Tubos termoretráteis no Médio Oriente e África para o mercado automóvel, por aplicação (mangueiras, conectores, terminais de anel, emendas em linha, tubos de travão , clusters de injeção de diesel, proteção de cabos sob o capô, tubos de gás, emendas em miniatura), material (poliolefina, polivinil Cloreto, Politetrafluoroetileno, Etileno Propileno Fluorado, Perfluoroalcoxi Alcano, Etileno Tetrafluoroetileno e Outros), Cor (Vermelho, Amarelo e Outros), Tipo ( Tubagem Retrátil de Parede Simples e Tubagem Retrátil de Parede Dupla), Tensão (Baixa, Média e Alta), Combustível Tipo (gasolina, diesel/GNV e elétrico ), canal de vendas (OEM e pós-venda), tipo de veículo (automóveis de passageiros, LCV, HCV e veículos elétricos), país (África do Sul, Israel, Emirados Árabes Unidos, Arábia Saudita, Egito, Resto do Médio Oriente e África) Tendências e previsões da indústria para 2028

Análise e insights de mercado: Tubos termoretráteis no Médio Oriente e em África para o mercado automóvel

Análise e insights de mercado: Tubos termoretráteis no Médio Oriente e em África para o mercado automóvel

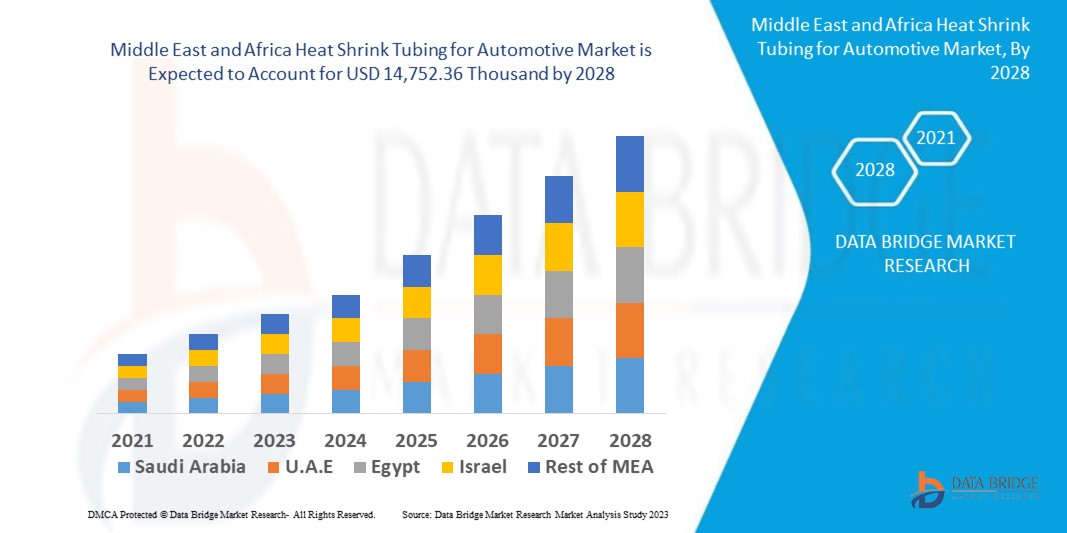

Espera-se que os tubos termoretráteis do Médio Oriente e de África para o mercado automóvel ganhem crescimento de mercado no período de previsão de 2021 a 2028. A Data Bridge Market Research analisa que o mercado está a crescer com um CAGR de 4,4% no período de previsão de 2021 a 2028. e deverá atingir os 14.752,36 mil dólares até 2028. Espera-se que a crescente procura de cablagens de veículos para sistemas de segurança automóvel impulsione significativamente o crescimento do mercado.

A tubagem termoretráctil é utilizada para isolar fios, proporcionando resistência à abrasão e proteção ambiental para condutores de fios sólidos entrançados com ligações, juntas e terminais em trabalhos elétricos . Em geral, um tubo com uma temperatura de contração mais baixa encolherá mais rapidamente. Quando o tubo termo retrátil é enrolado em conjuntos de fios e componentes elétricos, contrai-se radialmente para se ajustar aos contornos do equipamento, formando uma camada protetora. Pode proteger contra abrasão, baixo impacto, cortes, humidade e poeira, cobrindo fios individuais ou envolvendo conjuntos inteiros. Os fabricantes de plástico começam por extrudir um tubo termoplástico para criar um tubo termoretrátil. Os materiais dos tubos termoretráteis variam consoante a aplicação pretendida.

Um aumento da procura de uma vasta gama de materiais isolantes para manutenção preventiva é o principal fator impulsionador no mercado automóvel de tubos termoretráteis no Médio Oriente e em África. A falta de conhecimento do operador sobre a instalação de tubos termoretráteis pode ser um desafio. No entanto, a automatização no processo dos tubos termoretráteis pode ser uma oportunidade para o mercado. As rigorosas regulamentações governamentais sobre a emissão de gases tóxicos restringem os tubos termoretráteis do Médio Oriente e de África para o mercado automóvel.

O relatório sobre tubos termoretráteis para o mercado automóvel no Médio Oriente e África fornece detalhes de quota de mercado, novos desenvolvimentos e análise de pipeline de produtos, o impacto dos participantes do mercado doméstico e localizado, analisa as oportunidades em termos de bolsas de receitas emergentes , alterações nas regulamentações de mercado, aprovações de produtos, decisões estratégicas, lançamentos de produtos, expansões geográficas e inovações tecnológicas no mercado. Para compreender a análise do panorama dos tubos termoretráteis no Médio Oriente e em África para o mercado automóvel, contacte a Data Bridge Market Research para obter um resumo do analista; a nossa equipa irá ajudá-lo a criar uma solução de impacto na receita para atingir a meta desejada.

