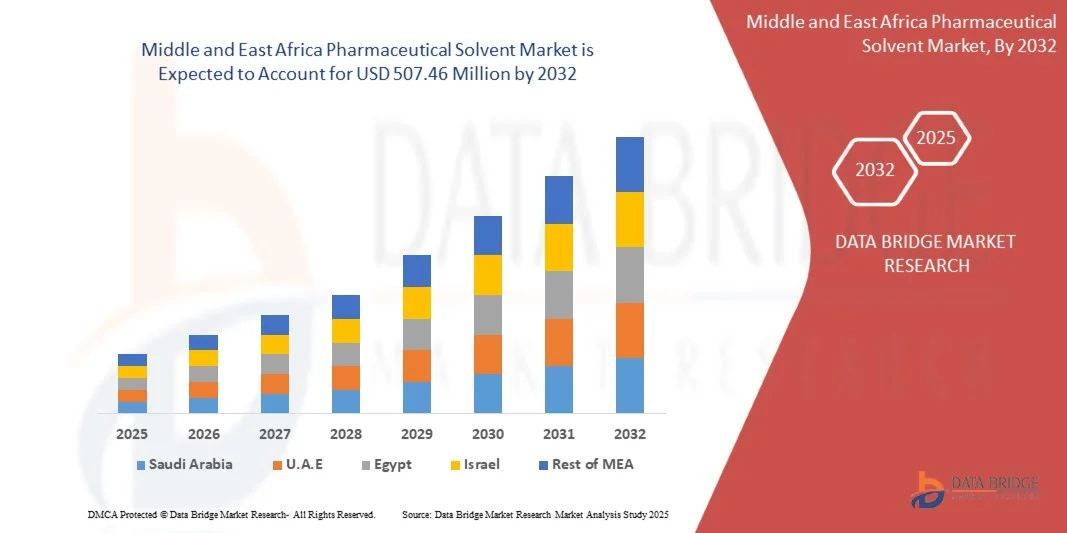

Middle And East Africa Pharmaceutical Solvent Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

367.96 Million

USD

507.46 Million

2024

2032

USD

367.96 Million

USD

507.46 Million

2024

2032

| 2025 –2032 | |

| USD 367.96 Million | |

| USD 507.46 Million | |

|

|

|

|

Segmentação do mercado de solventes farmacêuticos no Oriente Médio e África, por produto (álcool, amina, ésteres, éteres, hidrocarbonetos aromáticos, solventes clorados, cetonas e outros), aplicação (farmacêutica, laboratórios de pesquisa, química e outros) - Tendências e previsões do setor até 2032

Tamanho do mercado de solventes farmacêuticos na África Central e Oriental

- O tamanho do mercado de solventes farmacêuticos da África Central e do Oriente Médio foi avaliado em US$ 367,96 milhões em 2024 e está projetado para atingir US$ 507,46 milhões até 2032, crescendo a um CAGR de 4,10% durante o período previsto.

- A expansão do mercado é impulsionada principalmente pelo aumento da produção farmacêutica, pela crescente demanda por medicamentos genéricos e pela crescente infraestrutura de saúde nas economias emergentes da região

- Além disso, o apoio regulatório para a formulação de medicamentos de qualidade e o aumento do investimento em atividades de P&D estão alimentando a adoção de solventes de alta pureza, impulsionando ainda mais a trajetória de crescimento robusto do mercado.

Análise do mercado de solventes farmacêuticos na África Central e Oriental

- Os solventes farmacêuticos, essenciais para a formulação, síntese e purificação de medicamentos, são cada vez mais críticos no processo de fabricação farmacêutica na África Central e Oriental devido à crescente demanda por medicamentos de qualidade e à expansão das instalações de produção locais.

- A crescente demanda por solventes farmacêuticos é impulsionada principalmente pelo crescimento populacional da região, pela prevalência crescente de doenças crônicas e pelo foco crescente na melhoria do acesso e da infraestrutura de saúde.

- Os Emirados Árabes Unidos dominaram o mercado de solventes farmacêuticos da região Oriente Médio e África (MEA) com a maior participação de receita de 32,7% em 2024, devido ao seu setor farmacêutico avançado, suporte regulatório e redes de distribuição bem estabelecidas, enquanto países como Egito e Arábia Saudita estão testemunhando um rápido crescimento devido ao aumento de investimentos estrangeiros e reformas de assistência médica favoráveis.

