Global Small Molecule Sterile Injectable Drug Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

168.06 Billion

USD

293.10 Billion

2024

2032

USD

168.06 Billion

USD

293.10 Billion

2024

2032

| 2025 –2032 | |

| USD 168.06 Billion | |

| USD 293.10 Billion | |

|

|

|

|

Segmentação do mercado global de medicamentos injetáveis estéreis de pequenas moléculas, por produto (enchimento de frascos, enchimento de seringas, enchimento de cartuchos, antibióticos de pequenas moléculas , agentes quimioterápicos, anestésicos locais e gerais, relaxantes musculares esqueléticos, analgésicos, anticoagulantes, anticonvulsivantes, antivirais, anti-histamínicos/antialérgicos e outros), via de administração (intravenosa (IV), intramuscular (IM) e subcutânea (SC)), aplicação (oncologia, doenças infecciosas, doenças cardiovasculares, doenças metabólicas, neurologia, dermatologia, urologia, doenças autoimunes, distúrbios respiratórios, doenças infecciosas, doenças do SNC, distúrbios sanguíneos, distúrbios musculoesqueléticos e outros), usuários finais (hospitais, clínicas especializadas, ambientes de atendimento domiciliar e outros), canais de distribuição (licitação direta, farmácia de varejo, farmácia online e outros) - setor Tendências e previsões para 2032

Qual é o tamanho e a taxa de crescimento do mercado global de medicamentos injetáveis estéreis de pequenas moléculas?

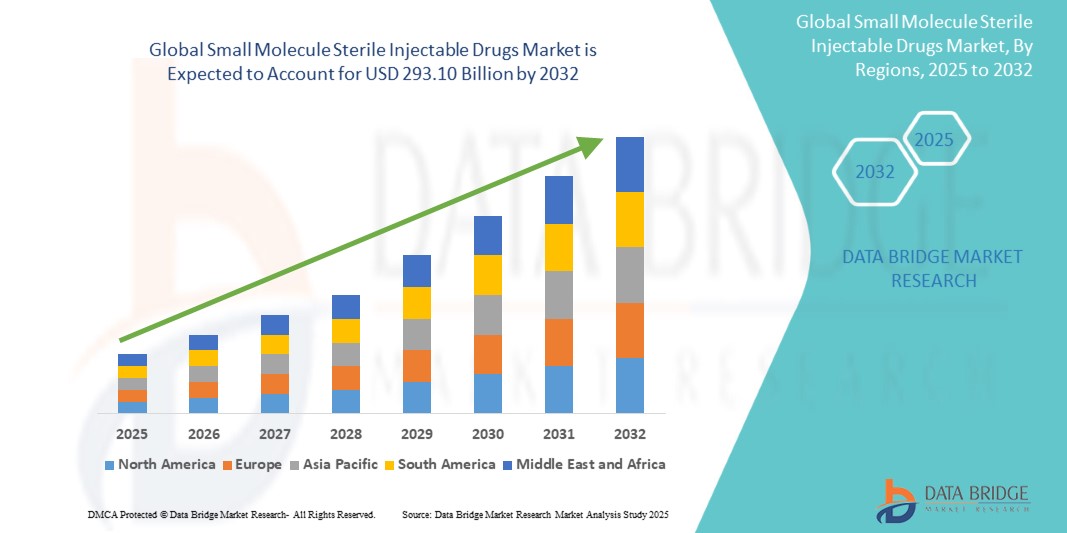

- O tamanho do mercado global de medicamentos injetáveis estéreis de pequenas moléculas foi avaliado em US$ 168,06 bilhões em 2024 e deve atingir US$ 293,10 bilhões até 2032 , com um CAGR de 7,20% durante o período previsto.

- Medicamentos injetáveis estéreis de pequenas moléculas são vitais para a administração de medicamentos diretamente na corrente sanguínea, garantindo efeitos terapêuticos rápidos e precisos. Amplamente utilizados em hospitais e clínicas, esses medicamentos tratam diversas condições, como infecções, controle da dor e cuidados intensivos, oferecendo intervenções que salvam vidas em ambientes de emergência e clínicos.

