Middle East And Africa Bioactive Ingredient Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

3.55 Billion

USD

6.01 Billion

2025

2033

USD

3.55 Billion

USD

6.01 Billion

2025

2033

| 2026 –2033 | |

| USD 3.55 Billion | |

| USD 6.01 Billion | |

|

|

|

|

O mercado de ingredientes bioativos do Médio Oriente e África está segmentado por tipo de ingrediente (prebióticos, probióticos, aminoácidos, peptídeos, ómega 3 e lípidos estruturados, fitoquímicos e extratos vegetais, minerais, vitaminas, fibras e hidratos de carbono especiais, carotenoides e antioxidantes e outros). Aplicação (Alimentos Funcionais, Suplementos Alimentares, Suplementos de Gomas, Nutrição Animal, Cuidados Pessoais e Outros) e Fonte (Planta, Animal e Microbiana), Por País (Emirados Árabes Unidos, Arábia Saudita, Qatar, Kuwait, África do Sul , Resto do Médio Oriente e África) ), tendências e previsões da indústria até 2028

Análise de Mercado e Insights: Mercado de Ingredientes Bioativos do Médio Oriente e África

Análise de Mercado e Insights: Mercado de Ingredientes Bioativos do Médio Oriente e África

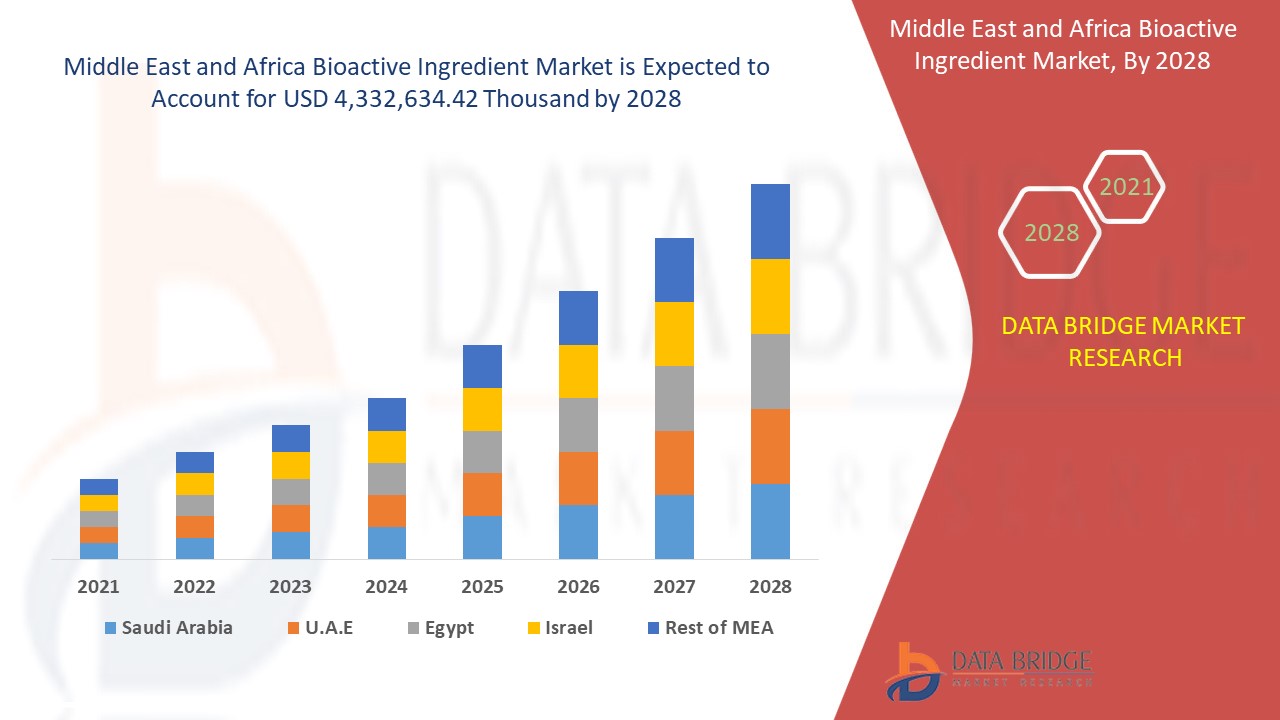

Espera-se que o mercado de ingredientes bioativos ganhe crescimento de mercado no período previsto de 2021 a 2028. A Data Bridge Market Research analisa que o mercado está a crescer a um CAGR de 6,8% no período previsto de 2021 a 2028 e deverá atingir 4.332.634,42 milhares de dólares até 2028.

Os ingredientes bioativos são substâncias que têm um efeito biológico nos organismos vivos. Os componentes provêm de diversas fontes, incluindo plantas, alimentos, animais, mar e microrganismos. As substâncias bioativas são adicionadas aos alimentos e rações para melhorar a saúde física e fisiológica dos clientes. Os alimentos e bebidas funcionais, os suplementos nutricionais e a nutrição para recém-nascidos fazem um uso extensivo de substâncias bioativas. Estes produtos químicos podem ajudar a prevenir o cancro, doenças cardíacas e outras enfermidades.

As substâncias bioativas são amplamente utilizadas em diversos setores, incluindo alimentos e bebidas, medicamentos e nutracêuticos, artigos de higiene pessoal e rações para animais. Os carotenoides, os óleos essenciais e os antioxidantes são exemplos de substâncias bioativas utilizadas em alimentos funcionais para melhorar as suas qualidades sensoriais e nutricionais. São um tipo de biomolécula que auxilia no processo metabólico de moléculas saudáveis adicionadas aos alimentos e a diferentes tipos de produtos.

