Global Ultra High Purity Anhydrous Hydrogen Chloride Hcl Gas Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

4.14 Billion

USD

6.17 Billion

2024

2032

USD

4.14 Billion

USD

6.17 Billion

2024

2032

| 2025 –2032 | |

| USD 4.14 Billion | |

| USD 6.17 Billion | |

|

|

|

|

Segmentação do mercado global de gás cloreto de hidrogênio anidro (HCL) de ultra-alta pureza, por produto (grau eletrônico e grau químico), aplicação (eletrônicos e elétricos, farmacêuticos, químicos e outros) - Tendências do setor e previsões até 2032

Tamanho do mercado de gás cloreto de hidrogênio anidro (HCL) de ultra-alta pureza

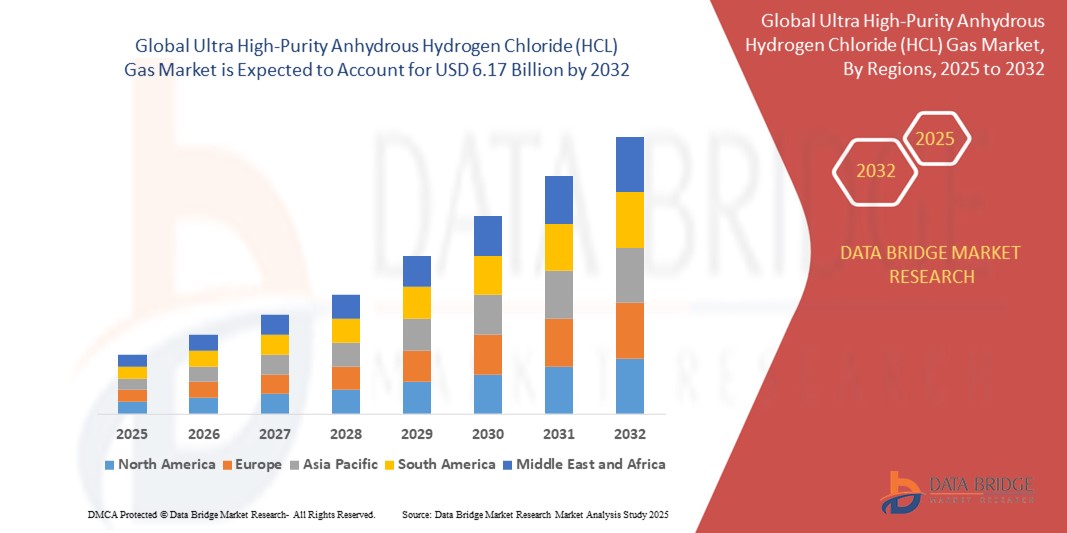

- O tamanho do mercado global de gás cloreto de hidrogênio anidro (HCL) de ultra-alta pureza foi avaliado em US$ 4,14 bilhões em 2024 e deve atingir US$ 6,17 bilhões até 2032 , com um CAGR de 5,12% durante o período previsto.

- O crescimento do mercado é amplamente impulsionado pela crescente demanda da indústria de semicondutores por gases de alta pureza usados na fabricação de chips e processos de gravação, juntamente com a crescente adoção na síntese farmacêutica e na produção de produtos químicos especiais.

- Os crescentes investimentos na fabricação de eletrônicos na Ásia-Pacífico e na América do Norte estão aumentando o consumo de gás cloreto de hidrogênio anidro de ultra-alta pureza, especialmente na produção de circuitos integrados e painéis de exibição.

Análise do Mercado de Gás Cloreto de Hidrogênio Anidro (HCL) de Ultra-Alta Pureza

- O mercado está experimentando uma demanda crescente da indústria eletrônica, onde o gás de alta pureza é essencial para gravação e limpeza na fabricação de semicondutores

- Os fabricantes estão se concentrando em refinar a qualidade do gás e garantir a consistência para atender às rigorosas especificações da indústria

- A América do Norte dominou o mercado de gás cloreto de hidrogênio anidro de ultra-alta pureza em 2024, impulsionada pela forte demanda dos setores de eletrônicos e semicondutores, especialmente nos EUA e Canadá

- Espera-se que a região da Ásia-Pacífico testemunhe a maior taxa de crescimento no mercado global de gás cloreto de hidrogênio anidro (HCL) de ultra-alta pureza, impulsionado pela rápida industrialização, expansão da fabricação de semicondutores e aumento dos investimentos nos setores eletrônico e farmacêutico em países como China, Japão e Coreia do Sul

- O segmento de grau eletrônico dominou o mercado com a maior participação na receita em 2024, devido ao seu papel crítico na fabricação de semicondutores, especialmente em processos de corrosão e limpeza. A alta pureza deste grau garante contaminação mínima durante a produção de componentes microeletrônicos. À medida que a complexidade e a miniaturização dos chips avançam, a demanda por gás HCL ultrapuro para garantir a consistência do desempenho e o rendimento no processamento de wafers está aumentando.

