Middle East and Africa Cardiac Safety Services Market, By Services (ECG/Holter Measurements, Blood Pressure Measurements, In Vitro Cardiac Safety Assessment Services, Cardiovascular Imaging, Real-Time Telemetry Monitoring, Central Over-Read of ECGS, Non-Invasive Cardiac Imaging, Physiologic Stress Testing, Thorough QT Studies, TQT and Exposure Response Modeling, Platelet Aggregation and Other Services), Phase (Phase 1, Phase 2 and Phase 3), Type (Integrated Services and Standalone Services), End User (Pharmaceuticals & Biopharmaceuticals Companies, Contract Research Organizations and Academic and Research Institute) Industry Trends and Forecast to 2029.

Market Analysis and Insights

Middle East and Africa cardiac safety services market is driven by the factors such as an increase in the number of clinical trials, a growing number of the major market players and the innovation in technology, which enhance its demand, as well as increasing investment in research and development, leads to the market growth. Currently, various research studies are taking place, which is expected to create a competitive advantage for manufacturers to develop new and innovative cardiac safety services systems, which is expected to provide various other opportunities in the cardiac safety services market. However, the strict government regulations on approval are expected to hamper the growth.

Middle East and Africa cardiac safety services market report provides details of market share, new developments, and product pipeline analysis, the impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, product approvals, strategic decisions, product launches, geographic expansions, and technological innovations in the market. To understand the analysis and the market scenario contact us for an analyst brief, our team will help you create a revenue impact solution to achieve your desired goal. The scalability and business expansion of the retail units in the developing countries of various regions and partnership with suppliers for safe distribution of machine and drugs products are the major drivers that propelled the market's demand in the forecast period.

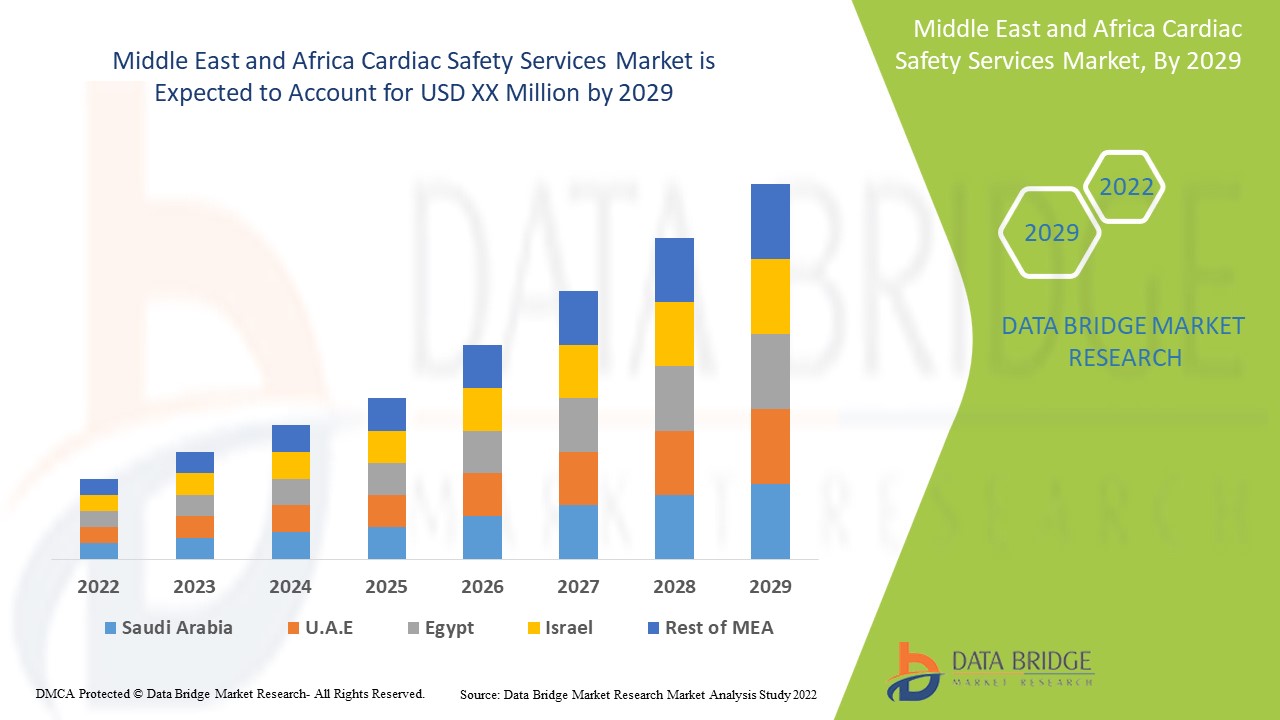

Middle East and Africa cardiac safety services market is supportive and aims to reduce the progression of the disease. Data Bridge Market Research analyses that Middle East and Africa cardiac safety services Market will grow at a CAGR of 13.7% during the forecast period of 2022 to 2029.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2019 - 2014) |

