Mercado de circuitos integrados de aplicação específica (ASIC) do Médio Oriente e África, por tipo de design (totalmente personalizado, semi-personalizado e programável), por tecnologia de programação (RAM estática, EPROM, EEPROM, antifusível e outros), por aplicação ( eletrónica de consumo , Data Center e Informática, TI e Telecomunicações, Médico, Multimédia, Automóvel e Industrial), Por País (Arábia Saudita, Emirados Árabes Unidos, Israel, África do Sul, Egito e Resto do Médio Oriente e África), Tendências de Mercado e Previsão para 2029.

Análise de mercado e insights : mercado de circuitos integrados de aplicação específica (ASIC) no Médio Oriente e África

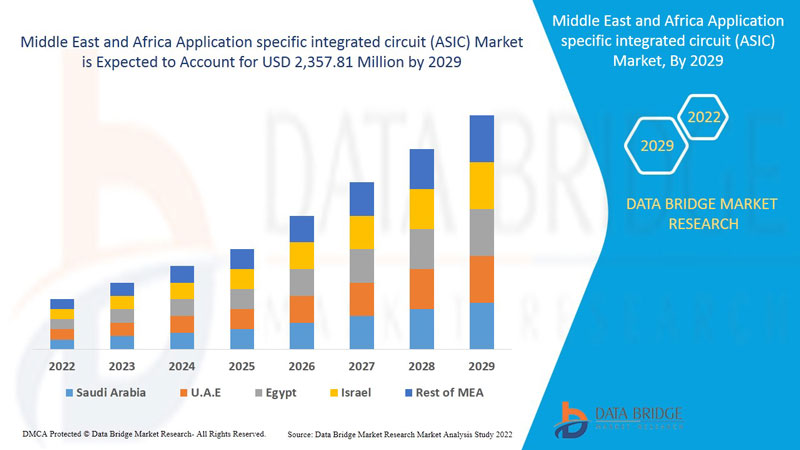

Espera-se que o mercado de circuitos integrados específicos para aplicações (ASIC) do Médio Oriente e África ganhe crescimento de mercado no período previsto de 2022 a 2029. A Data Bridge Market Research analisa que o mercado está a crescer com um CAGR de 6,9 % no período previsto de 2022 a 2029 e deverá atingir os 2.357,81 milhões de dólares até 2029.

Um circuito integrado de aplicação específica (ASIC) é um chip IC que é adaptado para uma aplicação específica, em vez de ser concebido para uma utilização generalizada. Um ASIC é, por exemplo, um chip que funciona num gravador de voz digital ou num codificador de vídeo de alta eficiência (como o AMD VCE). Os chips de produtos standard específicos para aplicações (ASSP) são um meio termo entre os ASIC e os circuitos integrados standard da indústria, como as séries 7400 ou 4000. Tal como os chips de circuito integrado MOS, os chips ASIC são geralmente produzidos através da tecnologia de metal-óxido-semicondutor (MOS), que inclui FPGA. A maior complexidade (e, portanto, utilidade) disponível num ASIC expandiu-se de 5.000 portas lógicas para mais de 100 milhões, à medida que os tamanhos das características diminuíram e as ferramentas de design melhoraram ao longo do tempo. Microprocessadores, blocos de memória como ROM, RAM, EEPROM, memória flash e outros blocos de construção significativos são frequentemente incluídos nos ASIC modernos. SoC é um apelido comum para um ASIC (sistema num chip). Uma linguagem de descrição de hardware (HDL), como o Verilog ou o VHDL, é frequentemente utilizada pelos designers de ASICs digitais para definir o funcionamento dos ASICs.

Alguns dos fatores que estão a impulsionar o mercado são o aparecimento de dispositivos IoT baseados em ASIC e o aumento da adoção de mecatrónica para aplicações automóveis. Mas o elevado custo associado ao fabrico de circuitos personalizados pode ser um fator restritivo. Além disso, o mercado europeu de circuitos integrados de aplicação específica (ASIC) também está a expandir-se devido à crescente utilização de tecnologias ASIC para alimentar IA.

Este relatório de mercado de circuitos integrados de aplicação específica (ASIC) fornece detalhes sobre a quota de mercado, novos desenvolvimentos e análise de pipeline de produtos, impacto dos participantes do mercado doméstico e localizado, analisa as oportunidades em termos de bolsas de receitas emergentes, mudanças nas regulamentações de mercado, aprovações de produtos, estratégias decisões, lançamentos de produtos, expansões geográficas e inovações tecnológicas no mercado. Para compreender a análise e o cenário de mercado, contacte-nos para um Briefing de Analista.

