Mercado de sistemas de codificação e marcação no Médio Oriente e África, por tipo de tecnologia (jato de tinta contínuo, codificação a laser, jato de tinta térmico, piezo, outros), tipo (impressoras a jato de tinta de pequenos caracteres, impressoras a jato de tinta de alta resolução, impressoras a jato de tinta de grandes dimensões, sistemas laser e spray Sistemas de Mercado), Aplicação (Secundária, Terciária, Primária), Material (Plásticos, Papel e Cartão, Metal, Madeira, Têxteis (Excluindo Alcatifa e Lã), Folhas, Superfícies Orgânicas, Borracha, Alcatifa, Lã e Outros), Número de Bicos (bico único, bicos múltiplos), utilização final (alimentos e bebidas, produtos farmacêuticos, elétricos e eletrónicos, automóvel e aeroespacial, cuidados pessoais, construção , fabrico de produtos químicos e outros) - Tendências e previsões do setor para 2030.

Análise e dimensão do mercado de sistemas de codificação e marcação no Médio Oriente e África

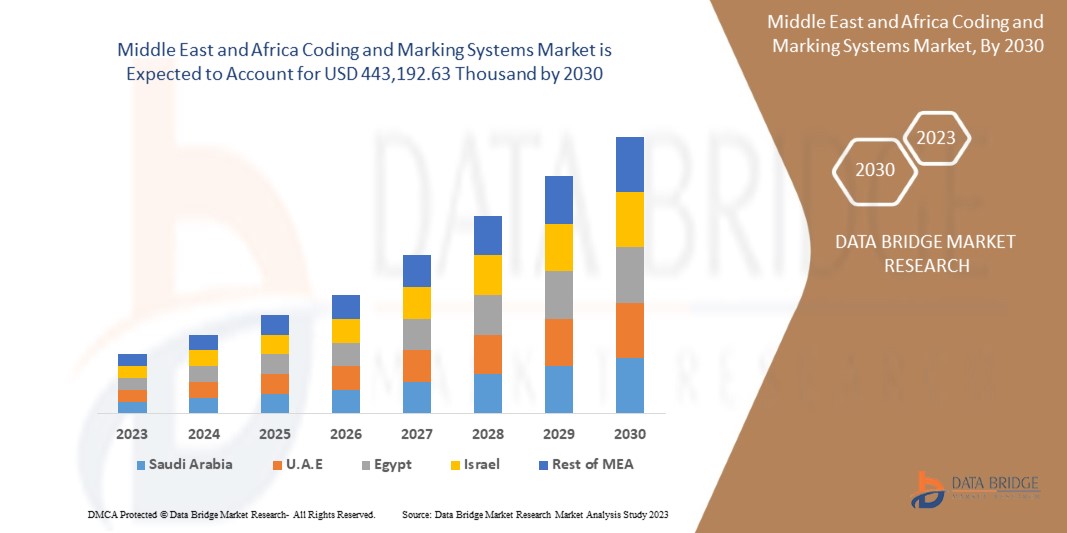

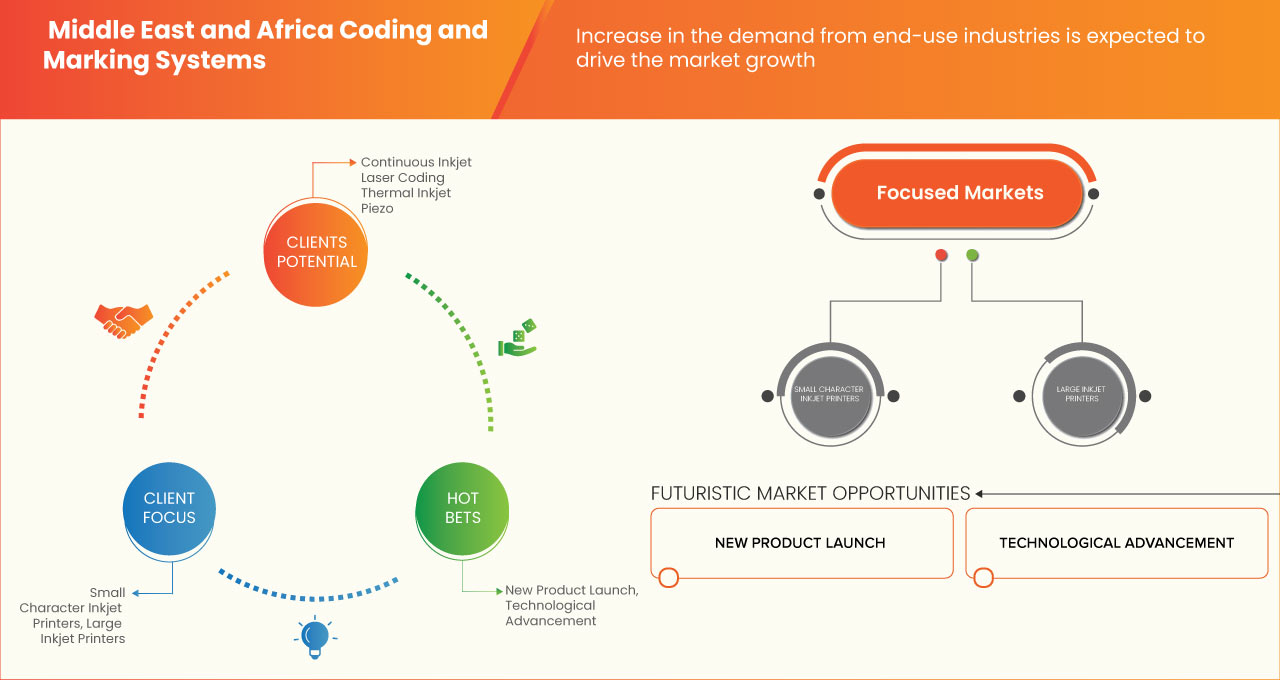

O mercado de sistemas de codificação e marcação do Médio Oriente e África deverá crescer significativamente no período de previsão de 2023 a 2030. A Data Bridge Market Research analisa que o mercado está a crescer com um CAGR de 5,2% no período de previsão de 2023 a 2030 e é deverá atingir os 443.192,63 mil dólares até 2030. A crescente utilização de sistemas de codificação e marcação em diversas indústrias tem sido o principal impulsionador do mercado de sistemas de codificação e marcação no Médio Oriente e em África .