|

Quantitative Units |

Revenue in USD Million, Pricing in USD |

|

Segments Covered |

By Services (ECG/Holter Measurements, Blood Pressure Measurements, In Vitro Cardiac Safety Assessment Services, Cardiovascular Imaging, Real-Time Telemetry Monitoring, Central Over-Read of ECGS, Non-Invasive Cardiac Imaging, Physiologic Stress Testing, Thorough QT Studies, TQT and Exposure Response Modeling, Platelet Aggregation and Other Services), Phase (Phase 1, Phase 2 and Phase 3), Type (Integrated Services and Standalone Services), End User (Pharmaceuticals & Biopharmaceuticals Companies, Contract Research Organizations and Academic and Research Institute) |

|

Countries Covered |

South Africa, Saudi Arabia, U.A.E, Israel, Egypt and Rest of Middle East |

|

Market Players Covered |

Koninklijke Philips N.V., Laboratory Corporation of America Holdings, IQVIA, Medpace, Ncardia, Certara, Eurofins Scientific, and SGS SA among others |

Market Definition:

Cardiac safety services generally help support and design clinical trials and other research needed to monitor heart safety. The demand for cardiac safety services market has been increased in both developed well as in developing countries and the reason behind this is the increasing number of clinical trials and product launch. The cardiac safety services market is growing due to introduction of innovative products, increasing in technological products and rising disposable income. The market will grow in forecasted period due to exploration of emerging markets, strategic initiatives by market players, increasing healthcare expenditure.

Middle East and Africa Cardiac safety services Market Dynamics

Drivers

- Increase in the number of clinical trials

A clinical trial is a well-structured system that is way back hundreds of years and is still the backbone of the regulatory requirements required for a drug to be approved. Recently there has been much advancement in the clinical trial field, which has increased the number of clinical trials and is expected to propel the market growth.

There have been various changes in the regulatory of the clinical trials, which has increased the number of clinical trials and their positive results-

For instance,

- According to the article by Medical News, there has been a significant increase in the number of trials due to the rise in the quality of clinical trials, such as mandatory training of all staff. Also, in 2017, NIH stated that all investigators and staff should be trained on good clinical practice (GCP) in trials that NIH funds

Increase in healthcare expenditure and funding

The expanse of money used by a country on its healthcare and its growth rate over time is inclined by a wide variety of economic and social factors, including the financing arrangements and structure of the organization of the health system.

Healthcare expenditure has increased across developed countries and emerging economies as the disposable income of people are growing. The more money is spent on healthcare, the healthier a country's population is.

Opportunity

- Increase in new drug development

The clinical trials are vital for discovering and developing new drugs for disease treatment. It is the best way researchers can find out what treatments work or don't work on humans. The drug development is characterized as forming new treatment as medicines or devices for curing various diseases such as cancer, endocrine, metabolic, and others.

- Thus, clinical trials are the most effective way to ensure the safety and efficacy of the therapeutic drug before launching in the market and human consumption that includes cardiac safety evaluation which is an essential part before any medical product goes into the market

Restraint/Challenge

The proper assessment and reporting of clinical cardiac safety data is essential. Approval and product recall for any medical products depend on cardiac safety evaluation. So it is necessary to provide and conduct cardiac safety evaluation according to the legal procedure, otherwise it leads to late approval of the product which is expected to restrain the market growth.

