Middle East And Africa Cancer Supportive Care Products Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

866.40 Million

USD

1,023.11 Million

2024

2032

USD

866.40 Million

USD

1,023.11 Million

2024

2032

| 2025 –2032 | |

| USD 866.40 Million | |

| USD 1,023.11 Million | |

|

|

|

|

Segmentação de mercado de produtos de tratamento de suporte ao câncer MEA, por tipo (fatores estimuladores de colônias de granulócitos (G-CSFs), agentes estimuladores da eritropoiese (ESAs), antieméticos, bifosfonatos, analgésicos opioides, anti-inflamatórios não esteroidais (AINEs), anti-infecciosos, anticorpos monoclonais e outros), indicação (náuseas e vômitos induzidos por quimioterapia (NVQI), anemia induzida por quimioterapia, neutropenia induzida por quimioterapia, dor oncológica, mucosite oral e boca seca, metástases ósseas, fadiga e outros), canal de distribuição (farmácias hospitalares, farmácias de varejo, farmácias de manipulação e farmácias on-line), aplicação (hospitais e clínicas, ambientes de atendimento domiciliar, centros especializados e outros) - Tendências do setor e previsão até 2028.

Tamanho do mercado de produtos de suporte ao câncer da MEA

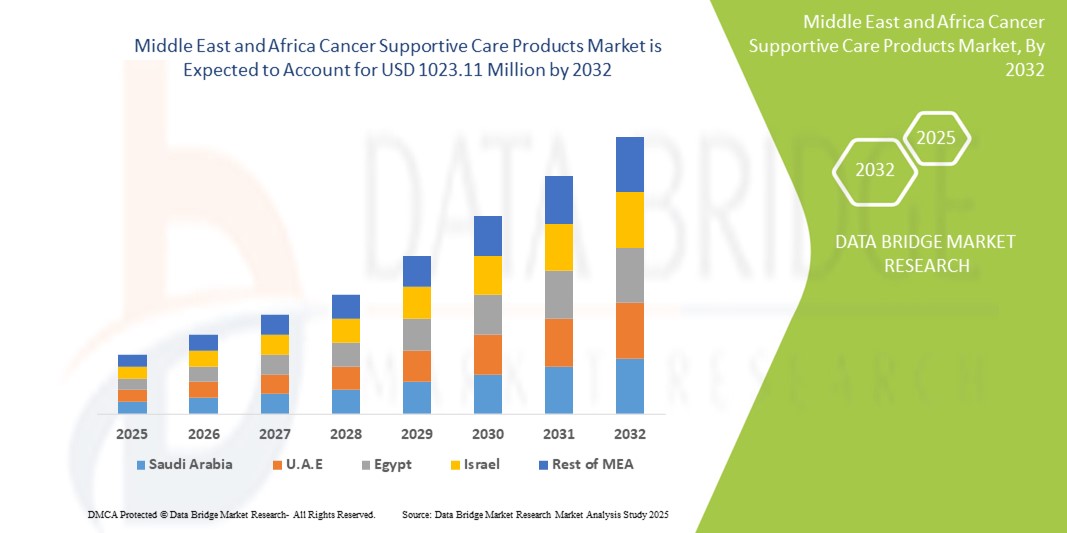

- O tamanho do mercado de produtos de suporte ao câncer da MEA foi avaliado em US$ 866,4 milhões em 2024 e deve atingir US$ 1.023,11 milhões até 2032 , com um CAGR de 2,1% durante o período previsto.

- A tendência do mercado é influenciada principalmente pela crescente incidência de câncer na região e pelo foco crescente na melhoria da qualidade de vida de pacientes com câncer, apesar da crescente disponibilidade de medicamentos genéricos e biossimilares, o que pode afetar a receita.

- Além disso, os avanços contínuos nos tratamentos oncológicos e a crescente conscientização sobre o gerenciamento dos efeitos colaterais relacionados ao tratamento estão impulsionando a demanda por soluções de cuidados de suporte, consolidando-as como parte integrante do tratamento abrangente do câncer. Esses fatores, juntamente com os esforços para aprimorar a infraestrutura de saúde, estão moldando a trajetória do setor.

Análise de mercado de produtos de suporte ao câncer da MEA

- Produtos de tratamento de suporte ao câncer, que oferecem alívio e controle essenciais dos efeitos colaterais decorrentes de tratamentos contra o câncer, como quimioterapia e radioterapia, são componentes cada vez mais vitais do tratamento oncológico abrangente na região MEA devido ao seu papel crucial na melhoria do bem-estar do paciente, na adesão ao tratamento e na qualidade de vida geral.

