Latin America At Home Testing Kits Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

547.03 Million

USD

791.57 Million

2024

2032

USD

547.03 Million

USD

791.57 Million

2024

2032

| 2025 –2032 | |

| USD 547.03 Million | |

| USD 791.57 Million | |

|

|

|

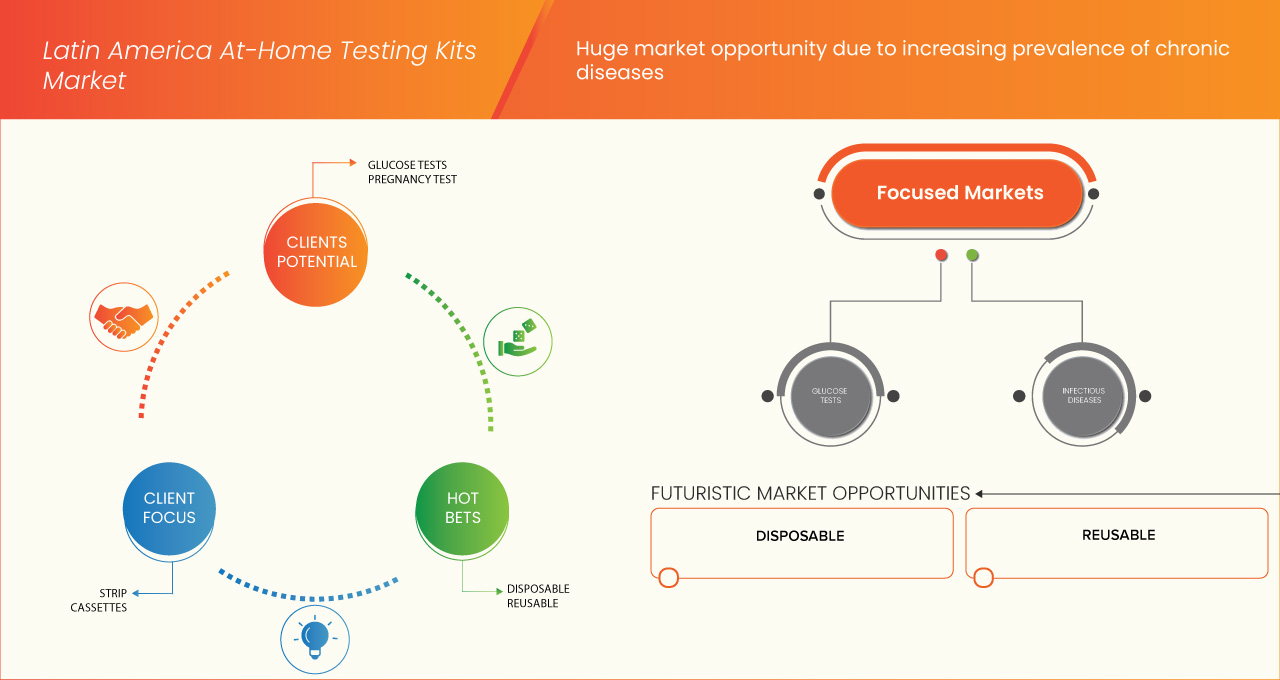

Segmentação do mercado de kits de teste ao domicílio na América Latina, tipo de teste (teste de gravidez, doenças infeciosas, testes de glicose, kit de teste preditor de ovulação, kits de teste de abuso de drogas e outros tipos de teste), tipo (cassetes, tira, midstream, painel de teste, imersão Cartão de Identificação e Outros), Idade (Pediátrica, Adulta e Geriátrica), Tipo de Amostra (Urina, Sangue, Saliva e Outros Tipos de Amostra), Utilização (Descartável e Reutilizável) , Canal de Distribuição (Farmácias de Retalho, Drogarias, Supermercados/Hipermercados , e Farmácias Online) – Tendências e Previsão do Sector até 2031

Análise do mercado de kits de teste ao domicílio na América Latina

O mercado de kits de teste domiciliário na América Latina tem apresentado um crescimento significativo, impulsionado pela crescente consciencialização sobre os cuidados de saúde e pela crescente procura de soluções de diagnóstico convenientes. A prevalência de doenças crónicas, incluindo a diabetes e a hipertensão, é notavelmente elevada na região, afectando uma parte substancial da população e motivando uma mudança para soluções de auto-monitorização. Além disso, estima-se que a penetração no mercado dos kits de teste ao domicílio poderá atingir cerca de 15% até 2025, refletindo a maior aceitação por parte dos consumidores e a crescente disponibilidade de uma variedade de opções de teste.

