladores que combinem alto desempenho com menor impacto ambiental.

- Sistemas energeticamente eficientes são cada vez mais preferidos devido aos incentivos governamentais para a redução das emissões de carbono e ao aumento dos preços da eletricidade. Essa tendência está influenciando as decisões de compra em mercados emergentes e consolidados.

- Os fabricantes estão integrando tecnologias avançadas de refrigeração para garantir maior consistência do produto e reduzir as flutuações de temperatura. Isso fortalece o mercado de congeladores inovadores que permitem o manuseio eficiente do produto durante todo o ciclo de armazenamento.

- O mercado está testemunhando um crescimento constante, à medida que a adoção de congeladores com eficiência energética apoia a sustentabilidade a longo prazo e a confiabilidade operacional. Essa crescente preferência está moldando os futuros designs de produtos e reforçando a transição para uma infraestrutura de armazenamento refrigerado mais eficiente em todo o setor.

Dinâmica do mercado de congeladores de sorvete no Oriente Médio e na África

Motorista

Consumo crescente de sorvetes e sobremesas congeladas

- O crescente consumo de sorvetes e sobremesas congeladas é um fator crucial que impulsiona a instalação de freezers de última geração para sorvetes em estabelecimentos comerciais e de varejo. Essa demanda crescente está incentivando os pontos de venda a expandir sua capacidade de armazenamento e investir em freezers confiáveis que preservem a qualidade e a textura do produto.

- Por exemplo, marcas que operam em grandes redes varejistas e lojas especializadas em sobremesas dependem de freezers de alta capacidade fornecidos por empresas como AHT e Whirlpool para gerenciar volumes de vendas maiores e garantir o armazenamento refrigerado ininterrupto. Esses freezers ajudam os varejistas a manter a integridade dos produtos durante os períodos de pico de demanda.

- A popularidade de sorvetes premium, artesanais e de consumo imediato está ampliando a necessidade de freezers especializados que suportem baixas temperaturas com estabilidade. Essa crescente diversificação de produtos está fortalecendo a demanda por freezers em diversos formatos de distribuição.

- A crescente preferência dos consumidores por sobremesas congeladas como lanches práticos e indulgentes está levando os varejistas a ampliar a disponibilidade de estoque, resultando em maior aquisição de freezers comerciais. Essa tendência reforça diretamente a demanda por equipamentos nos canais de varejo e foodservice.

- A expansão constante no consumo de sobremesas congeladas deverá continuar a fortalecer o crescimento do mercado, à medida que os operadores investem em soluções avançadas de congelamento para manter a qualidade consistente e atender às necessidades de estoque.

Restrição/Desafio

Altos custos de energia e manutenção

- Um dos principais desafios para o mercado de congeladores para sorvete é o alto consumo de energia e a necessidade de manutenção constante associados aos sistemas de congelamento comerciais. Esses sistemas operam continuamente para manter padrões rigorosos de temperatura, resultando em despesas significativas com energia para varejistas e operadores de serviços de alimentação.

- Por exemplo, os congeladores de grande formato utilizados por supermercados e hipermercados exigem manutenção regular, substituição de peças e verificações técnicas para garantir um desempenho de refrigeração eficiente. Esses custos de manutenção aumentam a pressão sobre os orçamentos operacionais, especialmente para empresas com grandes frotas de congeladores.

- Manter temperaturas de congelamento estáveis exige o uso contínuo do compressor, o que aumenta os custos de eletricidade e limita a acessibilidade para pequenas empresas. Esse desafio é particularmente evidente em regiões com altas tarifas de energia.

- Os congeladores comerciais geralmente exigem técnicos especializados para reparos e calibração do sistema. Essas necessidades de serviço prolongam o tempo de inatividade e aumentam a complexidade operacional para empresas que dependem do armazenamento refrigerado ininterrupto.

- Essas demandas combinadas de energia e manutenção atuam como um fator restritivo à expansão do mercado, incentivando os fabricantes a inovar, mas, simultaneamente, criando barreiras relacionadas a custos para os usuários finais que consideram novas instalações.

Escopo do mercado de congeladores de sorvete no Oriente Médio e na África

O mercado é segmentado com base no tipo, componentes, capacidade, tecnologia, canal de distribuição e usuário final.