Este relatório de mercado de ingredientes bioativos fornece detalhes sobre a quota de mercado, novos desenvolvimentos e análise de pipeline de produtos, impacto dos participantes do mercado nacional e localizado, analisa as oportunidades em termos de bolsas de receitas emergentes, alterações nas regulamentações de mercado, aprovações de produtos, decisões estratégicas, lançamentos de produtos, expansões geográficas e inovações tecnológicas no mercado. Para compreender a análise e o cenário de mercado, contacte-nos para um Briefing de Analista.

Âmbito e dimensão do mercado de ingredientes bioativos do Médio Oriente e África

Âmbito e dimensão do mercado de ingredientes bioativos do Médio Oriente e África

O mercado de ingredientes bioativos do Médio Oriente e África está categorizado em três segmentos notáveis, que se baseiam no tipo de ingrediente, aplicação e fonte. O crescimento entre segmentos ajuda-o a analisar os nichos de crescimento e as estratégias para abordar o mercado e determinar as suas principais áreas de aplicação e a diferença nos seus mercados-alvo.

- Com base no tipo de ingrediente, o mercado global de ingredientes bioativos está segmentado em prebióticos, probióticos, aminoácidos, peptídeos, ómega 3 e lípidos estruturados, fitoquímicos e extratos vegetais, minerais, vitaminas , fibras e hidratos de carbono especiais, carotenoides e antioxidantes, entre outros . O prebiótico é ainda segmentado em frutanos, galacto-oligossacarídeos, amido e oligossacarídeos derivados da glicose, oligossacarídeos não hidratos de carbono e outros. Os probióticos são ainda segmentados em lactobacilos, bifidobactérias e leveduras. O aminoácido é ainda segmentado em isoleucina, histidina, leucina, lisina, metionina, fenilalanina, treonina, triptofano, valina e outros. Os péptidos são ainda segmentados em dipéptidos, tripéptidos, oligopéptidos e polipéptidos. Os minerais são ainda segmentados em cálcio, fósforo, magnésio, sódio , potássio, manganês, ferro, cobre, iodo, zinco e outros. As vitaminas estão segmentadas em vitamina A, vitamina C, vitamina D, vitamina E, vitamina K, vitamina B1, vitamina B2, vitamina B3, vitamina B6, vitamina B12 e outras.