For instance,

- According to the article by IQVIA, there were 47 instances of post-marketing withdrawal of drugs between 1957 and 2007, in which 45% of these were due to concerns regarding cardiovascular toxicity. Similarly, 27% of the potential new drug molecules that failed in the preclinical phase in the last two decades did so because of cardiovascular toxicity as they did not meet the required regulatory

Middle East and Africa Cardiac Safety Services Market Segmentation

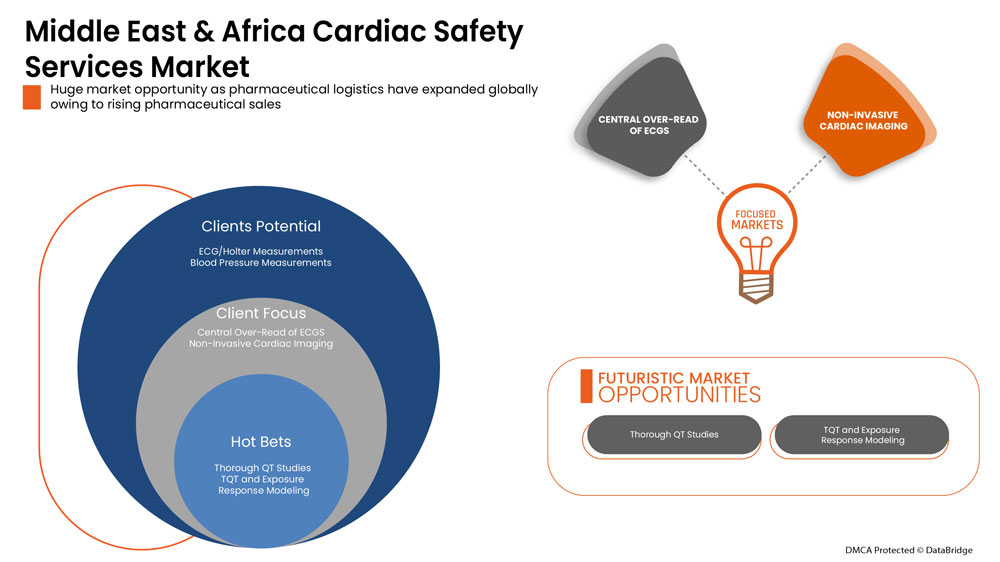

Middle East and Africa cardiac safety services market is categorized into type, services, phase and end user. The growth among segments helps you analyse niche pockets of growth and strategies to approach the market and determine your core application areas and the difference in your target markets.

Services

- ECG/holter measurements

- Blood pressure measurements

- In vitro cardiac safety assessment services

- Cardiovascular imaging

- Real-time telemetry monitoring

- Central over-read of ECGS

- Non-invasive cardiac imaging

- Physiologic stress testing

- Thorough QT studies

- TQT and exposure response modeling

- Platelet aggregation

- Other services

On the basis of services, the cardiac safety services market is segmented into ECG/Holter measurements, blood pressure measurements, in vitro cardiac safety assessment services, cardiovascular imaging, real-time telemetry monitoring, central over-read of ECGS, non-invasive cardiac imaging, physiologic stress testing, thorough QT studies, TQT and exposure response modeling, platelet aggregation and other services

Phase

- Phase 1

- Phase 2

- Phase 3

On the basis of phases, the cardiac safety services market is segmented into phase 1, phase 2, and phase 3.

Type

- Integrated services

- Standalone services

On the basis of type, the cardiac safety services market is segmented into integrated services and standalone services.

End User

- Pharmaceuticals & Biopharmaceuticals Companies

- Contract Research Organizations

- Academic and Research Institute

On the basis of end user, the cardiac safety services market is segmented pharmaceuticals & biopharmaceuticals companies, contract research organizations, and academic and research institute.

Cardiac Safety Services Regional Analysis/Insights

The cardiac safety services is analysed and market size insights and trends are provided by type, services, phase and end user as referenced above.

The countries covered in the cardiac safety services report are South Africa, Saudi Arabia, U.A.E, Israel, Egypt and Rest of Middle East.

The South Africa is expected to dominate due to increase in healthcare expenditure and disposable income.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Middle East and Africa brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Cardiac Safety Services Analysis

Middle East and Africa cardiac safety services market competitive landscape provides details by the competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Middle East and Africa presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, and application dominance. The above data points provided are only related to the companies' focus on cardiac safety services market.

Some of the major players in the market are Koninklijke Philips N.V., Laboratory Corporation of America Holdings, IQVIA, Medpace, Ncardia, Certara, Eurofins Scientific, and SGS SA among others.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The market data is analyzed and estimated using market statistical and coherent models. In addition, market share analysis and key trend analysis are the major success factors in the market report. The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market, and primary (industry expert) validation. Apart from this, data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Company Market Share Analysis, Standards of Measurement, Middle East and Africa Vs Regional and Vendor Share Analysis. Please request analyst call in case of further inquiry.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Índice

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST & AFRICA CARDIAC SAFETY SERVICES MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 SERVICES LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET END USER GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTERS FIVE FORCES

