Middle East And Africa Airless Packaging Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

248.64 Million

USD

399.29 Million

2024

2032

USD

248.64 Million

USD

399.29 Million

2024

2032

| 2025 –2032 | |

| USD 248.64 Million | |

| USD 399.29 Million | |

|

|

|

|

Segmentação do mercado de embalagens sem ar no Oriente Médio e África, por tipo de embalagem (plástico rígido e plástico flexível), tipo de material (plástico, vidro e outros), categoria (premium e de massa), canal de distribuição (supermercados, hipermercados, varejistas especializados, lojas de conveniência e comércio eletrônico), usuário final (cuidados pessoais e domésticos, saúde, alimentos e bebidas e outros) - tendências do setor e previsão até 2032

Tamanho do mercado de embalagens sem ar no Oriente Médio e África

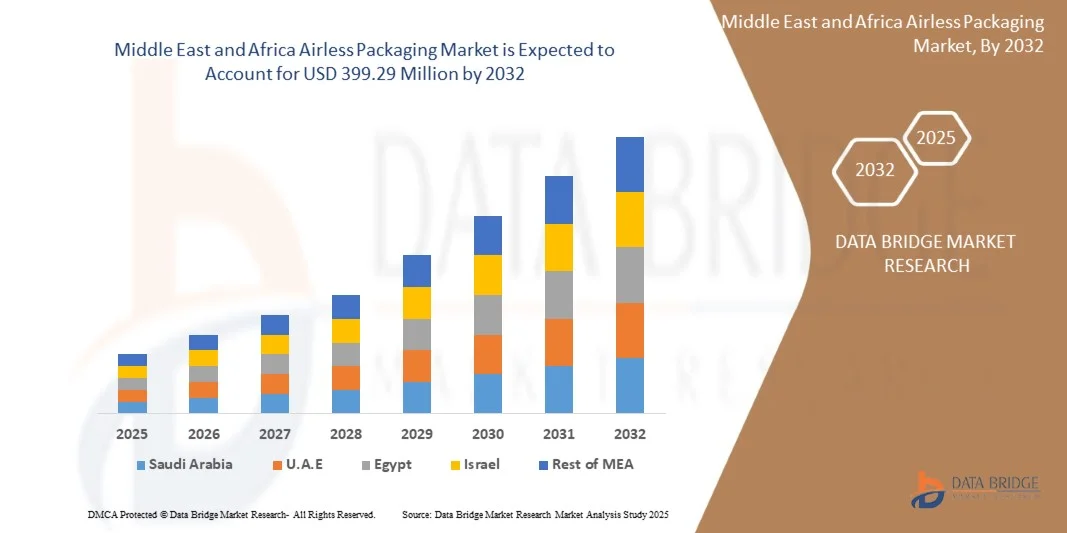

- O tamanho do mercado de embalagens sem ar do Oriente Médio e da África foi avaliado em US$ 248,64 milhões em 2024 e deve atingir US$ 399,29 milhões até 2032 , com um CAGR de 6,1% durante o período previsto.

- O crescimento do mercado é amplamente impulsionado pela crescente demanda por soluções de embalagens sustentáveis e livres de contaminação nos setores de cosméticos, cuidados pessoais e saúde. A mudança para sistemas sem ar, ecologicamente corretos, é impulsionada pela necessidade de preservar a integridade do produto, prevenir a oxidação e minimizar o desperdício, em linha com as metas de sustentabilidade e as expectativas dos consumidores por alternativas de embalagens verdes.

- Além disso, o aumento dos investimentos das marcas em tecnologias avançadas de dispensação e a introdução de recipientes sem ar recarregáveis e recicláveis estão acelerando a inovação e a adoção de produtos. Essas tendências reforçam a expansão do mercado, oferecendo maior proteção ao produto, conveniência ao usuário e soluções ambientalmente responsáveis.

Análise do mercado de embalagens sem ar no Oriente Médio e África

- As embalagens sem ar, projetadas para proteger formulações sensíveis da contaminação externa e da exposição ao ar, estão ganhando força significativa nos setores de cosméticos, produtos farmacêuticos e cuidados com a pele. Sua capacidade de estender a vida útil do produto, reduzir o uso de conservantes e melhorar a precisão da dosagem as torna uma solução ideal para produtos premium e de alto desempenho.