- Com base na aplicação, o mercado global de ingredientes bioativos está segmentado em alimentos funcionais, suplementos alimentares, suplementos de goma, nutrição animal, cuidados pessoais e outros. Os alimentos funcionais são ainda segmentados em produtos lácteos, alternativas aos produtos lácteos, pão, massas, cereais, produtos à base de ovos, barras de snacks, barras e bebidas. Os laticínios subdividem-se em leite, iogurte, queijo, manteiga e outros. As alternativas lácteas subdividem-se em leite vegetal, iogurte vegetal, ingredientes bioativos e outros. As barras subdividem-se em barras de proteína, barras de nutrição desportiva, barras de ioga, barras pré-treino, barras pós-treino e outras. As bebidas subdividem-se em sumos e vitaminas. A nutrição animal está ainda segmentada por categoria animal em carne de bovino, aves, marisco e carne de porco. Os cuidados pessoais são ainda segmentados em cuidados capilares e cuidados com a pele.

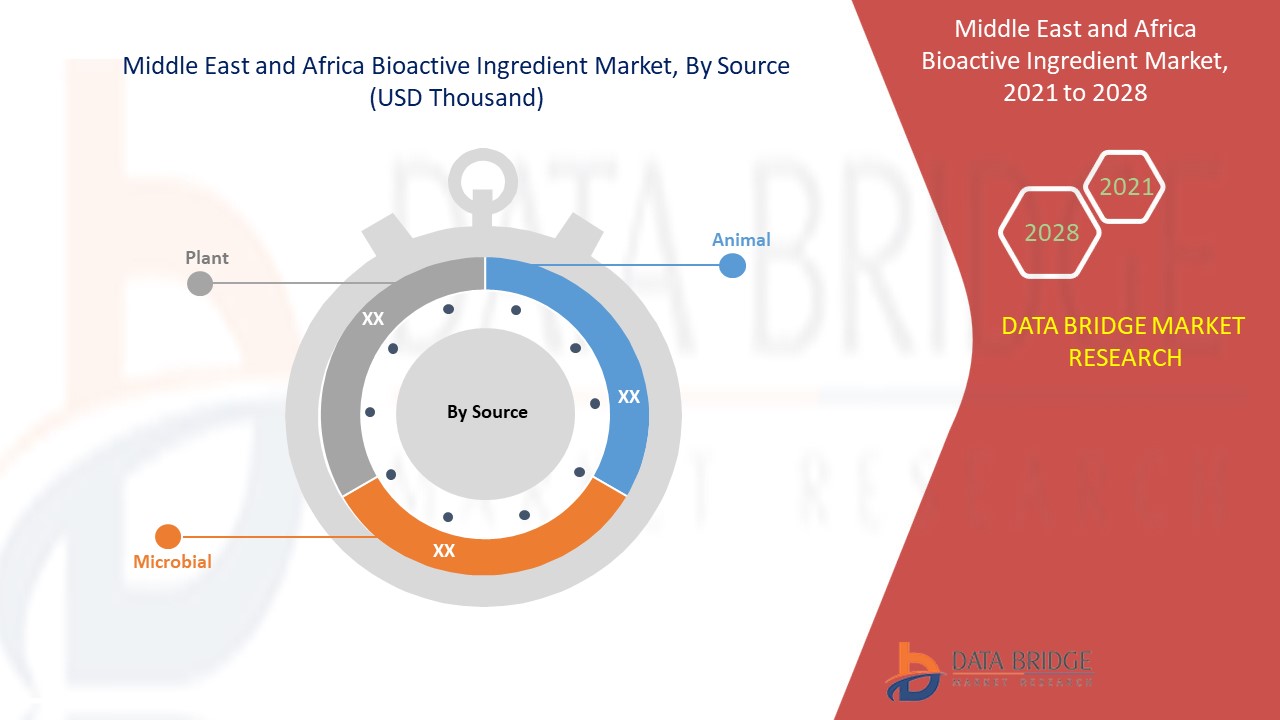

- Com base na origem, o mercado global de ingredientes bioativos está segmentado em vegetais, animais e microbianos.

