Middle East And Africa Corneal Transplant Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

22.87 Million

USD

32.76 Million

2024

2032

USD

22.87 Million

USD

32.76 Million

2024

2032

| 2025 –2032 | |

| USD 22.87 Million | |

| USD 32.76 Million | |

|

|

|

|

Segmentação do mercado de transplante de córnea no Oriente Médio e África, por tipo de procedimento (ceratoplastia endotelial, ceratoplastia penetrante, ceratoplastia lamelar anterior (ALK), transplante de células-tronco do limbo da córnea, transplante de córnea artificial e outros), tipo (córnea humana e sintética), tipo de doador (enxerto autólogo e aloenxerto), tipo de enxerto (enxertos de espessura parcial (lamelares) e enxertos de espessura total (penetrantes)), tipo de cirurgia (cirurgia convencional e cirurgia assistida a laser), indicação (distrofia endotelial de Fuchs, ceratite infecciosa, ceratopatia bolhosa, ceratocone, procedimentos de enxerto, cicatrizes na córnea, úlceras na córnea e outros), gênero (feminino e masculino), faixa etária (geriátrica, adulta e pediátrica), usuário final (hospitais, clínicas oftalmológicas, centros cirúrgicos ambulatoriais, acadêmicos e de pesquisa) Institutos e Outros) - Tendências e Previsões do Setor até 2032

Tamanho do mercado de transplante de córnea no Oriente Médio e África

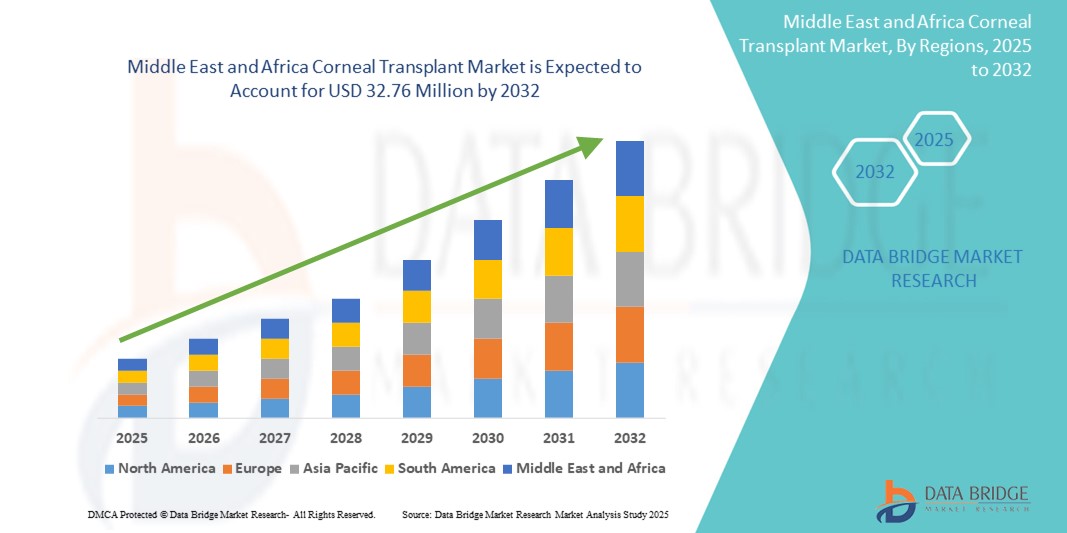

- O tamanho do mercado de transplante de córnea no Oriente Médio e na África foi avaliado em US$ 22,87 milhões em 2024 e deve atingir US$ 32,76 milhões até 2032 , com um CAGR de 4,60% durante o período previsto.

- A expansão do mercado é impulsionada pelo aumento da prevalência da cegueira da córnea, juntamente com a conscientização crescente e a melhoria da acessibilidade a cuidados oftalmológicos avançados e intervenções cirúrgicas em toda a região.