Quais são os principais resultados do mercado de medicamentos injetáveis estéreis de pequenas moléculas?

- O aumento da carga de doenças crônicas, incluindo diabetes, doenças cardiovasculares e câncer, destaca a necessidade de tratamentos eficazes. Medicamentos injetáveis estéreis de pequenas moléculas estão em alta demanda, pois oferecem terapia direcionada, impulsionando sua utilização no tratamento dessas condições e abordando os crescentes desafios de saúde associados a doenças crônicas.

- As inovações tecnológicas em biotecnologia impulsionam o desenvolvimento de novos injetáveis de pequenas moléculas, aumentando a eficácia, a segurança e a administração direcionada. Esses avanços expandem as opções de tratamento, impulsionando o crescimento do mercado ao atender a diversas necessidades terapêuticas com soluções farmacêuticas mais eficazes e precisas.

- A América do Norte dominou o mercado de medicamentos injetáveis estéreis de pequenas moléculas com a maior participação na receita de 36,25% em 2024, impulsionada pela crescente prevalência de doenças crônicas, aumento da demanda por tratamentos oncológicos e forte presença dos principais fabricantes farmacêuticos.

- O mercado de medicamentos injetáveis estéreis de pequenas moléculas da Ásia-Pacífico está prestes a crescer na taxa composta de crescimento anual (CAGR) mais rápida de 14,32% durante o período previsto de 2025 a 2032, impulsionado pela expansão do acesso à saúde, pelo aumento dos investimentos governamentais em infraestrutura de saúde e pela crescente prevalência de doenças crônicas na China, Japão e Índia.

- O segmento de enchimento de frascos dominou o mercado de medicamentos injetáveis estéreis de pequenas moléculas com a maior participação de receita de mercado de 38,4% em 2024, impulsionado por sua versatilidade, capacidade de armazenamento de alto volume e adequação para uso hospitalar e clínico.

Escopo do Relatório e Segmentação do Mercado de Medicamentos Injetáveis Estéreis de Pequenas Moléculas

|

Atributos |

Principais insights de mercado sobre medicamentos injetáveis estéreis de pequenas moléculas |

|

Segmentos abrangidos |

|

|

Países abrangidos |

América do Norte

Europa

Ásia-Pacífico

Oriente Médio e África

Ámérica do Sul

|

|

Principais participantes do mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor agregado |

Além dos insights sobre cenários de mercado, como valor de mercado, taxa de crescimento, segmentação, cobertura geográfica e principais participantes, os relatórios de mercado selecionados pela Data Bridge Market Research também incluem análises aprofundadas de especialistas, análises de preços, análises de participação de marca, pesquisas com consumidores, análises demográficas, análises da cadeia de suprimentos, análises da cadeia de valor, visão geral de matérias-primas/consumíveis, critérios de seleção de fornecedores, análise PESTLE, análise de Porter e estrutura regulatória. |

Qual é a principal tendência no mercado de medicamentos injetáveis estéreis de pequenas moléculas?

“ Aumento na demanda por terapias direcionadas e de ação rápida ”

- Uma tendência significativa e crescente no mercado global de medicamentos injetáveis estéreis de pequenas moléculas é a crescente demanda por terapias direcionadas e de ação rápida para tratar doenças crônicas, câncer e doenças infecciosas. A via injetável oferece início de ação mais rápido e maior biodisponibilidade, tornando esses medicamentos essenciais para ambientes de tratamento agudo e condições com risco de vida.

- Por exemplo, tratamentos oncológicos, como inibidores de ponto de controle imunológico e agentes quimioterápicos em formas injetáveis, são cada vez mais preferidos devido à sua eficiência em administrar doses precisas diretamente na corrente sanguínea. Da mesma forma, anti-infecciosos injetáveis, como antibióticos para sepse ou infecções respiratórias, são amplamente utilizados em hospitais devido à sua natureza de ação rápida.