Âmbito e dimensão do mercado de circuitos integrados de aplicação específica (ASIC) no Médio Oriente e África

O mercado de circuitos integrados de aplicação específica (ASIC) do Médio Oriente e de África está segmentado com base no tipo de design, tecnologia de programação e aplicação. O crescimento entre segmentos ajuda-o a analisar os nichos de crescimento e as estratégias para abordar o mercado e determinar as suas principais áreas de aplicação e a diferença nos seus mercados-alvo.

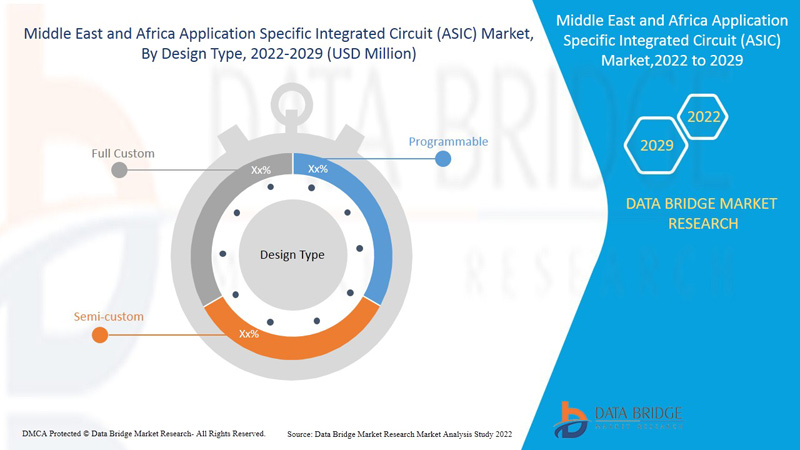

- Com base no tipo de design, o mercado de circuitos integrados específicos para aplicações (ASIC) do Médio Oriente e África foi segmentado em totalmente personalizado, semi-personalizado e programável. Em 2022, prevê-se que o segmento semi-customizado domine o mercado de circuitos integrados específicos para aplicações (ASIC) do Médio Oriente e de África, pois com a crescente procura de data centers avançados para satisfazer a crescente procura de dados, o conteúdo do consumidor é aumentando os requisitos de tecnologias ASIC semi-personalizadas que podem ser utilizadas para diversas aplicações, tais como automóvel, fabrico, médica, multimédia e outras.

- Com base no segmento da tecnologia de programação, o mercado de circuitos integrados específicos para aplicações (ASIC) do Médio Oriente e África foi segmentado em RAM estática, EPROM, EEPROM, antifusível e outros. Em 2022, prevê-se que o segmento da RAM estática domine o mercado de circuitos integrados específicos para aplicações (ASIC) do Médio Oriente e de África devido ao aumento da procura de dispositivos eletrónicos vestíveis inteligentes e à crescente procura de dispositivos de saúde baseados em dados, o que aumentou a procura de estática Tecnologias ASIC RAM, uma vez que estas tecnologias desempenham um papel vital no aperfeiçoamento das capacidades de processamento destes dispositivos eletrónicos, o que pode impulsionar o crescimento do mercado.

- Com base no segmento de aplicação, o mercado de circuitos integrados específicos para aplicações (ASIC) do Médio Oriente e África foi segmentado em eletrónica de consumo, data center e computação, TI e telecomunicações, medicina, multimédia, automóvel e industrial. Em 2022, espera-se que os produtos eletrónicos de consumo dominem o mercado de circuitos integrados específicos para aplicações (ASIC) do Médio Oriente e de África devido ao crescente conteúdo de streaming e transmissão do consumidor e com a disponibilidade de infraestruturas de alta velocidade para atender a estas exigências, está a impulsionar o consumidor inteligente produtos eletrónicos. As tecnologias ASIC ajudam a fornecer transmissão de conteúdos de dados a alta velocidade, utilizando CI de alto desempenho.

Análise ao nível do país do mercado de circuitos integrados específicos de aplicação (ASIC) do Médio Oriente e África

O mercado de circuitos integrados de aplicação específica (ASIC) do Médio Oriente e África é analisado e são fornecidas informações sobre o tamanho do mercado por tipo de design, tecnologia de programação e aplicação.

Os países abrangidos pelo relatório de mercado sobre os circuitos integrados de aplicação específica (ASIC) do Médio Oriente e África são a África do Sul, o Egito, os Emirados Árabes Unidos, a Arábia Saudita, Israel e o resto do Médio Oriente e África.

Israel domina o mercado de circuitos integrados de aplicação específica (ASIC) devido a vários fatores, como o surgimento de dispositivos IoT baseados em ASIC entre os consumidores e o aumento da adoção de mecatrónica para aplicações automóveis.

