Global Single Stream Flow Computers Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

1.19 Billion

USD

2.25 Billion

2025

2033

USD

1.19 Billion

USD

2.25 Billion

2025

2033

| 2026 –2033 | |

| USD 1.19 Billion | |

| USD 2.25 Billion | |

|

|

|

|

Global Single Stream Flow Computers Market Segmentation, By Component (Hardware, Software, and Services), Operations (Single Stream Flow Computers and Multi-Stream Flow Computers), Connectivity (Wired Flow Computers and Wireless Flow Computers), Equipment (Pressure Gauges, Temperature Probes, Gas Composition Sensors, Meter Prover, Sampling System, Density Measurement Equipment, and Others), Application (Fuel Monitoring, Liquid & Gas Measurement, Wellhead Measurement and Optimization, Pipeline Transmission and Distribution, and Others) - Industry Trends and Forecast to 2033

What is the Global Single Stream Flow Computers Market Size and Growth Rate?

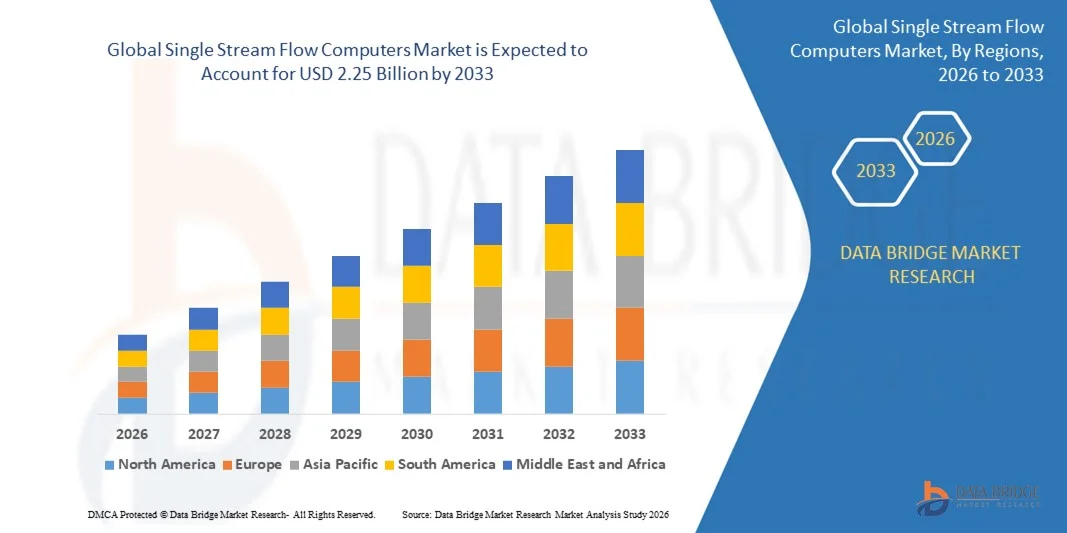

- The global single stream flow computers market size was valued at USD 1.19 billion in 2025 and is expected to reach USD 2.25 billion by 2033, at a CAGR of 8.30% during the forecast period

- Innovative and reliable flow computing solutions used in oil extraction processes such as integration with the cloud, compatibility with meters, and multi-meter run handling have increased the accuracy and usage of flow computers is a driving factor for the single stream flow computers market which is also a driver for the single stream flow computers market

What are the Major Takeaways of Single Stream Flow Computers Market?

- Rapid advances and innovation being carried out in flow computing technology is also a driver for the market. Integration of flow computer with the cloud is an opportunity for the single stream flow computers market

- Lot of instrumentation needed in using flow computers is a challenge for the single stream flow computers market. However, higher initial prices are the main restraint for the growth of single stream flow computers market

- North America dominated the single stream flow computers market with a 37.2% revenue share in 2025, supported by high adoption across upstream, midstream, and downstream oil & gas, chemical processing, and utility sectors

- Asia-Pacific is projected to register the fastest CAGR of 9.3% from 2026 to 2033, driven by growing industrialization, oil & gas exploration, and chemical processing in China, India, Japan, and South Korea

- The Hardware segment dominated the market with a revenue share of 55.8% in 2025, driven by the high demand for robust, durable, and accurate flow computers, sensors, and control units across oil & gas, chemical, and industrial applications

Report Scope and Single Stream Flow Computers Market Segmentation

|

Attributes |

Single Stream Flow Computers Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Single Stream Flow Computers Market?

