Middle East And Africa Automated Guided Vehicles Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

208.70 Million

USD

487.93 Million

2024

2032

USD

208.70 Million

USD

487.93 Million

2024

2032

| 2025 –2032 | |

| USD 208.70 Million | |

| USD 487.93 Million | |

|

|

|

|

Segmentação do mercado de veículos guiados automatizados no Oriente Médio e África, por tipo (veículos de reboque, transportadores de carga unitária, empilhadeiras, transpaleteiras, veículos de linha de montagem e outros), tecnologia de navegação (orientação magnética, orientação a laser, orientação visual, orientação por fita óptica, orientação indutiva e outros), tipo de bateria (chumbo, íon de lítio, à base de níquel e outros), aplicação (movimentação de trabalho em andamento, manuseio de matérias-primas, manuseio de paletes, manuseio de produto final, manuseio de contêineres, manuseio de rolos, carregamento de reboque e outros), indústria (saúde, manufatura, logística, varejo, alimentos e bebidas, papel e impressão, tabaco, produtos químicos e outros) - tendências e previsões da indústria até 2032

Tamanho do mercado de veículos guiados automatizados no Oriente Médio e na África

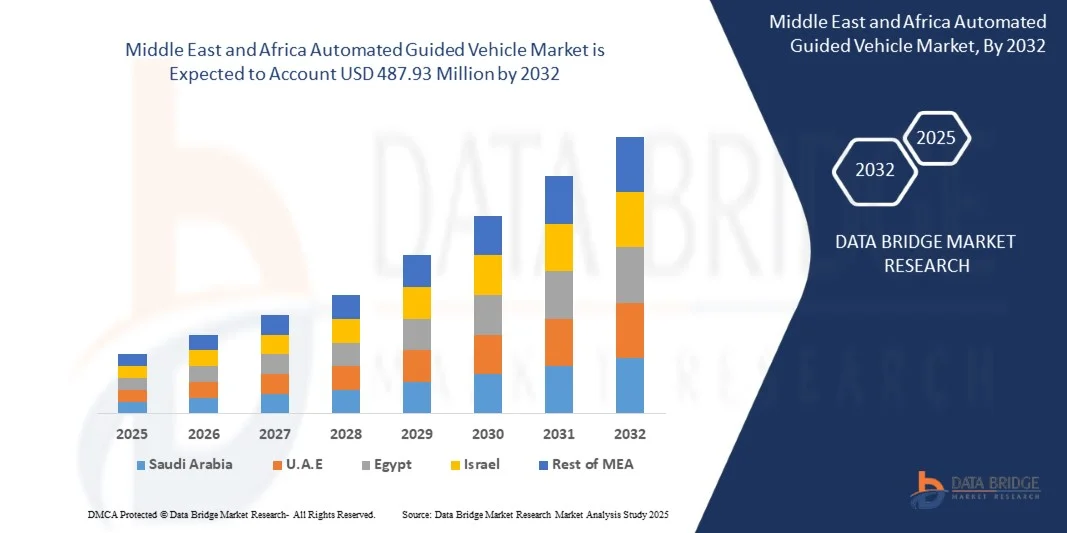

- O tamanho do mercado de veículos guiados automatizados do Oriente Médio e da África foi avaliado em US$ 208,7 milhões em 2024 e deve atingir US$ 487,93 milhões até 2032 , com um CAGR de 11,2% durante o período previsto.

- O crescimento do mercado é amplamente impulsionado pela crescente demanda por automação nos setores de manufatura, logística e armazenagem, impulsionado pela escassez de mão de obra, aumento dos custos trabalhistas e pela busca por eficiência operacional.

- Além disso, a integração de AGVs com tecnologias da Indústria 4.0, como IoT, IA e aprendizado de máquina, está possibilitando sistemas de movimentação de materiais mais inteligentes, flexíveis e baseados em dados. Esses fatores estão acelerando a adoção de AGVs em todos os setores, contribuindo significativamente para a expansão do mercado.