A secção do relatório sobre os países também fornece fatores individuais que impactam o mercado e alterações na regulamentação do mercado nacional que impactam as tendências atuais e futuras do mercado. Pontos de dados como novas vendas, vendas de reposição, demografia do país, atos regulamentares e tarifas de importação e exportação são alguns dos principais indicadores utilizados para prever o cenário de mercado para países individuais. Além disso, a presença e a disponibilidade de marcas do Médio Oriente e de África e os desafios enfrentados devido à grande ou escassa concorrência das marcas locais e nacionais, bem como o impacto dos canais de venda, são considerados quando se fornece uma análise de previsão dos dados do país.

Aumento da procura de circuitos integrados de aplicação específica (ASIC).

O mercado de circuitos integrados de aplicação específica (ASIC) também fornece uma análise detalhada do mercado para o crescimento da indústria de cada país com vendas, vendas de componentes, impacto do desenvolvimento tecnológico de circuitos integrados de aplicação específica (ASIC) e mudanças nos cenários regulamentares com o seu suporte para a aplicação específica mercado dos circuitos integrados (ASIC). Os dados estão disponíveis para o período histórico de 2012 a 2020.

Análise do panorama competitivo e da quota de mercado dos circuitos integrados de aplicação específica (ASIC)

O panorama competitivo do mercado de circuitos integrados de aplicação específica (ASIC) fornece detalhes por concorrente. Os detalhes incluídos são a visão geral da empresa, finanças da empresa, receitas geradas, potencial de mercado, investimento em investigação e desenvolvimento, novas iniciativas de mercado, presença no Médio Oriente e África, localizações e instalações de produção, pontos fortes e fracos da empresa , lançamento de produto, pipelines de testes de produto, aprovações de produto , patentes, amplitude e abrangência do produto, domínio da aplicação, curva de vida da tecnologia. Os pontos de dados fornecidos acima estão apenas relacionados com o foco das empresas no mercado de circuitos integrados de aplicação específica (ASIC) do Médio Oriente e de África.

Os principais participantes abordados no relatório são a Intel Corporation, Infineon Technologies AG, NXP Semiconductors, Qualcomm Technologies, Microchip Technology Inc., Analog Devices e outros. Os analistas do DBMR compreendem os pontos fortes competitivos e fornecem análises competitivas para cada concorrente em separado. Muitos desenvolvimentos de produtos são também iniciados por empresas de todo o mundo, o que está também a acelerar o crescimento do mercado de circuitos integrados de aplicação específica (ASIC).

Por exemplo,

- Em novembro de 2021, a Qualcomm Technologies, Inc. lançou a plataforma de cockpit automóvel Snapdragon para o veículo PEUGEOT 308. A principal característica do lançamento deste produto foi fornecer tecnologia digital e automóvel para oferecer uma experiência premium para condutores e passageiros. Este processador foi concebido especificamente para este veículo. Isto ajudou a empresa a aumentar a sua reputação no setor automóvel.

As parcerias, contratos, joint ventures e outras estratégias aumentam a quota de mercado da empresa com maior cobertura e presença. Oferece também o benefício para as organizações melhorarem a sua oferta para o mercado de circuitos integrados de aplicação específica (ASIC) através de uma gama alargada de tamanhos.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Índice

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST & AFRICA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMRMARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 DESIGN TYPE TIMELINE CURVE

