Middle East Africa Polyurethane Foam Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

2.20 Billion

USD

3.37 Billion

2024

2032

USD

2.20 Billion

USD

3.37 Billion

2024

2032

| 2025 –2032 | |

| USD 2.20 Billion | |

| USD 3.37 Billion | |

|

|

|

Segmentação do mercado de espuma de poliuretano do Médio Oriente e África, por produto (espuma flexível, espuma rígida e espuma de pulverização), categoria (célula aberta e célula fechada), composição de densidade (composição de baixa densidade, composição de média densidade e composição de alta densidade), processo (espuma moldada, espuma em bloco, pulverização e laminação), utilizador final (roupa de cama e mobiliário, construção civil, automóvel, eletrónica, embalagens, calçado e outros) - Tendências do setor e previsão até 2032.

Análise do mercado de espuma de poliuretano

O mercado da espuma de poliuretano está a registar um crescimento constante, impulsionado pela crescente procura de setores como a construção, automóvel e mobiliário devido às suas excelentes propriedades de isolamento e amortecimento. O mercado está amplamente dividido em espumas rígidas e flexíveis, sendo as espumas rígidas fortemente adotadas em aplicações de isolamento e as espumas flexíveis amplamente utilizadas em roupa de cama e mobiliário. As crescentes preocupações com a sustentabilidade e as regulamentações ambientais estão a incentivar o desenvolvimento de alternativas de base biológica e de baixas emissões. A região da Ásia-Pacífico lidera o mercado, impulsionada pela rápida urbanização, expansão das infraestruturas e crescimento industrial. Além disso, as inovações em soluções de espuma leves e energeticamente eficientes continuam a moldar o futuro do setor.

Tamanho do mercado de espuma de poliuretano

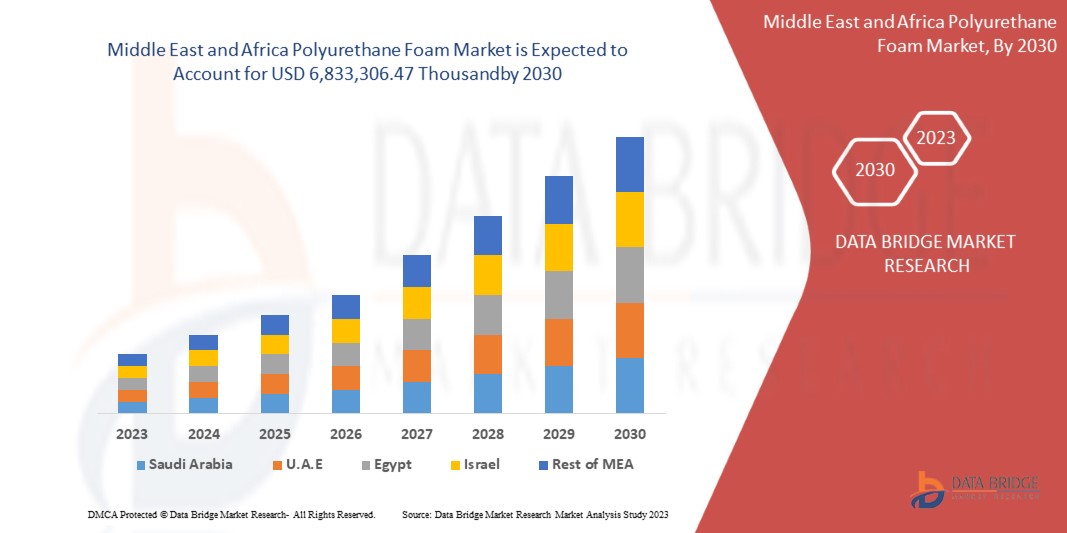

O mercado de espuma de poliuretano do Médio Oriente e África deverá atingir os 3,37 mil milhões de dólares até 2032, face aos 2,20 mil milhões de dólares em 2024, crescendo com um CAGR substancial de 5,6% no período previsto de 2025 a 2032. Para além dos insights sobre os cenários de mercado, como o valor de mercado, a taxa de crescimento, a segmentação, a cobertura geográfica e os principais participantes, os relatórios de mercado selecionados pela Data Bridge Market Research incluem também a análise de importação e exportação, capacidade de produção, análise de consumo de produção, análise de tendência de preço, cenário de alterações climáticas, análise da cadeia de abastecimento, análise da cadeia de valor, visão geral da matéria-prima/consumíveis, critérios de seleção de fornecedores, análise PESTLE, análise de Porter e estrutura regulamentar.

Tendências do mercado de espuma de poliuretano

“Perspetiva positiva em relação ao setor da construção”

O setor da construção pode ser uma grande força motriz na expansão do mercado da espuma de poliuretano. As atividades relacionadas com a construção estão a aumentar devido ao investimento direto estrangeiro nas economias emergentes. O cimento, a madeira, o vidro, os metais e o barro são alguns dos materiais mais comuns utilizados na indústria da construção. O poliuretano é utilizado na construção para criar produtos de alto desempenho que são fortes, mas leves, funcionam bem, são duradouros e adaptáveis. A espuma de poliuretano é um produto químico flexível utilizado em muitas aplicações típicas de construção, tais como colagem, enchimento, vedação e isolamento. As suas elevadas capacidades de isolamento térmico e acústico tornam-no um produto perfeito para o isolamento de tubagens de água, colagem e vedação de telhados e paredes e, mais significativamente, instalação de caixilhos de janelas e portas. Este crescimento das atividades relacionadas com a construção e a ampla aplicação da espuma de poliuretano na indústria da construção aumentaram o crescimento do mercado da espuma de poliuretano.

Âmbito do Relatório e Segmentação do Mercado da Espuma de Poliuretano

|

Atributos |

Insights sobre o mercado da espuma de poliuretano |

|

Segmentos abrangidos |

|

|

Países abrangidos |

África do Sul, Arábia Saudita, Emirados Árabes Unidos, Egito, Israel e Resto do Médio Oriente e África |

|

Principais participantes do mercado |

Henkel AG & Co. KGaA (Alemanha), Saint-Gobain (França), Huntsman International LLC (EUA), BASF (Alemanha), INOAC CORPORATION (Japão), Dow (EUA), SEKISUI CHEMICAL CO., LTD. (Japão), Sunpreeth Engineers (Índia), Recticel NV/SA (Bélgica), Sheela Foam Ltd. (Índia), Eurofoam Srl (Itália), Rogers Corporation (EUA), UFP Technologies, Inc. (EUA), General Plastics Manufacturing Company, Inc. (EUA), Meenakshi Polymers Pvt. Ltd. (Índia), Foamcraft Inc. (EUA), ALSTONE INDUSTRIES PVT. LDA. (Índia), Wisconsin Foam Products (EUA), Tirupati Foam Ltd (Índia) |

|

Oportunidades de Mercado |

|

|

Conjuntos de informações de dados de valor acrescentado |

Para além dos insights sobre cenários de mercado, tais como valor de mercado, taxa de crescimento, segmentação, cobertura geográfica e principais participantes, os relatórios de mercado selecionados pela Data Bridge Market Research incluem também análise de importação e exportação, visão geral da capacidade de produção, análise de consumo de produção, análise de tendências de preços, cenário de alterações climáticas, análise da cadeia de abastecimento, análise da cadeia de valor, visão geral de matérias-primas/consumíveis, critérios de seleção de fornecedores, análise PESTLE, análise Porter e estrutura regulamentar. |

Definição do mercado de espuma de poliuretano

A espuma de poliuretano é um polímero obtido pela reação do diisocianato e do poliol. A espuma de poliuretano é geralmente chamada de espuma PU ou espuma PUR. A espuma de poliuretano proporciona isolamento e proteção aos materiais contra fontes externas que causam corrosão. O tipo de reagente ou catalisador utilizado com o isocianato na produção de espuma de poliuretano depende da aplicação da espuma de PU. Existem três tipos de espuma de poliuretano disponíveis: rígida, flexível e espuma projetada.

