Middle East And Africa Hydrochloric Acid Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

51.51 Million

USD

72.69 Million

2025

2033

USD

51.51 Million

USD

72.69 Million

2025

2033

| 2026 –2033 | |

| USD 51.51 Million | |

| USD 72.69 Million | |

|

|

|

|

Segmentação do mercado de ácido clorídrico no Oriente Médio e África, por tipo (ácido clorídrico sintético e ácido clorídrico derivado de subprodutos), forma (à base de água, aquosa e em solução), aplicação (decapagem de aço, acidificação de poços de petróleo, processamento de minérios, processamento de alimentos, sanitização de piscinas, cloreto de cálcio e outros), canal de distribuição (e-commerce, B2B, lojas especializadas e outros), usuário final (alimentos e bebidas, produtos farmacêuticos, têxtil, petróleo e gás, siderurgia, indústria química e outros) - Tendências e previsões do setor até 2033.

Tamanho do mercado de ácido clorídrico no Oriente Médio e na África

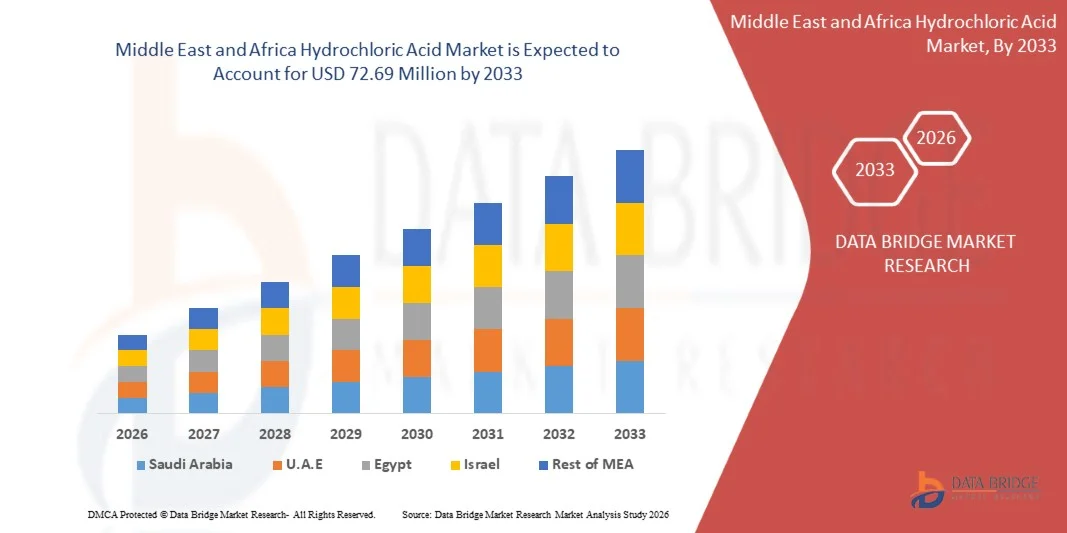

- O mercado de ácido clorídrico no Oriente Médio e na África foi avaliado em US$ 51,51 milhões em 2025 e deverá atingir US$ 72,69 milhões até 2033 , com uma taxa de crescimento anual composta (CAGR) de 4,4% durante o período de previsão.

- O crescimento do mercado é impulsionado principalmente pelo aumento do uso de ácido clorídrico em processos industriais essenciais, como decapagem de aço, acidificação de poços de petróleo, processamento de alimentos e síntese química, devido à expansão da produção industrial e ao aumento da demanda das indústrias pesadas. A crescente necessidade de HCl de alta pureza nas indústrias farmacêutica e eletrônica está impulsionando ainda mais os volumes de produção e fortalecendo as perspectivas de consumo.

- Além disso, a crescente adoção do ácido clorídrico, um subproduto das instalações cloro-álcali, e os sistemas de recuperação focados na sustentabilidade estão melhorando a disponibilidade para os setores de uso final. Esses fatores convergentes estão acelerando a utilização industrial do HCl e sustentando um crescimento estável da demanda em áreas de aplicação consolidadas e emergentes.