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 GROWING DEMAND FOR SMARTPHONES AND TABLETS

5.1.2 INCREASE IN DEMAND FROM SMART CONSUMER DEVICES

5.1.3 EMERGENCE OF ASIC DRIVEN IOT DEVICES

5.1.4 RISE IN DEMAND FOR MINIATURIZED ELECTRONICS DEVICE

5.2 RESTRAINTS

5.2.1 HIGH COST ASSOCIATED WITH MANUFACTURING CUSTOMIZED CIRCUITS

5.2.2 ASICS VULNERABILITY TOWARDS SECURITY ATTACKS/CYBER ATTACKS

5.3 OPPORTUNITIES

5.3.1 UTILIZING ASIC TECHNOLOGIES FOR POWERING AI

5.3.2 UPSURGE IN ADOPTION OF MECHATRONICS FOR AUTOMOTIVE APPLICATIONS

5.3.3 RISE IN DEPLOYMENT OF DATA CENTERS AND HIGH-PERFORMANCE COMPUTING

5.3.4 GROW IN PARTNERSHIP, ACQUISITIONS, AND MERGERS FOR ASIC

5.4 CHALLENGES

5.4.1 FUNCTIONAL RELIABILITY ISSUES FACED IN ASIA

5.4.2 COMPLEXITY INVOLVED IN DESIGNING AND FABRICATION OF APPLICATION SPECIFIC CIRCUITS

6 IMPACT OF COVID-19 PANDEMIC ON MIDDLE EAST & AFRICA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET

6.1 AFTERMATH OF COVID-19 AND GOVERNMENT INITIATIVES TO BOOST THE MARKET

6.2 STRATEGIC DECISIONS FOR MANUFACTURERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

6.3 IMPACT ON DEMAND

6.4 IMPACT ON PRICE

6.5 IMPACT ON SUPPLY CHAIN

6.6 CONCLUSION

7 MIDDLE EAST & AFRICA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY DESIGN TYPE

7.1 OVERVIEW

7.2 SEMI-CUSTOM

7.2.1 STANDARD –CELL-BASED ASICS

7.2.2 GATE-ARRAY-BASED ASICS

7.2.2.1 CHANNEL LESS GATE ARRAYS

7.2.2.2 STRUCTURED GATE ARRAYS

7.2.2.3 CHANNELLED GATE ARRAYS

7.3 PROGRAMMABLE

7.3.1 FPGAS (FIELD PROGRAMMABLE GATE ARRAY)

7.3.1.1 BY TYPE

7.3.1.1.1 HIGH-END FPGAS

7.3.1.1.2 LOW-END FPGAS

7.3.1.1.3 MID-RANGE FPGAS

7.3.1.2 BY NODE SIZE

7.3.1.2.1 LESS THAN 28 NM

7.3.1.2.2 28-90 NM

7.3.1.2.3 MORE THAN 90 NM

7.3.1.3 BY APPLICATION

7.3.1.3.1 FILTERING AND COMMUNICATION

7.3.1.3.2 MEDICAL IMAGING

7.3.1.3.3 COMPUTER HARDWARE EMULATION

7.3.1.3.4 SOFTWARE-DEFINED RADIO

7.3.1.3.5 BIOINFORMATICS

7.3.1.3.6 DIGITAL SIGNAL PROCESSING

7.3.1.3.7 VOICE RECOGNITION

7.3.1.3.8 CRYPTOGRAPHY

7.3.1.3.9 INTEGRATING MULTIPLE SPLDS

7.3.1.3.10 ASIC PROTOTYPING

7.3.1.3.11 DEVICE CONTROLLERS

7.3.2 PLDS (PROGRAMMABLE LOGIC DEVICES)

7.3.2.1 BY TYPE

7.3.2.1.1 SIMPLE PROGRAMMABLE LOGIC DEVICE (SPLDS)

7.3.2.1.2 HIGH CAPACITY PROGRAMMABLE LOGIC DEVICE (HCPLDS)

7.4 FULL CUSTOM

8 MIDDLE EAST & AFRICA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY PROGRAMMING TECHNOLOGY

8.1 OVERVIEW

8.2 STATIC RAM

8.3 ANTIFUSE

8.4 EEPROM

8.5 EPROM

8.6 OTHERS

9 MIDDLE EAST & AFRICA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 CONSUMER ELECTRONICS

9.2.1 SMARTPHONES AND TABLETS

9.2.2 WIRELESS VIRTUAL REALITY DEVICES

9.2.3 OTHERS

9.3 IT & TELECOMMUNICATION

9.3.1 WIRELESS COMMUNICATION

9.3.2 WIRED COMMUNICATION

9.4 DATA CENTER & COMPUTING

9.5 MEDICAL

9.5.1 IMAGING DIAGNOSTICS

9.5.2 WEARABLE DEVICES

9.5.3 OTHERS

9.6 INDUSTRIAL

9.6.1 BY SECTOR

9.6.1.1 MILITARY, AEROSPACE & DEFENSE

9.6.1.2 SATELLITE & SPACE

9.6.1.3 AVIATION

9.6.1.4 POWER GENERATION

9.6.1.5 OIL & GAS

9.6.2 BY APPLICATION

9.6.2.1 MACHINE VISION

9.6.2.2 ROBOTICS

9.6.2.3 INDUSTRIAL SENSOR

9.6.2.4 INDUSTRIAL NETWORKING

9.6.2.5 INDUSTRIAL MOTOR CONTROL

9.6.2.6 VIDEO SURVEILLANCE

9.7 AUTOMOTIVE

9.7.1 ADAS

9.7.2 AUTOMOTIVE INFOTAINMENT & DRIVER INFORMATION SYSTEM

9.8 MULTIMEDIA

9.8.1 COMMUNICATIONS

9.8.2 VIDEO PROCESSING

9.8.3 AUDIO

10 MIDDLE EAST & AFRICA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY REGION

10.1 MIDDLE EAST & AFRICA

10.1.1 ISRAEL

10.1.2 U.A.E.

10.1.3 SAUDI ARABIA

10.1.4 SOUTH AFRICA

10.1.5 EGYPT

10.1.6 REST OF MIDDLE EAST AND AFRICA

11 MIDDLE EAST & AFRICA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET: COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

