Mercado global de cinzas de casca de arroz, por forma (paletes, pó, flocos, nódulos/grânulos), teor de silício (80-84%, 85-89%, 90-94%, mais de 95%), aplicação posterior (misturas de betão, Tendências e previsões da indústria de blocos de construção, tijolos refractários, chapas metálicas, telhas, isolantes, produtos químicos impermeabilizantespesticidas , outros) até 2029.

Análise de Mercado e Insights

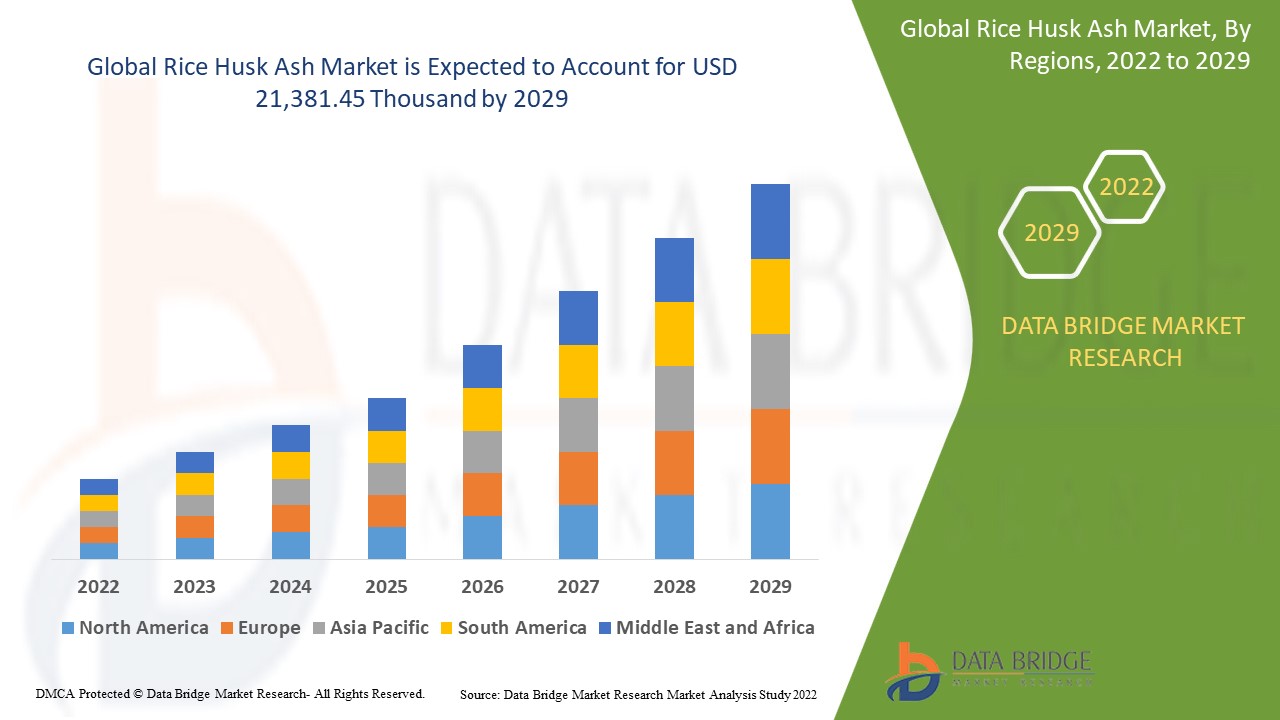

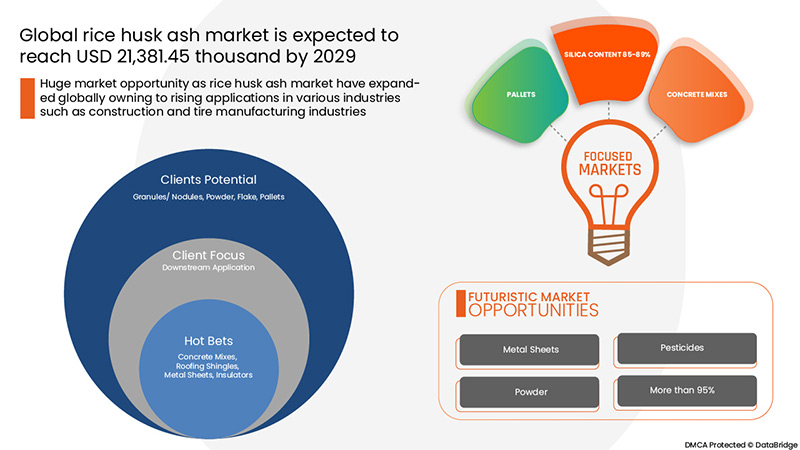

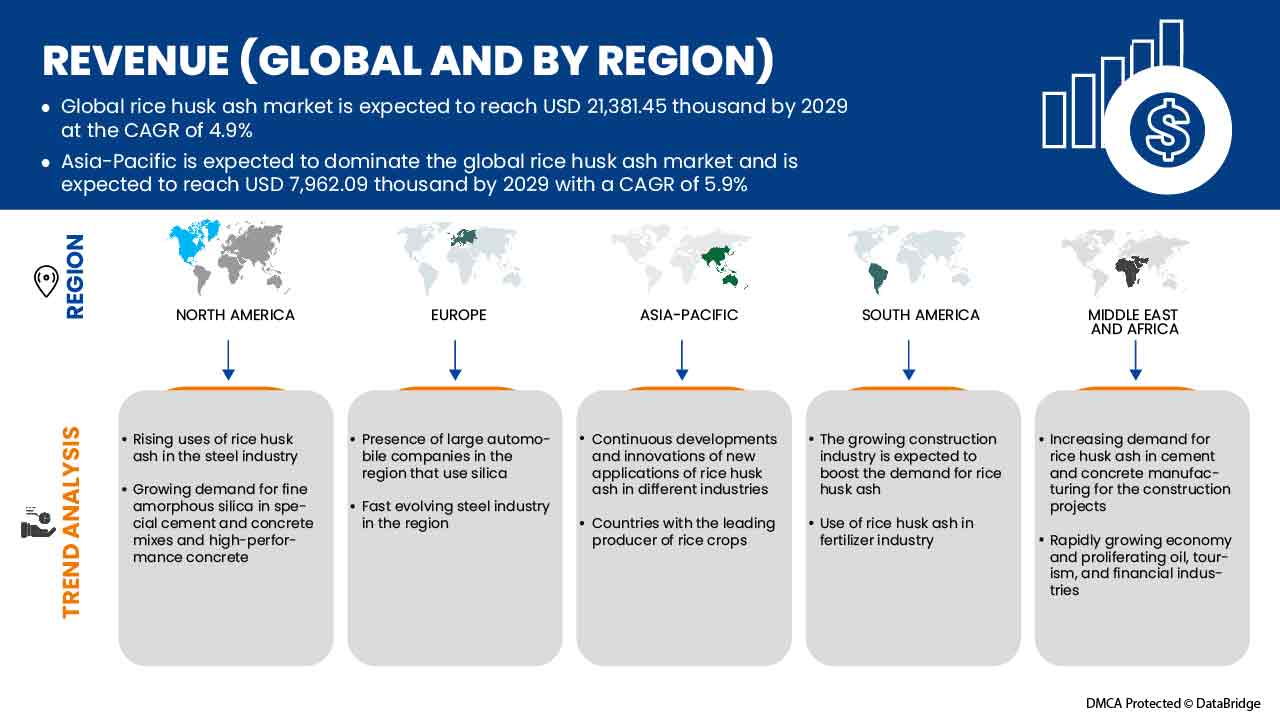

Espera-se que o mercado global de cinzas de casca de arroz ganhe um crescimento significativo no período previsto de 2022 a 2029. A Data Bridge Market Research analisa que o mercado está a crescer com um CAGR de 4,9% no período previsto de 2022 a 2029 e prevê-se que atinja os 21.381,45 milhares de dólares até 2029. O principal fator que impulsiona o crescimento do mercado global de cinzas de casca de arroz é o amplo âmbito de produtos na indústria da construção devido ao elevado teor de sílica.

Espera-se que o amplo âmbito de produtos no setor da construção devido ao elevado teor de sílica impulsione o mercado global de cinzas de casca de arroz. Espera-se que a crescente consciencialização sobre os benefícios técnicos da utilização de cinzas de casca de arroz impulsione o crescimento do mercado global de cinzas de casca de arroz.

As principais restrições que podem ter um impacto negativo no mercado global de cinzas de casca de arroz são os problemas associados à relação água/cimento pela utilização de cinzas de casca de arroz e o forte alcance de mercado de substitutos.

Devido à adesão às normas regulamentares ambientais e aos menores custos de matéria-prima e de fabrico, espera-se que a crescente procura ofereça oportunidades no mercado global de cinzas de casca de arroz.