- O desenvolvimento de seringas pré-preenchidas, autoinjetores e formulações prontas para administração está aumentando a conveniência, reduzindo erros de dosagem e melhorando a adesão do paciente, especialmente em ambientes de assistência domiciliar. Essas inovações permitem a autoadministração, mantendo a esterilidade e a precisão da dosagem.

- As empresas farmacêuticas estão se concentrando na formulação de produtos biológicos complexos e terapias combinadas, como injetáveis estéreis, para atender a necessidades médicas não atendidas. A integração de tecnologias avançadas de fabricação garante a estabilidade do produto e reduz os riscos de contaminação.

- Essa tendência está remodelando fundamentalmente o atendimento ao paciente, promovendo tempos de recuperação mais rápidos, melhorando o acesso ao tratamento e reduzindo as taxas de hospitalização. Consequentemente, empresas líderes como Pfizer, Sanofi e Amgen estão investindo fortemente na expansão de seus portfólios de injetáveis estéreis para atender à crescente demanda global.

- Espera-se que o uso crescente de medicamentos injetáveis estéreis de pequenas moléculas em tratamentos oncológicos, cardiovasculares, autoimunes e de doenças infecciosas acelere o crescimento do mercado, à medida que os sistemas de saúde em todo o mundo priorizam soluções terapêuticas eficientes, confiáveis e amigáveis ao paciente.

Quais são os principais impulsionadores do mercado de medicamentos injetáveis estéreis de pequenas moléculas?

- A crescente incidência de doenças crônicas e fatais, combinada com os avanços nas tecnologias de administração de medicamentos, é o principal impulsionador da demanda por medicamentos injetáveis estéreis de pequenas moléculas.

- Por exemplo, em fevereiro de 2024, a Gilead Sciences anunciou novos dados clínicos que apoiam a eficácia dos seus tratamentos antivirais injetáveis para doenças infeciosas resistentes, reforçando o papel crítico dos injetáveis estéreis nos cuidados de saúde modernos.

- A necessidade de ação terapêutica rápida em cenários de emergência e cuidados intensivos, como UTIs, centros de oncologia e ambientes cirúrgicos, aumenta significativamente a demanda por formulações de medicamentos injetáveis. Sua alta biodisponibilidade e absorção sistêmica imediata os tornam indispensáveis para tratamentos com prazos curtos.

- Além disso, a crescente população idosa, o aumento das despesas com saúde e a preferência por cuidados domiciliares e autoadministração estão impulsionando o desenvolvimento de seringas pré-cheias e canetas injetoras fáceis de usar para o tratamento de doenças crônicas, incluindo diabetes e artrite reumatoide.

- Além disso, os rigorosos padrões regulatórios que promovem a esterilidade, a segurança e a eficácia dos medicamentos estão pressionando os fabricantes farmacêuticos a aumentar as capacidades de produção e a investir em linhas injetáveis estéreis, o que deverá apoiar ainda mais a expansão do mercado.

Qual fator está desafiando o crescimento do mercado de medicamentos injetáveis estéreis de pequenas moléculas?

- Os processos de fabricação complexos e dispendiosos necessários para medicamentos injetáveis estéreis de pequenas moléculas representam um desafio significativo para uma penetração mais ampla no mercado. Os rigorosos requisitos de esterilidade, a conformidade regulatória e as demandas de infraestrutura das instalações aumentam os custos de produção.

- Por exemplo, recalls regulatórios e interrupções na cadeia de suprimentos devido a riscos de contaminação impactaram a disponibilidade de medicamentos injetáveis, deixando os profissionais de saúde e os pacientes cautelosos em relação a certas categorias de produtos.

- Os elevados custos de produção traduzem-se em preços elevados, o que pode restringir o acesso a estes medicamentos, especialmente em países de baixo e médio rendimento, onde os orçamentos para a saúde e a acessibilidade dos pacientes continuam limitados.