Escopo do Relatório e Segmentação do Mercado de Gás Cloreto de Hidrogênio Anidro (HCL) de Ultra-Alta Pureza

|

Atributos |

Principais insights de mercado sobre o gás cloreto de hidrogênio anidro (HCL) de ultra-alta pureza |

|

Segmentos abrangidos |

|

|

Países abrangidos |

América do Norte

Europa

Ásia-Pacífico

Oriente Médio e África

Ámérica do Sul

|

|

Principais participantes do mercado |

• Gas Innovations (EUA) |

|

Oportunidades de mercado |

• Aumento da demanda das indústrias de fabricação de semicondutores e eletrônicos • Expansão do uso em síntese farmacêutica avançada e processamento químico |

|

Conjuntos de informações de dados de valor agregado |

Além dos insights sobre cenários de mercado, como valor de mercado, taxa de crescimento, segmentação, cobertura geográfica e principais participantes, os relatórios de mercado selecionados pela Data Bridge Market Research também incluem análise de importação e exportação, visão geral da capacidade de produção, análise de consumo de produção, análise de tendência de preço, cenário de mudança climática, análise da cadeia de suprimentos, análise da cadeia de valor, visão geral de matéria-prima/consumíveis, critérios de seleção de fornecedores, análise PESTLE, análise de Porter e estrutura regulatória. |

Tendências do mercado de gás cloreto de hidrogênio anidro (HCL) de ultra-alta pureza

“Adoção crescente na fabricação de semicondutores”

- O cloreto de hidrogênio de alta pureza é essencial em processos de semicondutores, como limpeza e gravação de wafers, onde o controle da contaminação é crítico para a integridade do chip

- A crescente miniaturização dos chips está impulsionando a demanda por gases ultrapuros para atender às tolerâncias rigorosas da microeletrônica de última geração

- Empresas como a Samsung estão fazendo parcerias com fornecedores regionais de gás para criar soluções de pureza personalizadas para nós semicondutores avançados

- O aumento na construção de fábricas de semicondutores em Taiwan e na Coreia do Sul está impulsionando a aquisição em massa de cloreto de hidrogênio de alta pureza

- Os fabricantes de gás estão ampliando a infraestrutura de purificação para atender às demandas de qualidade e volume de clientes de alta tecnologia no setor eletrônico

Dinâmica do mercado de gás cloreto de hidrogênio anidro (HCL) de ultra-alta pureza

Motorista

“Expansão da Indústria de Semicondutores”

- A rápida expansão da indústria de semicondutores é um importante impulsionador do mercado de gás cloreto de hidrogênio anidro de ultra-alta pureza, com aumento da demanda por microchips de alto desempenho em dispositivos como smartphones, laptops e aparelhos inteligentes

- Este gás é essencial para etapas críticas de fabricação de semicondutores, como gravação e dopagem de wafers de silício, onde a pureza é crucial para evitar defeitos e garantir a confiabilidade do chip.

- The growing adoption of advanced technologies such as 5G, AI, and IoT is pushing chipmakers to produce more complex integrated circuits, increasing the need for ultra-pure gases

- New semiconductor fabrication facilities in countries such as Taiwan, South Korea, and the U.S. have significantly increased demand for ultra-pure hydrogen chloride; for instance, TSMC's expansion in Arizona is fueling demand from regional gas suppliers

- To meet rising demand, gas producers are investing in advanced purification technologies and strict quality assurance systems to support the growing needs of the global semiconductor supply chain

Restraint/Challenge

“Stringent Handling and Storage Requirements”

- Stringent handling and storage requirements present a major challenge in the ultra high-purity anhydrous hydrogen chloride gas market due to the gas’s corrosive and toxic nature

