Middle East And Africa Anti Friction Coating Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

62.28 Million

USD

105.42 Million

2025

2033

USD

62.28 Million

USD

105.42 Million

2025

2033

| 2026 –2033 | |

| USD 62.28 Million | |

| USD 105.42 Million | |

|

|

|

|

Segmentação do mercado de revestimentos antifricção no Oriente Médio e África, por produto (MOS2, PTFE, grafite, FEP, PFA e dissulfeto de tungstênio), natureza (à base de solvente e à base de água), aplicação (peças automotivas, itens de transmissão de potência, rolamentos, componentes de munição, componentes de válvulas e atuadores e outros) e uso final (automotivo, aeroespacial, naval, construção, saúde e outros) - Tendências e previsões do setor até 2033.

Tamanho do mercado de revestimentos antifricção no Oriente Médio e na África

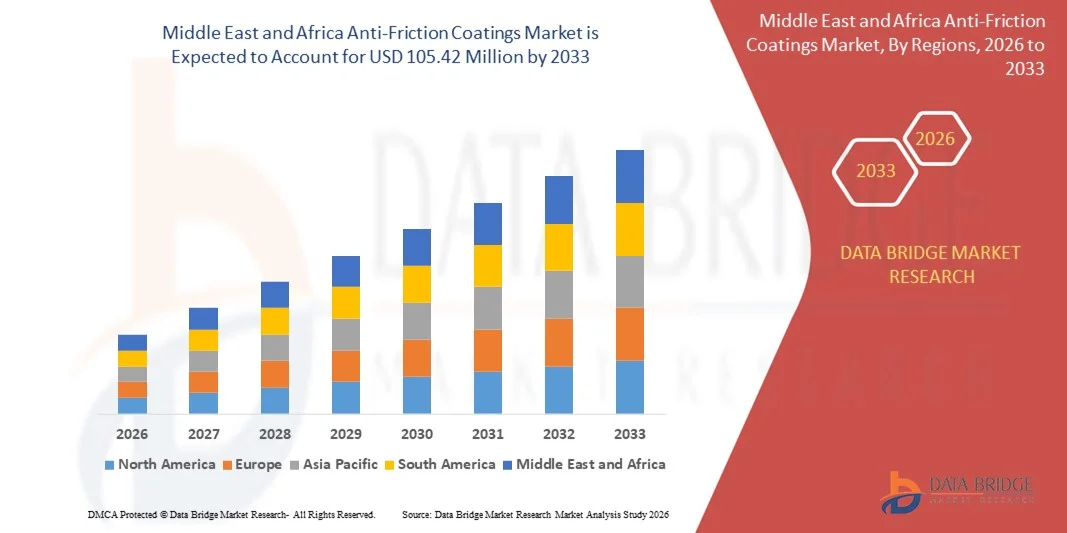

- O mercado de revestimentos antifricção no Oriente Médio e na África foi avaliado em US$ 62,28 milhões em 2025 e deverá atingir US$ 105,42 milhões até 2033 , com uma taxa de crescimento anual composta (CAGR) de 6,8% durante o período de previsão.

- O crescimento do mercado é impulsionado principalmente pela crescente demanda por maior durabilidade de componentes, eficiência energética e menor desgaste nos setores automotivo, industrial, aeroespacial e de saúde, onde os revestimentos antifricção desempenham um papel fundamental na minimização de perdas mecânicas e no prolongamento da vida útil dos equipamentos.

- Além disso, o crescente foco na eficiência operacional, na redução dos custos de manutenção e na conformidade com padrões ambientais e de desempenho rigorosos está acelerando a adoção de soluções avançadas de revestimento antifricção, contribuindo significativamente para a expansão geral do mercado.

Análise do mercado de revestimentos antifricção no Oriente Médio e na África

- Revestimentos antifricção, projetados para reduzir o atrito superficial, o desgaste e a degradação do material, tornaram-se essenciais em aplicações modernas de manufatura e engenharia devido à sua capacidade de melhorar o desempenho, a confiabilidade e a vida útil de componentes críticos que operam sob condições exigentes.

- A crescente demanda por esses revestimentos é impulsionada principalmente pelo aumento da automação industrial, pelos avanços nas tecnologias de revestimento e pela expansão do uso de materiais leves e de alto desempenho em setores-chave, reforçando a trajetória de crescimento constante do mercado.

- Os Emirados Árabes Unidos dominaram o mercado de revestimentos antifricção em 2025, devido ao forte crescimento na indústria de transformação, operações de petróleo e gás, atividades de manutenção aeroespacial e expansão dos serviços de pós-venda automotiva em todo o país.