12 SWOT ANALYSIS

13 COMPANY PROFILE

13.1 INTEL CORPORATION

13.1.1 COMPANY SNAPSHOT

13.1.2 REVENUE ANALYSIS

13.1.3 COMPANY SHARE ANALYSIS

13.1.4 PRODUCTS PORTFOLIO

13.1.5 RECENT DEVELOPMENTS

13.2 INFINEON TECHNOLOGIES AG

13.2.1 COMPANY SNAPSHOT

13.2.2 REVENUE ANALYSIS

13.2.3 COMPANY SHARE ANALYSIS

13.2.4 PRODUCTS PORTFOLIO

13.2.5 RECENT DEVELOPMENTS

13.3 ANALOG DEVICES, INC.

13.3.1 COMPANY SNAPHOT

13.3.2 REVENUE ANALYSIS

13.3.3 COMPANY SHARE ANALYSIS

13.3.4 PRODUCT PORTFOLIO

13.3.5 RECENT DEVELOPMENTS

13.4 NXP SEMICONDUCTORS

13.4.1 COMPANY SNAPSHOT

13.4.2 REVENUE ANALYSIS

13.4.3 COMPANY SHARE ANALYSIS

13.4.4 PRODUCTS PORTFOLIO

13.4.5 RECENT DEVELOPMENTS

13.5 MICROCHIP TECHNOLOGY INC.

13.5.1 COMPANY SNAPSHOT

13.5.2 REVENUE ANALYSIS

13.5.3 COMPANY SHARE ANALYSIS

13.5.4 PRODUCT PORTFOLIO

13.5.5 RECENT DEVELOPMENTS

13.6 TEXAS INSTRUMENTS INCORPORATED

13.6.1 COMPANY SNAPSHOT

13.6.2 REVENUE ANALYSIS

13.6.3 PRODUCT PORTFOLIO

13.6.4 RECENT DEVELOPMENTS

13.7 ACHRONIX SEMICONDUCTOR CORPORATION

13.7.1 COMPANY SNAPSHOT

13.7.2 PRODUCTS PORTFOLIO

13.7.3 RECENT DEVELOPMENTS

13.8 AVNET ASIC ISRAEL LTD.

13.8.1 COMPANY SNAPSHOT

13.8.2 PRODUCT PORTFOLIO

13.8.3 RECENT DEVELOPMENTS

13.9 COBHAM LIMITED

13.9.1 COMPANY SNAPSHOT

13.9.2 PRODUCT PORTFOLIO

13.9.3 RECENT DEVELOPMENTS

13.1 ENSILICA

13.10.1 COMPANY SNAPSHOT

13.10.2 PRODUCTS PORTFOLIO

13.10.3 RECENT DEVELOPMENTS

13.11 GOWIN SEMICONDUCTOR

13.11.1 COMPANY SNAPSHOT

13.11.2 PRODUCTS PORTFOLIO

13.11.3 RECENT DEVELOPMENTS

13.12 HONEYWELL INTERNATIONAL INC.

13.12.1 COMPANY SNAPHOT

13.12.2 REVENUE ANALYSIS

13.12.3 PRODUCT PORTFOLIO

13.12.4 RECENT DEVELOPMENTS

13.13 LATTICE SEMICONDUCTOR

13.13.1 COMPANY SNAPSHOT

13.13.2 REVENUE ANALYSIS

13.13.3 PRODUCT PORTFOLIO

13.13.4 RECENT DEVELOPMENTS

13.14 MAXIM INTEGRATED

13.14.1 COMPANY SNAPHOT

13.14.2 REVENUE ANALYSIS

13.14.3 PRODUCT PORTFOLIO

13.14.4 RECENT DEVELOPMENTS

13.15 MEGACHIPS CORPORATION

13.15.1 COMPANY SNAPSHOT

13.15.2 REVENUE ANALYSIS

13.15.3 PRODUCTS PORTFOLIO

13.15.4 RECENT DEVELOPMENTS

13.16 QUALCOMM TECHNOLOGIES, INC.

13.16.1 COMPANY SNAPSHOT

13.16.2 REVENUE ANALYSIS

13.16.3 PRODUCTS PORTFOLIO

13.16.4 RECENT DEVELOPMENTS

13.17 QUICKLOGIC CORPORATION

13.17.1 COMPANY SNAPSHOT

13.17.2 REVENUE ANALYSIS

13.17.3 PRODUCT PORTFOLIO

13.17.4 RECENT DEVELOPMENTS

13.18 RENESAS ELECTRONICS CORPORATION

13.18.1 COMPANY SNAPHOT

13.18.2 REVENUE ANALYSIS

13.18.3 PRODUCT PORTFOLIO

13.18.4 RECENT DEVELOPMENTS

13.19 SEMICONDUCTOR COMPONENTS INDUSTRIES, LLC

13.19.1 COMPANY SNAPSHOT

13.19.2 REVENUE ANALYSIS

13.19.3 PRODUCTS PORTFOLIO

13.19.4 RECENT DEVELOPMENTS

13.2 SOCIONEXT INC.

13.20.1 COMPANY SNAPSHOT

13.20.2 PRODUCT PORTFOLIO

13.20.3 RECENT DEVELOPMENTS

13.21 XILINX

13.21.1 COMPANY SNAPSHOT

13.21.2 REVENUE ANALYSIS

13.21.3 PRODUCTS PORTFOLIO

13.21.4 RECENT DEVELOPMENTS

14 QUESTIONNAIRE

15 RELATED REPORTS

Lista de Tabela

TABLE 1 MIDDLE EAST & AFRICA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY DESIGN TYPE, 2020-2029 (USD MILLION)

TABLE 2 MIDDLE EAST & AFRICA SEMI-CUSTOM IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 3 MIDDLE EAST & AFRICA SEMI-CUSTOM IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 4 MIDDLE EAST & AFRICA GATE-ARRAY-BASED ASICS IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 5 MIDDLE EAST & AFRICA PROGRAMMABLE IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 MIDDLE EAST & AFRICA PROGRAMMABLE IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 7 MIDDLE EAST & AFRICA FPGAS (FIELD PROGRAMMABLE GATE ARRAY) IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 8 MIDDLE EAST & AFRICA FPGAS (FIELD PROGRAMMABLE GATE ARRAY) IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY NODE SIZE, 2020-2029 (USD MILLION)

