Middle East And Africa Drive Shaft Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

1,427.53 Million

USD

988.58 Million

2024

2032

USD

1,427.53 Million

USD

988.58 Million

2024

2032

| 2025 –2032 | |

| USD 1,427.53 Million | |

| USD 988.58 Million | |

|

|

|

|

Segmentação do mercado de eixos de transmissão no Oriente Médio e África, por componentes (garfos deslizantes, eixos de garfo, garfos finais, flanges complementares, garfos de flange, garfos soldados, garfos centrais, pontas deslizantes estriadas, pontas intermediárias e outros), tipo de projeto (eixo oco e eixo sólido), tipo de eixo de transmissão (eixo de transmissão Hotchkiss, eixo de transmissão do tubo de torque, eixo de transmissão flexível e eixo de transmissão Slip-In-Tube), tipo de posição (eixo dianteiro e eixo traseiro), tipo de material ( aço carbono , alumínio, aço inoxidável , materiais compostos, fibra de carbono e outros), tipo de veículo (carros de passeio e veículos comerciais), canal de vendas (OEM e mercado de reposição) - Tendências do setor e previsão até 2032

Tamanho do mercado de eixos de transmissão no Oriente Médio e África

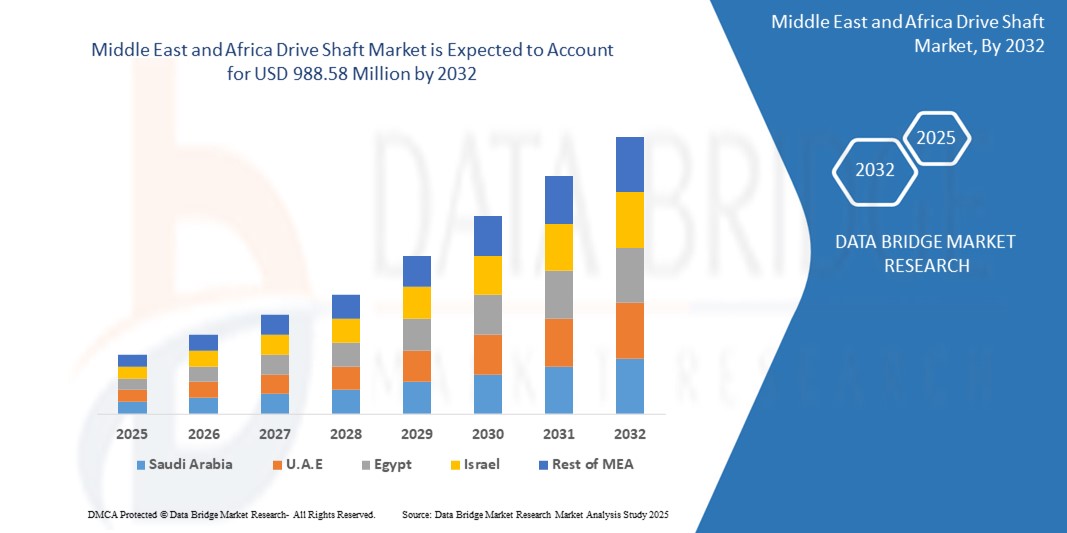

- Espera-se que o mercado de eixos de transmissão do Oriente Médio e da África atinja um valor de US$ 1.427,53 milhões até 2032 , ante US$ 988,58 milhões em 2024 , crescendo a um CAGR de 4,70% durante o período previsto de 2025 a 2032.

- Esse crescimento é impulsionado pelo aumento da produção de veículos na região, pela crescente demanda por componentes automotivos leves e com baixo consumo de combustível e pela crescente adoção de veículos elétricos e híbridos, que exigem tecnologias avançadas de eixo de transmissão. O mercado também é sustentado pelo desenvolvimento de infraestrutura, pela expansão dos setores de logística e transporte e por iniciativas governamentais favoráveis à promoção do crescimento industrial.

