Middle East And Africa Hot Fill Packaging Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

2.83 Billion

USD

3.69 Billion

2025

2033

USD

2.83 Billion

USD

3.69 Billion

2025

2033

| 2026 –2033 | |

| USD 2.83 Billion | |

| USD 3.69 Billion | |

|

|

|

|

Mercado de embalagens de enchimento a quente do Médio Oriente e África por tipo de produto (garrafas, frascos, recipientes, sacos, latas, tampas e fechos e outros), tipo de material (tereftalato de polietileno (PET), vidro, polipropileno e outros) , camada de embalagem ( Primário, Secundário e Terciário), Capacidade (Até 12 Oz, 13 Oz- 32 Oz, 33 Oz- 64 Oz, Acima de 64 Oz, 13 Oz- 32 Oz), Tipo de Máquina (Manual e Automático) , Utilizador Final (Molhos e pastas, sumos de fruta, sumos de vegetais, geleias, maionese, água aromatizada, bebidas prontas a beber, sopas, produtos lácteos, néctares e outros), canal de distribuição (off-line e on-line), país (África do Sul, Arábia Saudita, Emirados Árabes Unidos, Egito , Israel e resto do Médio Oriente e África) Tendências e previsões do setor até 2028.

Análise de mercado e insights: Mercado de embalagens de enchimento a quente do Médio Oriente e África

Análise de mercado e insights: Mercado de embalagens de enchimento a quente do Médio Oriente e África

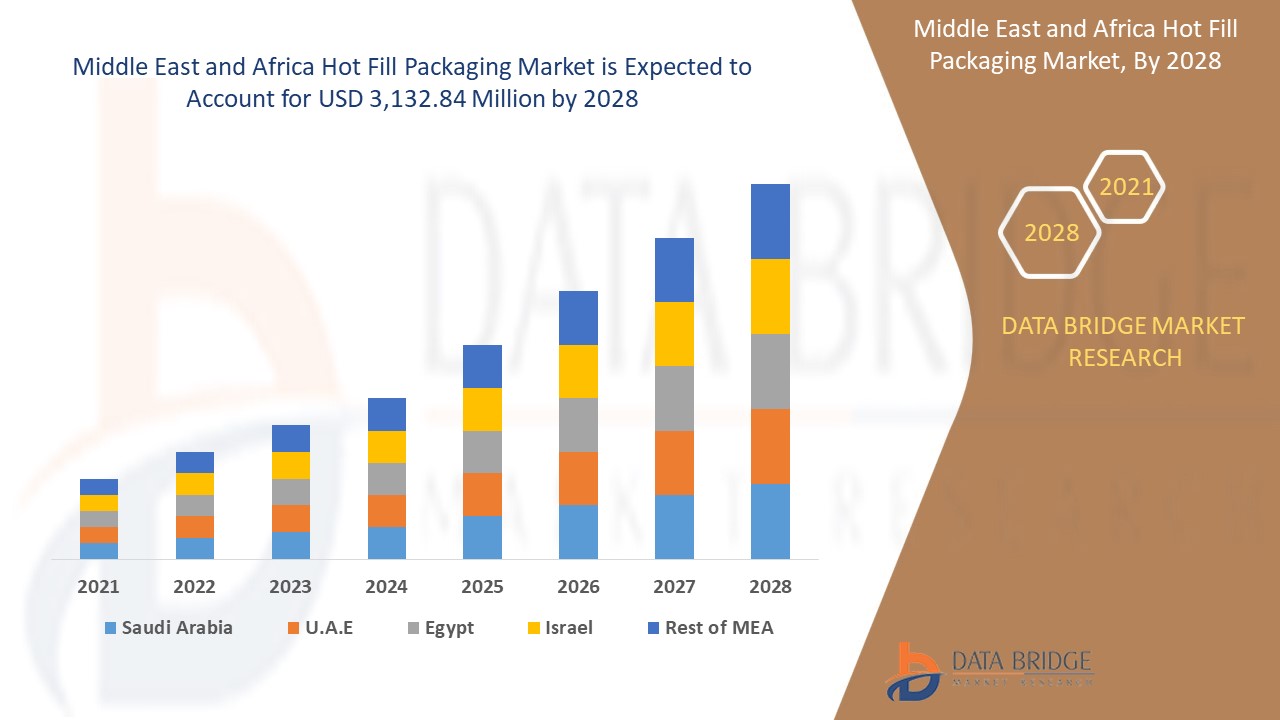

Espera-se que o mercado de embalagens de enchimento a quente do Médio Oriente e África ganhe crescimento de mercado no período previsto de 2021 a 2028. A Data Bridge Market Research analisa que o mercado está a crescer com um CAGR de 3,4% no período previsto de 2021 a 2028 e está deverá atingir os 3.132,84 milhões de dólares até 2028.