Tubos termorretráteis no Médio Oriente e África para o âmbito do mercado automóvel e tamanho do mercado

Tubos termorretráteis no Médio Oriente e África para o âmbito do mercado automóvel e tamanho do mercado

Os tubos termoretráteis do Médio Oriente e de África para o mercado automóvel estão segmentados em oito segmentos notáveis com base na aplicação, material, tipo, canal de vendas, cor, tensão, tipo de combustível e tipo de veículo. O crescimento entre segmentos ajuda-o a analisar os nichos de crescimento e as estratégias para abordar o mercado e determinar as suas principais áreas de aplicação e a diferença nos seus mercados-alvo.

- Com base na aplicação, os tubos termoretráteis do Médio Oriente e de África para o mercado automóvel estão segmentados em mangueiras, conectores, terminais de anel, emendas em linha, tubos de travão, conjuntos de injeção de gasóleo, proteção de cabos sob o capô, tubos de gás, emendas em miniatura. Em 2021, espera-se que o segmento das mangueiras domine o mercado, uma vez que transportam fluidos através do ar ou de ambientes fluidos.

- Com base no material, os tubos termoretráteis do Médio Oriente e de África para o mercado automóvel são segmentados em poliolefina, cloreto de polivinila, politetrafluoroetileno, etileno propileno fluorado, perfluoroalcóxi alcano, etileno tetrafluoroetileno, entre outros. Em 2021, prevê-se que o segmento das poliolefinas domine o mercado, uma vez que possui excelentes características físicas, químicas e elétricas e é resistente à abrasão e às chamas.

- Com base na cor, os tubos termoretráteis do Médio Oriente e de África para o mercado automóvel estão segmentados em vermelho, amarelo e outros. Em 2021, espera-se que o segmento vermelho domine o mercado, uma vez que são altamente retardadores de chama e podem ser utilizados numa vasta gama de aplicações industriais.

- Com base no tipo, os tubos termoretráteis do Médio Oriente e África para o mercado automóvel são segmentados em tubos retráteis de parede simples e tubos retráteis de parede dupla. Em 2021, espera-se que o segmento dos tubos retráteis de parede única domine o mercado, uma vez que oferece um alívio de tensão de isolamento superior e proteção contra danos mecânicos.

- Com base na tensão, os tubos termoretráteis do Médio Oriente e de África para o mercado automóvel estão segmentados em baixo, médio e alto. Em 2021, prevê-se que o segmento de baixa tensão domine o mercado devido ao aumento da utilização de tubos termoretráteis, principalmente para a selagem de cabos e isolamento.

- Com base no tipo de combustível, os tubos termoretráteis do Médio Oriente e África para o mercado automóvel estão segmentados em gasolina/gasóleo, GNV e elétrico. Em 2021, espera-se que o segmento da gasolina domine o mercado, uma vez que permite um arranque rápido, uma aceleração mais rápida e uma fácil combustão do combustível nos automóveis.

- Com base no canal de vendas, o mercado automóvel de tubos termoretráteis no Médio Oriente e em África está segmentado em OEM e mercado de pós-venda. Em 2021, espera-se que o segmento OEM domine o mercado, uma vez que as especificações dos produtos têm uma maior transparência.

- Com base no tipo de veículo, o mercado automóvel de tubos termoretráteis no Médio Oriente e em África está segmentado em automóveis de passageiros, LCV, HCV e veículos elétricos. Em 2021, prevê-se que o segmento dos automóveis de passageiros domine o mercado devido à crescente utilização da mobilidade privada nos dias de hoje.

Tubo termo retrátil no Médio Oriente e África para análise a nível de país do mercado automóvel

É analisado o mercado de tubos termoretráteis para automóveis no Médio Oriente e em África, e são fornecidas informações sobre o tamanho do mercado por país, aplicação, material, tipo, canal de vendas, cor, tensão, tipo de combustível e tipo de veículo conforme acima mencionado.

Os países abrangidos no relatório do mercado automóvel de tubos termoretráteis do Médio Oriente e África são a África do Sul, Israel, Emirados Árabes Unidos, Arábia Saudita, Egito, Resto do Médio Oriente e África.

A Arábia Saudita domina a região do Médio Oriente e de África devido ao rápido crescimento da indústria automóvel e ao domínio da indústria transformadora na região.

A secção do país do relatório também fornece fatores individuais de impacto no mercado e alterações na regulamentação do mercado que impactam as tendências atuais e futuras do mercado. Dados como novas vendas, vendas de reposição, demografia do país, atos regulamentares e tarifas de importação e exportação são alguns dos principais indicadores utilizados para prever o cenário de mercado para países individuais. Além disso, a presença e disponibilidade das marcas do Médio Oriente e de África e os desafios enfrentados devido à grande ou escassa concorrência de marcas locais e nacionais, o impacto dos canais de vendas são considerados ao mesmo tempo que fornecem uma análise de previsão dos dados do país.

O aumento dos avanços tecnológicos para aumentar o desempenho dos veículos está a impulsionar o crescimento do mercado de tubos termoretráteis no Médio Oriente e em África para o mercado automóvel

Os tubos termoretráteis para o mercado automóvel no Médio Oriente e em África também fornecem análises de mercado detalhadas para o crescimento de cada país num mercado específico. Além disso, fornece informação detalhada sobre a estratégia dos intervenientes no mercado e a sua presença geográfica. Os dados estão disponíveis para o período histórico de 2010 a 2019.