- A demanda flutuante por esses produtos é motivada principalmente pelo aumento contínuo de casos de câncer, pela necessidade persistente de mitigar os efeitos colaterais graves do tratamento e pela ênfase crescente no cuidado holístico ao paciente, que vai além da terapia direcionada ao tumor.

- Embora dados específicos sobre a dominância regional da MEA no mercado global não estejam disponíveis de forma consistente, a região é caracterizada por níveis variados de desenvolvimento da saúde, com países como Arábia Saudita, Emirados Árabes Unidos e Catar apresentando avanços em seus sistemas de saúde, o que deve aumentar a demanda por produtos de cuidados de suporte. No entanto, alguns países africanos enfrentam desafios com infraestrutura de saúde adequada, embora iniciativas com a OMS e outras organizações estejam trabalhando para melhorar isso.

- O segmento de antieméticos domina o mercado de produtos de suporte ao câncer na região MEA, com uma participação de mercado de 27,1% em 2024, impulsionado pela alta prevalência de náuseas e vômitos induzidos por quimioterapia (NVQQ) e seu papel crítico no conforto do paciente e na conclusão do tratamento.

Relatório sobre o escopo e a segmentação do mercado de produtos de suporte ao câncer MEA

|

Atributos |

Principais insights do mercado de produtos de suporte ao câncer da MEA |

|

Segmentos abrangidos |

|

|

Países abrangidos |

Oriente Médio e África

|

|

Principais participantes do mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor agregado |

Além dos insights sobre cenários de mercado, como valor de mercado, taxa de crescimento, segmentação, cobertura geográfica e principais participantes, os relatórios de mercado selecionados pela Data Bridge Market Research também incluem análises aprofundadas de especialistas, análises de preços, análises de participação de marca, pesquisas com consumidores, análises demográficas, análises da cadeia de suprimentos, análises da cadeia de valor, visão geral de matérias-primas/consumíveis, critérios de seleção de fornecedores, análise PESTLE, análise de Porter e estrutura regulatória. |

Tendências de mercado de produtos de suporte ao câncer da MEA

"Expandindo as modalidades de tratamento e o atendimento holístico ao paciente"

- Uma tendência significativa e crescente no mercado de produtos de suporte ao câncer na região MEA é a ampliação das modalidades de tratamento para abranger uma abordagem mais holística ao cuidado do paciente, indo além do simples gerenciamento da doença e melhorando o bem-estar geral durante e após o tratamento do câncer. Essa abordagem abrangente está melhorando significativamente os resultados e a qualidade de vida dos pacientes.

- Por exemplo, o foco crescente no tratamento da neuropatia periférica induzida por quimioterapia com novas estratégias de controle da dor, ou a ênfase crescente no suporte nutricional e no aconselhamento psicológico, além dos tratamentos convencionais. Da mesma forma, a integração dos cuidados paliativos no início da jornada do câncer destaca uma mudança em direção a uma experiência mais completa para o paciente.

- A evolução dos cuidados de suporte possibilita recursos como o gerenciamento proativo dos efeitos colaterais do tratamento, resultando em melhor adesão do paciente a protocolos exigentes e proporcionando intervenções mais inteligentes com base nas necessidades individuais do paciente. Por exemplo, alguns regimes antieméticos avançados utilizam uma abordagem multimedicamentosa para melhorar o controle de náuseas e vômitos. Além disso, a educação e o empoderamento aprimorados do paciente oferecem a ele a compreensão necessária para gerenciar melhor seus sintomas e participar ativamente de sua recuperação.

- A integração perfeita de produtos de cuidados de suporte com planos gerais de tratamento do câncer facilita o gerenciamento centralizado dos sintomas do paciente, juntamente com a resposta do tumor e outros parâmetros clínicos, criando uma experiência de cuidado unificada e otimizada.

- Essa tendência em direção a sistemas de cuidados de suporte mais integrados, centrados no paciente e proativos está remodelando fundamentalmente as expectativas dos pacientes em relação ao tratamento do câncer. Consequentemente, profissionais de saúde e empresas farmacêuticas estão desenvolvendo novos produtos e protocolos voltados para um espectro mais amplo de complicações relacionadas ao câncer.

- A demanda por produtos de suporte ao tratamento do câncer que ofereçam gerenciamento abrangente dos sintomas e melhorem o bem-estar do paciente está crescendo constantemente em vários ambientes de assistência médica, à medida que oncologistas e pacientes priorizam cada vez mais o cuidado holístico e a melhor tolerabilidade do tratamento.