Análise do mercado de veículos guiados automatizados no Oriente Médio e África

- Veículos guiados automaticamente são sistemas de transporte autônomos utilizados para movimentação e manuseio de materiais em armazéns, fábricas e centros de distribuição. Eles contam com tecnologias como orientação a laser, tarjas magnéticas, navegação por visão e roteamento baseado em IA para executar tarefas repetitivas com eficiência e com mínima intervenção humana.

- A crescente implantação de AGVs é impulsionada principalmente pela necessidade de melhorar a eficiência da cadeia de suprimentos, reduzir custos operacionais e minimizar acidentes de trabalho. Além disso, a crescente adoção do comércio eletrônico, juntamente com o aumento das iniciativas de fábricas inteligentes, está alimentando a demanda por soluções de automação escaláveis e inteligentes, como AGVs.

- A África do Sul dominou o mercado de veículos guiados automatizados do Oriente Médio e da África em 2024, devido ao crescimento dos setores automotivo e de manufatura do país, à crescente adoção da automação em operações de logística e à expansão do uso de AGVs para movimentação e armazenagem de materiais.

- Espera-se que os Emirados Árabes Unidos sejam o país com crescimento mais rápido no mercado de veículos guiados automatizados do Oriente Médio e da África durante o período previsto devido a investimentos em larga escala em logística inteligente, automação industrial e desenvolvimento de cidades inteligentes.

- O segmento de veículos rebocadores dominou o mercado, com uma participação de mercado de 39% em 2024, devido à sua comprovada eficiência no transporte de cargas pesadas por longas distâncias dentro de instalações industriais. Sua capacidade de reduzir a dependência de mão de obra e aumentar a segurança operacional os torna a escolha preferencial em ambientes de manufatura e logística. Além disso, os veículos rebocadores oferecem alta adaptabilidade a diferentes layouts de piso e podem ser integrados perfeitamente aos sistemas de gerenciamento de armazéns, fortalecendo ainda mais sua demanda.

Escopo do relatório e segmentação do mercado de veículos guiados automatizados no Oriente Médio e África

|

Atributos |

Principais insights de mercado sobre veículos guiados automatizados |

|

Segmentos abrangidos |

|

|

Países abrangidos |

Oriente Médio e África

|

|

Principais participantes do mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor agregado |

Além de insights de mercado, como valor de mercado, taxa de crescimento, segmentos de mercado, cobertura geográfica, participantes do mercado e cenário de mercado, o relatório de mercado selecionado pela equipe de pesquisa de mercado da Data Bridge inclui análise aprofundada de especialistas, análise de importação/exportação, análise de preços, análise de consumo de produção e análise Pilstle. |

Tendências do mercado de veículos guiados automatizados no Oriente Médio e na África

“Crescente demanda por automação em logística e manufatura”

- O mercado de veículos guiados automatizados (AGV) está experimentando um crescimento substancial devido à crescente necessidade de automação nos setores de logística e manufatura. As empresas estão integrando AGVs para otimizar o manuseio de materiais, reduzir a dependência humana e aumentar a eficiência operacional geral em instalações de produção e armazenamento.

- Por exemplo, a Toyota Material Handling introduziu soluções avançadas de AGV integradas a sistemas de navegação e gestão de frotas baseados em IA para armazéns operados pela Amazon e pela BMW. Esses veículos permitem a movimentação precisa de mercadorias, otimizando a eficiência das rotas e garantindo a segurança no local de trabalho.

- A adoção de AGVs está se acelerando à medida que fábricas e centros de distribuição avançam em direção aos padrões da Indústria 4.0. A tecnologia oferece conectividade perfeita com sistemas de gerenciamento de armazéns (WMS) e softwares de planejamento de recursos empresariais (ERP), proporcionando visibilidade em tempo real das operações e melhorando a precisão do estoque.

- Além disso, setores como o automotivo, de alimentos e bebidas e farmacêutico estão utilizando AGVs para tarefas repetitivas e de transporte de materiais de alto volume. Essa mudança está aumentando a produtividade e reduzindo os riscos associados ao trabalho manual em ambientes de manufatura de alta demanda.