Rising Adoption of Advanced, Multi-Functional, and Connected Single Stream Flow Computers

- The single stream flow computers market is witnessing strong growth toward highly accurate, multifunctional, and IoT-enabled flow measurement and control systems, supporting applications in oil & gas, water treatment, chemical, and industrial automation sectors

- Manufacturers are introducing multi-purpose flow computers capable of handling complex calculations, real-time data logging, and remote monitoring to improve operational efficiency and compliance with regulatory standards

- End-users increasingly prefer integrated solutions that combine measurement, diagnostics, and reporting in a single platform, reducing installation costs and operational complexity

- For instance, companies such as Schlumberger, TechnipFMC, Rockwell Automation, Honeywell, and ABB have enhanced their portfolios with high-performance, cloud-connected, and multi-stream flow computing solutions for upstream and midstream operations

- Growing awareness of process optimization, safety monitoring, and regulatory compliance is accelerating global market adoption

- As industrial automation and digitalization continue to advance, Single Stream Flow Computers are expected to remain central to innovation within the global flow measurement and monitoring market

What are the Key Drivers of Single Stream Flow Computers Market?

- Rising demand for accurate, reliable, and real-time flow measurement solutions is driving strong adoption of single stream flow computers globally

- For instance, in 2025, major industrial players such as Schlumberger, ABB, and Rockwell Automation upgraded their flow computer portfolios to include IoT-enabled, cloud-integrated, and multi-stream capable models

- Increasing adoption of industrial automation, digital twins, and remote monitoring solutions across oil & gas, chemical processing, and water management sectors is boosting demand in North America, Europe, and Asia-Pacific

- Advancements in sensor technology, computational algorithms, and connectivity protocols have improved measurement accuracy, data integration, and operational efficiency

- Growing emphasis on compliance with environmental, safety, and process regulations further supports market expansion, along with demand for energy-efficient, scalable, and multi-parameter device

- With continuous R&D, product innovation, global distribution, and partnerships, the Single Stream Flow Computers market is expected to maintain strong growth during the forecast period

Which Factor is Challenging the Growth of the Single Stream Flow Computers Market?

- High procurement, installation, and maintenance costs of advanced single stream flow computers limit adoption in cost-sensitive regions

- For instance, during 2024–2025, fluctuations in raw material prices, semiconductor supply, and sensor component availability affected production and delivery timelines for several manufacturers

- Complex integration with existing SCADA, PLC, and ERP systems adds operational and technical challenges

- Limited awareness and technical expertise among end-users in emerging markets restrict widespread adoption of sophisticated flow computing solutions

- Strong competition from conventional flow meters, analog systems, and low-cost digital alternatives exerts pressure on pricing and differentiation

- To overcome these challenges, companies are focusing on modular designs, cost-efficient manufacturing, training programs, and service support to expand global adoption of high-quality Single Stream Flow Computers

How is the Single Stream Flow Computers Market Segmented?

The market is segmented on the basis of component, operations, connectivity, equipment, and application.

- By Component

On the basis of component, the single stream flow computers market is segmented into Hardware, Software, and Services. The Hardware segment dominated the market with a revenue share of 55.8% in 2025, driven by the high demand for robust, durable, and accurate flow computers, sensors, and control units across oil & gas, chemical, and industrial applications. Hardware adoption is fueled by the need for precise measurement, real-time monitoring, and integration with existing SCADA and control systems. Flow computers with modular and scalable designs enable efficient installation and long-term operational reliability.

The Services segment is projected to grow at the fastest CAGR from 2026 to 2033, supported by increasing demand for calibration, maintenance, training, and remote diagnostics. Service-based contracts enhance uptime, ensure regulatory compliance, and optimize system performance, accelerating adoption across upstream, midstream, and downstream operations.