Dinâmica do mercado de produtos de suporte ao câncer da MEA

Motorista:

"Aumento da incidência do câncer e evolução dos cenários de tratamento"

- A prevalência crescente de vários tipos de câncer no Oriente Médio e na África, aliada à evolução contínua dos protocolos de tratamento do câncer, é um fator significativo para o aumento da demanda por produtos de cuidados de suporte.

- Por exemplo, a expansão do acesso à quimioterapia e à radioterapia na região significa um número maior de pacientes apresentando efeitos colaterais relacionados, aumentando assim a necessidade de cuidados de suporte. Espera-se que tais avanços no tratamento do câncer impulsionem o crescimento do setor de produtos de cuidados de suporte no período previsto.

- À medida que os sistemas de saúde se tornam mais sofisticados no diagnóstico e tratamento do câncer, e os pacientes passam por terapias mais intensivas e prolongadas, os produtos de cuidados de suporte oferecem alívio essencial de efeitos adversos como náusea, fadiga, dor e neutropenia, fornecendo uma necessidade convincente para o gerenciamento eficaz dessas complicações.

- Além disso, a crescente adoção de novas terapias contra o câncer, incluindo terapias direcionadas e imunoterapias, que também têm seus próprios perfis distintos de efeitos colaterais, está tornando os cuidados de suporte um componente integral desses paradigmas de tratamento avançado, oferecendo gerenciamento contínuo junto com agentes anticâncer específicos.

- A conveniência do controle dos sintomas, a maior adesão dos pacientes aos regimes de tratamento e a capacidade de melhorar a qualidade de vida geral durante e após o tratamento do câncer são fatores-chave que impulsionam a adoção de produtos de cuidados de suporte em hospitais, clínicas e ambientes de assistência domiciliar. O foco crescente nos resultados relatados pelos pacientes e a crescente conscientização entre os profissionais de saúde sobre a importância dos cuidados de suporte contribuem ainda mais para o crescimento do mercado.

Restrição/Desafio:

"Pressões de preços e estruturas de reembolso limitadas"

- Preocupações com a pressão sobre os preços de medicamentos genéricos e biossimilares, juntamente com as limitações das estruturas de reembolso para produtos de cuidados de suporte em alguns países da região MEA, representam um desafio significativo para uma penetração mais ampla no mercado. Como muitos medicamentos de cuidados de suporte têm equivalentes genéricos ou biossimilares entrando no mercado, isso leva à erosão dos preços, aumentando a ansiedade dos fabricantes quanto à sustentabilidade da receita.

- Por exemplo, relatos de alto nível sobre restrições orçamentárias nos sistemas de saúde e cobertura de seguro variável para tratamentos de suporte fizeram com que alguns pacientes e provedores hesitassem em utilizar totalmente o espectro de produtos disponíveis, incluindo opções novas ou de preços mais altos.

- Abordar essas preocupações com preços e reembolsos por meio de avaliações econômicas robustas, defesa de uma cobertura de seguro mais ampla e desenvolvimento de modelos de assistência baseados em valor é crucial para a construção de um acesso sustentável ao mercado. Empresas como fabricantes locais de produtos farmacêuticos enfatizam seus esforços para fornecer opções acessíveis e trabalham com governos para garantir reembolsos favoráveis. Além disso, o custo relativamente alto de algumas terapias avançadas de cuidados de suporte, em comparação com os tratamentos tradicionais, pode ser uma barreira à adoção por sistemas de saúde sensíveis a preços ou por pacientes com capacidade limitada de custeio, especialmente em regiões em desenvolvimento ou para populações menos abastadas. Embora os produtos básicos de cuidados de suporte tenham se tornado mais acessíveis, terapias especializadas ou inovadoras costumam ter um preço mais alto.

- Embora esforços estejam sendo feitos para reduzir custos e expandir o acesso, o peso financeiro percebido para certas tecnologias de cuidados de suporte ainda pode dificultar a adoção generalizada, especialmente para aqueles que não têm cobertura de seguro abrangente ou apoio governamental.

- Superar esses desafios por meio de estratégias aprimoradas de acesso ao mercado, educação do consumidor sobre os benefícios de longo prazo dos cuidados de suporte e o desenvolvimento de opções de produtos mais acessíveis e de menor custo será vital para o crescimento sustentado do mercado.

Escopo de mercado de produtos de suporte ao câncer da MEA

O mercado é segmentado com base no tipo, indicação, canal de distribuição e aplicação.