- A crescente tendência do comércio eletrônico e a necessidade de atendimento mais rápido de pedidos também impulsionam a demanda por soluções logísticas automatizadas. AGVs equipados com sensores e sistemas de IA auxiliam na movimentação eficiente de mercadorias em centros de distribuição de grande porte, garantindo economia de custos e maior produtividade.

- De modo geral, a crescente integração de tecnologias de automação em operações industriais e logísticas está posicionando os AGVs como um componente essencial da infraestrutura moderna da cadeia de suprimentos. Essa tendência está remodelando os processos de movimentação de materiais em todo o mundo e impulsionando avanços em sistemas de manufatura flexíveis.

Dinâmica do mercado de veículos guiados automatizados no Oriente Médio e na África

Motorista

“Crescente demanda por eficiência no manuseio de materiais”

- O aumento da automação industrial e a necessidade de um fluxo eficiente de materiais dentro das unidades de produção são fatores-chave que impulsionam a adoção de AGVs. As organizações estão recorrendo a sistemas automatizados para obter produtividade consistente, reduzir riscos operacionais e melhorar a precisão do manuseio em ambientes de produção dinâmicos.

- Por exemplo, a KUKA AG e a Daifuku Co., Ltd. desenvolveram AGVs inteligentes integrados com sensores de precisão e navegação guiada a laser para gerenciar layouts complexos de armazéns de forma eficaz. Sua implantação em fábricas de montagem automotiva reduziu significativamente os tempos de manuseio e minimizou os erros de logística.

- Os AGVs aumentam a eficiência da produção ao permitir a movimentação contínua de materiais entre estações de trabalho sem intervenção humana. Essa consistência operacional reduz o tempo de inatividade e melhora a sincronização entre as operações de fabricação e armazenamento, especialmente em configurações de produção enxutas.

- Além disso, a integração de AGVs com plataformas de monitoramento baseadas em IoT permite que os supervisores acompanhem as métricas de desempenho em tempo real. Essa conectividade auxilia na manutenção preditiva e na tomada de decisões baseada em dados, melhorando a eficiência geral dos equipamentos.

- A mudança para a manufatura digital e armazéns automatizados continua a reforçar a necessidade de movimentação rápida, segura e precisa de materiais. Consequentemente, os AGVs estão se tornando ativos indispensáveis para indústrias que buscam manter a competitividade e a agilidade operacional.

Restrição/Desafio

“Custo de investimento inicial limita taxa de adoção”

- O alto investimento inicial necessário para a implantação de veículos guiados automatizados representa um grande desafio para pequenas e médias empresas (PMEs). Os custos associados a sistemas avançados de navegação, sensores e integração com sistemas de gestão de armazéns existentes podem limitar a alocação orçamentária para projetos de automação.

- Por exemplo, pequenas empresas de logística e operadores de armazéns têm enfrentado dificuldades para adotar sistemas AGV fornecidos por empresas como Swisslog e Jungheinrich AG devido aos altos custos de instalação e personalização. Essas despesas incluem integração de software, mapeamento e treinamento de funcionários, o que atrasa a adoção em larga escala.

- A manutenção e a modernização das frotas de AGVs aumentam ainda mais as despesas operacionais gerais. Componentes complexos e requisitos de manutenção especializados exigem técnicos qualificados, o que pode elevar os custos de serviço para usuários industriais com recursos técnicos limitados.

- Além disso, a integração de AGVs em sistemas de manufatura legados frequentemente exige modificações na infraestrutura, como orientação de piso ou atualizações de conectividade sem fio. Esses ajustes são caros e podem interromper temporariamente os fluxos de trabalho existentes durante as fases de instalação.

- Para garantir uma adoção mais ampla, os fabricantes devem se concentrar no desenvolvimento de plataformas AGV escaláveis e econômicas. Reduzir a complexidade da integração e oferecer soluções de leasing ou modulares será essencial para promover a utilização de AGVs entre setores sensíveis a custos e operadores de pequena escala.

Escopo do mercado de veículos guiados automatizados no Oriente Médio e na África

O mercado é segmentado com base no tipo, tecnologia de navegação, tipo de bateria, aplicação e setor.

