Middle East And Africa Gaskets And Seals Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

5.92 Billion

USD

8.75 Billion

2025

2033

USD

5.92 Billion

USD

8.75 Billion

2025

2033

| 2026 –2033 | |

| USD 5.92 Billion | |

| USD 8.75 Billion | |

|

|

|

|

Segmentação do mercado de juntas e vedações no Oriente Médio e África, por tipo (juntas e vedações), aplicação (trocadores de calor, vasos de pressão, tampas de bueiro, bocais de inspeção, tampas de válvulas, flanges de tubulação e outros), canal de distribuição (OEMs e mercado de reposição), setor (indústria de papel e celulose, petróleo e gás, elétrica, automotiva, aeroespacial, manufatura industrial, naval e ferroviária e outros) - Tendências e previsões do setor até 2033

Tamanho do mercado de juntas e vedações no Oriente Médio e na África

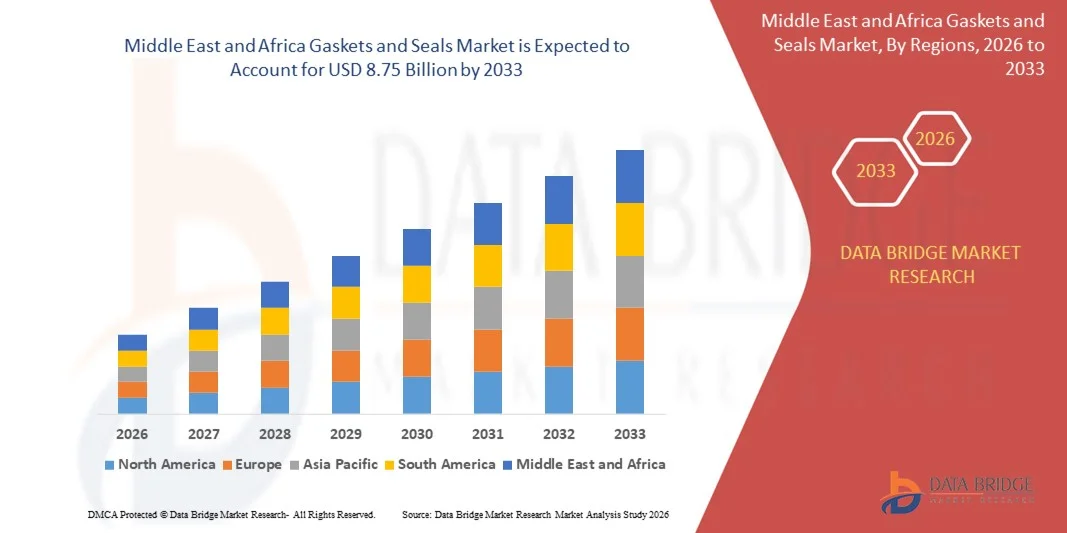

- O mercado de juntas e vedações no Oriente Médio e na África foi avaliado em US$ 5,92 bilhões em 2025 e deverá atingir US$ 8,75 bilhões até 2033 , com uma taxa de crescimento anual composta (CAGR) de 5,00% durante o período de previsão.

- O crescimento do mercado é impulsionado principalmente pela crescente demanda das indústrias automotiva, aeroespacial, de petróleo e gás e de manufatura por maior eficiência de vedação e prevenção de vazamentos.

- A crescente ênfase na confiabilidade dos equipamentos, na segurança operacional e na redução dos custos de manutenção está impulsionando ainda mais a adoção.

Análise do mercado de juntas e vedações no Oriente Médio e na África

- O mercado está testemunhando um crescimento constante impulsionado pela crescente necessidade de soluções de vedação de alto desempenho que possam suportar pressões e temperaturas extremas, além de ambientes corrosivos.

- Os avanços nas tecnologias de materiais, como elastômeros, compósitos e vedações reforçadas com metal, estão aprimorando a durabilidade e o desempenho.

- Os Emirados Árabes Unidos dominaram o mercado de juntas e vedações do Oriente Médio e da África em 2025, impulsionados por investimentos significativos em infraestrutura de petróleo e gás, expansão petroquímica e desenvolvimento industrial em larga escala.

- Prevê-se que a Arábia Saudita registre a maior taxa de crescimento anual composta (CAGR) no mercado de juntas e vedações do Oriente Médio e da África, devido ao aumento das iniciativas de diversificação industrial, à crescente adoção de soluções avançadas de vedação em projetos de energia e petroquímica e ao investimento contínuo liderado pelo governo em grandes projetos de infraestrutura.

- O segmento de vedações detinha a maior participação na receita de mercado em 2025, impulsionado por seu uso extensivo em equipamentos rotativos, como bombas, compressores e motores, nos setores de manufatura e automotivo. Sua capacidade de fornecer controle confiável de vazamentos em sistemas de alta pressão e alta temperatura as torna essenciais nas operações industriais.

