Middle East And Africa Cpap Devices Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

138.65 Million

USD

216.04 Million

2024

2032

USD

138.65 Million

USD

216.04 Million

2024

2032

| 2025 –2032 | |

| USD 138.65 Million | |

| USD 216.04 Million | |

|

|

|

|

Segmentação do mercado de dispositivos CPAP no Oriente Médio e África, por tipo de produto (dispositivo CPAP e consumível), modalidade (autônomo e portátil), usuário final (atendimento domiciliar, hospitais, clínicas particulares e outros) - Tendências do setor e previsão até 2032

Tamanho do mercado de dispositivos CPAP no Oriente Médio e África

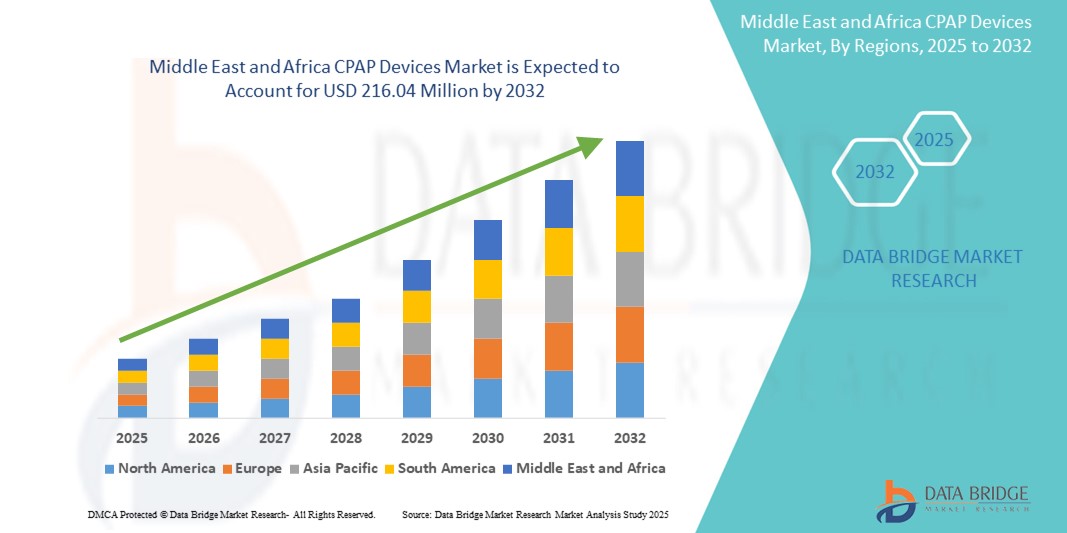

- O tamanho do mercado de dispositivos CPAP do Oriente Médio e África foi avaliado em US$ 138,65 milhões em 2024 e deve atingir US$ 216,04 milhões até 2032 , com um CAGR de 5,70% durante o período previsto.

- O crescimento do mercado é amplamente impulsionado pela crescente prevalência da apneia obstrutiva do sono (AOS) e pela crescente conscientização sobre os distúrbios relacionados ao sono em toda a região, levando a um aumento na adoção de diagnósticos e tratamentos.

- Além disso, a melhoria da infraestrutura de saúde, a crescente penetração de prestadores de serviços de saúde privados e a crescente disponibilidade de dispositivos CPAP tecnologicamente avançados estão acelerando a demanda. Esses fatores combinados estão impulsionando significativamente a expansão do mercado no Oriente Médio e na África.

Análise de mercado de dispositivos CPAP no Oriente Médio e África

- Os dispositivos CPAP, que fornecem pressão positiva contínua nas vias aéreas para mantê-las abertas durante o sono, estão se tornando cada vez mais essenciais no tratamento da apneia obstrutiva do sono (AOS) no Oriente Médio e na África devido à conscientização crescente, à expansão das capacidades de diagnóstico e à crescente carga de distúrbios relacionados ao sono nos setores de saúde públicos e privados.

- A crescente demanda por dispositivos CPAP é alimentada principalmente pelo aumento das taxas de obesidade, pelo envelhecimento da população e pela crescente adoção de soluções de cuidados respiratórios domiciliares, juntamente com a maior disponibilidade de dispositivos portáteis e fáceis de usar.