Análise ao nível do país do mercado de ingredientes bioativos

O mercado do Médio Oriente e África é analisado e a informação sobre o tamanho do mercado é fornecida por Ingrediente, Aplicações, Fonte. Os países abrangidos pelo relatório de mercado de ingredientes bioativos do Médio Oriente e África são os Emirados Árabes Unidos, a Arábia Saudita, o Qatar, o Kuwait e a África do Sul.

A secção do relatório sobre os países também fornece fatores individuais que impactam o mercado e alterações na regulamentação do mercado nacional que impactam as tendências atuais e futuras do mercado. Pontos de dados como novas vendas, vendas de reposição, demografia do país, atos regulamentares e tarifas de importação e exportação são alguns dos principais indicadores utilizados para prever o cenário de mercado para países individuais. Além disso, a presença e a disponibilidade das marcas e os desafios enfrentados devido à grande ou escassa concorrência das marcas locais e nacionais, bem como o impacto dos canais de vendas, são considerados ao fornecer uma análise de previsão dos dados do país.

Crescimento na indústria de ingredientes bioativos

O mercado de ingredientes bioativos do Médio Oriente e África também fornece uma análise detalhada do mercado para o crescimento de cada país na base instalada de diferentes tipos de produtos para o mercado de ingredientes bioativos, impacto da tecnologia utilizando curvas de linha de vida e mudanças nos cenários regulatórios das fórmulas infantis e o seu impacto no Mercado de ingredientes bioativos. Os dados estão disponíveis para o período histórico de 2010 a 2019.

Análise do cenário competitivo e da quota de mercado dos ingredientes bioativos

O panorama competitivo do mercado de ingredientes bioativos no Médio Oriente e em África fornece detalhes por concorrente. Os detalhes incluídos são a visão geral da empresa, finanças da empresa, receitas geradas, potencial de mercado, investimento em investigação e desenvolvimento, novas iniciativas de mercado, presença global, localizações e instalações de produção, pontos fortes e fracos da empresa, lançamento de produtos , pipelines de ensaios clínicos, análise de marca, aprovações de produtos , patentes, largura e extensão do produto, domínio da aplicação, curva de vida da tecnologia. Os pontos de dados fornecidos acima estão apenas relacionados com o foco da empresa no mercado de bioativos do Médio Oriente e África.

Os principais participantes do mercado envolvidos no mercado global de ingredientes bioativos são a DSM, BASF SE, Kerry, DuPont, ADM, Global Bio-chem Technology Group Company Limited, Evonik Industries AG, Cargill, Incorporated, Arla Food Ingredients Group P/S (uma subsidiária da Arla Foods amba), FMC Corporation, Sunrise Nutrachem Group, Adisseo (uma subsidiária da Bluestar Adisseo Co., Ltd.), Chr.Hansen Holding A/S, Sabinsa, Ajinomoto Co., Inc, NOVUS INTERNATIONAL (uma subsidiária da Mitsui & Co. (EUA), Inc.), Ingredion, Roquette Frères, Probi e Advanced Animal Nutrition Pty Ltd. entre outros

Por exemplo,

- Em janeiro de 2021, a DuPont Nutrition & Biosciences lançou um novo produto, o HOWARD Calm, um probiótico que visa ajudar os produtores de suplementos alimentares a quebrar o ciclo de stress do cliente. A implementação foi realizada para responder à crescente procura dos clientes do mercado.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.