- Por tipo

Com base no tipo, o mercado de congeladores para sorvete é segmentado em congeladores horizontais/verticais, congeladores verticais, congeladores de gaveta, congeladores portáteis, congeladores expositores, congeladores frost free, congeladores contínuos e congeladores de lote. O segmento de congeladores horizontais/verticais dominou o mercado com a maior participação, de 38,9% em 2025, devido à sua alta eficiência de isolamento e capacidade de manter temperaturas consistentes, essenciais para a conservação do sorvete. Esses congeladores suportam armazenamento em grande escala e resfriamento de longa duração, tornando-os adequados para sorveterias, lojas de varejo e pontos de distribuição. Suas baixas necessidades de manutenção e design com eficiência energética ajudam a reduzir os custos operacionais para pequenas e médias empresas. A versatilidade dos congeladores horizontais permite armazenar vários SKUs sem descongelamento frequente. A ampla adoção em regiões desenvolvidas e emergentes reforça sua posição de liderança.

O segmento de freezers expositores deverá apresentar o crescimento mais rápido entre 2026 e 2033, impulsionado pelo aumento de instalações em supermercados, hipermercados e sorveterias especializadas. Esses freezers aumentam a visibilidade dos produtos com painéis transparentes e iluminação LED, o que melhora as compras por impulso e a promoção da marca. Por exemplo, marcas como a Haier oferecem freezers expositores avançados, projetados para proporcionar resfriamento uniforme e apresentação atraente de sobremesas congeladas premium. Os varejistas preferem esses equipamentos por sua capacidade de atrair clientes e manter temperaturas consistentes, ao mesmo tempo que exibem uma variedade de produtos. A expansão dos formatos de varejo modernos sustenta a crescente implantação de freezers expositores. Sua flexibilidade de design e vantagem promocional contribuem para a rápida expansão do mercado.

- Por componentes

Com base nos componentes, o mercado de congeladores para sorvete é segmentado em compressor, condensador, filtro/secador, válvula de expansão, evaporador, acumulador, motor do ventilador e outros. O segmento de compressores dominou em 2025 devido ao seu papel crucial em garantir a confiabilidade do resfriamento e a operação estável. Compressores de alta eficiência mantêm as baixas temperaturas precisas necessárias para preservar a textura e a consistência do sorvete. Os fabricantes estão cada vez mais focados em compressores duráveis e energeticamente eficientes que reduzem o consumo de eletricidade tanto para usuários comerciais quanto residenciais. Esses componentes proporcionam capacidade de resfriamento rápido e maior vida útil do equipamento. Sua função essencial em todos os tipos de congeladores impulsiona a forte preferência entre varejistas e operadores comerciais. A consistência e a durabilidade oferecidas pelos compressores garantem a continuidade de sua posição dominante.

Prevê-se que o segmento de evaporadores apresente o crescimento mais rápido entre 2026 e 2033, impulsionado pela sua importância na troca de calor e na uniformidade da temperatura. Projetos de evaporadores aprimorados melhoram a distribuição do resfriamento e reduzem a formação de gelo, o que contribui para a manutenção da qualidade do produto. Por exemplo, empresas como a Carrier lançaram serpentinas de evaporador atualizadas que permitem tempos de congelamento mais rápidos e ciclos de temperatura consistentes. A crescente demanda por freezers com design anticongelante e otimizado para o consumo de energia acelera a adoção de evaporadores avançados. Sua contribuição para um desempenho de resfriamento eficiente fortalece a eficácia dos sistemas de refrigeração como um todo. A transição para soluções modernas de armazenamento refrigerado comercial contribui para o forte crescimento do segmento.

- Por capacidade

Com base na capacidade, o mercado de congeladores para sorvete é segmentado em menos de 70 litros, 70–150 litros, 150–300 litros, 300–500 litros, 500–700 litros e mais de 700 litros. O segmento de 150–300 litros dominou em 2025 por oferecer um equilíbrio ideal entre volume de armazenamento e aproveitamento do espaço. Varejistas e pequenos estabelecimentos comerciais preferem essa faixa de capacidade por sua capacidade de armazenar diversas variedades de sorvete com eficiência. Esses congeladores atendem a ambientes de alta rotatividade sem ocupar muito espaço. Seus sistemas de refrigeração com baixo consumo de energia proporcionam desempenho estável para diferentes cargas de produtos. Os fabricantes priorizam essa faixa de capacidade devido à forte demanda por reposição em mercados emergentes. Sua adaptabilidade a usuários comerciais e residenciais reforça sua dominância.