Dinâmica do mercado da espuma de poliuretano

Motoristas

- Crescente aceitação no setor automóvel e da aviação

A espuma de poliuretano é um material polimérico com elevada resistência à tracção, baixo peso, resistência química, processabilidade e características mecânicas que têm sido utilizadas em diversas aplicações. Devido às suas propriedades distintas, tem havido uma procura crescente por materiais leves e de alto desempenho nas indústrias aeroespacial e automóvel. Na indústria automóvel, a espuma automóvel desempenha um papel importante, uma vez que desempenha um papel significativo na segurança e conforto dos passageiros, desde os bancos automóveis aos revestimentos de alcatifa. A espuma de poliuretano é utilizada na indústria automóvel para acabamentos, bancos, encostos de cabeça, isolamento acústico e filtros de ar condicionado. Isto porque a espuma é um material que oferece uma vasta gama de propriedades, como o bloqueio de vibrações, a absorção sonora e o isolamento. As espumas de células abertas e fechadas podem ser utilizadas em estofos e bancos automóveis em carros modernos. A espuma de poliuretano nos automóveis atuais oferece aos veículos uma maior quilometragem devido à sua natureza durável e extremamente leve, reduzindo ainda mais o peso total do automóvel. Como resultado, a eficiência do combustível é melhorada e o impacto ambiental é reduzido. Estas aplicações de elevada utilização no setor automóvel impulsionarão o crescimento do mercado de espuma de poliuretano.

A aplicação da espuma de poliuretano na indústria aeroespacial é muito diversificada. É utilizado em peças estruturais, como paredes de cabines de passageiros, secções de bagagem, tetos, elementos de casas de banho, plataformas de convés de voo e divisórias de classes e secções. A espuma pode proteger a aeronave e os passageiros no seu interior de flutuações excessivas de temperatura. A densidade da espuma aeroespacial também auxilia na prevenção de fugas de ar para dentro e para fora da aeronave, preservando assim a pressão da cabine. Pode também servir como uma barreira sonora que protege os passageiros dos elevados níveis de decibéis dos motores dos aviões. Por exemplo, em junho de 2022, de acordo com um artigo publicado pela Linden Industries, LLC. A espuma de poliuretano é amplamente utilizada em interiores automóveis pelas suas propriedades de amortecimento, durabilidade e redução de ruído. Melhora o conforto e o apoio em cadeiras auto e apoios de cabeça, ao mesmo tempo que proporciona absorção de choque. Os painéis e as portas utilizam-no para isolar e minimizar o ruído da estrada. A sua durabilidade garante longevidade mesmo com uma utilização frequente. Essencial para melhorar a segurança e a experiência do passageiro, continua a ser um material essencial na construção de veículos

- Aumento da procura por diversas aplicações de mobiliário doméstico

Os móveis são objetos colocados numa divisão para torná-la mais confortável e agradável. Incluem todos os objetos móveis, como móveis, cortinas, tapetes e artigos de decoração que complementam o design do ambiente. As espumas de poliuretano são amplamente aplicadas em mobiliário residencial devido às suas características únicas, tais como baixa densidade, elevadas propriedades mecânicas e baixa condutividade térmica. As espumas de poliuretano são materiais porosos leves que apresentam características de desempenho promissoras. Estes materiais são ainda aplicados em aplicações finais em almofadas presentes em artigos de mobiliário, como sofás e cadeiras, o que impulsiona o crescimento do mercado da espuma de poliuretano.

Fatores como o aumento populacional, o aumento da urbanização, a inclinação para colchões de qualidade e a melhoria das infraestruturas institucionais impulsionam as vendas de colchões nos segmentos imobiliário e da hotelaria. A espuma flexível de poliuretano possui uma estrutura celular que permite uma certa compressão e resiliência, o que proporciona um efeito de amortecimento. Este recurso é amplamente utilizado em móveis, colchões, almofadas e carpetes. O crescimento de setores como a habitação, a hotelaria e os caminhos-de-ferro é um fator importante para o crescimento do mercado de colchões de espuma de poliuretano. Por exemplo, De acordo com a ISPF, o inquérito foi realizado pela Federação Indiana de Produtos para o Sono. Na Índia, o mercado geral de colchões era de cerca de 18,6 milhões de unidades, prevendo-se uma nova procura de colchões de 7 milhões de unidades por ano. Além disso, o ciclo médio de substituição de colchões foi de 12 anos, e a procura de substituição de colchões foi de 11,6 milhões de unidades. O estudo revelou ainda que o canal de mobiliário é essencial para a nova procura, sendo responsável por 50% das vendas totais de colchões. Além disso, os colchões à base de espuma representaram 52,6% do total das vendas, enquanto os colchões à base de molas representaram 13,5% e os colchões à base de fibra de coco representaram 34%.

Oportunidades

- Perspetiva lucrativa em direção a espumas ecologicamente corretas

As espumas de poliuretano tornaram-se um dos materiais mais essenciais da indústria, uma vez que estão entre os polímeros mais adaptáveis. São empregados na indústria automóvel para assentos, estofos e para-choques; em mobiliário como materiais de enchimento para almofadas de assento, sofás e colchões; no setor da embalagem; na construção para isolamento térmico e acústico; e entre outras aplicações. Para além da sua baixa densidade, baixa condutividade térmica e excelentes características mecânicas, uma das principais vantagens das espumas de poliuretano é a capacidade de ajustar a sua densidade e rigidez às exigências da aplicação do mercado.

Este polímero, no entanto, é principalmente à base de petróleo. As preocupações com o ambiente exigem que os poliuretanos sejam produzidos de forma mais sustentável, como a utilização de matérias-primas renováveis ou a reciclagem de espumas de poliuretano. A mudança no comportamento do consumidor em relação à utilização de materiais sustentáveis, as regras e regulamentos rigorosos do governo e as medidas do fabricante para diminuir a utilização de matérias-primas à base de petróleo na produção de espumas são alguns fatores que levaram à perspetiva positiva em relação às espumas amigas do ambiente. Tais medidas levarão ao desenvolvimento de espumas de poliuretano biodegradáveis e amigas do ambiente. Os fabricantes estão também a colaborar com outras empresas e a desenvolver instalações para a reciclagem de espuma de poliuretano. Por exemplo, em setembro de 2023, de acordo com um artigo publicado pela Crain Communications, Inc., a Covestro colaborou com o Selena Group para desenvolver espumas de poliuretano (PU) sustentáveis para o isolamento de edifícios. Utilizou o MDI bioatribuído da Covestro numa espuma Ultra-Fast 70 melhorada, reduzindo a sua pegada de carbono em 60%. A espuma curou em 90 minutos e rendeu 70 litros por recipiente. Correspondia à qualidade das espumas de origem fóssil e permitia uma integração perfeita. A Selena incluiu polióis de base biológica e materiais PET reciclados na sua gama de espumas

- Políticas governamentais de apoio ao investimento nos mercados nacionais

O aumento do rendimento disponível, a rápida urbanização, as diversas aplicações industriais, o elevado consumo, o aumento do investimento direto estrangeiro e o promissor potencial de exportação são alguns fatores que incentivam o crescimento da indústria química nas economias em desenvolvimento, como a Índia e a China. Várias oportunidades futuras para fabricar produtos químicos especiais e polímeros criarão uma enorme procura doméstica. Os países em desenvolvimento serão autossuficientes na produção de matérias-primas e do produto final. Além disso, o investimento dos países desenvolvidos ou a instalação de uma fábrica de produtos químicos nas economias emergentes pode oferecer uma grande oportunidade para o crescimento do mercado de espuma de poliuretano do Médio Oriente e de África.