Tamanho do mercado de kits de teste ao domicílio na América Latina

O tamanho do mercado de kits de teste ao domicílio na América Latina foi avaliado em 525,88 milhões de dólares em 2023 e está projetado para atingir 755,84 milhões de dólares até 2031, com um CAGR de 4,7% durante o período previsto de 2024 a 2031. Para além dos cenários de insights sobre o mercado, como o valor de mercado, a taxa de crescimento, a segmentação, a cobertura geográfica e os principais participantes, os relatórios de mercado selecionados pela Data Bridge Market Research incluem também a análise de importação e exportação, a visão geral da capacidade de produção, análise de consumo de produção, análise de tendência de preço, cenário de alterações climáticas, análise da cadeia de abastecimento, análise da cadeia de valor, visão geral das matérias-primas/consumíveis, critérios de seleção de fornecedores, análise PESTLE , análise de Porter e enquadramento regulamentar.

Tendências do mercado de kits de teste ao domicílio na América Latina

“Aumento da procura do consumidor por soluções de saúde convenientes e acessíveis”

Uma tendência significativa no mercado de kits de teste domiciliário na América Latina é a crescente procura dos consumidores por soluções de saúde convenientes e acessíveis, especialmente após a pandemia da COVID-19. À medida que as pessoas se tornam mais preocupadas com a saúde, há uma preferência crescente por kits de teste caseiros que permitem o autodiagnóstico de várias condições, incluindo doenças infeciosas, doenças crónicas e até testes genéticos. Esta mudança é motivada por fatores como o desejo de privacidade, a facilidade de utilização e a necessidade de reduzir as visitas ao hospital. Além disso, a expansão das plataformas de comércio eletrónico e das aplicações de saúde móvel facilitou a distribuição e a acessibilidade destes kits, tornando mais fácil para os consumidores encomendá-los e utilizá-los no conforto das suas casas. Como resultado, esta tendência levou os fabricantes e as empresas de saúde a inovar e a diversificar as suas ofertas de produtos, servindo uma base de consumidores cada vez mais proativa que procura gerir a sua saúde de forma mais independente.

Âmbito do relatório e segmentação do mercado de kits de teste ao domicílio na América Latina

|

Atributos |

Insights sobre o mercado de kits de teste ao domicílio na América Latina |

|

Segmentos abrangidos |

|

|

Países abrangidos |

México, Brasil, Argentina e resto da América Latina |

|

Principais participantes do mercado |

Abbott (EUA), F. Hoffmann-La Roche Ltd (Suíça), BD (EUA), Siemens Healthineers AG (Europa), B. Braun SE (Alemanha), ACON Laboratories, Inc (EUA), ARKRAY, Inc. (Japão ), OraSure Technologies, Inc (EUA), SA Scientific Ltd. (EUA), QuidelOrtho Corporation (EUA), PRIMA Lab SA (Suíça) e Bionime Corporation (Taiwan), entre outros |

|

Oportunidades de Mercado |

|

|

Conjuntos de informações de dados de valor acrescentado |

Para além dos insights sobre os cenários de mercado, tais como o valor de mercado, a taxa de crescimento, a segmentação, a cobertura geográfica e os principais participantes, os relatórios de mercado selecionados pela Data Bridge Market Research incluem também a análise de importação e exportação, a visão geral da capacidade de produção, análise de consumo de produção, análise de tendências de preço, cenário de alterações climáticas, análise da cadeia de abastecimento, análise da cadeia de valor, visão geral das matérias-primas/consumíveis, critérios de seleção de fornecedores, análise PESTLE, análise de Porter e estrutura regulatória. |

Definição do mercado de kits de teste ao domicílio na América Latina

Os kits de teste em casa significam instrumentos de teste que ajudam as pessoas a realizar testes em casa e fornecem resultados rápidos num minuto. Inclui também equipamento de monitorização da saúde para verificar e controlar continuamente a saúde do doente diabético. Os testes em casa são muito práticos para serem realizados com conforto e estão disponíveis a preços muito acessíveis. Os autotestes são geralmente versões avançadas de kits de testes rápidos para utilização no local de atendimento, que foram originalmente concebidos para profissionais de saúde e podem ser realizados por pessoas comuns. Os seus processos, embalagens e instruções foram simplificados para orientar a pessoa nas etapas de realização do teste. Estão disponíveis vários kits de teste caseiros, incluindo testes de VIH, teste de gravidez, diabetes, teste de ovulação, doenças infecciosas como a malária e outras. Para realizar estes testes rápidos em casa, podem ser recolhidas amostras de sangue, urina e fluido oral.