Prevê-se que o segmento de congeladores com capacidade superior a 700 litros seja o de crescimento mais rápido entre 2026 e 2033, devido ao aumento do investimento em armazenamento em larga escala para a produção e distribuição de sorvetes. Esses congeladores suportam as operações em grande volume exigidas por redes de cadeia de frio, redes de restaurantes de serviço rápido e grandes armazéns de varejo. Por exemplo, a Blue Star oferece congeladores comerciais de alta capacidade com isolamento aprimorado que garante estabilidade de temperatura por longos períodos. O armazenamento em grande volume ajuda as empresas a manter a consistência do fornecimento e a reduzir os custos logísticos. A crescente expansão das marcas de sorvete para novos mercados aumenta a necessidade de soluções de congelamento em escala industrial. O segmento se beneficia do crescimento das operações centralizadas de armazenamento refrigerado.

- Por meio da tecnologia

Com base na tecnologia, o mercado de congeladores para sorvete é segmentado em manuais, semiautomáticos e totalmente automáticos. O segmento manual dominou o mercado em 2025 devido à sua acessibilidade, confiabilidade a longo prazo e facilidade de uso em regiões com preços competitivos. Pequenas lojas e vendedores independentes de sorvete dependem de congeladores manuais por sua baixa necessidade de manutenção e durabilidade em condições variáveis de energia. Essas unidades possuem controles mecânicos simples que garantem estabilidade operacional em regiões remotas ou com infraestrutura precária. Seu longo ciclo de vida as torna adequadas para compradores preocupados com os custos e que priorizam o desempenho funcional. A ampla disponibilidade e o baixo investimento inicial reforçam sua liderança.

Prevê-se que o segmento totalmente automatizado registre o crescimento mais rápido de 2026 a 2033, impulsionado pela crescente demanda por refrigeração de precisão e maior eficiência operacional. Os congeladores automatizados contam com regulação digital de temperatura, descongelamento inteligente e controles otimizados para o consumo de energia. Por exemplo, a Panasonic oferece sistemas de congelamento com IoT integrada, que permitem o monitoramento do desempenho em tempo real para usuários comerciais. Grandes redes varejistas e marcas de fast-food preferem essas unidades para um controle preciso de temperatura e menor necessidade de supervisão manual. A maior economia de energia contribui para a redução de custos a longo prazo em operações de armazenamento de grande volume. A transição para uma infraestrutura de varejo tecnologicamente avançada fortalece a rápida expansão do segmento.

- Por canal de distribuição

Com base no canal de distribuição, o mercado de freezers para sorvete é segmentado em online, lojas especializadas, pontos de venda, distribuidores/revendedores, lojas de eletrônicos, supermercados/hipermercados e outros. O segmento de supermercados/hipermercados dominou em 2025 devido ao grande fluxo de consumidores e à capacidade de instalar múltiplos freezers de exposição e armazenamento. Esses estabelecimentos dependem de freezers de grande capacidade para garantir a disponibilidade ininterrupta de produtos em diversos SKUs. As redes varejistas preferem modelos com eficiência energética para otimizar os gastos com eletricidade, mantendo um alto volume de armazenamento. Seu layout estruturado favorece a exposição e a visibilidade eficazes dos produtos congelados. A rápida expansão das redes de varejo organizadas fortalece a dominância desse segmento. Altas taxas de rotatividade de produtos melhoram a utilização dos freezers.

Espera-se que o segmento online cresça mais rapidamente de 2026 a 2033, impulsionado pela conveniência da entrega de eletrodomésticos em domicílio e pela disponibilidade de especificações detalhadas dos produtos. Os clientes preferem cada vez mais os canais online devido à transparência nos preços, à ampla comparação de produtos e às opções de financiamento. Por exemplo, a Amazon oferece uma extensa lista de freezers para sorvete com suporte para instalação e avaliações de clientes verificadas, incentivando a adoção digital. Os fabricantes estão expandindo suas estratégias de venda direta ao consumidor online para alcançar um público mais amplo. A crescente penetração da internet em mercados emergentes fortalece o e-commerce como método de compra preferencial. A facilidade de registro de garantia e o atendimento digital ao cliente aceleram o crescimento.