- Specialized infrastructure, including corrosion-resistant storage tanks and pipelines, is necessary to maintain gas purity and ensure worker safety during transport and application

- Even minor contamination can compromise the gas’s suitability for semiconductor manufacturing, leading to production defects or equipment damage

- Smaller manufacturers often lack the financial capacity to invest in the advanced containment systems and compliance protocols needed to meet international safety regulations

- For instance, delays in export shipments due to strict hazardous material checks or lack of compliant logistics partners can interrupt supply chains for chipmakers relying on uninterrupted gas availability

Ultra High-Purity Anhydrous Hydrogen Chloride (HCL) Gas Market Scope

The ultra high-purity anhydrous hydrogen chloride (HCL) gas market is segmented on the basis of product and application.

• By Product

On the basis of product, the ultra high-purity anhydrous hydrogen chloride (HCL) gas market is segmented into electronics grade and chemical grade. The electronics grade segment dominated the market with the largest revenue share in 2024, owing to its critical role in semiconductor fabrication, especially in etching and cleaning processes. The high purity of this grade ensures minimal contamination during the production of microelectronic components. As chip complexity and miniaturization advance, the demand for ultra-pure HCL gas for ensuring performance consistency and yield in wafer processing is rising.

The chemical grade segment is expected to witness a fastest growth rate from 2025 to 2032, driven by its increasing usage in high-precision chemical synthesis and specialty chemical formulations. This grade is particularly useful in applications that demand consistency in reactivity without the risk of metallic or organic impurities, especially in industrial and laboratory-grade chemicals.

• By Application

On the basis of application, the market is segmented into electronics and electricals, pharmaceuticals, chemicals, and others. The electronics and electricals segment held the largest revenue share in 2024, fueled by rapid growth in semiconductor manufacturing and consumer electronics. Ultra high-purity anhydrous HCL gas is widely used in cleaning silicon wafers and as a reactive agent in integrated circuit production, making it indispensable in this sector.

The pharmaceuticals segment is expected to witness a fastest growth rate from 2025 to 2032, driven by increasing adoption in synthesizing active pharmaceutical ingredients (APIs) and fine chemicals. Its purity level makes it ideal for sensitive pharmaceutical formulations, particularly in the production of anti-infective and oncology drugs.

Ultra High-Purity Anhydrous Hydrogen Chloride (HCL) Gas Market Regional Analysis

• North America dominated the ultra high-purity anhydrous hydrogen chloride gas market in 2024, driven by strong demand from the electronics and semiconductor sectors, particularly in the U.S. and Canada

• The region’s well-established chemical industry, high purity standards, and growing investments in electronics manufacturing are key factors contributing to market leadership

• Advanced infrastructure, robust R&D activities, and the presence of major end-use industries further support widespread utilization of high-purity gas in North America

U.S. Ultra High-Purity Anhydrous Hydrogen Chloride Gas Market Insight

The U.S. market captured the largest share in North America in 2024, propelled by increasing use of high-purity gas in electronics manufacturing and pharmaceutical synthesis. The country's strong focus on semiconductor fabrication, coupled with rising demand for precision chemical processing, boosts the adoption of ultra high-purity anhydrous hydrogen chloride gas. The presence of leading manufacturers and favorable industrial policies continue to support the market’s expansion.

Europe Ultra High-Purity Anhydrous Hydrogen Chloride Gas Market Insight

The Europe market is expected to witness a fastest growth rate from 2025 to 2032, supported by rising environmental regulations and growing demand for high-purity chemicals in electronics and pharmaceutical sectors. Countries such as Germany and France are investing in cleaner technologies, and the shift toward sustainable industrial practices is fostering the use of high-purity gas. In addition, the region's commitment to innovation and product quality is encouraging adoption across specialized chemical applications.

U.K. Ultra High-Purity Anhydrous Hydrogen Chloride Gas Market Insight

Espera-se que o mercado do Reino Unido apresente uma taxa de crescimento mais rápida entre 2025 e 2032, impulsionada pelos avanços tecnológicos e por uma forte indústria farmacêutica. O foco do país na produção de APIs (ingredientes farmacêuticos ativos) de alta qualidade e sua participação nas cadeias de valor da eletrônica europeia estão gerando demanda por gás de ultra-alta pureza. Os esforços contínuos para fortalecer a produção nacional também aumentam as perspectivas de crescimento do mercado.

