Middle East And Africa Barrier Films Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

150.49 Billion

USD

4.38 Billion

2024

2032

USD

150.49 Billion

USD

4.38 Billion

2024

2032

| 2025 –2032 | |

| USD 150.49 Billion | |

| USD 4.38 Billion | |

|

|

|

|

Mercado de filmes de barreira do Oriente Médio e África, por tipo (filmes de barreira metalizados, filmes de barreira transparentes e filmes de barreira brancos), tipo de material (polietileno teraftalato (PET), polietileno (PE), polipropileno (PP), poliamidas (PA), etileno vinil álcool (EVOH), polietileno linear de baixa densidade (LLDPE) e outros), camada (múltiplas camadas e camadas únicas), aplicação (alimentos e bebidas, farmacêutica, eletrônica, agricultura e outros) - tendências do setor e previsão até 2032

Tamanho do mercado de filmes de barreira

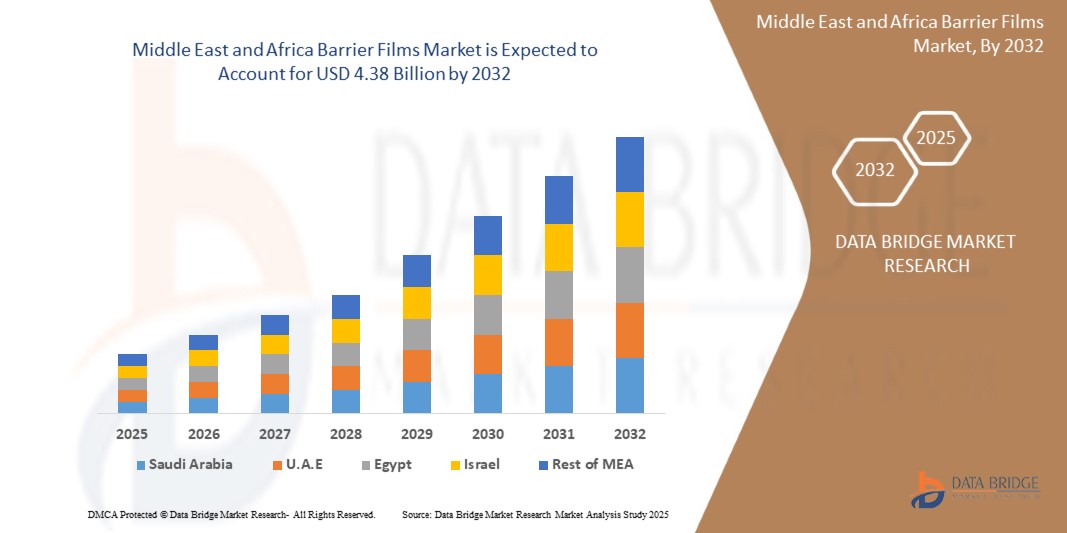

- O mercado de filmes de barreira do Oriente Médio e da África foi avaliado em US$ 3,23 bilhões em 2024 e deve atingir US$ 4,38 bilhões até 2032 , com um CAGR de 3,9% de 2025 a 2032.

- O crescimento do mercado é impulsionado principalmente pela crescente demanda por soluções de embalagens sustentáveis e recicláveis.

- Este crescimento é impulsionado por fatores como a crescente demanda por embalagens com prazo de validade estendido em alimentos e produtos farmacêuticos e o crescimento da indústria farmacêutica, e a necessidade de embalagens resistentes à umidade e ao oxigênio estão alimentando a demanda por filmes de barreira de alto desempenho.

Análise de Mercado de Filmes de Barreira

- O mercado de filmes de barreira é impulsionado pela crescente demanda por maior prazo de validade, segurança alimentar e integridade de produtos em alimentos embalados, produtos farmacêuticos e aplicações industriais. Consumidores e marcas buscam soluções de embalagem leves, duráveis e com alta barreira para minimizar a deterioração e o desperdício.

- Embora materiais biodegradáveis e recicláveis estejam ganhando atenção por questões de sustentabilidade, os filmes de barreira metalizados continuam dominantes devido às suas excelentes propriedades de barreira contra oxigênio, umidade e luz, principalmente em salgadinhos, embalagens de laticínios e produtos farmacêuticos.