- Por usuário final

Com base no usuário final, o mercado de freezers para sorvete é segmentado em residencial e comercial. O segmento comercial dominou em 2025 devido à alta demanda de sorveterias, cafés, restaurantes, lojas de conveniência e operadores de cadeia de frio. Os estabelecimentos comerciais exigem freezers de alto desempenho que mantenham temperaturas baixas e consistentes durante longos períodos de funcionamento. Essas unidades suportam ciclos de congelamento rápidos, essenciais para a qualidade do produto em ambientes de alto volume. As empresas priorizam modelos com construção durável e mecanismos otimizados para o consumo de energia, visando reduzir os custos operacionais a longo prazo. A expansão de lojas especializadas em sobremesas e redes de fast-food fortalece o uso comercial. Sua necessidade de refrigeração confiável e contínua garante forte domínio do mercado.

Prevê-se que o segmento residencial apresente o crescimento mais rápido entre 2026 e 2033, devido ao aumento do consumo doméstico de sobremesas congeladas e à crescente adoção de congeladores compactos. Os consumidores urbanos preferem congeladores dedicados para armazenar produtos de sorvete premium, artesanais e em grandes quantidades. Por exemplo, a LG oferece congeladores compactos frost-free projetados para cozinhas modernas, acompanhando as mudanças de estilo de vida. A crescente conscientização sobre eletrodomésticos com eficiência energética aumenta a adoção desses produtos entre as famílias urbanas. Esses aparelhos oferecem praticidade para armazenar uma variedade maior de lanches e sobremesas congeladas. A expansão da cultura de alimentos congelados premium acelera o crescimento do mercado residencial.

Análise Regional do Mercado de Freezers para Sorvete no Oriente Médio e na África

- A Arábia Saudita dominou o mercado de congeladores para sorvetes, com a maior participação na receita em 2025, impulsionada pela rápida expansão de formatos de varejo modernos, redes de restaurantes de serviço rápido e lojas especializadas em sobremesas que exigem equipamentos de congelamento confiáveis e com baixo consumo de energia para armazenamento e exposição em grande volume.

- O forte crescimento da infraestrutura da cadeia de frio no país e a crescente preferência do consumidor por sobremesas congeladas premium continuam a impulsionar a demanda por freezers comerciais em supermercados, hipermercados e estabelecimentos de alimentação. Iniciativas governamentais estratégicas que apoiam a modernização do varejo e a expansão da hotelaria no âmbito da Visão 2030 estão acelerando a instalação de freezers tanto em áreas urbanas quanto em desenvolvimento.

- A presença de fabricantes internacionais e regionais de refrigeração, aliada à crescente adoção de tecnologias de refrigeração avançadas e ecológicas, reforça a posição dominante da Arábia Saudita no mercado regional, consolidando sua liderança no armazenamento comercial de alimentos congelados.

Análise do mercado de congeladores de sorvete nos Emirados Árabes Unidos

Prevê-se que os Emirados Árabes Unidos registem a taxa de crescimento anual composta (CAGR) mais rápida no mercado de congeladores para sorvetes do Oriente Médio e da África entre 2026 e 2033, impulsionados pelo setor de hotelaria em expansão, pela cultura de cafés florescente e pelo número crescente de marcas premium de sorvetes e gelatos. Por exemplo, as colaborações entre fabricantes globais de congeladores e distribuidores sediados nos Emirados Árabes Unidos para o fornecimento de congeladores expositores com design estético e eficiência energética estão aumentando a presença dos produtos em shoppings, resorts e locais de varejo com grande fluxo de pessoas. A crescente demanda por sobremesas prontas para consumo, o forte investimento em infraestrutura de varejo moderna e a adoção de sistemas de refrigeração com baixo potencial de aquecimento global (GWP) e economia de energia estão acelerando a penetração no mercado. Iniciativas de cidades inteligentes, a expansão do varejo de alimentos impulsionada pelo turismo e a crescente preferência por congeladores de alto desempenho com controle avançado de temperatura posicionam ainda mais os Emirados Árabes Unidos como o mercado de crescimento mais rápido da região.

Análise do Mercado de Congeladores de Sorvete na África do Sul

A África do Sul deverá apresentar um crescimento constante entre 2026 e 2033, impulsionado pela expansão do seu setor de varejo organizado, pela crescente popularidade de sobremesas congeladas e pela maior adoção de freezers comerciais em padarias, lojas de conveniência e estabelecimentos de alimentação. A modernização de formatos de varejo de pequeno e médio porte e a crescente preferência do consumidor por sorvetes embalados estão impulsionando a demanda por unidades de congelamento confiáveis, duráveis e com bom custo-benefício. Parcerias entre marcas globais de refrigeração e distribuidores locais, juntamente com a maior disponibilidade de freezers com eficiência energética e tecnologia inverter, estão melhorando a cobertura do mercado em áreas urbanas e semiurbanas. O apoio governamental para o aprimoramento da capacidade da cadeia de frio, combinado com o crescente foco em tecnologias de refrigeração sustentáveis e de baixa emissão, contribui para o crescimento consistente a longo prazo do mercado de freezers para sorvete na África do Sul.