- Prevê-se que a Arábia Saudita seja a região de crescimento mais rápido no mercado de revestimentos antifricção durante o período de previsão, devido à rápida expansão industrial, aos projetos de petróleo e gás em larga escala e aos crescentes investimentos na indústria transformadora no âmbito das iniciativas da Visão 2030.

- O segmento de PTFE dominou o mercado com 56,22% em 2025, devido às suas excelentes propriedades de baixo atrito, resistência química e ampla aplicabilidade em componentes automotivos, industriais e aeroespaciais. Os revestimentos de PTFE são preferidos para melhorar o desempenho, reduzir o desgaste e prolongar a vida útil de máquinas críticas, principalmente em aplicações que exigem lubrificação consistente e resistência a ambientes operacionais agressivos.

Escopo do relatório e segmentação do mercado de revestimentos antifricção

|

Atributos |

Análises de mercado essenciais para revestimentos antifricção |

|

Segmentos abrangidos |

|

|

Países abrangidos |

Oriente Médio e África

|

|

Principais participantes do mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor agregado |

Além das informações sobre cenários de mercado, como valor de mercado, taxa de crescimento, segmentação, cobertura geográfica e principais participantes, os relatórios de mercado elaborados pela Data Bridge Market Research também incluem análise de importação e exportação, visão geral da capacidade de produção, análise de produção e consumo, análise de tendências de preços, cenário de mudanças climáticas, análise da cadeia de suprimentos, análise da cadeia de valor, visão geral de matérias-primas/insumos, critérios de seleção de fornecedores, análise PESTLE, análise de Porter e estrutura regulatória. |

Tendências do mercado de revestimentos antifricção no Oriente Médio e na África

Adoção crescente de revestimentos antifricção ecológicos

- Uma tendência significativa no mercado de revestimentos antifricção é a crescente adoção de soluções de revestimento ecológicas e com baixo teor de VOC (compostos orgânicos voláteis), impulsionada por regulamentações ambientais mais rigorosas e compromissos crescentes com a sustentabilidade nos setores automotivo, industrial e aeroespacial. Os fabricantes estão migrando ativamente para formulações à base de água, com controle de PFAS (substâncias perfluoroalquiladas e polifluoroalquiladas) e redução de solventes para se adequarem às normas regulatórias, mantendo o desempenho e a durabilidade do revestimento.

- Por exemplo, a DuPont tem expandido seu portfólio de revestimentos avançados de baixo atrito com perfis ambientais aprimorados que contribuem para a redução de emissões e o cumprimento das regulamentações químicas globais em constante evolução. Esses desenvolvimentos permitem que os usuários finais alcancem metas de sustentabilidade sem comprometer a resistência ao desgaste e o desempenho na redução do atrito.

- Os fabricantes de automóveis estão integrando cada vez mais revestimentos antifricção ecológicos para melhorar a eficiência de combustível e reduzir as perdas mecânicas, ao mesmo tempo que cumprem as normas de redução de emissões. Essa tendência está fortalecendo o papel dos revestimentos sustentáveis nas plataformas de veículos e sistemas de transmissão de última geração.

- Os fabricantes de equipamentos industriais também estão priorizando revestimentos ecologicamente responsáveis para melhorar a segurança no local de trabalho e atender aos requisitos de conformidade industrial mais rigorosos. Isso está acelerando a adoção de revestimentos à base de água e lubrificantes sólidos avançados em ambientes de fabricação em larga escala.

- O setor aeroespacial está incorporando progressivamente revestimentos antifricção ecológicos para equilibrar os requisitos de design leve com a durabilidade e a conformidade regulamentar. Essa mudança está reforçando a demanda por revestimentos que ofereçam longa vida útil e, ao mesmo tempo, reduzam o impacto ambiental.

- De forma geral, a crescente ênfase na sustentabilidade, no alinhamento regulatório e na otimização do desempenho está posicionando os revestimentos antifricção ecológicos como uma tendência fundamental que moldará o desenvolvimento futuro do mercado.

Dinâmica do mercado de revestimentos antifricção no Oriente Médio e na África

Motorista

Crescente demanda por maior durabilidade dos componentes e maior eficiência energética.

- A crescente demanda por maior durabilidade de componentes e eficiência energética em aplicações automotivas, de máquinas industriais e aeroespaciais é um dos principais impulsionadores do mercado de revestimentos antifricção. Esses revestimentos reduzem significativamente o desgaste superficial, as perdas por atrito e o consumo de energia, prolongando a vida útil dos equipamentos e melhorando a eficiência operacional.