A espuma de poliuretano tem aplicações em vários setores, como o automóvel, mobiliário, construção civil, embalagens, têxtil, calçado e outros. O crescimento do mercado destas indústrias irá impulsionar ainda mais a economia dos países em desenvolvimento. As atividades de investigação e desenvolvimento, os avanços tecnológicos, o aumento da procura por parte das indústrias de utilizadores finais e as políticas e estruturas favoráveis influenciaram o crescimento da indústria química nestes países. Por exemplo, em setembro de 2022, de acordo com o Arab News, com um gasto total de 1,1 triliões de dólares em projetos de infraestruturas e imobiliários desde o anúncio da Visão 2030 da Arábia Saudita em 2016, o país está a caminho de se tornar o maior estaleiro de construção do mundo. A Arábia Saudita tornar-se-á facilmente o maior estaleiro de construção do mundo, com mais de 555.000 unidades residenciais, mais de 275.000 chaves de hotel, mais de 4,3 milhões de metros quadrados de espaço comercial e mais de 6,1 milhões de metros quadrados de espaço de escritórios planeado para o reino. Uma infraestrutura tão grande levará à utilização generalizada de espuma de poliuretano no setor da construção nos próximos anos

Restrições/Desafios

- Utilização de produtos químicos nocivos na produção de espuma de poliuretano

As espumas de poliuretano são utilizadas em diversas aplicações, desde o mobiliário ao isolamento. No entanto, a utilização de vários produtos químicos na produção de espumas de poliuretano levanta preocupações ambientais e de saúde para a força de trabalho envolvida na produção. Vários agentes de expansão, pensos, retardantes de chama, tensioativos e catalisadores estão envolvidos no processo. Os polióis habitualmente utilizados são o polietilenoglicol, o polipropilenoglicol e o politetrametilenoglicol. Ao mesmo tempo, o diisocianato de tolueno (TDI) e o diisocianato de metileno difenil (MDI) são materiais diisocianato normalmente utilizados. Por exemplo, em março de 2023, de acordo com a Agência de Proteção Ambiental dos EUA (EPA), os di-isocianatos como o MDI e o TDI causariam asma, danos pulmonares e até a morte, em alguns casos, dos trabalhadores envolvidos. A EPA elaborou um plano de ação para controlo protetor dos mesmos em unidades de trabalho. Diz-se que a libertação de compostos orgânicos voláteis no processo de produção cria preocupações ambientais

- Volatilidade nos preços das matérias-primas

O processo de fabrico em qualquer setor depende do preço das matérias-primas. Quanto maior for a volatilidade do preço da matéria-prima, maior será a hipótese de flutuação no custo do produto e no crescimento do mercado.

As principais matérias-primas para a produção de espuma de poliuretano são os polióis e os diisocianatos derivados do petróleo bruto. Vários motivos, como o clima, a cadeia de abastecimento, a procura, a disponibilidade, as limitações e a situação económica do país, determinam o preço destas matérias-primas. Por exemplo, em novembro de 2024, de acordo com um artigo publicado pela Polymerupdate, as empresas de processamento de petróleo enfrentaram um declínio significativo na rentabilidade no terceiro trimestre de 2024 devido às fracas margens de refinação, com o GRM a cair para 1,3 dólares por barril em setembro de 2024, o valor mais baixo desde o pico da Covid-19. Isto resultou dos baixos preços do crude, do aumento da disponibilidade de crude russo e da fraca procura, principalmente por parte da China. O crescimento económico do Médio Oriente e de África manteve-se estável nos 3,1% em 2024, com riscos de queda devido às tensões geopolíticas e ao sector imobiliário da China. Sofreu também porque a adopção de veículos eléctricos, biocombustíveis e GNL reduziu a procura de combustível petrolífero na Ásia e na Europa. Nova capacidade de refinação pressionou ainda mais as margens

Impacto e cenário atual do mercado de escassez de matéria-prima e atrasos no envio

A Data Bridge Market Research oferece uma análise de alto nível do mercado e fornece informações tendo em conta o impacto e o ambiente atual do mercado de escassez de matérias-primas e atrasos nas remessas. Isto traduz-se em avaliar possibilidades estratégicas, criar planos de ação eficazes e auxiliar as empresas na tomada de decisões importantes.

Além do relatório padrão, também oferecemos análises aprofundadas do nível de aquisição, desde atrasos previstos nas remessas, mapeamento de distribuidores por região, análise de commodities, análise de produção, tendências de mapeamento de preços, fornecimento, análise de desempenho de categoria, soluções de gestão de risco da cadeia de abastecimento, benchmarking avançado e outros serviços de aquisição e apoio estratégico.

Impacto esperado da desaceleração económica nos preços e na disponibilidade dos produtos

Quando a atividade económica abranda, as indústrias começam a sofrer. Os efeitos previstos da crise económica nos preços e na acessibilidade dos produtos são tidos em conta nos relatórios de informação de mercado e nos serviços de inteligência fornecidos pelo DBMR. Com isto, os nossos clientes conseguem geralmente manter-se um passo à frente dos seus concorrentes, projetar as suas vendas e receitas e estimar as suas despesas com lucros e perdas.

Âmbito do mercado de espuma de poliuretano

O mercado é segmentado com base no produto, categoria, composição da densidade, processo e utilizador final. O crescimento entre estes segmentos irá ajudá-lo a analisar segmentos de baixo crescimento nos setores e fornecerá aos utilizadores uma visão geral e informações valiosas do mercado para os ajudar a tomar decisões estratégicas para identificar as principais aplicações do mercado.

Produto

- Espuma flexível

- Espuma rígida

- Espuma de spray

Categoria

- Célula aberta

- Célula fechada

Composição de densidade

- Composição de baixa densidade

- Composição de média densidade

- Composição de alta densidade

Processo

- Espuma moldada

- Espuma de bloco

- Pulverização

- Laminação

Utilizador final

- Cama e Móveis

- Construção e Edificação

- Automotivo

- Eletrônica

- Embalagem

- Calçados

- Outros

Análise regional do mercado de espuma de poliuretano

O mercado é analisado e são fornecidos insights e tendências sobre o tamanho do mercado por produto, categoria, composição de densidade, processo e utilizador final, conforme referenciado acima.

Os países abrangidos pelo mercado são a África do Sul, a Arábia Saudita, os Emirados Árabes Unidos, o Egipto, Israel e o resto do Médio Oriente e África.

Espera-se que a África do Sul domine o mercado de poliuretano do Médio Oriente e de África devido aos seus setores de construção, automóvel e mobiliário bem desenvolvidos. O país tem uma forte base industrial, apoiada por uma procura crescente por materiais duráveis e energeticamente eficientes. Além disso, a presença de importantes produtores de poliuretano e o acesso a matérias-primas reforçam ainda mais a posição de liderança da África do Sul na região.

Prevê-se que a África do Sul seja o mercado de crescimento mais rápido devido à rápida urbanização, ao desenvolvimento de infra-estruturas e à crescente procura de materiais de alto desempenho em vários sectores. As iniciativas governamentais que promovem o crescimento industrial e os investimentos estrangeiros no setor da indústria transformadora também contribuem para a expansão do mercado do poliuretano no país.

A secção do relatório sobre os países também fornece fatores individuais que impactam o mercado e alterações na regulamentação do mercado nacional que impactam as tendências atuais e futuras do mercado. Pontos de dados como a análise da cadeia de valor a montante e a jusante, tendências técnicas e análise das cinco forças de Porter, estudos de caso são alguns dos indicadores utilizados para prever o cenário de mercado para países individuais. Além disso, a presença e a disponibilidade de marcas do Médio Oriente e de África e os seus desafios enfrentados devido à grande ou escassa concorrência de marcas locais e nacionais, ao impacto das tarifas domésticas e das rotas comerciais são considerados ao fornecer uma análise de previsão dos dados do país.