Participação de mercado de congeladores de sorvete no Oriente Médio e na África

O setor de congeladores de sorvete é liderado principalmente por empresas consolidadas, incluindo:

- AHT Cooling Systems GmbH (Áustria)

- Panasonic Corporation (Japão)

- Grupo Haier (China)

- Whirlpool Corporation (EUA)

- Robert Bosch GmbH (Alemanha)

- Scandomestic A/S (Dinamarca)

- Grupo Midea (China)

- Siemens (Alemanha)

- Miele (Alemanha)

- Electrolux (Suécia)

- Metalfrio Solutions (Brasil)

- AHT (Áustria)

- Liebherr-International Deutschland GmbH (Alemanha)

- Vestfrost Solutions (Dinamarca)

- Ugur Sogutuma AS (Turquia)

- Qingdao Hiron Commercial Cold Chain Co., Ltd. (China)

- Viessmann (Alemanha)

Últimos desenvolvimentos no mercado de congeladores de sorvete no Oriente Médio e na África

- Em novembro de 2025, a Elanpro expandiu sua linha de freezers com tampa de vidro para o segmento de sorvetes e sobremesas congeladas, fortalecendo o mercado ao aumentar a disponibilidade de freezers de varejo de alta visibilidade e eficiência energética. Essa expansão atende às necessidades modernas de merchandising e permite que os varejistas adotem soluções de exibição aprimoradas que aumentam o apelo do produto e melhoram o engajamento do cliente. O portfólio de produtos mais amplo também ajuda a empresa a conquistar uma fatia maior da categoria de freezers comerciais, à medida que as lojas de marca e as lojas de conveniência continuam a crescer.

- Em março de 2024, a Blue Star Ltd lançou um novo portfólio de congeladores horizontais com eficiência energética, com capacidades que variam de 60 a 600 litros, reforçando a tendência do setor em direção a sistemas de refrigeração com otimização de energia. Este lançamento melhora o acesso a soluções de congelamento econômicas para empresas de todos os portes, reduzindo custos operacionais. A inclusão de múltiplas opções de capacidade amplia a penetração nos segmentos de varejo, serviços de alimentação e operadores da cadeia de frio, contribuindo para maior competitividade no mercado.

- Em maio de 2022, a Unilever iniciou dois programas piloto para testar freezers para sorvetes com temperatura mais elevada, visando reduzir o consumo de energia e as emissões de gases de efeito estufa em cerca de 20 a 30% por unidade, apoiando a transição do mercado para a refrigeração sustentável. Essa iniciativa incentiva os fabricantes de freezers a inovarem em designs com temperatura eficiente, mantendo os padrões de qualidade do produto. Também estimula os varejistas a considerarem opções de equipamentos mais ecológicos, acelerando a adoção de freezers ecologicamente corretos nos mercados globais.

- Em fevereiro de 2022, a True Manufacturing modernizou sua linha de freezers comerciais para sorvetes com sistemas de refrigeração de alta eficiência, projetados para reduzir o consumo de energia e aumentar a velocidade de recuperação da temperatura, impulsionando a demanda por freezers de última geração. Essa modernização auxilia os operadores de serviços de alimentação a manterem a textura consistente do produto mesmo com a abertura frequente da porta, um fator crucial em ambientes de varejo movimentados. Os sistemas aprimorados também reduzem as despesas operacionais gerais, promovendo uma transição mais ampla para unidades comerciais com otimização energética.

- Em outubro de 2021, a Haier expandiu sua presença no mercado de freezers para sorvetes com o lançamento de novos modelos equipados com iluminação LED avançada e tecnologia de resfriamento uniforme, aprimorando a exposição dos produtos para os varejistas. Essas melhorias ajudam as lojas a aumentar as compras por impulso, melhorando a visibilidade e a apresentação das sobremesas congeladas. O foco em um design que facilita o varejo também impulsiona a demanda por freezers expositores modernos em supermercados, hipermercados e lojas especializadas.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.