O relatório de mercado de sistemas de codificação e marcação fornece detalhes sobre a quota de mercado, novos desenvolvimentos e o impacto dos participantes do mercado doméstico e localizado, analisa as oportunidades em termos de bolsas de receitas emergentes, alterações nas regulamentações de mercado, aprovações de produtos , decisões estratégicas, lançamentos de produtos, geografia expansões e inovações tecnológicas no mercado. Para compreender a análise e o cenário do mercado, contacte-nos para um resumo do analista. A nossa equipa irá ajudá-lo a criar uma solução com impacto na receita para atingir a meta desejada.

|

Métrica de reporte |

Detalhes |

|

Período de previsão |

2023 a 2030 |

|

Ano base |

2022 |

|

Anos históricos |

2021 (personalizável para 2020 - 2015) |

|

Unidades Quantitativas |

Receita em mil dólares |

|

Segmentos cobertos |

Por tipo de tecnologia (jato de tinta contínuo, codificação a laser, jato de tinta térmico, piezo, outros), tipo (impressoras a jato de tinta de pequenos caracteres, impressoras a jato de tinta de alta resolução, impressoras a jato de tinta de grandes , sistemas laser e sistemas de mercado de pulverização), aplicação (secundária, terciária, Primária), material (plástico, papel e cartão, metal, madeira, têxteis (excluindo alcatifa e lã), folhas, superfícies orgânicas, borracha, alcatifa, lã e outros), número de bicos (bocal simples, bicos múltiplos), extremidade Utilização (alimentos e bebidas, produtos farmacêuticos, elétricos e eletrónicos, automóvel e aeroespacial, cuidados pessoais, construção, fabrico de produtos químicos e outros) |

|

Países abrangidos |

África do Sul, Emirados Árabes Unidos, Arábia Saudita, Omã, Qatar, Kuwait e Resto do Médio Oriente e África |

|

Participantes do mercado abrangidos |

Danaher, Weber Marking Systems GmbH, Dover Corporation, REA Elektronik GmbH, Leibinger Group, Hitachi, Ltd., Illinois Tool Works Inc., Matthews International Corporation, Brother Industries, Ltd., e HSA Systems A/S, entre outros |

Definição de Mercado

Os sistemas de codificação e marcação são amplamente utilizados na codificação automóvel. A codificação e a marcação são utilizadas para imprimir números de peças ou etiquetas antifalsificação em peças automóveis para evitar a venda de peças falsificadas. Os dispositivos de codificação e marcação são utilizados para imprimir detalhes específicos do produto na caixa do produto. Estas informações têm como objetivo fornecer aos utilizadores finais e fabricantes informações fiáveis sobre os seus produtos. A codificação inclui, entre outras coisas, a impressão da data de fabrico, do prazo de validade e do tamanho do lote de embalagem. Ao imprimir códigos ou etiquetas nos produtos, os fabricantes podem reduzir o risco de falsificação e proteger a imagem da marca do consumidor final.

Dinâmica de mercado dos sistemas de codificação e marcação no Médio Oriente e em África

Esta secção trata da compreensão dos impulsionadores, oportunidades, desafios e restrições do mercado. Tudo isto é discutido em detalhe abaixo:

Motoristas

- Aumento da procura na indústria automóvel

A crescente procura por sistemas de codificação e marcação na indústria automóvel aumentou devido ao aumento das vendas de produtos contrafeitos. Por conseguinte, os fabricantes utilizam sistemas de codificação e marcação para diminuir a utilização de produtos falsificados no mercado e utilizam frequentemente sistemas de codificação e marcação para codificar etiquetas de números de peças em máquinas de veículos. Os equipamentos de codificação e marcação devem ser capazes de satisfazer confortavelmente as complexas exigências dos fabricantes automóveis numa indústria que exige que a informação seja impressa em componentes individuais em várias fases do processo de fabrico. Os codificadores robustos devem proporcionar uma integração sem problemas aos processos existentes e operar de forma consistente em ambientes de produção exigentes. Os fabricantes procuram soluções de rastreabilidade e contenção no Médio Oriente e em África, bem como a capacidade de imprimir o seu logótipo, data de produção, data de validade, número de LOTE, números de peça e outras informações nos seus produtos.

- Aumento da utilização de sistemas de codificação e marcação em vários setores

Muitas indústrias estão a utilizar tecnologias de codificação e marcação, como FMCG, alimentos e bebidas, produtos eletrónicos, metais, borracha, têxteis, produtos químicos e agroquímicos , sementes, construção, saúde e produtos farmacêuticos. A crescente procura de alimentos embalados, alimentos embalados mais saudáveis e o aumento da urbanização estão a aumentar o consumo destes produtos, o que aumenta ainda mais a procura de sistemas de codificação e marcação. As indústrias alimentar e farmacêutica estão entre as mais regulamentadas em termos de rastreabilidade da cadeia de abastecimento. Os produtos de codificação e etiquetagem contribuem para a rastreabilidade total, protegendo os consumidores e as empresas através da utilização de números de lote, códigos de barras e datas de validade. À medida que as tecnologias de codificação evoluem com relatórios e análises em tempo real, os consumidores poderão obter informações mais transparentes sobre as origens dos componentes que compõem um produto.

Oportunidades

- Regras governamentais rigorosas para sistemas de codificação e marcação

Os governos de todo o mundo têm implementado novas regulamentações sobre embalagens e rotulagem. Muitas empresas de embalagens estão a ser forçadas a fazer investimentos significativos em equipamentos de codificação e marcação, a fim de cumprirem os regulamentos e evitarem sanções. Várias empresas estão a utilizar tecnologias avançadas, como o Data Set, para identificar e rastrear produtos em setores como alimentos e bebidas, saúde, farmacêutico e outros. Muitos governos em todo o mundo estão a impor regulamentos rigorosos sobre embalagens e rotulagem. Este regulamento exige a codificação de cor vermelha nas laterais dos rótulos das embalagens de produtos alimentares embalados com alto teor de gordura, alto teor de açúcar e alto teor de sal. Como resultado, a codificação tornou-se mais popular em todo o mundo.

- Aumento do uso de codificação laser

A procura pela tecnologia de codificação laser tem aumentado significativamente, principalmente devido às suas características e viabilidade em diversas aplicações industriais por parte dos utilizadores finais. Por exemplo, as soluções de codificação a laser estão a ganhar popularidade em bens de consumo, como cosméticos , cuidados pessoais, serviços alimentares e automóvel. As máquinas de codificação a laser representam os mais recentes avanços na tecnologia de codificação e marcação e são utilizadas para imprimir códigos em metal ou objetos metálicos e outros artigos. À medida que aumenta a procura dos clientes por tecnologia avançada, os fabricantes utilizadores finais estão a recorrer à tecnologia laser. Os codificadores a laser oferecem uma marcação contínua a alta velocidade e a capacidade de fornecer códigos ou logótipos de alta resolução para proteção da marca. Fornecem capacidades de marcação nítidas e detalhadas, o que é útil em muitas indústrias de utilização final. Além disso, os fabricantes de sistemas de codificação e marcação estão a concentrar-se em fornecer soluções amigas do ambiente para satisfazer a crescente procura de vários setores de utilização final, como envelopes para alimentos e embalagens.

Restrição

- Elevado custo de equipamentos de codificação e marcação e códigos impressos inadequados

Surgiram novos equipamentos para técnicas de impressão industrial, como a codificação e a marcação, prometendo melhorar a eficiência destes processos. No entanto, o desenvolvimento e a aplicação de equipamentos de codificação e marcação evoluíram como resultado da mudança dos formatos de embalagem e das complexidades de design. Códigos de barras que não são impressos corretamente, marcas registadas danificadas e informações de validade perdidas porque a tinta impressa desbota podem levar a mal-entendidos entre empresas e clientes. A falta de códigos apropriados pode fazer com que os produtos percam popularidade e os fabricantes podem ser atormentados por uma rastreabilidade ineficaz.