- A África do Sul dominou o mercado de dispositivos CPAP com a maior participação na receita de 31,9% em 2024, apoiada por uma infraestrutura de saúde bem estabelecida, campanhas ativas de conscientização sobre distúrbios do sono e crescente acessibilidade ao tratamento em centros urbanos

- Espera-se que os Emirados Árabes Unidos sejam o país com crescimento mais rápido no mercado de dispositivos CPAP durante o período previsto devido ao aumento do turismo médico, à digitalização da saúde e aos crescentes investimentos em serviços especializados de cuidados respiratórios.

- O segmento de dispositivos CPAP dominou o mercado de dispositivos CPAP por tipo de produto, com uma participação de 67,2% em 2024, impulsionado pelo aumento das taxas de diagnóstico e pela crescente disponibilidade de unidades de terapia tecnologicamente avançadas em ambientes de saúde e de assistência domiciliar.

Escopo do relatório e segmentação do mercado de dispositivos CPAP no Oriente Médio e África

|

Atributos |

Principais insights de mercado sobre dispositivos CPAP no Oriente Médio e África |

|

Segmentos abrangidos |

|

|

Países abrangidos |

Oriente Médio e África

|

|

Principais participantes do mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor agregado |

Além dos insights sobre cenários de mercado, como valor de mercado, taxa de crescimento, segmentação, cobertura geográfica e principais participantes, os relatórios de mercado selecionados pela Data Bridge Market Research também incluem análises aprofundadas de especialistas, análises de preços, análises de participação de marca, pesquisas com consumidores, análises demográficas, análises da cadeia de suprimentos, análises da cadeia de valor, visão geral de matérias-primas/consumíveis, critérios de seleção de fornecedores, análise PESTLE, análise de Porter e estrutura regulatória. |

Tendências do mercado de dispositivos CPAP no Oriente Médio e na África

“Crescente demanda por dispositivos CPAP portáteis e inteligentes”

- Uma tendência significativa e crescente no mercado de dispositivos CPAP no Oriente Médio e na África é a crescente preferência por soluções CPAP compactas, portáteis e tecnologicamente avançadas que atendem tanto a ambientes clínicos quanto domiciliares, especialmente em regiões urbanas com melhor acesso à saúde e conscientização crescente sobre apneia do sono

- Por exemplo, o DreamStation Go da Philips e o AirMini da ResMed ganharam força na região por seus designs leves e recursos inteligentes integrados, como conectividade Bluetooth, monitoramento baseado em aplicativo e compartilhamento de dados em nuvem com médicos, permitindo um gerenciamento de terapia mais personalizado e conveniente.

- Esses dispositivos CPAP inteligentes permitem que os pacientes monitorem seus padrões de sono, recebam feedback em tempo real e compartilhem relatórios de conformidade com os provedores de saúde remotamente, melhorando significativamente a adesão aos planos de tratamento.

- Além disso, inovações como o ajuste automático de pressão e os sistemas de umidificação melhoram ainda mais o conforto do usuário, enquanto plataformas conectadas à nuvem, como o myAir da ResMed, oferecem treinamento e suporte para melhorar os resultados da terapia.

- Essa mudança em direção à portabilidade e à funcionalidade inteligente está sendo impulsionada por uma população trabalhadora crescente, pelo aumento das viagens e pela crescente demanda por assistência médica domiciliar em países como África do Sul, Emirados Árabes Unidos e Arábia Saudita.

- A demanda por dispositivos CPAP inteligentes e portáteis está aumentando rapidamente, à medida que os pacientes buscam conforto, mobilidade e integração com ecossistemas de saúde digital mais amplos, transformando o tratamento da apneia do sono em uma experiência mais centrada no usuário e baseada em dados.

Dinâmica do mercado de dispositivos CPAP no Oriente Médio e na África

Motorista

“Crescente conscientização sobre apneia do sono e expansão da assistência médica domiciliar”

- A crescente prevalência da apneia obstrutiva do sono, juntamente com a crescente conscientização sobre seus impactos na saúde, é um dos principais impulsionadores do mercado de dispositivos CPAP no Oriente Médio e na África. Campanhas lideradas por organizações de saúde e prestadores privados estão incentivando o diagnóstico e a intervenção precoce, especialmente em grupos de alto risco, como idosos e obesos.

- Por exemplo, as iniciativas na África do Sul e nos Emirados Árabes Unidos para rastrear distúrbios do sono em ambientes de cuidados primários estão a impulsionar as taxas de diagnóstico precoce, alimentando assim a procura por dispositivos terapêuticos, como máquinas CPAP.