- O crescente foco do consumidor em higiene, segurança dos produtos e consumo sustentável é a principal força motriz por trás do crescimento do mercado. Os fabricantes estão adotando cada vez mais sistemas sem ar para atender às crescentes normas regulatórias e aos requisitos de sustentabilidade, reforçando assim a evolução do mercado em direção a soluções de embalagem inovadoras e de alta eficiência.

- Os Emirados Árabes Unidos dominaram o mercado de embalagens sem ar do Oriente Médio e da África em 2024, devido às suas indústrias avançadas de cosméticos, cuidados pessoais e farmacêuticas, forte foco em embalagens higiênicas e de alta qualidade e crescente demanda do consumidor por soluções sustentáveis

- Espera-se que a África do Sul seja o país com crescimento mais rápido no mercado de embalagens sem ar do Oriente Médio e da África durante o período previsto, devido à crescente adoção de produtos de cuidados pessoais e cosméticos entre a classe média em ascensão.

- O segmento de plástico dominou o mercado, com uma participação de mercado de 63,9% em 2024, devido à sua versatilidade, leveza e menor custo de produção em comparação com alternativas de vidro ou metal. Os sistemas airless à base de plástico são amplamente utilizados em aplicações de cuidados com a pele, cosméticos e cuidados pessoais, proporcionando alta flexibilidade de design e resiliência. Os avanços contínuos em plásticos recicláveis e PCR (resina pós-consumo) fortalecem ainda mais sua posição dominante, atendendo às demandas de desempenho e sustentabilidade.

Escopo do relatório e segmentação do mercado de embalagens sem ar no Oriente Médio e África

|

Atributos |

Principais insights do mercado de embalagens sem ar |

|

Segmentos abrangidos |

|

|

Países abrangidos |

Oriente Médio e África

|

|

Principais participantes do mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor agregado |

Além dos insights sobre cenários de mercado, como valor de mercado, taxa de crescimento, segmentação, cobertura geográfica e principais participantes, os relatórios de mercado selecionados pela Data Bridge Market Research também incluem análise de importação e exportação, visão geral da capacidade de produção, análise de consumo de produção, análise de tendência de preço, cenário de mudança climática, análise da cadeia de suprimentos, análise da cadeia de valor, visão geral de matéria-prima/consumíveis, critérios de seleção de fornecedores, análise PESTLE, análise de Porter e estrutura regulatória. |

Tendências do mercado de embalagens sem ar no Oriente Médio e na África

“Ascensão das embalagens Airless recarregáveis e recicláveis”

- O mercado de embalagens sem ar do Oriente Médio e da África está testemunhando uma forte mudança em direção a soluções recarregáveis e recicláveis, à medida que a sustentabilidade se torna um foco central para fabricantes e marcas de embalagens. Essa tendência é impulsionada pela crescente pressão regulatória e pela mudança de atitude dos consumidores em relação ao consumo de produtos ecologicamente corretos, levando as empresas a adotar modelos de economia circular em seus designs de embalagens.

- Por exemplo, a Lumson SpA lançou sua linha de embalagens airless recarregáveis sob o "Sistema TAG", que permite aos consumidores substituir os cartuchos internos enquanto reutilizam o recipiente externo. Da mesma forma, o Aptar Group desenvolveu sua linha Future Airless, projetada para reciclagem total, mantendo a integridade do produto e a estética premium.

- A inovação em ciência dos materiais, orientada pela sustentabilidade, está permitindo o desenvolvimento de sistemas sem ar, construídos a partir de monomateriais, como polietileno e polipropileno, para aumentar a reciclabilidade. Esses projetos garantem que todo o sistema de embalagem possa ser facilmente processado pelos fluxos de reciclagem existentes, mantendo o desempenho do mecanismo sem ar necessário para formulações sensíveis.

- Os formatos recarregáveis estão se tornando cada vez mais populares entre marcas de cuidados pessoais e de cuidados com a pele que buscam reduzir o desperdício de embalagens, mantendo uma experiência de uso luxuosa e conveniente. A adoção desses designs é apoiada pela disposição dos consumidores em investir em produtos que respeitem as responsabilidades ambientais e a usabilidade a longo prazo.

- A tendência também está influenciando os modelos da cadeia de suprimentos, com marcas e fabricantes colaborando na logística reversa de recipientes de refil e desenvolvendo designs modulares para estender o ciclo de vida dos produtos. Esse movimento é apoiado por padrões globais de embalagem e pelo crescente investimento em tecnologias sustentáveis de produção de embalagens.

