Global Superalloys Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

8.00 Billion

USD

13.75 Billion

2024

2032

USD

8.00 Billion

USD

13.75 Billion

2024

2032

| 2025 –2032 | |

| USD 8.00 Billion | |

| USD 13.75 Billion | |

|

|

|

|

Segmentação do mercado global de superligas, por tipo de produto (superligas à base de níquel, superligas à base de cobalto e superligas à base de ferro) e aplicação (aeroespacial e defesa, turbinas a gás industriais, automotivo, petróleo e gás, energia, indústria marítima, indústria de processamento químico, reatores nucleares, elétrica e eletrônica e outros) – Tendências da indústria e previsão até 2032.

Tamanho do mercado de superligas

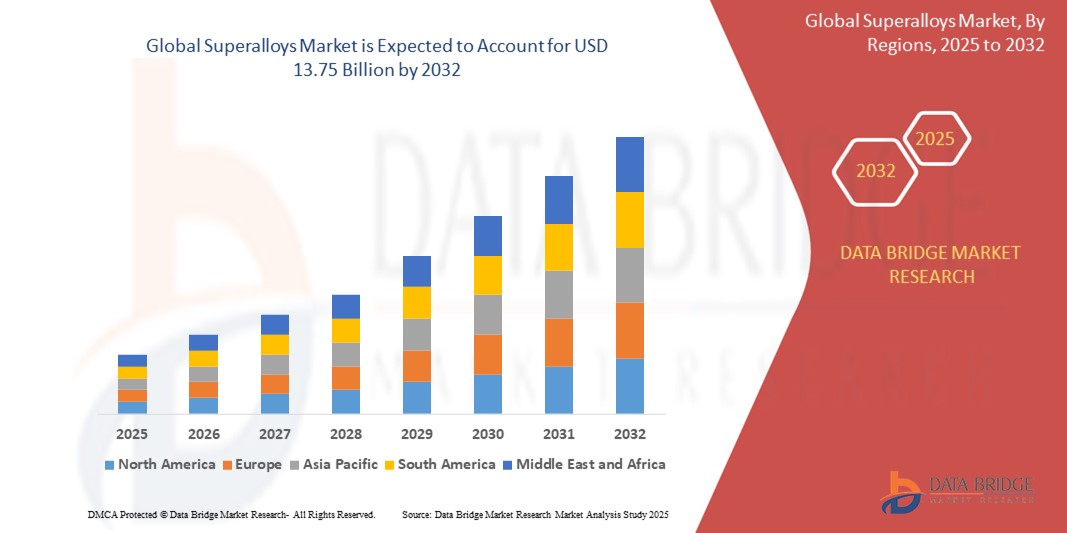

- O tamanho do mercado global de superligas foi avaliado em US$ 8,00 bilhões em 2024 e deve atingir US$ 13,75 bilhões até 2032 , com um CAGR de 7,00% durante o período previsto.

- O crescimento do mercado é impulsionado principalmente pela crescente demanda por materiais de alto desempenho em ambientes corrosivos e de alta temperatura, particularmente nos setores aeroespacial, de defesa e de energia, impulsionado por avanços nas tecnologias de fabricação e crescentes aplicações industriais.

- Os crescentes investimentos em infraestrutura aeroespacial e energética, juntamente com a necessidade de materiais leves, duráveis e resistentes ao calor, são fatores-chave que aceleram a adoção de superligas, impulsionando significativamente o crescimento da indústria.

Análise de Mercado de Superligas

- Superligas, ligas de alto desempenho projetadas para suportar temperaturas extremas, corrosão e estresse mecânico, são componentes essenciais em indústrias como aeroespacial, energética e automotiva devido à sua resistência superior, resistência à oxidação e durabilidade.

- A crescente demanda por superligas é impulsionada pela expansão do setor aeroespacial e de defesa, pelo aumento da demanda de energia e pela necessidade de materiais eficientes e de alto desempenho em turbinas a gás industriais e aplicações automotivas.