Análise de mercado de eixos de transmissão no Oriente Médio e África

- Os eixos cardã, componentes essenciais em sistemas de transmissão, são usados para transmitir o torque do motor para as rodas em diversos veículos, incluindo automóveis de passeio, veículos comerciais e equipamentos fora de estrada. Sua função na manutenção do desempenho do veículo, da eficiência de combustível e da estabilidade da linha de transmissão os torna essenciais em arquiteturas de veículos convencionais e elétricos.

- A crescente demanda por componentes automotivos leves e com baixo consumo de combustível, aliada à mudança global para a eletrificação, está impulsionando significativamente o mercado de eixos de transmissão. As montadoras estão adotando cada vez mais materiais avançados, como fibra de carbono e alumínio, em projetos de eixos para aprimorar o desempenho e reduzir o peso.

- A Arábia Saudita dominou o mercado de eixos de transmissão do Oriente Médio e da África com a maior participação na receita de 24,11% em 2024, impulsionada pela rápida expansão de sua indústria automotiva, aumento da produção de veículos e aumento na demanda por veículos comerciais

- Os Emirados Árabes Unidos são o país com crescimento mais rápido no mercado de eixos de transmissão do Oriente Médio e da África, com um CAGR de 13,33%, em grande parte devido ao seu status como um importante centro de comércio e logística

- O segmento de garfos deslizantes dominou o mercado com a maior participação de receita de 28,4% em 2024, devido ao seu amplo uso para acomodar o movimento do eixo de transmissão durante o curso da suspensão e seu papel crítico em garantir uma transmissão de potência suave.

Escopo do relatório e segmentação do mercado de eixos de transmissão no Oriente Médio e África

|

Atributos |

Insights importantes do mercado de eixos de transmissão do Oriente Médio e da África |

|

Segmentos abrangidos |

|

|

Países abrangidos |

|

|

Principais participantes do mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor agregado |

Além de insights de mercado, como valor de mercado, taxa de crescimento, segmentos de mercado, cobertura geográfica, participantes do mercado e cenário de mercado, o relatório de mercado selecionado pela equipe de pesquisa de mercado da Data Bridge inclui análise aprofundada de especialistas, análise de importação/exportação, análise de preços, análise de consumo de produção e análise pilão. |

Tendências do mercado de eixos de transmissão no Oriente Médio e na África

Adoção crescente de materiais leves e projetos compatíveis com eletrificação

- Uma tendência importante e crescente no mercado global de eixos cardã é o uso crescente de materiais e designs leves, desenvolvidos especificamente para veículos elétricos e híbridos. Essa mudança é impulsionada pelo foco da indústria automotiva em melhorar a eficiência de combustível, reduzir as emissões e otimizar o desempenho, especialmente em plataformas de veículos elétricos (VEs) que exigem transmissão de alto torque com perda mínima de energia.

- Por exemplo, a BorgWarner lançou uma nova linha de eixos cardã compostos que reduzem o peso em até 30% em comparação com as versões tradicionais de aço, melhorando a eficiência energética e a dirigibilidade em veículos elétricos. Da mesma forma, a GKN Automotive desenvolveu eixos cardã projetados especificamente para atender às demandas de torque e aos requisitos de arquitetura compacta dos veículos elétricos.

- O uso de materiais avançados, como polímeros reforçados com fibra de carbono e ligas de alumínio, reduz o peso e melhora a rigidez torcional e a durabilidade, permitindo melhor desempenho em condições de alta velocidade e alto torque. Essas inovações são essenciais para veículos elétricos, que operam de forma diferente dos veículos com motor de combustão interna e exigem um fornecimento de energia altamente eficiente.

- Além disso, os fabricantes estão se concentrando em sistemas de eixo de transmissão modulares e escaláveis, que podem ser facilmente adaptados a diferentes plataformas de veículos, incluindo aplicações elétricas, híbridas e comerciais. Isso permite que as montadoras otimizem a produção e reduzam custos, ao mesmo tempo em que atendem a diversos requisitos de transmissão.