- By Operations

On the basis of operations, the market is segmented into Single Stream Flow Computers and Multi-Stream Flow Computers. The Single Stream segment dominated the market with a revenue share of 60.2% in 2025, driven by its simplicity, cost-efficiency, and widespread application in smaller-scale oil & gas pipelines, chemical processing, and water treatment systems. These systems provide accurate, reliable measurement for individual streams, supporting billing, custody transfer, and process monitoring.

The Multi-Stream Flow Computers segment is projected to grow at the fastest CAGR from 2026 to 2033, supported by rising adoption in complex industrial operations, including multi-line pipelines, blending stations, and large-scale chemical plants. Multi-stream solutions enable simultaneous measurement of multiple fluids, improving operational efficiency, reducing downtime, and enhancing process optimization in high-volume environments.

- By Connectivity

On the basis of connectivity, the single stream flow computers market is segmented into Wired, Wireless, and Hybrid solutions. The Wired segment dominated the market with a revenue share of 58.7% in 2025, driven by its reliability, low latency, and seamless integration with industrial control systems. Wired connectivity remains the standard in high-accuracy flow measurement, critical for custody transfer, compliance, and automated reporting.

The Wireless segment is projected to grow at the fastest CAGR from 2026 to 2033, supported by increasing deployment of IoT-enabled flow computers, remote monitoring, cloud integration, and real-time data analytics. Wireless solutions reduce installation complexity, enhance scalability, and allow remote diagnostics, making them ideal for pipeline networks, offshore installations, and distributed industrial facilities.

- By Equipment

On the basis of equipment, the market is segmented into Pressure Gauges, Temperature Probes, Gas Composition Sensors, Meter Provers, Sampling Systems, Density Measurement Equipment, and Others. The Pressure Gauges segment dominated the market with a revenue share of 52.9% in 2025, owing to their critical role in monitoring and maintaining accurate flow measurements across pipelines, storage tanks, and processing units. Pressure gauges ensure operational safety, optimize flow, and support real-time system control.

The Gas Composition Sensors segment is projected to grow at the fastest CAGR from 2026 to 2033, driven by increasing adoption in natural gas, petrochemical, and multi-product processing applications. Enhanced accuracy, advanced sensing technologies, and integration with flow computers support regulatory compliance and improve overall process efficiency.

- By Application

On the basis of application, the single stream flow computers market is segmented into Fuel Monitoring, Liquid & Gas Measurement, Wellhead Measurement and Optimization, Pipeline Transmission and Distribution, and Others. The Liquid & Gas Measurement segment dominated the market with a revenue share of 61.5% in 2025, supported by high adoption in upstream, midstream, and downstream sectors for custody transfer, billing, and operational control. Accurate measurement ensures safety, regulatory compliance, and process efficiency.

The Wellhead Measurement and Optimization segment is projected to grow at the fastest CAGR from 2026 to 2033, fueled by increasing deployment in production optimization, reservoir monitoring, and enhanced oil recovery operations. Advanced flow computers integrated with wellhead systems enable real-time analytics, remote monitoring, and predictive maintenance, driving strong adoption globally.

Which Region Holds the Largest Share of the Single Stream Flow Computers Market?

- North America dominated the single stream flow computers market with a 37.2% revenue share in 2025, supported by high adoption across upstream, midstream, and downstream oil & gas, chemical processing, and utility sectors. Strong industrial infrastructure, technological advancements, and regulatory compliance standards drive widespread use of hardware, software, and services for flow measurement and monitoring

- Leading players are expanding solutions through innovations in multi-stream integration, IoT-enabled flow computers, and real-time analytics to enhance measurement accuracy, optimize pipeline operations, and ensure custody transfer compliance

- High industrial investment, presence of major flow computer manufacturers, and continuous R&D in automated and remote monitoring systems further strengthen regional leadership

U.S. Single Stream Flow Computers Market Insight

The U.S. is the largest contributor within North America, driven by rising investments in digital flow measurement, pipeline optimization, and remote monitoring solutions. Manufacturers are focusing on advanced hardware, cloud-enabled software, and predictive maintenance services to improve operational efficiency and compliance. Strong infrastructure, extensive pipeline networks, and high adoption of multi-stream systems continue to support growth.