Escopo do relatório e segmentação do mercado de juntas e vedações no Oriente Médio e na África.

|

Atributos |

Análises de mercado essenciais para juntas e vedações no Oriente Médio e na África |

|

Segmentos abrangidos |

|

|

Países abrangidos |

Oriente Médio e África

|

|

Principais participantes do mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor agregado |

Além das informações sobre cenários de mercado, como valor de mercado, taxa de crescimento, segmentação, cobertura geográfica e principais participantes, os relatórios de mercado elaborados pela Data Bridge Market Research também incluem análise de importação e exportação, visão geral da capacidade de produção, análise de produção e consumo, análise de tendências de preços, cenário de mudanças climáticas, análise da cadeia de suprimentos, análise da cadeia de valor, visão geral de matérias-primas/insumos, critérios de seleção de fornecedores, análise PESTLE, análise de Porter e estrutura regulatória. |

Tendências do mercado de juntas e vedações no Oriente Médio e na África

Ascensão da integração de materiais avançados em juntas e vedações

- A crescente adoção de materiais avançados, como elastômeros de alto desempenho, compósitos de PTFE e soluções de vedação reforçadas com metal, está transformando o cenário de juntas e vedações, aprimorando a durabilidade, a resistência química e a estabilidade térmica em diversas aplicações industriais. Esses materiais oferecem desempenho superior em ambientes operacionais severos, onde os componentes de vedação tradicionais falham. Sua ampla integração está proporcionando maior confiabilidade e eficiência em sistemas de máquinas críticas.

- A demanda por componentes de vedação capazes de suportar temperaturas extremas, fluidos agressivos e ambientes de alta pressão está acelerando a inovação na ciência dos materiais, particularmente em setores como petróleo e gás, química e automotiva, onde a confiabilidade operacional é crucial. Os fabricantes estão focando na criação de formulações que ofereçam maior resiliência e, ao mesmo tempo, reduzam os riscos de vazamento. Essa tendência está impulsionando a adoção de tecnologias avançadas de vedação tanto em novas instalações quanto em atividades de manutenção.

- A transição para máquinas leves e energeticamente eficientes está impulsionando o uso de materiais de engenharia com propriedades mecânicas aprimoradas, que proporcionam maior vida útil e menores requisitos de manutenção. Esses materiais contribuem para a redução do peso dos equipamentos, mantendo a integridade da vedação. Sua adoção está ajudando as indústrias a alcançarem economia de energia, melhoria da produção operacional e maior desempenho do sistema.

- Por exemplo, em 2023, diversas montadoras de veículos integraram vedações avançadas à base de fluorocarbono e silicone para melhorar a eficiência do motor e reduzir vazamentos, resultando em melhor desempenho e menos solicitações de garantia. Esses materiais proporcionaram maior resistência a ciclos térmicos e exposição a produtos químicos. A integração dessas soluções está estabelecendo novos padrões para os sistemas de vedação automotivos de próxima geração.

- Embora as inovações em materiais estejam aprimorando o desempenho e expandindo o escopo de aplicação, sua adoção depende da relação custo-benefício, dos testes de compatibilidade e da escalabilidade da produção. As empresas devem investir em processos de validação rigorosos para garantir a adequação em diversas condições operacionais. Os fabricantes precisam priorizar a produção localizada, formulações personalizadas e processos com boa relação custo-benefício para atender à crescente demanda de forma eficiente.

Dinâmica do mercado de juntas e vedações no Oriente Médio e na África

Motorista

Aumento da automação industrial e demanda por confiabilidade de ativos

- O aumento da automação industrial está levando fabricantes de diversos setores a priorizar soluções de vedação de alta qualidade que garantam operações ininterruptas e previnam falhas nos equipamentos. Sistemas automatizados dependem fortemente de componentes que minimizem vazamentos, mantenham a integridade da pressão e suportem longos ciclos operacionais. Essa tendência está elevando a necessidade de juntas e vedações duráveis e de engenharia de precisão em ambientes industriais de rápido crescimento.

- As indústrias estão cada vez mais conscientes dos elevados riscos financeiros associados à inatividade dos equipamentos, incluindo perda de produtividade, riscos de segurança e reparos dispendiosos. Essa consciência levou à adoção consistente de juntas e vedações de alta qualidade em máquinas críticas, onde a confiabilidade é imprescindível. Como resultado, as estratégias de manutenção preventiva estão se tornando mais robustas, impulsionando ainda mais a demanda por componentes de vedação de alto desempenho.