Dinâmica do mercado de kits de teste ao domicílio na América Latina

Motoristas

- Aumento da prevalência de doenças crónicas

A necessidade de deteção precoce também impulsiona esta procura. As doenças crónicas geralmente progridem gradualmente, e a identificação precoce de indicadores anormais de saúde pode fazer uma diferença significativa na prevenção do agravamento das condições. Os kits de teste domiciliários oferecem aos doentes a capacidade de realizar autoexames regulares, ajudando-os a identificar sinais de alerta precocemente e a procurar intervenção médica atempada. Além disso, a conveniência dos testes domiciliários reduz o tempo, o esforço e os custos associados às consultas médicas frequentes, o que é um fator atrativo para os doentes que lidam com condições de longa duração.

Além disso, a crescente carga sobre os sistemas de saúde na América Latina está a contribuir para a popularidade dos kits de teste em casa. Muitos sistemas de saúde pública estão a enfrentar hospitais sobrelotados e recursos limitados, e os testes domiciliários reduzem a pressão sobre estes sistemas, minimizando o número de visitas de rotina para fins de diagnóstico. Isto é particularmente importante na América Latina, onde o acesso aos cuidados de saúde pode variar muito em função da geografia e do estatuto socioeconómico.

- Adoção crescente de kits de autoteste

Antigamente, as pessoas visitavam os hospitais com frequência, mesmo para problemas básicos de saúde. No entanto, com a crescente consciencialização sobre os produtos de teste em casa, este comportamento mudou significativamente. Hoje em dia, muitos consumidores preferem utilizar kits de autoteste em casa para testes básicos antes de consultar um médico. Esta tendência crescente oferece conveniência, uma vez que os indivíduos podem aceder aos seus resultados de testes com rapidez e facilidade. Na América Latina, a crescente adoção de kits de autoteste é um dos principais impulsionadores do mercado de kits de teste ao domicílio, especialmente em regiões com infraestruturas de saúde limitadas. Estes kits oferecem uma solução acessível, fiável e conveniente para os doentes monitorizarem a sua saúde, reduzindo a necessidade de visitas frequentes ao hospital. São particularmente benéficos em zonas rurais e carenciadas, permitindo a deteção precoce e o tratamento de condições como a diabetes, COVID-19 e infeções sexualmente transmissíveis. Ao diminuir a sobrelotação dos hospitais e ao diminuir as taxas de consulta e diagnóstico, os kits de autoteste não só melhoram o acesso aos cuidados de saúde, como também ajudam a reduzir as despesas hospitalares, tornando-os uma solução prática para os doentes e para os sistemas de saúde.

Oportunidades

- Advento de tecnologias avançadas como a IA e a aprendizagem automática

As tecnologias mais recentes estão a desempenhar um papel crucial para tornar os produtos médicos muito avançados e fiáveis. A Inteligência Artificial (IA) e a Aprendizagem Automática (AM) em vários dispositivos médicos são uma parte importante do setor da saúde, com potencial para melhorar os cuidados ao paciente, bem como os processos administrativos, automatizando tarefas e alcançando resultados mais rápidos.

É certo que as ferramentas e instrumentos de diagnóstico alimentados por IA continuarão a evoluir por natureza. No sector da saúde, a IA deu apenas pequenos passos em direcção a uma oportunidade vasta e multidimensional.

- Aumento da adoção de kits de autoteste via online em relação à abordagem convencional

Hoje em dia, cada vez mais pessoas adotam as compras online, seja de roupa, mercearia ou produtos de saúde. As pessoas estão agora a adotar plataformas online para comprar instrumentos médicos e medicamentos genuínos. Durante a pandemia em curso, muitos consumidores preocupados com a saúde recorreram à internet para comprar uma grande variedade de produtos de saúde e bem-estar. Os kits de teste caseiros para muitas condições médicas estão agora disponíveis online através de sites de comércio eletrónico ou também no site da empresa.