- A integração de elementos de design inteligentes, como tecnologias de amortecimento de ruído, vibração e aspereza (NVH), também está ganhando força, especialmente em veículos premium e elétricos, onde a operação silenciosa é uma expectativa do consumidor. As empresas estão incorporando amortecedores leves e usando balanceamento de precisão para reduzir vibrações e aumentar o conforto ao dirigir.

- Essa tendência de inovação em materiais, prontidão para eletrificação e otimização de desempenho está remodelando fundamentalmente a filosofia de design dos eixos de transmissão modernos. À medida que a demanda por veículos elétricos continua a crescer e as normas de emissões se tornam mais rigorosas, o mercado de eixos de transmissão está evoluindo rapidamente para dar suporte à próxima geração de soluções de mobilidade com componentes de transmissão mais eficientes, leves e inteligentes.

Oriente Médio e África impulsionam a dinâmica do mercado de eixos

Motorista

Aumenta Demanda por Transmissão de Potência Eficiente em Aplicações Automotivas e Industriais

- A crescente necessidade por sistemas de transmissão de potência confiáveis e eficientes, especialmente nos setores automotivo e industrial, é um fator-chave para o mercado de eixos cardã. À medida que veículos e máquinas se tornam mais avançados, a demanda por eixos cardã duráveis e de alto desempenho continua a aumentar.

- Por exemplo, em maio de 2023, a American Axle & Manufacturing anunciou seu contrato para fornecer eixos e-Beam integrados à tecnologia e-Drive 3 em 1 para um futuro programa de veículos elétricos da Stellantis. Essas inovações estão impulsionando o mercado, alinhando-se às tendências do setor em direção à eletrificação e à eficiência.

- À medida que as montadoras aumentam a produção de veículos elétricos e híbridos, a integração de componentes leves e energeticamente eficientes, incluindo eixos de transmissão avançados, torna-se essencial para melhorar o desempenho do veículo e atingir as metas de emissões.

- Em aplicações industriais, o aumento da automação e do uso de máquinas pesadas criou uma forte demanda por sistemas de eixo de transmissão robustos e eficientes, capazes de lidar com alto torque e operar sob condições exigentes.

- Além disso, os avanços nas tecnologias de materiais — como fibra de carbono e ligas de alumínio — permitiram o desenvolvimento de eixos de transmissão mais leves e resistentes, contribuindo para maior eficiência de combustível, redução de emissões e melhor dinâmica geral do veículo, especialmente em veículos elétricos e aplicações de alto desempenho. A crescente tendência em direção à mobilidade sustentável e com eficiência energética reforça ainda mais essa demanda nos mercados automotivo e industrial.

Restrição/Desafio

Volatilidade nos preços das matérias-primas e processos complexos de fabricação

- A flutuação dos preços de matérias-primas essenciais, como aço, alumínio e compostos de carbono, representa um grande desafio para o mercado de eixos cardã. Esses materiais impactam diretamente o custo de produção e podem reduzir as margens de lucro dos fabricantes ou aumentar os preços para os consumidores finais.

- Por exemplo, recentes interrupções na cadeia de suprimentos global e incertezas na política comercial levaram ao aumento de custos e à redução da disponibilidade de certos materiais, criando imprevisibilidade nos preços e no planejamento da produção para fabricantes de eixos de transmissão.

- Além disso, a fabricação de eixos de transmissão avançados — especialmente aqueles feitos de materiais compósitos — exige processos complexos e equipamentos especializados, limitando o número de produtores capazes de produzir em alto volume. Isso cria barreiras à entrada e retarda a adoção, especialmente em mercados sensíveis a preços.

- Empresas como BorgWarner e GKN Automotive continuam investindo em otimização e automação de processos para reduzir os custos de fabricação, mas a complexidade continua sendo um fator significativo, especialmente para empresas pequenas ou emergentes.

