Middle East And Africa Aluminum Casting Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

4.60 Billion

USD

7.91 Billion

2024

2032

USD

4.60 Billion

USD

7.91 Billion

2024

2032

| 2025 –2032 | |

| USD 4.60 Billion | |

| USD 7.91 Billion | |

|

|

|

|

Segmentação do mercado de fundição de alumínio no Oriente Médio e na África, por processo (fundição em molde descartável e fundição em molde não descartável), fonte (primária (alumínio virgem) e secundária (alumínio reciclado)), aplicação (coletores de admissão, carcaças de cárter de óleo, peças estruturais, peças de chassi, cabeçotes de cilindro, blocos de motor, transmissões, rodas e freios, transferência de calor e outros), usuário final (automotivo, construção civil, industrial, eletrodomésticos, aeroespacial, eletrônico e elétrico, ferramentas de engenharia e outros) - Tendências e previsões do setor até 2032.

Tamanho do mercado de fundição de alumínio no Oriente Médio e na África

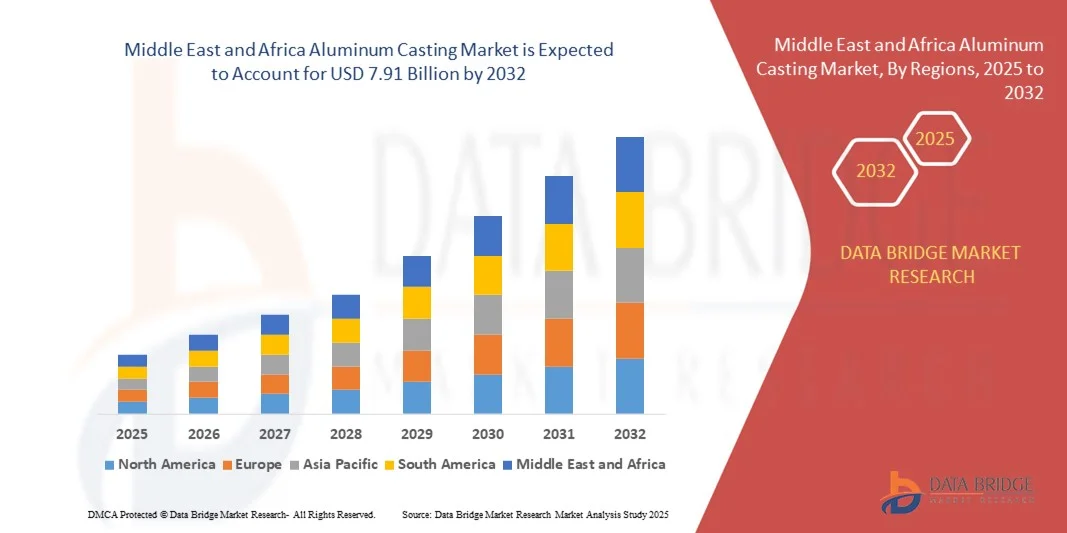

- O mercado de fundição de alumínio no Oriente Médio e na África foi avaliado em US$ 4,60 bilhões em 2024 e projeta-se que alcance US$ 7,91 bilhões até 2032 , crescendo a uma taxa composta de crescimento anual (CAGR) de 7,00% durante o período de previsão.

- O crescimento do mercado é impulsionado principalmente pela crescente industrialização, expansão dos setores automotivo e da construção civil e pela demanda cada vez maior por componentes leves e de alto desempenho em diversas aplicações.

- Além disso, os avanços nas tecnologias de fundição, aliados ao foco em práticas de fabricação sustentáveis e soluções energeticamente eficientes, estão impulsionando a adoção tanto em mercados consolidados quanto em mercados emergentes. Esses fatores combinados estão acelerando a adoção de soluções de fundição de alumínio, impulsionando significativamente o crescimento do setor.

Análise do mercado de fundição de alumínio no Oriente Médio e na África

- As peças fundidas de alumínio, que fornecem componentes leves e de alta resistência para aplicações automotivas, de construção e industriais, são cada vez mais importantes na manufatura moderna devido à sua durabilidade, resistência à corrosão e adaptabilidade a projetos complexos.

- A crescente demanda por fundição de alumínio é impulsionada principalmente pelo crescimento do setor automotivo, pela expansão das atividades de construção e pela necessidade de soluções leves e com eficiência energética em diversas aplicações industriais.

