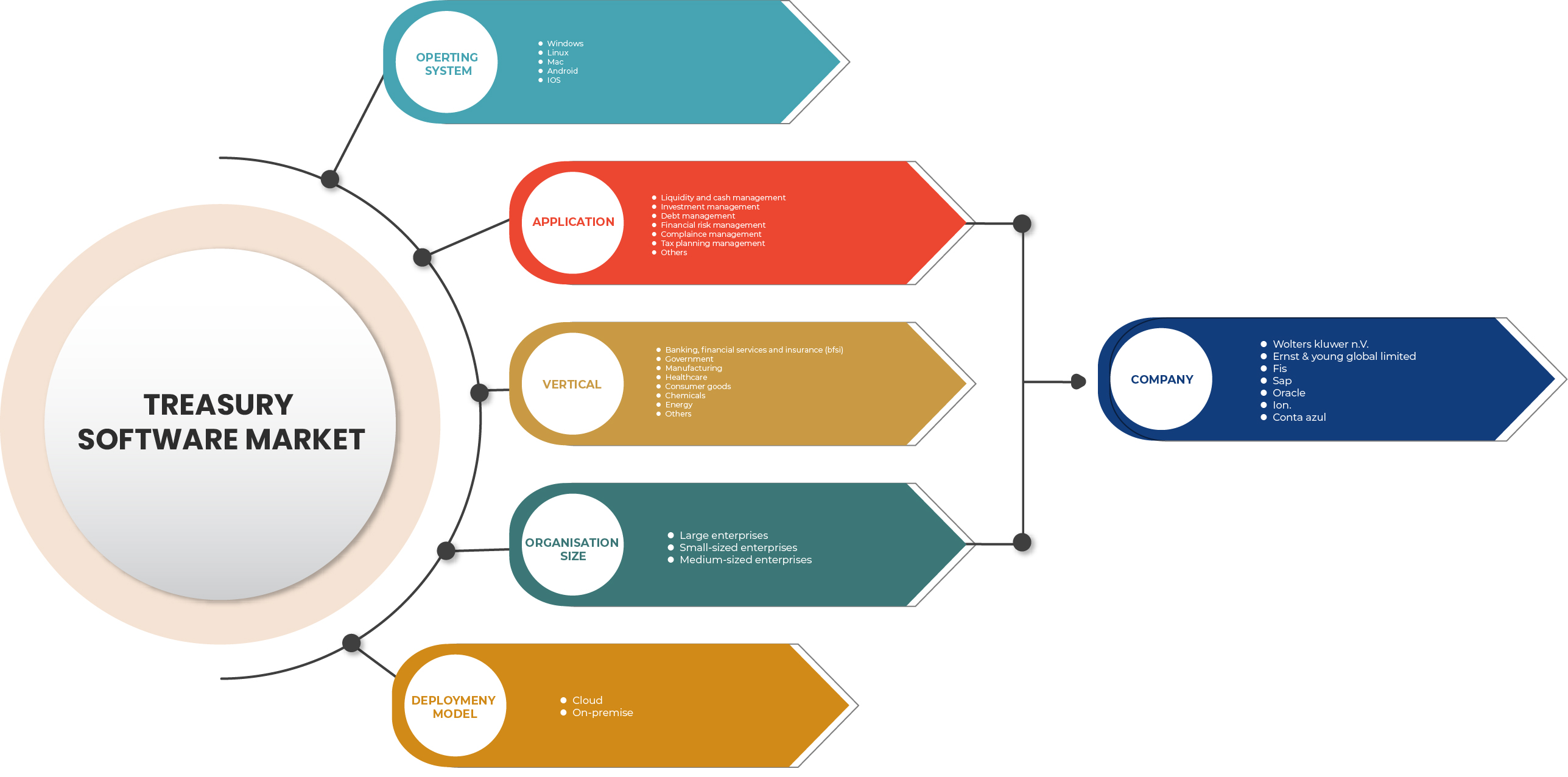

Latin America Treasury Software Market, By Operating System (Windows, Linux, Mac, Android, and iOS), Application (Liquidity And Cash Management, Investment Management, Debt Management, Financial Risk Management, Compliance Management, Tax Planning Management, and Others), Organization Size(Large Enterprises, Small-Sized Enterprises And Medium-Sized Enterprises), Deployment Model (Cloud and On-Premises), Verticals (Into Banking, Financial Services And Insurance (BFSI), Government, Manufacturing, Healthcare, Consumer Goods, Chemicals, Energy, and Others) Country (Argentina, Paraguay, Chile, Peru, Colombia and rest of Latin America), Industry Trends and Forecast to 2029.

Latin America Treasury Software Market Analysis and Insights

A treasury management system (TMS) is a software application that automates the process of managing an individual or company's financial operations. It helps to manage the financial activities, such as cash flow, assets and investments, automatically. Its functions are real-time cash management, cash-flow forecasting, payment reconciliation, debt management, and trade finance. A treasury management system software helps in automating repetitive, often manual treasury processes. By automating these steps, CFOs and treasurers of a company can gain greater visibility into cash and liquidity while gaining control of bank accounts, maintaining compliance, and managing in-house banking and financial transactions.