Participação no mercado de espuma de poliuretano

O cenário competitivo do mercado fornece detalhes por concorrentes. Os detalhes incluídos são a visão geral da empresa, finanças da empresa, receitas geradas, potencial de mercado, investimento em investigação e desenvolvimento, novas iniciativas de mercado, presença no Médio Oriente e África, localizações e instalações de produção, capacidades de produção, pontos fortes e fracos da empresa, lançamento de produtos, amplitude e abrangência do produto, domínio da aplicação. Os pontos de dados fornecidos acima estão apenas relacionados com o foco das empresas em relação ao mercado.

Os líderes de mercado de espuma de poliuretano que operam no mercado são:

- Henkel AG & Co. KGaA (Alemanha)

- Saint-Gobain (França)

- Huntsman International LLC (EUA)

- BASF (Alemanha)

- INOAC CORPORATION (Japão)

- Dow (EUA)

- SEKISUI QUÍMICA CO., LTD. (Japão)

- Engenheiros Sunpreeth (Índia)

- Recticel NV/SA (Bélgica)

- Sheela Foam Ltd. (Índia)

- Eurofoam Srl (Itália)

- Rogers Corporation (EUA)

- UFP Technologies, Inc. (EUA)

- General Plastics Manufacturing Company, Inc. (EUA)

- Meenakshi Polímeros Pvt. Lda. (Índia)

- Foamcraft Inc. (EUA)

- ALSTONE INDUSTRIES Pvt. Lda. LDA. (Índia)

- Produtos de espuma Wisconsin (EUA)

- Tirupati Foam Ltd (Índia)

Últimos desenvolvimentos no mercado da espuma de poliuretano:

- Em setembro de 2022, a Saint-Gobain recebeu todas as aprovações necessárias das autoridades relevantes para a aquisição da GCP Applied Technologies Inc. (uma importante empresa do Médio Oriente e África em produtos químicos para a construção). Esta aquisição ajuda a empresa a ganhar mais reconhecimento no campo dos produtos químicos para a construção

- Em maio de 2020, a Huntsman Corporation anunciou a mudança de marca do seu negócio líder mundial de espuma de poliuretano em spray para Huntsman Building Solutions. A Huntsman Building Solutions é uma plataforma mundial da divisão de poliuretanos da Huntsman. Esta reformulação da marca ajudou a empresa a expandir o seu negócio no ramo da espuma de poliuretano

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Índice

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 PRODUCT LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET END-USER COVERAGE GRID

2.11 DBMR VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTLE ANALYSIS

4.1.1 POLITICAL FACTORS:

4.1.2 ECONOMIC FACTORS:

4.1.3 SOCIAL FACTORS:

4.1.4 TECHNOLOGICAL FACTORS:

4.1.5 LEGAL FACTORS:

4.1.6 ENVIRONMENTAL FACTORS:

4.2 PORTER'S FIVE FORCES:

4.2.1 THE THREAT OF NEW ENTRANTS:

4.2.2 THE THREAT OF SUBSTITUTES:

4.2.3 CUSTOMER BARGAINING POWER:

4.2.4 SUPPLIER BARGAINING POWER:

4.2.5 INTERNAL COMPETITION (RIVALRY):

4.3 CLIMATE CHANGE SCENARIO

4.3.1 ENVIRONMENTAL CONCERNS

4.3.2 INDUSTRY RESPONSE

4.3.3 GOVERNMENT'S ROLE

4.3.4 ANALYST RECOMMENDATION

4.4 SUPPLY CHAIN ANALYSIS

4.4.1 OVERVIEW

4.4.2 LOGISTIC COST SCENARIO

4.4.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.5 TECHNOLOGICAL ADVANCEMENTS BY MANUFACTURERS

4.6 VENDOR SELECTION CRITERIA

4.6.1 RAW MATERIAL COVERAGE

4.7 PRICING ANALYSIS

4.8 PRODUCTION CONSUMPTION ANALYSIS

4.9 PRODUCTION CAPACITY ANALYSIS

5 REGULATION COVERAGE

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 POSITIVE OUTLOOK TOWARD THE CONSTRUCTION SECTOR

6.1.2 GROWING ACCEPTANCE IN THE AUTOMOTIVE AND AVIATION SECTOR

6.1.3 RISING DEMAND FOR VARIOUS HOME FURNISHING APPLICATIONS

6.1.4 INCREASING DEMAND FOR PROTECTIVE PACKAGING

6.1.5 RISING ADOPTION OF POLYURETHANE FOAMS IN THE TEXTILE AND FOOTWEAR INDUSTRY

6.2 RESTRAINTS

6.2.1 ENVIRONMENTAL AND HEALTH HAZARDS ASSOCIATED WITH THE USAGE OF POLYURETHANE FOAM

6.2.2 AVAILABILITY OF SUBSTITUTES IN MARKET

6.3 OPPORTUNITIES

6.3.1 LUCRATIVE OUTLOOK TOWARDS ENVIRONMENTALLY FRIENDLY FOAMS

6.3.2 SUPPORTIVE GOVERNMENT POLICIES REGARDING INVESTMENT IN DOMESTIC MARKETS, INCLUDING CHINA AND INDIA

6.4 CHALLENGES

6.4.1 HARMFUL CHEMICAL USAGE IN POLYURETHANE FOAM PRODUCTION

6.4.2 VOLATILITY IN RAW MATERIAL PRICES

6.4.3 STRINGENT RULES AND REGULATIONS FOR POLYURETHANE FOAMS

7 MIDDLE EAST AND AFRICA POLYURETHANE FOAM MARKET, BY PRODUCT

7.1 OVERVIEW

7.2 FLEXIBLE FOAM

7.3 RIGID FOAM

7.4 SPRAY FOAM

8 MIDDLE EAST AND AFRICA POLYURETHANE FOAM MARKET, BY CATEGORY

8.1 OVERVIEW

8.2 OPEN CELL

8.3 CLOSED CELL

9 MIDDLE EAST AND AFRICA POLYURETHANE FOAM MARKET, BY DENSITY COMPOSITION

9.1 OVERVIEW

9.2 LOW-DENSITY COMPOSITION

9.3 MEDIUM-DENSITY COMPOSITION

9.4 HIGH-DENSITY COMPOSITION

10 MIDDLE EAST AND AFRICA POLYURETHANE FOAM MARKET, BY PROCESS

10.1 OVERVIEW

10.2 MOLDED FOAM

10.3 SLABSTOCK FOAM

10.4 SPRAYING

10.5 LAMINATION

11 MIDDLE EAST AND AFRICA POLYURETHANE FOAM MARKET, BY END-USER

11.1 OVERVIEW

11.2 BEDDING & FURNITURE

11.3 BUILDING & CONSTRUCTION

11.4 AUTOMOTIVE

11.5 ELECTRONICS

11.6 PACKAGING

11.7 FOOTWEAR

11.8 OTHERS

12 MIDDLE EAST AND AFRICA POLYURETHANE FOAM MARKET, BY REGION

12.1 MIDDLE EAST AND AFRICA

12.1.1 SOUTH AFRICA

12.1.2 SAUDI ARABIA

12.1.3 UNITED ARAB EMIRATES

12.1.4 EGYPT

12.1.5 QATAR

12.1.6 OMAN

12.1.7 KUWAIT

12.1.8 BAHRAIN

12.1.9 REST OF MIDDLE EAST & AFRICA

13 MIDDLE EAST AND AFRICA POLYURETHANE FOAM MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: MIDDLE EAST AND AFRICA