- Espera-se que o segmento de filmes de barreira metalizados domine o mercado por tipo, respondendo por aproximadamente 35,1% de participação em 2025, já que os filmes de barreira metalizados são especialmente projetados para preservar vários tipos de produtos para fornecer uma alta barreira contra oxigênio e umidade em termos de garantir maior prazo de validade para produtos sensíveis, o que ajuda a aumentar sua demanda no período previsto.

Escopo do Relatório e Segmentação do Mercado de Filmes de Barreira

|

Atributos |

Principais insights de mercado sobre filmes de barreira |

|

Segmentos abrangidos |

|

|

Países abrangidos |

|

|

Principais participantes do mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor agregado |

Além dos insights sobre cenários de mercado, como valor de mercado, taxa de crescimento, segmentação, cobertura geográfica e principais participantes, os relatórios de mercado selecionados pela Data Bridge Market Research também incluem análise de importação e exportação, visão geral da capacidade de produção, análise de consumo de produção, análise de tendência de preço, cenário de mudança climática, análise da cadeia de suprimentos, análise da cadeia de valor, visão geral de matéria-prima/consumíveis, critérios de seleção de fornecedores, análise PESTLE, análise de Porter e estrutura regulatória. |

Tendências do mercado de filmes de barreira

“Mudança em direção a filmes de barreira sustentáveis e recicláveis em resposta às preocupações ambientais”

- Uma tendência significativa no mercado de filmes de barreira no Oriente Médio e na África é a crescente demanda por soluções de embalagens sustentáveis e recicláveis. Essa mudança é impulsionada pela crescente conscientização ambiental entre os consumidores e por regulamentações rigorosas que visam reduzir o desperdício de plástico.

- Os fabricantes estão inovando ao desenvolver filmes de barreira que incorporam materiais biodegradáveis e são projetados para reciclagem, alinhados aos princípios de uma economia circular.

- A adoção de filmes de alta barreira feitos de recursos sustentáveis está ganhando força, principalmente na indústria de alimentos e bebidas, onde preservar o frescor do produto e minimizar o impacto ambiental é crucial.

- Por exemplo, um relatório da Smithers destaca que a indústria de embalagens está se concentrando cada vez mais em filmes multicamadas sustentáveis, que podem ser projetados para incorporar conteúdo reciclado e serem mais facilmente recicláveis.

Dinâmica do mercado de filmes de barreira

Motorista

“Crescente demanda por embalagens com maior prazo de validade em alimentos e produtos farmacêuticos”

- Um fator-chave para o mercado de películas de barreira no Oriente Médio e na África é a crescente necessidade de embalagens que garantam maior prazo de validade, especialmente nas indústrias alimentícia e farmacêutica. As películas de barreira ajudam a proteger o conteúdo da umidade, oxigênio, luz e outros fatores externos que comprometem a qualidade do produto.

- A crescente preferência do consumidor por refeições prontas para consumo, alimentos processados e formatos de embalagens individuais está levando os fabricantes a adotar materiais de alta barreira que evitam contaminação e deterioração.

- No setor farmacêutico, requisitos regulatórios rigorosos para segurança e estabilidade de produtos estão estimulando o uso generalizado de filmes de barreira em embalagens blister, sachês e bolsas flexíveis.

Por exemplo,

- A Amcor lançou seu filme de alta barreira "AmLite Ultra Recyclable" para embalagens de produtos farmacêuticos e alimentos em 2023, oferecendo proteção do produto e reciclabilidade para atender às demandas de sustentabilidade e segurança.

- À medida que a demanda por maior prazo de validade, proteção de produtos e embalagens sustentáveis se intensifica em todos os setores, o mercado de filmes de barreira está pronto para um crescimento robusto, especialmente nos setores de alimentos, produtos farmacêuticos e cuidados pessoais.

Oportunidade

“Desenvolvimento de Filmes de Barreira Recicláveis e de Base Biológica para Atender aos Objetivos da Economia Circular”

- A mudança para modelos de economia circular está levando os fabricantes de embalagens a desenvolver filmes de barreira recicláveis, biodegradáveis e compostáveis que mantêm alto desempenho e reduzem o impacto ambiental.