Desafio

- Elevado custo de instalação e erros operacionais

A negligência e o erro humano podem muitas vezes prejudicar os interesses dos criadores de mercado e dos vendedores. Este é um grande desafio na indústria de utilização final, no qual os fabricantes se concentram constantemente. Nas grandes empresas industriais, os trabalhadores trabalham normalmente por turnos, aumentando a interação homem-máquina. Isto tende a aumentar a margem de erro, uma vez que o processo de impressão demora mais tempo a aprender. Além disso, retira tempo e recursos às empresas que poderiam ser utilizados noutro local.

Os equipamentos de codificação e marcação tendem a ser muito caros. Por isso, instalar sistemas de codificação e marcação é um desafio. Todos os intervenientes na cadeia de abastecimento, especialmente as pequenas empresas, podem não ter os recursos financeiros para construir a infra-estrutura necessária para implementar sistemas de codificação e marcação. Os elevados custos operacionais serão um grande desafio para o mercado durante o período de previsão.

Desenvolvimentos recentes

- Em dezembro de 2021, a Koenig & Bauer lançou uma embalagem especial para folhas de tabaco premium com marcação a laser. Esta tarefa será realizada no local no futuro pelo sistema de codificação semiautomático udaFORMAXX Offline, que está equipado com um laser de marcação CO2 para marcação permanente sem manchas

- Em junho de 2022, a CONTROL PRINT LTD. lançou um novo produto Pench, que é uma impressora jato de tinta contínuo. É utilizado principalmente em setores como cabos, fios, aço e outras aplicações ultrarrápidas e de alta velocidade, uma vez que pode imprimir a velocidades até 700 m/min. O lançamento do produto ajudará a empresa a expandir o seu portefólio de produtos e a sua base de clientes em diversos setores de utilização final.

Âmbito de mercado dos sistemas de codificação e marcação do Médio Oriente e África

O mercado de sistemas de codificação e marcação do Médio Oriente e África está categorizado com base no tipo de tecnologia, tipo, aplicação, número de bicos, material e utilização final. O crescimento entre estes segmentos irá ajudá-lo a analisar os principais segmentos de crescimento nas indústrias e a fornecer aos utilizadores uma valiosa visão geral do mercado e insights de mercado para tomar decisões estratégicas para identificar as principais aplicações do mercado.

Tipo de tecnologia

- Jato de tinta contínuo

- Codificação a laser

- Codificação Térmica

- Piezo

- Outros

Com base no tipo de tecnologia, o mercado dos sistemas de codificação e marcação está segmentado em jato de tinta contínuo, codificação laser, jato de tinta térmico, piezo, entre outros.

Tipo

- Impressoras de jacto de tinta de pequenos caracteres

- Impressoras jato de tinta de alta resolução

- Grandes impressoras a jacto de tinta

- Sistema Laser e Sistemas de Mercado de Pulverização

Com base no tipo, o mercado de sistemas de codificação e marcação está segmentado em impressoras a jacto de tinta de pequenos caracteres, impressoras a jacto de tinta de alta resolução, impressoras a jacto de tinta de grandes dimensões e sistemas de laser e sistemas de mercado de pulverização.

Aplicação

- Primário

- Secundário

- Terciário

Com base na aplicação, o mercado de sistemas de codificação e marcação está segmentado em primário, secundário e terciário.

Número de bicos

- Bocal Único

- Vários bicos

Com base no número de bicos, o mercado dos sistemas de codificação e marcação está segmentado em bico único e bicos múltiplos.

Material

- Plásticos

- Papel e cartão

- Metal

- Madeira

- Têxteis (excluindo alcatifas e lã)

- Folhas

- Superfícies Orgânicas

- Borracha

- Alcatifa

- Velo

- Outros

Com base no material, o mercado dos sistemas de codificação e marcação está segmentado em plásticos, papel e cartão, metal, madeira, têxteis (excluindo alcatifa e lã), folhas, superfícies orgânicas, borracha, alcatifa, lã, entre outros.

Uso final

- Alimentos e bebidas

- Produtos farmacêuticos

- Elétrica e eletrónica

- Automóvel e aeroespacial

- Cuidados pessoais

- Construção

- Fabricação química

- Outros

Com base na utilização final, o mercado de sistemas de codificação e marcação está segmentado em alimentos e bebidas, produtos farmacêuticos, elétricos e eletrónicos, automóvel e aeroespacial, cuidados pessoais, construção, fabrico de produtos químicos, entre outros.

Análise/perspetivas regionais do mercado de sistemas de codificação e marcação do Médio Oriente e África

O mercado de sistemas de codificação e marcação do Médio Oriente e África está segmentado com base no tipo de tecnologia, tipo, aplicação, número de bicos, material e utilização final.

Os países do mercado de sistemas de codificação e marcação são a África do Sul, os Emirados Árabes Unidos, a Arábia Saudita, o Omã, o Qatar, o Kuwait e o resto do Médio Oriente e África.

Espera-se que a África do Sul domine o mercado de sistemas de codificação e marcação do Médio Oriente e de África devido à crescente procura de sistemas de codificação e marcação a laser em vários setores.

A secção do relatório sobre países também fornece fatores individuais que impactam o mercado e alterações na regulamentação do mercado que impactam as tendências atuais e futuras do mercado. A análise dos pontos de dados a jusante e a montante da cadeia de valor, as tendências técnicas, a análise das cinco forças de Porter e os estudos de caso são alguns dos indicadores utilizados para prever o cenário de mercado para países individuais. Além disso, são considerados a presença e disponibilidade de marcas do Médio Oriente e de África e os desafios enfrentados devido à grande ou escassa concorrência de marcas locais e nacionais, o impacto das tarifas nacionais e as rotas comerciais, ao mesmo tempo que se proporciona uma análise de previsão dos dados do país.

Cenário competitivo e análise da quota de mercado dos sistemas de codificação e marcação no Médio Oriente e África

The Middle East and Africa coding and marking systems market competitive landscape provides details by competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width and breadth, application dominance, technology lifeline curve. The above data points provided are only related to the companies' focus related to the Middle East and Africa coding and marking systems market.