- O aumento de soluções airless recarregáveis e recicláveis está definindo um novo padrão para embalagens ambientalmente responsáveis, incentivando pesquisas contínuas e melhorias de design para equilibrar a sustentabilidade com a funcionalidade, a estética e a conveniência do usuário em várias categorias de produtos, como cosméticos, produtos farmacêuticos e cuidados pessoais.

Dinâmica do mercado de embalagens sem ar no Oriente Médio e na África

Motorista

“Crescente demanda por soluções sustentáveis e livres de contaminação”

- A crescente demanda dos consumidores por embalagens sustentáveis, alinhadas à conscientização sobre saúde e higiene, tornou-se um dos principais impulsionadores da adoção de embalagens sem ar. O sistema sem ar garante a evacuação completa do produto, preserva os ingredientes ativos e previne a contaminação por meio de seu método de dispensação sem ventilação, atraindo fortemente marcas premium de cosméticos e produtos farmacêuticos.

- Por exemplo, a Quadpack Industries lançou uma coleção de potes sem ar ecológicos, utilizando PET reciclável para proporcionar uma distribuição higiênica e consistente de produtos para a pele. Essa inovação reflete o esforço contínuo da indústria em direção a embalagens mais seguras e com menor desperdício, que ofereçam benefícios ambientais e de desempenho.

- A crescente conscientização ambiental entre os consumidores está levando os fabricantes a integrar materiais com certificação ecológica e a projetar dispensadores recicláveis. Esses sistemas previnem a contaminação externa e também reduzem o desperdício de produtos residuais, reforçando a eficiência e a confiabilidade da marca para formulações sensíveis e de alto valor.

- A embalagem sem ar também é favorecida por permitir que formulações sensíveis ao oxigênio permaneçam estáveis ao longo de sua vida útil, o que impulsiona diretamente o crescimento do mercado nos segmentos de dermocosméticos e farmacêuticos. A ausência de entrada de ar prolonga a longevidade do produto, reduzindo a necessidade de conservantes.

- O crescente avanço tecnológico em sistemas airless, por meio de bombas de engenharia de precisão, revestimentos de barreira aprimorados e designs recicláveis, está gradualmente expandindo sua presença para produtos de mercado de massa. A convergência contínua de sustentabilidade, segurança e funcionalidade continua a fortalecer o papel da embalagem airless como uma solução à prova de futuro para marcas que buscam soluções livres de contaminação e ecoconscientes.

Restrição/Desafio

“Altos custos de fabricação”

- Os altos custos de produção associados à engenharia de precisão e componentes especializados representam uma grande restrição para o mercado de embalagens sem ar do Oriente Médio e da África. O mecanismo requer projetos complexos envolvendo bombas, válvulas e recipientes herméticos, o que aumenta os custos de ferramentas e montagem em comparação com os formatos de embalagem tradicionais.

- Por exemplo, empresas como o Grupo Albéa relataram maiores gastos de produção em suas linhas de embalagem airless devido à integração de moldagem multicomponente e conjuntos de bombas especializados. Essa diferença de custo frequentemente torna as soluções airless menos acessíveis para marcas menores ou segmentos de produtos sensíveis ao custo.

- A fabricação de sistemas sem ar que mantêm a estabilidade da pressão e, ao mesmo tempo, garantem a reciclabilidade, aumenta ainda mais os custos de material e processo. O desafio reside em equilibrar objetivos ecologicamente corretos com integridade mecânica e eficiência de produção, visto que soluções monomateriais recicláveis frequentemente exigem tecnologias de moldagem avançadas.

- As complexidades da cadeia de suprimentos também aumentam as despesas gerais, visto que peças de precisão em recipientes sem ar frequentemente exigem resinas poliméricas de alta qualidade e tolerâncias rigorosas, o que aumenta os requisitos de testes, controle de qualidade e manutenção de moldes. Esses fatores atrasam a escalabilidade e impactam a competitividade de custos nos mercados globais.

- A redução dos custos de produção por meio da automação, de tecnologias inovadoras de moldagem e da eficiência de materiais continua sendo fundamental para uma adoção mais ampla. Superar esse desafio por meio da otimização da produção em massa e da padronização do design será essencial para que o mercado de embalagens sem ar do Oriente Médio e da África alcance escalabilidade econômica sustentável nos próximos anos.