A embalagem de enchimento a quente é o procedimento de desinfeção/esterilização do produto para prolongar a sua vida útil, garantindo a sua segurança. Com o processo de enchimento a quente, as bactérias nocivas na garrafa podem contaminar ou danificar o produto, tornando-o inseguro e prejudicial para o consumo, afetando a saúde das pessoas. O líquido é aquecido a uma temperatura de 194 graus Fahrenheit para eliminar a contaminação do produto e criar uma garrafa de plástico de enchimento a quente. O enchimento a quente é um procedimento feito com vidro ou outro tipo de plásticos rígidos, que suportam a elevada temperatura necessária para esterilizar completamente a garrafa, contendo produtos com pH <4,5, como bebidas isotónicas, sopas, marinadas , sumos, entre outros .

O relatório do mercado de embalagens de enchimento a quente do Médio Oriente e África fornece detalhes sobre a quota de mercado, novos desenvolvimentos e impacto dos participantes do mercado doméstico e localizado, analisa as oportunidades em termos de bolsas de receitas emergentes, alterações nas regulamentações do mercado, aprovações de produtos, decisões estratégicas e lançamentos de produtos. Para compreender a análise e o cenário do mercado de embalagens de enchimento a quente, contacte a Data Bridge Market Research para obter um briefing de analista.

Âmbito e dimensão do mercado de embalagens de enchimento a quente no Médio Oriente e África

Âmbito e dimensão do mercado de embalagens de enchimento a quente no Médio Oriente e África

O mercado de embalagens de enchimento a quente está segmentado em sete segmentos com base no tipo de produto, tipo de material, camada de embalagem, capacidade, tipo de máquina, utilizador final e canal de distribuição. O crescimento entre segmentos ajuda-o a analisar os nichos de crescimento e as estratégias para abordar o mercado e determinar as suas principais áreas de aplicação e a diferença nos seus mercados-alvo.

- Com base no tipo de produto, o mercado das embalagens de enchimento a quente está segmentado em garrafas, frascos, recipientes, bolsas, latas, tampas e fechos, entre outros. Em 2021, prevê-se que o segmento das garrafas domine o mercado devido ao seu tamanho e formato práticos.

- Com base no tipo de material, o mercado de embalagens de enchimento a quente está segmentado em polietileno tereftalato (PET), vidro, polipropileno e outros. Em 2021, prevê-se que o segmento do polietileno tereftalato (PET) domine o mercado, uma vez que é um dos materiais de embalagem mais acessíveis para alimentos e bebidas.

- Com base na camada de embalagem, o mercado de embalagens de enchimento a quente está segmentado em primária, secundária e terciária. Em 2021, prevê-se que o segmento primário domine o mercado, uma vez que a principal é a camada de embalagem que contacta diretamente com o produto.

- Com base na capacidade, o mercado de embalagens de enchimento a quente está segmentado até 12 oz, 13 oz-32 oz, 33 oz-64 oz, acima de 64 oz. Em 2021, prevê-se que o segmento de 13 oz-32 oz domine o mercado devido à inclinação dos consumidores jovens e adultos em relação a este tamanho de embalagem.

- Com base no tipo de máquina, o mercado de embalagens de enchimento a quente está segmentado em manual e automático. Em 2021, espera-se que o segmento automático domine o mercado, uma vez que poupa tempo e permite a produção em massa.

- Com base no utilizador final, o mercado de embalagens de enchimento a quente está segmentado em molhos e pastas, sumos de fruta, sumos de vegetais, geleias, maionese, água aromatizada, bebidas prontas a beber, sopas, produtos lácteos, néctares e outros. Em 2021, prevê-se que o segmento dos sumos de fruta domine o mercado devido ao crescente consumo de sumos de fruta no mercado.