Some of the major market players operating in the Middle East and Africa market are Danaher, Weber Marking Systems GmbH, Dover Corporation, REA Elektronik GmbH, Leibinger Group, Hitachi, Ltd., Illinois Tool Works Inc., Matthews International Corporation, Brother Industries, Ltd., and HSA Systems A/S among others.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Índice

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE MIDDLE EAST & AFRICA CODING AND MARKING SYSTEMS MARKET

1.4 LIMITATION

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 TECHNOLOGY TYPE LIFELINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 DBMR VENDOR SHARE ANALYSIS

2.13 SECONDARY SOURCES

2.14 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTLE ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 LEGAL FACTORS

4.1.6 ENVIRONMENTAL FACTORS

4.2 PORTER'S FIVE FORCES:

4.2.1 THREAT OF NEW ENTRANTS:

4.2.2 THREAT OF SUBSTITUTES:

4.2.3 CUSTOMER BARGAINING POWER:

4.2.4 SUPPLIER BARGAINING POWER:

4.2.5 INTERNAL COMPETITION (RIVALRY):

4.3 CLIMATE CHANGE SCENARIO

4.3.1 ENVIRONMENTAL CONCERNS

4.3.2 INDUSTRY RESPONSE

4.3.3 GOVERNMENT’S ROLE

4.3.4 ANALYST RECOMMENDATION

4.4 OVERVIEW ON NEW MACHINES V/S CONSUMBALES SOLD

4.4.1 END USER INDUSTRIES

4.4.2 PRODUCT AND BATCH SIZE

4.4.3 TYPE OF PRINTING

4.4.4 TECHNOLOGICAL ADVANCEMENTS

4.5 LIST OF KEY BUYERS

4.6 PRODUCTION CONSUMPTION ANALYSIS

4.7 SUPPLY CHAIN ANALYSIS

4.7.1 OVERVIEW

4.7.2 LOGISTIC COST SCENARIO

4.7.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.8 TECHNOLOGICAL ADVANCEMENTS BY MANUFACTURERS

4.9 VENDOR SELECTION CRITERIA

4.1 RAW MATERIAL PRODUCTION COVERAGE

5 REGULATION COVERAGE

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RISING DEMAND IN THE AUTOMOTIVE INDUSTRY