- Os Emirados Árabes Unidos dominaram o mercado de fundição de alumínio do Oriente Médio e da África, com a maior participação na receita, de 37,2% em 2024, impulsionados por uma infraestrutura industrial significativa, investimentos nos setores automotivo e aeroespacial e a presença de importantes fabricantes de fundição, principalmente em países como os Emirados Árabes Unidos e a Arábia Saudita, onde a demanda por componentes de alumínio de alto desempenho está em ascensão.

- Prevê-se que a Arábia Saudita seja a região de crescimento mais rápido no mercado de fundição de alumínio do Oriente Médio e da África durante o período de previsão, devido à rápida industrialização, ao desenvolvimento da infraestrutura e ao aumento da produção automotiva em países como África do Sul e Nigéria.

- O segmento de fundição em moldes descartáveis dominou o mercado com a maior participação na receita, de 57,4% em 2024, impulsionado por sua adequação para a produção de geometrias complexas, componentes leves e peças de alto desempenho em aplicações automotivas e industriais.

Escopo do relatório e segmentação do mercado de fundição de alumínio no Oriente Médio e na África

|

Atributos |

Fundição de Alumínio: Principais Análises de Mercado |

|

Segmentos abrangidos |

|

|

Países abrangidos |

Oriente Médio e África

|

|

Principais participantes do mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor agregado |

Além das informações sobre cenários de mercado, como valor de mercado, taxa de crescimento, segmentação, cobertura geográfica e principais participantes, os relatórios de mercado elaborados pela Data Bridge Market Research também incluem análises aprofundadas de especialistas, análises de preços, análises de participação de marcas, pesquisas com consumidores, análises demográficas, análises da cadeia de suprimentos, análises da cadeia de valor, visão geral de matérias-primas/insumos, critérios de seleção de fornecedores, análise PESTLE, análise de Porter e estrutura regulatória. |

Tendências do mercado de fundição de alumínio no Oriente Médio e na África

Avanços em componentes de alumínio leves e de alto desempenho

- Uma tendência significativa e crescente no mercado de fundição de alumínio do Oriente Médio e da África é a adoção cada vez maior de componentes de alumínio leves e de alto desempenho em aplicações automotivas, aeroespaciais e industriais. Essa mudança é impulsionada pela necessidade de maior eficiência de combustível, redução de emissões e melhor desempenho estrutural.

- Por exemplo, os fabricantes de automóveis estão utilizando cada vez mais blocos de motor, componentes de chassis e painéis de carroceria em alumínio para reduzir o peso dos veículos, mantendo a resistência e a durabilidade. Da mesma forma, as empresas aeroespaciais estão integrando peças fundidas de alumínio em componentes estruturais para otimizar o peso sem comprometer a segurança e o desempenho.

- Os avanços nas tecnologias de fundição, como a fundição sob pressão e a fundição assistida por vácuo, permitem a produção de geometrias complexas com tolerâncias rigorosas e acabamentos superficiais superiores. Essas inovações melhoram o desempenho e a confiabilidade dos componentes, ao mesmo tempo que reduzem o tempo de produção e o desperdício de material.

- O crescente foco em práticas de fabricação sustentáveis também está impulsionando a adoção, visto que o alumínio é altamente reciclável e pode ser reutilizado sem perda significativa de suas propriedades. Isso está em consonância com as regulamentações ambientais globais e as metas de sustentabilidade corporativa, principalmente em regiões de rápida industrialização no Oriente Médio e na África.

- Empresas como a Emirates Global Aluminium e a SABIC estão desenvolvendo ligas de alumínio de alta resistência e soluções avançadas de fundição, adaptadas aos setores automotivo, de construção e aeroespacial, visando otimizar o desempenho e promover a sustentabilidade ambiental.

- A demanda por peças fundidas de alumínio leves, duráveis e eficientes está se expandindo rapidamente no Oriente Médio e na África, impulsionada pelo crescimento industrial, projetos de infraestrutura e pela crescente ênfase em práticas de fabricação energeticamente eficientes e ambientalmente responsáveis .

Dinâmica do mercado de fundição de alumínio no Oriente Médio e na África

Motorista

A crescente demanda é impulsionada pela expansão industrial e pela adoção de materiais leves.

- A rápida industrialização no Oriente Médio e na África, juntamente com a crescente demanda dos setores automotivo, de construção e aeroespacial, é um fator significativo para o aumento da adoção de peças fundidas de alumínio.