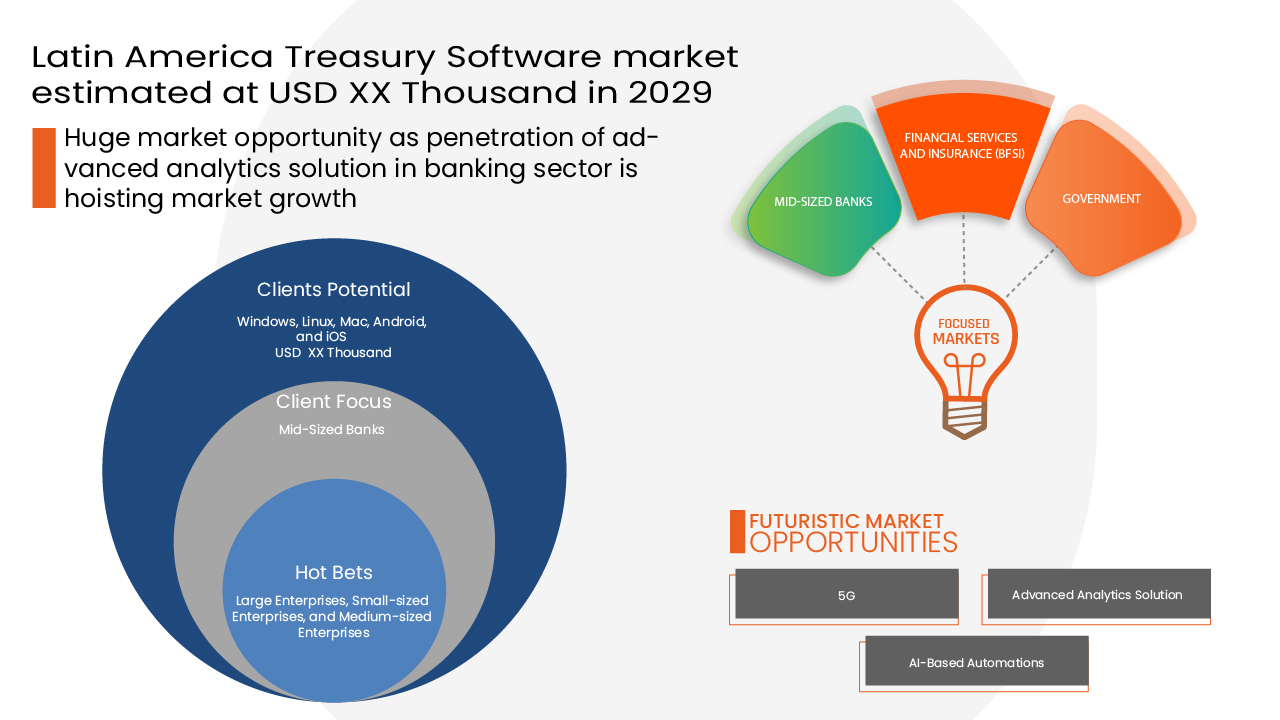

The treasury software is essential as it has become a necessity for sectors such as banks and finance, and the risk analytics department. Data Bridge Market Research analyses that the Latin America treasury software market will grow at a CAGR of 2.35% during the forecast period of 2022 to 2029.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2019 - 2014) |

|

Quantitative Units |

Revenue in USD Thousand, Volumes in Units, Pricing in USD |

|

Segments Covered |

Operating System (Windows, Linux, Mac, Android, and iOS), Application (Liquidity And Cash Management, Investment Management, Debt Management, Financial Risk Management, Compliance Management, Tax Planning Management, and Others), Organization Size(Large Enterprises, Small-Sized Enterprises And Medium-Sized Enterprises), Deployment Model (Cloud And On-Premises), Verticals (Into Banking, Financial Services And Insurance (BFSI), Government, Manufacturing, Healthcare, Consumer Goods, Chemicals, Energy, and Others) |

|

Countries Covered |

Mexico, Chile, Colombia, Argentina, Bolivia, Paraguay, Peru, Uruguay, Panama, Nicargua, Costa Rica, Ecuador, Honduras, Guatemala, El Salvador, The Dominican Republic and rest of Latin America |

|

Market Players Covered |

Wolters Kluwer N.V., Ernst & Young Global Limited, FIS, SAP, Oracle, ION, Conta Azul, Calypso, Finastra, Kyriba Corp., MUREX S.A.S, among others |

Latin America Treasury Software Market Dynamics

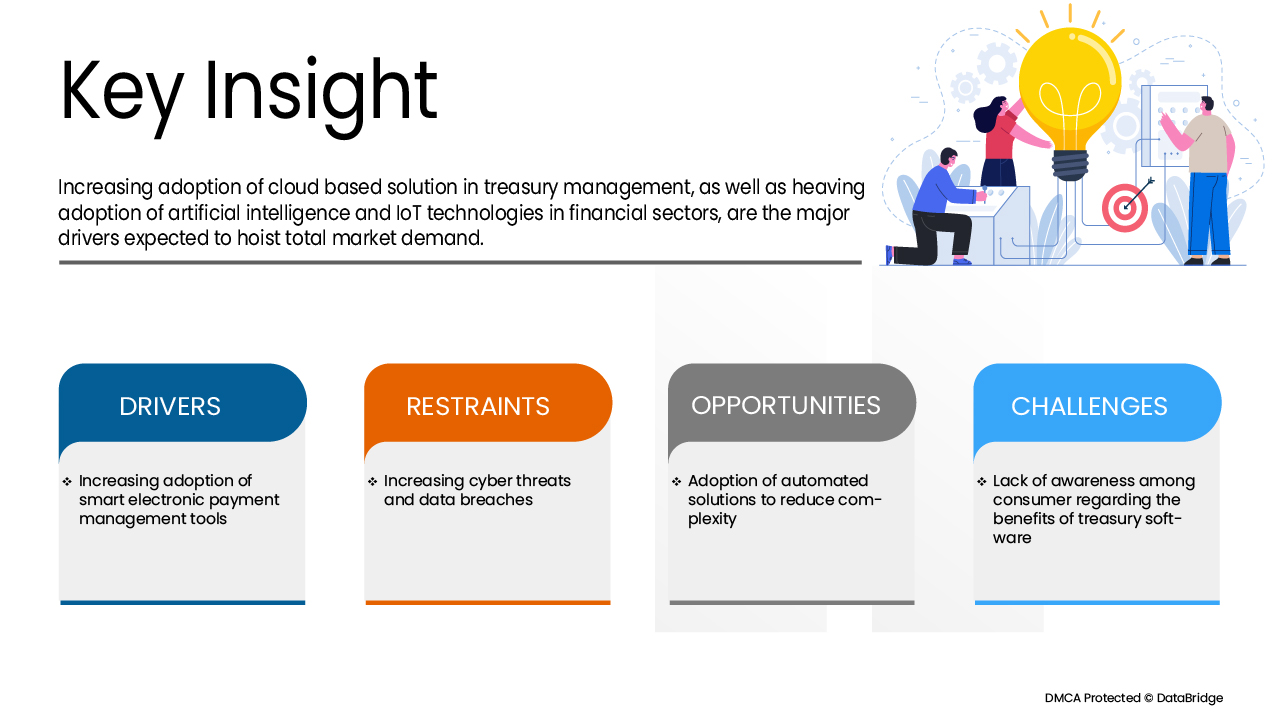

Drivers

Increasing Adoption of Smart Electronic Payment Management Tools

Increasing adoption of smart electronic payment management among all generations of the population has a positive impact. Smart gadgets have gained immense popularity among consumers and have become an integral part of the human lifestyle. Consumers are becoming comfortable with managing their transactions through their smart devices, and are more likely to continue managing their finance from electronic payment management tools hoisting the market growth.