Cenário competitivo e análise de tubos termoretráteis no Médio Oriente e África para participação no mercado automóvel

O panorama competitivo dos tubos termoretráteis no Médio Oriente e em África para o mercado automóvel fornece detalhes do concorrente. Os detalhes incluídos são a visão geral da empresa, finanças da empresa, receitas geradas, potencial de mercado, investimento em investigação e desenvolvimento, novas iniciativas de mercado, localizações e instalações de produção, pontos fortes e fracos da empresa, lançamento de produtos, pipelines de testes de produtos, aprovações de produtos, patentes, largura do produto, e amplitude, domínio de aplicação, curva de segurança tecnológica. Os dados acima fornecidos estão apenas relacionados com o foco da empresa relacionado com o Médio Oriente e África de tubos termoretráteis para o mercado automóvel.

Alguns dos principais players que operam no mercado de tubos termorretráteis para automóveis no Médio Oriente e em África são a ABB, SHAWCOR, HellermannTyton, 3M, Alpha Wire, Molex, TE Connectivity, Panduit, entre outros.

Muitos contratos e acordos são também iniciados por empresas de todo o mundo, que estão também a acelerar o mercado de tubos termoretráteis no Médio Oriente e em África para o mercado automóvel.

Por exemplo,

- Em fevereiro de 2021, a Panduit lançou um conector CS 400G de última geração para otimizar a fibra do data center para a densidade do rack. O CS Connector está disponível para opções unitárias de fibra monomodo e multimodo. O lançamento desta solução de conector de fibra de alta densidade otimiza o data center para aplicações de próxima geração, o que ajuda a melhorar o portfólio de produtos da empresa

- Em março de 2019, a HellermannTyton introduziu vários produtos termorretráteis alternativos a diesel nas tecnologias diesel. A empresa alargou o seu portfólio de negócios gerando mais receita e lucro para si

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Índice

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST & AFRICA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 MULTIVARIATE MODELING

2.8 APPLICATION TIMELINE CURVE

2.9 SECONDARY SOURCES

2.1 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 GROWING DEMAND FOR VEHICLE WIRING HARNESS FOR AUTOMOTIVE SAFETY SYSTEMS