Análise do mercado de ácido clorídrico no Oriente Médio e na África

- O ácido clorídrico, um importante composto químico inorgânico utilizado no tratamento de metais, controle de pH, processamento químico e recuperação de recursos, continua sendo um insumo fundamental para indústrias como a siderúrgica, de petróleo e gás, de processamento de alimentos e farmacêutica. Sua versatilidade e papel essencial em fluxos de trabalho industriais de grande escala reforçam sua importância na manufatura global e nas operações da cadeia de valor.

- A crescente demanda por ácido clorídrico é impulsionada principalmente pela expansão do desenvolvimento de infraestrutura, pelo aumento das atividades de exploração de petróleo bruto que requerem acidificação e pelo crescente consumo de alimentos processados e produtos químicos especiais. Esses fatores de mercado estão fortalecendo as tendências de utilização a longo prazo e contribuindo para o crescimento constante na produção de HCl sintético e de subprodutos.

- Os Emirados Árabes Unidos dominaram o mercado de ácido clorídrico no Oriente Médio e na África em 2025, devido à sua crescente base de fabricação de produtos químicos, fortes operações de refino e consumo crescente nos setores de tratamento de água, processamento de alimentos e limpeza de metais.

- Prevê-se que a Arábia Saudita seja o país com o crescimento mais rápido no mercado de ácido clorídrico do Oriente Médio e da África durante o período de previsão, devido à expansão dos setores petroquímico, de petróleo e gás e de manufatura, juntamente com investimentos em larga escala no âmbito da Visão 2030.

- O segmento de ácido clorídrico sintético dominou o mercado com uma participação de 74,5% em 2025, devido à sua pureza consistente, processo de produção controlado e adequação para indústrias que exigem composição química precisa. Os fabricantes preferem variantes sintéticas para aplicações como as indústrias farmacêutica, de processamento de alimentos e de tratamento de água, onde a confiabilidade da qualidade impacta diretamente a produção. A disponibilidade de instalações de produção em larga escala e com custo-benefício fortalece sua presença tanto em economias desenvolvidas quanto em desenvolvimento. As indústrias que utilizam HCl sintético se beneficiam de níveis de concentração uniformes, o que reduz a variabilidade do processo e melhora a qualidade do produto final. O segmento também avança por meio de melhores tecnologias de manuseio e investimentos crescentes em polos de fabricação química em todo o mundo, elevando sua participação de mercado.

Escopo do relatório e segmentação do mercado de ácido clorídrico no Oriente Médio e na África

|

Atributos |

Análises de mercado essenciais do ácido clorídrico |

|

Segmentos abrangidos |

|

|

Países abrangidos |

Oriente Médio e África

|

|

Principais participantes do mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor agregado |

Além das informações sobre cenários de mercado, como valor de mercado, taxa de crescimento, segmentação, cobertura geográfica e principais participantes, os relatórios de mercado elaborados pela Data Bridge Market Research também incluem análise de importação e exportação, visão geral da capacidade de produção, análise de produção e consumo, análise de tendências de preços, cenário de mudanças climáticas, análise da cadeia de suprimentos, análise da cadeia de valor, visão geral de matérias-primas/insumos, critérios de seleção de fornecedores, análise PESTLE, análise de Porter e estrutura regulatória. |

Tendências do mercado de ácido clorídrico no Oriente Médio e na África

“Crescente adoção de sistemas de produção de ácido clorídrico baseados em recuperação”

- Uma das principais tendências no mercado de ácido clorídrico no Oriente Médio e na África é a crescente transição para tecnologias de produção baseadas na recuperação, que permitem a reutilização eficiente do gás cloreto de hidrogênio proveniente de operações industriais. Essa mudança é impulsionada pela necessidade de reduzir o desperdício de produtos químicos, diminuir os custos de produção e cumprir as regulamentações ambientais que promovem práticas industriais sustentáveis.

- Por exemplo, a Covestro AG e a BASF SE implementaram sistemas de recuperação de cloreto de hidrogênio integrados em unidades de fabricação de policarbonato e isocianato. Esses sistemas de circuito fechado capturam e convertem o gás cloreto de hidrogênio em ácido clorídrico reutilizável, melhorando a eficiência de recursos e reduzindo as emissões em instalações de produção química.