- Growing Demand for Advanced TMS Systems for Enhancing Customer Experience

Advanced treasury management systems (TMS) are basically software-as-a-service (SaaS) which basically offers greater visibility into cash and liquidity while gaining control of bank accounts, maintaining compliance, and managing financial transactions which contributes to enhancing customer satisfaction. In recent times, advanced treasury management system (TMS) applications are gaining immense popularity in the Latin American region, making it one of the huge factors for market growth.

- Heaving Adoption of Artificial Intelligence in Treasury Management

In recent times banking and finance sectors are using AI technologies in banks. Chatbots for financial services such as transactional efficiency, monitoring, and enhancing treasury management capabilities have gained immense popularity in the Latin American region and are acting as one of the driving factors which is hoisting the market growth.

- Adoption of Cloud-Based Solution in Treasury Management

Cloud technology enables user’s to access storage, files, software, and servers using their internet-connected devices. It also means or signifies having the ability to store and access data and programs over the internet instead of on a hard drive which can be utilized by businesses of any size. This is hoisting the market growth.

Opportunities

- Penetration of Advanced Analytics Solutions in the Banking Sector

As analytics is the systematic computational analysis of data or statistics. It is used for the discovery, interpretation, and communication of meaningful patterns in data, it can be used in the banking sector for various purposes such as model selection, increasing efficiency, and revenue in customer service which will be accurate and resource-saving as well, providing a huge opportunity for the growth of the treasury software market.

Also, the launch of various new treasury software will provide beneficial opportunities for the treasury software market in the forecast period of 2022-2029.

Restraints/Challenges

In recent times businesses/industries are adopting digitization heavily which gives a platform for cybercrime. Cybercrime has become a real threat for all businesses either small or large, flaws in network security is a weakness that is exploited by hackers to perform unauthorized actions within a system. The sheer presence of cybercrime will the market growth of the treasury software market.

COVID-19 Impact on Latin America Treasury Software Market

COVID-19 has negatively affected the treasury software market. After the sudden outbreak of the pandemic, many factories and technical units were running limited operations under the guidance of governments. Few of them had even stopped production and temporarily closed their units. This is the reason why the technology industry is still facing a shortage of materials, and delay in shipping is making it worse due to the heavy impact of COVID-19.

Recent Development

- In December 2021, Oracle acquired Cerner. This acquisition has strengthened the expertise of the company in the software solution and helped to gain the lead in financial services, cloud, AI, and machine learning applications which in return has boosted the company's revenue

Latin America Treasury Software Market Scope

The Latin America treasury software market is are segmented on the basis of the operating system, application, organization size, deployment model, and vertical. The growth amongst these segments will help you analyze meager growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Operating System

- Windows

- Linux

- Mac

- Android

- iOS

On the basis of the operating system, the Latin America treasury software market is segmented into Windows, Linux, Mac, Android, and iOS.

Application

- Liquidity and cash management

- Investment management

- Debt management

- Financial risk management

- Complaince management

- Tax planning management

- Others

On the basis of application, the Latin America treasury software market is segmented into liquidity and cash management, investment management, debt management, financial risk management, compliance management, tax planning management, and others.

Organization Size

- Large enterprises

- Small-sized enterprises

- Medium-sized enterprises

On the basis of organization size, the Latin America treasury software market is segmented into large enterprises, small-sized enterprises, and medium-sized enterprises.

Deployment Model

- Cloud

- On-Premise

On the basis of the deployment model, the Latin America treasury software market is segmented into cloud and on-premises.

Vertical

- Banking, financial services and insurance (BFSI)

- Government

- Manufacturing

- Healthcare

- Consumer goods

- Chemicals

- Energy

- Others

On the basis of vertical, the Latin America treasury software market is segmented into banking, financial services and insurance (BFSI), government, manufacturing, healthcare, consumer goods, chemicals, energy, and others.

Latin America Treasury Software Market Regional Analysis/Insights

The Latin America treasury software market is analyzed and market size insights and trends are provided by the operating system, application, organization size, deployment model, and vertical as referenced above.

The countries covered in the Latin America treasury software market are Mexico, Chile, Colombia, Argentina, Bolivia, Paraguay, Peru, Uruguay, Panama, Nicargua, Costa Rica, Ecuador, Honduras, Guatemala, El Salvador, The Dominican Republic and rest of Latin America.

Mexico is expected to dominate the Latin America treasury software market as Mexico has one of Latin America's most developed banking systems which increases the demand for treasury software. Moreover, over years Mexico has transformed its banking and treasury management processes and policies to ensure a more secure and efficient banking environment.

The country section of the report also provides individual market impacting factors and changes in regulations in the market domestically that impact the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, disease epidemiology, and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of sales channels are considered while providing forecast analysis of the country data.

Competitive Landscape and Latin America Treasury Software Market Share Analysis

The Latin America treasury software market competitive landscape provides details by the competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to the Latin America treasury software market.

Some of the major players operating in the treasury software market are SAP, FIS, MUREX S.A.S, Finastra, Calypso, Kyriba Corp., Conta Azul, Wolters Kluwer N.V., Oracle, ION, Ernst & Young Global Limited, among others.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Índice

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF LATIN AMERICA TREASURY SOFTWARE MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 YEARS CONSIDERED FOR THE STUDY

2.3 GEOGRAPHIC SCOPE

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MARKET END-USER COVERAGE GRID