Visão geral do mercado de gás cloreto de hidrogênio anidro de ultra-alta pureza da Alemanha

Espera-se que o mercado alemão apresente a maior taxa de crescimento entre 2025 e 2032, devido ao papel do país como um polo fundamental para a fabricação de precisão e o processamento químico de alta pureza. As indústrias alemãs priorizam padrões rigorosos de pureza e segurança, alinhados às características de desempenho do gás cloreto de hidrogênio anidro de altíssima pureza. O desenvolvimento contínuo da fabricação inteligente e de aplicações eletrônicas impulsiona ainda mais o crescimento desse mercado.

Visão do mercado de gás cloreto de hidrogênio anidro de ultra-alta pureza na Ásia-Pacífico

A região Ásia-Pacífico deverá apresentar a maior taxa de crescimento entre 2025 e 2032, impulsionada pela rápida industrialização, especialmente na China, Japão, Coreia do Sul e Índia. A crescente indústria de semicondutores e o investimento significativo na produção de eletrônicos são os principais impulsionadores. O apoio governamental à produção local e a crescente demanda por processos químicos limpos e eficientes estão incentivando o uso generalizado de gás de ultra-alta pureza em diversas aplicações.

Visão geral do mercado de gás cloreto de hidrogênio anidro de ultra-alta pureza do Japão

Espera-se que o mercado japonês apresente a maior taxa de crescimento entre 2025 e 2032, devido à avançada indústria eletrônica do país e ao alto foco em precisão na fabricação. A demanda por gás de ultra-alta pureza está crescendo na produção de semicondutores, onde a pureza química é crucial. A abordagem inovadora do Japão e sua adesão aos padrões internacionais de qualidade sustentam a expansão contínua do mercado em aplicações técnicas e farmacêuticas.

Visão geral do mercado de gás cloreto de hidrogênio anidro de ultra-alta pureza da China

A China detinha a maior fatia de mercado na Ásia-Pacífico em 2024, impulsionada pelo rápido crescimento dos setores de eletrônicos, químicos e farmacêuticos. O país é um importante polo de produção de semicondutores e vem investindo fortemente na modernização de sua capacidade de fabricação. A disponibilidade de fornecedores locais e a crescente demanda por processamento químico de alta eficiência impulsionam ainda mais o crescimento do mercado em diversos setores.

Participação no mercado de gás cloreto de hidrogênio anidro (HCL) de ultra-alta pureza

A indústria de gás cloreto de hidrogênio anidro (HCL) de ultra-alta pureza é liderada principalmente por empresas bem estabelecidas, incluindo:

• Gas Innovations (EUA)

• Air Liquide (França)

• Matheson Tri-Gas, Inc. (Japão)

• WEITAI CHEM (China)

• Linde plc (Reino Unido)

Últimos desenvolvimentos no mercado global de gás cloreto de hidrogênio anidro (HCL) de ultra-alta pureza

- Em setembro de 2023, o programa de tratamento de cilindros da Air Liquide, apresentado no recente evento Laborama, enfatiza a importância de garantir a estabilidade e a vida útil dos gases de calibração utilizados em equipamentos de medição de emissões. Reconhecendo a reatividade de compostos como o cloreto de hidrogênio (HCL), a Air Liquide emprega diversas técnicas, como aspiração, tratamento térmico, polimento interno, corrosão e revestimento para modificar a superfície interna dos cilindros. Comercializados sob as marcas Aculife e AlphaTech, esses tratamentos são respaldados por dados científicos e oferecem uma vida útil consistente de três anos em todo o mundo.

- Em novembro de 2021, a Linde Índia (subsidiária da Linde) firmou um Contrato de Transferência de Negócios com a HPS Gases Ltd., sediada em Vadodara, com vigência a partir de 1º de novembro de 2021, para a aquisição de todo o seu negócio de gases engarrafados e ativos de distribuição específicos, totalizando uma contraprestação em dinheiro de USD 3,3 milhões. Essa mudança estratégica inclui acordos adicionais, como o Contrato de Compra de Ativos, o Contrato de Não Concorrência e o Contrato de Fornecimento e Compra de Produtos.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Índice

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 MARKET APPLICATION COVERAGE GRID

2.1 DBMR VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTLE ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 LEGAL FACTORS