5.1.2 RISE IN TECHNOLOGICAL ADVANCEMENT TO INCREASE VEHICLE PERFORMANCE

5.1.3 INCREASING VEHICLE SALES AND DEMAND FOR PREMIUM VEHICLES

5.1.4 INCREASING DEMAND FOR WIDE RANGE OF INSULATING MATERIAL FOR PREVENTIVE MAINTENANCE

5.2 RESTARINTS

5.2.1 STRINGENT GOVERNMENT REGULATION ON EMISSION OF TOXIC GASES

5.2.2 TRADE BARRIERS IN LEAST DEVELOPED COUNTRIES

5.3 OPPORTUNITIES

5.3.1 INCREASE IN STRATEGIC ACQUISITIONS & PARTNERSHIPS BETWEEN ORGANIZATIONS

5.3.2 INVOLVEMENT OF AUTOMATION IN HEAT SHRINK TUBING PROCESS

5.3.3 INCREASE IN PENETRATION OF ELECTRIC VEHICLE ACROSS THE GLOBE

5.3.4 EASY PRODUCTION OF HEAT SHRINK TUBING PRODUCTS

5.4 CHALLENGES

5.4.1 INCREASE IN PRICES OF RAW MATERIALS FOR TUBING

5.4.2 AVAILABILITY OF DUPLICATE & INEXPENSIVE PRODUCTS IN THE MARKET

5.4.3 LACK OF OPERATOR EXPERTISE FOR INSTALLATION OF HEAT SHRINKING TUBE

6 IMPACT ANALYSIS OF COVID-19 ON MIDDLE EAST & AFRICA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET

6.1 AFTERMATH OF MIDDLE EAST & AFRICA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET

6.2 OPPORTUNITIES FOR THE MARKET POST-COVID-19 PANDEMIC

6.3 IMPACT ON SUPPLY, DEMAND, AND PRICES

6.4 CONCLUSION

7 MIDDLE EAST & AFRICA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION

7.1 OVERVIEW

7.2 HOSES

7.2.1 HEATING AND COOLING SYSTEM HOSES

7.2.2 FUEL DELIVERY SYSTEM HOSES

7.2.3 BRAKING SYSTEM HOSES

7.2.4 TURBOCHARGER HOSES

7.2.5 POWER STEERING SYSTEM HOSES

7.3 CONNECTORS

7.3.1 BY TYPE

7.3.1.1 WIRE TO WIRE

7.3.1.2 WIRE TO BOARD

7.3.1.3 BOARD TO BOARD

7.3.2 BY SYSTEM TYPE

7.3.2.1 UNSEALED

7.3.2.2 SEALED

7.3.3 BY APPLICATION

7.3.3.1 HTAT

7.3.3.2 ATUM

7.3.3.3 CGPT

7.3.3.4 LSTT<150 C

7.3.3.5 OTHERS

7.4 RING TERMINAL

7.4.1 12-10 GAUGE HEAT SHRINK RING TERMINALS

7.4.2 14-16 GAUGE HEAT SHRINK RING TERMINALS

7.4.3 18-20 GAUGE HEAT SHRINK RING TERMINALS

7.5 IN-LINE SPLICES

7.6 BRAKE PIPES

7.7 DIESEL INJECTION CLUSTERS

7.8 UNDER BONNET CABLE PROTECTION

7.9 GAS PIPES

7.1 MINIATURE SPLICES

8 MIDDLE EAST & AFRICA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY MATERIAL

8.1 OVERVIEW

8.2 POLYOLEFIN

8.3 POLYVINYL CHLORIDE

8.4 POLYTETRAFLUOROETHYLENE

8.5 FLOURINATED ETHYLENE PROPYLENE

8.6 PERFLUOROALKOXY ALKANES

8.7 ETHYLENE TETRAFLUORO ETHYLENE

8.8 OTHERS

9 MIDDLE EAST & AFRICA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY COLOUR

9.1 OVERVIEW

9.2 RED

9.3 YELLOW

9.4 OTHERS

10 MIDDLE EAST & AFRICA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE

10.1 OVERVIEW

10.2 SINGLE WALL SHRINK TUBING

10.3 DUAL WALL SHRINK TUBING

11 MIDDLE EAST & AFRICA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY VOLTAGE

11.1 OVERVIEW

11.2 LOW VOLTAGE

11.3 MEDIUM VOLTAGE

11.4 HIGH VOLTAGE

12 MIDDLE EAST & AFRICA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY FUEL TYPE

12.1 OVERVIEW

12.2 PETROL

12.3 DIESEL/CNG

12.4 ELECTRIC

13 MIDDLE EAST & AFRICA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY SALES CHANNEL

13.1 OVERVIEW

13.2 OEM

13.3 AFTERMARKET

14 MIDDLE EAST & AFRICA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY VEHICLE TYPE

14.1 OVERVIEW

14.2 PASSENGER CARS

14.2.1 BY TYPE

14.2.1.1 SUV

14.2.1.2 SEDAN

14.2.1.3 CROSSOVER

14.2.1.4 COUPE

14.2.1.5 HATCHBACK

14.2.1.6 MPV

14.2.1.7 CONVERTIBLE

14.2.1.8 OTHERS

14.2.2 BY APPLICATION

14.2.2.1 HOSES

14.2.2.2 CONNECTORS

14.2.2.3 RING TERMINALS

14.2.2.4 IN-LINE SPLICES

14.2.2.5 BRAKING PIPES

14.2.2.6 DIESEL INJECTION CLUSTERS

14.2.2.7 UNDER BONNET CABLE PROTECTION

14.2.2.8 GAS PIPES

14.2.2.9 MINIATURE SPLICES

14.3 LCV

14.3.1 BY TYPE

14.3.1.1 PICKUP TRUCKS

14.3.1.2 VANS

14.3.1.2.1 CARGO VANS

14.3.1.2.2 PASSENGER VANS

14.3.1.3 MINI BUS

14.3.1.4 COACHES

14.3.1.5 OTHERS

14.3.2 BY APPLICATION

14.3.2.1 HOSES

14.3.2.2 CONNECTORS

14.3.2.3 RING TERMINALS

14.3.2.4 IN-LINE SPLICES

14.3.2.5 BRAKE PIPES

14.3.2.6 DIESEL INJECTION CLUSTERS

14.3.2.7 UNDER BONNET CABLE PROTECTION

14.3.2.8 GAS PIPES

14.3.2.9 MINIATURE SPLICES

14.4 ELECTRIC VEHICLE

14.4.1 BY TYPE

14.4.1.1 BATTERY OPERATED VEHICLES

14.4.1.2 PLUGIN VEHICLES

14.4.1.3 HYBRID VEHICLES

14.4.1.4 FUEL CELL ELECTRIC VEHICLES

14.4.2 BY APPLICATION

14.4.2.1 HOSES

14.4.2.2 CONNECTORS

14.4.2.3 RING TERMINALS

14.4.2.4 IN-LINE SPLICES

14.4.2.5 BRAKING PIPES

14.4.2.6 DIESEL INJECTION CLUSTERS

14.4.2.7 UNDER BONNET CABLE PROTECTION

14.4.2.8 GAS PIPES

14.4.2.9 MINIATURE SPLICES

14.5 HCV

14.5.1 BY TYPE

14.5.1.1 TRUCKS

14.5.1.1.1 DUMP TRUCKS

14.5.1.1.2 TOW TRUCKS

14.5.1.1.3 CEMENT TRUCKS

14.5.1.2 BUSES

14.5.2 BY APPLICATION