- Além disso, iniciativas governamentais e não governamentais crescentes para estabelecer bancos de olhos e fortalecer a infraestrutura de transplante estão catalisando a demanda. Esses esforços coletivos estão fomentando uma adoção mais ampla do transplante de córnea, impulsionando assim o crescimento do mercado em toda a região MEA.

Análise do Mercado de Transplante de Córnea no Oriente Médio e África

- Os transplantes de córnea, que envolvem a substituição de tecido corneano danificado ou doente por córneas de doadores, estão se tornando procedimentos cada vez mais vitais no Oriente Médio e na África devido ao aumento da incidência de cegueira corneana, traumas e doenças oculares infecciosas na região.

- A crescente demanda é amplamente alimentada pelo aumento dos investimentos em saúde, maior conscientização sobre causas tratáveis de deficiência visual e o desenvolvimento de centros oftalmológicos especializados em países como África do Sul, Arábia Saudita e Emirados Árabes Unidos.

- A África do Sul dominou o mercado de transplante de córnea no Oriente Médio e na África, com a maior participação na receita de 32,5% em 2024, apoiada por uma infraestrutura cirúrgica mais forte, expansão da disponibilidade de córneas de doadores e iniciativas público-privadas para combater a cegueira da córnea.

- Espera-se que os Emirados Árabes Unidos sejam o país com crescimento mais rápido no mercado de transplante de córnea durante o período previsto, impulsionado por programas avançados de modernização da assistência médica, aumento do turismo médico e expansão da adoção de tecnologias inovadoras de tratamento da córnea.

- O segmento de ceratoplastia penetrante dominou o mercado de transplante de córnea com uma participação de mercado de 49,2% em 2024, atribuída à sua taxa de sucesso estabelecida e adequação para uma ampla gama de condições da córnea comumente tratadas na região

Escopo do relatório e segmentação do mercado de transplante de córnea no Oriente Médio e África

|

Atributos |

Principais insights de mercado sobre transplante de córnea no Oriente Médio e África |

|

Segmentos abrangidos |

|

|

Países abrangidos |

Oriente Médio e África

|

|

Principais participantes do mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor agregado |

Além dos insights sobre cenários de mercado, como valor de mercado, taxa de crescimento, segmentação, cobertura geográfica e principais participantes, os relatórios de mercado selecionados pela Data Bridge Market Research também incluem análises aprofundadas de especialistas, análises de preços, análises de participação de marca, pesquisas com consumidores, análises demográficas, análises da cadeia de suprimentos, análises da cadeia de valor, visão geral de matérias-primas/consumíveis, critérios de seleção de fornecedores, análise PESTLE, análise de Porter e estrutura regulatória. |

Tendências do mercado de transplante de córnea no Oriente Médio e na África

“Avanço dos Bancos de Olhos e da Infraestrutura Cirúrgica”

- Uma tendência notável que molda o mercado de transplante de córnea no Oriente Médio e na África é o desenvolvimento contínuo de bancos de olhos regionais e o acesso aprimorado à infraestrutura cirúrgica oftalmológica avançada. Esses esforços são cruciais para lidar com a alta incidência de cegueira corneana e melhorar a disponibilidade de transplantes.

- Por exemplo, em 2024, o Banco Nacional de Olhos da África do Sul expandiu sua rede de doadores e sua capacidade de preservação de córnea, aumentando significativamente a disponibilidade de enxertos de córnea. Da mesma forma, a Arábia Saudita está investindo em centros cirúrgicos oftalmológicos de última geração como parte de suas metas de saúde da Visão 2030.

- A expansão das instalações de bancos de olhos está melhorando a qualidade e a segurança do tecido transplantável, permitindo uma distribuição mais eficiente da córnea e reduzindo o tempo de espera para transplante. Além disso, a incorporação de tecnologias avançadas de diagnóstico e cirurgia, incluindo lasers de femtosegundo e técnicas de ceratoplastia endotelial, está elevando os resultados cirúrgicos em toda a região.