- Além disso, a dependência de uma logística especializada em cadeia fria para injetáveis sensíveis à temperatura acrescenta complexidade à distribuição, levando frequentemente a gargalos ou desperdícios no fornecimento, especialmente em regiões remotas.

- Embora as empresas se esforcem para superar esses desafios por meio de investimentos em tecnologias avançadas de fabricação e automação de processos, a necessidade de despesas de capital substanciais e de mão de obra qualificada continua sendo um obstáculo para os novos participantes do mercado.

- Abordar essas barreiras por meio da melhoria da escalabilidade da produção, do reforço da conformidade regulatória e do desenvolvimento de formulações com boa relação custo-benefício será essencial para garantir o crescimento sustentável do mercado e uma maior acessibilidade a terapias injetáveis que salvam vidas.

Como o mercado de medicamentos injetáveis estéreis de pequenas moléculas é segmentado?

O mercado é segmentado com base no tipo, protocolo de comunicação, mecanismo de desbloqueio e aplicação.

• Por produto

Com base no produto, o mercado de medicamentos injetáveis estéreis de pequenas moléculas é segmentado em Envase de Frascos, Envase de Seringas, Envase de Cartuchos, Antibióticos de Pequenas Moléculas, Quimioterápicos, Anestésicos Locais e Gerais, Relaxantes Musculoesqueléticos, Analgésicos, Anticoagulantes, Anticonvulsivantes, Antivirais, Anti-histamínicos/Antialérgicos e Outros. O segmento de Envase de Frascos dominou o mercado de medicamentos injetáveis estéreis de pequenas moléculas, com a maior participação de mercado na receita, de 38,4% em 2024, impulsionado por sua versatilidade, capacidade de armazenamento em alto volume e adequação para uso hospitalar e clínico. Os frascos continuam sendo o formato preferido para antibióticos, anestésicos e quimioterápicos injetáveis, garantindo esterilidade, precisão da dosagem e facilidade de uso em instalações de saúde.

Prevê-se que o segmento de Preenchimento de Seringas apresente a taxa de crescimento mais rápida, de 20,5%, entre 2025 e 2032, devido à crescente demanda por seringas pré-preenchidas prontas para uso, para vacinas, terapias para doenças crônicas e medicamentos de emergência. As seringas pré-preenchidas aumentam a conveniência, reduzem os riscos de contaminação e facilitam a autoadministração em ambientes de atendimento domiciliar, impulsionando sua ampla adoção.

• Por via de administração

Com base na via de administração, o mercado é segmentado em intravenosa (IV), intramuscular (IM) e subcutânea (SC). O segmento intravenoso (IV) deteve a maior participação de mercado em 2024, devido ao rápido início de ação, alta biodisponibilidade e adequação para tratamentos de cuidados intensivos, oncologia e doenças infecciosas. A administração intravenosa continua sendo o padrão ouro para a administração de medicamentos que salvam vidas em ambientes hospitalares.

Espera-se que o segmento subcutâneo (SC) apresente o CAGR mais rápido entre 2025 e 2032, impulsionado por seu uso crescente no tratamento de doenças crônicas, incluindo diabetes, doenças autoimunes e oncologia. A administração SC permite a autoinjeção, reduz as visitas hospitalares e melhora a adesão do paciente, tornando-se uma via preferencial para medicamentos biológicos e injetáveis estéreis.

• Por aplicação

Com base na aplicação, o mercado é segmentado em Oncologia, Doenças Infecciosas, Doenças Cardiovasculares, Doenças Metabólicas, Neurologia, Dermatologia, Urologia, Doenças Autoimunes, Distúrbios Respiratórios, Doenças Infecciosas, Doenças do SNC, Distúrbios Sanguíneos, Distúrbios Musculoesqueléticos e Outros. O segmento de Oncologia foi responsável pela maior fatia da receita de mercado em 2024, impulsionado pelo aumento da prevalência de câncer e pela crescente dependência de agentes quimioterápicos injetáveis estéreis, terapias direcionadas e medicamentos de suporte. A necessidade de administração rápida, precisa e estéril de medicamentos em tratamentos contra o câncer aumenta significativamente a demanda.