- Além disso, à medida que as plataformas de veículos se diversificam, especialmente com o surgimento dos veículos elétricos, a necessidade de soluções de eixo de transmissão personalizadas ou específicas para cada aplicação aumentou, adicionando complexidade de engenharia e design. Essa personalização pode aumentar o tempo e os custos de desenvolvimento, impactando a escalabilidade.

- Superar esses desafios exigirá investimento contínuo em tecnologias de fabricação econômicas, garantindo cadeias de fornecimento de materiais estáveis e projetando sistemas de eixo de transmissão modulares que possam ser adaptados a diversas plataformas de veículos sem comprometer o desempenho.

Escopo de mercado de eixos de transmissão no Oriente Médio e África

O mercado de eixos de transmissão automotivos é segmentado em sete segmentos notáveis com base no componente, tipo de design, tipo de eixo de transmissão, tipo de posição, tipo de material, tipo de veículo e canal de vendas.

- Por componente

Com base nos componentes, o mercado é segmentado em garfos deslizantes, eixos de garfo, garfos terminais, flanges de acoplamento, garfos de flange, garfos soldados, garfos centrais, pontas deslizantes estriadas, pontas intermediárias e outros. O segmento de garfos deslizantes dominou o mercado, com a maior participação na receita, de 28,4% em 2024, devido à sua ampla utilização para acomodar o movimento do eixo cardã durante o curso da suspensão e ao seu papel crítico em garantir uma transmissão de potência suave. Os garfos deslizantes são altamente preferidos em automóveis de passeio e veículos comerciais leves por sua durabilidade e custo-benefício.

O segmento de garfos de flange deverá registrar o CAGR mais rápido, de 8,9%, entre 2025 e 2032, impulsionado pela crescente demanda por caminhões pesados, veículos fora de estrada e frotas comerciais. Sua capacidade de suportar altas cargas de torque e fornecer conexões de junta estáveis os torna essenciais em sistemas de transmissão modernos, onde desempenho e confiabilidade são primordiais.

- Por tipo de design

Com base no tipo de projeto, o mercado é segmentado em eixo oco e eixo sólido. O segmento de eixo oco dominou o mercado, com uma participação de 63,5% na receita em 2024, principalmente devido à sua estrutura leve, inércia reduzida e benefícios superiores em termos de eficiência de combustível. As montadoras preferem eixos ocos em veículos de passeio e veículos elétricos para melhorar o desempenho geral do veículo, ao mesmo tempo em que atendem às normas regulatórias de emissões.

Prevê-se que o segmento de eixos sólidos apresente o CAGR mais rápido, de 7,6%, entre 2025 e 2032, impulsionado por sua crescente adoção em aplicações pesadas que exigem maior resistência e capacidade de torque. Eixos sólidos são particularmente populares em caminhões, ônibus e veículos industriais, onde a robustez e a capacidade de carga superam a redução de peso.

- Por tipo de eixo de transmissão

Com base no tipo de eixo cardã, o mercado é segmentado em eixo cardã Hotchkiss, eixo cardã com tubo de torque, eixo cardã flexível e eixo cardã slip-in-tube. O eixo cardã Hotchkiss dominou, com uma participação de 41,7% na receita em 2024, devido ao seu amplo uso em automóveis de passeio e caminhões leves com tração traseira. Seu design simples, eficiência de custos e confiabilidade comprovada impulsionam sua forte presença no mercado.

Espera-se que o segmento de eixos de transmissão flexíveis registre o CAGR mais rápido, de 9,3%, entre 2025 e 2032, impulsionado pela crescente demanda por veículos elétricos, veículos híbridos e máquinas industriais especializadas. Eixos flexíveis permitem uma transmissão de torque mais suave, melhor absorção de vibração e integração de design compacto, tornando-os ideais para aplicações automotivas leves.