- A América do Norte dominou o mercado de superligas com a maior participação na receita de 42,5% em 2024, impulsionada por uma forte indústria aeroespacial e de defesa, capacidades avançadas de fabricação e investimentos significativos em P&D

- Espera-se que a Ásia-Pacífico seja a região de crescimento mais rápido durante o período previsto devido à rápida industrialização, ao aumento da demanda por energia e ao crescimento da indústria aeroespacial em países como China e Índia.

- O segmento de superligas à base de níquel dominou o mercado com uma participação de receita de 66,88% em 2024, impulsionado por sua resistência superior a altas temperaturas, resistência à corrosão e propriedades mecânicas, tornando-as ideais para aplicações exigentes, como motores aeroespaciais e turbinas a gás industriais.

Escopo do Relatório e Segmentação do Mercado de Superligas

|

Atributos |

Principais insights do mercado de superligas |

|

Segmentos abrangidos |

|

|

Países abrangidos |

América do Norte

Europa

Ásia-Pacífico

Oriente Médio e África

Ámérica do Sul

|

|

Principais participantes do mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor agregado |

Além dos insights sobre cenários de mercado, como valor de mercado, taxa de crescimento, segmentação, cobertura geográfica e principais participantes, os relatórios de mercado selecionados pela Data Bridge Market Research também incluem análise de importação e exportação, visão geral da capacidade de produção, análise de consumo de produção, análise de tendência de preço, cenário de mudança climática, análise da cadeia de suprimentos, análise da cadeia de valor, visão geral de matéria-prima/consumíveis, critérios de seleção de fornecedores, análise PESTLE, análise de Porter e estrutura regulatória. |

Tendências do mercado de superligas

“Aumento da integração da manufatura aditiva e técnicas avançadas de processamento”

- O mercado global de superligas está vivenciando uma tendência significativa em direção à integração da manufatura aditiva (impressão 3D) e técnicas avançadas de processamento para aumentar a eficiência da produção e o desempenho do material

- Essas tecnologias permitem a criação de componentes complexos de superligas com menor desperdício de material, menores custos de produção e prazos de entrega mais curtos em comparação aos métodos de fabricação tradicionais.

- Por exemplo, inovações como o desenvolvimento da superliga ABD-900AM à base de níquel para impressão 3D sem fissuras estão permitindo a produção direta de peças complexas para turbinas a gás aeroespaciais e industriais.

- A manufatura aditiva permite um controle preciso sobre a microestrutura da liga, melhorando propriedades mecânicas, como resistência a altas temperaturas e resistência à corrosão.

- Esta tendência está aumentando o apelo das superligas para os fabricantes dos setores aeroespacial, automotivo e de geração de energia, pois apoia a produção de componentes leves e de alto desempenho.

- Técnicas avançadas de processamento, como a fusão por indução a vácuo e a metalurgia do pó, estão otimizando ainda mais a durabilidade e o desempenho das superligas, expandindo suas aplicações em vários setores.

Dinâmica do mercado de superligas

Motorista

“Crescente demanda por materiais de alto desempenho nos setores aeroespacial e energético”

- A crescente demanda por materiais de alto desempenho capazes de suportar temperaturas extremas, estresse mecânico e ambientes corrosivos é um grande impulsionador do mercado global de superligas

- As superligas, especialmente as à base de níquel, são essenciais em aplicações aeroespaciais para componentes como lâminas de turbinas, motores a jato e câmaras de combustão, motivadas pela necessidade de aeronaves duráveis e com baixo consumo de combustível.

- Os investimentos governamentais na modernização da defesa e na expansão da aviação comercial, especialmente na América do Norte, estão impulsionando a adoção de superligas

- A proliferação de energia renovável e a geração de energia a partir do gás natural está impulsionando a demanda por superligas em turbinas a gás industriais e reatores nucleares, onde a resistência a altas temperaturas e a integridade estrutural são essenciais

- As montadoras estão utilizando cada vez mais superligas em veículos elétricos e de alto desempenho para aumentar a eficiência e a durabilidade do motor, impulsionando ainda mais o crescimento do mercado

- O desenvolvimento da tecnologia 5G e da IoT está permitindo o monitoramento e a otimização em tempo real de componentes baseados em superligas, aumentando seu valor em aplicações industriais inteligentes

Restrição/Desafio

“Altos custos de produção e volatilidade da cadeia de suprimentos”

- O alto custo das matérias-primas, como níquel, cobalto e titânio, combinado com processos de fabricação complexos, como a refusão a arco a vácuo e a fundição de investimento, representa uma barreira significativa à adoção generalizada de superligas, especialmente em mercados sensíveis a custos.