- Por tipo:

Com base no tipo, o mercado de produtos de suporte ao câncer MEA é segmentado em Fatores Estimuladores de Colônias de Granulócitos (G-CSFs), Agentes Estimuladores de Eritropoiese (ESAs), Antieméticos, Bifosfonatos, Analgésicos Opioides, Anti-inflamatórios Não Esteroidais (AINEs), Anti-Infecciosos, Anticorpos Monoclonais e Outros. O segmento de Antieméticos domina a maior fatia de receita de mercado de 27,1% em 2024 , impulsionado pela alta prevalência de náuseas e vômitos induzidos por quimioterapia (NVIQ) e seu papel crítico no conforto do paciente e na conclusão do tratamento. Oncologistas frequentemente priorizam o suporte antiemético por seu impacto imediato no bem-estar do paciente e no gerenciamento direto de um efeito colateral comum e angustiante. O mercado também vê forte demanda por tipos de antieméticos devido à sua compatibilidade com vários regimes de quimioterapia e à disponibilidade de diversas formulações que aumentam a adesão do paciente.

Prevê-se que o segmento de Fatores Estimuladores de Colônias de Granulócitos (G-CSFs) apresente uma taxa de crescimento significativa entre 2024 e 2032, impulsionado pela crescente adoção no tratamento da neutropenia induzida por quimioterapia e seu papel fundamental em permitir que os pacientes completem seus ciclos de quimioterapia planejados. Os G-CSFs oferecem suporte vital na prevenção de infecções graves, tornando-os adequados para pacientes em tratamento mielossupressor, e sua integração às diretrizes oncológicas padrão fornece aos profissionais de saúde ferramentas essenciais para o manejo de complicações terapêuticas. A crescente incidência de cânceres que requerem quimioterapia intensiva também contribui para sua crescente popularidade.

- Por Indicação:

Com base na indicação, o mercado de produtos de suporte ao câncer MEA é segmentado em Náuseas e Vômitos Induzidos por Quimioterapia (NVQI), Anemia Induzida por Quimioterapia, Neutropenia Induzida por Quimioterapia, Dor Oncológica, Mucosite Oral e Boca Seca, Metástases Ósseas, Fadiga e Outros. O segmento de Náuseas e Vômitos Induzidos por Quimioterapia (NVQI) deteve a maior participação de mercado na receita em 2024 , impulsionado pela alta incidência e impacto significativo da NQQI na qualidade de vida do paciente e na adesão ao tratamento. O tratamento da NQQI é uma prioridade máxima para o tratamento oncológico, e a ampla disponibilidade de antieméticos eficazes contribui para o domínio deste segmento.

Espera-se que o segmento de Neutropenia Induzida por Quimioterapia apresente um crescimento significativo de 6,4% entre 2025 e 2032, impulsionado por sua importância crucial na prevenção de infecções potencialmente fatais em pacientes com câncer imunocomprometidos e por sua ligação direta com a conclusão dos ciclos de quimioterapia. O manejo proativo da neutropenia é uma prática padrão em oncologia, tornando os G-CSFs e produtos relacionados altamente procurados.

- Por canal de distribuição:

Com base no canal de distribuição, o mercado de produtos de suporte para câncer na região MEA é segmentado em Farmácias Hospitalares, Farmácias de Varejo, Farmácias de Manipulação e Farmácias Online. O segmento de Farmácias Hospitalares deteve a maior participação de mercado na receita em 2024 , impulsionado pela administração direta de muitos produtos de suporte durante ou imediatamente após os ciclos de quimioterapia em ambientes hospitalares. As farmácias hospitalares atuam como o principal ponto de distribuição de medicamentos oncológicos especializados e cuidados de suporte relacionados.

Espera-se que o segmento de Farmácias de Varejo testemunhe um crescimento significativo entre 2025 e 2032, impulsionado pela crescente mudança para o tratamento ambulatorial do câncer e pela crescente conveniência para os pacientes de acessar medicamentos de suporte mais perto de suas casas. As farmácias de varejo desempenham um papel crucial no fornecimento de soluções contínuas de gerenciamento de sintomas para pacientes fora das consultas hospitalares.

- Por aplicação:

Com base na aplicação, o mercado de produtos de suporte para câncer da MEA é segmentado em Hospitais e Clínicas, Unidades de Assistência Domiciliar, Centros de Especialidades e Outros. O segmento de Hospitais e Clínicas foi responsável pela maior fatia da receita de mercado em 2024 , impulsionado pelo fato de que a maioria dos tratamentos contra o câncer, incluindo quimioterapia e radioterapia, são administrados nessas instalações, exigindo, portanto, acesso imediato a produtos de suporte. Hospitais e clínicas também gerenciam os efeitos colaterais agudos e fornecem monitoramento abrangente dos pacientes.