Escopo do mercado de embalagens sem ar no Oriente Médio e na África

O mercado é segmentado com base no tipo de embalagem, tipo de material, categoria, canal de distribuição e usuário final.

• Por tipo de embalagem

Com base no tipo de embalagem, o mercado de embalagens sem ar do Oriente Médio e África é segmentado em plástico rígido e plástico flexível. O segmento de plástico rígido dominou o mercado com a maior participação na receita em 2024 devido à sua proteção superior, durabilidade e capacidade de manter a integridade do produto sem exposição ao ar. As embalagens rígidas sem ar são altamente preferidas nos setores de cosméticos e cuidados pessoais por sua capacidade de prevenir a oxidação e a contaminação de formulações sensíveis. A dominância do segmento também é sustentada pelo uso crescente de recipientes rígidos de alta barreira em aplicações farmacêuticas e de cuidados com a pele, onde a preservação do produto é fundamental.

Prevê-se que o segmento de plásticos flexíveis apresente a maior taxa de crescimento entre 2025 e 2032, impulsionado pela crescente demanda por soluções de embalagens leves, econômicas e sustentáveis. Bolsas e tubos flexíveis sem ar oferecem portabilidade e facilidade de dispensação, alinhando-se à tendência de formatos de embalagens fáceis de transportar e descartáveis. As crescentes inovações em materiais flexíveis recicláveis e de base biológica estão incentivando ainda mais os fabricantes a adotar esses formatos, principalmente em produtos de beleza, saúde e bem-estar.

• Por tipo de material

Com base no tipo de material, o mercado de embalagens sem ar do Oriente Médio e África é segmentado em plástico, vidro e outros. O segmento de plástico detinha a maior participação de mercado, 63,9% em 2024, devido à sua versatilidade, leveza e menor custo de produção em comparação com alternativas de vidro ou metal. Os sistemas sem ar à base de plástico são amplamente utilizados em aplicações de cuidados com a pele, cosméticos e cuidados pessoais, proporcionando alta flexibilidade de design e resiliência. Os avanços contínuos em plásticos recicláveis e PCR (resina pós-consumo) fortalecem ainda mais sua posição dominante, atendendo às demandas de desempenho e sustentabilidade.

Espera-se que o segmento de vidro testemunhe o crescimento mais rápido entre 2025 e 2032, devido ao seu apelo premium e características ecológicas. Recipientes sem ar à base de vidro são cada vez mais preferidos por marcas de cosméticos e cuidados com a pele de luxo que buscam uma embalagem com aparência sustentável e sofisticada. Sua inércia química e capacidade de preservar formulações sensíveis aumentam a confiança do consumidor, enquanto inovações em designs de vidro leves e resistentes a estilhaços ampliam ainda mais a adoção.

• Por categoria

Com base na categoria, o mercado de embalagens airless do Oriente Médio e África é segmentado em premium e de massa. O segmento premium dominou o mercado em 2024, impulsionado pela crescente demanda por cuidados com a pele, cosméticos e produtos de higiene pessoal de luxo. As embalagens airless premium garantem proteção superior ao produto, dispensação precisa e uma estética sofisticada, aprimorando a percepção da marca e a experiência do consumidor. A preferência dos consumidores de alta renda por embalagens sustentáveis, porém elegantes, continua impulsionando a inovação nesta categoria.

O segmento de massa deverá crescer com a CAGR mais rápida entre 2025 e 2032, impulsionado pela crescente adoção de sistemas airless por marcas de médio e grande porte. Os fabricantes estão desenvolvendo soluções airless com boa relação custo-benefício, que mantêm a funcionalidade e, ao mesmo tempo, atendem ao mercado sensível ao preço. A crescente conscientização sobre higiene e preservação de produtos de uso diário, como loções e higienizadores, também está expandindo a penetração das embalagens airless em aplicações de mercado de massa.

• Por Canal de Distribuição

Com base no canal de distribuição, o mercado de embalagens sem ar do Oriente Médio e África é segmentado em supermercados, hipermercados, varejistas especializados, lojas de conveniência e comércio eletrônico. O segmento de supermercados e hipermercados deteve a maior participação na receita em 2024 devido à alta visibilidade do produto, à confiança do consumidor e à ampla variedade de itens de marca para cuidados pessoais e cuidados com a pele. Esses pontos de venda proporcionam engajamento direto com o consumidor, permitindo que produtos premium embalados sem ar atraiam a atenção por meio do design e da funcionalidade.