- A integração de superligas em projetos existentes ou sua adaptação a sistemas mais antigos pode ser tecnicamente desafiadora e cara, limitando seu uso em certas aplicações.

- Interrupções na cadeia de suprimentos, motivadas por tensões geopolíticas e flutuações na disponibilidade de matéria-prima, criam incerteza no mercado de superligas, impactando os cronogramas e custos de produção.

- As preocupações ambientais e as pressões regulatórias relacionadas à mineração e ao processamento de matérias-primas, como o cobalto, estão pressionando os fabricantes a adotar práticas sustentáveis, o que pode aumentar ainda mais os custos de produção.

- Esses fatores podem impedir a adoção em mercados emergentes ou indústrias com orçamentos mais baixos, potencialmente retardando a expansão do mercado em regiões fora da América do Norte e Ásia-Pacífico.

Escopo do mercado de superligas

O mercado é segmentado com base no tipo de produto e aplicação.

- Por tipo de produto

Com base no tipo de produto, o mercado global de superligas é segmentado em superligas à base de níquel, superligas à base de cobalto e superligas à base de ferro. O segmento de superligas à base de níquel dominou o mercado, com uma participação de receita de 66,88% em 2024, impulsionado por sua superior resistência a altas temperaturas, resistência à corrosão e propriedades mecânicas, tornando-as ideais para aplicações exigentes, como motores aeroespaciais e turbinas a gás industriais. Seu amplo uso em pás de turbinas, câmaras de combustão e outros componentes críticos consolida ainda mais seu domínio de mercado.

Espera-se que o segmento de superligas à base de cobalto testemunhe a taxa de crescimento mais rápida de 8,9% entre 2025 e 2032. Esse crescimento é impulsionado por sua excelente resistência à sulfetação e alta resistência, particularmente em aplicações de nicho nos setores aeroespacial, turbinas a gás e usinas de energia, onde a confiabilidade e a longevidade do material são essenciais.

- Por aplicação

Com base na aplicação, o mercado global de superligas é segmentado em aeroespacial e defesa, turbinas a gás industriais, automotivo, petróleo e gás, energia, indústria naval, indústria de processamento químico, reatores nucleares, elétrica e eletrônica, entre outros. O segmento aeroespacial e de defesa deteve a maior participação de mercado na receita, com 38,99% em 2024, impulsionado pela crescente demanda por materiais duráveis e de alto desempenho em motores de aeronaves, pás de turbinas e componentes estruturais. A busca por aeronaves leves e com baixo consumo de combustível, aliada ao aumento dos orçamentos de defesa em todo o mundo, sustenta o domínio desse segmento.

Espera-se que o segmento de turbinas a gás industriais experimente a taxa de crescimento mais rápida, de 9,2%, de 2025 a 2032. Esse crescimento é impulsionado pela crescente demanda por sistemas de geração de energia com eficiência energética e pela expansão da infraestrutura de energia renovável, como usinas eólicas e de energia solar concentrada, que dependem de superligas para componentes como lâminas de turbina e trocadores de calor que suportam estresse térmico extremo.

Análise regional do mercado de superligas

- A América do Norte dominou o mercado de superligas com a maior participação na receita de 42,5% em 2024, impulsionada por uma forte indústria aeroespacial e de defesa, capacidades avançadas de fabricação e investimentos significativos em P&D

- Os consumidores e as indústrias priorizam as superligas por sua excepcional resistência ao calor, resistência mecânica e resistência à corrosão, especialmente em aplicações que exigem durabilidade sob altas temperaturas.

- O crescimento é apoiado por avanços na tecnologia de ligas, incluindo manufatura aditiva e composições leves, juntamente com a crescente adoção nos segmentos OEM e de reposição nas indústrias aeroespacial, energética e automotiva.