No entanto, prevê-se que os problemas de eliminação associados às cinzas da casca de arroz e a elevada dependência da produção de arroz em casca desafiem o crescimento do mercado global de cinzas da casca de arroz.

O relatório do mercado global de cinzas de casca de arroz fornece detalhes sobre a quota de mercado, novos desenvolvimentos, o impacto dos participantes do mercado doméstico e localizado, analisa as oportunidades em termos de bolsas de receitas emergentes, alterações nas regulamentações do mercado, aprovações de produtos , decisões estratégicas, lançamentos de produtos, expansões geográficas, e inovações tecnológicas no mercado. Para compreender a análise e o cenário de mercado, contacte-nos para um Analista Briefing; a nossa equipa irá ajudá-lo a criar uma solução de impacto na receita para atingir a sua meta desejada.

|

Métrica de Reporte |

Detalhes |

|

Período de previsão |

2022 a 2029 |

|

Ano base |

2021 |

|

Anos históricos |

2020 (Personalizável para 2019 - 2014) |

|

Unidades quantitativas |

Receita em USD Mil, Volume em Quilo Tonelada, Preço em USD |

|

Segmentos abrangidos |

Por forma (paletes, pó, flocos, nódulos/grânulos), teor de silício (80-84%, 85-89%, 90-94%, mais de 95%), aplicação posterior (misturas de betão, blocos de construção, tijolos refractários, Chapas metálicas, telhas, isolantes, produtos químicos impermeabilizantes, pesticidas, outros) |

|

Países abrangidos |

EUA, Canadá e México, Alemanha, Reino Unido, Itália, França, Espanha, Rússia, Suíça, Turquia, Bélgica, Países Baixos, Luxemburgo e restante Europa, Japão, China, Coreia do Sul, Índia, Singapura, Tailândia, Indonésia, Malásia, Filipinas, Austrália e Nova Zelândia, e o resto da Ásia-Pacífico, África do Sul, Egito, Arábia Saudita, Emirados Árabes Unidos, Israel e o resto do Médio Oriente e África |