- Além disso, a expansão dos serviços de saúde domiciliar está criando oportunidades para soluções de terapia do sono não invasivas, apoiadas por sistemas CPAP portáteis e plataformas de monitoramento remoto.

- À medida que os investimentos públicos e privados em saúde crescem na região, especialmente nos centros urbanos, a disponibilidade e a acessibilidade dos dispositivos CPAP estão melhorando, impulsionando ainda mais o crescimento do mercado

- A conveniência da terapia domiciliar e a crescente preferência por opções de tratamento não hospitalares estão acelerando a adoção de dispositivos CPAP em economias de alta renda e emergentes na região

Restrição/Desafio

“Conscientização limitada e problemas de acessibilidade em regiões carentes”

- Apesar da crescente adoção em áreas urbanas, a conscientização limitada sobre a apneia do sono e seus riscos continua sendo uma barreira significativa nas áreas rurais e carentes do Oriente Médio e da África.

- Muitos indivíduos permanecem sem diagnóstico devido à falta de serviços especializados, laboratórios do sono e conhecimento público sobre opções de tratamento, como terapia CPAP

- Além disso, o custo inicial relativamente alto dos dispositivos CPAP e as despesas contínuas com consumíveis, como máscaras e filtros, podem ser proibitivos para populações sensíveis a preços. Em regiões onde o reembolso ou a cobertura de seguro são limitados, a acessibilidade torna-se um grande obstáculo à adoção generalizada.

- Por exemplo, embora marcas premium como a ResMed e a Philips dominem os mercados urbanos, ainda há escassez de alternativas económicas para uma acessibilidade mais ampla.

- Colmatar estas lacunas através de campanhas de sensibilização apoiadas pelo governo, parcerias público-privadas e a introdução de opções de CPAP de baixo custo adaptadas aos mercados africano e do Médio Oriente será essencial para a expansão do mercado a longo prazo.

Escopo de mercado de dispositivos CPAP no Oriente Médio e África

O mercado é segmentado com base no tipo de produto, modalidade e usuário final.

- Por tipo de produto

Com base no tipo de produto, o mercado de dispositivos CPAP no Oriente Médio e África é segmentado em dispositivos CPAP e consumíveis. O segmento de dispositivos CPAP dominou o mercado, com a maior participação na receita, de 67,2% em 2024, impulsionado pela crescente prevalência de apneia obstrutiva do sono (AOS), avanços na tecnologia de dispositivos e crescente conscientização sobre a terapia do sono. Os aparelhos CPAP são a principal linha de tratamento para AOS moderada a grave, e sua crescente adoção é sustentada pelo aumento das taxas de diagnóstico e pelo número crescente de clínicas do sono na região.

O segmento de Consumíveis, incluindo máscaras, tubos, filtros e umidificadores, deverá apresentar o crescimento mais rápido entre 2025 e 2032, devido à necessidade recorrente de substituições e manutenção da higiene. À medida que a base instalada de dispositivos CPAP cresce, a demanda por consumíveis associados aumentará de forma constante, impulsionada por um foco maior no conforto e na adesão do usuário.

- Por Modalidade

Com base na modalidade, o mercado de dispositivos CPAP é categorizado em dispositivos CPAP autônomos e portáteis. O segmento de Dispositivos CPAP Portáteis deteve a maior participação na receita, 58,6% em 2024, impulsionado pela crescente preferência por terapia domiciliar, pela conveniência de dispositivos fáceis de transportar e pela crescente demanda entre profissionais e viajantes frequentes. Modelos portáteis como o ResMed AirMini e o Philips DreamStation Go estão ganhando popularidade por seu tamanho compacto, recursos de conectividade inteligentes e facilidade de uso.

O segmento de Dispositivos CPAP Independentes, dominante em ambientes clínicos, deverá apresentar crescimento moderado durante o período previsto, impulsionado principalmente por hospitais e laboratórios do sono. Esses dispositivos são geralmente mais volumosos e oferecem recursos avançados de diagnóstico, mas são menos indicados para uso pessoal em comparação com seus equivalentes portáteis.