- A adoção de sistemas de recuperação está se expandindo nos setores de cloro-álcali e petroquímico, visto que esses processos geram grandes volumes de cloreto de hidrogênio como subproduto. Ao converter esse gás em ácido clorídrico comercializável, as empresas aumentam a sustentabilidade operacional, otimizando suas estruturas de custos e a eficiência da cadeia de suprimentos.

- A crescente inovação tecnológica em unidades de recuperação de ácido, como separadores baseados em membranas e módulos de recuperação térmica, está aprimorando ainda mais a eficiência do processo. Esses avanços permitem a obtenção de produtos com maior pureza e minimizam o consumo de energia, o que sustenta a viabilidade econômica a longo prazo de sistemas sustentáveis de produção de ácido.

- Além disso, a crescente ênfase na manufatura química circular está incentivando a integração do ácido clorídrico recuperado em cadeias de valor nos setores de metalurgia, processamento de alimentos e tratamento de água. Essa integração está alinhada aos esforços globais para reduzir a pegada de carbono e melhorar a utilização de recursos industriais.

- A crescente adoção da produção de ácido clorídrico baseada na recuperação de recursos reflete um compromisso mais amplo da indústria com a sustentabilidade e a resiliência operacional. À medida que as empresas continuam investindo em sistemas de ciclo fechado e estruturas de produção sustentáveis, espera-se que essas tecnologias redefinam os parâmetros competitivos na fabricação de ácido e na eficiência da recuperação de recursos.

Dinâmica do mercado de ácido clorídrico no Oriente Médio e na África

Motorista

“A crescente demanda por decapagem de aço e aplicações de acidificação de poços de petróleo”

- A crescente demanda das indústrias de decapagem de aço e acidificação de poços de petróleo impulsiona o mercado de ácido clorídrico no Oriente Médio e na África. Na produção de aço, o ácido clorídrico desempenha um papel fundamental na remoção de impurezas e películas de óxido das superfícies metálicas antes da galvanização ou revestimento, garantindo qualidade superior do produto e resistência à corrosão.

- Por exemplo, a ArcelorMittal e a Tata Steel integraram plantas próprias de regeneração de ácido clorídrico em suas instalações de produção para garantir o fornecimento constante para as operações de decapagem. Da mesma forma, empresas de serviços petrolíferos como a Halliburton e a Schlumberger dependem fortemente do ácido clorídrico para tratamentos de acidificação que visam aumentar a permeabilidade em reservatórios carbonáticos.

- A expansão dos projetos de exploração de petróleo e gás, combinada com o crescimento das operações de refino, está impulsionando o aumento do consumo de ácido clorídrico. A eficácia do composto na dissolução de incrustações minerais e na limpeza das superfícies dos poços o torna indispensável para manter a eficiência da produção nos processos de perfuração e estimulação.

- Na indústria siderúrgica, a modernização das unidades de processamento e o desenvolvimento de linhas de decapagem avançadas estão impulsionando ainda mais a demanda a longo prazo. O uso de ácido clorídrico em operações contínuas de decapagem permite superfícies metálicas mais limpas, maior produtividade e menor impacto ambiental em comparação com os métodos mais antigos que utilizavam ácido sulfúrico.

- O crescimento contínuo de projetos de construção, automotivos e de infraestrutura industrial em todo o mundo garante uma demanda constante por aço de alta qualidade, sustentando assim a demanda por ácido clorídrico. O uso combinado nos setores de energia, metalurgia e manufatura posiciona o composto como um produto químico industrial essencial, impulsionando a atividade econômica global.

Restrição/Desafio

“Volatilidade no fornecimento de cloro e matéria-prima”

- A volatilidade no fornecimento e nos preços do cloro, matéria-prima essencial na produção de ácido clorídrico, representa um desafio significativo para os fabricantes. Como a disponibilidade de cloro está intimamente ligada às operações da indústria cloro-álcali, as flutuações na produção ou na demanda subsequente por soda cáustica podem influenciar diretamente as taxas de produção de ácido clorídrico e a estabilidade de seus preços.

- Por exemplo, durante períodos de escassez de cloro, grandes produtores como a Olin Corporation e a Westlake Chemical relataram restrições na produção e aumento nos custos de aquisição de derivados, incluindo o ácido clorídrico. Esses desequilíbrios na oferta podem interromper os compromissos contratuais e prejudicar a lucratividade em diversos setores dependentes.