TABLE 9 MIDDLE EAST & AFRICA FPGAS (FIELD PROGRAMMABLE GATE ARRAY) IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 10 MIDDLE EAST & AFRICA PLDS (PROGRAMMABLE LOGIC DEVICES) IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 11 MIDDLE EAST & AFRICA FULL CUSTOM IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 MIDDLE EAST & AFRICA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY PROGRAMMING TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 13 MIDDLE EAST & AFRICA STATIC RAM IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 MIDDLE EAST & AFRICA ANTIFUSE IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 MIDDLE EAST & AFRICA EEPROM IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 MIDDLE EAST & AFRICA EPROM IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 MIDDLE EAST & AFRICA OTHERS IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 MIDDLE EAST & AFRICA CONSUMER ELECTRONICS SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 19 MIDDLE EAST & AFRICA CONSUMER ELECTRONICS IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 MIDDLE EAST & AFRICA CONSUMER ELECTRONICS IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 21 MIDDLE EAST & AFRICA IT & TELECOMMUNICATION IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 MIDDLE EAST & AFRICA IT & TELECOMMUNICATION IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 23 MIDDLE EAST & AFRICA DATA CENTER & COMPUTING IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 MIDDLE EAST & AFRICA MEDICAL IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY REGION, 202O-2029 (USD MILLION)

TABLE 25 MIDDLE EAST & AFRICA MEDICAL IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 26 MIDDLE EAST & AFRICA INDUSTRIAL IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 MIDDLE EAST & AFRICA INDUSTRIAL IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY SECTOR, 2020-2029 (USD MILLION)

TABLE 28 MIDDLE EAST & AFRICA INDUSTRIAL IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 29 MIDDLE EAST & AFRICA AUTOMOTIVE IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 MIDDLE EAST & AFRICA AUTOMOTIVE IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 31 MIDDLE EAST & AFRICA MULTIMEDIA IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 32 MIDDLE EAST & AFRICA MULTIMEDIA IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 33 MIDDLE EAST & AFRICA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 34 MIDDLE EAST & AFRICA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY DESIGN TYPE, 2020-2029 (USD MILLION)

TABLE 35 MIDDLE EAST & AFRICA SEMI-CUSTOM IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 36 MIDDLE EAST & AFRICA GATE-ARRAY-BASED ASICS IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 37 MIDDLE EAST & AFRICA PROGRAMMABLE IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 38 MIDDLE EAST & AFRICA FPGAS (FIELD PROGRAMMABLE GATE ARRAY) IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 39 MIDDLE EAST & AFRICA FPGAS (FIELD PROGRAMMABLE GATE ARRAY) IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY NODE SIZE, 2020-2029 (USD MILLION)

TABLE 40 MIDDLE EAST & AFRICA FPGAS (FIELD PROGRAMMABLE GATE ARRAY) IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 41 MIDDLE EAST & AFRICA PLDS (PROGRAMMABLE LOGIC DEVICES) IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 42 MIDDLE EAST & AFRICA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY PROGRAMMING TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 43 MIDDLE EAST & AFRICA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 44 MIDDLE EAST & AFRICA CONSUMER ELECTRONICS IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 45 MIDDLE EAST & AFRICA IT & TELECOMMUNICATION IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 46 MIDDLE EAST & AFRICA MEDICAL IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 47 MIDDLE EAST & AFRICA INDUSTRIAL IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY SECTOR, 2020-2029 (USD MILLION)