- Por exemplo, a Parker Hannifin aplica tecnologias avançadas de revestimento antifricção para aumentar a durabilidade e a eficiência de componentes de movimento e controle usados em equipamentos industriais e móveis. Essas aplicações ajudam a reduzir a frequência de manutenção e as perdas de energia em condições de operação de alta carga.

- Os fabricantes de automóveis estão cada vez mais dependendo de revestimentos antifricção para melhorar a economia de combustível e prolongar a vida útil dos componentes do motor e da transmissão. Essa demanda está diretamente ligada a padrões de eficiência mais rigorosos e à necessidade de reduzir o custo total de propriedade.

- Em sistemas de automação industrial e transmissão de energia, os revestimentos desempenham um papel fundamental na minimização do tempo de inatividade e na melhoria da eficiência mecânica. Isso impulsiona a adoção consistente em manufatura de alta precisão e máquinas pesadas.

- Os setores de saúde e dispositivos médicos também contribuem para esse crescimento, uma vez que revestimentos duráveis e de baixo atrito aumentam a confiabilidade e o desempenho de instrumentos cirúrgicos e dispositivos implantáveis. O foco contínuo em eficiência, confiabilidade e otimização do ciclo de vida reforça esse fator, sustentando um crescimento constante do mercado em diversos setores de uso final.

Restrição/Desafio

Altos custos de produção e processos de aplicação complexos.

- O mercado de revestimentos antifricção enfrenta desafios relacionados aos altos custos de produção e aos complexos processos de aplicação que exigem equipamentos especializados, mão de obra qualificada e ambientes de processamento controlados. Esses fatores aumentam as despesas de fabricação e limitam a flexibilidade de custos para os fornecedores de revestimentos.

- Por exemplo, a CARL BECHEM GMBH utiliza técnicas avançadas de formulação e aplicação para fornecer revestimentos antifricção de alto desempenho para usos industriais e automotivos. Esses processos de alta precisão elevam os custos operacionais e criam barreiras para a redução de custos em larga escala.

- A obtenção de espessura, adesão e desempenho consistentes do revestimento geralmente envolve processos de aplicação e cura em várias etapas. Esses requisitos prolongam os prazos de produção e aumentam a complexidade geral da fabricação.

- O uso de matérias-primas especializadas e lubrificantes sólidos contribui ainda mais para a volatilidade dos custos e os desafios da cadeia de suprimentos. Os fabricantes devem equilibrar o desempenho dos materiais com a viabilidade econômica.

- Em conjunto, os elevados custos e a complexidade técnica continuam a dificultar a adoção em larga escala, obrigando os participantes da indústria a investir na otimização de processos e em tecnologias de aplicação economicamente eficientes para sustentar o crescimento a longo prazo.

Escopo do mercado de revestimentos antifricção no Oriente Médio e na África

O mercado é segmentado com base no produto, natureza, aplicação e uso final.

- Por produto

Com base no produto, o mercado é segmentado em MOS2, PTFE, Grafite, FEP, PFA e Dissulfeto de Tungstênio. O segmento de PTFE detinha a maior participação na receita de mercado em 2025, impulsionado por suas excelentes propriedades de baixo atrito, resistência química e ampla aplicabilidade em componentes automotivos, industriais e aeroespaciais. Os revestimentos de PTFE são preferidos para melhorar o desempenho, reduzir o desgaste e prolongar a vida útil de máquinas críticas, principalmente em aplicações que exigem lubrificação consistente e resistência a ambientes operacionais agressivos.

O segmento MOS2 deverá apresentar o crescimento mais rápido entre 2026 e 2033, impulsionado por sua capacidade superior de suportar cargas e alta estabilidade térmica, tornando-o ideal para aplicações exigentes em motores automotivos, componentes de transmissão de potência e máquinas industriais. Os revestimentos MOS2 são particularmente populares por reduzirem o atrito em condições extremas, melhorarem a eficiência operacional e minimizarem os custos de manutenção em sistemas expostos a alta pressão e cargas térmicas variáveis.

- Por natureza

Com base na natureza, o mercado é segmentado em revestimentos à base de solvente e à base de água. O segmento à base de água detinha a maior participação em 2025, impulsionado pelo aumento das regulamentações ambientais e pela preferência por soluções de revestimento ecológicas. Os revestimentos à base de água oferecem emissões reduzidas de COVs (Compostos Orgânicos Voláteis), maior segurança no local de trabalho e conformidade com os padrões de sustentabilidade, tornando-os cada vez mais adequados para operações de revestimento em larga escala nos setores industrial e automotivo.