14 COMPANY PROFILES

14.1 HENKEL AG & CO. KGAA

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 SWOT ANALYSIS

14.1.4 COMPANY SHARE ANALYSIS

14.1.5 PRODUCT PORTFOLIO

14.1.6 RECENT DEVELOPMENTS

14.2 SAINT-GOBAIN

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 COMPANY SHARE ANALYSIS

14.2.4 PRODUCT PORTFOLIO

14.2.5 SWOT ANALYSIS

14.2.6 RECENT DEVELOPMENT

14.3 HUNTSMAN INTERNATIONAL LLC

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 COMPANY SHARE ANALYSIS

14.3.4 SWOT ANALYSIS

14.3.5 PRODUCT PORTFOLIO

14.3.6 RECENT DEVELOPMENTS

14.4 BASF

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 COMPANY SHARE ANALYSIS

14.4.4 PRODUCT PORTFOLIO

14.4.5 SWOT ANALYSIS

14.4.6 RECENT DEVELOPMENT

14.5 INOAC CORPORATION

14.5.1 COMPANY SNAPSHOT

14.5.2 COMPANY SHARE ANALYSIS

14.5.3 PRODUCT PORTFOLIO

14.5.4 SWOT ANALYSIS

14.5.5 RECENT DEVELOPMENT

14.6 ALSTONE INDUSTRIES PVT. LTD.

14.6.1 COMPANY SNAPSHOT

14.6.2 SWOT ANALYSIS

14.6.3 PRODUCT PORTFOLIO

14.6.4 RECENT DEVELOPMENTS

14.7 DOW

14.7.1 COMPANY SNAPSHOT

14.7.2 REVENUE ANALYSIS

14.7.3 PRODUCT PORTFOLIO

14.8 EUROFOAM S.R.L.

14.8.1 COMPANY SNAPSHOT

14.8.2 SWOT ANALYSIS

14.8.3 PRODUCT PORTFOLIO

14.8.4 RECENT DEVELOPMENTS

14.9 FOAMCRAFT, INC.

14.9.1 COMPANY SNAPSHOT

14.9.2 PRODUCT PORTFOLIO

14.9.3 SWOT ANALYSIS

14.9.4 RECENT DEVELOPMENTS

14.1 GENERAL PLASTICS MANUFACTURING COMPANY, INC.

14.10.1 COMPANY SNAPSHOT

14.10.2 SWOT ANALYSIS

14.10.3 PRODUCT PORTFOLIO

14.10.4 RECENT DEVELOPMENTS

14.11 MEENAKSHI POLYMERS PVT. LTD.

14.11.1 COMPANY SNAPSHOT

14.11.2 SWOT ANALYSIS

14.11.3 PRODUCT PORTFOLIO

14.11.4 RECENT DEVELOPMENTS

14.12 RECTICEL NV/SA

14.12.1 COMPANY SNAPSHOT

14.12.2 REVENUE ANALYSIS

14.12.3 SWOT ANALYSIS

14.12.4 PRODUCT PORTFOLIO

14.12.5 RECENT DEVELOPMENT

14.13 ROGERS CORPORATION

14.13.1 COMPANY SNAPSHOT

14.13.2 PRODUCT PORTFOLIO

14.13.3 REVENUE ANALYSIS

14.13.4 SWOT ANALYSIS

14.13.5 RECENT DEVELOPMENTS

14.14 SEKISUI CHEMICAL CO., LTD.

14.14.1 COMPANY SNAPSHOT

14.14.2 REVENUE ANALYSIS

14.14.3 PRODUCT PORTFOLIO

14.14.4 SWOT ANALYSIS

14.14.5 RECENT DEVELOPMENT

14.15 SHEELA FOAM LTD.

14.15.1 COMPANY SNAPSHOT

14.15.2 REVENUE ANALYSIS

14.15.3 SWOT ANALYSIS

14.15.4 PRODUCT PORTFOLIO

14.15.5 RECENT DEVELOPMENTS

14.16 SUNPREETH ENGINEERS

14.16.1 COMPANY SNAPSHOT

14.16.2 SWOT ANALYSIS

14.16.3 PRODUCT PORTFOLIO

14.16.4 RECENT DEVELOPMENTS

14.17 TIRUPATI FOAM LTD.

14.17.1 COMPANY SNAPSHOT

14.17.2 REVENUE ANALYSIS

14.17.3 SWOT ANALYSIS

14.17.4 PRODUCT PORTFOLIO

14.17.5 RECENT DEVELOPMENTS

14.18 UFP TECHNOLOGIES, INC.

14.18.1 COMPANY SNAPSHOT

14.18.2 REVENUE ANALYSIS

14.18.3 PRODUCT PORTFOLIO

14.18.4 SWOT ANALYSIS

14.18.5 RECENT DEVELOPMENT

14.19 WISCONSIN FOAM PRODUCTS

14.19.1 COMPANY SNAPSHOT

14.19.2 PRODUCT PORTFOLIO

14.19.3 SWOT ANALYSIS

14.19.4 RECENT DEVELOPMENTS

15 QUESTIONNAIRE

16 RELATED REPORTS

Lista de Tabela

TABLE 1 REGULATORY COVERAGE

TABLE 2 MIDDLE EAST AND AFRICA POLYURETHANE FOAM MARKET: BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 3 MIDDLE EAST AND AFRICA POLYURETHANE FOAM MARKET: BY PRODUCT, 2018-2032 (TONS)

TABLE 4 MIDDLE EAST AND AFRICA FLEXIBLE FOAM IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 5 MIDDLE EAST AND AFRICA FLEXIBLE FOAM IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (TONS)

TABLE 6 MIDDLE EAST AND AFRICA RIGID FOAM IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 7 MIDDLE EAST AND AFRICA RIGID FOAM IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (TONS)

TABLE 8 MIDDLE EAST AND AFRICA SPRAY FOAM IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 9 MIDDLE EAST AND AFRICA SPRAY FOAM IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (TONS)

TABLE 10 MIDDLE EAST AND AFRICA POLYURETHANE FOAM MARKET: BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 11 MIDDLE EAST AND AFRICA POLYURETHANE FOAM MARKET: BY CATEGORY, 2018-2032 (TONS)

TABLE 12 MIDDLE EAST AND AFRICA OPEN CELL IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 13 MIDDLE EAST AND AFRICA OPEN CELL IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (TONS)

TABLE 14 MIDDLE EAST AND AFRICA CLOSED CELL IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 15 MIDDLE EAST AND AFRICA CLOSED CELL IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (TONS)

TABLE 16 MIDDLE EAST AND AFRICA POLYURETHANE FOAM MARKET: BY DENSITY COMPOSITION, 2018-2032 (USD THOUSAND)

TABLE 17 MIDDLE EAST AND AFRICA POLYURETHANE FOAM MARKET: BY DENSITY COMPOSITION, 2018-2032 (TONS)

TABLE 18 MIDDLE EAST AND AFRICA LOW-DENSITY COMPOSITION IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 19 MIDDLE EAST AND AFRICA LOW-DENSITY COMPOSITION IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (TONS)

TABLE 20 MIDDLE EAST AND AFRICA MEDIUM-DENSITY COMPOSITION IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 21 MIDDLE EAST AND AFRICA MEDIUM-DENSITY COMPOSITION IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (TONS)

TABLE 22 MIDDLE EAST AND AFRICA HIGH-DENSITY COMPOSITION IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 23 MIDDLE EAST AND AFRICA HIGH-DENSITY COMPOSITION IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (TONS)

TABLE 24 MIDDLE EAST AND AFRICA POLYURETHANE FOAM MARKET: BY PROCESS, 2018-2032 (USD THOUSAND)