|

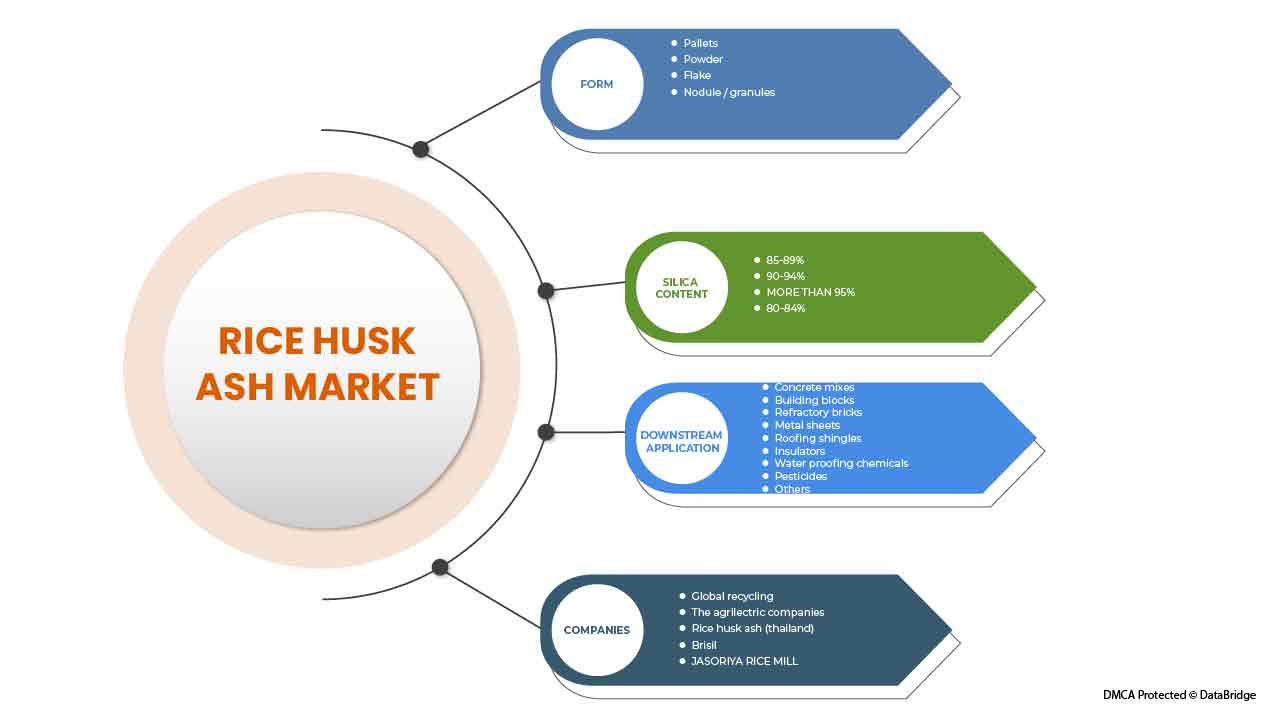

Atores do mercado abrangidos |

Astrra Chemicals, Global Recycling, KV Metachem, Brisil, The Agrilectric Companies, Rice Husk Ash (Tailândia), Guru Corporation, JASORIYA RICE MILL e PIONEER Carbon, entre outras |

Definição de Mercado

A cinza da casca de arroz é um subproduto natural recuperado do campo de arroz após o descasque do arroz. O invólucro da casca de arroz é geralmente composto por 30% de lignina, 20% de sílica e 50% de celulose e, se incinerado por decomposição térmica controlada, transforma o resíduo em cinzas.

As cinzas da casca de arroz são produzidas após a combustão controlada da casca de arroz e possuem uma elevada propriedade pozolânica e reatividade. É considerado um material de cimentação adequado na indústria da construção, quer como substituto do cimento, quer como aditivo. Como mistura, a cinza da casca de arroz produz betão de alta resistência, enquanto a substituição do cimento por cinza da casca de arroz produz blocos de construção de baixo custo. As cinzas da casca de arroz são utilizadas para produzir materiais de construção leves, uma vez que a adição de RHA torna o betão mais leve.

Dinâmica do mercado global de cinzas de casca de arroz

Motoristas

- Amplo âmbito de produtos na indústria da construção devido ao elevado teor de sílica

A aplicação de cinzas de casca de arroz está a ganhar destaque na indústria da construção civil, uma vez que está a ser amplamente utilizada como pozolana, enchimento, aditivo, agente abrasivo, adsorvente de óleo, componente de varrimento e agente de suspensão para esmaltes de porcelana. Na indústria cimenteira, a cinza da casca de arroz é utilizada pela sua sílica amorfa para fabricar betão. É utilizado para substituir o cimento Portland comum (OPC), um componente de betão muito caro e importante. A utilização de cinzas de casca de arroz ajuda a produzir blocos de construção de baixo custo. Os blocos de construção de baixo custo são altamente preferidos em muitos países subdesenvolvidos e em desenvolvimento, como o Quénia, a Nigéria e a Indonésia, entre muitos outros.

Assim, espera-se que a crescente utilização de cinzas de casca de arroz na indústria da construção para fazer betão e produtos de betão e outros produtos usados, como pavimentos de casas de banho, impulsione o mercado global de cinzas de casca de arroz.

- Crescente sensibilização sobre os benefícios técnicos das cinzas da casca de arroz

A principal utilização das cinzas de casca de arroz é na indústria da construção civil como material cimentício suplementar (SCM) em cimento misturado, uma vez que as cinzas de casca de arroz são adicionadas ao cimento Portland para melhorar alguns aspetos do desempenho da mistura resultante .