- Por exemplo, em 2024, a Emirates Global Aluminium expandiu sua capacidade de produção para atender à crescente demanda por componentes de alumínio leves e de alta resistência para aplicações automotivas e de construção. Espera-se que iniciativas como essa, tomadas por empresas importantes, impulsionem o crescimento do mercado de fundição de alumínio durante o período de previsão.

- À medida que os fabricantes priorizam cada vez mais a eficiência de combustível, a redução do peso estrutural e o melhor desempenho, as peças fundidas de alumínio oferecem uma solução versátil em comparação com materiais tradicionais mais pesados, como o aço. As peças fundidas avançadas oferecem durabilidade, resistência à corrosão e flexibilidade de design, tornando-as ideais para aplicações de alto desempenho.

- Além disso, o desenvolvimento contínuo de edifícios inteligentes e energeticamente eficientes, aliado a projetos de infraestrutura em mercados emergentes, está impulsionando a adoção de peças fundidas de alumínio em aplicações estruturais e arquitetônicas, onde tanto a resistência quanto a leveza são essenciais.

- A demanda por componentes de engenharia de precisão, incluindo peças de motores automotivos, chassis e máquinas industriais, está impulsionando ainda mais o crescimento, sustentada por avanços em fundição sob pressão, fundição assistida a vácuo e outras tecnologias modernas de produção.

Restrição/Desafio

Altos custos de produção e requisitos de habilidades técnicas

- O investimento inicial relativamente elevado exigido para instalações, máquinas e tecnologia avançadas de fundição de alumínio pode representar um desafio para os fabricantes de pequeno e médio porte da região.

- Por exemplo, a instalação de linhas de fundição sob pressão de alta precisão ou a adoção de técnicas de fundição assistida por vácuo envolvem investimentos de capital substanciais e treinamento de mão de obra qualificada, o que pode limitar a penetração no mercado em áreas em desenvolvimento.

- Além disso, manter a qualidade consistente em peças fundidas de alumínio exige conhecimento técnico e controles de processo rigorosos. Variações na composição da liga, temperatura e taxas de resfriamento podem afetar o desempenho e a confiabilidade dos produtos finais, representando desafios para fabricantes com experiência ou recursos limitados.

- Embora a automação e as modernas tecnologias de fundição estejam gradualmente reduzindo a necessidade de mão de obra manual e melhorando a eficiência, a necessidade de pessoal treinado e de processos de garantia de qualidade continua sendo um obstáculo crítico.

- Superar esses desafios por meio de investimentos em tecnologias avançadas de fundição, treinamento da força de trabalho e otimização de processos será vital para o crescimento sustentável e a competitividade no mercado de fundição de alumínio do Oriente Médio e da África.

Escopo do mercado de fundição de alumínio no Oriente Médio e na África

O mercado de fundição de alumínio no Oriente Médio e na África é segmentado com base no processo, na fonte, na aplicação e no usuário final.

- Por processo

Com base no processo, o mercado de fundição de alumínio no Oriente Médio e na África é segmentado em fundição com moldes descartáveis e fundição com moldes não descartáveis. O segmento de fundição com moldes descartáveis dominou o mercado com a maior participação de receita, de 57,4% em 2024, impulsionado por sua adequação para a produção de geometrias complexas, componentes leves e peças de alto desempenho em aplicações automotivas e industriais. Os fabricantes preferem os processos de moldes descartáveis devido à sua capacidade de minimizar as necessidades de usinagem e permitir flexibilidade de projeto.

O segmento de fundição em moldes não descartáveis deverá apresentar a taxa de crescimento anual composta (CAGR) mais rápida, de 19,8%, entre 2025 e 2032, impulsionado pela crescente demanda por soluções de moldes reutilizáveis e com boa relação custo-benefício, principalmente em cenários de produção de médio a alto volume, onde durabilidade, repetibilidade e custos operacionais reduzidos tornam essa opção atraente.

- Por Fonte

Com base na origem, o mercado é segmentado em alumínio primário (alumínio virgem) e secundário (alumínio reciclado). O segmento de alumínio primário detinha a maior participação na receita, com 62,1% em 2024, impulsionado pelo fornecimento consistente de alumínio de alta qualidade e suas propriedades mecânicas superiores, necessárias para aplicações críticas, como componentes de motores, peças de chassis e máquinas industriais. A crescente industrialização e a produção automotiva na região sustentam essa demanda.