2.9 MULTIVARIATE MODELLING

2.1 OPERATING SYSTEM CURVE

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 LIST OF PROVIDERS FOR MID-SIZED BANKS IN LATIN AMERICA

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASING ADOPTION OF SMART ELECTRONIC PAYMENT MANAGEMENT TOOLS

5.1.2 GROWING DEMAND FOR ADVANCED TMS SYSTEMS FOR ENHANCING CUSTOMER EXPERIENCE

5.1.3 HEAVING ADOPTION OF ARTIFICIAL INTELLIGENCE IN TREASURY MANAGEMENT

5.1.4 ADOPTION OF CLOUD-BASED SOLUTION IN TREASURY MANAGEMENT

5.2 RESTRAINTS

5.2.1 INCREASING CYBER THREATS AND DATA BREACHES

5.2.2 HIGH COST ASSOCIATED WITH TREASURY MANAGEMENT SYSTEMS

5.3 OPPORTUNITIES

5.3.1 PENETRATION OF ADVANCED ANALYTICS SOLUTIONS IN THE BANKING SECTOR

5.3.2 ADOPTION OF AUTOMATED SOLUTIONS TO REDUCE COMPLEXITY

5.4 CHALLENGES

5.4.1 LACK OF AWARENESS AMONG CONSUMERS REGARDING THE BENEFITS OF TREASURY SOFTWARE

5.4.2 INADEQUATE INFRASTRUCTURE AND FX VOLATILITY HAMPER TREASURY MANAGEMENT EFFICIENCY

6 LATIN AMERICA TREASURY SOFTWARE MARKET, BY OPERATING SYSTEM

6.1 OVERVIEW

6.2 WINDOWS

6.3 LINUX

6.4 MAC

6.5 ANDROID

6.6 IOS

7 LATIN AMERICA TREASURY SOFTWARE MARKET, BY APPLICATION

7.1 OVERVIEW

7.2 LIQUIDITY AND CASH MANAGEMENT

7.3 INVESTMENT MANAGEMENT

7.4 DEBT MANAGEMENT

7.5 FINANCIAL RISK MANAGEMENT

7.6 COMPLIANCE MANAGEMENT

7.7 TAX PLANNING

7.8 OTHERS

8 LATIN AMERICA TREASURY SOFTWARE MARKET, BY ORGANIZATION SIZE

8.1 OVERVIEW

8.2 LARGE ENTERPRISES

8.3 MEDIUM-SIZED ENTERPRISES

8.4 SMALL-SIZED ENTERPRISES

9 LATIN AMERICA TREASURY SOFTWARE MARKET, BY DEPLOYMENT MODEL

9.1 OVERVIEW

9.2 CLOUD

9.2.1 PUBLIC

9.2.2 HYBRID

9.2.3 PRIVATE

9.3 ON-PREMISES

10 LATIN AMERICA TREASURY SOFTWARE MARKET, BY VERTICAL

10.1 OVERVIEW

10.2 BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI)

10.2.1 LIQUIDITY AND CASH MANAGEMENT

10.2.2 INVESTMENT MANAGEMENT

10.2.3 DEBT MANAGEMENT

10.2.4 FINANCIAL RISK MANAGEMENT

10.2.5 COMPLIANCE MANAGEMENT

10.2.6 TAX PLANNING MANAGEMENT

10.2.7 OTHERS

10.3 GOVERNMENT

10.3.1 LIQUIDITY AND CASH MANAGEMENT

10.3.2 INVESTMENT MANAGEMENT

10.3.3 DEBT MANAGEMENT

10.3.4 FINANCIAL RISK MANAGEMENT

10.3.5 COMPLIANCE MANAGEMENT

10.3.6 TAX PLANNING MANAGEMENT

10.3.7 OTHERS

10.4 MANUFACTURING

10.4.1 LIQUIDITY AND CASH MANAGEMENT

10.4.2 INVESTMENT MANAGEMENT

10.4.3 DEBT MANAGEMENT

10.4.4 FINANCIAL RISK MANAGEMENT

10.4.5 COMPLIANCE MANAGEMENT

10.4.6 TAX PLANNING MANAGEMENT

10.4.7 OTHERS

10.5 HEALTHCARE

10.5.1 LIQUIDITY AND CASH MANAGEMENT

10.5.2 INVESTMENT MANAGEMENT

10.5.3 DEBT MANAGEMENT

10.5.4 FINANCIAL RISK MANAGEMENT

10.5.5 COMPLIANCE MANAGEMENT

10.5.6 TAX PLANNING MANAGEMENT

10.5.7 OTHERS

10.6 CONSUMER GOODS

10.6.1 LIQUIDITY AND CASH MANAGEMENT

10.6.2 INVESTMENT MANAGEMENT

10.6.3 DEBT MANAGEMENT

10.6.4 FINANCIAL RISK MANAGEMENT

10.6.5 COMPLIANCE MANAGEMENT

10.6.6 TAX PLANNING MANAGEMENT

10.6.7 OTHERS

10.7 CHEMICALS

10.7.1 LIQUIDITY AND CASH MANAGEMENT

10.7.2 INVESTMENT MANAGEMENT

10.7.3 DEBT MANAGEMENT

10.7.4 FINANCIAL RISK MANAGEMENT

10.7.5 COMPLIANCE MANAGEMENT

10.7.6 TAX PLANNING MANAGEMENT

10.7.7 OTHERS

10.8 ENERGY

10.8.1 LIQUIDITY AND CASH MANAGEMENT

10.8.2 INVESTMENT MANAGEMENT

10.8.3 DEBT MANAGEMENT

10.8.4 FINANCIAL RISK MANAGEMENT

10.8.5 COMPLIANCE MANAGEMENT

10.8.6 TAX PLANNING MANAGEMENT

10.8.7 OTHERS

10.9 OTHERS

10.9.1 LIQUIDITY AND CASH MANAGEMENTS

10.9.2 INVESTMENT MANAGEMENT

10.9.3 DEBT MANAGEMENT

10.9.4 FINANCIAL RISK MANAGEMENT

10.9.5 COMPLIANCE MANAGEMENT

10.9.6 TAX PLANNING MANAGEMENT

10.9.7 OTHERS

11 LATIN AMERICA TREASURY SOFTWARE MARKET, COUNTRY

11.1 MEXICO

11.2 CHILE

11.3 COLOMBIA

11.4 ARGENTINA

11.5 BOLIVIA

11.6 PARAGUAY

11.7 PERU

11.8 URUGUAY

11.9 PANAMA

11.1 NICARAGUA

11.11 COSTA RICA

11.12 ECUADOR

11.13 HONDURAS

11.14 GUATEMALA

11.15 EL SALVADOR

11.16 THE DOMINICAN REPUBLIC

11.17 REST OF LATIN AMERICA

12 LATIN AMERICA TREASURY SOFTWARE MARKET: COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: LATIN AMERICA

13 SWOT ANALYSIS

14 COMPANY PROFILE

14.1 WOLTERS KLUWER N.V.

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 SOLUTION PORTFOLIO

14.1.4 RECENT DEVELOPMENTS

14.2 ERNST & YOUNG GLOBAL LIMITED

14.2.1 COMPANY SNAPSHOT

14.2.2 SOLUTION PORTFOLIO

14.2.3 RECENT DEVELOPMENTS

14.3 FIS

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 SOLUTION PORTFOLIO

14.3.4 RECENT DEVELOPMENTS

14.4 SAP

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 PRODUCT PORTFOLIO

14.4.4 RECENT DEVELOPMENTS

14.5 ORACLE

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 SOLUTION PORTFOLIO

14.5.4 RECENT DEVELOPMENTS

14.6 ION

14.6.1 COMPANY SNAPSHOT

14.6.2 SOLUTION PORTFOLIO

14.6.3 RECENT DEVELOPMENTS

14.7 CONTA AZUL

14.7.1 COMPANY SNAPSHOT

14.7.2 SOLUTION PORTFOLIO

14.7.3 RECENT DEVELOPMENTS

14.8 CALYPSO

14.8.1 COMPANY SNAPSHOT

14.8.2 SOLUTION PORTFOLIO

14.8.3 RECENT DEVELOPMENTS

14.9 FINASTRA

14.9.1 COMPANY SNAPSHOT

14.9.2 SOLUTION PORTFOLIO

14.9.3 RECENT DEVELOPMENTS

14.1 KYRIBA CORP.

14.10.1 COMPANY SNAPSHOT

14.10.2 SOLUTION PORTFOLIO

14.10.3 RECENT DEVELOPMENTS

14.11 MUREX S.A.S

14.11.1 COMPANY SNAPSHOT

14.11.2 SOLUTION PORTFOLIO

14.11.3 RECENT DEVELOPMENTS

15 QUESTIONNAIRE

16 RELATED REPORTS

Lista de Tabela

TABLE 1 LATIN AMERICA TREASURY SOFTWARE MARKET, BY OPERATING SYSTEM, 2020-2029 (USD THOUSAND)