6.1.2 INCREASING USE OF CODING AND MARKING SYSTEMS IN VARIOUS INDUSTRIES

6.2 RESTRAINT

6.2.1 HIGH COST OF CODING AND MARKING EQUIPMENT AND IMPROPER PRINTED CODES

6.3 OPPORTUNITIES

6.3.1 STRINGENT GOVERNMENT RULES FOR CODING AND MARKING SYSTEMS

6.3.2 INCREASING USE OF LASER CODING

6.4 CHALLENGES

6.4.1 HIGH INSTALLATION COST AND OPERATIONAL ERRORS

7 MIDDLE EAST & AFRICA CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE

7.1 OVERVIEW

7.2 CONTINUOUS INKJET

7.3 LASER CODING

7.4 THERMAL INKJET

7.5 PIEZO

7.6 OTHERS

8 MIDDLE EAST & AFRICA CODING AND MARKING SYSTEMS MARKET, BY TYPE

8.1 OVERVIEW

8.2 SMALL CHARACTER INKJET PRINTERS

8.3 HIGH RESOLUTION INKJET PRINTERS

8.4 LARGE INKJET PRINTERS

8.5 LASER SYSTEMS AND SPRAY MARKET SYSTEMS

9 MIDDLE EAST & AFRICA CODING AND MARKING SYSTEMS MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 SECONDARY

9.3 TERTIARY

9.4 PRIMARY

10 MIDDLE EAST & AFRICA CODING AND MARKING SYSTEMS MARKET, BY MATERIAL

10.1 OVERVIEW

10.2 PLASTICS

10.3 PAPER & CARDBOARD

10.4 METAL

10.5 WOOD

10.6 TEXTILES (EXCLUDING CARPET AND FLEECE)

10.7 FOILS

10.8 ORGANIC SURFACES

10.9 RUBBER

10.1 CARPET

10.11 FLEECE

10.12 OTHERS

11 MIDDLE EAST & AFRICA CODING AND MARKING SYSTEMS MARKET, BY NUMBER OF NOZZLES

11.1 OVERVIEW

11.2 SINGLE NOZZLE

11.3 MULTIPLE NOZZLES

12 MIDDLE EAST & AFRICA CODING AND MARKING SYSTEMS MARKET, BY END USE

12.1 OVERVIEW

12.2 FOOD & BEVERAGE

12.2.1 FOOD & BEVERAGE, BY TYPE

12.2.1.1 PACKAGED FOOD

12.2.1.2 DAIRY PRODUCTS

12.2.1.3 MEAT & POULTRY

12.2.1.4 FRUITS & VEGETABLES

12.2.1.5 PET FOOD & ANIMAL FEED

12.2.1.6 OTHERS

12.2.2 FOOD & BEVERAGE, BY TECHNOLOGY TYPE

12.2.2.1 THERMAL INKJET

12.2.2.2 CONTINUOUS INKJET

12.2.2.3 LASER CODING

12.2.2.4 PIEZO

12.2.2.5 OTHERS

12.2.3 FOOD & BEVERAGE, BY MATERIAL

12.2.3.1 PLASTICS

12.2.3.2 FOILS

12.2.3.3 PAPER & CARDBOARD

12.2.3.4 METAL

12.2.3.5 WOOD

12.2.3.6 RUBBER

12.2.3.7 TEXTILES (EXCLUDING CARPET AND FLEECE)

12.2.3.8 ORGANIC SURFACES

12.2.3.9 CARPET

12.2.3.10 FLEECE

12.2.3.11 OTHERS

12.3 PHARMACEUTICALS

12.3.1 PHARMACEUTICALS, BY TECHNOLOGY TYPE

12.3.1.1 THERMAL INKJET

12.3.1.2 CONTINUOUS INKJET

12.3.1.3 LASER CODING

12.3.1.4 PIEZO

12.3.1.5 OTHERS

12.3.2 PHARMACEUTICALS, BY MATERIAL

12.3.2.1 PAPER & CARDBOARD

12.3.2.2 PLASTICS

12.3.2.3 FOILS

12.3.2.4 METAL

12.3.2.5 TEXTILES (EXCLUDING CARPET AND FLEECE)

12.3.2.6 RUBBER

12.3.2.7 WOOD

12.3.2.8 ORGANIC SURFACES

12.3.2.9 CARPET

12.3.2.10 FLEECE

12.3.2.11 OTHERS

12.4 ELECTRICAL & ELECTRONICS

12.4.1 ELECTRICAL & ELECTRONICS, BY TECHNOLOGY TYPE

12.4.1.1 CONTINUOUS INKJET

12.4.1.2 THERMAL INKJET

12.4.1.3 LASER CODING

12.4.1.4 PIEZO

12.4.1.5 OTHERS

12.4.2 ELECTRICAL & ELECTRONICS, BY MATERIAL

12.4.2.1 PLASTICS

12.4.2.2 METAL

12.4.2.3 RUBBER

12.4.2.4 FOILS

12.4.2.5 WOOD

12.4.2.6 PAPER & CARDBOARD

12.4.2.7 ORGANIC SURFACES

12.4.2.8 TEXTILES (EXCLUDING CARPET AND FLEECE)

12.4.2.9 CARPET

12.4.2.10 FLEECE

12.4.2.11 OTHERS

12.5 AUTOMOTIVE & AEROSPACE

12.5.1 AUTOMOTIVE & AEROSPACE, BY TECHNOLOGY TYPE

12.5.1.1 CONTINUOUS INKJET

12.5.1.2 LASER CODING

12.5.1.3 THERMAL INKJET

12.5.1.4 PIEZO

12.5.1.5 OTHERS

12.5.2 AUTOMOTIVE & AEROSPACE, BY MATERIAL

12.5.2.1 RUBBER

12.5.2.2 METAL

12.5.2.3 PLASTICS

12.5.2.4 TEXTILES (EXCLUDING CARPET AND FLEECE)

12.5.2.5 CARPET

12.5.2.6 FLEECE

12.5.2.7 FOILS

12.5.2.8 PAPER & CARDBOARD

12.5.2.9 WOOD

12.5.2.10 ORGANIC SURFACES

12.5.2.11 OTHERS

12.6 PERSONAL CARE

12.6.1 PERSONAL CARE, BY TECHNOLOGY TYPE

12.6.1.1 CONTINUOUS INKJET

12.6.1.2 THERMAL INKJET

12.6.1.3 LASER CODING

12.6.1.4 PIEZO

12.6.1.5 OTHERS

12.6.2 PERSONAL CARE, BY MATERIAL

12.6.2.1 PLASTICS

12.6.2.2 PAPER & CARDBOARD

12.6.2.3 FOILS

12.6.2.4 METAL

12.6.2.5 RUBBER

12.6.2.6 TEXTILES (EXCLUDING CARPET AND FLEECE)

12.6.2.7 ORGANIC SURFACES

12.6.2.8 WOOD

12.6.2.9 CARPET

12.6.2.10 FLEECE

12.6.2.11 OTHERS

12.7 CONSTRUCTION

12.7.1 CONSTRUCTION, BY TECHNOLOGY TYPE

12.7.1.1 CONTINUOUS INKJET

12.7.1.2 LASER CODING

12.7.1.3 PIEZO

12.7.1.4 THERMAL INKJET

12.7.1.5 OTHERS

12.7.2 CONSTRUCTION, BY MATERIAL

12.7.2.1 METAL

12.7.2.2 WOOD

12.7.2.3 CARPET

12.7.2.4 PLASTICS

12.7.2.5 PAPER & CARDBOARD

12.7.2.6 RUBBER

12.7.2.7 TEXTILES (EXCLUDING CARPET AND FLEECE)

12.7.2.8 FOILS

12.7.2.9 FLEECE

12.7.2.10 ORGANIC SURFACES

12.7.2.11 OTHERS

12.8 CHEMICAL MANUFACTURING

12.8.1 CHEMICAL MANUFACTURING, BY TECHNOLOGY TYPE

12.8.1.1 CONTINUOUS INKJET

12.8.1.2 LASER CODING

12.8.1.3 THERMAL INKJET

12.8.1.4 PIEZO

12.8.1.5 OTHERS

12.8.2 CHEMICAL MANUFACTURING, BY MATERIAL

12.8.2.1 PLASTICS

12.8.2.2 RUBBER

12.8.2.3 METAL

12.8.2.4 PAPER & CARDBOARD

12.8.2.5 WOOD

12.8.2.6 FOILS

12.8.2.7 TEXTILES (EXCLUDING CARPET AND FLEECE)

12.8.2.8 ORGANIC SURFACES

12.8.2.9 CARPET

12.8.2.10 FLEECE

12.8.2.11 OTHERS

12.9 OTHERS

13 MIDDLE EAST & AFRICA CODING AND MARKING SYSTEMS MARKET, BY REGION

13.1 MIDDLE EAST & AFRICA

13.1.1 SOUTH AFRICA

13.1.2 SAUDI ARABIA

13.1.3 UNITED ARAB EMIRATES

13.1.4 QATAR

13.1.5 KUWAIT

13.1.6 OMAN

13.1.7 REST OF MIDDLE EAST & AFRICA

14 MIDDLE EAST & AFRICA CODING AND MARKING SYSTEMS MARKET: COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

14.2 ACQUISITION

14.3 PRODUCT LAUNCH

14.4 CERTIFICATION

15 COMPANY PROFILES

15.1 ILLINOIS TOOL WORKS INC.

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 SWOT ANALYSIS

15.1.5 PRODUCT PORTFOLIO

15.1.6 RECENT DEVELOPMENTS

15.2 HITACHI, LTD.

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 SWOT ANALYSIS

15.2.5 PRODUCT PORTFOLIO

15.2.6 RECENT DEVELOPMENTS

15.3 DANAHER

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 COMPANY SHARE ANALYSIS

15.3.4 SWOT ANALYSIS

15.3.5 PRODUCT PORTFOLIO

15.3.6 RECENT DEVELOPMENTS

15.4 BROTHER INDUSTRIES, LTD.

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 COMPANY SHARE ANALYSIS

15.4.4 SWOT ANALYSIS

15.4.5 PRODUCT PORTFOLIO

15.4.6 RECENT DEVELOPMENTS

15.5 DOVER CORPORATION

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 COMPANY SHARE ANALYSIS

15.5.4 SWOT ANALYSIS

15.5.5 PRODUCT PORTFOLIO

15.5.6 RECENT DEVELOPMENTS

15.6 ATD UK

15.6.1 COMPANY SNAPSHOT

15.6.2 SWOT ANALYSIS

15.6.3 PRODUCT PORTFOLIO

15.6.4 RECENT DEVELOPMENTS

15.7 CODELINE AUTOMATION

15.7.1 COMPANY SNAPSHOT

15.7.2 SWOT ANALYSIS

15.7.3 PRODUCT PORTFOLIO

15.7.4 RECENT DEVELOPMENTS

15.8 CONTROL PRINT LTD.

15.8.1 COMPANY SNAPSHOT

15.8.2 REVENUE ANALYSIS

15.8.3 SWOT ANALYSIS

15.8.4 PRODUCT PORTFOLIO

15.8.5 RECENT DEVELOPMENTS

15.9 HSA SYSTEMS A/S

15.9.1 COMPANY SNAPSHOT

15.9.2 SWOT ANALYSIS

15.9.3 PRODUCT PORTFOLIO

15.9.4 RECENT DEVELOPMENTS

15.1 LEIBINGER GROUP

15.10.1 COMPANY SNAPSHOT

15.10.2 SWOT ANALYSIS

15.10.3 PRODUCT PORTFOLIO

15.10.4 RECENT DEVELOPMENTS

15.11 MATTHEWS INTERNATIONAL CORPORATION

15.11.1 COMPANY SNAPSHOT

15.11.2 REVENUE ANALYSIS

15.11.3 SWOT ANALYSIS

15.11.4 PRODUCT PORTFOLIO

15.11.5 RECENT DEVELOPMENTS

15.12 NOVANTA INC.

15.12.1 COMPANY SNAPSHOT

15.12.2 REVENUE ANALYSIS

15.12.3 SWOT ANALYSIS

15.12.4 PRODUCT PORTFOLIO

15.12.5 RECENT DEVELOPMENTS

15.13 OVERPRINT LTD.

15.13.1 COMPANY SNAPSHOT

15.13.2 SWOT ANALYSIS

15.13.3 PRODUCT PORTFOLIO

15.13.4 RECENT DEVELOPMENTS

15.14 PAK-TEC

15.14.1 COMPANY SNAPSHOT