- Por usuário final

Com base no usuário final, o mercado de dispositivos CPAP é segmentado em atendimento domiciliar, hospitais, clínicas particulares e outros. O segmento de Atendimento Domiciliar liderou o mercado com a maior participação na receita, de 46,9% em 2024, devido à forte mudança para o tratamento domiciliar da apneia do sono, à boa relação custo-benefício e à disponibilidade de dispositivos CPAP compactos e fáceis de usar, adequados para uso pessoal. O aumento da conscientização, os programas de apoio à adesão à terapia e a integração de aplicativos móveis estão impulsionando ainda mais a preferência dos pacientes por soluções domiciliares.

Espera-se que o segmento de Hospitais apresente o crescimento mais acelerado durante o período previsto, devido à necessidade de cuidados intensivos e diagnóstico profissional em casos graves de AOS, enquanto Clínicas Particulares estão adotando cada vez mais serviços de terapia com CPAP para atender à crescente demanda ambulatorial. A categoria Outros, incluindo laboratórios do sono e centros de reabilitação, também representa um grupo crescente de usuários finais, à medida que a conscientização e o diagnóstico melhoram em toda a região.

Análise regional do mercado de dispositivos CPAP no Oriente Médio e África

- A África do Sul dominou o mercado de dispositivos CPAP com a maior participação na receita de 31,9% em 2024, apoiada por uma infraestrutura de saúde bem estabelecida, campanhas ativas de conscientização sobre distúrbios do sono e crescente acessibilidade ao tratamento em centros urbanos

- Os consumidores da região estão cada vez mais reconhecendo a importância do diagnóstico precoce e do tratamento contínuo da apneia obstrutiva do sono, com uma mudança notável em direção ao atendimento domiciliar e ao uso de dispositivos CPAP portáteis.

- Esta adoção é ainda apoiada pela melhoria do acesso aos cuidados respiratórios, pelo aumento das taxas de obesidade e pela presença de prestadores de cuidados de saúde internacionais, posicionando a África do Sul como líder regional na adoção da terapia CPAP em ambientes de saúde clínicos e pessoais.

Visão geral do mercado de dispositivos CPAP na África do Sul

O mercado de dispositivos CPAP da África do Sul obteve a maior fatia da receita, de 31,4%, em 2024, no Oriente Médio e na África, impulsionado pela alta conscientização sobre distúrbios do sono, acesso a instalações de diagnóstico e sólidas parcerias público-privadas na área da saúde. O crescimento da população geriátrica do país e a crescente prevalência de obesidade estão alimentando ainda mais a necessidade de um tratamento eficaz para a apneia do sono. Além disso, a mudança para soluções de atendimento domiciliar e o crescente interesse do consumidor por plataformas digitais de saúde estão impulsionando o crescimento de dispositivos CPAP inteligentes e portáteis no mercado.

Visão geral do mercado de dispositivos CPAP na Arábia Saudita

O mercado de dispositivos CPAP da Arábia Saudita deverá crescer a um forte CAGR durante o período previsto, impulsionado pelas iniciativas governamentais de saúde da Visão 2030 e pela crescente ênfase na melhoria da qualidade de vida. A crescente prevalência de doenças crônicas, como diabetes e obesidade , juntamente com o aumento dos investimentos em infraestrutura hospitalar e clínicas do sono, está criando condições favoráveis à adoção de dispositivos CPAP. A expansão do setor privado de saúde e o uso crescente da telemedicina para acompanhamento também impulsionam o crescimento do mercado.

Visão do mercado de dispositivos CPAP dos Emirados Árabes Unidos

Prevê-se que o mercado de dispositivos CPAP dos Emirados Árabes Unidos cresça a uma taxa composta de crescimento anual (CAGR) expressiva durante o período previsto, impulsionado pela rápida urbanização, uma população de alta renda e um foco crescente em saúde digital. Os consumidores nos Emirados Árabes Unidos estão recorrendo cada vez mais a soluções de atendimento domiciliar e monitoramento remoto, tornando os dispositivos CPAP portáteis e inteligentes altamente atraentes. Além disso, o aumento do turismo médico e a moderna infraestrutura de saúde do país estão impulsionando a disponibilidade e o uso de equipamentos avançados de terapia do sono.