Espera-se que o segmento de Cuidados Domiciliares apresente o CAGR mais rápido entre 2025 e 2032 , impulsionado pela crescente tendência de cuidados baseados em valor, pela preferência crescente dos pacientes por receber cuidados em suas próprias casas e pelos avanços nos sistemas de administração de medicamentos que permitem a autoadministração de determinados produtos de cuidados de suporte. Os cuidados domiciliares oferecem maior conforto e conveniência para pacientes em tratamentos prolongados.

Análise regional do mercado de produtos de suporte ao câncer da MEA

- A região do Oriente Médio e África (MEA) está vivenciando um crescimento significativo no mercado de produtos de suporte ao câncer , impulsionado pelo aumento da incidência do câncer, pelo aumento dos gastos com assistência médica e pela ênfase crescente na melhoria da qualidade de vida dos pacientes.

- Os profissionais de saúde e os pacientes da região valorizam cada vez mais o gerenciamento abrangente dos efeitos colaterais relacionados ao tratamento e o bem-estar aprimorado oferecido pelos produtos de cuidados de suporte.

- Essa adoção crescente é ainda apoiada pela melhoria da infraestrutura de assistência médica, pela conscientização crescente da importância do tratamento holístico do câncer e pela disponibilidade crescente de serviços especializados de oncologia, estabelecendo produtos de cuidados de suporte como um componente crucial do tratamento do câncer em toda a região do MEA.

Visão do mercado de produtos de suporte ao câncer da MEA

- Visão geral do mercado de produtos de suporte ao câncer na África do Sul

O mercado de produtos de suporte para câncer na África do Sul está apresentando um crescimento substancial, impulsionado pelo aumento da incidência de câncer e pela expansão do acesso a tratamentos oncológicos. Consumidores e profissionais de saúde estão priorizando cada vez mais o gerenciamento eficaz dos efeitos colaterais dos tratamentos por meio de soluções abrangentes de suporte. A crescente preferência por modelos de cuidado centrados no paciente, aliada à crescente conscientização sobre os benefícios dos cuidados de suporte na melhoria dos resultados do tratamento, impulsiona ainda mais a indústria de produtos de suporte. Além disso, o crescente investimento em infraestrutura de saúde e a disponibilidade de uma gama mais ampla de produtos de suporte estão contribuindo significativamente para a expansão do mercado.

- Visão geral do mercado de produtos de suporte ao câncer na Arábia Saudita

O mercado de produtos de suporte para câncer na Arábia Saudita deverá crescer a um CAGR substancial ao longo do período previsto, impulsionado principalmente por investimentos governamentais significativos em saúde, pelo aumento da incidência de câncer e pela crescente demanda por tratamentos médicos avançados. O aumento do número de centros oncológicos especializados, aliado à demanda por cuidados abrangentes ao paciente, está fomentando a adoção de produtos de suporte. Os profissionais de saúde da Arábia Saudita também se sentem atraídos pela eficácia e pelo conforto que esses produtos oferecem ao paciente. A região está vivenciando um crescimento significativo em aplicações hospitalares, clínicas e de assistência domiciliar, com produtos de suporte sendo incorporados tanto a protocolos de tratamento estabelecidos quanto a abordagens emergentes de medicina personalizada.

- Visão geral do mercado de produtos de suporte ao câncer nos Emirados Árabes Unidos

Espera-se que o mercado de produtos de suporte para câncer nos Emirados Árabes Unidos cresça a uma CAGR notável de 6,5% durante o período previsto, impulsionado pela crescente tendência do turismo médico, pela alta renda disponível e pelo desejo por padrões de saúde mais elevados e bem-estar do paciente. Além disso, preocupações com os efeitos colaterais relacionados ao tratamento e o conforto do paciente estão incentivando tanto os profissionais de saúde quanto os pacientes a optarem por soluções abrangentes de suporte. A adoção de tecnologias médicas avançadas pelos Emirados Árabes Unidos, juntamente com sua robusta infraestrutura de saúde e cobertura de seguros, deve continuar a estimular o crescimento do mercado.

- Visão geral do mercado de produtos de suporte ao câncer no Egito

Espera-se que o mercado de produtos de suporte para câncer no Egito cresça a uma CAGR substancial de 5,8% durante o período previsto, impulsionado pela crescente conscientização sobre o câncer e suas complicações associadas ao tratamento, e pela demanda por soluções de suporte acessíveis e de baixo custo. A melhoria da infraestrutura de saúde do Egito, aliada à sua grande população de pacientes, promove a adoção de produtos de suporte, especialmente em hospitais públicos e privados. A integração de cuidados de suporte aos protocolos oncológicos padrão também está se tornando cada vez mais prevalente, com uma forte preferência por soluções custo-efetivas, porém eficazes, alinhadas às prioridades locais de saúde.