- Além disso, a mistura de betão à base de cinza de casca de arroz oferece uma resistência superior contra a penetração de iões cloreto no meio marinho. Como resultado, a aplicação destas misturas de betão está a crescer para as atividades de construção no ambiente marinho. Para além destas aplicações, as cinzas da casca de arroz são utilizadas noutros setores, como telhas, produtos químicos impermeabilizantes, absorventes de derrames de óleo, tintas especiais, retardantes de chama, inseticidas e biofertilizantes, o que pode impulsionar o crescimento do mercado global de cinzas da casca de arroz.

Crescimento na produção de sílica de alta qualidade

Utilização crescente de sílica de alta qualidade obtida a partir de cinzas de casca de arroz nas indústrias da construção civil, siderurgia, cerâmica e refractários, entre muitas outras. Isto dá uma perspetiva positiva sobre o crescimento do mercado. O aumento da preferência pelas cinzas de casca de arroz em vez da sílica ativa e das cinzas volantes na indústria do cimento e da construção influenciará o mercado. Para além das vantagens ambientais e económicas, espera-se que métodos mais simples e de baixo consumo energético para a obtenção de sílica pura impulsionem o mercado e criem novas oportunidades para desenvolver novas aplicações industriais de cinzas de casca de arroz.

Oportunidades

- Procura crescente devido à adesão às normas regulamentares ambientais

A casca de arroz é um resíduo orgânico e é produzida em grandes quantidades. É um subproduto importante da indústria de moagem de arroz e de biomassa de base agrícola. Por conseguinte, a utilização de subprodutos de cinzas de casca de arroz por outras indústrias ajuda na redução de resíduos, e as cinzas de casca de arroz são utilizadas como aditivo em muitos materiais e aplicações, tais como tijolos refractários, fabrico de isolamento e materiais para retardantes de chamas. . Além disso, a cinza da casca de arroz está a ganhar popularidade e a obter aprovação das entidades reguladoras devido aos seus efeitos favoráveis no solo em termos de correção da acidez. Assim sendo, espera-se que a adesão às cinzas de casca de arroz para diversos outros fins ofereça oportunidades de crescimento lucrativas no mercado global de cinzas de casca de arroz.

- Aumento da utilização de cinzas de casca de arroz para produzir pneus de borracha

A utilização de sílica extraída de cinzas de casca de arroz apresenta também outros benefícios. A energia consumida na extração de sílica de fontes tradicionais, como a areia, é muito maior. Precisa de ser aquecido a 1.400 graus Celsius para extrair sílica da areia. Em comparação, a temperatura necessária para extrair sílica das cinzas da casca de arroz é de apenas 100 graus Celsius. Além disso, a sílica extraída das cinzas da casca de arroz confere à banda de rodagem muito mais resistência e rigidez, além de proporcionar uma menor resistência ao rolamento. Espera-se que isto ofereça uma oportunidade para o crescimento do mercado global de cinzas de casca de arroz.

Restrições/Desafios

- Problemas associados à relação água/cimento pela utilização de cinzas de casca de arroz

A cinza da casca de arroz melhora as propriedades do betão quando utilizada numa quantidade específica, mas à medida que a quantidade de cinza da casca de arroz aumenta, a resistência do cimento e do betão tende a diminuir, uma vez que a cinza da casca de arroz é mais fina do que o cimento e requer mais quantidade de água para se estabelecer. Isto impacta muito a resistência, o que deverá limitar a utilização de cinzas de casca de arroz no mercado global de cinzas de casca de arroz

- Forte alcance de mercado de substitutos

A necessidade de sílica não pode ser suprida apenas pela produção de sílica a partir das cinzas da casca de arroz. Os métodos convencionais de produção de sílica são ainda os preferidos e empregados para cobrir a crescente necessidade de matérias-primas em vários sectores. Além disso, a combustão da casca de arroz para produzir cinzas de casca de arroz produz muita poluição, afectando o seu crescimento e limitando a sua utilização no período previsto. Isto intensificará e fortalecerá o mercado de substitutos.

- Problemas de eliminação associados às cinzas da casca de arroz

Adoção de tecnologias de alta tecnologia para lidar com resíduos como as cinzas de casca de arroz e a água, enquanto alguns moinhos de arroz também estão a utilizar as cinzas de casca para bons usos ecológicos, como o rejuvenescimento do solo e o aumento da sua fertilidade. Além disso, para resolver isto, as cinzas da casca de arroz são utilizadas em diferentes aplicações para uma eliminação segura. Estão a ser pensadas várias formas para descartar as cinzas da casca de arroz, tornando o seu uso comercial mais viável e eficiente. No entanto, a eliminação inadequada de cinzas de casca de arroz e a falta de instalações em vários moinhos de arroz são um sério desafio que pode prejudicar o crescimento do mercado no período previsto .

- Elevada dependência da produção de arroz em casca

A percentagem de produção de cinzas de casca de arroz depende também da taxa de moagem do arroz e do tipo de arroz disponível. Além disso, o arroz é uma cultura Kharif ou de inverno e cresce apenas numa época específica do ano, durante o inverno. Por conseguinte, pode não estar disponível em grandes quantidades durante todo o ano, o que pode afectar a disponibilidade de cinzas de casca de arroz para outras aplicações noutros sectores, como a indústria do cimento, a indústria produtora de sílica, a indústria de pneus e muitas outras. A isto junta-se outro problema: a participação da Ásia na produção mundial de arroz é superior a 90%. O arrozal é o principal cereal alimentar em muitos países asiáticos, como a Índia e a China. Em 2018, a Índia foi responsável por apenas cerca de 21% da produção mundial de arroz. Por conseguinte, torna-se difícil para outras partes terem um bom acesso aos recursos, incluindo a matéria-prima e os produtos acabados. Por conseguinte, a presença geográfica limitada e a total dependência da casca de arroz em relação ao arroz com casca é um sério desafio que o mercado global de cinzas de casca de arroz precisa de ultrapassar para registar um crescimento significativo no período previsto.