• Por tipo

Com base no tipo, o mercado de AGVs é segmentado em veículos de reboque, transportadores de carga unitizada, empilhadeiras, transpaleteiras, veículos de linha de montagem e outros. O segmento de veículos de reboque dominou o mercado com a maior participação na receita, de 39% em 2024, impulsionado por sua comprovada eficiência no transporte de cargas pesadas por longas distâncias dentro de instalações industriais. Sua capacidade de reduzir a dependência de mão de obra e aumentar a segurança operacional os torna a escolha preferencial em ambientes de manufatura e logística. Além disso, os veículos de reboque oferecem alta adaptabilidade a diferentes layouts de piso e podem ser integrados perfeitamente aos sistemas de gerenciamento de armazéns, fortalecendo ainda mais sua demanda.

Prevê-se que o segmento de Transportadores de Carga Unitária (UPC) apresentará o crescimento mais rápido entre 2025 e 2032, impulsionado pela crescente adoção em centros de distribuição de e-commerce e armazéns de grande porte. Sua capacidade de transportar cargas padronizadas com eficiência, reduzindo o tempo de manuseio e minimizando os danos aos produtos, os torna atraentes para empresas que buscam maior produtividade. O design modular e a compatibilidade com sistemas de navegação avançados também contribuem para sua rápida adoção em diversos setores.

• Por Tecnologia de Navegação

Com base na tecnologia de navegação, o mercado de AGVs é segmentado em Guia Magnética, Guia a Laser, Guia por Visão, Guia por Fita Óptica, Guia Indutiva e outros. O segmento de Guia a Laser deteve a maior participação na receita em 2024, devido à sua alta precisão e flexibilidade no planejamento de rotas sem a necessidade de modificações físicas no piso. AGVs guiados a laser são amplamente preferidos para layouts dinâmicos de armazéns e instalações de fabricação onde a adaptabilidade e a segurança são essenciais. Seus sistemas de sensores avançados permitem a detecção de obstáculos em tempo real, aumentando a eficiência operacional e reduzindo o tempo de inatividade.

Espera-se que o segmento de Orientação Visual testemunhe o crescimento mais rápido entre 2025 e 2032, impulsionado pela crescente implementação de sistemas visuais baseados em IA em AGVs. AGVs guiados por visão podem navegar em ambientes complexos de forma autônoma, reconhecer objetos e otimizar caminhos para um manuseio mais rápido de materiais. Sua capacidade de operar em ambientes não estruturados e integrar-se a sistemas de fábrica inteligentes está acelerando a adoção em setores avançados de manufatura e logística.

• Por tipo de bateria

Com base no tipo de bateria, o mercado de AGVs é segmentado em chumbo, íons de lítio, níquel e outros. O segmento de íons de lítio dominou o mercado, com a maior participação na receita em 2024, devido à sua maior vida útil, capacidade de carregamento mais rápida e maior densidade de energia em comparação com as baterias convencionais. As baterias de íons de lítio aumentam a eficiência operacional dos AGVs, reduzindo o tempo de inatividade e os requisitos de manutenção, tornando-os adequados para operações industriais contínuas. Seu design leve também contribui para a economia de energia e melhor manobrabilidade em espaços apertados.

Prevê-se que o segmento de baterias à base de níquel apresentará o crescimento mais rápido entre 2025 e 2032, impulsionado pela crescente demanda por soluções de baterias econômicas e ambientalmente resilientes nos mercados em desenvolvimento. Baterias à base de níquel oferecem desempenho confiável em ambientes de alta temperatura e são preferidas em aplicações onde a segurança e a durabilidade são priorizadas em detrimento da densidade energética. O aumento da automação industrial em economias emergentes está impulsionando a adoção desses tipos de baterias.