- Os países da Arábia Saudita devem apresentar o crescimento mais rápido durante o período previsto, impulsionados pelos esforços de localização liderados pelo governo, pelo aumento das iniciativas de P&D e pela expansão estratégica dos centros regionais de fabricação farmacêutica.

- O segmento de álcool dominou o mercado com a maior participação na receita de 38,5% em 2024, impulsionado por seu amplo uso na formulação de medicamentos, particularmente na preparação de medicamentos líquidos orais e agentes tópicos

Escopo do relatório e segmentação do mercado de solventes farmacêuticos na África do Oriente Médio

|

Atributos |

Principais insights do mercado de solventes farmacêuticos |

|

Segmentos abrangidos |

|

|

Países abrangidos |

Oriente Médio e África

|

|

Principais participantes do mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor agregado |

Além dos insights sobre cenários de mercado, como valor de mercado, taxa de crescimento, segmentação, cobertura geográfica e principais participantes, os relatórios de mercado selecionados pela Data Bridge Market Research também incluem análises aprofundadas de especialistas, análises de preços, análises de participação de marca, pesquisas com consumidores, análises demográficas, análises da cadeia de suprimentos, análises da cadeia de valor, visão geral de matérias-primas/consumíveis, critérios de seleção de fornecedores, análise PESTLE, análise de Porter e estrutura regulatória. |

Tendências do mercado de solventes farmacêuticos na África Central e Oriental

“Foco crescente em solventes de alta pureza e tecnologias avançadas de formulação”

- Uma tendência significativa e crescente no mercado de solventes farmacêuticos da África Central e do Oriente Médio é a ênfase crescente em solventes de alta pureza e tecnologias avançadas de formulação para atender a padrões regulatórios rigorosos e melhorar a segurança e a eficácia dos medicamentos no crescente setor farmacêutico da região.

- Por exemplo, fornecedores multinacionais como a BASF e a Merck KGaA estão cada vez mais oferecendo solventes de grau farmacêutico adaptados para atender aos requisitos de Boas Práticas de Fabricação (BPF), apoiando os fabricantes locais na conformidade com as regulamentações de qualidade regionais e internacionais.

- O uso de solventes de alta pureza permite formulações mais precisas de medicamentos, reduz o risco de contaminação e auxilia na produção de genéricos complexos e medicamentos especiais. Tecnologias avançadas de formulação que envolvem esses solventes também contribuem para o aumento da solubilidade e da biodisponibilidade de ingredientes farmacêuticos ativos (IFAs), um fator fundamental no tratamento de doenças crônicas e infecciosas disseminadas na região.

- Além disso, as empresas farmacêuticas estão adotando sistemas de recuperação e reciclagem de solventes para garantir a sustentabilidade ambiental e a eficiência de custos, especialmente em países como África do Sul e Quênia, onde as regulamentações ambientais estão se tornando cada vez mais rigorosas.

- Essa tendência também está impulsionando a inovação entre participantes regionais e globais, com empresas como Clariant e Eastman Chemical Company investindo em P&D para desenvolver solventes de última geração que combinam desempenho com perfis ecológicos.

- A demanda por solventes especiais de alta pureza continua a aumentar nas iniciativas farmacêuticas dos setores público e privado, à medida que governos e organizações de saúde trabalham para expandir o acesso a medicamentos seguros, eficazes e acessíveis na África Central e Oriental.

Dinâmica do mercado de solventes farmacêuticos na África Central e Oriental

Motorista

“Crescente demanda impulsionada pela expansão da fabricação farmacêutica e das necessidades de saúde”

- A expansão da base de fabricação farmacêutica na África Central e Oriental, aliada à crescente demanda por soluções de saúde acessíveis e de baixo custo, é um fator-chave que alimenta a necessidade de solventes farmacêuticos na região.

- Por exemplo, em março de 2024, o governo sul-africano lançou iniciativas para aumentar a produção local de medicamentos essenciais, incentivando o investimento em infraestrutura farmacêutica e aumentando a demanda por solventes de alta qualidade usados na formulação de medicamentos.

- À medida que mais países na região priorizam a autossuficiência na produção de medicamentos — especialmente para medicamentos genéricos e essenciais — os solventes farmacêuticos estão desempenhando um papel vital para garantir consistência, qualidade e conformidade regulatória nos processos de fabricação locais.