A COVID-19 teve um impacto mínimo no mercado global de cinzas de casca de arroz

A COVID-19 impactou vários setores de manufatura no ano 2020-2021, uma vez que levou ao encerramento de locais de trabalho, à interrupção das cadeias de abastecimento e a restrições ao transporte. No entanto, foi observado um impacto significativo nas cinzas da casca de arroz nas operações globais e na cadeia de abastecimento, existindo ainda várias instalações fabris a operar. Os prestadores de serviços continuaram a oferecer cinzas de casca de arroz seguindo medidas de saneamento e segurança no cenário pós-COVID.

Desenvolvimento recente

- A Brisil recebeu vários prémios e reconhecimentos nacionais e internacionais pela sua tecnologia que aborda um dos problemas da utilização de resíduos. Estes incluem o reconhecimento da Leaders in Innovation Fellowship, do Global Cleantech Innovation Programme e do The Economic Times, entre outros.

Âmbito do mercado global de cinzas de casca de arroz

O mercado global de cinzas de casca de arroz é categorizado com base na forma, no teor de silício e na aplicação posterior. O crescimento entre estes segmentos irá ajudá-lo a analisar os principais segmentos de crescimento do setor e fornecerá aos utilizadores uma visão geral e informações valiosas do mercado para tomar decisões estratégicas para identificar as principais aplicações do mercado.

Forma

- Grânulos/ Nódulos

- Paletes

- Floco

- Pó

Com base na forma, o mercado global de cinzas de casca de arroz é classificado em grânulos/nódulos, paletes, flocos e pó.

Conteúdo de Silício

- 80-84%

- 85-89%

- 90-94%,

- Mais de 95%

Com base no teor de sílica, o mercado global de cinzas de casca de arroz está classificado em 80-84%, 85-89%, 90-94% e mais de 95%.

Aplicação a jusante

- Misturas de betão

- Telhas de cobertura

- Blocos de construção

- Tijolos refratários

- Chapas de metal

- Isoladores

- Produtos químicos impermeabilizantes

- Pesticidas

- Outros

Com base na aplicação posterior, o mercado global de cinzas de casca de arroz é classificado em misturas de betão, telhas, blocos de construção, tijolos refratários, chapas metálicas, isolantes, produtos químicos impermeabilizantes, pesticidas e outros.

Análise regional/insights globais sobre as cinzas de casca de arroz

O mercado global de cinzas de casca de arroz é categorizado com base no país, forma, teor de silício e aplicação posterior.

O mercado global de cinzas de casca de arroz está segmentado na América do Norte, América do Sul, Ásia-Pacífico, Europa, Médio Oriente e África. A América do Norte está segmentada em EUA, Canadá e México, Alemanha, Reino Unido, Itália, França, Espanha, Rússia, Suíça, Turquia, Bélgica, Holanda, Luxemburgo e restante Europa, Japão, China, Coreia do Sul, Índia , Singapura , Tailândia, Indonésia, Malásia, Filipinas, Austrália e Nova Zelândia, e restante Ásia-Pacífico, África do Sul, Egito, Arábia Saudita, Emirados Árabes Unidos, Israel e resto do Médio Oriente e África.

Espera-se que a China domine o mercado de cinzas de casca de arroz da Ásia-Pacífico em termos de quota de mercado e receitas e continuará a aumentar o seu domínio durante o período previsto. Isto deve-se à crescente consciencialização sobre os benefícios técnicos das cinzas da casca de arroz na região. Prevê-se que a Alemanha domine o mercado europeu de cinzas de casca de arroz devido à crescente procura de sílica por parte de várias indústrias de utilização final na Europa. Espera-se que os EUA dominem o mercado norte-americano de cinzas de casca de arroz devido ao crescimento das indústrias de construção e siderurgia.

A secção de países do relatório também fornece fatores individuais que impactam o mercado e alterações nas regulamentações do mercado que impactam as tendências atuais e futuras do mercado. Os pontos de dados, como as vendas de produtos novos e de substituição, a demografia dos países e as tarifas de importação e exportação, são alguns dos principais indicadores utilizados para prever o cenário de mercado para países individuais. Além disso, a presença e a disponibilidade de marcas globais e os seus desafios enfrentados devido à elevada concorrência de marcas locais e nacionais e o impacto dos canais de vendas são considerados ao fornecer uma análise de previsão dos dados do país.

Análise do panorama competitivo e da quota de mercado global de cinzas de casca de arroz

O panorama competitivo do mercado global de cinzas de casca de arroz fornece detalhes por concorrentes. Os detalhes incluídos são a visão geral da empresa, finanças da empresa, receitas geradas, potencial de mercado, investimento em investigação e desenvolvimento, novas iniciativas de mercado, localizações e instalações de produção, pontos fortes e fracos da empresa, lançamento de produtos, pipelines de testes de produto, aprovações de produto, patentes, largura e amplitude do produto, domínio da aplicação, curva de vida da tecnologia. Os pontos de dados fornecidos acima estão apenas relacionados com o foco das empresas no mercado global de cinzas de casca de arroz.

Alguns dos principais participantes que operam no mercado global de cinzas de casca de arroz são a Astrra Chemicals, Global Recycling, KV Metachem, Brisil, The Agrilectric Companies, Rice Husk Ash (Tailândia), Guru Corporation, JASORIYA RICE MILL e PIONEER Carbon, entre outros .