14.5.2.1 HOSES

14.5.2.2 CONNECTORS

14.5.2.3 RING TERMINALS

14.5.2.4 IN-LINE SPLICES

14.5.2.5 BRAKING PIPES

14.5.2.6 DIESEL INJECTION CLUSTERS

14.5.2.7 UNDER BONNET CABLE PROTECTION

14.5.2.8 GAS PIPES

14.5.2.9 MINIATURE SPLICES

15 MIDDLE EAST & AFRICA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY REGION

15.1 MIDDLE EAST AND AFRICA

15.1.1 SAUDI ARABIA

15.1.2 SOUTH AFRICA

15.1.3 U.A.E.

15.1.4 EGYPT

15.1.5 ISRAEL

15.1.6 REST OF MIDDLE EAST & AFRICA

16 MIDDLE EAST & AFRICA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET: COMPANY LANDSCAPE

16.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

17 SWOT ANALYSIS

18 COMPANY PROFILE

18.1 SUMITOMO ELECTRIC INDUSTRIES, LTD.

18.1.1 COMPANY SNAPSHOT

18.1.2 REVENUE ANALYSIS

18.1.3 COMPANY SHARE ANALYSIS

18.1.4 PRODUCT PORTFOLIO

18.1.5 RECENT DEVELOPMENTS

18.2 TE CONNECTIVITY

18.2.1 COMPANY SNAPSHOT

18.2.2 REVENUE ANALYSIS

18.2.3 COMPANY SHARE ANALYSIS

18.2.4 PRODUCT PORTFOLIO

18.2.5 RECENT DEVELOPMENTS

18.3 SHAWCOR

18.3.1 COMPANY SNAPSHOT

18.3.2 REVENUE ANALYSIS

18.3.3 COMPANY SHARE ANALYSIS

18.3.4 PRODUCT PORTFOLIO

18.3.5 RECENT DEVELOPMENTS

18.4 ABB

18.4.1 COMPANY SNAPSHOT

18.4.2 REVENUE ANALYSIS

18.4.3 COMPANY SHARE AANLYSIS

18.4.4 PRODUCT PORTFOLIO

18.4.5 RECENT DEVELOPMENTS

18.5 HELLERMANNTYTON

18.5.1 COMPANY SNAPSHOT

18.5.2 COMPANY SHARE ANALYSIS

18.5.3 PRODUCT PORTFOILIO

18.5.4 RECENT DEVELOPMENT

18.6 AUTOSPARKS

18.6.1 COMPANY SNAPSHOT

18.6.2 PRODUCT PORTFOLIO

18.6.3 RECENT DEVELOPMENT

18.7 ALPHA WIRE

18.7.1 COMPANY SNAPSHOT

18.7.2 PRODUCT PORTFOLIO

18.7.3 RECENT DEVELOPMENT

18.8 DEE FIVE SHRINK INSULATION PVT. LTD.

18.8.1 COMPANY SNAPSHOT

18.8.2 PRODUCT PORTFOLIO

18.8.3 RECENT DEVELOPMENTS

18.9 DASENGH, INC.

18.9.1 COMPANY SNAPSHOT

18.9.2 PRODUCT PORTFOLIO

18.9.3 RECENT DEVELOPMENT

18.1 FLEX WIRES INC.

18.10.1 COMPANY SNAPSHOT

18.10.2 PRODUCT PORTFOLIO

18.10.3 RECENT DEVELOPMENT

18.11 GREMCO GMBH

18.11.1 COMPANY SNAPSHOT

18.11.2 PRODUCT PORTFOLIO

18.11.3 RECENT DEVELOPMENTS

18.12 HUIZHOU GUANGHAI ELECTRONIC INSULATION MATERIALS CO.,LTD.

18.12.1 COMPANY SNAPSHOT

18.12.2 PRODUCT PORTFOLIO

18.12.3 RECENT DEVLOPMENT

18.13 INSULTAB, PEXCO

18.13.1 COMPANY SNAPSHOT

18.13.2 PRODUCT PORTFOLIO

18.13.3 RECENT DEVELOPMENTS

18.14 IS-RAYFAST LTD

18.14.1 COMPANY SNAPSHOT

18.14.2 PRODUCT PORTFOLIO

18.14.3 RECENT DEVELOPMENT

18.15 3M

18.15.1 COMPANY SNAPSHOT

18.15.2 REVENUE ANALYSIS

18.15.3 PRODUCT PORTFOLIO

18.15.4 RECENT DEVELOPMENT

18.16 MOLEX

18.16.1 COMPANY SNAPSHOT

18.16.2 PRODUCT PORTFOLIO

18.16.3 RECENT DEVELOPMENTS

18.17 NELCO

18.17.1 COMPANY SNAPSHOT

18.17.2 PRODUCT PORTFOLIO

18.17.3 RECENT DEVELOPMENT

18.18 PARAS ENTERPRISES

18.18.1 COMPANY SNAPSHOT

18.18.2 PRODUCT PORTFOLIO

18.18.3 RECENT DEVELOPMENT

18.19 PANDUIT

18.19.1 COMPANY SNAPSHOT

18.19.2 PRODUCT PORTFOLIO

18.19.3 RECENT DEVELOPMENTS

18.2 QUALTEK ELECTRONICS CORP.

18.20.1 COMPANY SNAPSHOT

18.20.2 PRODUCT PORTFOLIO

18.20.3 RECENT DEVELOPMENT

18.21 RADPOL S.A.

18.21.1 COMPANY SNAPSHOT

18.21.2 REVENUE ANALYSIS

18.21.3 PRODUCT PORTFOLIO

18.21.4 RECENT DEVELOPMENTS

18.22 SHENZHEN WOER HEAT - SHRINKABLE MATERIAL CO., LTD.

18.22.1 COMPANY SNAPSHOT

18.22.2 PRODUCT PORTFOLIO

18.22.3 RECENT DEVELOPMENTS

18.23 SUZHOU FEIBO COLD AND HEAT SHRINKING CO., LTD.

18.23.1 COMPANY SNAPSHOT

18.23.2 PRODUCT PORTFOLIO

18.23.3 RECENT DEVELOPMENTS

18.24 TECHFLEX, INC.

18.24.1 COMPANY SNAPSHOT

18.24.2 PRODUCT PORTFOLIO

18.24.3 RECENT DEVELOPMENT

18.25 THERMOSLEEVE USA

18.25.1 COMPANY SNAPSHOT

18.25.2 PRODUCT PORTFOLIO

18.25.3 RECENT DEVELOPMENTS

18.26 THE ZIPPERTUBING COMPANY

18.26.1 COMPANY SNAPSHOT

18.26.2 PRODUCT PORTFOLIO

18.26.3 RECENT DEVELOPMENTS

18.27 TEXCAN

18.27.1 COMPANY SNAPSHOT

18.27.2 PRODUCT PORTFOLIO

18.27.3 RECENT DEVELOPMENT

18.28 ZEUS INDUSTRIAL PRODUCTS, INC.

18.28.1 COMPANY SNAPSHOT

18.28.2 PRODUCT PORTFOLIO

18.28.3 RECENT DEVELOPMENTS

19 QUESTIONNAIRE

20 RELATED REPORTS

Lista de Tabela

TABLE 1 MIDDLE EAST & AFRICA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 2 MIDDLE EAST & AFRICA HOSES IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 3 MIDDLE EAST & AFRICA HOSES IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 4 MIDDLE EAST & AFRICA CONNECTORS IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 5 MIDDLE EAST & AFRICA CONNECTORS IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 6 MIDDLE EAST & AFRICA CONNECTORS IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY SYSTEM TYPE, 2019-2028 (USD THOUSAND)