- Parcerias público-privadas emergentes estão apoiando campanhas de conscientização, iniciativas de recrutamento de doadores e programas de capacitação para cirurgiões oftalmológicos. Esses esforços estão gradualmente alinhando a região aos padrões globais de transplante de córnea.

- Essa tendência de construção de um ecossistema sustentável de transplantes está remodelando os sistemas regionais de saúde oftalmológica e melhorando o acesso a procedimentos de restauração da visão. Consequentemente, países como os Emirados Árabes Unidos e o Egito estão se tornando polos regionais de cuidados oftalmológicos, apoiados pelo crescente turismo médico e pelos crescentes investimentos em hospitais oftalmológicos especializados.

- A ênfase na expansão dos grupos de doadores de córnea, no refinamento da precisão cirúrgica e no treinamento de profissionais qualificados está acelerando o ritmo do transplante de córnea no Oriente Médio e na África, melhorando a viabilidade do mercado a longo prazo.

Dinâmica do mercado de transplante de córnea no Oriente Médio e na África

Motorista

“Aumento da cegueira corneana e iniciativas governamentais para a saúde ocular”

- A crescente incidência de cegueira corneana devido a traumas, infecções e doenças degenerativas é um dos principais impulsionadores do crescimento do mercado de transplante de córnea no Oriente Médio e na África. Essa crescente necessidade de restauração da visão está impulsionando a demanda por soluções cirúrgicas.

- Por exemplo, em 2024, o Ministério da Saúde dos Emirados Árabes Unidos lançou um registro nacional de doação de córneas e um sistema de coordenação de transplantes para agilizar o acesso e reduzir a dependência de tecido de doadores importados. Iniciativas semelhantes no Quênia e no Egito visam a cegueira evitável por meio de intervenções cirúrgicas e melhoria da acessibilidade.

- Governos e organizações de saúde estão priorizando cada vez mais os cuidados oftalmológicos em suas estratégias nacionais de saúde, com foco em capacitação, educação de pacientes e desenvolvimento de infraestrutura. Espera-se que esses compromissos em nível de políticas aumentem o volume de transplantes nos próximos anos.

- Os transplantes de córnea estão ganhando importância como soluções econômicas para restaurar a visão e melhorar a qualidade de vida, especialmente em populações carentes. Campanhas de conscientização de doadores e a adoção de serviços móveis de oftalmologia também estão contribuindo para um acesso mais amplo em áreas rurais.

- A integração de sistemas de rastreamento de doadores, métodos de preservação aprimorados e programas de treinamento especializado para cirurgiões de córnea estão reforçando ainda mais o cenário regional de transplantes, tornando-o mais responsivo à crescente demanda.

Restrição/Desafio

“Disponibilidade limitada de córneas de doadores e altos custos de tratamento”

- Um desafio crítico no mercado de transplante de córnea no Oriente Médio e na África é a persistente escassez de córneas de doadores, o que limita o número de cirurgias viáveis que podem ser realizadas. Essa escassez é particularmente grave em países com poucos recursos e sistemas de doação subdesenvolvidos.

- Por exemplo, muitas nações subsaarianas dependem fortemente de tecidos de doadores importados devido à infraestrutura inadequada de bancos de olhos locais, o que leva a atrasos e ao aumento dos custos processuais.

- Altos custos com tratamento, especialmente para procedimentos avançados de transplante, como DMEK ou DSAEK, representam outra barreira em mercados sensíveis a custos. Despesas diretas frequentemente impedem os pacientes de buscar atendimento cirúrgico, especialmente em regiões rurais e carentes.

- Lacunas regulatórias, leis de doação inconsistentes e resistência cultural à doação de olhos também dificultam a expansão do banco de doadores em vários países. Além disso, a falta de cirurgiões oftalmológicos treinados e de instrumentos cirúrgicos modernos em algumas áreas reduz as taxas de sucesso dos procedimentos e limita a escalabilidade.