- A natureza cíclica da produção de cloro, aliada às limitações logísticas e de armazenamento, frequentemente leva a uma dinâmica desequilibrada entre oferta e demanda. Como o ácido clorídrico é difícil de transportar por longas distâncias devido a preocupações com a segurança, a escassez regional de produção pode resultar em aumentos localizados de preços e disponibilidade limitada.

- Além disso, as flutuações econômicas globais e as paradas para manutenção em instalações de cloro-álcali podem agravar ainda mais a escassez de matérias-primas. Variações nos preços da energia e nos custos de produção também impactam a economia da fabricação de cloro, influenciando, consequentemente, as tendências de preços do ácido clorídrico em todas as regiões industriais.

- Garantir o fornecimento consistente de matérias-primas e desenvolver modelos de produção eficientes baseados na recuperação de recursos serão essenciais para combater a volatilidade do mercado. Espera-se que colaborações estratégicas, integração vertical e a adoção de sistemas circulares de produção química ajudem a estabilizar as cadeias de suprimentos e a manter uma produção confiável de ácido clorídrico a longo prazo.

Escopo do mercado de ácido clorídrico no Oriente Médio e na África

O mercado é segmentado com base no tipo, formato, aplicação, canal de distribuição e usuário final.

• Por tipo

Com base no tipo, o mercado é segmentado em Ácido Clorídrico Sintético e Ácido Clorídrico Subproduto. O segmento de ácido clorídrico sintético dominou o mercado com a maior participação, de 74,5% em 2025, devido à sua pureza consistente, processo de produção controlado e adequação para indústrias que exigem composição química precisa. Os fabricantes preferem variantes sintéticas para aplicações como as indústrias farmacêutica, de processamento de alimentos e de tratamento de água, onde a confiabilidade da qualidade impacta diretamente a produção operacional. A disponibilidade de instalações de produção em larga escala e com custo-benefício fortalece sua presença tanto em economias desenvolvidas quanto em desenvolvimento. As indústrias que utilizam HCl sintético se beneficiam de níveis de concentração uniformes, o que reduz a variabilidade do processo e melhora a qualidade do produto final. O segmento também avança por meio de melhores tecnologias de manuseio e investimentos crescentes em polos de fabricação química em todo o mundo, elevando sua participação de mercado.

Prevê-se que o segmento de ácido clorídrico como subproduto apresente o crescimento mais rápido entre 2026 e 2033, impulsionado pela sua crescente disponibilidade proveniente de siderúrgicas e plantas químicas integradas. Este tipo de ácido clorídrico ganha força à medida que as indústrias buscam alternativas economicamente viáveis, decorrentes do crescente foco na eficiência de recursos e na manufatura circular. Sua adoção se fortalece com a modernização das operações das siderúrgicas e a geração de maiores volumes de HCl como subproduto, adequado para consumo posterior. Muitos setores de uso final aceitam variantes de subprodutos para aplicações como processamento de metais e estimulação de poços de petróleo, onde a pureza ultra-alta não é obrigatória. Considerações ambientais e a redução dos custos de produção aceleram ainda mais sua trajetória de crescimento nos mercados globais.

• Por formulário

Com base na forma, o mercado é segmentado em Ácido Clorídrico à Base de Água, Ácido Clorídrico Aquoso e Ácido Clorídrico em Solução. O segmento de Ácido Clorídrico à base de água dominou o mercado do Oriente Médio e da África em 2025 devido à sua ampla aplicabilidade em síntese química, tratamento de metais e processamento industrial. O HCl à base de água é preferido por seus níveis de concentração equilibrados, facilidade de manuseio e compatibilidade com grandes sistemas industriais. As indústrias de uso final preferem essa forma, pois ela proporciona taxas de reação estáveis e reduz os riscos associados a formas ácidas altamente concentradas. O segmento se beneficia da expansão das operações de fabricação nos setores de aço e petróleo e gás, onde as variantes à base de água são amplamente utilizadas. Sua relação custo-benefício e vantagens em segurança garantem demanda contínua tanto por parte dos compradores de produtos químicos a granel quanto por compradores de especialidades químicas.