Algumas empresas, incluindo a Everlywell e a LetsGetChecked, também oferecem a recolha de amostras em casa e levam-nas para laboratórios certificados para testes e entrega dos resultados em 2 a 3 dias com um profissional certificado. Estas empresas estão a conquistar a confiança dos clientes através dos resultados dos testes dos seus processos laboratoriais certificados e do fornecimento de privacidade completa. Muitas empresas estão a entregar os seus próprios kits de autoteste às pessoas.

Restrições/Desafios

- Imprecisão dos resultados dos kits de autoteste

Os kits de teste em casa permitem que o utilizador final recolha a sua amostra em casa e depois realize os testes em casa ou envie a amostra para o laboratório para análise. Os kits de teste caseiros facilitam, sem dúvida, o processo de confirmação da preocupação da pessoa, seja um teste de gravidez caseiro, um teste de VIH ou qualquer outro teste de doenças infeciosas. Estes testes caseiros não são apenas fáceis de utilizar, mas também são acessíveis. No entanto, existem sempre dúvidas sobre a precisão dos resultados.

No entanto, um resultado falso positivo de um teste pode causar ansiedade e stress à pessoa, mesmo que não o tenha. É muito perturbador e perturbador para a pessoa receber um resultado falso positivo ou negativo. Existem vários problemas relacionados com a precisão, devido aos quais a distribuição de kits de teste em casa foi suspensa para verificar a sua fiabilidade.

- Sensibilização e educação limitadas

A sensibilização e a educação limitadas apresentam desafios significativos para o mercado de kits de testes domiciliários na América Latina. Muitos consumidores desconhecem os benefícios e a disponibilidade destes kits de teste, o que pode impedir a sua disponibilidade para os adotar. Este problema é particularmente pronunciado nas zonas rurais, onde o acesso à informação e os níveis de literacia em saúde podem ser mais baixos. Sem uma compreensão adequada destas ferramentas, os indivíduos podem não reconhecer o seu valor, levando ao cepticismo quanto à sua precisão e eficácia. Consequentemente, esta lacuna na sensibilização pode resultar em oportunidades perdidas de diagnóstico precoce e prevenção de problemas de saúde, impactando, em última análise, os resultados de saúde pública nestas comunidades.

Este relatório de mercado fornece detalhes de novos desenvolvimentos recentes, regulamentos comerciais, análise de importação e exportação, análise de produção, otimização da cadeia de valor, quota de mercado, impacto dos participantes do mercado doméstico e localizado, analisa as oportunidades em termos de bolsas de receitas emergentes, alterações nas regulamentações do mercado, análise estratégica do crescimento do mercado, tamanho do mercado, crescimento do mercado das categorias, nichos de aplicação e dominância, aprovações de produtos, lançamentos de produtos, expansões geográficas, inovações tecnológicas no mercado. Para mais informações sobre o mercado, contacte a Data Bridge Market Research para obter um briefing de analista.

Âmbito do mercado de kits de teste ao domicílio na América Latina

O mercado é segmentado com base no tipo de teste, tipo, idade, tipo de amostra, utilização e canal de distribuição. O crescimento entre estes segmentos irá ajudá-lo a analisar segmentos de baixo crescimento nos setores e fornecerá aos utilizadores uma visão geral e informações valiosas do mercado para os ajudar a tomar decisões estratégicas para identificar as principais aplicações do mercado.

Tipo de teste

- Teste de gravidez

- Kit de teste VIH

- Diabetes

- Doenças Infecciosas

- Testes de Glicose

- Kit de teste de previsão da ovulação

- Kit de teste de abuso de drogas

- Outros tipos de teste.

Tipo

- Cassete

- Faixa

- No meio do caminho

- Painel de teste

- Cartão de mergulho

- Outros tipos de formulários

Idade

- Pediátrico

- Adulto

- Geriátrico

Tipo de amostra

- Urina

- Sangue

- Saliva

- Outros tipos de amostra

Uso

- Descartável

- Reutilizável

Canal de Distribuição

- Farmácias de retalho

- Farmácia

- Supermercado/Hipermercado

- Farmácias Online

Análise regional do mercado de kits de teste ao domicílio na América Latina

O mercado é analisado e são fornecidos insights sobre o tamanho e as tendências do mercado por país, tipo de teste, tipo, idade, tipo de amostra, utilização e canal de distribuição, conforme referenciado acima.

Os países abrangidos pelo mercado são o México, o Brasil, a Argentina e o resto da América Latina.