TABLE 7 MIDDLE EAST & AFRICA CONNECTORS IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 8 MIDDLE EAST & AFRICA RING TERMINAL IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 9 MIDDLE EAST & AFRICA RING TERMINAL IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 10 MIDDLE EAST & AFRICA IN-LINE SPLICES IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 11 MIDDLE EAST & AFRICA BRAKE PIPES IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 12 MIDDLE EAST & AFRICA DIESEL INJECTION CLUSTERS IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 13 MIDDLE EAST & AFRICA UNDER BONNET CABLE PROTECTION IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 14 MIDDLE EAST & AFRICA GAS PIPES IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 15 MIDDLE EAST & AFRICA MINIATURE SPLICES IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 16 MIDDLE EAST & AFRICA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY MATERIAL, 2019-2028 (USD THOUSAND)

TABLE 17 MIDDLE EAST & AFRICA POLYOLEFIN IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 18 MIDDLE EAST & AFRICA POLYVINYL CHLORIDE IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 19 MIDDLE EAST & AFRICA POLYTETRAFLUOROETHYLENE IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 20 MIDDLE EAST & AFRICA FLUORINATED ETHYLENE PROPYLENE IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 21 MIDDLE EAST & AFRICA PERFLUOROALKOXY ALKANES IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 22 MIDDLE EAST & AFRICA ETHYLENE TETRAFLUORO ETHYLENE IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 23 MIDDLE EAST & AFRICA OTHERS IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 24 MIDDLE EAST & AFRICA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY COLOUR, 2019-2028 (USD THOUSAND)

TABLE 25 MIDDLE EAST & AFRICA RED IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 26 MIDDLE EAST & AFRICA YELLOW IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 27 MIDDLE EAST & AFRICA OTHERS IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 28 MIDDLE EAST & AFRICA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 29 MIDDLE EAST & AFRICA SINGLE WALL SHRINK TUBING IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 30 MIDDLE EAST & AFRICA DUAL WALL SHRINK TUBING IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 31 MIDDLE EAST & AFRICA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY VOLTAGE, 2019-2028 (USD THOUSAND)

TABLE 32 MIDDLE EAST & AFRICA LOW VOLTAGE IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 33 MIDDLE EAST & AFRICA MEDIUM VOLTAGE IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 34 MIDDLE EAST & AFRICA HIGH VOLTAGE IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 35 MIDDLE EAST & AFRICA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY FUEL TYPE, 2019-2028 (USD THOUSAND)

TABLE 36 MIDDLE EAST & AFRICA PETROL IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 37 MIDDLE EAST & AFRICA DIESEL/CNG IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 38 MIDDLE EAST & AFRICA ELECTRIC IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 39 MIDDLE EAST & AFRICA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY SALES CHANNEL, 2019-2028 (USD THOUSAND)

TABLE 40 MIDDLE EAST & AFRICA OEM IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 41 MIDDLE EAST & AFRICA AFTERMARKET IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 42 MIDDLE EAST & AFRICA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET: BY VEHICLE TYPE, 2019-2028 (USD THOUSAND)

TABLE 43 MIDDLE EAST & AFRICA PASSENGER CARS IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 44 MIDDLE EAST & AFRICA PASSENGER CARS IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 45 MIDDLE EAST & AFRICA PASSENGER CARS IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 46 MIDDLE EAST & AFRICA LCV IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 47 MIDDLE EAST & AFRICA LCV IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 48 MIDDLE EAST & AFRICA VANS IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 49 MIDDLE EAST & AFRICA LCV IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 50 MIDDLE EAST & AFRICA ELECTRIC VEHICLE IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 51 MIDDLE EAST & AFRICA ELECTRIC VEHICLE IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 52 MIDDLE EAST & AFRICA ELECTRIC VEHICLE IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 53 MIDDLE EAST & AFRICA HCV IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 54 MIDDLE EAST & AFRICA HCV IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 55 MIDDLE EAST & AFRICA TRUCKS IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 56 MIDDLE EAST & AFRICA HCV IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 57 MIDDLE EAST AND AFRICA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY COUNTRY, 2019-2028 (USD THOUSAND)

TABLE 58 MIDDLE EAST & AFRICA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 59 MIDDLE EAST & AFRICA HOSES IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 60 MIDDLE EAST & AFRICA CONNECTORS IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 61 MIDDLE EAST & AFRICA CONNECTORS IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY SYSTEM TYPE, 2019-2028 (USD THOUSAND)

TABLE 62 MIDDLE EAST & AFRICA CONNECTORS IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 63 MIDDLE EAST & AFRICA RING TERMINAL IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 64 MIDDLE EAST & AFRICA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY MATERIAL 2019-2028 (USD THOUSAND)

TABLE 65 MIDDLE EAST & AFRICA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY COLOUR, 2019-2028 (USD THOUSAND)

TABLE 66 MIDDLE EAST & AFRICA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 67 MIDDLE EAST & AFRICA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY VOLTAGE, 2019-2028 (USD THOUSAND)

TABLE 68 MIDDLE EAST & AFRICA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY FUEL TYPE, 2019-2028 (USD THOUSAND)