4.1.6 ENVIRONMENTAL FACTORS

4.2 PORTER'S FIVE FORCES:

4.2.1 THE THREAT OF NEW ENTRANTS:

4.2.2 THE THREAT OF SUBSTITUTES:

4.2.3 CUSTOMER BARGAINING POWER:

4.2.4 SUPPLIER BARGAINING POWER:

4.2.5 INTERNAL COMPETITION (RIVALRY):

4.3 PRICING ANALYSIS

4.4 VENDOR SELECTION CRITERIA

4.5 RAW MATERIAL COVERAGE

4.6 SUPPLY CHAIN ANALYSIS

5 GLOBAL ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET: REGULATION COVERAGE

6 PRODUCTION CAPACITY OVERVIEW

6.1 ESTIMATED PRODUCTION CAPACITY

7 PRODUCTION CONSUMPTION ANALYSIS

8 MARKET OVERVIEW

8.1 DRIVERS

8.1.1 RISING DEMAND IN SEMICONDUCTOR INDUSTRY

8.1.2 THE INCREASING UTILIZATION OF ANHYDROUS HYDROGEN CHLORIDE GAS AS A REAGENT IN SPECIALTY CHEMICALS SYNTHESIS

8.2 RESTRAINTS

8.2.1 SIGNIFICANT HEALTH RISKS ASSOCIATED WITH HANDLING ULTRA-HIGH PURITY ANHYDROUS HYDROGEN CHLORIDE

8.2.2 REGULATORY REQUIREMENTS ASSOCIATED WITH ULTRA-HIGH PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS.

8.3 OPPORTUNITIES

8.3.1 ADOPTION OF ULTRA-HIGH PURITY ANHYDROUS HCL GAS IN SPECIALIZED RESEARCH AND DEVELOPMENT ACTIVITIES

8.3.2 INTEGRATION OF CUTTING-EDGE PURIFICATION TECHNOLOGIES FOR ULTRA-HIGH PURITY HCL GAS PRODUCTION

8.4 CHALLENGES

8.4.1 DIFFICULTY IN HANDLING AND TRANSPORTATION COST OF ULTRA HIGH PURITY ANHYDROUS HYDROGEN CHLORIDE GAS

9 GLOBAL ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) MARKET, BY PRODUCT

9.1 OVERVIEW

9.2 ELECTRONICS GRADE

9.3 CHEMICAL GRADE

10 GLOBAL ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) MARKET, BY APPLICATION

10.1 OVERVIEW

10.2 ELECTRONICS AND ELECTRICALS

10.3 PHARMACEUTICALS

10.4 CHEMICALS

10.5 OTHERS

11 GLOBAL ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY REGION

11.1 OVERVIEW

11.2 ASIA PACIFIC

11.2.1 TAIWAN

11.2.2 CHINA

11.2.3 SOUTH KOREA

11.2.4 JAPAN

11.2.5 SINGAPORE

11.2.6 INDIA

11.2.7 MALAYSIA

11.2.8 THAILAND

11.2.9 INDONESIA

11.2.10 AUSTRALIA

11.2.11 NEW ZEALAND

11.2.12 PHILIPPINES

11.2.13 REST OF ASIA-PACIFIC

11.3 NORTH AMERICA

11.3.1 U.S.

11.3.2 CANADA

11.3.3 MEXICO

11.4 EUROPE

11.4.1 GERMANY

11.4.2 FRANCE

11.4.3 U.K.

11.4.4 NETHERLANDS

11.4.5 SWITZERLAND

11.4.6 ITALY

11.4.7 BELGIUM

11.4.8 SPAIN

11.4.9 PORTUGAL

11.4.10 RUSSIA

11.4.11 TURKEY

11.4.12 DENMARK

11.4.13 NORWAY

11.4.14 FINLAND

11.4.15 SWEDEN

11.4.16 REST OF EUROPE

11.5 MIDDLE EAST AND AFRICA

11.5.1 SAUDI ARABIA

11.5.2 U.A.E.

11.5.3 SOUTH AFRICA

11.5.4 EGYPT

11.5.5 ISRAEL

11.5.6 QATAR

11.5.7 REST OF MIDDLE EAST AND AFRICA

11.6 SOUTH AMERICA

11.6.1 BRAZIL

11.6.2 ARGENTINA

11.6.3 REST OF SOUTH AMERICA

12 GLOBAL ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET: COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: GLOBAL