Visão do mercado de superligas dos EUA

O mercado de superligas dos EUA capturou a maior fatia da receita, de 81,7%, em 2024, na América do Norte, impulsionado pela forte demanda dos setores aeroespacial e de defesa e pela crescente conscientização sobre os benefícios das superligas em aplicações de alta temperatura. A tendência por aeronaves leves e com baixo consumo de combustível e o aumento das regulamentações que promovem padrões avançados de materiais impulsionam ainda mais a expansão do mercado. A crescente incorporação de superligas em componentes críticos por montadoras e fabricantes aeroespaciais complementa as vendas de peças de reposição, criando um ecossistema de produtos diversificado.

Visão do mercado de superligas na Europa

Espera-se que o mercado europeu de superligas testemunhe um crescimento significativo, impulsionado pela ênfase regulatória em eficiência energética e segurança em aplicações aeroespaciais e automotivas. Consumidores e indústrias buscam superligas que aprimorem o desempenho em condições extremas, além de oferecer durabilidade. O crescimento é evidente tanto em novas instalações quanto em projetos de retrofit, com países como Alemanha e França demonstrando uma adesão significativa devido às crescentes preocupações ambientais e aos avanços industriais.

Visão geral do mercado de superligas do Reino Unido

Espera-se que o mercado britânico de superligas testemunhe um rápido crescimento, impulsionado pela demanda por materiais de alto desempenho em turbinas a gás aeroespaciais e industriais em ambientes urbanos e industriais. O crescente interesse por componentes leves e duráveis e a crescente conscientização sobre os benefícios da resistência à corrosão incentivam a adoção. A evolução das regulamentações sobre emissões e padrões de materiais influencia as escolhas da indústria, equilibrando desempenho e conformidade.

Visão do mercado de superligas da Alemanha

Espera-se que a Alemanha testemunhe um rápido crescimento no mercado de superligas, devido ao seu avançado setor de fabricação aeroespacial e automotiva e ao alto foco da indústria em eficiência energética e durabilidade. As indústrias alemãs preferem superligas tecnologicamente avançadas que resistem a altas temperaturas e contribuem para um menor consumo de combustível. A integração dessas ligas em veículos premium, aeronaves e opções de reposição sustenta o crescimento sustentado do mercado.

Visão do mercado de superligas da Ásia-Pacífico

Espera-se que a região Ásia-Pacífico testemunhe a maior taxa de crescimento, impulsionada pela expansão da produção aeroespacial e automotiva e pelo aumento dos investimentos em infraestrutura energética em países como China, Índia e Japão. A crescente conscientização sobre a resistência ao calor, a proteção contra corrosão e a resistência mecânica das superligas impulsiona a demanda. Iniciativas governamentais que promovem a eficiência energética e a segurança industrial incentivam ainda mais o uso de superligas avançadas.

Visão do mercado de superligas do Japão

Espera-se que o mercado de superligas do Japão testemunhe um rápido crescimento devido à forte preferência da indústria por superligas de alta qualidade e tecnologicamente avançadas que aprimoram o desempenho e a segurança nos setores aeroespacial e de geração de energia. A presença de grandes fabricantes aeroespaciais e automotivos e a integração de superligas em componentes OEM aceleram a penetração no mercado. O crescente interesse em aplicações de reposição também contribui para o crescimento.

Visão do mercado de superligas da China

A China detém a maior fatia do mercado de superligas da Ásia-Pacífico, impulsionada pela rápida industrialização, pelo aumento da produção aeroespacial e automotiva e pela crescente demanda por materiais de alto desempenho. A crescente base industrial do país e o foco em manufatura avançada apoiam a adoção de superligas. A forte capacidade de fabricação nacional e os preços competitivos aumentam a acessibilidade ao mercado.