- Além disso, o crescente fardo de doenças não transmissíveis, como diabetes e distúrbios cardiovasculares, está aumentando a demanda por formulações complexas de medicamentos, muitas das quais exigem solventes específicos para solubilidade e estabilidade.

- Empresas farmacêuticas globais e regionais também estão investindo em unidades de produção e operações de P&D na África Central e Oriental, alavancando vantagens de custo e acesso a mercados emergentes. Isso é ainda apoiado por incentivos governamentais e parcerias com organizações internacionais de saúde para melhorar a acessibilidade e a qualidade dos medicamentos.

- A tendência de modernização e automação na fabricação farmacêutica, incluindo o uso de sistemas avançados de formulação e recuperação de solventes, está aumentando a eficiência e impulsionando o consumo de solventes em toda a região.

Restrição/Desafio

“Desafios regulatórios e acesso limitado a solventes de alta qualidade”

- Um dos desafios significativos enfrentados pelo mercado de solventes farmacêuticos da África Central e do Oriente Médio é o cenário regulatório fragmentado e em evolução, que pode complicar a entrada no mercado e levar a inconsistências nos padrões de qualidade entre fronteiras.

- Por exemplo, alguns países da região não possuem estruturas regulatórias farmacêuticas bem estabelecidas, o que resulta em dificuldades para garantir a disponibilidade consistente de solventes de grau farmacêutico que atendam aos padrões internacionais de BPF.

- A produção local limitada de solventes de alta pureza e a dependência de importações também contribuem para vulnerabilidades na cadeia de suprimentos, flutuações de preços e acesso limitado em áreas rurais ou carentes. Isso pode prejudicar a consistência das operações de fabricação de medicamentos e atrasar o tempo de lançamento de produtos farmacêuticos no mercado.

- Além disso, o alto custo de manutenção da pureza do solvente, do armazenamento e da infraestrutura de manuseio seguro pode ser um fardo financeiro para fabricantes farmacêuticos de pequeno e médio porte, principalmente em países com bases industriais menos desenvolvidas.

- Para lidar com essas questões, será necessária uma harmonização regulatória regional coordenada, investimento em capacidades locais de produção de solventes e maior apoio às empresas farmacêuticas na adoção de tecnologias de fabricação modernas e sistemas de controle de qualidade.

- Fortalecer parcerias entre governos, partes interessadas da indústria e organismos internacionais de saúde será essencial para superar essas barreiras e garantir o crescimento sustentável do mercado de solventes farmacêuticos na África Central e Oriental.

Escopo do mercado de solventes farmacêuticos na África Central e Oriental

O mercado de solventes farmacêuticos do Oriente Médio e da África é segmentado em dois segmentos notáveis que são baseados no produto e na aplicação.

• Por produto

Com base no produto, o mercado de solventes farmacêuticos da África Central e do Oriente Médio é segmentado em álcool, amina, ésteres, éteres, hidrocarbonetos aromáticos, solventes clorados, cetonas e outros. O segmento de álcool dominou o mercado com a maior participação na receita, de 38,5% em 2024, impulsionado por seu amplo uso na formulação de medicamentos, particularmente na preparação de medicamentos líquidos orais e agentes tópicos. Álcoois como etanol e isopropanol são preferidos por sua alta solvência, baixa toxicidade e compatibilidade com uma variedade de APIs, tornando-os ideais tanto para fins de formulação quanto de esterilização.

Espera-se que o segmento de cetonas apresente o CAGR mais rápido entre 2025 e 2032, impulsionado por sua crescente aplicação em formulações complexas, particularmente para medicamentos pouco solúveis em água. Solventes como acetona e metiletilcetona estão ganhando popularidade devido às suas taxas de evaporação superiores e miscibilidade com outros solventes, permitindo o processamento eficiente de medicamentos. O aumento das atividades de P&D na indústria farmacêutica está impulsionando ainda mais o crescimento de categorias de solventes de alto desempenho, como as cetonas.

• Por aplicação

Com base na aplicação, o mercado de solventes farmacêuticos da África Central e do Oriente Médio é segmentado em Farmacêutico, Laboratórios de Pesquisa, Químico e Outros. O segmento Farmacêutico representou a maior fatia da receita de mercado, com 66,3% em 2024, impulsionado principalmente pela crescente demanda por medicamentos genéricos e de marca, pelo crescimento da produção farmacêutica local e pelas crescentes iniciativas governamentais para fortalecer a infraestrutura regional de saúde. Os solventes neste segmento são amplamente utilizados em processos de síntese, purificação e formulação, tornando-os componentes essenciais no ciclo de vida do desenvolvimento de medicamentos.