- Por tipo de posição

Com base no tipo de posição, o mercado é segmentado em eixo dianteiro e eixo traseiro. O segmento de eixo traseiro dominou o mercado, com uma participação de 58,2% na receita em 2024, impulsionado pela forte prevalência de configurações de tração traseira em caminhões leves, SUVs e veículos comerciais. Os eixos traseiros exigem eixos de transmissão robustos para transferência eficiente de torque em distâncias maiores.

O segmento de eixos dianteiros deverá crescer à taxa composta de crescimento anual (CAGR) mais rápida, de 8,1%, entre 2025 e 2032, em grande parte devido à crescente adoção de veículos com tração integral e dianteira em automóveis de passeio. A crescente demanda dos consumidores por maior estabilidade, eficiência de combustível e tração em carros compactos e crossovers está impulsionando a demanda por semi-eixos dianteiros.

- Por tipo de material

Com base no tipo de material, o mercado é segmentado em aço carbono, alumínio, aço inoxidável, materiais compósitos, fibra de carbono e outros. O segmento de aço carbono foi responsável pela maior participação na receita, 46,9% em 2024, sendo favorecido por sua resistência, durabilidade e custo-benefício em veículos de passeio e comerciais. Eixos cardã de aço carbono continuam sendo uma escolha padrão em veículos a combustão tradicionais.

Espera-se que o segmento de fibra de carbono se expanda a uma taxa composta de crescimento anual (CAGR) de 10,4% entre 2025 e 2032, impulsionado pela crescente adoção em carros de alto desempenho, veículos de luxo e veículos elétricos. Sua leveza e excelente relação resistência-peso a tornam ideal para melhorar a eficiência de combustível e reduzir as emissões, em linha com as metas globais de sustentabilidade.

- Por tipo de veículo

Com base no tipo de veículo, o mercado é segmentado em automóveis de passeio e veículos comerciais. O segmento de automóveis de passeio dominou o mercado, com uma participação de receita de 61,4% em 2024, impulsionado pelo aumento da produção de sedãs, SUVs e hatchbacks em todo o mundo. O aumento da urbanização, da renda disponível e da mudança para veículos conectados impulsiona ainda mais a adoção.

A previsão é de que o segmento de veículos comerciais registre o CAGR mais rápido, de 7,8%, entre 2025 e 2032, com a expansão dos setores globais de logística e construção. Caminhões e ônibus pesados exigem eixos de transmissão duráveis e de alto desempenho, capazes de suportar altas cargas de torque e longas horas de operação.

- Por canal de vendas

Com base no canal de vendas, o mercado é segmentado em OEM e mercado de reposição. O segmento OEM dominou o mercado, com participação de 68,7% na receita em 2024, devido ao aumento da produção global de automóveis e à preferência dos fabricantes por integrar eixos de transmissão avançados e leves durante a montagem inicial. O fornecimento OEM garante qualidade consistente, conformidade regulatória e garantia para os usuários finais.

O segmento de reposição deverá registrar o CAGR mais rápido, de 8,6%, entre 2025 e 2032, impulsionado pelo aumento do envelhecimento dos veículos, maiores taxas de substituição e demanda por personalização. Frotas comerciais e proprietários de veículos individuais estão recorrendo a soluções de reposição para eficiência de custos e disponibilidade de componentes especializados.

Análise regional do mercado de eixos de transmissão no Oriente Médio e África

- A Arábia Saudita dominou o mercado de eixos de transmissão do Oriente Médio e da África com a maior participação na receita de 24,11% em 2024, impulsionada pela rápida expansão de sua indústria automotiva, aumento da produção de veículos e aumento na demanda por veículos comerciais

- O foco do país no desenvolvimento industrial, juntamente com o crescimento da infraestrutura e iniciativas governamentais de apoio no âmbito da Visão 2030, impulsionou significativamente os setores automotivo e de manufatura — principais consumidores de componentes de eixos de transmissão.