4.2 PESTEL ANALYSIS

5 EPIDEMIOLOGY

5.1 INCIDENCE OF ALL BY GENDER

5.2 TREATMENT RATE

5.3 MORTALITY RATE

5.4 DRUG ADHERENCE AND THERAPY SWITCH MODEL

6 INDUSTRY INSIGHT

6.1 DEMOGRAPHIC TRENDS: IMPACTS ON ALL INCIDENCE RATES

6.2 PATENT ANALYSIS

6.3 PATENT FLOW DIAGRAM

6.4 KEY PATIENT ENROLLMENT STRATEGIES

6.5 PRICING STRATEGY

7 MIDDLE EAST & AFRICA CARDIAC SAFETY SERVICES MARKET: REGULATIONS

8 MARKET OVERVIEW

8.1 DRIVERS

8.1.1 INCREASE IN THE NUMBER OF CLINICAL TRIALS

8.1.2 INCREASE IN HEALTHCARE EXPENDITURE AND FUNDING

8.1.3 INCREASE IN STRATEGIC INITIATIVES BY MAJOR MARKET PLAYERS

8.1.4 INCREASE IN R&D ACTIVITIES

8.2 RESTRAINTS

8.2.1 HIGH COST OF CARDIAC SAFETY EVALUATION

8.2.2 STRICT REGULATORY

8.3 OPPORTUNITIES:

8.3.1 INCREASE IN NEW DRUG DEVELOPMENT

8.3.2 RISE IN THE EXPANSION OF THE CARDIAC SAFETY SERVICES

8.4 CHALLENGES

8.4.1 TIME-CONSUMING PROCEDURE

8.4.2 LACK OF SKILLED PERSON TO OPERATE DEVICES DURING CARDIAC SAFETY EVALUATION

9 MIDDLE EAST & AFRICA CARDIAC SAFETY SERVICES MARKET, BY SERVICES

9.1 OVERVIEW

9.2 ECG/HOLTER MEASUREMENTS

9.3 BLOOD PRESSURE MEASUREMENTS

9.4 IN VITRO CARDIAC SAFETY ASSESSMENT SERVICES

9.4.1 HUMAN IPSC-DERIVED CARDIOMYOCYTES MEA ASSAYS

9.4.1.1 1 CONCENTRATIONS

9.4.1.2 4 CONCENTRATIONS

9.4.2 COMPREHENSIVE IN VITRO PROARRHYTHMIA ASSAY (CIPA)

9.4.2.1 3 CONCENTRATIONS

9.4.2.2 5 CONCENTRATIONS

9.4.3 IN VITRO HERG ASSAY

9.4.4 OTHERS

9.5 CARDIOVASCULAR IMAGING

9.6 REAL TIME TELEMETRY MONITORING

9.7 CENTRAL OVER-READ OF ECGS

9.8 NON-INVASIVE CARDIAC IMAGING

9.9 PHYSIOLOGIC STRESS TESTING

9.1 THOROUGH QT STUDIES

9.11 TQT AND EXPOSURE RESPONSE MODELLING

9.12 PLATELET AGGREGATION

9.13 OTHERS

10 MIDDLE EAST & AFRICA CARDIAC SAFETY SERVICES MARKET, BY PHASE

10.1 OVERVIEW

10.2 PHASE I

10.3 PHASE II

10.4 PHASE III

11 MIDDLE EAST & AFRICA CARDIAC SAFETY SERVICES MARKET, BY TYPE

11.1 OVERVIEW

11.2 INTEGRATED SERVICES

11.3 STANDALONE SERVICES

12 MIDDLE EAST & AFRICA CARDIAC SAFETY SERVICES MARKET, BY END USER

12.1 OVERVIEW

12.2 PHARMACEUTICALS & BIOPHARMACEUTICALS COMPANIES

12.3 CONTRACT RESEARCH ORGANIZATIONS

12.4 ACADEMIC AND RESEARCH INSTITUTE

13 MIDDLE EAST & AFRICA CARDIAC SAFETY SERVICES MARKET, BY REGION

13.1 MIDDLE EAST AND AFRICA

13.1.1 SOUTH AFRICA

13.1.2 SAUDI ARABIA

13.1.3 U.A.E.

13.1.4 ISRAEL

13.1.5 EGYPT

13.1.6 REST OF MIDDLE EAST AND AFRICA

14 MIDDLE EAST & AFRICA CARDIAC SAFETY SERVICES MARKET: COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

15 COMPANY PROFILE

15.1 EUROFINS SCIENTIFIC

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENTS

15.1.5.1 AGREEMENTS

15.1.5.2 ACQUISITION

15.2 PPD INC. (SUBSIDIARY OF THERMO FISHER SCIENTIFIC INC)

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENT

15.2.5.1 INVESTMENT

15.3 KONINKLIJKE PHILIPS N.V.

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 COMPANY SHARE ANALYSIS

15.3.4 PRODUCT PORTFOLIO

15.3.5 RECENT DEVELOPMENT

15.3.5.1 ACQUISITION

15.4 IQVIA

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 COMPANY SHARE ANALYSIS

15.4.4 PRODUCT PORTFOLIO

15.4.5 RECENT DEVELOPMENTS

15.4.5.1 ACQUISITION

15.5 LABORATORY CORPORATION OF AMERICA HOLDINGS

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 COMPANY SHARE ANALYSIS

15.5.4 PRODUCT PORTFOLIO

15.5.5 RECENT DEVELOPMENTS

15.5.5.1 NEW LABORATORY

15.5.5.2 ACQUISITION

15.6 BANOOK

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT DEVELOPMENT

15.6.3.1 AGREEMENT

15.7 BIOTRIAL

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT DEVELOPMENT

15.7.3.1 NEW CENTER OPENING

15.8 CELERION

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENT

15.8.3.1 NEW CENTER OPENING

15.9 CERTARA

15.9.1 COMPANY SNAPSHOT

15.9.2 REVENUE ANALYSIS

15.9.3 PRODUCT PORTFOLIO

15.9.4 RECENT DEVELOPMENTS

15.9.4.1 CONTRACT

15.9.4.2 ACQUISITION

15.1 CLARIO

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENT

15.10.3.1 PRODUCT EXPANSION

15.11 MEDPACE

15.11.1 COMPANY SNAPSHOT

15.11.2 REVENUE ANALYSIS

15.11.3 PRODUCT PORTFOLIO

15.11.4 RECENT DEVELOPMENTS

15.11.4.1 ACQUISITION

15.12 NCARDIA

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT DEVELOPMENT

15.12.3.1 PARTNERSHIP

15.13 NEXEL CO., LTD

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT DEVELOPMENTS

15.13.3.1 JOINT VENTURE

15.13.3.2 PARTNERSHIP

15.14 PHYSIOSTIM

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENT

15.14.3.1 PARTNERSHIP

15.15 RICHMOND PHARMACOLOGY

15.15.1 COMPANY SNAPSHOT

15.15.2 PRODUCT PORTFOLIO

15.15.3 RECENT DEVELOPMENT

15.15.3.1 EVENT

15.16 SGS SA

15.16.1 COMPANY SNAPSHOT

15.16.2 REVENUE ANALYSIS

15.16.3 PRODUCT PORTFOLIO

15.16.4 RECENT DEVELOPMENT

15.16.4.1 ACQUISITION

15.17 SHANGHAI MEDICILON INC.

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT DEVELOPMENTS

15.17.3.1 PARTNERSHIP

15.17.3.2 PARTNERSHIP

16 QUESTIONNAIRE

17 RELATED REPORTS

Lista de Tabela

TABLE 1 PROPORTION OF WOMEN IN CLINICAL STUDIES, ACCORDING TO DEVELOPMENT PHASE

TABLE 2 PROBABILITY OF SUCCESS BY CLINICAL TRIAL PHASE TO THERAPEUTIC AREA

TABLE 3 MORTALITY RATES FROM CLINICAL TRIALS AND EUROPEAN SAFETY AND EXPOSURE SURVEY (ESES), DEATHS PER 100 (PYE)