Espera-se que o segmento de Laboratórios de Pesquisa apresente o CAGR mais rápido entre 2025 e 2032, apoiado por investimentos crescentes em descoberta de medicamentos, pesquisa em biociências e colaborações entre academia e indústria em países-chave como África do Sul, Quênia e Nigéria. À medida que a P&D se intensifica em áreas terapêuticas, a demanda por solventes de alta pureza em aplicações analíticas e experimentais cresce rapidamente. Além disso, organizações internacionais e o financiamento do setor privado desempenham um papel fundamental no aprimoramento das capacidades laboratoriais na região, impulsionando o crescimento a longo prazo.

Análise regional do mercado de solventes farmacêuticos na África Central e Oriental

- Os Emirados Árabes Unidos dominaram um segmento-chave do mercado emergente de solventes farmacêuticos com a maior participação de 32,7% em 2024, apoiados pela expansão da fabricação farmacêutica, pela crescente demanda por medicamentos genéricos e pelo aumento dos investimentos em infraestrutura local de saúde.

- As empresas farmacêuticas da região estão priorizando cada vez mais solventes de alta qualidade para formulação e processamento de medicamentos, impulsionadas por padrões regulatórios mais rigorosos e pela necessidade de qualidade consistente do produto em todas as aplicações terapêuticas.

- Esse crescimento é ainda mais impulsionado pelo aumento dos gastos com saúde, estratégias de localização apoiadas pelo governo e parcerias com empresas farmacêuticas globais, posicionando os solventes farmacêuticos como componentes essenciais para atingir as metas regionais de produção de medicamentos.

Visão geral do mercado de solventes farmacêuticos na África do Sul

A África do Sul dominou o mercado de solventes farmacêuticos da África Central e Oriental, com a maior participação na receita, de 37,8% em 2024, impulsionada por sua indústria farmacêutica bem estabelecida e um ambiente regulatório favorável. O crescente foco do país na produção e exportação local de medicamentos impulsionou a demanda por solventes farmacêuticos de alta qualidade. Investimentos em infraestrutura de saúde e a crescente adoção de tecnologias avançadas de fabricação impulsionam ainda mais a expansão do mercado. O papel da África do Sul como polo farmacêutico regional também facilita a distribuição e a eficiência da cadeia de suprimentos, fortalecendo sua posição no mercado.

Visão do mercado de solventes farmacêuticos da Arábia Saudita

Espera-se que o mercado de solventes farmacêuticos da Arábia Saudita cresça a uma CAGR significativa durante o período previsto, apoiado pelos ambiciosos planos de modernização da saúde do país e pelas iniciativas da Visão 2030. O aumento dos investimentos em unidades de produção farmacêutica, aliado à crescente demanda por medicamentos genéricos, impulsiona o consumo de solventes. Além disso, as reformas regulatórias que visam aumentar a produção local e reduzir a dependência de importações estão fomentando o crescimento do mercado, particularmente no caso de solventes especializados utilizados na formulação e síntese de medicamentos.

Visão do mercado de solventes farmacêuticos dos Emirados Árabes Unidos

O mercado de solventes farmacêuticos dos Emirados Árabes Unidos deverá apresentar crescimento constante, impulsionado por sua localização estratégica como polo logístico e comercial, além do aumento dos investimentos em saúde. O apoio do governo à inovação farmacêutica e a crescente demanda por serviços de fabricação e pesquisa sob contrato impulsionaram o uso de solventes. Além disso, a expansão das atividades de pesquisa clínica dos Emirados Árabes Unidos e os esforços para atrair empresas farmacêuticas multinacionais contribuem para o aumento da demanda por solventes de alta qualidade na região.

Visão geral do mercado de solventes farmacêuticos do Egito

O mercado de solventes farmacêuticos do Egito deverá expandir-se de forma constante, impulsionado pela diversificação do setor farmacêutico do país e pelo crescimento das exportações para a África e o Oriente Médio. As iniciativas governamentais para modernizar a infraestrutura de fabricação e harmonizar os padrões regulatórios estão alinhadas à crescente demanda por solventes para a produção de medicamentos de qualidade. O crescimento de empresas farmacêuticas locais e as parcerias com players globais impulsionam ainda mais as perspectivas de mercado.