Visão geral do mercado de dispositivos CPAP no Egito

O mercado de dispositivos CPAP do Egito está pronto para um crescimento moderado, impulsionado por campanhas de conscientização mais intensas e melhorias graduais no acesso à saúde. Embora o mercado ainda esteja em estágio inicial, as crescentes taxas de diagnóstico de distúrbios do sono e o apoio de organizações internacionais de saúde estão ajudando a impulsionar a adoção de dispositivos CPAP. À medida que a acessibilidade melhora e mais players entram no mercado com soluções econômicas, espera-se que o Egito emerja como um contribuinte significativo para o crescimento regional.

Participação no mercado de dispositivos CPAP no Oriente Médio e África

O setor de dispositivos CPAP do Oriente Médio e da África é liderado principalmente por empresas bem estabelecidas, incluindo:

- ResMed Inc. (EUA)

- Koninklijke Philips NV (Holanda)

- Fisher & Paykel Healthcare Limited (Nova Zelândia)

- BMC Medical Co., Ltd. (China)

- Apex Medical Corp. (Taiwan)

- Löwenstein Medical GmbH & Co. KG (Alemanha)

- Drive DeVilbiss Healthcare LLC (EUA)

- 3B Medical, Inc. (EUA)

- Breas Medical AB (Suécia)

- Somnetics International, Inc. (EUA)

- Tecnologia Médica SLS (China)

- Resvent Medical Technology Co., Ltd. (China)

- Teijin Pharma Limited (Japão)

- Koike Medical Co., Ltd. (Japão)

- Nidek Medical India Pvt. Ltd. (Índia)

- Medtronic (Irlanda)

- Cardinal Health, Inc. (EUA)

- Smiths Medical, Inc. (Reino Unido)

- Fosun Pharma (China)

- Elmaslar Medikal Sistemleri (Turquia)

Quais são os desenvolvimentos recentes no mercado de dispositivos CPAP do Oriente Médio e da África?

- Em maio de 2024, a ResMed Inc., líder global em cuidados respiratórios e do sono, firmou parceria com importantes distribuidores de serviços de saúde da África do Sul para expandir o acesso aos seus dispositivos CPAP portáteis em áreas urbanas e semiurbanas. Esta colaboração estratégica visa atender à crescente demanda por tratamento domiciliar para apneia do sono e aumentar a conscientização por meio de campanhas educacionais direcionadas, destacando o compromisso da ResMed em melhorar os resultados da saúde do sono na região.

- Em março de 2024, a Philips Respironics lançou uma iniciativa regional de treinamento e suporte nos Emirados Árabes Unidos para aprimorar a adoção clínica de seus sistemas avançados de CPAP, incluindo o DreamStation 2 Auto CPAP. O programa foi desenvolvido para equipar os profissionais de saúde com as ferramentas e o conhecimento mais recentes para o gerenciamento eficaz da apneia do sono, apoiando os esforços da Philips para impulsionar a penetração da terapia com CPAP e garantir melhores resultados para os pacientes em todo o Oriente Médio.

- Em fevereiro de 2024, a BMC Medical Co., Ltd., uma prestadora de serviços de saúde respiratória sediada na China, expandiu sua presença no Oriente Médio por meio de novos acordos de distribuição no Egito e na Arábia Saudita. A empresa lançou uma gama de soluções de CPAP acessíveis e portáteis, adaptadas às necessidades do mercado local, incluindo dispositivos com umidificadores integrados e aplicativos de monitoramento móvel. Essa expansão reflete a estratégia da BMC de atender a segmentos sensíveis a custos, promovendo, ao mesmo tempo, a adoção da terapia domiciliar.

- Em janeiro de 2024, a Löwenstein Medical, empresa alemã de tecnologia médica, lançou um centro de suporte regional na África do Sul para fornecer serviço pós-venda e treinamento de produtos para seus sistemas CPAP PrismaLINE. Essa iniciativa aprimora o engajamento do cliente e o suporte operacional, reforçando a presença da Löwenstein no mercado africano e seu compromisso com a prestação de cuidados respiratórios de alta qualidade.

- Em dezembro de 2023, a Fisher & Paykel Healthcare realizou uma campanha de conscientização sobre bem-estar do sono em parceria com hospitais privados no Quênia e na Nigéria. A iniciativa focou no diagnóstico precoce da AOS e apresentou a linha de dispositivos CPAP da empresa, equipados com tecnologia avançada de umidificação. A campanha enfatiza os esforços contínuos da Fisher & Paykel para promover a conscientização sobre distúrbios do sono e apoiar opções terapêuticas acessíveis e confortáveis em regiões carentes.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.