TABLE 25 MIDDLE EAST AND AFRICA POLYURETHANE FOAM MARKET: BY PROCESS, 2018-2032 (TONS)

TABLE 26 MIDDLE EAST AND AFRICA MOLDED FOAM IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 27 MIDDLE EAST AND AFRICA MOLDED FOAM IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (TONS)

TABLE 28 MIDDLE EAST AND AFRICA SLABSTOCK FOAM IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 29 MIDDLE EAST AND AFRICA SLABSTOCK FOAM IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (TONS)

TABLE 30 MIDDLE EAST AND AFRICA SPRAYING IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 31 MIDDLE EAST AND AFRICA SPRAYING IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (TONS)

TABLE 32 MIDDLE EAST AND AFRICA LAMINATION IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 33 MIDDLE EAST AND AFRICA LAMINATION IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (TONS)

TABLE 34 MIDDLE EAST AND AFRICA POLYURETHANE FOAM MARKET: BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 35 MIDDLE EAST AND AFRICA POLYURETHANE FOAM MARKET: BY END-USER, 2018-2032 (TONS)

TABLE 36 MIDDLE EAST AND AFRICA BEDDING & FURNITURE IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 37 MIDDLE EAST AND AFRICA BEDDING & FURNITURE IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (TONS)

TABLE 38 MIDDLE EAST AND AFRICA BEDDING & FURNITURE IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 39 MIDDLE EAST AND AFRICA BEDDING & FURNITURE IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 40 MIDDLE EAST AND AFRICA BUILDING & CONSTRUCTION IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 41 MIDDLE EAST AND AFRICA BUILDING & CONSTRUCTION IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (TONS)

TABLE 42 MIDDLE EAST AND AFRICA BUILDING & CONSTRUCTION IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 43 MIDDLE EAST AND AFRICA BUILDING & CONSTRUCTION IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 44 MIDDLE EAST AND AFRICA AUTOMOTIVE IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 45 MIDDLE EAST AND AFRICA AUTOMOTIVE IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (TONS)

TABLE 46 MIDDLE EAST AND AFRICA AUTOMOTIVE IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 47 MIDDLE EAST AND AFRICA AUTOMOTIVE IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 48 MIDDLE EAST AND AFRICA ELECTRONICS IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 49 MIDDLE EAST AND AFRICA ELECTRONICS IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (TONS)

TABLE 50 MIDDLE EAST AND AFRICA ELECTRONICS IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 51 MIDDLE EAST AND AFRICA PACKAGING IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 52 MIDDLE EAST AND AFRICA PACKAGING IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (TONS)

TABLE 53 MIDDLE EAST AND AFRICA PACKAGING IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 54 MIDDLE EAST AND AFRICA PACKAGING IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 55 MIDDLE EAST AND AFRICA FOOTWEAR IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 56 MIDDLE EAST AND AFRICA FOOTWEAR IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (TONS)

TABLE 57 MIDDLE EAST AND AFRICA FOOTWEAR IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 58 MIDDLE EAST AND AFRICA FOOTWEAR IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 59 MIDDLE EAST AND AFRICA OTHERS IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 60 MIDDLE EAST AND AFRICA OTHERS IN POLYURETHANE FOAM MARKET, BY REGION, 2018-2032, (TONS)

TABLE 61 MIDDLE EAST AND AFRICA OTHERS IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 62 MIDDLE EAST AND AFRICA POLYURETHANE FOAM MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 63 MIDDLE EAST & AFRICA POLYURETHANE FOAM MARKET, BY COUNTRY, 2018-2032 (TONS)

TABLE 64 MIDDLE EAST & AFRICA POLYURETHANE FOAM MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 65 MIDDLE EAST & AFRICA POLYURETHANE FOAM MARKET, BY PRODUCT, 2018-2032 (TONS)

TABLE 66 MIDDLE EAST & AFRICA POLYURETHANE FOAM MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 67 MIDDLE EAST & AFRICA POLYURETHANE FOAM MARKET, BY CATEGORY, 2018-2032 (TONS)

TABLE 68 MIDDLE EAST & AFRICA POLYURETHANE FOAM MARKET, BY DENSITY COMPOSITION, 2018-2032 (USD THOUSAND)

TABLE 69 MIDDLE EAST & AFRICA POLYURETHANE FOAM MARKET, BY DENSITY COMPOSITION, 2018-2032 (TONS)

TABLE 70 MIDDLE EAST & AFRICA POLYURETHANE FOAM MARKET, BY PROCESS, 2018-2032 (USD THOUSAND)

TABLE 71 MIDDLE EAST & AFRICA POLYURETHANE FOAM MARKET, BY PROCESS, 2018-2032 (TONS)

TABLE 72 MIDDLE EAST & AFRICA POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 73 MIDDLE EAST & AFRICA POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (TONS)

TABLE 74 MIDDLE EAST & AFRICA BEDDING & FURNITURE IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 75 MIDDLE EAST & AFRICA BEDDING & FURNITURE IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 76 MIDDLE EAST & AFRICA BUILDING & CONSTRUCTION IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 77 MIDDLE EAST & AFRICA BUILDING & CONSTRUCTION IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 78 MIDDLE EAST & AFRICA AUTOMOTIVE IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 79 MIDDLE EAST & AFRICA AUTOMOTIVE IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 80 MIDDLE EAST & AFRICA ELECTRONICS IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 81 MIDDLE EAST & AFRICA PACKAGING IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 82 MIDDLE EAST & AFRICA PACKAGING IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 83 MIDDLE EAST & AFRICA FOOTWEAR IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 84 MIDDLE EAST & AFRICA FOOTWEAR IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 85 MIDDLE EAST & AFRICA OTHERS IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 86 SOUTH AFRICA POLYURETHANE FOAM MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 87 SOUTH AFRICA POLYURETHANE FOAM MARKET, BY PRODUCT, 2018-2032 (TONS)

TABLE 88 SOUTH AFRICA POLYURETHANE FOAM MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 89 SOUTH AFRICA POLYURETHANE FOAM MARKET, BY CATEGORY, 2018-2032 (TONS)

TABLE 90 SOUTH AFRICA POLYURETHANE FOAM MARKET, BY DENSITY COMPOSITION, 2018-2032 (USD THOUSAND)

TABLE 91 SOUTH AFRICA POLYURETHANE FOAM MARKET, BY DENSITY COMPOSITION, 2018-2032 (TONS)

TABLE 92 SOUTH AFRICA POLYURETHANE FOAM MARKET, BY PROCESS, 2018-2032 (USD THOUSAND)

TABLE 93 SOUTH AFRICA POLYURETHANE FOAM MARKET, BY PROCESS, 2018-2032 (TONS)

TABLE 94 SOUTH AFRICA POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 95 SOUTH AFRICA POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (TONS)

TABLE 96 SOUTH AFRICA BEDDING & FURNITURE IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 97 SOUTH AFRICA BEDDING & FURNITURE IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 98 SOUTH AFRICA BUILDING & CONSTRUCTION IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 99 SOUTH AFRICA BUILDING & CONSTRUCTION IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 100 SOUTH AFRICA AUTOMOTIVE IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 101 SOUTH AFRICA AUTOMOTIVE IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 102 SOUTH AFRICA ELECTRONICS IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 103 SOUTH AFRICA PACKAGING IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 104 SOUTH AFRICA PACKAGING IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 105 SOUTH AFRICA FOOTWEAR IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 106 SOUTH AFRICA FOOTWEAR IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 107 SOUTH AFRICA OTHERS IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 108 SAUDI ARABIA POLYURETHANE FOAM MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 109 SAUDI ARABIA POLYURETHANE FOAM MARKET, BY PRODUCT, 2018-2032 (TONS)