- Enfrentar estes desafios através de financiamento governamental direcionado, colaboração transfronteiriça em bancos de olhos, educação pública e parcerias internacionais será essencial para alargar o acesso e melhorar a acessibilidade em toda a região.

Escopo do mercado de transplante de córnea no Oriente Médio e África

O mercado é segmentado com base no tipo de procedimento, tipo, tipo de doador, tipo de enxerto, tipo de cirurgia, indicação, gênero, faixa etária e usuário final.

- Por tipo de procedimento

Com base no tipo de procedimento, o mercado de transplante de córnea no Oriente Médio e na África é segmentado em ceratoplastia endotelial, ceratoplastia penetrante, ceratoplastia lamelar anterior (ALK), transplante de células-tronco límbicas da córnea, transplante de córnea artificial e outros. O segmento de ceratoplastia penetrante dominou o mercado, com a maior participação na receita de 49,2% em 2024, atribuída à sua ampla aplicabilidade no tratamento de doenças da córnea de espessura total, especialmente em regiões com acesso limitado a instrumentos cirúrgicos avançados. Hospitais e centros oftalmológicos na África do Sul e Nigéria continuam a confiar neste procedimento tradicional devido à sua eficácia e familiaridade cirúrgica.

Prevê-se que o segmento de ceratoplastia endotelial apresentará a maior taxa de crescimento entre 2025 e 2032, impulsionado por sua natureza minimamente invasiva, recuperação visual mais rápida e crescente disponibilidade de cirurgiões oftalmológicos qualificados, especialmente nos Emirados Árabes Unidos e na Arábia Saudita. A ascensão das técnicas DMEK e DSAEK está contribuindo para a expansão do segmento.

- Por tipo

Com base no tipo, o mercado de transplante de córnea no Oriente Médio e na África é segmentado em córnea humana e sintética. O segmento de córnea humana deteve a maior participação de mercado em 2024, impulsionado pela preferência contínua por tecidos derivados de doadores e pela crescente criação de bancos de olhos em países como África do Sul, Egito e Quênia. A compatibilidade natural e as altas taxas de sucesso dos transplantes sustentam sua dominância.

Espera-se que o segmento sintético cresça de forma constante durante o período previsto, devido aos avanços tecnológicos em ceratopróteses e ao uso crescente em casos de falhas de múltiplos enxertos ou quando não houver tecido de doador humano disponível.

- Por tipo de doador

Com base no tipo de doador, o mercado de transplante de córnea no Oriente Médio e na África é segmentado em enxerto autógeno e aloenxerto. O segmento de aloenxerto dominou o mercado, com a maior participação na receita em 2024, principalmente devido à prática comum de usar córneas de doadores de indivíduos falecidos e aos crescentes programas de conscientização sobre doadores. Esforços de ministérios da saúde regionais e ONGs estão aprimorando a base de registros de doadores em países como Egito e Quênia.

Espera-se que o segmento de enxerto autólogo testemunhe o crescimento mais rápido durante o período previsto, restrito principalmente a procedimentos de transplante de células-tronco do limbo da córnea, sendo normalmente usado em casos altamente especializados.

- Por tipo de enxerto

Com base no tipo de enxerto, o mercado de transplante de córnea no Oriente Médio e na África é segmentado em enxertos de espessura parcial (lamelares) e enxertos de espessura total (penetrantes). O segmento de enxertos de espessura total (penetrantes) deteve a maior participação de mercado na receita em 2024, impulsionado por seu uso consolidado em hospitais públicos e privados e por sua capacidade de tratar condições corneanas avançadas e complexas em toda a região do Oriente Médio e África (MEA).

O segmento de enxertos de espessura parcial (lamelares) deverá crescer em um ritmo mais acelerado durante o período previsto devido a menos complicações pós-operatórias, tempo de cicatrização mais rápido e crescente adoção em centros oftalmológicos tecnologicamente avançados.