15.14.2 SWOT ANALYSIS

15.14.3 PRODUCT PORTFOLIO

15.14.4 RECENT DEVELOPMENTS

15.15 PROMACH INC.

15.15.1 COMPANY SNAPSHOT

15.15.2 SWOT ANALYSIS

15.15.3 PRODUCT PORTFOLIO

15.15.4 RECENT DEVELOPMENTS

15.16 REA ELEKTRONIK GMBH.

15.16.1 COMPANY SNAPSHOT

15.16.2 SWOT ANALYSIS

15.16.3 PRODUCT PORTFOLIO

15.16.4 RECENT DEVELOPMENTS

15.17 WEBER MARKING SYSTEMS GMBH

15.17.1 COMPANY SNAPSHOT

15.17.2 SWOT ANALYSIS

15.17.3 PRODUCT PORTFOLIO

15.17.4 RECENT DEVELOPMENTS

16 QUESTIONNAIRE

17 RELATED REPORTS

Lista de Tabela

TABLE 1 REGULATORY COVERAGE

TABLE 2 MIDDLE EAST & AFRICA CODING AND MARKING SYSTEMS MARKET: BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 3 MIDDLE EAST & AFRICA CONTINUOUS INKJET IN CODING AND MARKING SYSTEMS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 4 MIDDLE EAST & AFRICA LASER CODING IN CODING AND MARKING SYSTEMS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 5 MIDDLE EAST & AFRICA THERMAL INKJET IN CODING AND MARKING SYSTEMS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 6 MIDDLE EAST & AFRICA PIEZO IN CODING AND MARKING SYSTEMS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 7 MIDDLE EAST & AFRICA OTHERS IN CODING AND MARKING SYSTEMS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 8 MIDDLE EAST & AFRICA CODING AND MARKING SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 9 MIDDLE EAST & AFRICA SMALL CHARACTER INKJET PRINTERS IN CODING AND MARKING SYSTEMS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 10 MIDDLE EAST & AFRICA HIGH RESOLUTION INKJET PRINTERS IN CODING AND MARKING SYSTEMS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 11 MIDDLE EAST & AFRICA LARGE INKJET PRINTERS IN CODING AND MARKING SYSTEMS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 12 MIDDLE EAST & AFRICA LASER SYSTEMS AND SPRAY MARKET SYSTEMS IN CODING AND MARKING SYSTEMS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 13 MIDDLE EAST & AFRICA CODING AND MARKING SYSTEMS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 14 MIDDLE EAST & AFRICA SECONDARY IN CODING AND MARKING SYSTEMS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 15 MIDDLE EAST & AFRICA TERTIARY IN CODING AND MARKING SYSTEMS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 16 MIDDLE EAST & AFRICA PRIMARY IN CODING AND MARKING SYSTEMS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 17 MIDDLE EAST & AFRICA CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 18 MIDDLE EAST & AFRICA PLASTICS IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 19 MIDDLE EAST & AFRICA PAPER & CARDBOARD IN CODING AND MARKING SYSTEMS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 20 MIDDLE EAST & AFRICA METAL IN CODING AND MARKING SYSTEMS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 21 MIDDLE EAST & AFRICA WOOD IN CODING AND MARKING SYSTEMS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 22 MIDDLE EAST & AFRICA TEXTILES (EXCLUDING CARPET AND FLEECE) CODING AND MARKING SYSTEMS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 23 MIDDLE EAST & AFRICA FOILS IN CODING AND MARKING SYSTEMS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 24 MIDDLE EAST & AFRICA ORGANIC SURFACES IN CODING AND MARKING SYSTEMS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 25 MIDDLE EAST & AFRICA RUBBER IN CODING AND MARKING SYSTEMS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 26 MIDDLE EAST & AFRICA CARPET IN CODING AND MARKING SYSTEMS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 27 MIDDLE EAST & AFRICA FLEECE IN CODING AND MARKING SYSTEMS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 28 MIDDLE EAST & AFRICA OTHERS IN CODING AND MARKING SYSTEMS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 29 MIDDLE EAST & AFRICA CODING AND MARKING SYSTEMS MARKET, BY NUMBER OF NOZZLES, 2021-2030 (USD THOUSAND)

TABLE 30 MIDDLE EAST & AFRICA SINGLE NOZZLE IN CODING AND MARKING SYSTEMS MARKET, BY NUMBER OF NOZZLES, 2021-2030 (USD THOUSAND)

TABLE 31 MIDDLE EAST & AFRICA MULTIPLE NOZZLES IN CODING AND MARKING SYSTEMS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 32 MIDDLE EAST & AFRICA CODING AND MARKING SYSTEMS MARKET, BY END USE, 2021-2030 (USD THOUSAND)

TABLE 33 MIDDLE EAST & AFRICA FOOD & BEVERAGE IN CODING AND MARKING SYSTEMS, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 34 MIDDLE EAST & AFRICA FOOD & BEVERAGE IN CODING AND MARKING SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 35 MIDDLE EAST & AFRICA FOOD & BEVERAGE IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 36 MIDDLE EAST & AFRICA FOOD & BEVERAGE IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 37 MIDDLE EAST & AFRICA PHARMACEUTICALS IN CODING AND MARKING SYSTEMS, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 38 MIDDLE EAST & AFRICA PHARMACEUTICALS IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 39 MIDDLE EAST & AFRICA PHARMACEUTICALS IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 40 MIDDLE EAST & AFRICA ELECTRICAL & ELECTRONICS IN CODING AND MARKING SYSTEMS, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 41 MIDDLE EAST & AFRICA ELECTRICAL & ELECTRONICS IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 42 MIDDLE EAST & AFRICA ELECTRICAL & ELECTRONICS IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 43 MIDDLE EAST & AFRICA AUTOMOTIVE & AEROSPACE IN CODING AND MARKING SYSTEMS, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 44 MIDDLE EAST & AFRICA AUTOMOTIVE & AEROSPACE IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 45 MIDDLE EAST & AFRICA AUTOMOTIVE & AEROSPACE IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 46 MIDDLE EAST & AFRICA PERSONAL CARE IN CODING AND MARKING SYSTEMS, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 47 MIDDLE EAST & AFRICA PERSONAL CARE IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 48 MIDDLE EAST & AFRICA PERSONAL CARE IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 49 MIDDLE EAST & AFRICA CONSTRUCTION IN CODING AND MARKING SYSTEMS, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 50 MIDDLE EAST & AFRICA CONSTRUCTION IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 51 MIDDLE EAST & AFRICA CONSTRUCTION IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 52 MIDDLE EAST & AFRICA CHEMICAL MANUFACTURING IN CODING AND MARKING SYSTEMS, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 53 MIDDLE EAST & AFRICA CHEMICAL MANUFACTURING IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 54 MIDDLE EAST & AFRICA CONSTRUCTION IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 55 MIDDLE EAST & AFRICA OTHERS IN CODING AND MARKING SYSTEMS, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 56 MIDDLE EAST & AFRICA CODING AND MARKING SYSTEMS MARKET, BY COUNTRY, 2021-2030 (USD THOUSAND)

TABLE 57 MIDDLE EAST & AFRICA CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 58 MIDDLE EAST & AFRICA CODING AND MARKING SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 59 MIDDLE EAST & AFRICA CODING AND MARKING SYSTEMS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 60 MIDDLE EAST & AFRICA CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 61 MIDDLE EAST & AFRICA CODING AND MARKING SYSTEMS MARKET, BY NUMBER OF NOZZLES, 2021-2030 (USD THOUSAND)