- Visão do mercado de produtos de suporte ao câncer em Israel

O mercado israelense de produtos de suporte para câncer está ganhando força, apoiado pela avançada capacidade de pesquisa médica do país, pelo alto padrão de assistência médica e pela demanda por soluções terapêuticas inovadoras. O mercado israelense dá grande ênfase a tratamentos oncológicos de ponta, e a adoção de produtos de suporte é impulsionada pelo crescente número de diagnósticos de câncer e pelo forte foco na qualidade de vida do paciente durante o tratamento. A integração de produtos de suporte com outras tecnologias médicas avançadas e abordagens de medicina personalizada está impulsionando o crescimento. Além disso, o robusto setor farmacêutico israelense e as iniciativas ativas de pesquisa e desenvolvimento provavelmente estimularão a demanda por soluções de suporte inovadoras e aprimoradas, tanto em ambientes hospitalares quanto ambulatoriais.

Participação no mercado de produtos de suporte ao câncer da MEA

O setor de produtos de suporte ao câncer na região MEA é liderado principalmente por empresas farmacêuticas globais bem estabelecidas, com forte presença em oncologia e foco crescente na região MEA. Entre elas, destacam-se:

- Amgen Inc. (EUA)

- Novartis AG (Suíça)

- Merck & Co. Inc. (EUA)

- F. Hoffmann-La Roche AG (Suíça)

- Johnson & Johnson (EUA)

- Helsinn Healthcare SA (Suíça)

- Heron Therapeutics (EUA)

- GSK plc (Reino Unido)

- Teva Pharmaceutical Industries Ltd. (Israel)

- Baxter International Inc. (EUA)

- Sanofi (França)

- Sun Pharmaceutical Industries Ltd. (Índia)

Últimos desenvolvimentos no mercado de produtos de suporte ao câncer MEA

- Em outubro de 2024 , a OncoZenge AB anunciou sua intenção de firmar parceria com a Pharmanovia para a comercialização do BupiZenge na Europa, Oriente Médio e Norte da África (a "região EMENA"). O acordo visa tratar a dor da mucosite oral, um efeito colateral comum e debilitante dos tratamentos contra o câncer, destacando o compromisso com a melhoria da qualidade de vida dos pacientes na região.

- Em maio de 2024, o Barkat Pharmaceutical Group, por meio de sua subsidiária Sobhan Oncology, introduziu cinco novos medicamentos anticâncer e antifúngicos, ajudando a atender à demanda interna e a expandir as exportações, marcando-os como o primeiro fabricante de medicamentos oncológicos na região do Oriente Médio.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Índice

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST AND AFRICA CANCER SUPPORTIVE CARE PRODUCTS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 DRUG TYPE LIFELINE CURVE

2.8 DBMR MARKET POSITION GRID

2.9 VENDOR SHARE ANALYSIS

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 EGULATORY

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 GROWING CANCER BURDEN WORLDWIDE