Visão do mercado de solventes farmacêuticos de Israel

O mercado israelense de solventes farmacêuticos é caracterizado por rápido crescimento devido à sua forte ênfase em P&D farmacêutico e inovação biofarmacêutica. O ecossistema de pesquisa avançada do país, aliado ao aumento das atividades de ensaios clínicos, promove alta demanda por solventes especializados. Além disso, o próspero cenário de startups israelenses em tecnologias farmacêuticas e os incentivos governamentais para empresas de biotecnologia contribuem significativamente para a expansão do mercado de solventes.

Participação no mercado de solventes farmacêuticos na África Central e Oriental

A indústria de solventes farmacêuticos é liderada principalmente por empresas bem estabelecidas, incluindo:

- DuPont (EUA)

- Mitsui Chemicals (Japão)

- DOW (EUA)

- Clariant (Suíça)

- Brenntag SE (Alemanha)

- Olin Corporation (EUA)

- Merck KGaA (Alemanha)

- Royal Dutch Shell Plc (Reino Unido/Holanda)

- SK geo centric Co., Ltd. (Coreia do Sul)

- Eastman Chemical Company (EUA)

- LyondellBasell Industries Holdings BV (Holanda)

- BASF SE (Alemanha)

- Exxon Mobil Corporation (EUA)

- Avantor, Inc. (EUA)

Quais são os desenvolvimentos recentes no mercado de solventes farmacêuticos da África Central e do Oriente Médio?

- Em abril de 2023, a Sasol Limited (África do Sul), empresa líder em produtos químicos e energia integrados, lançou uma iniciativa para expandir sua capacidade de produção de solventes farmacêuticos para atender à crescente demanda na África Central e Oriental. Essa iniciativa estratégica visa fortalecer as cadeias de suprimentos locais e reduzir a dependência de importações, apoiando o crescimento da indústria farmacêutica regional. Ao alavancar tecnologias avançadas de refino e práticas sustentáveis, a Sasol reforça seu compromisso de fornecer solventes de alta qualidade, adaptados às necessidades em evolução da indústria farmacêutica na região.

- Em março de 2023, a Sipchem (Arábia Saudita), importante empresa do setor de especialidades químicas, anunciou o lançamento de uma nova linha de solventes farmacêuticos ecológicos, projetados para atender às rigorosas regulamentações ambientais. O lançamento deste produto tem como alvo fabricantes farmacêuticos que buscam alternativas mais sustentáveis sem comprometer o desempenho. O foco da Sipchem em inovação e sustentabilidade destaca sua dedicação em atender às demandas regulatórias e de mercado nos setores farmacêuticos do Oriente Médio.

- Em março de 2023, a Gulf Pharmaceutical Industries (Julphar) (EAU) iniciou um projeto de larga escala para aprimorar os processos de purificação de solventes em suas unidades fabris, visando melhorar a qualidade dos solventes e a eficiência operacional. Esse avanço apoia a missão da Julphar de elevar os padrões de produção farmacêutica e garantir a conformidade regulatória em todo o Oriente Médio e África, contribuindo assim para medicamentos mais seguros e eficazes.

- Em fevereiro de 2023, a EIPICO (Egyptian International Pharmaceutical Industries Company) (Egito) firmou uma colaboração com fornecedores químicos internacionais para diversificar seu portfólio de solventes, com foco em solventes especiais para formulações complexas de medicamentos. Esta parceria visa melhorar a disponibilidade dos produtos e reduzir os prazos de entrega para os fabricantes farmacêuticos locais. A colaboração estratégica da EIPICO reforça seu compromisso com o fortalecimento da posição do Egito como um polo de fabricação farmacêutica na região.

- Em janeiro de 2023, a Teva Pharmaceutical Industries Ltd. (Israel) revelou uma nova iniciativa de pesquisa com o objetivo de desenvolver novos solventes farmacêuticos otimizados para produtos biológicos e sistemas avançados de administração de medicamentos. Esta iniciativa enfatiza o investimento da Teva em P&D e sua liderança em inovação farmacêutica no Oriente Médio. Ao integrar tecnologias de solventes de ponta, a Teva visa aprimorar a eficácia dos medicamentos e a eficiência de fabricação, impulsionando ainda mais o crescimento do setor farmacêutico regional.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.