- Além disso, a presença de fabricantes de veículos locais e internacionais, juntamente com a crescente demanda por veículos de passeio e pesados, aumentou a necessidade de sistemas avançados de transmissão de energia. Isso posiciona a Arábia Saudita como um polo central para a adoção de eixos de transmissão em toda a região.

Visão geral do mercado de eixos de transmissão dos Emirados Árabes Unidos

Os Emirados Árabes Unidos são o país com crescimento mais rápido no mercado de eixos de transmissão do Oriente Médio e África, com um CAGR de 13,33%, em grande parte devido ao seu status como um importante polo comercial e logístico. A infraestrutura bem desenvolvida do país e as políticas favoráveis aos negócios atraem fabricantes automotivos e prestadores de serviços de reposição, facilitando o crescimento do mercado. O aumento dos investimentos na adoção de veículos elétricos e híbridos, juntamente com iniciativas governamentais que promovem o transporte sustentável, estão impulsionando a demanda por tecnologias avançadas de eixos de transmissão. O setor automotivo dos Emirados Árabes Unidos se beneficia de uma população crescente com renda disponível crescente, o que impulsiona as vendas de veículos de passeio e a demanda por peças de reposição. Além disso, a localização estratégica do país permite uma gestão eficiente da cadeia de suprimentos para componentes automotivos em toda a região. No entanto, o crescimento do mercado é moderado pela concorrência de players internacionais estabelecidos e pela sensibilidade aos preços no segmento de reposição. No geral, o mercado dos Emirados Árabes Unidos está pronto para um crescimento constante, apoiado pela inovação tecnológica e pela expansão da produção de veículos.

Mercado de eixos de transmissão da África do Sul

A África do Sul representa um mercado automotivo maduro na região do Oriente Médio e África, caracterizado por uma base de fabricação bem estabelecida e políticas governamentais de apoio voltadas para o aumento da produção local. A indústria automotiva do país se beneficia da presença de fabricantes globais de veículos e de uma rede robusta de fornecedores, o que impulsiona uma demanda consistente por eixos de transmissão e componentes relacionados. As tendências de automação industrial também estão impulsionando o crescimento em setores não automotivos que utilizam extensivamente eixos de transmissão. Incentivos governamentais focados no aumento das exportações e na melhoria da infraestrutura industrial aumentaram a competitividade do setor automotivo. Apesar de desafios como a volatilidade econômica e a flutuação dos preços das matérias-primas, a África do Sul continua a manter uma posição forte no mercado regional. O impulso contínuo por inovação, juntamente com a crescente adoção de veículos elétricos e híbridos, apresenta novas oportunidades para soluções avançadas de eixos de transmissão, tornando a África do Sul um mercado vital para fabricantes que visam a região MEA.

Visão geral do mercado de eixos de transmissão do Egito

O mercado de eixos cardã do Egito está se expandindo gradualmente, impulsionado pelo aumento da propriedade de veículos e pela crescente industrialização do país. Como um dos maiores mercados automotivos do Norte da África, o Egito tem visto um crescimento constante nas vendas de veículos de passeio e comerciais, o que impulsiona a demanda por componentes confiáveis para sistemas de transmissão. O foco do governo no desenvolvimento de infraestrutura, como expansões de estradas e novas zonas industriais, apoia o crescimento nos setores automotivo e de máquinas, onde os eixos cardã são essenciais. Além disso, o aumento da capacidade de fabricação local e a melhoria da logística da cadeia de suprimentos contribuem para o desenvolvimento do mercado. No entanto, os desafios econômicos e os ambientes regulatórios flutuantes podem impactar o ritmo de crescimento. Apesar desses obstáculos, a expansão da classe média egípcia e as tendências de urbanização criam oportunidades de longo prazo para os fabricantes de eixos cardã. A crescente conscientização sobre eficiência de combustível e desempenho de veículos também está incentivando a adoção de eixos cardã avançados e leves no mercado.