Prevê-se que o segmento de alumínio secundário apresente a taxa de crescimento anual composta (CAGR) mais rápida, de 21,5%, entre 2025 e 2032, impulsionado pela crescente conscientização ambiental, iniciativas governamentais que promovem a reciclagem e vantagens de custo. A adoção de alumínio reciclado está aumentando na construção civil, na indústria automotiva e em bens de consumo devido aos seus benefícios em termos de eficiência energética e sustentabilidade.

- Por meio de aplicação

Com base na aplicação, o mercado de fundição de alumínio no Oriente Médio e na África é segmentado em coletores de admissão, carcaças de cárter de óleo, peças estruturais, peças de chassi, cabeçotes de cilindro, blocos de motor, transmissões, rodas e freios, transferência de calor e outros. O segmento de peças estruturais dominou o mercado com uma participação de 38,7% da receita em 2024, devido ao seu uso generalizado em aplicações automotivas e de construção que exigem componentes leves, porém duráveis.

O segmento de rodas e freios deverá apresentar a taxa de crescimento anual composta (CAGR) mais rápida, de 20,3%, entre 2025 e 2032, impulsionado pelo aumento da produção de veículos, pela busca por eficiência de combustível e pela crescente adoção de ligas de alumínio leves para melhor desempenho e redução de emissões.

- Por usuário final

Com base no usuário final, o mercado de fundição de alumínio no Oriente Médio e na África é segmentado em automotivo, construção civil, industrial, eletrodomésticos, aeroespacial, eletrônico e elétrico, ferramentas de engenharia e outros. O segmento automotivo representou a maior participação na receita, com 45,6% em 2024, impulsionado pela demanda por componentes leves e de alta resistência, pelas pressões regulatórias para redução de emissões e pela proliferação de veículos elétricos.

Prevê-se que o segmento aeroespacial apresente a taxa de crescimento anual composta (CAGR) mais rápida, de 22,1%, entre 2025 e 2032, devido à crescente adoção de peças fundidas de alumínio em componentes de aeronaves para otimização de peso, eficiência de combustível e melhoria de desempenho, juntamente com o crescimento das atividades de aviação comercial e de defesa na região.

Análise Regional do Mercado de Fundição de Alumínio no Oriente Médio e na África

- Os Emirados Árabes Unidos dominaram o mercado de fundição de alumínio com a maior participação na receita, de 37,2% em 2024, impulsionados pela rápida industrialização, expansão dos setores automotivo e de construção e crescente demanda por componentes leves e de alto desempenho.

- Fabricantes e usuários finais da região preferem cada vez mais as peças fundidas de alumínio devido à sua relação resistência/peso, resistência à corrosão e versatilidade em aplicações automotivas, industriais e de construção.

- Essa ampla adoção é ainda mais impulsionada por iniciativas governamentais que promovem a manufatura sustentável, avanços nas tecnologias de fundição e investimentos crescentes em soluções de eficiência energética, estabelecendo a fundição de alumínio como uma opção preferencial tanto para indústrias consolidadas quanto para mercados emergentes no Oriente Médio e na África.

Análise do Mercado de Fundição de Alumínio na Arábia Saudita

O mercado de fundição de alumínio da Arábia Saudita detinha uma parcela significativa da receita em 2024, impulsionado pelos grandes projetos de infraestrutura do país, pela expansão da produção automotiva e pelas iniciativas governamentais para diversificar o setor industrial. A demanda por componentes de alumínio leves e de alto desempenho para aplicações em construção, transporte e máquinas industriais está impulsionando o crescimento do mercado. Além disso, a adoção de tecnologias avançadas de fundição e o foco em práticas de fabricação sustentáveis e energeticamente eficientes estão acelerando ainda mais a expansão do mercado.

Análise do Mercado de Fundição de Alumínio nos Emirados Árabes Unidos

O mercado de fundição de alumínio dos Emirados Árabes Unidos deverá apresentar um crescimento substancial durante o período de previsão, impulsionado pela rápida urbanização, pelo aumento da construção comercial e residencial e pelos investimentos nos setores aeroespacial, de defesa e automotivo. O uso de peças fundidas de alumínio de alta qualidade em edifícios modernos, veículos e equipamentos industriais, juntamente com os avanços tecnológicos nos processos de produção, está impulsionando a adoção do mercado. Iniciativas governamentais que apoiam a inovação industrial e a eficiência energética também contribuem para o crescimento.