TABLE 4 ADHERENCE RATE TO COMMON CARDIOVASCULAR MEDICATION

TABLE 5 PROPORTION OF WOMEN IN CLINICAL STUDIES, ACCORDING TO DEVELOPMENT PHASE

TABLE 6 INITIATIVES TO INCREASE ENROLLMENT IN CLINICAL TRIALS AMONG UNDERREPRESENTED POPULATIONS

TABLE 7 ESTIMATED COST OF CARDIAC SAFETY EVALUATION DEVICES

TABLE 8 MIDDLE EAST & AFRICA CARDIAC SAFETY SERVICES MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 9 MIDDLE EAST & AFRICA ECG/HOLTER MEASUREMENTS IN CARDIAC SAFETY SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 MIDDLE EAST & AFRICA BLOOD PRESSURE MEASUREMENTS IN CARDIAC SAFETY SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 MIDDLE EAST & AFRICA IN VITRO CARDIAC SAFETY ASSESSMENT SERVICES IN CARDIAC SAFETY SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 MIDDLE EAST & AFRICA IN VITRO CARDIAC SAFETY ASSESSMENT SERVICES IN CARDIAC SAFETY SERVICES MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 13 MIDDLE EAST & AFRICA HUMAN IPSC-DERIVED CARDIOMYOCYTES MEA ASSAYS IN CARDIAC SAFETY SERVICES MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 14 MIDDLE EAST & AFRICA COMPREHENSIVE IN VITRO PROARRHYTHMIA ASSAY (CIPA) IN CARDIAC SAFETY SERVICES MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 15 MIDDLE EAST & AFRICA CARDIOVASCULAR IMAGING IN CARDIAC SAFETY SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 MIDDLE EAST & AFRICA REAL TIME TELEMETRY MONITORING IN CARDIAC SAFETY SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 MIDDLE EAST & AFRICA CENTRAL OVER-READ OF ECGS IN CARDIAC SAFETY SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 MIDDLE EAST & AFRICA NON-INVASIVE CARDIAC IMAGING IN CARDIAC SAFETY SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 MIDDLE EAST & AFRICA PHYSIOLOGIC STRESS TESTING IN CARDIAC SAFETY SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 MIDDLE EAST & AFRICA THOROUGH QT STUDIES IN CARDIAC SAFETY SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 MIDDLE EAST & AFRICA TQT AND EXPOSURE RESPONSE MODELLING IN CARDIAC SAFETY SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 MIDDLE EAST & AFRICA PLATELET AGGREGATION IN CARDIAC SAFETY SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 MIDDLE EAST & AFRICA OTHERS IN CARDIAC SAFETY SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 MIDDLE EAST & AFRICA CARDIAC SAFETY SERVICES MARKET, BY PHASE, 2020-2029 (USD MILLION)

TABLE 25 MIDDLE EAST & AFRICA PHASE I IN CARDIAC SAFETY SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 MIDDLE EAST & AFRICA PHASE II IN CARDIAC SAFETY SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 MIDDLE EAST & AFRICA PHASE III IN CARDIAC SAFETY SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 MIDDLE EAST & AFRICA CARDIAC SAFETY SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 29 MIDDLE EAST & AFRICA INTEGRATED SERVICES IN CARDIAC SAFETY SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 MIDDLE EAST & AFRICA STANDALONE SERVICES IN CARDIAC SAFETY SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 MIDDLE EAST & AFRICA CARDIAC SAFETY SERVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 32 MIDDLE EAST & AFRICA PHARMACEUTICALS & BIOPHARMACEUTICALS COMPANIES IN CARDIAC SAFETY SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 MIDDLE EAST & AFRICA CONTRACT RESEARCH ORGANIZATIONS IN CARDIAC SAFETY SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 34 MIDDLE EAST & AFRICA ACADEMIC AND RESEARCH INSTITUTE IN CARDIAC SAFETY SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 MIDDLE EAST AND AFRICA CARDIAC SAFETY SERVICES MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 36 MIDDLE EAST AND AFRICA CARDIAC SAFETY SERVICES MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 37 MIDDLE EAST AND AFRICA IN VITRO CARDIAC SAFETY ASSESSMENT SERVICES IN CARDIAC SAFETY SERVICES MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 38 MIDDLE EAST AND AFRICA HUMAN IPSC-DERIVED CARDIOMYOCYTES MEA ASSAYS IN CARDIAC SAFETY SERVICES MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 39 MIDDLE EAST AND AFRICA COMPREHENSIVE IN VITRO PROARRHYTHMIA ASSAY (CIPA) IN CARDIAC SAFETY SERVICES MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 40 MIDDLE EAST AND AFRICA CARDIAC SAFETY SERVICES MARKET, BY PHASE, 2020-2029 (USD MILLION)

TABLE 41 MIDDLE EAST AND AFRICA CARDIAC SAFETY SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 42 MIDDLE EAST AND AFRICA CARDIAC SAFETY SERVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 43 SOUTH AFRICA CARDIAC SAFETY SERVICES MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 44 SOUTH AFRICA IN VITRO CARDIAC SAFETY ASSESSMENT SERVICES IN CARDIAC SAFETY SERVICES MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 45 SOUTH AFRICA HUMAN IPSC-DERIVED CARDIOMYOCYTES MEA ASSAYS IN CARDIAC SAFETY SERVICES MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 46 SOUTH AFRICA COMPREHENSIVE IN VITRO PROARRHYTHMIA ASSAY (CIPA) IN CARDIAC SAFETY SERVICES MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 47 SOUTH AFRICA CARDIAC SAFETY SERVICES MARKET, BY PHASE, 2020-2029 (USD MILLION)