TABLE 69 MIDDLE EAST & AFRICA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY SALES CHANNEL, 2019-2028 (USD THOUSAND)

TABLE 70 MIDDLE EAST & AFRICA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY VEHICLE TYPE, 2019-2028 (USD THOUSAND)

TABLE 71 MIDDLE EAST & AFRICA PASSENGER CARS IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 72 MIDDLE EAST & AFRICA PASSENGER CARS IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 73 MIDDLE EAST & AFRICA LCV IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 74 MIDDLE EAST & AFRICA VANS IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 75 MIDDLE EAST & AFRICA LCV IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 76 MIDDLE EAST & AFRICA HCV IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 77 MIDDLE EAST & AFRICA TRUCKS IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 78 MIDDLE EAST & AFRICA HCV IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 79 MIDDLE EAST & AFRICA ELECTRIC VEHICLE IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 80 MIDDLE EAST & AFRICA ELECTRIC VEHICLE IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 81 SAUDI ARABIA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 82 SAUDI ARABIA HOSES IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 83 SAUDI ARABIA CONNECTORS IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 84 SAUDI ARABIA CONNECTORS IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY SYSTEM TYPE, 2019-2028 (USD THOUSAND)

TABLE 85 SAUDI ARABIA CONNECTORS IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 86 SAUDI ARABIA RING TERMINAL IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 87 SAUDI ARABIA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY MATERIAL 2019-2028 (USD THOUSAND)

TABLE 88 SAUDI ARABIA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY COLOUR, 2019-2028 (USD THOUSAND)

TABLE 89 SAUDI ARABIA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 90 SAUDI ARABIA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY VOLTAGE, 2019-2028 (USD THOUSAND)

TABLE 91 SAUDI ARABIA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY FUEL TYPE, 2019-2028 (USD THOUSAND)

TABLE 92 SAUDI ARABIA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY SALES CHANNEL, 2019-2028 (USD THOUSAND)

TABLE 93 SAUDI ARABIA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY VEHICLE TYPE, 2019-2028 (USD THOUSAND)

TABLE 94 SAUDI ARABIA PASSENGER CARS IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 95 SAUDI ARABIA PASSENGER CARS IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 96 SAUDI ARABIA LCV IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 97 SAUDI ARABIA VANS IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 98 SAUDI ARABIA LCV IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 99 SAUDI ARABIA HCV IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 100 SAUDI ARABIA TRUCKS IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 101 SAUDI ARABIA HCV IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 102 SAUDI ARABIA ELECTRIC VEHICLE IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 103 SAUDI ARABIA ELECTRIC VEHICLE IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 104 SOUTH AFRICA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 105 SOUTH AFRICA HOSES IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 106 SOUTH AFRICA CONNECTORS IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 107 SOUTH AFRICA CONNECTORS IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY SYSTEM TYPE, 2019-2028 (USD THOUSAND)

TABLE 108 SOUTH AFRICA CONNECTORS IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 109 SOUTH AFRICA RING TERMINAL IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 110 SOUTH AFRICA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY MATERIAL 2019-2028 (USD THOUSAND)

TABLE 111 SOUTH AFRICA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY COLOUR, 2019-2028 (USD THOUSAND)

TABLE 112 SOUTH AFRICA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 113 SOUTH AFRICA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY VOLTAGE, 2019-2028 (USD THOUSAND)

TABLE 114 SOUTH AFRICA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY FUEL TYPE, 2019-2028 (USD THOUSAND)

TABLE 115 SOUTH AFRICA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY SALES CHANNEL, 2019-2028 (USD THOUSAND)

TABLE 116 SOUTH AFRICA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY VEHICLE TYPE, 2019-2028 (USD THOUSAND)

TABLE 117 SOUTH AFRICA PASSENGER CARS IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 118 SOUTH AFRICA PASSENGER CARS IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 119 SOUTH AFRICA LCV IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 120 SOUTH AFRICA VANS IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 121 SOUTH AFRICA LCV IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 122 SOUTH AFRICA HCV IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 123 SOUTH AFRICA TRUCKS IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 124 SOUTH AFRICA HCV IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 125 SOUTH AFRICA ELECTRIC VEHICLE IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 126 SOUTH AFRICA ELECTRIC VEHICLE IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 127 U.A.E. HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 128 U.A.E. HOSES IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 129 U.A.E. CONNECTORS IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 130 U.A.E. CONNECTORS IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY SYSTEM TYPE, 2019-2028 (USD THOUSAND)

TABLE 131 U.A.E. CONNECTORS IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 132 U.A.E. RING TERMINAL IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 133 U.A.E. HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY MATERIAL 2019-2028 (USD THOUSAND)

TABLE 134 U.A.E. HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY COLOUR, 2019-2028 (USD THOUSAND)

TABLE 135 U.A.E. HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 136 U.A.E. HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY VOLTAGE, 2019-2028 (USD THOUSAND)

TABLE 137 U.A.E. HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY FUEL TYPE, 2019-2028 (USD THOUSAND)

TABLE 138 U.A.E. HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY SALES CHANNEL, 2019-2028 (USD THOUSAND)

TABLE 139 U.A.E. HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY VEHICLE TYPE, 2019-2028 (USD THOUSAND)

TABLE 140 U.A.E. PASSENGER CARS IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 141 U.A.E. PASSENGER CARS IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 142 U.A.E. LCV IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 143 U.A.E. VANS IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 144 U.A.E. LCV IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 145 U.A.E. HCV IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 146 U.A.E. TRUCKS IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 147 U.A.E. HCV IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 148 U.A.E. ELECTRIC VEHICLE IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 149 U.A.E. ELECTRIC VEHICLE IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 150 EGYPT HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 151 EGYPT HOSES IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 152 EGYPT CONNECTORS IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 153 EGYPT CONNECTORS IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY SYSTEM TYPE, 2019-2028 (USD THOUSAND)