TABLE 48 MIDDLE EAST & AFRICA INDUSTRIAL IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 49 MIDDLE EAST & AFRICA AUTOMOTIVE IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 50 MIDDLE EAST & AFRICA MULTIMEDIA IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 51 ISRAEL APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY DESIGN TYPE, 2020-2029 (USD MILLION)

TABLE 52 ISRAEL SEMI-CUSTOM IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 53 ISRAEL GATE-ARRAY-BASED ASICS IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 54 ISRAEL PROGRAMMABLE IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 55 ISRAEL FPGAS (FIELD PROGRAMMABLE GATE ARRAY) IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 56 ISRAEL FPGAS (FIELD PROGRAMMABLE GATE ARRAY) IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY NODE SIZE, 2020-2029 (USD MILLION)

TABLE 57 ISRAEL FPGAS (FIELD PROGRAMMABLE GATE ARRAY) IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 58 ISRAEL PLDS (PROGRAMMABLE LOGIC DEVICES) IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 59 ISRAEL APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY PROGRAMMING TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 60 ISRAEL APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 61 ISRAEL CONSUMER ELECTRONICS IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 62 ISRAEL IT & TELECOMMUNICATION IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 63 ISRAEL MEDICAL IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 64 ISRAEL INDUSTRIAL IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY SECTOR, 2020-2029 (USD MILLION)

TABLE 65 ISRAEL INDUSTRIAL IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 66 ISRAEL AUTOMOTIVE IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYP APPLICATION, 2020-2029 (USD MILLION)

TABLE 67 ISRAEL MULTIMEDIA IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 68 U.A.E. APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY DESIGN TYPE, 2020-2029 (USD MILLION)

TABLE 69 U.A.E. SEMI-CUSTOM IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 70 U.A.E. GATE-ARRAY-BASED ASICS IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 71 U.A.E. PROGRAMMABLE IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 72 U.A.E. FPGAS (FIELD PROGRAMMABLE GATE ARRAY) IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 73 U.A.E. FPGAS (FIELD PROGRAMMABLE GATE ARRAY) IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY NODE SIZE, 2020-2029 (USD MILLION)

TABLE 74 U.A.E. FPGAS (FIELD PROGRAMMABLE GATE ARRAY) IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 75 U.A.E. PLDS (PROGRAMMABLE LOGIC DEVICES) IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 76 U.A.E. APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY PROGRAMMING TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 77 U.A.E. APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 78 U.A.E. CONSUMER ELECTRONICS IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 79 U.A.E. IT & TELECOMMUNICATION IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 80 U.A.E. MEDICAL IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 81 U.A.E. INDUSTRIAL IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY SECTOR, 2020-2029 (USD MILLION)

TABLE 82 U.A.E. INDUSTRIAL IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 83 U.A.E. AUTOMOTIVE IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 84 U.A.E. MULTIMEDIA IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 85 SAUDI ARABIA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY DESIGN TYPE, 2020-2029 (USD MILLION)

TABLE 86 SAUDI ARABIA SEMI-CUSTOM IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 87 SAUDI ARABIA GATE-ARRAY-BASED ASICS IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 88 SAUDI ARABIA PROGRAMMABLE IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 89 SAUDI ARABIA FPGAS (FIELD PROGRAMMABLE GATE ARRAY) IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 90 SAUDI ARABIA FPGAS (FIELD PROGRAMMABLE GATE ARRAY) IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY NODE SIZE, 2020-2029 (USD MILLION)

TABLE 91 SAUDI ARABIA FPGAS (FIELD PROGRAMMABLE GATE ARRAY) IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 92 SAUDI ARABIA PLDS (PROGRAMMABLE LOGIC DEVICES) IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 93 SAUDI ARABIA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY PROGRAMMING TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 94 SAUDI ARABIA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 95 SAUDI ARABIA CONSUMER ELECTRONICS IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 96 SAUDI ARABIA IT & TELECOMMUNICATION IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 97 SAUDI ARABIA MEDICAL IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 98 SAUDI ARABIA INDUSTRIAL IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY SECTOR, 2020-2029 (USD MILLION)

TABLE 99 SAUDI ARABIA INDUSTRIAL IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 100 SAUDI ARABIA AUTOMOTIVE IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 101 SAUDI ARABIA MULTIMEDIA IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 102 SOUTH AFRICA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY DESIGN TYPE, 2020-2029 (USD MILLION)