- Iniciativas governamentais e normas de segurança industrial estão fortalecendo a infraestrutura para manutenção preventiva e certificação de equipamentos, acelerando a necessidade de componentes de vedação confiáveis. Os marcos de conformidade exigem que as indústrias implementem soluções de vedação capazes de suportar rigorosos padrões operacionais. Isso está aumentando o investimento em tecnologias avançadas de vedação em operações industriais de manufatura, processamento e grande porte.

- Por exemplo, diversas instalações industriais modernizaram seus sistemas de vedação em aplicações de alta pressão para melhorar a segurança operacional e reduzir as interrupções relacionadas à manutenção. Essas melhorias ajudaram a reduzir paradas não planejadas e falhas de equipamentos. Essa iniciativa reflete uma mudança mais ampla em direção a soluções de vedação orientadas ao desempenho e adaptadas às necessidades industriais modernas.

- Embora a automação e o foco regulatório estejam impulsionando a adoção, atualizações contínuas em design, validação de desempenho e integração com máquinas em constante evolução são necessárias para sustentar o crescimento do mercado a longo prazo. Os fabricantes precisam inovar para atender à crescente complexidade dos sistemas automatizados. Isso inclui a criação de vedações que ofereçam maior durabilidade, vida útil mais longa e compatibilidade com arquiteturas de sistemas avançados.

Restrição/Desafio

Flutuação dos preços das matérias-primas e altos custos de produção

- O alto custo de matérias-primas essenciais, como borracha sintética, fluoropolímeros e metais especiais, cria desafios de precificação para os fabricantes, principalmente para os fornecedores de pequeno e médio porte. A volatilidade dos preços do petróleo bruto impacta diretamente a disponibilidade de elastômeros, afetando o planejamento de materiais e a estabilidade de custos. Essas flutuações frequentemente obrigam os produtores a ajustar suas estruturas de preços, impactando a competitividade do mercado.

- Muitas indústrias enfrentam limitações na adoção de soluções avançadas de vedação devido aos altos custos de produção e à necessidade de tecnologias de fabricação de precisão. A exigência de maquinário especializado e mão de obra qualificada eleva ainda mais os custos de produção. Isso restringe a adoção em setores sensíveis a custos, onde as alternativas tradicionais de baixo custo continuam a dominar, apesar das limitações de desempenho.

- Interrupções na cadeia de suprimentos e a disponibilidade inconsistente de matérias-primas representam desafios para a produção e entrega em tempo hábil, muitas vezes levando à dependência de alternativas de qualidade inferior com desempenho reduzido. Atrasos no transporte, restrições de fornecimento global e escassez de materiais contribuem para prazos de entrega prolongados. Esses problemas impactam, em última instância, os usuários finais que dependem de um desempenho de vedação consistente para a continuidade operacional.

- Por exemplo, vários fabricantes relataram atrasos na produção devido à escassez de elastômeros de alta qualidade, afetando os prazos de fornecimento para aplicações automotivas e de máquinas. Essa escassez impactou os cronogramas das montadoras e a disponibilidade no mercado de reposição, criando gargalos em toda a cadeia de suprimentos. Tais incidentes destacam a importância de estratégias robustas de fornecimento e da diversificação na aquisição de materiais.

- Embora os avanços tecnológicos estejam aprimorando a eficiência da produção, superar as barreiras de custo e garantir cadeias de suprimentos estáveis continua sendo fundamental. Os fabricantes devem investir em estruturas de produção com custos otimizados e em engenharia de materiais avançada. O fornecimento local, materiais recicláveis e modelos de produção escaláveis desempenharão um papel central na superação dos desafios de fornecimento e custo a longo prazo.

Escopo do mercado de juntas e vedações no Oriente Médio e na África

O mercado está segmentado com base no tipo, aplicação, canal de distribuição e setor.

- Por tipo

Com base no tipo, o mercado de juntas e vedações do Oriente Médio e da África é segmentado em juntas e vedações. O segmento de vedações detinha a maior participação na receita de mercado em 2025, impulsionado por seu uso extensivo em equipamentos rotativos, como bombas, compressores e motores, nos setores de manufatura e automotivo. Sua capacidade de fornecer controle confiável de vazamentos em sistemas de alta pressão e alta temperatura as torna essenciais nas operações industriais.

O segmento de juntas deverá apresentar o crescimento mais rápido entre 2026 e 2033, impulsionado pela crescente demanda em sistemas de tubulação, trocadores de calor e equipamentos de processo. O foco cada vez maior na eficiência dos equipamentos, na redução da manutenção e na melhoria do desempenho de vedação está acelerando ainda mais a adoção de materiais avançados para juntas em diversos ambientes industriais.