Prevê-se que o segmento de e-commerce apresente a maior taxa de crescimento entre 2025 e 2032, impulsionado pela mudança para compras online e estratégias de venda direta ao consumidor. A crescente popularidade das plataformas digitais de varejo de beleza e saúde impulsiona a demanda por embalagens sem ar, que garantem entregas à prova de vazamentos e invioláveis. Além disso, marcas de cosméticos exclusivas online preferem embalagens sem ar personalizáveis e visualmente atraentes para aprimorar a identidade da marca e a experiência de desembalar do cliente.

• Por usuário final

Com base no usuário final, o mercado de embalagens sem ar do Oriente Médio e África é segmentado em cuidados pessoais e domésticos, saúde, alimentos e bebidas, entre outros. O segmento de cuidados pessoais e domésticos dominou o mercado em 2024, impulsionado pelo alto uso de embalagens sem ar em produtos para a pele, cosméticos e higiene. O segmento se beneficia da crescente conscientização do consumidor sobre a segurança dos produtos e a dispensação sem contaminação, tornando os sistemas sem ar essenciais para a preservação dos ingredientes ativos. Os lançamentos contínuos de produtos por marcas de beleza que adotam designs sem ar reforçam ainda mais a liderança no segmento.

Espera-se que o segmento de saúde registre o crescimento mais rápido entre 2025 e 2032, impulsionado pelo aumento da aplicação em cremes farmacêuticos, tratamentos tópicos e formulações médicas que exigem dispensação controlada. A embalagem sem ar garante a precisão da dosagem e evita a exposição ao ar e à contaminação microbiana, o que é fundamental para a eficácia médica. A crescente demanda por soluções de embalagem estéreis e sem conservantes no setor de saúde continua a impulsionar a adoção em todas as linhas de produtos farmacêuticos e terapêuticos.

Análise regional do mercado de embalagens sem ar no Oriente Médio e África

- Os Emirados Árabes Unidos dominaram o mercado de embalagens sem ar do Oriente Médio e da África com a maior participação na receita em 2024, impulsionados por suas indústrias avançadas de cosméticos, cuidados pessoais e farmacêuticas, forte foco em embalagens higiênicas e de alta qualidade e crescente demanda do consumidor por soluções sustentáveis

- A inovação contínua em sistemas airless recarregáveis e multifuncionais, juntamente com colaborações entre fabricantes nacionais e marcas globais, reforça a liderança do país no mercado regional

- A crescente preferência por embalagens compactas, fáceis de transportar e ecologicamente corretas, aliada a investimentos constantes em P&D, fortalece a posição dominante dos Emirados Árabes Unidos. A expansão das redes de varejo e a crescente conscientização sobre a preservação dos produtos consolidam ainda mais a presença no mercado.

Visão geral do mercado de embalagens airless na África do Sul, Oriente Médio e África

A África do Sul deverá registrar o CAGR mais rápido no mercado de embalagens sem ar do Oriente Médio e África entre 2025 e 2032, impulsionado pela crescente adoção de produtos de higiene pessoal e cosméticos entre a classe média em ascensão. A crescente conscientização do consumidor sobre higiene, sustentabilidade e soluções modernas de embalagem está acelerando o crescimento do mercado. A demanda por sistemas sem ar acessíveis, fáceis de usar e tecnologicamente avançados é particularmente forte entre os consumidores urbanos. A expansão da distribuição no varejo, o rápido crescimento das plataformas de comércio eletrônico e as parcerias com marcas internacionais estão aumentando a acessibilidade. Iniciativas governamentais que promovem práticas sustentáveis e padrões de qualidade reforçam ainda mais a ascensão da África do Sul como o mercado de crescimento mais rápido da região.

Visão geral do mercado de embalagens sem ar na Arábia Saudita, Oriente Médio e África

A Arábia Saudita deverá apresentar um crescimento constante entre 2025 e 2032, impulsionado pela crescente adoção de embalagens sem ar em cosméticos, cuidados com a pele e aplicações farmacêuticas. A crescente preferência do consumidor por embalagens higiênicas e sustentáveis, aliada ao apoio regulatório a práticas ecologicamente corretas, está impulsionando a expansão do mercado. Colaborações entre empresas globais de embalagens e fabricantes locais estão aprimorando as capacidades tecnológicas e a disponibilidade dos produtos. Iniciativas governamentais que promovem a sustentabilidade e a modernização industrial, aliadas à crescente penetração do varejo e do comércio eletrônico, reforçam a sólida perspectiva de mercado da Arábia Saudita a longo prazo.