TABLE 2 LATIN AMERICA TREASURY SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 3 LATIN AMERICA TREASURY SOFTWARE MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD THOUSAND)

TABLE 4 LATIN AMERICA TREASURY SOFTWARE MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD THOUSAND)

TABLE 5 LATIN AMERICA CLOUD IN TREASURY SOFTWARE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 6 LATIN AMERICA TREASURY SOFTWARE MARKET, BY VERTICAL, 2020-2029 (USD THOUSAND)

TABLE 7 LATIN AMERICA BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI) IN TREASURY SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 8 LATIN AMERICA GOVERNMENT IN TREASURY SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 9 LATIN AMERICA MANUFACTURING IN TREASURY SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 10 LATIN AMERICA HEALTHCARE IN TREASURY SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 11 LATIN AMERICA CONSUMER GOODS IN TREASURY SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 12 LATIN AMERICA CHEMICALS IN TREASURY SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 13 LATIN AMERICA ENERGY IN TREASURY SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 14 LATIN AMERICA OTHERS IN TREASURY SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 15 LATIN AMERICA TREASURY SOFTWARE MARKET, BY COUNTRY, 2020-2029 (USD THOUSAND)

TABLE 16 MEXICO TREASURY SOFTWARE MARKET, BY OPERATING SYSTEM, 2020-2029 (USD THOUSAND)

TABLE 17 MEXICO TREASURY SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 18 MEXICO TREASURY SOFTWARE MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD THOUSAND)

TABLE 19 MEXICO CLOUD IN TREASURY SOFTWARE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 20 MEXICO TREASURY SOFTWARE MARKET, BY ORGANISATION SIZE, 2020-2029 (USD THOUSAND)

TABLE 21 MEXICO TREASURY SOFTWARE MARKET, BY VERTICAL, 2020-2029 (USD THOUSAND)

TABLE 22 MEXICO BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI) IN TREASURY SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 23 MEXICO GOVERNMENT IN TREASURY SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 24 MEXICO MANUFACTURING IN TREASURY SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 25 MEXICO HEALTHCARE IN TREASURY SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 26 MEXICO CONSUMER GOODS IN TREASURY SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 27 MEXICO CHEMICALS IN TREASURY SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 28 MEXICO ENERGY IN TREASURY SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 29 MEXICO OTHERS IN TREASURY SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 30 CHILE TREASURY SOFTWARE MARKET, BY OPERATING SYSTEM, 2020-2029 (USD THOUSAND)

TABLE 31 CHILE TREASURY SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 32 CHILE TREASURY SOFTWARE MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD THOUSAND)

TABLE 33 CHILE CLOUD IN TREASURY SOFTWARE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 34 CHILE TREASURY SOFTWARE MARKET, BY ORGANISATION SIZE, 2020-2029 (USD THOUSAND)

TABLE 35 CHILE TREASURY SOFTWARE MARKET, BY VERTICAL, 2020-2029 (USD THOUSAND)

TABLE 36 CHILE BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI) IN TREASURY SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 37 CHILE GOVERNMENT IN TREASURY SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 38 CHILE MANUFACTURING IN TREASURY SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 39 CHILE HEALTHCARE IN TREASURY SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 40 CHILE CONSUMER GOODS IN TREASURY SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 41 CHILE CHEMICALS IN TREASURY SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 42 CHILE ENERGY IN TREASURY SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 43 CHILE OTHERS IN TREASURY SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 44 COLOMBIA TREASURY SOFTWARE MARKET, BY OPERATING SYSTEM, 2020-2029 (USD THOUSAND)

TABLE 45 COLOMBIA TREASURY SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 46 COLOMBIA TREASURY SOFTWARE MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD THOUSAND)

TABLE 47 COLOMBIA CLOUD IN TREASURY SOFTWARE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 48 COLOMBIA TREASURY SOFTWARE MARKET, BY ORGANISATION SIZE, 2020-2029 (USD THOUSAND)

TABLE 49 COLOMBIA TREASURY SOFTWARE MARKET, BY VERTICAL, 2020-2029 (USD THOUSAND)

TABLE 50 COLOMBIA BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI) IN TREASURY SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 51 COLOMBIA GOVERNMENT IN TREASURY SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 52 COLOMBIA MANUFACTURING IN TREASURY SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 53 COLOMBIA HEALTHCARE IN TREASURY SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 54 COLOMBIA CONSUMER GOODS IN TREASURY SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 55 COLOMBIA CHEMICALS IN TREASURY SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 56 COLOMBIA ENERGY IN TREASURY SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 57 COLOMBIA OTHERS IN TREASURY SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 58 ARGENTINA TREASURY SOFTWARE MARKET, BY OPERATING SYSTEM, 2020-2029 (USD THOUSAND)