O segmento de revestimentos à base de solventes deverá apresentar o crescimento mais rápido entre 2026 e 2033, impulsionado por sua forte adesão, alto desempenho em condições extremas e adequação para aplicações industriais e automotivas críticas. Os revestimentos à base de solventes continuam sendo os preferidos onde durabilidade e extrema resistência operacional são necessárias, especialmente em aplicações que envolvem altas temperaturas, cargas pesadas e ambientes corrosivos.

- Por meio de aplicação

Com base na aplicação, o mercado é segmentado em peças automotivas, itens de transmissão de potência, rolamentos, componentes de munição, componentes de válvulas e atuadores, entre outros. O segmento de peças automotivas detinha a maior participação de mercado em 2025 devido à crescente demanda por componentes leves e de alto desempenho e aos rigorosos padrões de eficiência automotiva. Os revestimentos antifricção melhoram a eficiência de combustível, reduzem o desgaste e aumentam a confiabilidade dos sistemas automotivos, permitindo intervalos de manutenção mais longos e melhor desempenho do veículo.

O segmento de itens de transmissão de potência deverá apresentar o crescimento mais rápido entre 2026 e 2033, impulsionado pelo aumento da automação industrial e pela demanda por caixas de engrenagens e máquinas de alta eficiência. Os revestimentos reduzem o atrito, melhoram a eficiência energética e minimizam o tempo de inatividade, tornando-os cruciais nas operações industriais modernas, onde produtividade e confiabilidade são prioridades essenciais.

- Por uso final

Com base no uso final, o mercado é segmentado em automotivo, aeroespacial, naval, construção, saúde e outros. O segmento automotivo detinha a maior participação na receita em 2025, impulsionado pelo crescimento da produção de veículos, pela adoção de tecnologias de baixo consumo de combustível e pelo foco na redução dos custos de manutenção. Os revestimentos antifricção melhoram o desempenho do motor, a vida útil dos componentes e a eficiência geral do veículo, contribuindo para maior durabilidade e redução das perdas operacionais.

O segmento aeroespacial deverá apresentar o crescimento mais rápido entre 2026 e 2033, impulsionado pela crescente necessidade de componentes leves e de alto desempenho, capazes de suportar temperaturas e tensões extremas. Os revestimentos proporcionam lubrificação superior, resistência ao desgaste e eficiência energética, características essenciais para aplicações aeroespaciais que exigem alta confiabilidade e longos ciclos de vida operacional.

Análise Regional do Mercado de Revestimentos Antifricção no Oriente Médio e África

- Os Emirados Árabes Unidos dominaram o mercado de revestimentos antifricção, com a maior participação na receita em 2025, impulsionados pelo forte crescimento na manufatura industrial, operações de petróleo e gás, atividades de manutenção aeroespacial e expansão dos serviços de pós-venda automotiva em todo o país.

- A presença de instalações industriais avançadas, a crescente adoção de soluções de engenharia de superfície de alto desempenho e a demanda por revestimentos resistentes ao desgaste em máquinas pesadas e equipamentos do setor de energia reforçam ainda mais a posição dominante dos Emirados Árabes Unidos no mercado regional. A colaboração entre fornecedores regionais de serviços industriais e fabricantes globais de revestimentos facilita o acesso a tecnologias antifricção avançadas.

- O aumento dos investimentos em desenvolvimento de infraestrutura, a expansão das zonas industriais e a ênfase na melhoria da eficiência dos equipamentos e no desempenho ao longo do seu ciclo de vida estão alinhados com os objetivos regionais de modernização industrial, ajudando os Emirados Árabes Unidos a manter sua posição de liderança. Parcerias estratégicas, a adoção de tecnologias avançadas de revestimento e as melhorias na cadeia de suprimentos aumentam a penetração no mercado, criando uma presença sustentável.

Análise do Mercado de Revestimentos Antifricção na Arábia Saudita

Prevê-se que a Arábia Saudita registre a taxa de crescimento anual composta (CAGR) mais rápida no mercado de revestimentos antifricção do Oriente Médio e da África entre 2026 e 2033, impulsionada pela rápida expansão industrial, por projetos de petróleo e gás em larga escala e pelo aumento dos investimentos em manufatura no âmbito das iniciativas da Visão 2030. Por exemplo, as colaborações com fornecedores globais de revestimentos industriais apoiam a aplicação de revestimentos antifricção avançados em operações de energia, petroquímica e equipamentos pesados, melhorando a eficiência e a durabilidade. A expansão das instalações industriais, o crescimento da produção automotiva e de máquinas e o foco crescente na redução do tempo de inatividade para manutenção estão acelerando a adoção. Programas de diversificação industrial liderados pelo governo e o desenvolvimento de infraestrutura impulsionam ainda mais o crescimento do mercado. A ênfase crescente na eficiência operacional, na confiabilidade dos equipamentos e na redução de custos a longo prazo posiciona a Arábia Saudita como o mercado de crescimento mais rápido da região.