12.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

12.3 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

12.4 COMPANY SHARE ANALYSIS: EUROPE

12.5 NEW PRODUCTION PLANT

13 SWOT ANALYSIS

14 COMPANY PROFILES

14.1 AIR LIQUIDE

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 COMPANY SHARE ANALYSIS

14.1.4 PRODUCT PORTFOLIO

14.1.5 RECENT DEVELOPMENT

14.2 LINDE PLC

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 COMPANY SHARE ANALYSIS

14.2.4 PRODUCT PORTFOLIO

14.2.5 RECENT DEVELOPMENT

14.3 MATHESON TRI-GAS, INC. ((A SUBSIDIARY OF NIPPON HOLDINGS GROUP)

14.3.1 COMPANY SNAPSHOT

14.3.2 COMPANY SHARE ANALYSIS

14.3.3 PRODUCT PORTFOLIO

14.3.4 RECENT DEVELOPMENTS

14.4 GAS INNOVATIONS

14.4.1 COMPANY SNAPSHOT

14.4.2 PRODUCT PORTFOLIO

14.4.3 RECENT DEVELOPMENTS

14.5 WEITAI CHEM

14.5.1 COMPANY SNAPSHOT

14.5.2 PRODUCT PORTFOLIO

14.5.3 RECENT DEVELOPMENT

15 QUESTIONNAIRE

16 RELATED REPORTS

Lista de Tabela

TABLE 1 REGULATORY FRAMEWORK

TABLE 2 ESTIMATED PRODUCTION OVERVIEW

TABLE 3 GLOBAL ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 4 GLOBAL ELECTRONICS GRADE IN ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 5 GLOBAL CHEMICAL GRADE IN ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 6 GLOBAL ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 7 GLOBAL ELECTRONICS AND ELECTRICALS IN ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 8 GLOBAL PHARMACEUTICALS IN ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 9 GLOBAL CHEMICALS IN ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 10 GLOBAL OTHERS IN ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 11 GLOBAL ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 12 ASIA-PACIFIC ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY COUNTRY, 2022-2031 (USD THOUSAND)

TABLE 13 ASIA-PACIFIC ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY COUNTRY, 2022-2031 (GRAMS)

TABLE 14 ASIA-PACIFIC ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 15 ASIA-PACIFIC ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (GRAMS)

TABLE 16 ASIA-PACIFIC ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 17 TAIWAN ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 18 TAIWAN ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (GRAMS)

TABLE 19 TAIWAN ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 20 CHINA ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 21 CHINA ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (GRAMS)

TABLE 22 CHINA ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 23 SOUTH KOREA ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 24 SOUTH KOREA ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (GRAMS)

TABLE 25 SOUTH KOREA ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 26 JAPAN ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 27 JAPAN ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (GRAMS)

TABLE 28 JAPAN ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 29 SINGAPORE ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 30 SINGAPORE ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (GRAMS)

TABLE 31 SINGAPORE ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 32 INDIA ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 33 INDIA ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (GRAMS)

TABLE 34 INDIA ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 35 MALAYSIA ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 36 MALAYSIA ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (GRAMS)

TABLE 37 MALAYSIA ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 38 THAILAND ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 39 THAILAND ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (GRAMS)

TABLE 40 THAILAND ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 41 INDONESIA ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 42 INDONESIA ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (GRAMS)

TABLE 43 INDONESIA ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 44 AUSTRALIA ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 45 AUSTRALIA ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (GRAMS)

TABLE 46 AUSTRALIA ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 47 NEW ZEALAND ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 48 NEW ZEALAND ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (GRAMS)

TABLE 49 NEW ZEALAND ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 50 PHILIPPINES ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 51 PHILIPPINES ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (GRAMS)

TABLE 52 PHILIPPINES ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 53 REST OF ASIA-PACIFIC ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 54 REST OF ASIA-PACIFIC ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (GRAMS)

TABLE 55 NORTH AMERICA ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY COUNTRY, 2022-2031 (USD THOUSAND)

TABLE 56 NORTH AMERICA ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY COUNTRY, 2022-2031 (GRAMS)

TABLE 57 NORTH AMERICA ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 58 NORTH AMERICA ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (GRAMS)

TABLE 59 NORTH AMERICA ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 60 U.S. ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 61 U.S. ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (GRAMS)