- Por tipo de cirurgia

Com base no tipo de cirurgia, o mercado de transplante de córnea no Oriente Médio e na África é segmentado em cirurgia convencional e cirurgia assistida a laser. O segmento de cirurgia convencional dominou o mercado em 2024, devido ao amplo uso de técnicas manuais tradicionais em operações de transplante de córnea, particularmente em países de baixa e média renda com acesso limitado a sistemas cirúrgicos avançados.

Espera-se que o segmento de cirurgia assistida a laser cresça rapidamente de 2025 a 2032, impulsionado pela crescente demanda por precisão, tempo de cura reduzido e uso crescente de sistemas de laser de femtossegundo nos Emirados Árabes Unidos e na Arábia Saudita.

- Por Indicação

Com base na indicação, o mercado de transplante de córnea no Oriente Médio e na África é segmentado em distrofia endotelial de Fuchs, ceratite infecciosa, ceratopatia bolhosa, ceratocone, procedimentos de reenxerto, cicatrizes corneanas, úlceras corneanas e outros. O segmento de ceratocone deteve a maior participação de mercado em 2024, devido à alta prevalência regional, particularmente entre jovens adultos em países do Oriente Médio, como Arábia Saudita e Emirados Árabes Unidos. O diagnóstico precoce e a disponibilidade de opções cirúrgicas avançadas são fatores-chave.

Espera-se que o segmento de distrofia endotelial de Fuchs testemunhe o crescimento mais rápido durante o período previsto, apoiado pelo aumento da população geriátrica, maior conscientização e acesso a procedimentos de ceratoplastia endotelial em ambientes urbanos de saúde.

- Por gênero

Com base no gênero, o mercado de transplante de córnea no Oriente Médio e na África é segmentado em feminino e masculino. O segmento masculino representou a maior participação de mercado em 2024, principalmente devido à maior exposição a lesões oculares ocupacionais e à maior prevalência de casos de trauma de córnea em homens, especialmente em zonas industriais da África do Sul e Nigéria.

Espera-se que o segmento feminino apresente o crescimento mais rápido durante o período previsto, auxiliado pelo aumento do acesso feminino à saúde, campanhas de conscientização crescentes e foco na igualdade de gênero em iniciativas regionais de saúde.

- Por faixa etária

Com base na faixa etária, o mercado de transplante de córnea no Oriente Médio e na África é segmentado em geriátrico, adulto e pediátrico. O segmento adulto dominou o mercado, com a maior participação na receita em 2024, impulsionado pela alta incidência de doenças como ceratocone e ceratite infecciosa na população em idade produtiva.

O segmento geriátrico deverá crescer na taxa mais rápida durante o período previsto devido ao envelhecimento da população e ao aumento de casos de disfunção endotelial e ceratopatia bolhosa entre idosos nos Emirados Árabes Unidos e no Egito.

- Por usuário final

Com base no usuário final, o mercado de transplante de córnea no Oriente Médio e na África é segmentado em hospitais, clínicas oftalmológicas, centros cirúrgicos ambulatoriais, institutos acadêmicos e de pesquisa, entre outros. O segmento de hospitais liderou o mercado em 2024, apoiado por infraestrutura avançada, recursos cirúrgicos integrados e pela presença de oftalmologistas qualificados em instalações médicas de ponta na África do Sul, Egito e Emirados Árabes Unidos.

Espera-se que o segmento de clínicas oftalmológicas testemunhe o crescimento mais rápido entre 2025 e 2032, impulsionado pela expansão de redes especializadas de cuidados oftalmológicos e maior acessibilidade em áreas urbanas e suburbanas.

Análise regional do mercado de transplante de córnea no Oriente Médio e África

- A África do Sul dominou o mercado de transplante de córnea no Oriente Médio e na África, com a maior participação na receita de 32,5% em 2024, apoiada por uma infraestrutura cirúrgica mais forte, expansão da disponibilidade de córneas de doadores e iniciativas público-privadas para combater a cegueira da córnea.