TABLE 48 SOUTH AFRICA CARDIAC SAFETY SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 49 SOUTH AFRICA CARDIAC SAFETY SERVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 50 SAUDI ARABIA CARDIAC SAFETY SERVICES MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 51 SAUDI ARABIA IN VITRO CARDIAC SAFETY ASSESSMENT SERVICES IN CARDIAC SAFETY SERVICES MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 52 SAUDI ARABIA HUMAN IPSC-DERIVED CARDIOMYOCYTES MEA ASSAYS IN CARDIAC SAFETY SERVICES MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 53 SAUDI ARABIA COMPREHENSIVE IN VITRO PROARRHYTHMIA ASSAY (CIPA) IN CARDIAC SAFETY SERVICES MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 54 SAUDI ARABIA CARDIAC SAFETY SERVICES MARKET, BY PHASE, 2020-2029 (USD MILLION)

TABLE 55 SAUDI ARABIA CARDIAC SAFETY SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 56 SAUDI ARABIA CARDIAC SAFETY SERVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 57 U.A.E. CARDIAC SAFETY SERVICES MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 58 U.A.E. IN VITRO CARDIAC SAFETY ASSESSMENT SERVICES IN CARDIAC SAFETY SERVICES MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 59 U.A.E. HUMAN IPSC-DERIVED CARDIOMYOCYTES MEA ASSAYS IN CARDIAC SAFETY SERVICES MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 60 U.A.E. COMPREHENSIVE IN VITRO PROARRHYTHMIA ASSAY (CIPA) IN CARDIAC SAFETY SERVICES MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 61 U.A.E. CARDIAC SAFETY SERVICES MARKET, BY PHASE, 2020-2029 (USD MILLION)

TABLE 62 U.A.E. CARDIAC SAFETY SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 63 U.A.E. CARDIAC SAFETY SERVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 64 ISRAEL CARDIAC SAFETY SERVICES MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 65 ISRAEL IN VITRO CARDIAC SAFETY ASSESSMENT SERVICES IN CARDIAC SAFETY SERVICES MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 66 ISRAEL HUMAN IPSC-DERIVED CARDIOMYOCYTES MEA ASSAYS IN CARDIAC SAFETY SERVICES MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 67 ISRAEL COMPREHENSIVE IN VITRO PROARRHYTHMIA ASSAY (CIPA) IN CARDIAC SAFETY SERVICES MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 68 ISRAEL CARDIAC SAFETY SERVICES MARKET, BY PHASE, 2020-2029 (USD MILLION)

TABLE 69 ISRAEL CARDIAC SAFETY SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 70 ISRAEL CARDIAC SAFETY SERVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 71 EGYPT CARDIAC SAFETY SERVICES MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 72 EGYPT IN VITRO CARDIAC SAFETY ASSESSMENT SERVICES IN CARDIAC SAFETY SERVICES MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 73 EGYPT HUMAN IPSC-DERIVED CARDIOMYOCYTES MEA ASSAYS IN CARDIAC SAFETY SERVICES MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 74 EGYPT COMPREHENSIVE IN VITRO PROARRHYTHMIA ASSAY (CIPA) IN CARDIAC SAFETY SERVICES MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 75 EGYPT CARDIAC SAFETY SERVICES MARKET, BY PHASE, 2020-2029 (USD MILLION)

TABLE 76 EGYPT CARDIAC SAFETY SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 77 EGYPT CARDIAC SAFETY SERVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 78 REST OF MIDDLE EAST AND AFRICA CARDIAC SAFETY SERVICES MARKET, BY SERVICES, 2020-2029 (USD MILLION)

Lista de Figura

FIGURE 1 MIDDLE EAST & AFRICA CARDIAC SAFETY SERVICES MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST & AFRICA CARDIAC SAFETY SERVICES MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA CARDIAC SAFETY SERVICES MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA CARDIAC SAFETY SERVICES MARKET: MIDDLE EAST & AFRICA VS COUNTRY MARKET ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA CARDIAC SAFETY SERVICES MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA CARDIAC SAFETY SERVICES MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST & AFRICA CARDIAC SAFETY SERVICES MARKET: DBMR MARKET POSITION GRID