TABLE 62 U.S. ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 63 CANADA ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 64 CANADA ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (GRAMS)

TABLE 65 CANADA ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 66 MEXICO ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 67 MEXICO ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (GRAMS)

TABLE 68 MEXICO ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 69 EUROPE ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY COUNTRY, 2022-2031 (USD THOUSAND)

TABLE 70 EUROPE ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY COUNTRY, 2022-2031 (GRAMS)

TABLE 71 EUROPE ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 72 EUROPE ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (GRAMS)

TABLE 73 EUROPE ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 74 GERMANY ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 75 GERMANY ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (GRAMS)

TABLE 76 GERMANY ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 77 FRANCE ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 78 FRANCE ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (GRAMS)

TABLE 79 FRANCE ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 80 U.K. ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 81 U.K. ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (GRAMS)

TABLE 82 U.K. ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 83 NETHERLANDS ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 84 NETHERLANDS ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (GRAMS)

TABLE 85 NETHERLANDS ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 86 SWITZERLAND ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 87 SWITZERLAND ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (GRAMS)

TABLE 88 SWITZERLAND ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 89 ITALY ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 90 ITALY ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (GRAMS)

TABLE 91 ITALY ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 92 BELGIUM ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 93 BELGIUM ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (GRAMS)

TABLE 94 BELGIUM ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 95 SPAIN ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 96 SPAIN ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (GRAMS)

TABLE 97 SPAIN ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 98 PORTUGAL ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 99 PORTUGAL ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (GRAMS)

TABLE 100 PORTUGAL ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 101 RUSSIA ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 102 RUSSIA ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (GRAMS)

TABLE 103 RUSSIA ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 104 TURKEY ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 105 TURKEY ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (GRAMS)

TABLE 106 TURKEY ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 107 DENMARK ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 108 DENMARK ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (GRAMS)

TABLE 109 DENMARK ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 110 NORWAY ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 111 NORWAY ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (GRAMS)

TABLE 112 NORWAY ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 113 FINLAND ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 114 FINLAND ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (GRAMS)

TABLE 115 FINLAND ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 116 SWEDEN ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 117 SWEDEN ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (GRAMS)

TABLE 118 SWEDEN ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 119 REST OF EUROPE ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 120 REST OF EUROPE ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (GRAMS)

TABLE 121 MIDDLE EAST AND AFRICA ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY COUNTRY, 2022-2031 (USD THOUSAND)

TABLE 122 MIDDLE EAST AND AFRICA ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY COUNTRY, 2022-2031 (GRAMS)

TABLE 123 MIDDLE EAST AND AFRICA ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 124 MIDDLE EAST AND AFRICA ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (GRAMS)

TABLE 125 MIDDLE EAST AND AFRICA ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 126 SAUDI ARABIA ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 127 SAUDI ARABIA ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (GRAMS)

TABLE 128 SAUDI ARABIA ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 129 U.A.E. ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 130 U.A.E. ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (GRAMS)

TABLE 131 U.A.E. ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 132 SOUTH AFRICA ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 133 SOUTH AFRICA ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (GRAMS)

TABLE 134 SOUTH AFRICA ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 135 EGYPT ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 136 EGYPT ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (GRAMS)

TABLE 137 EGYPT ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 138 ISRAEL ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 139 ISRAEL ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (GRAMS)

TABLE 140 ISRAEL ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 141 QATAR ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 142 QATAR ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (GRAMS)

TABLE 143 QATAR ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 144 REST OF MIDDLE EAST AND AFRICA ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 145 REST OF MIDDLE EAST AND AFRICA ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (GRAMS)

TABLE 146 SOUTH AMERICA ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY COUNTRY, 2022-2031 (USD THOUSAND)

TABLE 147 SOUTH AMERICA ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY COUNTRY, 2022-2031 (GRAMS)

TABLE 148 SOUTH AMERICA ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 149 SOUTH AMERICA ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (GRAMS)

TABLE 150 SOUTH AMERICA ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 151 BRAZIL ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 152 BRAZIL ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (GRAMS)

TABLE 153 BRAZIL ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 154 ARGENTINA ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 155 ARGENTINA ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (GRAMS)

TABLE 156 ARGENTINA ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 157 REST OF SOUTH AMERICA ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 158 REST OF SOUTH AMERICA ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET, BY PRODUCT, 2022-2031 (GRAMS)