- As marcas estão buscando alternativas sustentáveis às tradicionais estruturas plásticas multicamadas que são difíceis de reciclar devido às composições de polímeros mistos.

- Avanços em filmes de barreira monomateriais (por exemplo, polietileno reciclável ou polipropileno com revestimentos de barreira) estão criando novas oportunidades em embalagens de alimentos e produtos farmacêuticos.

Por exemplo,

- A UFlex lançou filmes de embalagem de alta barreira com grau PCR, feitos com 90% de conteúdo reciclado pós-consumo, em sua linha "FlexGreen". Esses filmes oferecem propriedades de barreira comparáveis às do plástico virgem e são voltados para embalagens de alimentos e produtos de higiene pessoal.

- À medida que a demanda por embalagens ecológicas e recicláveis aumenta, o mercado de filmes de barreira está pronto para se beneficiar da rápida inovação de materiais e do suporte regulatório, especialmente nos setores de alimentos, farmacêutico e comércio eletrônico.

Restrição/Desafio

“A Reciclagem Complexa e o Alto Custo das Estruturas de Barreira Multicamadas Restringem a Escalabilidade do Mercado”

- Os filmes de barreira geralmente são feitos de laminados multicamadas que combinam polímeros como PET, PE, EVOH e alumínio, o que torna a reciclagem extremamente difícil com a infraestrutura atual.

- A incompatibilidade de filmes multicamadas com fluxos de reciclagem padrão limita sua circularidade, atraindo escrutínio regulatório e aumentando os custos de conformidade para empresas de embalagens.

- Os altos custos de produção e a necessidade de maquinário especializado para fabricar filmes de alta barreira também dificultam a adoção generalizada, principalmente entre fabricantes de pequeno e médio porte.

- À medida que os desafios de reciclabilidade e as barreiras de custo persistem, os fabricantes do mercado de filmes de barreira enfrentam uma pressão crescente para inovar ou mudar para alternativas monomateriais mais simples para se alinhar às metas de sustentabilidade em evolução.

Escopo de mercado de filmes de barreira

O mercado é segmentado com base no tipo, tipo de material, camada e aplicação.

|

Segmentação |

Sub-segmentação |

|

Por tipo |

|

|

Por tipo de material |

|

|

Por camada |

|

|

Por aplicação |

|

Em 2025, o segmento de Alimentos e Bebidas deverá dominar o mercado com a maior participação no segmento de aplicações

Espera-se que o segmento de alimentos e bebidas domine o mercado de filmes de barreira do Oriente Médio e da África com a maior participação de aproximadamente 47,8% em 2025. Esse crescimento é impulsionado pela crescente demanda por alimentos embalados e processados com prazo de validade prolongado, bem como pela necessidade de proteção contra umidade, oxigênio e aroma em salgadinhos, laticínios e refeições prontas para consumo.

Em 2025, espera-se que o segmento de Filmes de Barreira Metalizados seja responsável pela maior participação durante o período previsto no segmento de tipos.

Em 2025, espera-se que o segmento de Filmes de Barreira Metalizados domine o mercado por tipo, respondendo por aproximadamente 35,1% da receita. Isso se deve ao seu desempenho superior de barreira contra luz, gás e umidade, além da boa relação custo-benefício e ampla adoção em embalagens flexíveis para alimentos, produtos farmacêuticos e bens de consumo.

Análise regional do mercado de filmes de barreira

“A Arábia Saudita é o país dominante no mercado de filmes de barreira”

- A Arábia Saudita domina o mercado de filmes de barreira do Oriente Médio e da África, respondendo por aproximadamente 27% da participação de mercado da região em 2025. Essa liderança é impulsionada pela forte demanda da indústria de alimentos e bebidas, pela diversificação industrial liderada pelo governo e pela expansão dos setores de embalagens farmacêuticas e agrícolas.

- O crescimento populacional do Reino e a crescente urbanização levaram a um aumento na demanda por alimentos embalados e processados, aumentando a necessidade de filmes de barreira de alto desempenho que ofereçam maior vida útil e resistência à contaminação.