• Por aplicação

Com base na aplicação, o mercado de AGVs é segmentado em Movimentação de Trabalho em Processo, Manuseio de Matérias-Primas, Manuseio de Paletes, Manuseio de Produto Final, Manuseio de Contêineres, Manuseio de Rolos, Carregamento de Reboques e Outros. O segmento de Manuseio de Paletes obteve a maior participação na receita em 2024, impulsionado por seu papel crítico na otimização das operações de armazém e na otimização do armazenamento e da recuperação de mercadorias. Os AGVs para manuseio de paletes reduzem a necessidade de mão de obra manual, minimizam os danos aos produtos e permitem o rastreamento do estoque em tempo real, vital para setores de alto volume, como varejo e logística.

O segmento de Movimentação de Trabalho em Processo deverá apresentar o crescimento mais rápido entre 2025 e 2032, impulsionado pela adoção de princípios de manufatura inteligente e estruturas da Indústria 4.0. Os AGVs utilizados para movimentar itens em andamento aumentam a eficiência da linha de produção, reduzem gargalos e apoiam estratégias de manufatura just-in-time. Sua integração com sistemas de monitoramento da produção permite coordenação e manutenção preditiva integradas, aumentando a produtividade operacional geral.

• Por indústria

Com base na indústria, o mercado de AGVs é segmentado em Saúde, Manufatura, Logística, Varejo, Alimentos e Bebidas, Papel e Impressão, Tabaco, Química e Outros. O segmento de Manufatura dominou o mercado com a maior participação na receita em 2024, devido à alta demanda por manuseio automatizado de materiais e otimização de processos em linhas de montagem e instalações de produção. Os AGVs na manufatura ajudam a reduzir custos operacionais, melhorar os padrões de segurança e permitir alta produtividade, mantendo a qualidade consistente.

Prevê-se que o segmento de Logística testemunhe o crescimento mais rápido entre 2025 e 2032, impulsionado pela crescente demanda por comércio eletrônico e pela necessidade de operações de armazéns e centros de distribuição mais rápidas e confiáveis. As empresas de logística estão cada vez mais utilizando AGVs para transporte de estoque, carga/descarga e atendimento de pedidos, a fim de cumprir prazos de entrega apertados e aumentar a eficiência da cadeia de suprimentos. Recursos avançados de rastreamento e navegação aceleram ainda mais a adoção neste setor.

Análise regional do mercado de veículos guiados automatizados no Oriente Médio e África

- A África do Sul dominou o mercado de veículos guiados automatizados do Oriente Médio e da África com a maior participação na receita em 2024, impulsionada pelos crescentes setores automotivo e de manufatura do país, pela crescente adoção da automação em operações de logística e pela expansão do uso de AGVs para movimentação e armazenagem de materiais.

- A infraestrutura industrial bem estabelecida do país, o apoio governamental à manufatura inteligente e as parcerias com provedores globais de automação reforçam sua liderança no mercado regional

- A crescente demanda por eficiência operacional, otimização da mão de obra e segurança no local de trabalho continua a acelerar a integração de AGVs em setores-chave. Investimentos contínuos em energia renovável, produção automotiva e iniciativas de transformação digital fortalecem ainda mais a posição dominante da África do Sul.

Visão geral do mercado de veículos guiados automatizados nos Emirados Árabes Unidos, Oriente Médio e África

A projeção é que os Emirados Árabes Unidos registrem o CAGR mais rápido no mercado de veículos guiados automatizados do Oriente Médio e África entre 2025 e 2032, impulsionado por investimentos em larga escala em logística inteligente, automação industrial e desenvolvimento de cidades inteligentes. A crescente ênfase do país em inovação, aliada a iniciativas apoiadas pelo governo que apoiam a transformação digital e a infraestrutura sustentável, está impulsionando a adoção de AGVs em centros logísticos, portos e instalações fabris. Colaborações estratégicas com fornecedores globais de tecnologia de automação e avanços em sistemas de navegação baseados em IA estão aumentando a eficiência e a precisão. O compromisso dos Emirados Árabes Unidos em construir ecossistemas industriais preparados para o futuro os posiciona como o mercado de crescimento mais rápido da região.