- Por meio de aplicação

Com base na aplicação, o mercado de juntas e vedações do Oriente Médio e da África é segmentado em trocadores de calor, vasos de pressão, tampas de bueiro, bocais de inspeção, tampas de válvulas, flanges de tubulação e outros. O segmento de flanges de tubulação detinha a maior participação na receita de mercado em 2025, devido à sua ampla utilização em infraestruturas de petróleo e gás, petroquímica e tratamento de água. Seu papel fundamental em garantir conexões seguras e estanques em dutos impulsiona uma demanda constante.

O segmento de trocadores de calor deverá apresentar o crescimento mais rápido entre 2026 e 2033, impulsionado pela expansão industrial, pelo crescimento do processamento químico e pelas crescentes exigências de eficiência energética. O aumento dos investimentos em sistemas de climatização (HVAC), usinas de energia e instalações fabris também contribui para a adoção acelerada de soluções de vedação em conjuntos de trocadores de calor.

- Por canal de distribuição

Com base no canal de distribuição, o mercado de juntas e vedações do Oriente Médio e da África é segmentado em fabricantes de equipamentos originais (OEMs) e mercado de reposição. O segmento de OEMs detinha a maior participação na receita de mercado em 2025 devido ao crescimento da produção de máquinas industriais, componentes automotivos e equipamentos pesados na região. Os fabricantes integram cada vez mais componentes de vedação de alta qualidade durante a montagem inicial para aumentar a confiabilidade e a vida útil dos equipamentos.

Espera-se que o segmento de peças de reposição apresente a taxa de crescimento mais rápida de 2026 a 2033, impulsionado pelo aumento das atividades de manutenção, reforma de máquinas e substituição de componentes de vedação desgastados. A crescente ênfase na manutenção preventiva e no desempenho operacional com boa relação custo-benefício em diversos setores está impulsionando ainda mais a demanda por peças de reposição.

- Por setor

Com base no setor industrial, o mercado de juntas e vedações do Oriente Médio e da África é segmentado em indústria de papel e celulose, petróleo e gás, elétrica, automotiva, aeroespacial, manufatura industrial, naval e ferroviária, entre outros. O segmento automotivo detinha a maior participação na receita de mercado em 2025, devido à forte base de produção de veículos da região e ao uso generalizado de soluções de vedação em motores, transmissões, sistemas de freios e unidades de gerenciamento térmico.

O segmento de manufatura industrial deverá apresentar o crescimento mais rápido entre 2026 e 2033, impulsionado pela rápida industrialização, expansão das instalações de produção e crescente adoção de máquinas automatizadas. As indústrias estão investindo cada vez mais em componentes de vedação duráveis para aumentar a segurança, minimizar o tempo de inatividade e alcançar maior eficiência operacional em ambientes de manufatura complexos.

Análise Regional do Mercado de Juntas e Vedações no Oriente Médio e África

- Os Emirados Árabes Unidos dominaram o mercado de juntas e vedações do Oriente Médio e da África em 2025, impulsionados por investimentos significativos em infraestrutura de petróleo e gás, expansão petroquímica e desenvolvimento industrial em larga escala.

- A ênfase do país em equipamentos de alto desempenho, rigorosa conformidade com as normas de segurança e maior confiabilidade operacional está impulsionando uma forte demanda por componentes de vedação avançados.

- As constantes melhorias nas instalações de energia, manufatura e processamento reforçam ainda mais a posição dos Emirados Árabes Unidos como o principal mercado da região.

Análise do Mercado de Juntas e Vedações na Arábia Saudita

Prevê-se que a Arábia Saudita seja o país de crescimento mais rápido no mercado de juntas e vedações do Oriente Médio e da África entre 2026 e 2033, impulsionada pela crescente diversificação industrial, pela adoção cada vez maior de máquinas modernas e por fortes iniciativas governamentais de apoio à produção em larga escala. O foco crescente do país na eficiência da manutenção, no melhor desempenho dos ativos e no aumento da segurança operacional está acelerando a necessidade de soluções de vedação de alta qualidade, posicionando a Arábia Saudita como o mercado de crescimento mais rápido da região.

Participação de mercado de juntas e vedações no Oriente Médio e na África

O setor de juntas e vedações do Oriente Médio e da África é liderado principalmente por empresas consolidadas, incluindo:

• Klinger Oriente Médio (Emirados Árabes Unidos)

• Delta Gaskets (Emirados Árabes Unidos)

• Sealmech Trading LLC (Emirados

Árabes Unidos) • Afron Seals (África do Sul)

• Dual Valves Africa (África do Sul)

• Blue Seal Africa (África do Sul)

• Sondel Gaskets (África do Sul)

• Rubseal Gaskets (África do Sul)

• Sunflex Oriente Médio (Emirados Árabes Unidos)

• Al Zerwa Trading (Emirados Árabes Unidos)

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.