TABLE 154 EGYPT CONNECTORS IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 155 EGYPT RING TERMINAL IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 156 EGYPT HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY MATERIAL 2019-2028 (USD THOUSAND)

TABLE 157 EGYPT HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY COLOUR, 2019-2028 (USD THOUSAND)

TABLE 158 EGYPT HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 159 EGYPT HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY VOLTAGE, 2019-2028 (USD THOUSAND)

TABLE 160 EGYPT HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY FUEL TYPE, 2019-2028 (USD THOUSAND)

TABLE 161 EGYPT HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY SALES CHANNEL, 2019-2028 (USD THOUSAND)

TABLE 162 EGYPT HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY VEHICLE TYPE, 2019-2028 (USD THOUSAND)

TABLE 163 EGYPT PASSENGER CARS IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 164 EGYPT PASSENGER CARS IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 165 EGYPT LCV IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 166 EGYPT VANS IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 167 EGYPT LCV IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 168 EGYPT HCV IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 169 EGYPT TRUCKS IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 170 EGYPT HCV IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 171 EGYPT ELECTRIC VEHICLE IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 172 EGYPT ELECTRIC VEHICLE IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 173 ISRAEL HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 174 ISRAEL HOSES IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 175 ISRAEL CONNECTORS IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 176 ISRAEL CONNECTORS IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY SYSTEM TYPE, 2019-2028 (USD THOUSAND)

TABLE 177 ISRAEL CONNECTORS IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 178 ISRAEL RING TERMINAL IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 179 ISRAEL HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY MATERIAL 2019-2028 (USD THOUSAND)

TABLE 180 ISRAEL HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY COLOUR, 2019-2028 (USD THOUSAND)

TABLE 181 ISRAEL HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 182 ISRAEL HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY VOLTAGE, 2019-2028 (USD THOUSAND)

TABLE 183 ISRAEL HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY FUEL TYPE, 2019-2028 (USD THOUSAND)

TABLE 184 ISRAEL HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY SALES CHANNEL, 2019-2028 (USD THOUSAND)

TABLE 185 ISRAEL HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY VEHICLE TYPE, 2019-2028 (USD THOUSAND)

TABLE 186 ISRAEL PASSENGER CARS IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 187 ISRAEL PASSENGER CARS IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 188 ISRAEL LCV IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 189 ISRAEL VANS IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 190 ISRAEL LCV IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 191 ISRAEL HCV IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 192 ISRAEL TRUCKS IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 193 ISRAEL HCV IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 194 ISRAEL ELECTRIC VEHICLE IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 195 ISRAEL ELECTRIC VEHICLE IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 196 REST OF MIDDLE EAST AND AFRICA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

Lista de Figura

FIGURE 1 MIDDLE EAST & AFRICA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST & AFRICA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET: MIDDLE EAST & AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST & AFRICA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET: DBMR MARKET POSITION GRID

FIGURE 8 MIDDLE EAST & AFRICA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 MIDDLE EAST & AFRICA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET: SEGMENTATION

FIGURE 10 GROWING DEMAND FOR VEHICLE WIRING HARNESS FOR AUTOMOTIVE SAFETY SYSTEMS & RISE IN TECHNOLOGICAL ADVANCEMENTS TO IMPROVE VEHICLE PERFORMANCE IS EXPECTED TO DRIVE MIDDLE EAST & AFRICA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET IN THE FORECAST PERIOD OF 2021 TO 2028

FIGURE 11 HOSES SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF MIDDLE EAST & AFRICA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET IN 2021 & 2028

FIGURE 12 ASIA-PACIFIC IS EXPECTED TO DOMINATE AND IS THE FASTEST-GROWING REGION IN THE MIDDLE EAST & AFRICA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET IN THE FORECAST PERIOD OF 2021 TO 2028

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, CHALLENGES FOR MIDDLE EAST & AFRICA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET

FIGURE 14 MIDDLE EAST & AFRICA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET: BY APPLICATION, 2020

FIGURE 15 MIDDLE EAST & AFRICA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET: BY MATERIAL, 2020

FIGURE 16 MIDDLE EAST & AFRICA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET: BY COLOUR, 2020

FIGURE 17 MIDDLE EAST & AFRICA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET: BY TYPE, 2020

FIGURE 18 MIDDLE EAST & AFRICA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET: BY VOLTAGE, 2020

FIGURE 19 MIDDLE EAST & AFRICA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET: BY FUEL TYPE, 2020

FIGURE 20 MIDDLE EAST & AFRICA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET: BY SALES CHANNEL, 2020

FIGURE 21 MIDDLE EAST & AFRICA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET: BY VEHICLE TYPE, 2020

FIGURE 22 MIDDLE EAST AND AFRICA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET: SNAPSHOT (2020)

FIGURE 23 MIDDLE EAST AND AFRICA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET: BY COUNTRY (2020)

FIGURE 24 MIDDLE EAST AND AFRICA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET: BY COUNTRY (2021 & 2028)

FIGURE 25 MIDDLE EAST AND AFRICA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET: BY COUNTRY (2020 & 2028)

FIGURE 26 MIDDLE EAST AND AFRICA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET: BY COMPONENT (2021-2028)

FIGURE 27 MIDDLE EAST & AFRICA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET: COMPANY SHARE 2020 (%)

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.