Participação no mercado de embalagens sem ar no Oriente Médio e África

O setor de embalagens sem ar é liderado principalmente por empresas bem estabelecidas, incluindo:

- Ball Corporation (EUA)

- Viva Group (EUA)

- Silgan Holdings Inc. (EUA)

- Amcor plc (Suíça)

- Sonoco Products Company (EUA)

- ALBÉA (França)

- AptarGroup, Inc. (EUA)

- FUSIONPKG (EUA)

- Grupo HCT (EUA)

- East Hill Industries, LLC. (EUA)

- Rieke, uma subsidiária da TriMas (EUA)

- Embalagem HCP (China)

- Ningbo Gidea Packaging Co., Ltd. (China)

- TricorBraun (EUA)

- WWP (EUA)

- RPC Group Plc (Reino Unido)

- RAEPAK LTD (Reino Unido)

Últimos desenvolvimentos no mercado de embalagens sem ar no Oriente Médio e na África

- Em outubro de 2023, a Quadpack lançou sua caneta airless recarregável, um avanço significativo em embalagens de beleza sustentáveis. Esta inovação apresenta um sistema de dispensação airless que garante a máxima preservação da formulação, minimizando o desperdício do produto. A funcionalidade recarregável atende à crescente demanda do consumidor por soluções ecológicas e reutilizáveis, fortalecendo a posição da Quadpack como pioneira em embalagens airless sustentáveis. Espera-se que o lançamento acelere a adoção de formatos recarregáveis pelo mercado e influencie outros fabricantes a investir em inovações em embalagens circulares no setor de cosméticos.

- Em outubro de 2023, a Lumson lançou uma nova linha de soluções de embalagens sem ar, projetadas para atender às crescentes exigências da indústria cosmética. O lançamento se concentra em sustentabilidade, higiene e maior prazo de validade, oferecendo sistemas avançados que previnem a contaminação e a oxidação do produto. Essa iniciativa reforça a vantagem competitiva da Lumson, atendendo à crescente preferência do mercado por embalagens ecologicamente corretas e de alto desempenho. A inovação impulsiona o valor da marca Lumson e também contribui para impulsionar o crescimento do mercado por meio da proteção aprimorada do produto e da redução do desperdício de embalagens.

- Em novembro de 2022, a Embelia lançou uma versão recarregável do seu sistema airless para embalagens Baia, desenvolvido em colaboração com a Lablabo, especialista em tecnologias airless baseadas em embalagens flexíveis. Este desenvolvimento reforça a dedicação da Embelia à sustentabilidade e à inovação em embalagens flexíveis airless. O novo sistema recarregável permite que as marcas reduzam o consumo de plástico, mantendo a integridade do produto, marcando um avanço fundamental em soluções de embalagens ecológicas para beleza e cuidados pessoais. O lançamento deverá expandir a influência da empresa entre as marcas que adotam alternativas de embalagens verdes.

- Em maio de 2022, a Carlyle anunciou planos para adquirir 100% das ações da HCP Packaging, empresa líder global em embalagens para cosméticos. Esta aquisição estratégica visa aumentar a eficiência operacional da HCP, ampliar seu alcance global e fortalecer suas capacidades de inovação em embalagens airless e sustentáveis. Ao alavancar a expertise da Carlyle nos setores de consumo e manufatura, espera-se que a mudança estimule ainda mais investimentos em soluções de embalagens airless de alta qualidade e baseadas em tecnologia, apoiando assim a consolidação e o crescimento do mercado.

- Em dezembro de 2021, a Qosmedix expandiu seu portfólio de produtos com o lançamento de novas opções de embalagens airless em estoque, incluindo um frasco branco de 30 ml (1 oz.) feito com 50% de material reciclado pós-consumo (PCR). Esta iniciativa destaca o compromisso da empresa com práticas de fabricação sustentáveis e a crescente integração de materiais reciclados em sistemas airless. O desenvolvimento apoia a mudança do mercado em direção a soluções de embalagens ecologicamente responsáveis, reforçando o papel da Qosmedix na promoção de ofertas de produtos ecologicamente conscientes nas indústrias de cosméticos e cuidados pessoais.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.