- Os pacientes no país se beneficiam da conscientização crescente sobre deficiências visuais tratáveis, do acesso a profissionais oftalmológicos treinados e de programas liderados pelo governo que visam reduzir o fardo da cegueira da córnea.

- A liderança da região em procedimentos de transplante é ainda mais reforçada pelos avanços em bancos de olhos, melhor acesso a tecnologias cirúrgicas e colaborações contínuas com organizações internacionais, posicionando a África do Sul como um centro importante para o tratamento da córnea no Oriente Médio e na África.

Visão geral do mercado de transplante de córnea na África do Sul

O mercado de transplante de córnea da África do Sul obteve a maior fatia da receita, de 32,5%, em 2024, em toda a região, impulsionado por suas instalações avançadas de tratamento oftalmológico e pela crescente rede de programas de doação de córneas. Parcerias público-privadas e o aumento do treinamento de cirurgiões oftalmológicos melhoraram significativamente o acesso aos procedimentos e os resultados. O país continua a liderar a adoção regional devido ao forte apoio governamental, à expansão dos registros de transplantes e às colaborações com organizações internacionais de saúde ocular, posicionando-se como um polo fundamental para o tratamento da córnea.

Visão do mercado de transplante de córnea nos Emirados Árabes Unidos

Prevê-se que o mercado de transplante de córnea dos Emirados Árabes Unidos cresça a uma CAGR robusta durante o período previsto, apoiado por infraestrutura de saúde de ponta e pelo crescente turismo médico. O foco do governo em saúde digital, inovação e atendimento especializado levou ao aumento da disponibilidade de procedimentos de transplante assistido por laser. A crescente conscientização, aliada a programas nacionais de doadores e à integração de padrões cirúrgicos globais, está fomentando uma forte adoção em hospitais públicos e privados.

Visão do mercado de transplante de córnea na Arábia Saudita

Espera-se que o mercado de transplante de córnea na Arábia Saudita se expanda de forma constante devido às reformas de saúde do país, a Visão 2030, e à crescente prevalência de doenças da córnea. Investimentos em centros oftalmológicos e iniciativas para aumentar a conscientização dos doadores estão ajudando a diminuir a lacuna entre oferta e demanda por córneas transplantáveis. Avanços tecnológicos e melhor acesso a treinamentos estão impulsionando o crescimento de técnicas cirúrgicas avançadas, como a ceratoplastia endotelial, em hospitais de ponta em Riad e Jidá.

Visão geral do mercado de transplante de córnea no Egito

O mercado de transplante de córnea no Egito está vivenciando um momento de crescimento, impulsionado pela crescente incidência de doenças oculares infecciosas e lesões corneanas relacionadas a traumas. A expansão dos serviços públicos de oftalmologia e as colaborações internacionais com bancos de olhos estão contribuindo para aumentar a disponibilidade de córneas. Espera-se que o mercado se beneficie de uma forte base de pacientes, de campanhas de conscientização lideradas pelo governo e de parcerias internacionais focadas na redução da cegueira corneana em regiões carentes.

Visão geral do mercado de transplante de córnea no Quênia

O mercado de transplante de córnea do Quênia deverá crescer gradualmente, impulsionado pela expansão de iniciativas de cuidados oftalmológicos sem fins lucrativos e unidades cirúrgicas móveis. À medida que o acesso a cuidados oftalmológicos especializados melhora nas áreas rurais, a demanda por procedimentos de transplante de córnea acessíveis e eficazes está aumentando. Iniciativas de organizações globais de saúde e melhorias em hospitais do setor público devem melhorar o acesso à córnea de doadores e os resultados cirúrgicos durante o período previsto.