Espera-se que o segmento de Doenças Infecciosas apresente a taxa composta de crescimento anual (CAGR) mais rápida entre 2025 e 2032, devido ao aumento da resistência antimicrobiana, pandemias e infecções hospitalares. Antibióticos injetáveis estéreis, antivirais e antifúngicos são essenciais para o tratamento de infecções graves, especialmente em unidades de terapia intensiva.

• Por usuários finais

Com base nos usuários finais, o mercado é segmentado em hospitais, clínicas especializadas, ambientes de atendimento domiciliar e outros. O segmento de hospitais dominou o mercado de medicamentos injetáveis estéreis de pequenas moléculas, com a maior participação na receita em 2024, impulsionado pela alta demanda por terapias injetáveis em pronto-socorros, centros cirúrgicos, enfermarias de oncologia e UTIs. Os hospitais continuam sendo o principal ambiente para a administração de medicamentos injetáveis estéreis devido à sua complexidade e à necessidade de supervisão profissional.

O segmento de ambientes de atendimento domiciliar deverá registrar o crescimento mais rápido entre 2025 e 2032, apoiado por avanços em seringas pré-cheias, autoinjetores e formulações amigáveis ao paciente que permitem a administração de terapias crônicas em casa, reduzindo custos com assistência médica e aumentando a conveniência.

• Por Canais de Distribuição

Com base nos canais de distribuição, o mercado é segmentado em Licitação Direta, Farmácia de Varejo, Farmácia Online e Outros. O segmento de Licitação Direta foi responsável pela maior fatia da receita de mercado em 2024, visto que a aquisição em grandes quantidades por hospitais, instituições governamentais e grandes prestadores de serviços de saúde garante fornecimento estável, eficiência de custos e conformidade regulatória para medicamentos injetáveis de alto volume.

Espera-se que o segmento de farmácias on-line testemunhe o CAGR mais rápido de 2025 a 2032, impulsionado pela tendência crescente de plataformas de saúde digital, telemedicina e comércio eletrônico, permitindo que os pacientes peçam medicamentos injetáveis e dispositivos de uso doméstico de forma conveniente, especialmente para o tratamento de doenças crônicas.

Qual região detém a maior fatia do mercado de medicamentos injetáveis estéreis de pequenas moléculas?

- A América do Norte dominou o mercado de medicamentos injetáveis estéreis de pequenas moléculas com a maior participação na receita de 36,25% em 2024, impulsionada pela crescente prevalência de doenças crônicas, aumento da demanda por tratamentos oncológicos e forte presença dos principais fabricantes farmacêuticos.

- A região se beneficia de infraestrutura avançada de saúde, políticas de reembolso favoráveis e investimentos significativos no desenvolvimento de medicamentos injetáveis estéreis, especialmente para oncologia, doenças infecciosas e condições cardiovasculares.

- Além disso, a demanda por formulações injetáveis prontas para uso e de alta qualidade continua a crescer, especialmente em hospitais e clínicas especializadas, reforçando a posição de liderança da América do Norte no mercado.

Visão geral do mercado de medicamentos injetáveis estéreis de pequenas moléculas nos EUA

O mercado de medicamentos injetáveis estéreis de pequenas moléculas nos EUA conquistou a maior fatia da receita em 2024 na América do Norte, impulsionado pelo aumento das taxas de incidência de câncer, pela expansão da infraestrutura hospitalar e pela crescente preferência por terapias injetáveis devido à sua rápida eficácia e controle preciso da dosagem. A tendência crescente de atendimento ambulatorial, aliada à forte supervisão regulatória da FDA para segurança e qualidade dos medicamentos, acelera ainda mais a adoção de injetáveis estéreis no país.