O segmento de HCl aquoso e em solução deverá apresentar o crescimento mais rápido entre 2026 e 2033, devido à crescente adoção em laboratórios, aplicações industriais controladas e síntese química de precisão. Essas formulações oferecem níveis de concentração personalizáveis que atendem aos rigorosos requisitos operacionais das indústrias farmacêutica, alimentícia e eletrônica. O crescimento é ainda impulsionado pela crescente automação em sistemas de dosagem que utilizam formatos de solução padronizados para evitar variabilidade. O segmento se beneficia da expansão de aplicações em áreas onde o comportamento químico consistente e a segurança no manuseio são priorizados. Essa flexibilidade na formulação sustenta sua rápida expansão em indústrias emergentes de uso final.

• Mediante inscrição

Com base na aplicação, o mercado é segmentado em Decapagem de Aço, Acidificação de Poços de Petróleo, Processamento de Minérios, Processamento de Alimentos, Sanitização de Piscinas, Cloreto de Cálcio e Outros. A aplicação de decapagem de aço dominou o mercado em 2025 devido ao papel indispensável do ácido na remoção de incrustações, ferrugem e impurezas durante o processamento do aço. O ácido clorídrico proporciona eficiência de decapagem superior em comparação com outros ácidos, oferecendo taxas de reação mais rápidas e preparação de superfície mais limpa para processos subsequentes. A expansão da produção global de aço, particularmente na região Ásia-Pacífico, reforça ainda mais sua dominância. Os fabricantes de aço preferem o HCl por sua reciclabilidade através de sistemas de regeneração de ácido, reduzindo o impacto ambiental e os custos operacionais. O segmento mantém uma posição sólida devido à modernização contínua das linhas de decapagem e à demanda das indústrias automotiva, de construção e pesada.

Prevê-se que a acidificação de poços de petróleo registre o crescimento mais rápido entre 2026 e 2033, impulsionada pelo aumento das atividades de perfuração em reservas convencionais e não convencionais. O ácido clorídrico é preferido por sua capacidade de dissolver carbonatos, aumentar a permeabilidade do reservatório e melhorar as taxas de fluxo de hidrocarbonetos. A expansão da exploração de xisto e dos projetos de recuperação avançada de petróleo amplifica a demanda por soluções de acidificação de alto desempenho. O foco da indústria em maximizar a produtividade dos poços e reduzir o tempo de inatividade incentiva uma maior adoção de formulações à base de HCl. O aumento do investimento em serviços de campos petrolíferos e técnicas avançadas de estimulação coloca esse segmento na vanguarda do crescimento futuro.

• Por canal de distribuição

Com base no canal de distribuição, o mercado é segmentado em Comércio Eletrônico, B2B, Lojas Especializadas e Outros. O canal de distribuição B2B dominou o mercado de ácido clorídrico no Oriente Médio e na África em 2025, devido aos padrões de aquisição em grande escala de consumidores industriais nos setores de aço, químico e de petróleo e gás. As empresas preferem contratos de fornecimento direto para garantir disponibilidade ininterrupta, preços estáveis e concentrações personalizadas. Fabricantes e distribuidores de produtos químicos fortalecem esse canal com redes logísticas bem estabelecidas e contratos de serviço de longo prazo. Usuários de grande escala se beneficiam de sistemas integrados de armazenamento, transporte e segurança que otimizam as entregas de alto volume. O canal permanece dominante, visto que a dependência industrial de um fornecimento controlado e pontual continua a aumentar globalmente.

Espera-se que o segmento de comércio eletrônico apresente o crescimento mais rápido de 2026 a 2033, devido à crescente digitalização dos processos de aquisição e à expansão dos marketplaces online de produtos químicos. As pequenas e médias empresas dependem cada vez mais de plataformas online para obter preços transparentes, comparar produtos e agilizar o processamento de pedidos. As plataformas de comércio eletrônico facilitam o acesso a fichas de dados de segurança, certificações e especificações técnicas, permitindo a tomada de decisões mais informadas. A tendência para compras descentralizadas e a demanda por embalagens menores também impulsionam o crescimento. A crescente participação de fornecedores de produtos químicos na distribuição online acelera a expansão do segmento.