Espera-se que o México domine o mercado devido à sua infraestrutura de cuidados de saúde bem estabelecida e à elevada taxa de adoção de tecnologias avançadas, incluindo soluções baseadas na cloud e automação. Iniciativas governamentais de apoio e investimentos significativos em TI de saúde impulsionam a inovação e aumentam a eficiência das operações laboratoriais na região.

Espera-se que o Brasil seja o país com crescimento mais rápido devido aos rápidos avanços na infraestrutura de saúde e ao crescente foco na adoção de soluções de saúde digital. Além disso, a crescente prevalência de doenças crónicas e a necessidade de sistemas de gestão laboratorial eficientes alimentam ainda mais a procura de LIS nesta região.

A secção do relatório sobre os países também fornece fatores individuais que impactam o mercado e alterações na regulamentação do mercado nacional que impactam as tendências atuais e futuras do mercado. Pontos de dados como a análise da cadeia de valor a montante e a jusante, tendências técnicas e análise das cinco forças de Porter, estudos de caso são alguns dos indicadores utilizados para prever o cenário de mercado para países individuais. Além disso, a presença e a disponibilidade de marcas globais e os seus desafios enfrentados devido à grande ou escassa concorrência de marcas locais e nacionais, ao impacto de tarifas domésticas e rotas comerciais são considerados ao fornecer uma análise de previsão dos dados do país.

Participação no mercado de kits de teste ao domicílio na América Latina

O cenário competitivo do mercado fornece detalhes por concorrente. Os detalhes incluídos são a visão geral da empresa, finanças da empresa, receitas geradas, potencial de mercado, investimento em investigação e desenvolvimento, novas iniciativas de mercado, presença global, localizações e instalações de produção, capacidades de produção, pontos fortes e fracos da empresa , lançamento do produto, amplitude e abrangência do produto, aplicação domínio. Os pontos de dados fornecidos acima estão apenas relacionados com o foco das empresas em relação ao mercado.

Os líderes de mercado de kits de teste ao domicílio na América Latina que operam no mercado são:

- Abbott (EUA)

- F. Hoffmann-La Roche Ltd (Suíça)

- BD (EUA)

- Siemens Healthineers AG (Alemanha)

- B. Braun SE (Europa)

- ACON Laboratories, Inc (EUA)

- ARKRAY, Inc. (Japão)

- OraSure Technologies, Inc (EUA)

- SA Scientific Ltd. (EUA)

- QuidelOrtho Corporation (EUA)

- PRIMA Lab SA (Suíça)

- Bionime Corporation (Taiwan)

Últimos desenvolvimentos no mercado de kits de teste ao domicílio na América Latina

- Em setembro de 2024, a Agilent Technologies Inc. anunciou a conclusão da aquisição da BIOVECTRA, melhorando as suas capacidades de desenvolvimento e fabrico de contratos. Esta mudança expandiu os serviços de CDMO da Agilent e apoiou a edição genética, refletindo o seu compromisso com o avanço dos programas terapêuticos com o melhor fabrico da sua classe.

- Em julho de 2021, a STARLIMS Corporation assinou um acordo definitivo com a Francisco Partners para o conjunto de produtos informáticos STARLIMS e ativos comerciais relacionados da Abbott. Esta parceria ajudará ainda mais a empresa a posicionar-se bem para o crescimento contínuo no mercado competitivo

- Em abril de 2023, a Microsoft e a Epic expandiram a sua parceria para integrar a IA generativa na área da saúde, aproveitando o Azure OpenAI Service com o software EHR da Epic. Esta colaboração visa aumentar a produtividade, melhorar os cuidados prestados aos doentes e melhorar a integridade financeira dos sistemas de saúde em todo o mundo.

- Em outubro de 2024, a Xybion lançou o LIMS 10.0, uma solução moderna habilitada para IA que melhora a eficiência do laboratório em todos os setores. Apresentando uma interface intuitiva, QMS integrado e funcionalidades robustas como gestão de inventário e registos de auditoria, transforma as operações laboratoriais e acelera a conformidade e a produtividade a nível global

- Em setembro de 2024, a LabVantage Solutions estabeleceu uma parceria com a Henkel para criar uma plataforma de I&D integrada, ligando o LabVantage LIMS e o SAP PLM. Esta colaboração teve como objetivo agilizar processos, melhorar a partilha de dados e impulsionar a transformação digital na divisão de marcas de consumo da Henkel

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.