Visão geral do mercado de medicamentos injetáveis estéreis de pequenas moléculas na Europa

O mercado europeu de medicamentos injetáveis estéreis de pequenas moléculas deverá crescer a um CAGR substancial ao longo do período previsto, impulsionado principalmente por uma forte base de fabricação farmacêutica, pelo aumento da população geriátrica e pela crescente carga de doenças crônicas e infecciosas. A Europa registra uma demanda significativa por antibióticos injetáveis estéreis, agentes oncológicos e medicamentos cardiovasculares, amparada por rigorosos padrões regulatórios que garantem a qualidade dos medicamentos. O foco crescente na modernização da saúde e na expansão de clínicas especializadas impulsiona ainda mais o mercado regional.

Visão geral do mercado de medicamentos injetáveis estéreis de pequenas moléculas no Reino Unido

Prevê-se que o mercado de medicamentos injetáveis estéreis de pequenas moléculas do Reino Unido cresça a uma CAGR considerável durante o período previsto, impulsionado pelo aumento dos gastos com saúde, iniciativas governamentais que promovem opções de tratamento avançadas e aumento da prevalência de câncer e distúrbios metabólicos. A ênfase do país na detecção precoce de doenças e no atendimento centrado no paciente sustenta a crescente demanda por medicamentos injetáveis prontos para administração em hospitais e clínicas especializadas.

Visão geral do mercado de medicamentos injetáveis estéreis de pequenas moléculas na Alemanha

Espera-se que o mercado alemão de medicamentos injetáveis estéreis de pequenas moléculas se expanda a um CAGR considerável durante o período previsto, apoiado por sua infraestrutura de saúde de classe mundial, um robusto ecossistema de P&D farmacêutico e uma crescente população de pacientes que necessitam de terapias injetáveis para oncologia, neurologia e doenças infecciosas. O foco do país em inovação, segurança e eficiência de medicamentos continua a impulsionar a demanda por medicamentos injetáveis estéreis, principalmente em ambientes hospitalares e ambulatoriais.

Qual região é a que mais cresce no mercado de medicamentos injetáveis estéreis de pequenas moléculas?

O mercado de medicamentos injetáveis estéreis de pequenas moléculas da Ásia-Pacífico deverá crescer a uma taxa composta de crescimento anual (CAGR) de 14,32% durante o período previsto de 2025 a 2032, impulsionado pela expansão do acesso à saúde, pelo aumento dos investimentos governamentais em infraestrutura de saúde e pela crescente prevalência de doenças crônicas na China, Japão e Índia. A forte base de fabricação farmacêutica da região, juntamente com a mudança para tratamentos injetáveis de alta qualidade para oncologia, doenças infecciosas e condições metabólicas, está impulsionando o crescimento do mercado.

Visão geral do mercado de medicamentos injetáveis estéreis de pequenas moléculas no Japão

O mercado japonês de medicamentos injetáveis estéreis de pequenas moléculas está ganhando força, devido ao envelhecimento da população do país, ao aumento da incidência de câncer e doenças cardiovasculares e à forte demanda por opções de tratamento convenientes e eficazes. O sistema de saúde tecnologicamente avançado do Japão e a preferência pela medicina de precisão estão impulsionando o crescimento de formulações injetáveis estéreis, especialmente para oncologia e tratamento de doenças crônicas.

Visão geral do mercado de medicamentos injetáveis estéreis de pequenas moléculas da China

O mercado chinês de medicamentos injetáveis estéreis de pequenas moléculas foi responsável pela maior fatia da receita de mercado na região Ásia-Pacífico em 2024, impulsionado pela rápida urbanização, pela crescente conscientização sobre os cuidados de saúde e por uma crescente demanda da classe média por cuidados de saúde de alta qualidade. A China continua sendo um importante polo de fabricação de produtos farmacêuticos, com crescente produção nacional de injetáveis estéreis para oncologia, doenças infecciosas e condições metabólicas. O impulso do país em direção à modernização da saúde, aliado às iniciativas governamentais que promovem a qualidade e a acessibilidade dos medicamentos, continua a impulsionar a forte expansão do mercado.