• Por usuário final

Com base no usuário final, o mercado é segmentado em Alimentos e Bebidas, Produtos Farmacêuticos, Têxtil, Petróleo e Gás, Siderurgia, Indústria Química e Outros. A indústria siderúrgica dominou o mercado em 2025 devido ao consumo em larga escala de ácido clorídrico para processos de decapagem, remoção de incrustações e otimização da produção. As siderúrgicas dependem do HCl para obter superfícies limpas, reduzir impurezas e viabilizar operações eficientes de laminação e acabamento. O crescimento contínuo dos setores de construção, automotivo e infraestrutura mantém altos níveis de produção de aço. As tecnologias de regeneração de ácido incentivam ainda mais a adoção, reduzindo o desperdício e melhorando a relação custo-benefício. O segmento se beneficia da expansão contínua da capacidade produtiva nas principais regiões produtoras de aço, garantindo a manutenção da sua posição dominante.

Prevê-se que o segmento de petróleo e gás apresente o crescimento mais acelerado entre 2026 e 2033, impulsionado pela crescente demanda por estimulação ácida, limpeza de poços e operações de recuperação aprimorada. O ácido clorídrico desempenha um papel crucial na melhoria do desempenho dos reservatórios, especialmente em formações carbonáticas, onde a acidificação é essencial. O crescimento da extração de xisto e da perfuração de poços profundos impulsiona a demanda por misturas ácidas personalizadas. O setor adota soluções químicas mais avançadas para maximizar o rendimento e a eficiência operacional. O aumento do investimento global em projetos de exploração e produção garante a rápida expansão desse segmento de usuários finais.

Análise Regional do Mercado de Ácido Clorídrico no Oriente Médio e África

- Os Emirados Árabes Unidos dominaram o mercado de ácido clorídrico no Oriente Médio e na África, com a maior participação na receita em 2025, impulsionados por sua crescente base de fabricação de produtos químicos, fortes operações de refinaria e consumo crescente nos setores de tratamento de água, processamento de alimentos e limpeza de metais.

- A infraestrutura industrial avançada do país e a expansão das instalações petroquímicas e de cloro-álcalis, impulsionada pelo governo, estão fortalecendo a produção nacional de ácido clorídrico. Parcerias estratégicas entre produtores químicos globais e polos industriais locais estão aprimorando a confiabilidade do fornecimento, a eficiência dos processos e a qualidade do produto.

- O aumento dos investimentos em diversificação industrial, projetos de infraestrutura de grande escala e iniciativas de tratamento de águas residuais reforça a liderança dos Emirados Árabes Unidos no mercado regional. O compromisso do país em fortalecer as cadeias de valor da indústria química continua a sustentar sua posição dominante.

Análise do Mercado de Ácido Clorídrico na Arábia Saudita, Oriente Médio e África

Prevê-se que a Arábia Saudita registre a taxa de crescimento anual composta (CAGR) mais rápida no mercado de ácido clorídrico do Oriente Médio e da África durante o período de 2026 a 2033, impulsionada pela expansão dos setores petroquímico, de petróleo e gás e de manufatura, juntamente com investimentos em larga escala no âmbito da Visão 2030. O país está aumentando o uso de ácido clorídrico em perfuração, recuperação aprimorada de petróleo, processamento de aço e produção química para sustentar a expansão industrial. A crescente colaboração entre produtores locais e empresas químicas internacionais está acelerando a adoção de tecnologia, aprimorando as capacidades de produção e expandindo as redes de distribuição. Iniciativas governamentais que promovem a autossuficiência industrial, o crescimento do processamento mineral e a infraestrutura de tratamento de água estão criando fortes perspectivas de demanda. O foco estratégico da Arábia Saudita na modernização industrial e no desenvolvimento sustentável continua a impulsionar o crescimento constante do mercado.

Análise do Mercado de Ácido Clorídrico na África do Sul, Oriente Médio e África

Prevê-se que a África do Sul testemunhe um crescimento robusto entre 2026 e 2033, impulsionado pelo fortalecimento de suas indústrias de mineração, metalurgia e processamento químico. Os setores de extração e refino de minerais, já consolidados no país, estão aumentando a demanda por ácido clorídrico no processamento de minérios e no tratamento de metais. Os avanços nas tecnologias de produção de cloro-álcali e os crescentes investimentos do setor público em infraestrutura de tratamento de água estão aprimorando o fornecimento interno. A colaboração entre fabricantes de produtos químicos, empresas de mineração e organizações focadas em sustentabilidade está promovendo a inovação e ampliando a visibilidade do mercado. A ênfase da África do Sul na eficiência de recursos, na modernização industrial e no desenvolvimento da economia circular sustenta sua posição como o mercado de crescimento mais rápido da região.