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com grandes tamanhos de amostra. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados, que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Além disso, os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha do tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise da quota de mercado da empresa, padrões de medição, global versus regional e análise da participação dos fornecedores. Solicite uma chamada de analista em caso de dúvidas adicionais.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Índice

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL RICE HUSK ASH MARKET

1.4 LIMITATION

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 FORM LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET DOWNSTREAM APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 DBMR VENDOR SHARE ANALYSIS

2.13 IMPORT-EXPORT DATA

2.14 SECONDARY SOURCES

2.15 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 CLIMATE CHANGE SCENARIO

4.1.1 ENVIRONMENTAL CONCERNS

4.1.2 INDUSTRY RESPONSE

4.1.3 GOVERNMENT’S ROLE

4.1.4 ANALYST RECOMMENDATION

4.2 GLOBAL IMPORT EXPORT SCENARIO

4.3 LIST OF KEY BUYERS

4.4 PESTLE ANALYSIS

4.4.1 POLITICAL FACTORS

4.4.2 ECONOMIC FACTORS

4.4.3 SOCIAL FACTORS

4.4.4 TECHNOLOGICAL FACTORS

4.4.5 LEGAL FACTORS

4.4.6 ENVIRONMENTAL FACTORS

4.5 PORTER’S FIVE FORCES:

4.6 PRODUCTION CONSUMPTION ANALYSIS- GLOBAL RICE HUSK ASH MARKET

4.6.1 RICE HUSK ASH PRODUCTION BY INCINERATION OF RICE HUSK

4.7 RAW MATERIAL PRODUCTION COVERAGE – GLOBAL RICE HUSK ASH MARKET

RICE PADDY/RICE HUSK 60

4.8 SUPPLY CHAIN ANALYSIS

4.8.1 RAW MATERIAL PROCUREMENT

4.8.2 MANUFACTURING AND PACKAGING

4.8.3 MARKETING AND DISTRIBUTION

4.8.4 END USERS

4.9 TECHNOLOGICAL ADVANCEMENT BY MANUFACTURERS

4.1 VENDOR SELECTION CRITERIA

4.11 REGULATORY COVERAGE

4.11.1 INDIA’S CENTRAL POLLUTION CONTROL BOARD

4.11.2 EUROPEAN COMMISSION (EC)

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 EXTENSIVE PRODUCT SCOPE IN THE CONSTRUCTION INDUSTRY DUE TO HIGH SILICA CONTENT