- Com base no canal de distribuição, o mercado de embalagens de enchimento a quente está segmentado em offline e online. Em 2021, prevê-se que o segmento offline domine o mercado devido ao vasto alcance dos canais offline no mercado.

Análise ao nível do país do mercado de embalagens de enchimento a quente no Médio Oriente e África

O mercado de embalagens de enchimento a quente é analisado e são fornecidas informações sobre o tamanho do mercado por país, tipo de produto, tipo de material, camada de embalagem, capacidade, tipo de máquina, utilizador final e canal de distribuição, conforme referenciado acima.

- Com base na geografia, o mercado de embalagens de enchimento a quente do Médio Oriente e África está segmentado na África do Sul, Arábia Saudita, Emirados Árabes Unidos, Egito, Israel e resto do Médio Oriente e África. Em 2021, prevê-se que a África do Sul domine o mercado devido à elevada procura de uma variedade de bebidas, molhos e pastas.

A secção do relatório sobre os países também fornece fatores individuais que impactam o mercado e alterações na regulamentação do mercado nacional que impactam as tendências atuais e futuras do mercado. Pontos de dados como novas vendas, vendas de reposição, demografia do país, atos regulamentares e tarifas de importação e exportação são alguns dos principais indicadores utilizados para prever o cenário de mercado para países individuais. Além disso, a presença e a disponibilidade de marcas do Médio Oriente e de África e os desafios enfrentados devido à grande ou escassa concorrência das marcas locais e nacionais, bem como o impacto dos canais de venda, são considerados quando se fornece uma análise de previsão dos dados do país.

O crescimento das atividades estratégicas dos principais participantes do mercado para aumentar a sensibilização para as embalagens de enchimento a quente está a impulsionar o crescimento do mercado de embalagens de enchimento a quente

O mercado de embalagens de enchimento a quente também fornece análises de mercado detalhadas para o crescimento de cada país num mercado específico. Além disso, fornece informações detalhadas sobre a estratégia dos participantes do mercado e a sua presença geográfica. Os dados estão disponíveis para o período histórico de 2010 a 2019.

Análise do panorama competitivo e da quota de mercado de embalagens de enchimento a quente no Médio Oriente e em África

O panorama competitivo do mercado de embalagens de enchimento a quente no Médio Oriente e em África fornece detalhes por concorrente. Os detalhes incluídos são a visão geral da empresa, finanças da empresa, receitas geradas, potencial de mercado, investimento em investigação e desenvolvimento, novas iniciativas de mercado, localizações e instalações de produção, pontos fortes e fracos da empresa, lançamento de produtos, aprovações de produto, patentes, amplitude e amplitude do produto, domínio da aplicação , curva de salvação da tecnologia. Os pontos de dados fornecidos acima estão apenas relacionados com o foco da empresa no mercado de embalagens de enchimento a quente do Médio Oriente e de África.

Alguns dos principais participantes que operam no mercado de embalagens de enchimento a quente são: United States Plastic Corporation, Berry Global Inc., Imperial Packaging, DS Smith, Samkin Industries, Smurfit Kappa, RESILUX NV, SAMYANG PACKAGING CORPORATION, MJS Packaging, Gualapack SpA , E- proPLAST GmbH, LOG Plastic Products Company Ltd., Klöckner Pentaplast, Kaufman Container, Pipeline Packaging, Amcor plc, Graham Packaging Company, SMYPC e Borealis AG, entre outros participantes nacionais. Os analistas do DBMR compreendem os pontos fortes competitivos e fornecem análises competitivas para cada concorrente em separado.

Muitos desenvolvimentos são também iniciados por empresas de todo o mundo, o que está também a acelerar o mercado de embalagens de enchimento a quente no Médio Oriente e em África.

Por exemplo,

-

Em julho de 2021, a Graham Packaging Company obteve os direitos de patente para o método de moldagem por sopro de um recipiente de plástico. Isto ajudou a empresa a aumentar o portfólio de produtos, aumentando assim as vendas e a receita

A colaboração, o lançamento de produtos, a expansão de negócios, prémios e reconhecimentos, joint ventures e outras estratégias do participante no mercado estão a aumentar a presença da empresa no mercado de embalagens de enchimento a quente do Médio Oriente e de África, o que também traz benefícios para o crescimento do lucro da organização.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.