TABLE 110 SAUDI ARABIA POLYURETHANE FOAM MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 111 SAUDI ARABIA POLYURETHANE FOAM MARKET, BY CATEGORY, 2018-2032 (TONS)

TABLE 112 SAUDI ARABIA POLYURETHANE FOAM MARKET, BY DENSITY COMPOSITION, 2018-2032 (USD THOUSAND)

TABLE 113 SAUDI ARABIA POLYURETHANE FOAM MARKET, BY DENSITY COMPOSITION, 2018-2032 (TONS)

TABLE 114 SAUDI ARABIA POLYURETHANE FOAM MARKET, BY PROCESS, 2018-2032 (USD THOUSAND)

TABLE 115 SAUDI ARABIA POLYURETHANE FOAM MARKET, BY PROCESS, 2018-2032 (TONS)

TABLE 116 SAUDI ARABIA POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 117 SAUDI ARABIA POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (TONS)

TABLE 118 SAUDI ARABIA BEDDING & FURNITURE IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 119 SAUDI ARABIA BEDDING & FURNITURE IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 120 SAUDI ARABIA BUILDING & CONSTRUCTION IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 121 SAUDI ARABIA BUILDING & CONSTRUCTION IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 122 SAUDI ARABIA AUTOMOTIVE IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 123 SAUDI ARABIA AUTOMOTIVE IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 124 SAUDI ARABIA ELECTRONICS IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 125 SAUDI ARABIA PACKAGING IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 126 SAUDI ARABIA PACKAGING IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 127 SAUDI ARABIA FOOTWEAR IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 128 SAUDI ARABIA FOOTWEAR IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 129 SAUDI ARABIA OTHERS IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 130 UNITED ARAB EMIRATES POLYURETHANE FOAM MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 131 UNITED ARAB EMIRATES POLYURETHANE FOAM MARKET, BY PRODUCT, 2018-2032 (TONS)

TABLE 132 UNITED ARAB EMIRATES POLYURETHANE FOAM MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 133 UNITED ARAB EMIRATES POLYURETHANE FOAM MARKET, BY CATEGORY, 2018-2032 (TONS)

TABLE 134 UNITED ARAB EMIRATES POLYURETHANE FOAM MARKET, BY DENSITY COMPOSITION, 2018-2032 (USD THOUSAND)

TABLE 135 UNITED ARAB EMIRATES POLYURETHANE FOAM MARKET, BY DENSITY COMPOSITION, 2018-2032 (TONS)

TABLE 136 UNITED ARAB EMIRATES POLYURETHANE FOAM MARKET, BY PROCESS, 2018-2032 (USD THOUSAND)

TABLE 137 UNITED ARAB EMIRATES POLYURETHANE FOAM MARKET, BY PROCESS, 2018-2032 (TONS)

TABLE 138 UNITED ARAB EMIRATES POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 139 UNITED ARAB EMIRATES POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (TONS)

TABLE 140 UNITED ARAB EMIRATES BEDDING & FURNITURE IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 141 UNITED ARAB EMIRATES BEDDING & FURNITURE IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 142 UNITED ARAB EMIRATES BUILDING & CONSTRUCTION IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 143 UNITED ARAB EMIRATES BUILDING & CONSTRUCTION IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 144 UNITED ARAB EMIRATES AUTOMOTIVE IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 145 UNITED ARAB EMIRATES AUTOMOTIVE IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 146 UNITED ARAB EMIRATES ELECTRONICS IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 147 UNITED ARAB EMIRATES PACKAGING IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 148 UNITED ARAB EMIRATES PACKAGING IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 149 UNITED ARAB EMIRATES FOOTWEAR IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 150 UNITED ARAB EMIRATES FOOTWEAR IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 151 UNITED ARAB EMIRATES OTHERS IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 152 EGYPT POLYURETHANE FOAM MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 153 EGYPT POLYURETHANE FOAM MARKET, BY PRODUCT, 2018-2032 (TONS)

TABLE 154 EGYPT POLYURETHANE FOAM MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 155 EGYPT POLYURETHANE FOAM MARKET, BY CATEGORY, 2018-2032 (TONS)

TABLE 156 EGYPT POLYURETHANE FOAM MARKET, BY DENSITY COMPOSITION, 2018-2032 (USD THOUSAND)

TABLE 157 EGYPT POLYURETHANE FOAM MARKET, BY DENSITY COMPOSITION, 2018-2032 (TONS)

TABLE 158 EGYPT POLYURETHANE FOAM MARKET, BY PROCESS, 2018-2032 (USD THOUSAND)

TABLE 159 EGYPT POLYURETHANE FOAM MARKET, BY PROCESS, 2018-2032 (TONS)

TABLE 160 EGYPT POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 161 EGYPT POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (TONS)

TABLE 162 EGYPT BEDDING & FURNITURE IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 163 EGYPT BEDDING & FURNITURE IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 164 EGYPT BUILDING & CONSTRUCTION IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 165 EGYPT BUILDING & CONSTRUCTION IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 166 EGYPT AUTOMOTIVE IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 167 EGYPT AUTOMOTIVE IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 168 EGYPT ELECTRONICS IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 169 EGYPT PACKAGING IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 170 EGYPT PACKAGING IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 171 EGYPT FOOTWEAR IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 172 EGYPT FOOTWEAR IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 173 EGYPT OTHERS IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 174 QATAR POLYURETHANE FOAM MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 175 QATAR POLYURETHANE FOAM MARKET, BY PRODUCT, 2018-2032 (TONS)

TABLE 176 QATAR POLYURETHANE FOAM MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 177 QATAR POLYURETHANE FOAM MARKET, BY CATEGORY, 2018-2032 (TONS)

TABLE 178 QATAR POLYURETHANE FOAM MARKET, BY DENSITY COMPOSITION, 2018-2032 (USD THOUSAND)

TABLE 179 QATAR POLYURETHANE FOAM MARKET, BY DENSITY COMPOSITION, 2018-2032 (TONS)

TABLE 180 QATAR POLYURETHANE FOAM MARKET, BY PROCESS, 2018-2032 (USD THOUSAND)

TABLE 181 QATAR POLYURETHANE FOAM MARKET, BY PROCESS, 2018-2032 (TONS)

TABLE 182 QATAR POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 183 QATAR POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (TONS)

TABLE 184 QATAR BEDDING & FURNITURE IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 185 QATAR BEDDING & FURNITURE IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 186 QATAR BUILDING & CONSTRUCTION IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 187 QATAR BUILDING & CONSTRUCTION IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 188 QATAR AUTOMOTIVE IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 189 QATAR AUTOMOTIVE IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 190 QATAR ELECTRONICS IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 191 QATAR PACKAGING IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 192 QATAR PACKAGING IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 193 QATAR FOOTWEAR IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 194 QATAR FOOTWEAR IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 195 QATAR OTHERS IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 196 OMAN POLYURETHANE FOAM MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 197 OMAN POLYURETHANE FOAM MARKET, BY PRODUCT, 2018-2032 (TONS)

TABLE 198 OMAN POLYURETHANE FOAM MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 199 OMAN POLYURETHANE FOAM MARKET, BY CATEGORY, 2018-2032 (TONS)

TABLE 200 OMAN POLYURETHANE FOAM MARKET, BY DENSITY COMPOSITION, 2018-2032 (USD THOUSAND)

TABLE 201 OMAN POLYURETHANE FOAM MARKET, BY DENSITY COMPOSITION, 2018-2032 (TONS)

TABLE 202 OMAN POLYURETHANE FOAM MARKET, BY PROCESS, 2018-2032 (USD THOUSAND)