Lista de Figura

FIGURE 1 GLOBAL ULTRA-HIGH-PURITY ANHYDROUS HYDROCHLORIDE (HCL) GAS MARKET

FIGURE 2 GLOBAL ULTRA-HIGH-PURITY ANHYDROUS HYDROCHLORIDE (HCL) GAS MARKET: DATA TRIANGULATION

FIGURE 3 GLOBAL ULTRA-HIGH-PURITY ANHYDROUS HYDROCHLORIDE (HCL) GAS MARKET: DROC ANALYSIS

FIGURE 4 GLOBAL ULTRA-HIGH-PURITY ANHYDROUS HYDROCHLORIDE (HCL) GAS MARKET: GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 5 GLOBAL ULTRA-HIGH-PURITY ANHYDROUS HYDROCHLORIDE (HCL) GAS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 GLOBAL ULTRA-HIGH-PURITY ANHYDROUS HYDROCHLORIDE (HCL) GAS MARKET: MULTIVARIATE MODELLING

FIGURE 7 GLOBAL ULTRA-HIGH-PURITY ANHYDROUS HYDROCHLORIDE (HCL) GAS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 GLOBAL ULTRA-HIGH-PURITY ANHYDROUS HYDROCHLORIDE (HCL) GAS MARKET: DBMR MARKET POSITION GRID

FIGURE 9 GLOBAL ULTRA-HIGH-PURITY ANHYDROUS HYDROCHLORIDE (HCL) GAS MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 10 GLOBAL ULTRA-HIGH-PURITY ANHYDROUS HYDROCHLORIDE (HCL) GAS MARKET: VENDOR SHARE ANALYSIS

FIGURE 11 GLOBAL ULTRA-HIGH-PURITY ANHYDROUS HYDROCHLORIDE (HCL) GAS MARKET: SEGMENTATION

FIGURE 12 ASIA-PACIFIC IS EXPECTED TO DOMINATE THE GLOBAL ULTRA-HIGH-PURITY ANHYDROUS HYDROCHLORIDE (HCL) GAS MARKET, AND IS EXPECTED TO GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD

FIGURE 13 RISING DEMAND IN SEMICONDUCTOR INDUSTRY IS DRIVING THE GROWTH OF THE GLOBAL ULTRA-HIGH-PURITY ANHYDROUS HYDROCHLORIDE (HCL) GAS MARKET IN THE FORECAST PERIOD 2024 TO 2031

FIGURE 14 ELECTRONICS GRADE IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE GLOBAL ULTRA-HIGH-PURITY ANHYDROUS HYDROCHLORIDE (HCL) GAS MARKET IN 2024 AND 2031

FIGURE 15 ASIA-PACIFIC IS THE FASTEST-GROWING MARKET FOR ULTRA-HIGH-PURITY ANHYDROUS HYDROCHLORIDE (HCL) GAS IN THE FORECAST PERIOD

FIGURE 16 PRICING ANALYSIS FOR GLOBAL ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET (USD/KG)

FIGURE 17 VENDOR SELECTION CRITERIA

FIGURE 18 ESTIMATED PRODUCTION CONSUMPTION ANALYSIS

FIGURE 19 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF THE MARKET

FIGURE 20 GLOBAL ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) MARKET: BY PRODUCT, 2023

FIGURE 21 GLOBAL ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) MARKET: BY APPLICATION, 2023

FIGURE 22 GLOBAL ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET: SNAPSHOT (2023)

FIGURE 23 ASIA-PACIFIC ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET: SNAPSHOT (2023)

FIGURE 24 NORTH AMERICA ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET (2023)

FIGURE 25 EUROPE ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET (2023)

FIGURE 26 MIDDLE EAST AND AFRICA ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET: SNAPSHOT (2023)

FIGURE 27 SOUTH AMERICA ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET (2023)

FIGURE 28 GLOBAL ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET COMPANY SHARE 2023 (%)

FIGURE 29 NORTH AMERICA ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET: COMPANY SHARE 2023 (%)

FIGURE 30 ASIA-PACIFIC ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET: COMPANY SHARE 2023 (%)

FIGURE 31 EUROPE ULTRA-HIGH-PURITY ANHYDROUS HYDROGEN CHLORIDE (HCL) GAS MARKET: COMPANY SHARE 2023 (%)

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.