FIGURE 8 MIDDLE EAST & AFRICA CARDIAC SAFETY SERVICES MARKET: MARKET END USER GRID

FIGURE 9 MIDDLE EAST & AFRICA CARDIAC SAFETY SERVICES MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 MIDDLE EAST & AFRICA CARDIAC SAFETY SERVICES MARKET: SEGMENTATION

FIGURE 11 THE INCREASE IN DEMAND FOR CARDIAC SAFETY SERVICES ARE EXPECTED TO DRIVE THE MIDDLE EAST & AFRICA CARDIAC SAFETY SERVICES MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 ECG/HOLTER MEASUREMENTS SUBSTITUTE IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST & AFRICA CARDIAC SAFETY SERVICES MARKET IN 2022 & 2029

FIGURE 13 PATIENT FLOW DIAGRAM FOR ANY RANDOM DRUG

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE MIDDLE EAST & AFRICA CARDIAC SAFETY SERVICES MARKET

FIGURE 15 MIDDLE EAST & AFRICA CARDIAC SAFETY SERVICES MARKET: BY SERVICES, 2021

FIGURE 16 MIDDLE EAST & AFRICA CARDIAC SAFETY SERVICES MARKET: BY SERVICES, 2022-2029 (USD MILLION)

FIGURE 17 MIDDLE EAST & AFRICA CARDIAC SAFETY SERVICES MARKET: BY SERVICES, CAGR (2022-2029)

FIGURE 18 MIDDLE EAST & AFRICA CARDIAC SAFETY SERVICES MARKET: BY SERVICES, LIFELINE CURVE

FIGURE 19 MIDDLE EAST & AFRICA CARDIAC SAFETY SERVICES MARKET: BY PHASE, 2021

FIGURE 20 MIDDLE EAST & AFRICA CARDIAC SAFETY SERVICES MARKET: BY PHASE, 2022-2029 (USD MILLION)

FIGURE 21 MIDDLE EAST & AFRICA CARDIAC SAFETY SERVICES MARKET: BY PHASE, CAGR (2022-2029)

FIGURE 22 MIDDLE EAST & AFRICA CARDIAC SAFETY SERVICES MARKET: BY PHASE, LIFELINE CURVE

FIGURE 23 MIDDLE EAST & AFRICA CARDIAC SAFETY SERVICES MARKET: BY TYPE, 2021

FIGURE 24 MIDDLE EAST & AFRICA CARDIAC SAFETY SERVICES MARKET: BY TYPE, 2022-2029 (USD MILLION)

FIGURE 25 MIDDLE EAST & AFRICA CARDIAC SAFETY SERVICES MARKET: BY TYPE, CAGR (2022-2029)

FIGURE 26 MIDDLE EAST & AFRICA CARDIAC SAFETY SERVICES MARKET: BY TYPE, LIFELINE CURVE

FIGURE 27 MIDDLE EAST & AFRICA CARDIAC SAFETY SERVICES MARKET: BY END USER, 2021

FIGURE 28 MIDDLE EAST & AFRICA CARDIAC SAFETY SERVICES MARKET: BY END USER, 2022-2029 (USD MILLION)

FIGURE 29 MIDDLE EAST & AFRICA CARDIAC SAFETY SERVICES MARKET: BY END USER, CAGR (2022-2029)

FIGURE 30 MIDDLE EAST & AFRICA CARDIAC SAFETY SERVICES MARKET: BY END USER, LIFELINE CURVE

FIGURE 31 MIDDLE EAST AND AFRICA CARDIAC SAFETY SERVICES MARKET: SNAPSHOT (2021)

FIGURE 32 MIDDLE EAST AND AFRICA CARDIAC SAFETY SERVICES MARKET: BY COUNTRY (2021)

FIGURE 33 MIDDLE EAST AND AFRICA CARDIAC SAFETY SERVICES MARKET: BY COUNTRY (2022 & 2029)

FIGURE 34 MIDDLE EAST AND AFRICA CARDIAC SAFETY SERVICES MARKET: BY COUNTRY (2021 & 2029)

FIGURE 35 MIDDLE EAST AND AFRICA CARDIAC SAFETY SERVICES MARKET: BY SERVICES (2022-2029)

FIGURE 36 MIDDLE EAST & AFRICA CARDIAC SAFETY SERVICES MARKET: COMPANY SHARE 2021 (%)

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.