Visão geral do mercado de eixos de transmissão de Israel

O mercado de eixos cardã de Israel é caracterizado por um crescimento constante impulsionado pela inovação tecnológica e por uma indústria automotiva dinâmica. O país é conhecido por seus avanços em engenharia automotiva e tecnologias de veículos elétricos, que criam demanda por eixos cardã sofisticados e de alto desempenho. O foco de Israel em pesquisa e desenvolvimento, combinado com incentivos governamentais para soluções de transporte limpas e eficientes, apoia a adoção de componentes de eixo cardã leves e duráveis. O país também se beneficia de uma forte base de fabricação de peças e componentes automotivos, fomentando um ambiente de mercado competitivo. No entanto, o tamanho relativamente menor do mercado automotivo doméstico e a dependência de importações podem limitar a rápida expansão. No entanto, a ênfase de Israel em inovação e qualidade o posiciona bem para o crescimento futuro, particularmente em segmentos especializados, como veículos elétricos e híbridos. A perspectiva de mercado permanece positiva, apoiada pelo progresso tecnológico contínuo e pela evolução das preferências do consumidor.

Oriente Médio e África impulsionam a participação de mercado do eixo

Os líderes de mercado que operam no mercado são:

- Bailey Morris (Reino Unido)

- Cummins Inc. (EUA)

- HYUNDAI WIA CORP (Coreia do Sul)

- THE TIMKEN COMPANY (EUA)

- GSP EUROPE GmbH (Alemanha)

- TUNGALOY CORPORATION (Japão)

- GKN Automotive Limited (Reino Unido)

Últimos desenvolvimentos no mercado de eixos de transmissão no Oriente Médio e na África

- Em setembro de 2024, a Cummins Inc. concluiu a aquisição da Jacobs Vehicle Systems, incluindo a renomada tecnologia Jake Brake, originalmente inspirada na inovação de Clessie Cummins de 1931. Esta aquisição fortalece o portfólio da Cummins em tecnologias de transmissão e aprimora a segurança e a eficiência de frenagem em veículos comerciais, alinhando-se à estratégia da empresa de fornecer soluções avançadas e integradas de motores para mercados globais.

- Em agosto de 2024, a Nexteer Automotive lançou um novo sistema modular de direção elétrica (EPS) com assistência de pinhão. Projetado para compatibilidade com todas as arquiteturas EPS, este sistema oferece integração flexível, peso reduzido e maior eficiência de combustível. Ele apoia a iniciativa mais ampla da Nexteer de aprimorar os sistemas de transmissão e direção para plataformas de veículos elétricos e autônomos.

- Em setembro de 2023, a JTEKT Corporation apresentou avanços significativos em sistemas de direção e transmissão no Salão do Automóvel de Tóquio de 2023. Essas inovações visam aprimorar o desempenho do veículo, o conforto ao dirigir e a eficiência energética. A exposição da empresa refletiu seu compromisso em apoiar a evolução da mobilidade com componentes inteligentes e de alto desempenho, adaptados tanto para veículos convencionais quanto elétricos.

- Em maio de 2023, a American Axle & Manufacturing (AAM) anunciou um importante contrato para o fornecimento de eixos e-Beam integrados à tecnologia e-Drive 3 em 1 para um futuro programa de veículos elétricos da Stellantis. A produção está prevista para começar no final da década, reforçando o papel da AAM na eletrificação e sua capacidade de atender às altas demandas de torque e eficiência das plataformas elétricas modernas.

- Em dezembro de 2021, a AEQUITA SE & Co. KGaA finalizou a aquisição do Grupo IFA, especialista líder em tecnologia de eixos cardã. Essa aquisição elevou as vendas da AEQUITA no setor automotivo para mais de 1 bilhão de euros. A aquisição alavanca os sólidos relacionamentos com fabricantes de equipamentos originais (OEMs) e a expertise técnica da IFA, posicionando a AEQUITA para inovação contínua e crescimento competitivo no mercado global de eixos cardã .

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.