Visão do mercado de veículos guiados automatizados na Arábia Saudita, Oriente Médio e África

A Arábia Saudita deverá apresentar um crescimento constante entre 2025 e 2032, apoiado pelas iniciativas da Visão 2030 voltadas à diversificação industrial, automação e modernização logística. A adoção de AGVs está se expandindo em aplicações automotivas, de alimentos e bebidas e de armazenagem para melhorar a produtividade e a segurança. Os crescentes investimentos estrangeiros em automação industrial e o estabelecimento de zonas de manufatura avançada estão impulsionando a expansão do mercado. As colaborações com fabricantes globais de AGVs e a integração de tecnologias inteligentes de movimentação de materiais estão melhorando a eficiência em todas as operações industriais. O foco contínuo da Arábia Saudita em inovação tecnológica e sustentabilidade industrial sustenta sua perspectiva de crescimento de mercado a longo prazo.

Participação no mercado de veículos guiados automatizados no Oriente Médio e na África

O setor de veículos guiados automatizados é liderado principalmente por empresas bem estabelecidas, incluindo:

- Robert Bosch GmbH (Alemanha)

- Hanwha Techwin Co., Ltd. (Coreia do Sul)

- Honeywell International Inc. (EUA)

- Schneider Electric (França)

- Axis Communications AB (Suécia)

- Johnson Controls (Irlanda)

- Hangzhou Hikvision Digital Technology Co., Ltd. (China)

- NetApp (EUA)

- Tecnologia Dahua (China)

- KEDACOM (China)

- Verint Systems Inc. (EUA)

- LTIMindtree Limited (Índia)

- AxxonSoft. (EUA)

- eInfochips (EUA)

- Panasonic Holdings Corporation (Japão)

- Panopto (EUA)

- Vigilância de Backstreet (EUA)

- Eagle Eye Solutions Group Plc. (EUA)

- Arcules, Inc. (EUA)

Últimos desenvolvimentos no mercado de veículos guiados automatizados no Oriente Médio e na África

- Em julho de 2024, a Bastian Solutions, LLC inaugurou seu novo campus corporativo e de fabricação em Noblesville, Indiana. Espera-se que esta unidade consolidada e estrategicamente localizada aumente a eficiência operacional e a capacidade de produção da empresa, fortalecendo sua posição competitiva no mercado de Veículos Guiados Automatizados do Oriente Médio e da África e atendendo à crescente demanda por soluções avançadas de automação em setores-chave.

- Em junho de 2023, a Mitsubishi Logisnext Americas e a Jungheinrich expandem sua parceria, formando a Rocrich AGV Solutions na América do Norte. Esta colaboração alavanca a expertise combinada da Jungheinrich e da Rocla para oferecer uma gama completa de AGVs e empilhadeiras automatizadas, atendendo às diversas necessidades dos clientes, desde aplicações padrão até aplicações especializadas.

- Em agosto de 2022, a Swissport inicia um programa piloto no Aeroporto de Frankfurt, implementando Veículos Guiados Automatizados (AGVs) não tripulados para dispositivos de carga unitária em seu novo centro de carga. Essa iniciativa visa aumentar a eficiência, substituindo o transporte manual de cargas, demonstrando o compromisso da Swissport com soluções inovadoras de logística e manuseio de cargas.

- Em março de 2022, a Third Wave Automation (TWA) e a CLARK Material Handling Company anunciaram uma parceria, revelando planos para o "TWA Reach", uma empilhadeira retrátil automatizada com lançamento previsto para a primavera de 2023. A colaboração integra a tecnologia de automação e os recursos de gerenciamento inteligente de frota da TWA com a empilhadeira retrátil NPX da CLARK, oferecendo soluções avançadas de manuseio autônomo de materiais.

- Em março de 2022, a KNAPP e a Covariant fortaleceram sua colaboração para desenvolver ainda mais soluções robóticas com tecnologia de IA. Com foco em aumentar a eficiência dos armazéns, seus esforços conjuntos se concentram no robô Pick-it-Easy da KNAPP, conhecido por sua versatilidade no manuseio de itens diversos. Esta parceria visa expandir a presença no mercado e avançar a robótica com IA na logística.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.