- A iniciativa Visão 2030 da Arábia Saudita está acelerando investimentos em setores não petrolíferos, incluindo processamento de alimentos e embalagens flexíveis, criando novas oportunidades para aplicações de filmes de barreira

- Os fabricantes locais de embalagens estão fazendo parcerias com fornecedores globais de tecnologia para produzir filmes de barreira multicamadas e recicláveis avançados, alinhados às metas de sustentabilidade e aos padrões de segurança alimentar.

“A Arábia Saudita deverá registar a maior taxa de crescimento”

- A Arábia Saudita deverá registrar a maior taxa de crescimento no mercado de filmes de barreira do Oriente Médio e da África, impulsionada pela crescente demanda em setores como embalagens de comércio eletrônico, produtos farmacêuticos e agricultura.

- O governo está a promover activamente embalagens sustentáveis através de reformas políticas, como a rotulagem obrigatória e requisitos de reciclagem para embalagens de plástico, incentivando o desenvolvimento de películas de barreira monomateriais recicláveis.

- O aumento do investimento em infraestrutura de cadeia fria e logística para produtos alimentícios e farmacêuticos está impulsionando a adoção de filmes de barreira à umidade e ao gás

- Os avanços tecnológicos na capacidade de produção local, incluindo tecnologias de coextrusão e revestimento de alta barreira, estão permitindo que os participantes nacionais atendam à crescente demanda com soluções localizadas e econômicas.

Participação de mercado de filmes de barreira

O cenário competitivo do mercado fornece detalhes por concorrente. Os detalhes incluem visão geral da empresa, finanças da empresa, receita gerada, potencial de mercado, investimento em pesquisa e desenvolvimento, novas iniciativas de mercado, presença no Oriente Médio e África, locais e instalações de produção, capacidades de produção, pontos fortes e fracos da empresa, lançamento de produto, abrangência e amplitude do produto e domínio da aplicação. Os pontos de dados fornecidos acima referem-se apenas ao foco das empresas em relação ao mercado.

Os principais líderes de mercado que operam no mercado são:

- Honeywell International Inc (EUA)

- Mitsubishi Chemical Holdings Corporation (Japão)

- Amcor plc (Suíça)

- IMPRESSÃO TOPPAN CO., LTD. (Japão)

- Berry Oriente Médio e África Inc. (EUA)

- GRUPO CLONDALKIN (Holanda)

- Sonoco Products Company (EUA)

- Huhtamaki (Finlândia)

- Dupont Teijin Films US Limited Partnership (EUA)

- Mondi (Reino Unido)

- Fraunhofer-Gesellschaft (Alemanha)

- Klöckner Pentaplast (Alemanha)

- ProAmpac (EUA)

- Glenroy, Inc. (EUA)

- Constantia Flexíveis (Áustria)

- UFlex Limited (Índia)

- WINPAK LTD (Canadá)

Últimos desenvolvimentos no mercado de filmes de barreira no Oriente Médio e na África

- Em maio de 2023, a Amcor assinou um acordo definitivo para adquirir a Moda Systems, um importante fabricante de máquinas avançadas de embalagem automatizada de proteínas

- Em abril de 2023, a Sealed Air e a Koenig & Bauer AG assinaram uma carta de intenções não vinculativa para expandir sua parceria estratégica, com o objetivo de aprimorar o design de embalagens por meio do desenvolvimento de tecnologia, equipamentos e serviços de impressão digital de ponta.

- Em julho de 2021, a Toppan adquiriu o InterFlex Group, um conversor de embalagens flexíveis com cinco unidades de produção nos Estados Unidos e no Reino Unido, oferecendo um amplo portfólio que inclui filmes retráteis impressos, bolsas stand-up, sacolas pré-formadas, papéis revestidos de cera, rolos laminados e de impressão de superfície, e laminações de filmes com e sem barreira, adaptadas para vários mercados de bens de consumo.

- Em setembro de 2024, a Amcor lançou soluções de embalagens recicláveis à base de papel de alta barreira, projetadas para substituir os tradicionais filmes multimateriais. A inovação apoia a sustentabilidade ao simplificar as estruturas dos materiais e incorporar conteúdo renovável e reciclado.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.