TABLE 103 SOUTH AFRICA SEMI-CUSTOM IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 104 SOUTH AFRICA GATE-ARRAY-BASED ASICS IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 105 SOUTH AFRICA PROGRAMMABLE IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 106 SOUTH AFRICA FPGAS (FIELD PROGRAMMABLE GATE ARRAY) IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 107 SOUTH AFRICA FPGAS (FIELD PROGRAMMABLE GATE ARRAY) IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY NODE SIZE, 2020-2029 (USD MILLION)

TABLE 108 SOUTH AFRICA FPGAS (FIELD PROGRAMMABLE GATE ARRAY) IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 109 SOUTH AFRICA PLDS (PROGRAMMABLE LOGIC DEVICES) IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 110 SOUTH AFRICA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY PROGRAMMING TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 111 SOUTH AFRICA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 112 SOUTH AFRICA CONSUMER ELECTRONICS IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 113 SOUTH AFRICA IT & TELECOMMUNICATION IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 114 SOUTH AFRICA MEDICAL IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 115 SOUTH AFRICA INDUSTRIAL IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY SECTOR, 2020-2029 (USD MILLION)

TABLE 116 SOUTH AFRICA INDUSTRIAL IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 117 SOUTH AFRICA AUTOMOTIVE IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 118 SOUTH AFRICA MULTIMEDIA IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 119 EGYPT APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY DESIGN TYPE, 2020-2029 (USD MILLION)

TABLE 120 EGYPT SEMI-CUSTOM IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 121 EGYPT GATE-ARRAY-BASED ASICS IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 122 EGYPT PROGRAMMABLE IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 123 EGYPT FPGAS (FIELD PROGRAMMABLE GATE ARRAY) IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 124 EGYPT FPGAS (FIELD PROGRAMMABLE GATE ARRAY) IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY NODE SIZE, 2020-2029 (USD MILLION)

TABLE 125 EGYPT FPGAS (FIELD PROGRAMMABLE GATE ARRAY) IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 126 EGYPT PLDS (PROGRAMMABLE LOGIC DEVICES) IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 127 EGYPT APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY PROGRAMMING TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 128 EGYPT APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 129 EGYPT CONSUMER ELECTRONICS IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 130 EGYPT IT & TELECOMMUNICATION IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 131 EGYPT MEDICAL IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 132 EGYPT INDUSTRIAL IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY SECTOR, 2020-2029 (USD MILLION)

TABLE 133 EGYPT INDUSTRIAL IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 134 EGYPT AUTOMOTIVE IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 135 EGYPT MULTIMEDIA IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 136 REST OF MIDDLE EAST AND AFRICA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY DESIGN TYPE, 2020-2029 (USD MILLION)

Lista de Figura

FIGURE 1 MIDDLE EAST & AFRICA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST & AFRICA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET: MIDDLE EAST & AFRICA VS REGIONAL ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST & AFRICA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET: DBMRMARKET POSITION GRID

FIGURE 8 MIDDLE EAST & AFRICA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 MIDDLE EAST & AFRICA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET:MARKET APPLICATION COVERAGE GRID

FIGURE 10 MIDDLE EAST & AFRICA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET: SEGMENTATION

FIGURE 11 GROWING DEMAND FOR SMARTPHONES AND TABLETS IS EXPECTED TO DRIVE MIDDLE EAST & AFRICA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 SEMI-CUSTOM SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF MIDDLE EAST & AFRICA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET IN 2022 & 2029

FIGURE 13 ASIA-PACIFIC IS EXPECTED TO DOMINATE AND IS THE FASTEST GROWING REGION IN THE MIDDLE EAST & AFRICA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF MIDDLE EAST & AFRICA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET

FIGURE 15 TOP 10 COUNTRIES WITH SMARTPHONES (IN MILLIONS)

FIGURE 16 MIDDLE EAST & AFRICA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET: BY DESIGN TYPE, 2021

FIGURE 17 MIDDLE EAST & AFRICA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET: BY PROGRAMMING TECHNOLOGY, 2021

FIGURE 18 MIDDLE EAST & AFRICA CONSUMER ELECTRONICS IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET: BY APPLICATION, 2021

FIGURE 19 MIDDLE EAST & AFRICA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET: SNAPSHOT (2021)

FIGURE 20 MIDDLE EAST & AFRICA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET: BY COUNTRY (2021)

FIGURE 21 MIDDLE EAST & AFRICA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET: BY COUNTRY (2022 & 2029)

FIGURE 22 MIDDLE EAST & AFRICA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET: BY COUNTRY (2021 & 2029)

FIGURE 23 MIDDLE EAST & AFRICA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET: BY DESIGN TYPE (2022-2029)

FIGURE 24 MIDDLE EAST & AFRICA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET: COMPANY SHARE 2021 (%)

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.