TABLE 62 MIDDLE EAST & AFRICA CODING AND MARKING SYSTEMS MARKET, BY END USE, 2021-2030 (USD THOUSAND)

TABLE 63 MIDDLE EAST & AFRICA FOOD & BEVERAGE IN CODING AND MARKING SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 64 MIDDLE EAST & AFRICA FOOD & BEVERAGE IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 65 MIDDLE EAST & AFRICA FOOD & BEVERAGE IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 66 MIDDLE EAST & AFRICA PHARMACEUTICALS IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 67 MIDDLE EAST & AFRICA PHARMACEUTICALS IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 68 MIDDLE EAST & AFRICA ELECTRICAL & ELECTRONICS IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 69 MIDDLE EAST & AFRICA ELECTRICAL & ELECTRONICS IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 70 MIDDLE EAST & AFRICA AUTOMOTIVE & AEROSPACE IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 71 MIDDLE EAST & AFRICA AUTOMOTIVE & AEROSPACE IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 72 MIDDLE EAST & AFRICA PERSONAL CARE IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 73 MIDDLE EAST & AFRICA PERSONAL CARE IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 74 MIDDLE EAST & AFRICA CONSTRUCTION IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 75 MIDDLE EAST & AFRICA CONSTRUCTION IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 76 MIDDLE EAST & AFRICA CHEMICAL MANUFACTURING IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 77 MIDDLE EAST & AFRICA CHEMICAL MANUFACTURING IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 78 SOUTH AFRICA CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 79 SOUTH AFRICA CODING AND MARKING SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 80 SOUTH AFRICA CODING AND MARKING SYSTEMS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 81 SOUTH AFRICA CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 82 SOUTH AFRICA CODING AND MARKING SYSTEMS MARKET, BY NUMBER OF NOZZLES, 2021-2030 (USD THOUSAND)

TABLE 83 SOUTH AFRICA CODING AND MARKING SYSTEMS MARKET, BY END USE, 2021-2030 (USD THOUSAND)

TABLE 84 SOUTH AFRICA FOOD & BEVERAGE IN CODING AND MARKING SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 85 SOUTH AFRICA FOOD & BEVERAGE IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 86 SOUTH AFRICA FOOD & BEVERAGE IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 87 SOUTH AFRICA PHARMACEUTICALS IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 88 SOUTH AFRICA PHARMACEUTICALS IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 89 SOUTH AFRICA ELECTRICAL & ELECTRONICS IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 90 SOUTH AFRICA ELECTRICAL & ELECTRONICS IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 91 SOUTH AFRICA AUTOMOTIVE & AEROSPACE IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 92 SOUTH AFRICA AUTOMOTIVE & AEROSPACE IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 93 SOUTH AFRICA PERSONAL CARE IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 94 SOUTH AFRICA PERSONAL CARE IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 95 SOUTH AFRICA CONSTRUCTION IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 96 SOUTH AFRICA CONSTRUCTION IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 97 SOUTH AFRICA CHEMICAL MANUFACTURING IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 98 SOUTH AFRICA CHEMICAL MANUFACTURING IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 99 SAUDI ARABIA CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 100 SAUDI ARABIA CODING AND MARKING SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 101 SAUDI ARABIA CODING AND MARKING SYSTEMS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 102 SAUDI ARABIA CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 103 SAUDI ARABIA CODING AND MARKING SYSTEMS MARKET, BY NUMBER OF NOZZLES, 2021-2030 (USD THOUSAND)

TABLE 104 SAUDI ARABIA CODING AND MARKING SYSTEMS MARKET, BY END USE, 2021-2030 (USD THOUSAND)

TABLE 105 SAUDI ARABIA FOOD & BEVERAGE IN CODING AND MARKING SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 106 SAUDI ARABIA FOOD & BEVERAGE IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 107 SAUDI ARABIA FOOD & BEVERAGE IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 108 SAUDI ARABIA PHARMACEUTICALS IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 109 SAUDI ARABIA PHARMACEUTICALS IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 110 SAUDI ARABIA ELECTRICAL & ELECTRONICS IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 111 SAUDI ARABIA ELECTRICAL & ELECTRONICS IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 112 SAUDI ARABIA AUTOMOTIVE & AEROSPACE IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 113 SAUDI ARABIA AUTOMOTIVE & AEROSPACE IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 114 SAUDI ARABIA PERSONAL CARE IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 115 SAUDI ARABIA PERSONAL CARE IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 116 SAUDI ARABIA CONSTRUCTION IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 117 SAUDI ARABIA CONSTRUCTION IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 118 SAUDI ARABIA CHEMICAL MANUFACTURING IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 119 SAUDI ARABIA CHEMICAL MANUFACTURING IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 120 UNITED EMIRATES ARAB CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 121 UNITED EMIRATES ARAB CODING AND MARKING SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 122 UNITED EMIRATES ARAB CODING AND MARKING SYSTEMS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 123 UNITED EMIRATES ARAB CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 124 UNITED EMIRATES ARAB CODING AND MARKING SYSTEMS MARKET, BY NUMBER OF NOZZLES, 2021-2030 (USD THOUSAND)

TABLE 125 UNITED EMIRATES ARAB CODING AND MARKING SYSTEMS MARKET, BY END USE, 2021-2030 (USD THOUSAND)

TABLE 126 UNITED EMIRATES ARAB FOOD & BEVERAGE IN CODING AND MARKING SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 127 UNITED EMIRATES ARAB FOOD & BEVERAGE IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 128 UNITED EMIRATES ARAB FOOD & BEVERAGE IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 129 UNITED EMIRATES ARAB PHARMACEUTICALS IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 130 UNITED EMIRATES ARAB PHARMACEUTICALS IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 131 UNITED EMIRATES ARAB ELECTRICAL & ELECTRONICS IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 132 UNITED EMIRATES ARAB ELECTRICAL & ELECTRONICS IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 133 UNITED EMIRATES ARAB AUTOMOTIVE & AEROSPACE IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 134 UNITED EMIRATES ARAB AUTOMOTIVE & AEROSPACE IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 135 UNITED EMIRATES ARAB PERSONAL CARE IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 136 UNITED EMIRATES ARAB PERSONAL CARE IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 137 UNITED EMIRATES ARAB CONSTRUCTION IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 138 UNITED EMIRATES ARAB CONSTRUCTION IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 139 UNITED EMIRATES ARAB CHEMICAL MANUFACTURING IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 140 UNITED EMIRATES ARAB CHEMICAL MANUFACTURING IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 141 QATAR CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 142 QATAR CODING AND MARKING SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 143 QATAR CODING AND MARKING SYSTEMS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 144 QATAR CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 145 QATAR CODING AND MARKING SYSTEMS MARKET, BY NUMBER OF NOZZLES, 2021-2030 (USD THOUSAND)

TABLE 146 QATAR CODING AND MARKING SYSTEMS MARKET, BY END USE, 2021-2030 (USD THOUSAND)