5.1.2 INCREASING INITIATIVES BY GOVERNMENT AND OTHER HEALTHCARE ORGANIZATIONS

5.1.3 GROWING GERIATRIC POPULATION

5.1.4 RISING NUMBER OF PRODUCT APPROVAL

5.1.5 RISING EXPENDITURE ON HEALTHCARE

5.2 RESTRAINTS

5.2.1 ADVERSE EFFECTS AND RISKS ASSOCIATED WITH CANCER SUPPORTIVE DRUGS

5.2.2 LACK OF EARLY DETECTION

5.3 OPPORTUNITIES

5.3.1 ACQUISITION AND AGREEMENT BY MAJOR PLAYERS

5.3.2 RISING PRODUCT LAUNCHES

5.3.3 GROWING R&D ACTIVITIES

5.4 CHALLENGES

5.4.1 STRINGENT REGULATION POLICY

5.4.2 PATENT EXPIRY OF DRUGS

6 COVID-19 IMPACT ON MIDDLE EAST AND AFRICA CANCER SUPPORTIVE CARE PRODUCTS MARKET

6.1 PRICE IMPACT

6.2 IMPACT ON SUPPLY CHAIN

6.3 IMPACT ON DEMAND

6.4 STRATEGIC DECISIONS FOR MANUFACTURERS

6.5 CONCLUSION

7 MIDDLE EAST AND AFRICA CANCER SUPPORTIVE CARE PRODUCTS MARKET, BY DRUG TYPE

7.1 OVERVIEW

7.2 GRANULOCYTE COLONY STIMULATING FACTOR (GCSFS)

7.2.1 LONG ACTING FILGRASTIM

7.2.2 FILGRASTIM

7.2.3 LENOGRASTIM

7.3 ERYTHROPOIETIN STIMULATING AGENTS (ESA’S)

7.3.1 EPO-Α/Β

7.3.2 DPO

7.3.3 CERA

7.3.4 EPO-Κ

7.4 OPIOID ANALGESICS

7.4.1 FENTANYL

7.4.2 METHADONE

7.4.3 TRAMADOL

7.4.4 OTHERS

7.5 MONOCLONAL ANTIBODIES

7.6 NONSTEROIDAL ANTI-INFLAMMATORY DRUGS (NSAIDS)

7.6.1 OTC NSAIDS

7.6.1.1 ASPIRIN

7.6.1.2 IBUPROFEN

7.6.1.3 NAPROXEN SODIUM

7.6.2 PRESCRIPTION NSAIDS

7.6.2.1 CELECOXIB

7.6.2.2 DICLOFENAC

7.6.2.3 INDOMETHACIN

7.6.2.4 KETOROLAC

7.6.2.5 MELOXICAM

7.6.2.6 NABUMETONE

7.6.2.7 NAPROXEN

7.6.2.8 OXAPROZIN

7.6.2.9 PIROXICAM

7.6.2.10 SULINDAC

7.6.2.11 OTHERS

7.7 BISPHOSPHONATES

7.7.1 ZOLEDRONIC ACID OR ZOLEDRONATE

7.7.2 DISODIUM PAMIDRONATE

7.7.3 IBANDRONIC ACID OR IBANDRONATE

7.7.4 SODIUM CLODRONATE

7.8 ANTI-EMETICS

7.8.1 APREPITANT

7.8.2 DEXAMETHASONE

7.8.3 DOLASETRON

7.8.4 GRANISETRON

7.8.5 ONDANSETRON

7.8.6 PALONOSETRON

7.8.7 PROCHLORPERAZINE

7.8.8 ROLAPITANT

7.8.9 OTHERS

7.9 ANTIHISTAMINES

7.9.1 HYDROXYZINE

7.9.2 DIPHENHYDRAMINE

7.9.3 OTHERS

7.1 OTHERS

8 MIDDLE EAST AND AFRICA CANCER SUPPORTIVE CARE PRODUCTS MARKET, BY TYPE

8.1 OVERVIEW

8.2 BRANDED

8.2.1 NEULASTA

8.2.2 ARANESP

8.2.3 PROLIA

8.2.4 XGEVA

8.2.5 EPOGEN

8.2.6 EPREX

8.2.7 NEUPOGEN

8.2.8 OTHERS

8.3 GENERICS

9 MIDDLE EAST AND AFRICA CANCER SUPPORTIVE CARE PRODUCTS MARKET, BY CANCER TYPE

9.1 OVERVIEW

9.2 LUNG CANCER

9.3 BREAST CANCER

9.4 PROSTATE CANCER

9.5 LIVER CANCER

9.6 BLADDER CANCER

9.7 LEUKAEMIA

9.8 MELANOMA

9.9 OVARIAN CANCER

9.1 OTHER CANCERS

10 MIDDLE EAST AND AFRICA CANCER SUPPORTIVE CARE PRODUCTS MARKET, BY END USER

10.1 OVERVIEW

10.2 HOSPITALS

10.2.1 ACUTE CARE HOSPITALS

10.2.2 LONG-TERM CARE HOSPITALS

10.2.3 NURSING FACILITIES

10.3 CLINICS

10.4 HOSPITALS & ACADEMIC INSTITUTIONS

10.5 OTHERS

11 MIDDLE EAST AND AFRICA CANCER SUPPORTIVE CARE PRODUCTS MARKET, BY DISTRIBUTION CHANNEL

11.1 OVERVIEW

11.2 HOSPITAL PHARMACIES

11.3 RETAIL PHARMACIES

11.4 COMPOUNDING PHARMACIES

12 MIDDLE EAST AND AFRICA CANCER SUPPORTIVE CARE PRODUCTS MARKET, BY GEOGRAPHY

12.1 MIDDLE EAST & AFRICA

12.1.1 SOUTH AFRICA

12.1.2 SAUDI ARABIA

12.1.3 UAE

12.1.4 ISRAEL

12.1.5 EGYPT

12.1.6 REST OF MIDDLE EAST AND AFRICA

13 MIDDLE EAST AND AFRICA CANCER SUPPORTIVE CARE PRODUCTS MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: MIDDLE EAST AND AFRICA