Canada Single Stream Flow Computers Market Insight

Canada contributes significantly to regional growth, supported by investments in natural gas pipelines, energy monitoring systems, and multi-stream flow computers. Rising adoption of smart metering, cloud-based analytics, and advanced process automation in oil, gas, and water utilities is driving demand. Expanding industrial projects and regulatory compliance for custody transfer measurement further fuel market penetration.

Asia-Pacific Single Stream Flow Computers Market Insight

Asia-Pacific is projected to register the fastest CAGR of 9.3% from 2026 to 2033, driven by growing industrialization, oil & gas exploration, and chemical processing in China, India, Japan, and South Korea. Increasing adoption of digital flow computers for real-time monitoring, energy optimization, and multi-stream operations accelerates market expansion.

China Single Stream Flow Computers Market Insight

China is the largest contributor to Asia-Pacific, supported by strong investments in oil & gas infrastructure, chemical plants, and water utilities. Increasing focus on industrial automation, energy efficiency, and regulatory compliance drives demand for advanced flow measurement solutions. Manufacturers are investing heavily in IoT-enabled hardware, software platforms, and predictive maintenance systems.

India Single Stream Flow Computers Market Insight

India is emerging as a key growth market, fueled by industrial modernization, expanding energy pipelines, and adoption of smart flow metering systems. Increasing government initiatives toward process optimization, industrial digitalization, and accurate measurement for custody transfer and billing support market penetration.

Japan Single Stream Flow Computers Market Insight

Japan shows steady growth, driven by modernization of energy and chemical plants, and rising adoption of multi-stream flow computers for optimized operations. Focus on advanced monitoring, cloud-based analytics, and predictive maintenance enhances efficiency across industrial sectors.

South Korea Single Stream Flow Computers Market Insight

South Korea contributes significantly due to increasing industrial automation and adoption of digital flow computers across oil & gas, chemical, and utility sectors. Emphasis on real-time data, energy efficiency, and multi-stream monitoring supports rapid growth. Innovations in smart metering, cloud integration, and predictive analytics enhance operational accuracy and reliability.

Which are the Top Companies in Single Stream Flow Computers Market?

The single stream flow computers industry is primarily led by well-established companies, including:

- TechnipFMC plc (U.K.)

- Schlumberger Limited (U.S.)

- ABB (Switzerland)

- Rockwell Automation (U.S.)

- Honeywell International Inc. (U.S.)

- Kessler-Ellis Products, Co (U.S.)

- Flow Systems (U.S.)

- Dynamic Flow Computers, Inc. (U.S.)

- Contrec Ltd (U.K.)

- Thermo Fisher Scientific Inc. (U.S.)

- OMNI FLOW COMPUTERS, Inc. (U.S.)

- KROHNE Messtechnik GmbH (Germany)

- ProSoft Technology, Inc. (U.S.)

- Emersion Electric Co. (U.S.)

- Yokogawa India Ltd (India)

- Schneider Electric (France)

- SICK AG (Germany)

- Cameron International (U.S.)

- ZICOM Group Limited (India)

What are the Recent Developments in Global Single Stream Flow Computers Market?

- In September 2025, OMRON launched the Sysmac-Edge DX1 Data Flow Controller, designed to accelerate digital transformation in the manufacturing sector, enhancing operational efficiency and enabling faster decision-making

- In May 2025, ABB introduced a new range of flow computers tailored for industrial and utility applications, providing improved measurement accuracy, real-time monitoring, and optimized process control

- In January 2025, SICK AG partnered with Endress+Hauser to develop an advanced flow measurement solution for the industrial sector, combining expertise in sensor technology and digital analytics to drive precise and reliable data acquisition

- In October 2021, FLOWCAL by Quorum Software was adopted by Utah Gas Corp to enhance data accuracy and streamline acquisition integration, enabling rapid incorporation of new assets while reducing subsequent operational costs significantly

- In March 2020, Emerson Electric introduced new data visualization software for flow measurement, allowing plant managers and operators to monitor processes in a clear and actionable manner without manual data manipulation, improving operational transparency and problem detection

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.