Participação de mercado do ácido clorídrico no Oriente Médio e na África

A indústria do ácido clorídrico é liderada principalmente por empresas consolidadas, incluindo:

- Olin Corporation (EUA)

- Corporação de Petróleo Ocidental (EUA)

- Shin-Etsu Chemical Co., Ltd. (Japão)

- BASF SE (Alemanha)

- UNID (Coreia do Sul)

- Detrex Corporation – Italmatch Chemicals SpA (EUA/Itália)

- Tronox Holdings plc (EUA)

- IXOM (Austrália)

- Nouryon (Países Baixos)

- ERCO Worldwide – Superior Plus (Canadá)

- SEQUÊNCIAS (França)

- Formosa Plastics Corporation (Taiwan)

- Grupo Tessenderlo (Bélgica)

- Westlake Chemical Corporation (EUA)

- Aditya Birla Chemicals (Índia)

- AGC Chemicals Américas (EUA/Japão)

- TOAGOSEI CO., LTD (Japão)

Últimos desenvolvimentos no mercado de ácido clorídrico no Oriente Médio e na África

- Em novembro de 2025, a Agência de Proteção Ambiental dos EUA (EPA) introduziu regulamentações mais rigorosas para emissões atmosféricas em incineradores de resíduos perigosos, impondo controles mais rígidos às instalações que recuperam ácido clorídrico de fluxos de resíduos. Os padrões atualizados aumentam a necessidade de tecnologias avançadas de controle de emissões, elevando os custos operacionais e de conformidade para unidades de recuperação de HCl. Espera-se que esse desenvolvimento influencie a viabilidade econômica da produção de ácido clorídrico como subproduto, podendo desacelerar a expansão da capacidade de recuperação e levando os produtores a reavaliarem suas estratégias de investimento de longo prazo em sistemas de conversão de resíduos em produtos químicos.

- Em julho de 2025, a Olin Corporation expandiu sua capacidade de produção de ácido clorídrico em sua unidade fabril na Louisiana para atender à crescente demanda das indústrias de processamento de aço, síntese química e tratamento de água. Essa expansão aumenta a capacidade da Olin de atender às necessidades de suprimento regionais e internacionais, reduz a dependência de volumes importados e estabiliza a disponibilidade em todos os segmentos de uso final. Ao fortalecer a confiabilidade da produção, a Olin também melhora sua vantagem competitiva na cadeia de valor cloro-álcali, contribuindo para o equilíbrio do mercado em meio ao aumento do consumo.

- Em janeiro de 2025, a Jones-Hamilton Co. concluiu a aquisição da Nexchlor LLC, expandindo significativamente sua capacidade de produção de ácido clorídrico e sua presença geográfica. A integração fortalece a posição da empresa no mercado global, aumentando a segurança do fornecimento e possibilitando uma cobertura de serviços mais ampla em mais de 20 países. Com a nomeação de Jon Cupps como Gerente de Divisão para o negócio de HCl, a empresa visa otimizar as operações e aprimorar o alinhamento estratégico, enquanto o CEO Tim Poure enfatizou como a expertise combinada elevará o relacionamento com os clientes e o desempenho do fornecimento a longo prazo.

- Em agosto de 2024, a Westlake Corporation realizou uma audiência pública para discutir sua proposta de instalação de dois fornos de ácido clorídrico movidos a resíduos perigosos, projetados para recuperar HCl de fluxos de resíduos industriais. O projeto destaca o crescente foco da indústria na eficiência de recursos e em modelos de produção sustentáveis. Embora os participantes da comunidade tenham expressado preocupações com relação aos impactos ambientais e de segurança, especialistas em regulamentação enfatizaram a necessidade de estrita conformidade com os requisitos de remoção de contaminantes previstos na Lei de Conservação e Recuperação de Recursos (Resource Conservation and Recovery Act). O avanço do projeto pode melhorar o fornecimento regional e apoiar modelos de produção circular, embora a análise regulatória e o feedback da comunidade possam influenciar o cronograma final de implementação.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.