5.1.2 RISING AWARENESS ABOUT THE TECHNICAL BENEFITS OF RICE HUSK ASH

5.1.3 GROWTH IN PRODUCTION OF HIGH-QUALITY SILICA

5.2 RESTRAINTS

5.2.1 PROBLEMS ASSOCIATED WITH WATER/CEMENT RATIO BY USING RICE HUSK ASH

5.2.2 STRONG MARKET REACH OF SUBSTITUTES

5.3 OPPORTUNITIES

5.3.1 GROWING DEMAND OWING TO ADHERENCE TO ENVIRONMENTAL REGULATORY NORMS

5.3.2 INCREASING USE OF RICE HUSK ASH TO PRODUCE RUBBER TIRES

5.3.3 ABUNDANT AVAILABILITY OF RICE HUSK ASH

5.4 CHALLENGES

5.4.1 DISPOSAL ISSUES ASSOCIATED WITH RICE HUSK ASH

5.4.2 HIGH DEPENDENCY ON THE PRODUCTION OF RICE PADDY

6 GLOBAL RICE HUSK ASH MARKET, BY FORM

6.1 OVERVIEW

6.2 PALLETS

6.3 POWDER

6.4 FLAKE

6.5 NODULE / GRANULES

7 GLOBAL RICE HUSK ASH MARKET, BY SILICON CONTENT

7.1 OVERVIEW

7.2 85-89%

7.3 90-94%

7.4 MORE THAN 95%

7.5 80-84%

8 GLOBAL RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION

8.1 OVERVIEW

8.2 CONCRETE MIXES

8.2.1 CONCRETE MIXES, BY TYPE

8.2.1.1 GREEN CONCRETE

8.2.1.2 HIGH PERFORMANCE CONCRETE

8.2.1.3 OTHERS

8.3 BUILDING BLOCKS

8.4 REFRACTORY BRICKS

8.5 METAL SHEETS

8.6 ROOFING SHINGLES

8.7 INSULATORS

8.8 WATER PROOFING CHEMICALS

8.9 PESTICIDES

8.1 OTHERS

9 GLOBAL RICE HUSK ASH MARKET, BY GEOGRAPHY

9.1 OVERVIEW

9.2 ASIA-PACIFIC

9.2.1 CHINA

9.2.2 INDIA

9.2.3 JAPAN

9.2.4 SOUTH KOREA

9.2.5 THAILAND

9.2.6 INDONESIA

9.2.7 AUSTRALIA & NEW ZEALAND

9.2.8 PHILIPPINES

9.2.9 MALAYSIA

9.2.10 SINGAPORE

9.2.11 REST OF ASIA-PACIFIC

9.3 EUROPE

9.3.1 GERMANY

9.3.2 U.K.

9.3.3 FRANCE

9.3.4 ITALY

9.3.5 SPAIN

9.3.6 RUSSIA

9.3.7 SWITZERLAND

9.3.8 TURKEY

9.3.9 BELGIUM

9.3.10 NETHERLANDS

9.3.11 LUXEMBURG

9.3.12 REST OF EUROPE

9.4 NORTH AMERICA

9.4.1 U.S.

9.4.2 CANADA

9.4.3 MEXICO

9.5 MIDDLE EAST AND AFRICA

9.5.1 EGYPT

9.5.2 SAUDI ARABIA

9.5.3 ISRAEL

9.5.4 SOUTH AFRICA

9.5.5 UNITED ARAB EMIRATES

9.5.6 REST OF MIDDLE EAST AND AFRICA

9.6 SOUTH AMERICA

9.6.1 BRAZIL

9.6.2 ARGENTINA

9.6.3 REST OF SOUTH AMERICA

10 GLOBAL RICE HUSK ASH MARKET, COMPANY LANDSCAPE

10.1 COMPANY SHARE ANALYSIS: GLOBAL

10.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

10.3 COMPANY SHARE ANALYSIS: EUROPE

10.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

11 SWOT ANALYSIS

12 COMPANY PROFILES

12.1 GLOBAL RECYCLING

12.1.1 COMPANY SNAPSHOT

12.1.2 COMPANY SHARE ANALYSIS

12.1.3 PRODUCT PORTFOLIO

12.1.4 RECENT UPDATE

12.2 THE AGRILECTIC COMPANIES

12.2.1 COMPANY SNAPSHOT

12.2.2 COMPANY SHARE ANALYSIS

12.2.3 PRODUCT PORTFOLIO

12.2.4 RECENT UPDATE

12.3 RICE HUSK ASH (THAILAND)

12.3.1 COMPANY SNAPSHOT

12.3.2 COMPANY SHARE ANALYSIS

12.3.3 PRODUCT PORTFOLIO

12.3.4 RECENT UPDATE

12.4 JASORIYA RICE MILL

12.4.1 COMPANY SNAPSHOT

12.4.2 COMPANY SHARE ANALYSIS

12.4.3 PRODUCT PORTFOLIO

12.4.4 RECENT UPDATE

12.5 BRISIL

12.5.1 COMPANY SNAPSHOT

12.5.2 COMPANY SHARE ANALYSIS

12.5.3 PRODUCT PORTFOLIO

12.5.4 RECENT UPDATE

12.6 PIONEER CARBON

12.6.1 COMPANY SNAPSHOT

12.6.2 PRODUCT PORTFOLIO

12.6.3 RECENT UPDATE

12.7 ASTRRA CHEMICALS

12.7.1 COMPANY SNAPSHOT

12.7.2 PRODUCT PORTFOLIO

12.7.3 RECENT UPDATE

12.8 GURU CORPORATION

12.8.1 COMPANY SNAPSHOT

12.8.2 PRODUCT PORTFOLIO

12.8.3 RECENT UPDATE

12.9 K V METACHEM

12.9.1 COMPANY SNAPSHOT

12.9.2 PRODUCT PORTFOLIO

12.9.3 RECENT UPDATE

13 QUESTIONNAIRE

14 RELATED REPORTS

Lista de Tabela

TABLE 1 IMPORT DATA OF SLAG AND ASH, INCL. SEAWEED ASH ""KELP"" (EXCLUDING SLAG, INCL. GRANULATED, FROM THE MANUFACTURE; HS CODE – 262190 (USD THOUSAND)

TABLE 2 EXPORT DATA OF SLAG AND ASH, INCL. SEAWEED ASH ""KELP"" (EXCLUDING SLAG, INCL. GRANULATED, FROM THE MANUFACTURE; HS CODE – 262190 (USD THOUSAND)

TABLE 3 COMPRESSION STRENGTH OF CONCRETE WITH DIFFERENT PERCENTAGES OF RICE HUSK ASH

TABLE 4 GLOBAL RICE HUSK ASH MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 5 GLOBAL RICE HUSK ASH MARKET, BY FORM, 2020-2029 (KILO TONNE)

TABLE 6 GLOBAL PALLETS IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 7 GLOBAL PALLETS IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (KILO TONNE)

TABLE 8 GLOBAL POWDER IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 9 GLOBAL POWDER IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (KILO TONNE)

TABLE 10 GLOBAL FLAKE IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 11 GLOBAL FLAKE IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (KILO TONNE)

TABLE 12 GLOBAL NODULE / GRANULES IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 13 GLOBAL NODULE / GRANULES IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (KILO TONNE)

TABLE 14 GLOBAL RICE HUSK ASH MARKET, BY SILICON CONTENT, 2020-2029 (USD THOUSAND)

TABLE 15 GLOBAL RICE HUSK ASH MARKET, BY SILICON CONTENT, 2020-2029 (KILO TONNE)

TABLE 16 GLOBAL 85-89% IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 17 GLOBAL 85-89% IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (KILO TONNE)

TABLE 18 GLOBAL 90-94% IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 19 GLOBAL 90-94% IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (KILO TONNE)

TABLE 20 GLOBAL MORE THAN 95% IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 21 GLOBAL MORE THAN 95% IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (KILO TONNE)

TABLE 22 GLOBAL 80-84% IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 23 GLOBAL 80-84% IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (KILO TONNE)

TABLE 24 GLOBAL RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 25 GLOBAL RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION, 2020-2029 (KILO TONNE)

TABLE 26 GLOBAL CONCRETE MIXES IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 27 GLOBAL CONCRETE MIXES IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (KILO TONNE)

TABLE 28 GLOBAL CONCRETE MIXES IN RICE HUSK ASH MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 29 GLOBAL CONCRETE MIXES IN RICE HUSK ASH MARKET, BY TYPE, 2020-2029 (KILO TONNE)

TABLE 30 GLOBAL BUILDING BLOCKS IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 31 GLOBAL BUILDING BLOCKS IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (KILO TONNE)