Participação de mercado de superligas

A indústria de superligas é liderada principalmente por empresas bem estabelecidas, incluindo:

- Special Melted Products Ltd. (Reino Unido)

- Proterial, Ltd. (Japão)

- Precision Castparts Corp. (EUA)

- BAOTI Group Co., Ltd (China)

- Sandvik Coromant US (EUA)

- Rolled Alloys Inc. (EUA)

- VDM Metals (Alemanha)

- Doncasters Group (Reino Unido)

- Fushun Special Steel Co., Ltd. (China)

- Alcoa Corporation (EUA)

- Outokumpu (Finlândia)

- ATI (EUA)

- CRS Holdings, LLC. (EUA)

- HAYNES INTERNATIONAL (EUA)

- AMG ALUMÍNIO (EUA)

- IBC Advanced Alloys (EUA)

- Eramet (França)

- Mishra Dhatu Nigam Limited (Índia)

- Aperam (Luxemburgo)

Quais são os desenvolvimentos recentes no mercado global de superligas?

- Em novembro de 2024, a Acerinox finalizou a aquisição da Haynes International, líder americana em ligas de alto desempenho. Este movimento estratégico fortalece a presença da Acerinox no mercado americano e amplia significativamente suas capacidades no setor aeroespacial. A integração da Haynes – juntamente com a VDM Metals – forma a nova Divisão de Ligas de Alto Desempenho (HPA) da Acerinox, alinhando-se ao objetivo da empresa de expandir seu portfólio de produtos e alcance global. A Acerinox planeja, ao longo de quatro anos, principalmente nas operações da Haynes em Kokomo, construir uma plataforma unificada de aço inoxidável e ligas. Esta aquisição reflete uma tendência mais ampla do setor em direção à consolidação e especialização em materiais avançados.

- Em novembro de 2024, a EOS expandiu seu portfólio de materiais para manufatura aditiva com os pós EOS IN738 e EOS K500 à base de níquel. Esses dois pós de superliga à base de níquel foram adicionados às suas máquinas de manufatura aditiva por fusão a laser em leito de pó (PBF-LB), com disponibilidade comercial para as máquinas EOS M 290 a partir de dezembro de 2024 e para a EOS M 400-4 no primeiro semestre de 2025. O lançamento deste produto destaca a crescente integração de superligas com tecnologias de manufatura aditiva.

- Em junho de 2024, a Aubert & Duval e a Alloyed Ltd. lançaram a superliga de níquel de alta temperatura ABD-1000AM. Esta nova superliga à base de níquel foi projetada especificamente para manufatura aditiva (MA) de metais e apresenta excepcional resistência ambiental e resistência a altas temperaturas, tornando-a ideal para as condições extremas predominantes nesta técnica de fabricação avançada. Este lançamento de produto representa um avanço fundamental em superligas de níquel de alta temperatura, especialmente desenvolvidas para MA.

- Em setembro de 2023, a ATI (Allegheny Technologies Incorporated) recebeu um contrato da Bechtel Plant Machinery Inc. (BPMI) para apoiar o desenvolvimento de soluções de peças de alta engenharia para o Programa de Propulsão Nuclear Naval dos EUA. Como parte dessa iniciativa, a ATI anunciou planos para construir uma unidade dedicada à manufatura aditiva perto de Fort Lauderdale, Flórida, equipada com impressão 3D de metais de grande formato, tratamento térmico, usinagem e recursos de inspeção. Essa unidade foi projetada para acelerar a construção de navios, melhorar a prontidão operacional e aprimorar o desempenho para aplicações críticas de defesa — destacando um grande investimento em tecnologias avançadas de manufatura para os setores de segurança nacional e aeroespacial.

- Em julho de 2023, a Doncasters e a Safran Aircraft Engines renovaram e expandiram sua parceria de longa data para oferecer suporte às plataformas de motores LEAP-1A e LEAP-1B. O acordo se concentra no fornecimento de peças fundidas estruturais de superligas de grande porte e peças fundidas para fluxo de ar de seção quente, essenciais para aplicações aeroespaciais de alto desempenho. Essa colaboração reflete o aprofundamento do relacionamento entre as duas empresas e alavanca os investimentos de capital contínuos da Doncasters para aumentar a capacidade de produção. Também destaca uma tendência mais ampla do setor de alianças estratégicas com o objetivo de garantir o fornecimento confiável de componentes para os principais programas aeroespaciais.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.