Participação no mercado de transplante de córnea no Oriente Médio e África

O setor de transplante de córnea do Oriente Médio e da África é liderado principalmente por empresas bem estabelecidas, incluindo:

- CorneaGen, Inc. (EUA)

- KeraLink International (EUA)

- Aurolab (Índia)

- AJL Ophthalmic SA (Espanha)

- DIOPTEX GmbH (Áustria)

- Presbia PLC (Irlanda)

- Banco de Olhos Florida Lions (EUA)

- Banco de Olhos de San Diego (EUA)

- TissueTech, Inc. (EUA)

- Eversight (EUA)

- Alcon Inc. (Suíça)

- Bausch + Lomb Incorporated (EUA)

- Ziemer Ophthalmic Systems AG (Suíça)

- Gebauer Medizintechnik GmbH (Alemanha)

- MEDIPHACOS Ltda. (Brasil)

- Ophtec BV (Holanda)

- Surgical Specialties Corporation (EUA)

- EyeYon Medical Ltda. (Israel)

- Miracles Optical (Índia)

- Keramed, Inc. (EUA)

Quais são os desenvolvimentos recentes no mercado de transplante de córnea no Oriente Médio e na África?

- Em maio de 2024, o Banco Nacional de Olhos da África do Sul anunciou uma importante iniciativa de expansão para aprimorar a capacidade de coleta e preservação de córneas de doadores. Essa iniciativa visa atender à crescente demanda por transplantes de córnea na região, aumentando a disponibilidade de enxertos de alta qualidade. A iniciativa reforça o compromisso da organização em reduzir a cegueira corneana por meio do fortalecimento da infraestrutura dos bancos de olhos, da melhoria dos protocolos de manuseio de tecidos e de programas mais amplos de alcance de doadores em toda a África do Sul.

- Em abril de 2024, o Moorfields Eye Hospital Dubai, um centro de tratamento oftalmológico líder nos Emirados Árabes Unidos, lançou um programa avançado de transplante de córnea integrando a tecnologia de laser femtosegundo. Este programa foi projetado para fornecer resultados cirúrgicos de precisão para condições como distrofia de Fuchs e ceratocone. Ao adotar equipamentos de última geração e padrões cirúrgicos internacionais, o Moorfields reforça seu papel como líder regional em tratamento da córnea e apoia o objetivo dos Emirados Árabes Unidos de se tornar um centro de excelência médica.

- Em março de 2024, o Hospital Oftalmológico King Khaled, na Arábia Saudita, assinou um acordo de colaboração com a organização sem fins lucrativos global Orbis International para expandir os programas de treinamento para cirurgiões de córnea. A parceria se concentra na capacitação, incluindo treinamento cirúrgico presencial, workshops e suporte por telemedicina para aprimorar as capacidades de transplante em todo o Reino. Esta iniciativa destaca a importância das parcerias internacionais para melhorar a qualidade e a acessibilidade dos cuidados oftalmológicos na Arábia Saudita.

- Em fevereiro de 2024, o Ministério da Saúde do Quênia lançou uma campanha pública de conscientização sobre doação de olhos, em colaboração com ONGs regionais e bancos de olhos internacionais. A campanha visa aumentar o registro de doadores locais e reduzir a dependência do país de tecido corneano importado. Esse desenvolvimento reflete o crescente foco governamental no combate à cegueira evitável por meio da mobilização de doadores locais e da melhoria da infraestrutura de transplante.

- Em janeiro de 2024, o Magrabi Hospitals & Centers, no Egito, introduziu um registro centralizado de transplantes de córnea para agilizar o gerenciamento de pacientes e otimizar a alocação de tecido doado. O sistema permite o rastreamento transparente dos resultados cirúrgicos, a correspondência doador-receptor e os cuidados pós-operatórios. Esta iniciativa reflete uma abordagem baseada em dados para aumentar a eficiência dos transplantes, posicionando o Egito como um player emergente em inovação cirúrgica oftálmica na região.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.