Análise do Mercado de Revestimentos Antifricção na África do Sul

A África do Sul deverá apresentar um crescimento constante entre 2026 e 2033, impulsionado pela demanda contínua dos setores de mineração, fabricação automotiva e manutenção de equipamentos industriais. A crescente adoção de revestimentos antifricção para reduzir o desgaste e melhorar o desempenho em máquinas de mineração e componentes industriais sustenta a expansão consistente do mercado. A presença de fornecedores regionais de serviços industriais, a modernização gradual das instalações de produção e o acesso facilitado a tecnologias avançadas de revestimento fortalecem o desenvolvimento do mercado. O foco crescente na eficiência, durabilidade e soluções de manutenção com boa relação custo-benefício dos equipamentos também contribui para o crescimento estável da África do Sul e sua presença no mercado regional.

Participação de mercado de revestimentos antifricção no Oriente Médio e na África

O setor de revestimentos antifricção é liderado principalmente por empresas consolidadas, incluindo:

- DuPont (EUA)

- Parker Hannifin Corp (EUA)

- CARL BECHEM GMBH (Alemanha)

- ASV Mutichemie Private Limited (Índia)

- Whitmore Manufacturing LLC (EUA)

- FUCHS LUBRITECH GmbH (Alemanha)

- Corporação Lubrizol (EUA)

- Lubrificação Klüber (Alemanha)

- Royal DSM NV (Países Baixos)

- Evonik Industries AG (Alemanha)

Novidades no mercado de revestimentos antifricção no Oriente Médio e na África

- Em janeiro de 2026, a SSG anunciou a criação de uma unidade de revestimentos médicos na Costa Rica, com um investimento de longo prazo superior a US$ 10 milhões para aquisição de terrenos e construção de instalações dedicadas. Espera-se que essa iniciativa aumente significativamente sua capacidade de produção de revestimentos antifricção especializados, fortaleça sua presença no segmento de saúde, melhore a eficiência da cadeia de suprimentos e atenda à crescente demanda por soluções de revestimento biocompatíveis e de alta precisão.

- Em maio de 2025, a PPG Industries lançou uma nova geração de revestimentos antifricção ultrabaixo atrito e sem cobre, em paralelo aos esforços contínuos de expansão da capacidade de produção. Espera-se que esse desenvolvimento reforce a liderança da empresa no mercado, atendendo a rigorosas regulamentações ambientais, apoiando metas de sustentabilidade e atendendo às crescentes exigências de desempenho em aplicações aeroespaciais, industriais e automotivas.

- Em abril de 2025, a Orion Industries apresentou soluções avançadas de revestimento antifricção projetadas para aplicações aeroespaciais e de defesa, destacando a mudança do setor em direção a tecnologias de alta durabilidade e resistência ao desgaste que reduzem o atrito em condições operacionais extremas, prolongam a vida útil dos componentes e melhoram a confiabilidade em ambientes críticos e de alta pressão.

- Em maio de 2021, a DuPont lançou a graxa MOLYKOTE G-1079, um revestimento antifricção com redução de ruído, desenvolvido especificamente para aplicações de contato deslizante em atuadores, incluindo veículos elétricos de última geração. A nova formulação aprimora o desempenho tanto em movimentos rápidos com alta carga quanto em movimentos lentos com baixa carga, melhorando a eficiência operacional e a vida útil dos componentes. Essa inovação fortalece o portfólio de produtos da DuPont e espera-se que impulsione as vendas no mercado, atendendo à crescente demanda por lubrificantes avançados e de alto desempenho nos setores automotivo e industrial.

- Em abril de 2021, a Whitmore Manufacturing, LLC lançou o Lustor, um sistema escalável de armazenamento e distribuição de lubrificantes. A unidade compacta e durável prolonga a vida útil dos lubrificantes e se adapta a praticamente qualquer ambiente industrial, oferecendo maior eficiência e facilidade de uso. Esse desenvolvimento contribui para a otimização operacional de clientes industriais e fortalece a presença da Whitmore Manufacturing no mercado, impulsionando o crescimento da receita e a adoção de soluções avançadas de lubrificação.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.