Quais são as principais empresas no mercado de medicamentos injetáveis estéreis de pequenas moléculas?

O setor de medicamentos injetáveis estéreis de pequenas moléculas é liderado principalmente por empresas bem estabelecidas, incluindo:

- Gilead Sciences, Inc. (EUA)

- BioCryst Pharmaceuticals, Inc. (EUA)

- AstraZeneca (Reino Unido)

- Genentech, Inc. (EUA)

- Merck KGaA (Alemanha)

- Hikma Pharmaceuticals PLC (Reino Unido)

- AbbVie Inc. (EUA)

- American Regent, Inc. (EUA)

- Amgen Inc. (EUA)

- Bristol-Myers Squibb Company (EUA)

- Teligent (EUA)

- Eisai Co., Ltd. (Japão)

- Teva Pharmaceutical Industries Ltd. (Israel)

- Neuren Pharmaceuticals (Austrália)

- Noxopharm (Austrália)

- Amomed Pharma GmbH (Áustria)

- Sanofi (França)

- Exelixis, Inc. (EUA)

- Fresenius Kabi EUA (EUA)

- Pfizer Inc. (EUA)

Quais são os desenvolvimentos recentes no mercado global de medicamentos injetáveis estéreis de pequenas moléculas?

- Em dezembro de 2022, a Gilead Sciences, Inc. recebeu a aprovação da Food and Drug Administration (FDA) dos EUA para o uso do Sunlenca em conjunto com outras terapias antirretrovirais no tratamento de infecções por HIV-1 em adultos com HIV-1 multirresistente e com longa experiência em tratamento. Essa aprovação regulatória introduziu uma nova opção terapêutica no tratamento do HIV, permitindo à empresa expandir seu portfólio atual de doenças infecciosas e fortalecer sua posição competitiva.

- Em maio de 2022, a Eli Lilly recebeu a aprovação da FDA (Food and Drug Administration) dos EUA para a injeção de Mounjaro (tirzepatida), um agonista duplo dos receptores GIP e GLP-1, administrado uma vez por semana, desenvolvido para melhorar o controle glicêmico em adultos com diabetes tipo 2. Essa aprovação representou um avanço significativo no controle do diabetes, oferecendo aos pacientes uma opção de tratamento inovadora, conveniente e eficaz para regular os níveis de açúcar no sangue e ampliando o portfólio de produtos da Eli Lilly.

- Em fevereiro de 2021, a BioCryst Pharmaceuticals, Inc. obteve a aprovação da FDA para um pedido suplementar de novo medicamento, expandindo a elegibilidade para o RAPIVAB, seu tratamento antiviral para gripe. Essa aprovação permitiu à empresa atender uma população de pacientes mais ampla e reforçou seu compromisso em oferecer novas terapias antivirais no setor de doenças infecciosas.

- Em julho de 2021, a Novartis anunciou que o branaplam, uma pequena molécula oral, havia avançado para a Fase 2 dos ensaios clínicos para o tratamento da atrofia muscular espinhal (AME). Este marco representou um avanço crucial na exploração de potenciais tratamentos para esta grave doença genética, destacando o foco da Novartis na inovação em doenças neurológicas.

- Em janeiro de 2020, a Sanofi SA concluiu a aquisição da Syntrox para aprimorar sua capacidade de desenvolver tratamentos biotecnológicos para câncer e doenças autoimunes. Espera-se que esta aquisição estratégica acelere a expansão do pipeline da Sanofi e contribua para avanços em soluções terapêuticas, apoiando assim oportunidades de crescimento no mercado de medicamentos injetáveis estéreis de pequenas moléculas.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.