TABLE 59 ARGENTINA TREASURY SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 60 ARGENTINA TREASURY SOFTWARE MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD THOUSAND)

TABLE 61 ARGENTINA CLOUD IN TREASURY SOFTWARE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 62 ARGENTINA TREASURY SOFTWARE MARKET, BY ORGANISATION SIZE, 2020-2029 (USD THOUSAND)

TABLE 63 ARGENTINA TREASURY SOFTWARE MARKET, BY VERTICAL, 2020-2029 (USD THOUSAND)

TABLE 64 ARGENTINA BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI) IN TREASURY SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 65 ARGENTINA GOVERNMENT IN TREASURY SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 66 ARGENTINA MANUFACTURING IN TREASURY SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 67 ARGENTINA HEALTHCARE IN TREASURY SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 68 ARGENTINA CONSUMER GOODS IN TREASURY SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 69 ARGENTINA CHEMICALS IN TREASURY SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 70 ARGENTINA ENERGY IN TREASURY SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 71 ARGENTINA OTHERS IN TREASURY SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 72 BOLIVIA TREASURY SOFTWARE MARKET, BY OPERATING SYSTEM, 2020-2029 (USD THOUSAND)

TABLE 73 BOLIVIA TREASURY SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 74 BOLIVIA TREASURY SOFTWARE MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD THOUSAND)

TABLE 75 BOLIVIA CLOUD IN TREASURY SOFTWARE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 76 BOLIVIA TREASURY SOFTWARE MARKET, BY ORGANISATION SIZE, 2020-2029 (USD THOUSAND)

TABLE 77 BOLIVIA TREASURY SOFTWARE MARKET, BY VERTICAL, 2020-2029 (USD THOUSAND)

TABLE 78 BOLIVIA BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI) IN TREASURY SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 79 BOLIVIA GOVERNMENT IN TREASURY SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 80 BOLIVIA MANUFACTURING IN TREASURY SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 81 BOLIVIA HEALTHCARE IN TREASURY SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 82 BOLIVIA CONSUMER GOODS IN TREASURY SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 83 BOLIVIA CHEMICALS IN TREASURY SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 84 BOLIVIA ENERGY IN TREASURY SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 85 BOLIVIA OTHERS IN TREASURY SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 86 PARAGUAY TREASURY SOFTWARE MARKET, BY OPERATING SYSTEM, 2020-2029 (USD THOUSAND)

TABLE 87 PARAGUAY TREASURY SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 88 PARAGUAY TREASURY SOFTWARE MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD THOUSAND)

TABLE 89 PARAGUAY CLOUD IN TREASURY SOFTWARE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 90 PARAGUAY TREASURY SOFTWARE MARKET, BY ORGANISATION SIZE, 2020-2029 (USD THOUSAND)

TABLE 91 PARAGUAY TREASURY SOFTWARE MARKET, BY VERTICAL, 2020-2029 (USD THOUSAND)

TABLE 92 PARAGUAY BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI) IN TREASURY SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 93 PARAGUAY GOVERNMENT IN TREASURY SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 94 PARAGUAY MANUFACTURING IN TREASURY SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 95 PARAGUAY HEALTHCARE IN TREASURY SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 96 PARAGUAY CONSUMER GOODS IN TREASURY SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 97 PARAGUAY CHEMICALS IN TREASURY SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 98 PARAGUAY ENERGY IN TREASURY SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 99 PARAGUAY OTHERS IN TREASURY SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 100 PERU TREASURY SOFTWARE MARKET, BY OPERATING SYSTEM, 2020-2029 (USD THOUSAND)

TABLE 101 PERU TREASURY SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 102 PERU TREASURY SOFTWARE MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD THOUSAND)

TABLE 103 PERU CLOUD IN TREASURY SOFTWARE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 104 PERU TREASURY SOFTWARE MARKET, BY ORGANISATION SIZE, 2020-2029 (USD THOUSAND)

TABLE 105 PERU TREASURY SOFTWARE MARKET, BY VERTICAL, 2020-2029 (USD THOUSAND)

TABLE 106 PERU BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI) IN TREASURY SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 107 PERU GOVERNMENT IN TREASURY SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 108 PERU MANUFACTURING IN TREASURY SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 109 PERU HEALTHCARE IN TREASURY SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 110 PERU CONSUMER GOODS IN TREASURY SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 111 PERU CHEMICALS IN TREASURY SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 112 PERU ENERGY IN TREASURY SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 113 PERU OTHERS IN TREASURY SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 114 URUGUAY TREASURY SOFTWARE MARKET, BY OPERATING SYSTEM, 2020-2029 (USD THOUSAND)

TABLE 115 URUGUAY TREASURY SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 116 URUGUAY TREASURY SOFTWARE MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD THOUSAND)

TABLE 117 URUGUAY CLOUD IN TREASURY SOFTWARE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 118 URUGUAY TREASURY SOFTWARE MARKET, BY ORGANISATION SIZE, 2020-2029 (USD THOUSAND)

TABLE 119 URUGUAY TREASURY SOFTWARE MARKET, BY VERTICAL, 2020-2029 (USD THOUSAND)

TABLE 120 URUGUAY BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI) IN TREASURY SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 121 URUGUAY GOVERNMENT IN TREASURY SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 122 URUGUAY MANUFACTURING IN TREASURY SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 123 URUGUAY HEALTHCARE IN TREASURY SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 124 URUGUAY CONSUMER GOODS IN TREASURY SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 125 URUGUAY CHEMICALS IN TREASURY SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 126 URUGUAY ENERGY IN TREASURY SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 127 URUGUAY OTHERS IN TREASURY SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 128 PANAMA TREASURY SOFTWARE MARKET, BY OPERATING SYSTEM, 2020-2029 (USD THOUSAND)

TABLE 129 PANAMA TREASURY SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 130 PANAMA TREASURY SOFTWARE MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD THOUSAND)

TABLE 131 PANAMA CLOUD IN TREASURY SOFTWARE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 132 PANAMA TREASURY SOFTWARE MARKET, BY ORGANISATION SIZE, 2020-2029 (USD THOUSAND)