TABLE 203 OMAN POLYURETHANE FOAM MARKET, BY PROCESS, 2018-2032 (TONS)

TABLE 204 OMAN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 205 OMAN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (TONS)

TABLE 206 OMAN BEDDING & FURNITURE IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 207 OMAN BEDDING & FURNITURE IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 208 OMAN BUILDING & CONSTRUCTION IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 209 OMAN BUILDING & CONSTRUCTION IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 210 OMAN AUTOMOTIVE IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 211 OMAN AUTOMOTIVE IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 212 OMAN ELECTRONICS IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 213 OMAN PACKAGING IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 214 OMAN PACKAGING IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 215 OMAN FOOTWEAR IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 216 OMAN FOOTWEAR IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 217 OMAN OTHERS IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 218 KUWAIT POLYURETHANE FOAM MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 219 KUWAIT POLYURETHANE FOAM MARKET, BY PRODUCT, 2018-2032 (TONS)

TABLE 220 KUWAIT POLYURETHANE FOAM MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 221 KUWAIT POLYURETHANE FOAM MARKET, BY CATEGORY, 2018-2032 (TONS)

TABLE 222 KUWAIT POLYURETHANE FOAM MARKET, BY DENSITY COMPOSITION, 2018-2032 (USD THOUSAND)

TABLE 223 KUWAIT POLYURETHANE FOAM MARKET, BY DENSITY COMPOSITION, 2018-2032 (TONS)

TABLE 224 KUWAIT POLYURETHANE FOAM MARKET, BY PROCESS, 2018-2032 (USD THOUSAND)

TABLE 225 KUWAIT POLYURETHANE FOAM MARKET, BY PROCESS, 2018-2032 (TONS)

TABLE 226 KUWAIT POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 227 KUWAIT POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (TONS)

TABLE 228 KUWAIT BEDDING & FURNITURE IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 229 KUWAIT BEDDING & FURNITURE IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 230 KUWAIT BUILDING & CONSTRUCTION IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 231 KUWAIT BUILDING & CONSTRUCTION IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 232 KUWAIT AUTOMOTIVE IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 233 KUWAIT AUTOMOTIVE IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 234 KUWAIT ELECTRONICS IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 235 KUWAIT PACKAGING IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 236 KUWAIT PACKAGING IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 237 KUWAIT FOOTWEAR IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 238 KUWAIT FOOTWEAR IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 239 KUWAIT OTHERS IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 240 BAHRAIN POLYURETHANE FOAM MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 241 BAHRAIN POLYURETHANE FOAM MARKET, BY PRODUCT, 2018-2032 (TONS)

TABLE 242 BAHRAIN POLYURETHANE FOAM MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 243 BAHRAIN POLYURETHANE FOAM MARKET, BY CATEGORY, 2018-2032 (TONS)

TABLE 244 BAHRAIN POLYURETHANE FOAM MARKET, BY DENSITY COMPOSITION, 2018-2032 (USD THOUSAND)

TABLE 245 BAHRAIN POLYURETHANE FOAM MARKET, BY DENSITY COMPOSITION, 2018-2032 (TONS)

TABLE 246 BAHRAIN POLYURETHANE FOAM MARKET, BY PROCESS, 2018-2032 (USD THOUSAND)

TABLE 247 BAHRAIN POLYURETHANE FOAM MARKET, BY PROCESS, 2018-2032 (TONS)

TABLE 248 BAHRAIN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 249 BAHRAIN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (TONS)

TABLE 250 BAHRAIN BEDDING & FURNITURE IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 251 BAHRAIN BEDDING & FURNITURE IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 252 BAHRAIN BUILDING & CONSTRUCTION IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 253 BAHRAIN BUILDING & CONSTRUCTION IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 254 BAHRAIN AUTOMOTIVE IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 255 BAHRAIN AUTOMOTIVE IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 256 BAHRAIN ELECTRONICS IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 257 BAHRAIN PACKAGING IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 258 BAHRAIN PACKAGING IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 259 BAHRAIN FOOTWEAR IN POLYURETHANE FOAM MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 260 BAHRAIN FOOTWEAR IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 261 BAHRAIN OTHERS IN POLYURETHANE FOAM MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 262 REST OF MIDDLE EAST & AFRICA POLYURETHANE FOAM MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 263 REST OF MIDDLE EAST & AFRICA POLYURETHANE FOAM MARKET, BY PRODUCT, 2018-2032 (TONS)

Lista de Figura

FIGURE 1 MIDDLE EAST AND AFRICA POLYURETHANE FOAM MARKET

FIGURE 2 MIDDLE EAST AND AFRICA POLYURETHANE FOAM MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST AND AFRICA POLYURETHANE FOAM MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST AND AFRICA POLYURETHANE FOAM MARKET: MIDDLE EAST AND AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST AND AFRICA POLYURETHANE FOAM MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST AND AFRICA POLYURETHANE FOAM MARKET: THE PRODUCT LIFE LINE CURVE

FIGURE 7 MIDDLE EAST AND AFRICA POLYURETHANE FOAM MARKET: MULTIVARIATE MODELLING

FIGURE 8 MIDDLE EAST AND AFRICA POLYURETHANE FOAM MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 MIDDLE EAST AND AFRICA POLYURETHANE FOAM MARKET: DBMR MARKET POSITION GRID

FIGURE 10 MIDDLE EAST AND AFRICA POLYURETHANE FOAM MARKET: MARKET END-USER COVERAGE GRID

FIGURE 11 MIDDLE EAST AND AFRICA POLYURETHANE FOAM MARKET: VENDOR SHARE ANALYSIS

FIGURE 12 MIDDLE EAST AND AFRICA POLYURETHANE FOAM MARKET: SEGMENTATION

FIGURE 13 MIDDLE EAST AND AFRICA POLYURETHANE FOAM MARKET EXECUTIVE SUMMARY

FIGURE 14 THREE SEGMENTS COMPRISE THE MIDDLE EAST AND AFRICA POLYURETHANE FOAM MARKET, BY PRODUCT

FIGURE 15 STRATEGIC DECISIONS

FIGURE 16 A POSITIVE OUTLOOK TOWARDS THE BUILDING AND CONSTRUCTION SECTOR IS EXPECTED TO DRIVE THE MIDDLE EAST AND AFRICA POLYURETHANE FOAM MARKET IN THE FORECAST PERIOD

FIGURE 17 THE FLEXIBLE FOAM SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST AND AFRICA POLYURETHANE FOAM MARKET IN 2025 AND 2032

FIGURE 18 VENDOR SELECTION CRITERIA

FIGURE 19 ESTIMATED PRODUCTION CONSUMPTION ANALYSIS

FIGURE 20 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE MIDDLE EAST AND AFRICA POLYURETHANE FOAM MARKET

FIGURE 21 MIDDLE EAST AND AFRICA POLYURETHANE FOAM MARKET: BY PRODUCT, 2024

FIGURE 22 MIDDLE EAST AND AFRICA POLYURETHANE FOAM MARKET: BY CATEGORY, 2024

FIGURE 23 MIDDLE EAST AND AFRICA POLYURETHANE FOAM MARKET: BY DENSITY COMPOSITION, 2024

FIGURE 24 MIDDLE EAST AND AFRICA POLYURETHANE FOAM MARKET: BY PROCESS, 2024

FIGURE 25 MIDDLE EAST AND AFRICA POLYURETHANE FOAM MARKET: BY END-USER, 2024

FIGURE 26 MIDDLE EAST AND AFRICA POLYURETHANE FOAM MARKET: SNAPSHOT (2024)

FIGURE 27 MIDDLE EAST AND AFRICA POLYURETHANE FOAM MARKET: COMPANY SHARE 2024 (%)

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.