TABLE 147 QATAR FOOD & BEVERAGE IN CODING AND MARKING SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 148 QATAR FOOD & BEVERAGE IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 149 QATAR FOOD & BEVERAGE IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 150 QATAR PHARMACEUTICALS IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 151 QATAR PHARMACEUTICALS IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 152 QATAR ELECTRICAL & ELECTRONICS IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 153 QATAR ELECTRICAL & ELECTRONICS IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 154 QATAR AUTOMOTIVE & AEROSPACE IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 155 QATAR AUTOMOTIVE & AEROSPACE IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 156 QATAR PERSONAL CARE IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 157 QATAR PERSONAL CARE IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 158 QATAR CONSTRUCTION IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 159 QATAR CONSTRUCTION IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 160 QATAR CHEMICAL MANUFACTURING IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 161 QATAR CHEMICAL MANUFACTURING IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 162 KUWAIT CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 163 KUWAIT CODING AND MARKING SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 164 KUWAIT CODING AND MARKING SYSTEMS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 165 KUWAIT CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 166 KUWAIT CODING AND MARKING SYSTEMS MARKET, BY NUMBER OF NOZZLES, 2021-2030 (USD THOUSAND)

TABLE 167 KUWAIT CODING AND MARKING SYSTEMS MARKET, BY END USE, 2021-2030 (USD THOUSAND)

TABLE 168 KUWAIT FOOD & BEVERAGE IN CODING AND MARKING SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 169 KUWAIT FOOD & BEVERAGE IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 170 KUWAIT FOOD & BEVERAGE IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 171 KUWAIT PHARMACEUTICALS IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 172 KUWAIT PHARMACEUTICALS IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 173 KUWAIT ELECTRICAL & ELECTRONICS IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 174 KUWAIT ELECTRICAL & ELECTRONICS IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 175 KUWAIT AUTOMOTIVE & AEROSPACE IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 176 KUWAIT AUTOMOTIVE & AEROSPACE IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 177 KUWAIT PERSONAL CARE IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 178 KUWAIT PERSONAL CARE IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 179 KUWAIT CONSTRUCTION IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 180 KUWAIT CONSTRUCTION IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 181 KUWAIT CHEMICAL MANUFACTURING IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 182 KUWAIT CHEMICAL MANUFACTURING IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 183 OMAN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 184 OMAN CODING AND MARKING SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 185 OMAN CODING AND MARKING SYSTEMS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 186 OMAN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 187 OMAN CODING AND MARKING SYSTEMS MARKET, BY NUMBER OF NOZZLES, 2021-2030 (USD THOUSAND)

TABLE 188 OMAN CODING AND MARKING SYSTEMS MARKET, BY END USE, 2021-2030 (USD THOUSAND)

TABLE 189 OMAN FOOD & BEVERAGE IN CODING AND MARKING SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 190 OMAN FOOD & BEVERAGE IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 191 OMAN FOOD & BEVERAGE IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 192 OMAN PHARMACEUTICALS IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 193 OMAN PHARMACEUTICALS IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 194 OMAN ELECTRICAL & ELECTRONICS IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 195 OMAN ELECTRICAL & ELECTRONICS IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 196 OMAN AUTOMOTIVE & AEROSPACE IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 197 OMAN AUTOMOTIVE & AEROSPACE IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 198 OMAN PERSONAL CARE IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 199 OMAN PERSONAL CARE IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 200 OMAN CONSTRUCTION IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 201 OMAN CONSTRUCTION IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 202 OMAN CHEMICAL MANUFACTURING IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 203 OMAN CHEMICAL MANUFACTURING IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 204 REST OF MIDDLE EAST & AFRICA CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

Lista de Figura

FIGURE 1 MIDDLE EAST & AFRICA CODING AND MARKING SYSTEMS MARKET

FIGURE 2 MIDDLE EAST & AFRICA CODING AND MARKING SYSTEMS MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA CODING AND MARKING SYSTEMS MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA CODING AND MARKING SYSTEMS MARKET: MIDDLE EAST & AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA CODING AND MARKING SYSTEMS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA CODING AND MARKING SYSTEMS MARKET: THE TECHNOLOGY TYPE LIFE LINE CURVE

FIGURE 7 MIDDLE EAST & AFRICA CODING AND MARKING SYSTEMS MARKET: MULTIVARIATE MODELLING

FIGURE 8 MIDDLE EAST & AFRICA CODING AND MARKING SYSTEMS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 MIDDLE EAST & AFRICA CODING AND MARKING SYSTEMS MARKET: DBMR MARKET POSITION GRID

FIGURE 10 MIDDLE EAST & AFRICA CODING AND MARKING SYSTEMS MARKET: MARKET END – USE COVERAGE GRID

FIGURE 11 MIDDLE EAST & AFRICA CODING AND MARKING SYSTEMS MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 MIDDLE EAST & AFRICA CODING AND MARKING SYSTEMS MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 MIDDLE EAST & AFRICA CODING AND MARKING SYSTEMS MARKET: SEGMENTATION

FIGURE 14 THE GROWING USE OF CODING AND MARKING SYSTEMS IN VARIOUS INDUSTRIES IS ONE OF THE DRIVING FACTORS FOR THR MARKET GROWTH

FIGURE 15 CONTINUOUS INKJET IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST & AFRICA CODING AND MARKING SYSTEMS MARKET IN 2023 & 2030

FIGURE 16 VENDOR SELECTION CRITERIA

FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF THE MIDDLE EAST & AFRICA CODING AND MARKING SYSTEMS MARKET

FIGURE 18 MIDDLE EAST & AFRICA CODING AND MARKING SYSTEMS MARKET: BY TECHNOLOGY TYPE, 2022

FIGURE 19 MIDDLE EAST & AFRICA CODING AND MARKING SYSTEMS MARKET, BY TYPE, 2022

FIGURE 20 MIDDLE EAST & AFRICA CODING AND MARKING SYSTEMS MARKET: BY APPLICATION, 2022

FIGURE 21 MIDDLE EAST & AFRICA CODING AND MARKING SYSTEMS MARKET: BY MATERIAL, 2022

FIGURE 22 MIDDLE EAST & AFRICA CODING AND MARKING SYSTEMS MARKET: BY NUMBER OF NOZZLES, 2022

FIGURE 23 MIDDLE EAST & AFRICA CODING AND MARKING SYSTEMS MARKET: BY END USE, 2022

FIGURE 24 MIDDLE EAST & AFRICA CODING AND MARKING SYSTEMS MARKET: SNAPSHOT (2022)

FIGURE 25 MIDDLE EAST & AFRICA CODING AND MARKING SYSTEMS MARKET: BY COUNTRY (2022)

FIGURE 26 MIDDLE EAST & AFRICA CODING AND MARKING SYSTEMS MARKET: BY COUNTRY (2023 & 2030)

FIGURE 27 MIDDLE EAST & AFRICA CODING AND MARKING SYSTEMS MARKET: BY COUNTRY (2022 & 2030)

FIGURE 28 MIDDLE EAST & AFRICA CODING AND MARKING SYSTEMS MARKET: BY TECHNOLOGY TYPE (2023-2030)

FIGURE 29 MIDDLE EAST & AFRICA CODING AND MARKING SYSTEMS MARKET: COMPANY SHARE 2022 (%)

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.