TABLE 133 PANAMA TREASURY SOFTWARE MARKET, BY VERTICAL, 2020-2029 (USD THOUSAND)

TABLE 134 PANAMA BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI) IN TREASURY SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 135 PANAMA GOVERNMENT IN TREASURY SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 136 PANAMA MANUFACTURING IN TREASURY SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 137 PANAMA HEALTHCARE IN TREASURY SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 138 PANAMA CONSUMER GOODS IN TREASURY SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 139 PANAMA CHEMICALS IN TREASURY SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 140 PANAMA ENERGY IN TREASURY SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 141 PANAMA OTHERS IN TREASURY SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 142 NICARAGUA TREASURY SOFTWARE MARKET, BY OPERATING SYSTEM, 2020-2029 (USD THOUSAND)

TABLE 143 NICARAGUA TREASURY SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 144 NICARAGUA TREASURY SOFTWARE MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD THOUSAND)

TABLE 145 NICARAGUA CLOUD IN TREASURY SOFTWARE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 146 NICARAGUA TREASURY SOFTWARE MARKET, BY ORGANISATION SIZE, 2020-2029 (USD THOUSAND)

TABLE 147 NICARAGUA TREASURY SOFTWARE MARKET, BY VERTICAL, 2020-2029 (USD THOUSAND)

TABLE 148 NICARAGUA BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI) IN TREASURY SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 149 NICARAGUA GOVERNMENT IN TREASURY SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 150 NICARAGUA MANUFACTURING IN TREASURY SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 151 NICARAGUA HEALTHCARE IN TREASURY SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 152 NICARAGUA CONSUMER GOODS IN TREASURY SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 153 NICARAGUA CHEMICALS IN TREASURY SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 154 NICARAGUA ENERGY IN TREASURY SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 155 NICARAGUA OTHERS IN TREASURY SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 156 COSTA RICA TREASURY SOFTWARE MARKET, BY OPERATING SYSTEM, 2020-2029 (USD THOUSAND)

TABLE 157 COSTA RICA TREASURY SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 158 COSTA RICA TREASURY SOFTWARE MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD THOUSAND)

TABLE 159 COSTA RICA CLOUD IN TREASURY SOFTWARE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 160 COSTA RICA TREASURY SOFTWARE MARKET, BY ORGANISATION SIZE, 2020-2029 (USD THOUSAND)

TABLE 161 COSTA RICA TREASURY SOFTWARE MARKET, BY VERTICAL, 2020-2029 (USD THOUSAND)

TABLE 162 COSTA RICA BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI) IN TREASURY SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 163 COSTA RICA GOVERNMENT IN TREASURY SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 164 COSTA RICA MANUFACTURING IN TREASURY SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 165 COSTA RICA HEALTHCARE IN TREASURY SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 166 COSTA RICA CONSUMER GOODS IN TREASURY SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 167 COSTA RICA CHEMICALS IN TREASURY SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 168 COSTA RICA ENERGY IN TREASURY SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 169 COSTA RICA OTHERS IN TREASURY SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 170 ECUADOR TREASURY SOFTWARE MARKET, BY OPERATING SYSTEM, 2020-2029 (USD THOUSAND)

TABLE 171 ECUADOR TREASURY SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 172 ECUADOR TREASURY SOFTWARE MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD THOUSAND)

TABLE 173 ECUADOR CLOUD IN TREASURY SOFTWARE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 174 ECUADOR TREASURY SOFTWARE MARKET, BY ORGANISATION SIZE, 2020-2029 (USD THOUSAND)

TABLE 175 ECUADOR TREASURY SOFTWARE MARKET, BY VERTICAL, 2020-2029 (USD THOUSAND)

TABLE 176 ECUADOR BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI) IN TREASURY SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 177 ECUADOR GOVERNMENT IN TREASURY SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 178 ECUADOR MANUFACTURING IN TREASURY SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 179 ECUADOR HEALTHCARE IN TREASURY SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 180 ECUADOR CONSUMER GOODS IN TREASURY SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 181 ECUADOR CHEMICALS IN TREASURY SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 182 ECUADOR ENERGY IN TREASURY SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 183 ECUADOR OTHERS IN TREASURY SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 184 HONDURAS TREASURY SOFTWARE MARKET, BY OPERATING SYSTEM, 2020-2029 (USD THOUSAND)

TABLE 185 HONDURAS TREASURY SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 186 HONDURAS TREASURY SOFTWARE MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD THOUSAND)

TABLE 187 HONDURAS CLOUD IN TREASURY SOFTWARE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 188 HONDURAS TREASURY SOFTWARE MARKET, BY ORGANISATION SIZE, 2020-2029 (USD THOUSAND)

TABLE 189 HONDURAS TREASURY SOFTWARE MARKET, BY VERTICAL, 2020-2029 (USD THOUSAND)

TABLE 190 HONDURAS BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI) IN TREASURY SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 191 HONDURAS GOVERNMENT IN TREASURY SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 192 HONDURAS MANUFACTURING IN TREASURY SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 193 HONDURAS HEALTHCARE IN TREASURY SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 194 HONDURAS CONSUMER GOODS IN TREASURY SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 195 HONDURAS CHEMICALS IN TREASURY SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 196 HONDURAS ENERGY IN TREASURY SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 197 HONDURAS OTHERS IN TREASURY SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 198 GUATEMALA TREASURY SOFTWARE MARKET, BY OPERATING SYSTEM, 2020-2029 (USD THOUSAND)

TABLE 199 GUATEMALA TREASURY SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 200 GUATEMALA TREASURY SOFTWARE MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD THOUSAND)

TABLE 201 GUATEMALA CLOUD IN TREASURY SOFTWARE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 202 GUATEMALA TREASURY SOFTWARE MARKET, BY ORGANISATION SIZE, 2020-2029 (USD THOUSAND)

TABLE 203 GUATEMALA TREASURY SOFTWARE MARKET, BY VERTICAL, 2020-2029 (USD THOUSAND)

TABLE 204 GUATEMALA BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI) IN TREASURY SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 205 GUATEMALA GOVERNMENT IN TREASURY SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 206 GUATEMALA MANUFACTURING IN TREASURY SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 207 GUATEMALA HEALTHCARE IN TREASURY SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 208 GUATEMALA CONSUMER GOODS IN TREASURY SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 209 GUATEMALA CHEMICALS IN TREASURY SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 210 GUATEMALA ENERGY IN TREASURY SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 211 GUATEMALA OTHERS IN TREASURY SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 212 EL SALVADOR TREASURY SOFTWARE MARKET, BY OPERATING SYSTEM, 2020-2029 (USD THOUSAND)