14 SWOT

15 COMPANY PROFILES

15.1 AMGEN INC.

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENTS

15.2 PFIZER INC.

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENTS

15.3 JANSSEN PHARMACEUTICALS, INC. (A SUBSIDIARY OF JOHNSON & JOHNSON SERVICES, INC.)

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 COMPANY SHARE ANALYSIS

15.3.4 PRODUCT PORTFOLIO

15.3.5 RECENT DEVELOPMENTS

15.4 NOVARTIS AG

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 COMPANY SHARE ANALYSIS

15.4.4 PRODUCT PORTFOLIO

15.4.5 RECENT DEVELOPMENTS

15.5 ACACIA PHARMA GROUP PLC

15.5.1 COMPANY SNAPSHOT

15.5.2 PRODUCT PORTFOLIO

15.5.3 RECENT DEVELOPMENTS

15.6 ACROTECH BIOPHARMA

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT DEVELOPMENT

15.7 APR

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT DEVELOPMENTS

15.8 BAXTER

15.8.1 COMPANY SNAPSHOT

15.8.2 REVENUE ANALYSIS

15.8.3 PRODUCT PORTFOLIO

15.8.4 RECENT DEVELOPMENT

15.9 BAYER AG

15.9.1 COMPANY SNAPSHOT

15.9.2 REVENUE ANALYSIS

15.9.3 PRODUCT PORTFOLIO

15.9.4 RECENT DEVELOPMENTS

15.1 F. HOFFMANN-LA ROCHE LTD

15.10.1 COMPANY SNAPSHOT

15.10.2 REVENUE ANALYSIS

15.10.3 PRODUCT PORTFOLIO

15.10.4 RECENT DEVELOPMENTS

15.11 HELSINN HEALTHCARE SA

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENTS

15.12 HERON THERAPEUTICS, INC.

15.12.1 COMPANY SNAPSHOT

15.12.2 REVENUE ANALYSIS

15.12.3 PRODUCT PORTFOLIO

15.12.4 RECENT DEVELOPMENTS

15.13 KYOWA KIRIN CO., LTD.

15.13.1 COMPANY SNAPSHOT

15.13.2 REVENUE ANALYSIS

15.13.3 PRODUCT PORTFOLIO

15.13.4 RECENT DEVELOPMENTS

15.14 MERCK SHARP & DOHME CORP. (A SUBSIDIARY OF MERCK & CO., INC.)

15.14.1 COMPANY SNAPSHOT

15.14.2 REVENUE ANALYSIS

15.14.3 PRODUCT PORTFOLIO

15.14.4 RECENT DEVELOPMENTS

15.15 MYLAN N.V.

15.15.1 COMPANY SNAPSHOT

15.15.2 REVENUE ANALYSIS

15.15.3 PRODUCT PORTFOLIO

15.15.4 RECENT DEVELOPMENTS

15.16 OXFORD PHARMASCIENCE LTD

15.16.1 COMPANY SNAPSHOT

15.16.2 TECHNOLOGY PORTFOLIO

15.16.3 RECENT DEVELOPMENT

15.17 SPECTRUM PHARMACEUTICALS, INC.

15.17.1 COMPANY SNAPSHOT

15.17.2 REVENUE ANALYSIS

15.17.3 PRODUCT PORTFOLIO

15.17.4 RECENT DEVELOPMENT

15.18 SUN PHARMACEUTICAL INDUSTRIES LTD.

15.18.1 COMPANY SNAPSHOT

15.18.2 REVENUE ANALYSIS

15.18.3 PRODUCT PORTFOLIO

15.18.4 RECENT DEVELOPMENTS

15.19 TERSERA THERAPEUTICS LLC

15.19.1 COMPANY SNAPSHOT

15.19.2 PRODUCT PORTFOLIO

15.19.3 RECENT DEVELOPMENT

15.2 TEVA PHARMACEUTICALS USA, INC. (A SUBSIDIARY OF TEVA PHARMACEUTICAL INDUSTRIES LTD.)

15.20.1 COMPANY SNAPSHOT

15.20.2 REVENUE ANALYSIS

15.20.3 PRODUCT PORTFOLIO

15.20.4 RECENT DEVELOPMENTS

16 QUESTIONNAIRE

17 RELATED REPORTS

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.