Análise do Mercado de Fundição de Alumínio na África do Sul

Prevê-se que o mercado de fundição de alumínio na África do Sul cresça de forma constante, impulsionado pela fabricação de automóveis, produção de máquinas industriais e fabricação de equipamentos de mineração. A crescente demanda por componentes de alumínio leves e resistentes à corrosão, juntamente com os esforços governamentais para modernizar a base industrial, está promovendo a adoção nos setores automotivo, de construção e industrial. O investimento em tecnologias avançadas de fundição e a melhoria da eficiência energética contribuem ainda mais para a expansão do mercado.

Análise do Mercado de Fundição de Alumínio no Egito

Prevê-se que o mercado de fundição de alumínio no Egito cresça a uma taxa composta de crescimento anual (CAGR) notável durante o período de previsão, impulsionado pelo desenvolvimento de infraestrutura, crescimento na montagem automotiva e investimentos em projetos de construção e energia. A crescente demanda por componentes de alumínio duráveis e leves em aplicações estruturais, mecânicas e automotivas está impulsionando a adoção do mercado. A integração de práticas de fabricação sustentáveis e avanços tecnológicos na fundição está impulsionando ainda mais o crescimento do mercado.

Participação de mercado de fundição de alumínio no Oriente Médio e na África

A indústria de fundição de alumínio é liderada principalmente por empresas consolidadas, incluindo:

• Laminadores de alumínio do Golfo (Emirados Árabes Unidos)

• Sabic (Arábia Saudita)

• Emirates Global Aluminium (EAU)

• Alcoa (EUA)

• Noranda Aluminum (Canadá)

• Constellium (França)

• Indústrias Hindalco (Índia)

• China Zhongwang Holdings (China)

• Novelis (EUA)

• ElvalHalcor (Grécia)

• Mubadala Aluminium (EAU)

• Produtos de aço Al Jazeera (Catar)

• Alumínio Bahrein (Bahrein)

• Companhia Nacional de Produtos de Alumínio (Arábia Saudita)

• Maaden Aluminium (Arábia Saudita)

• Sundwiger Aluminium (Alemanha)

• AAI (Indústrias Africanas de Alumínio) (África do Sul)

• Metallum (África do Sul)

• Alumeco (EAU)

• Laminação de alumínio no Bahrein (Bahrein)

Quais são os desenvolvimentos recentes no mercado de fundição de alumínio no Oriente Médio e na África?

- Em abril de 2023, a Emirates Global Aluminium (EGA), uma das principais produtoras de alumínio dos Emirados Árabes Unidos, anunciou a expansão de suas instalações de fundição de alumínio de última geração para atender à crescente demanda dos setores automotivo e da construção civil. A iniciativa tem como foco o fornecimento de componentes de alumínio de alta qualidade, leves e com eficiência energética, reforçando o compromisso da EGA com a inovação e as práticas de fabricação sustentáveis no Oriente Médio e na África.

- Em março de 2023, a South African Foundries Ltd. lançou uma nova linha de peças fundidas de alumínio de precisão, desenvolvida especificamente para aplicações em máquinas industriais e automotivas. Este desenvolvimento estratégico reforça o foco da empresa em aprimorar o desempenho e a durabilidade dos produtos, apoiar os fabricantes locais e consolidar sua presença no crescente mercado regional de fundição de alumínio.

- Em março de 2023, a Egyptian Aluminum Company (EGAL) inaugurou com sucesso uma moderna unidade de fundição de alumínio, projetada para atender aos crescentes setores da construção civil e de transportes. Ao adotar tecnologias de fundição de ponta, a EGAL está aprimorando a eficiência da produção, melhorando a qualidade dos componentes e impulsionando a região rumo a práticas de fabricação mais sustentáveis.

- Em fevereiro de 2023, a Aluminium Bahrain BSC (Alba) anunciou uma colaboração com fabricantes de equipamentos originais (OEMs) automotivos regionais para o fornecimento de peças fundidas de alumínio de alto desempenho para componentes de motores e estruturas. Essa parceria reforça o compromisso da Alba em apoiar o crescimento industrial, promover soluções de baixo peso e expandir a adoção de peças fundidas de alumínio em diversas aplicações no Oriente Médio e na África.

- Em janeiro de 2023, a United Casting Solutions (UCS), líder regional em componentes de alumínio de precisão, inaugurou uma nova linha de fundição automatizada nos Emirados Árabes Unidos, projetada para aplicações aeroespaciais e automotivas. A iniciativa destaca o foco da UCS na integração de tecnologia avançada, na melhoria da eficiência da produção e no fornecimento de componentes de alumínio leves e de alta qualidade para atender à crescente demanda regional.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.