TABLE 213 EL SALVADOR TREASURY SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 214 EL SALVADOR TREASURY SOFTWARE MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD THOUSAND)

TABLE 215 EL SALVADOR CLOUD IN TREASURY SOFTWARE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 216 EL SALVADOR TREASURY SOFTWARE MARKET, BY ORGANISATION SIZE, 2020-2029 (USD THOUSAND)

TABLE 217 EL SALVADOR TREASURY SOFTWARE MARKET, BY VERTICAL, 2020-2029 (USD THOUSAND)

TABLE 218 EL SALVADOR BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI) IN TREASURY SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 219 EL SALVADOR GOVERNMENT IN TREASURY SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 220 EL SALVADOR MANUFACTURING IN TREASURY SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 221 EL SALVADOR HEALTHCARE IN TREASURY SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 222 EL SALVADOR CONSUMER GOODS IN TREASURY SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 223 EL SALVADOR CHEMICALS IN TREASURY SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 224 EL SALVADOR ENERGY IN TREASURY SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 225 EL SALVADOR OTHERS IN TREASURY SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 226 THE DOMINICAN REPUBLIC TREASURY SOFTWARE MARKET, BY OPERATING SYSTEM, 2020-2029 (USD THOUSAND)

TABLE 227 THE DOMINICAN REPUBLIC TREASURY SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 228 THE DOMINICAN REPUBLIC TREASURY SOFTWARE MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD THOUSAND)

TABLE 229 THE DOMINICAN REPUBLIC CLOUD IN TREASURY SOFTWARE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 230 THE DOMINICAN REPUBLIC TREASURY SOFTWARE MARKET, BY ORGANISATION SIZE, 2020-2029 (USD THOUSAND)

TABLE 231 THE DOMINICAN REPUBLIC TREASURY SOFTWARE MARKET, BY VERTICAL, 2020-2029 (USD THOUSAND)

TABLE 232 THE DOMINICAN REPUBLIC BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI) IN TREASURY SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 233 THE DOMINICAN REPUBLIC GOVERNMENT IN TREASURY SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 234 THE DOMINICAN REPUBLIC MANUFACTURING IN TREASURY SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 235 THE DOMINICAN REPUBLIC HEALTHCARE IN TREASURY SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 236 THE DOMINICAN REPUBLIC CONSUMER GOODS IN TREASURY SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 237 THE DOMINICAN REPUBLIC CHEMICALS IN TREASURY SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 238 THE DOMINICAN REPUBLIC ENERGY IN TREASURY SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 239 THE DOMINICAN REPUBLIC OTHERS IN TREASURY SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 240 REST OF LATIN AMERICA TREASURY SOFTWARE MARKET, BY OPERATING SYSTEM, 2020-2029 (USD THOUSAND)

Lista de Figura

FIGURE 1 LATIN AMERICA TREASURY SOFTWARE MARKET: SEGMENTATION

FIGURE 2 LATIN AMERICA TREASURY SOFTWARE MARKET: DATA TRIANGULATION

FIGURE 3 LATIN AMERICA TREASURY SOFTWARE MARKET: DROC ANALYSIS

FIGURE 4 LATIN AMERICA TREASURY SOFTWARE MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 LATIN AMERICA TREASURY SOFTWARE MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 LATIN AMERICA TREASURY SOFTWARE MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 LATIN AMERICA TREASURY SOFTWARE MARKET: DBMR MARKET POSITION GRID

FIGURE 8 LATIN AMERICA TREASURY SOFTWARE MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 LATIN AMERICA TREASURY SOFTWARE MARKET: END-USER COVERAGE GRID

FIGURE 10 LATIN AMERICA TREASURY SOFTWARE MARKET: SEGMENTATION

FIGURE 11 INCREASING ADOPTION OF SMART ELECTRONIC PAYMENT MANAGEMENT TOOLS IS EXPECTED TO DRIVE THE LATIN AMERICA TREASURY SOFTWARE MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 WINDOWS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE LATIN AMERICA TREASURY SOFTWARE MARKET IN 2022 & 2029

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE LATIN AMERICA TREASURY SOFTWARE MARKET

FIGURE 14 MOBILE PAYMENTS SHARE (%) BY COUNTRY

FIGURE 15 FACTORS AFFECTING THE TMS AND CUSTOMER EXPERIENCE

FIGURE 16 THREE WAYS ARTIFICIAL INTELLIGENCE IS TRANSFORMING TREASURY

FIGURE 17 CYBER-ATTACKS INCIDENTS BY COUNTRY AND REGION IN 2020

FIGURE 18 TECHNOLOGIES USED IN TREASURY DEPARTMENT CURRENTLY

FIGURE 19 LATIN AMERICA TREASURY SOFTWARE MARKET: BY OPERATING SYSTEM, 2021

FIGURE 20 LATIN AMERICA TREASURY SOFTWARE MARKET: BY APPLICATION, 2021

FIGURE 21 LATIN AMERICA TREASURY SOFTWARE MARKET: BY ORGANIZATION SIZE, 2021

FIGURE 22 LATIN AMERICA TREASURY SOFTWARE MARKET: BY DEPLOYMENT MODEL, 2021

FIGURE 23 LATIN AMERICA TREASURY SOFTWARE MARKET: BY VERTICAL, 2021

FIGURE 24 LATIN AMERICA TREASURY SOFTWARE MARKET: SNAPSHOT (2021)

FIGURE 25 LATIN AMERICA TREASURY SOFTWARE MARKET: BY COUNTRY (2021)

FIGURE 26 LATIN AMERICA TREASURY SOFTWARE MARKET: BY COUNTRY (2022 & 2029)

FIGURE 27 LATIN AMERICA TREASURY SOFTWARE MARKET: BY COUNTRY (2021 & 2029)

FIGURE 28 LATIN AMERICA TREASURY SOFTWARE MARKET: BY OPERATING SYSTEM (2022-2029)

FIGURE 29 LATIN AMERICA TREASURY SOFTWARE MARKET: COMPANY SHARE 2021 (%)

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.