TABLE 32 GLOBAL REFRACTORY BRICKS IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 33 GLOBAL REFRACTORY BRICKS IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (KILO TONNE)

TABLE 34 GLOBAL METAL SHEETS IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 35 GLOBAL METAL SHEETS IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (KILO TONNE)

TABLE 36 GLOBAL ROOFING SHINGLES IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 37 GLOBAL ROOFING SHINGLES IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (KILO TONNE)

TABLE 38 GLOBAL INSULATORS IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 39 GLOBAL INSULATORS IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (KILO TONNE)

TABLE 40 GLOBAL WATER PROOFING CHEMICALS IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 41 GLOBAL WATER PROOFING CHEMICALS IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (KILO TONNE)

TABLE 42 GLOBAL PESTICIDES IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 43 GLOBAL PESTICIDES IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (KILO TONNE)

TABLE 44 GLOBAL OTHERS IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 45 GLOBAL OTHERS IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (KILO TONNE)

TABLE 46 GLOBAL RICE HUSK ASH MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 47 GLOBAL RICE HUSK ASH MARKET, BY REGION, 2020-2029 (KILO TONNE)

TABLE 48 ASIA-PACIFIC RICE HUSK ASH MARKET, BY COUNTRY, 2020-2029 (USD THOUSAND)

TABLE 49 ASIA-PACIFIC RICE HUSK ASH MARKET, BY COUNTRY, 2020-2029 (KILO TONNE)

TABLE 50 ASIA-PACIFIC RICE HUSK ASH MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 51 ASIA-PACIFIC RICE HUSK ASH MARKET, BY FORM, 2020-2029 (KILO TONNE)

TABLE 52 ASIA-PACIFIC RICE HUSK ASH MARKET, BY SILICON CONTENT, 2020-2029 (USD THOUSAND)

TABLE 53 ASIA-PACIFIC RICE HUSK ASH MARKET, BY SILICON CONTENT, 2020-2029 (KILO TONNE)

TABLE 54 ASIA-PACIFIC RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 55 ASIA-PACIFIC RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION, 2020-2029 (KILO TONNE)

TABLE 56 ASIA-PACIFIC CONCRETE MIXES IN RICE HUSK ASH MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 57 ASIA-PACIFIC CONCRETE MIXES IN RICE HUSK ASH MARKET, BY TYPE, 2020-2029 (KILO TONNE)

TABLE 58 CHINA RICE HUSK ASH MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 59 CHINA RICE HUSK ASH MARKET, BY FORM, 2020-2029 (KILO TONNE)

TABLE 60 CHINA RICE HUSK ASH MARKET, BY SILICON CONTENT, 2020-2029 (USD THOUSAND)

TABLE 61 CHINA RICE HUSK ASH MARKET, BY SILICON CONTENT, 2020-2029 (KILO TONNE)

TABLE 62 CHINA RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 63 CHINA RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION, 2020-2029 (KILO TONNE)

TABLE 64 CHINA CONCRETE MIXES IN RICE HUSK ASH MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 65 CHINA CONCRETE MIXES IN RICE HUSK ASH MARKET, BY TYPE, 2020-2029 (KILO TONNE)

TABLE 66 INDIA RICE HUSK ASH MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 67 INDIA RICE HUSK ASH MARKET, BY FORM, 2020-2029 (KILO TONNE)

TABLE 68 INDIA RICE HUSK ASH MARKET, BY SILICON CONTENT, 2020-2029 (USD THOUSAND)

TABLE 69 INDIA RICE HUSK ASH MARKET, BY SILICON CONTENT, 2020-2029 (KILO TONNE)

TABLE 70 INDIA RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 71 INDIA RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION, 2020-2029 (KILO TONNE)

TABLE 72 INDIA CONCRETE MIXES IN RICE HUSK ASH MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 73 INDIA CONCRETE MIXES IN RICE HUSK ASH MARKET, BY TYPE, 2020-2029 (KILO TONNE)

TABLE 74 JAPAN RICE HUSK ASH MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 75 JAPAN RICE HUSK ASH MARKET, BY FORM, 2020-2029 (KILO TONNE)

TABLE 76 JAPAN RICE HUSK ASH MARKET, BY SILICON CONTENT, 2020-2029 (USD THOUSAND)

TABLE 77 JAPAN RICE HUSK ASH MARKET, BY SILICON CONTENT, 2020-2029 (KILO TONNE)

TABLE 78 JAPAN RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 79 JAPAN RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION, 2020-2029 (KILO TONNE)

TABLE 80 JAPAN CONCRETE MIXES IN RICE HUSK ASH MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 81 JAPAN CONCRETE MIXES IN RICE HUSK ASH MARKET, BY TYPE, 2020-2029 (KILO TONNE)

TABLE 82 SOUTH KOREA RICE HUSK ASH MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 83 SOUTH KOREA RICE HUSK ASH MARKET, BY FORM, 2020-2029 (KILO TONNE)

TABLE 84 SOUTH KOREA RICE HUSK ASH MARKET, BY SILICON CONTENT, 2020-2029 (USD THOUSAND)

TABLE 85 SOUTH KOREA RICE HUSK ASH MARKET, BY SILICON CONTENT, 2020-2029 (KILO TONNE)

TABLE 86 SOUTH KOREA RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 87 SOUTH KOREA RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION, 2020-2029 (KILO TONNE)

TABLE 88 SOUTH KOREA CONCRETE MIXES IN RICE HUSK ASH MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 89 SOUTH KOREA CONCRETE MIXES IN RICE HUSK ASH MARKET, BY TYPE, 2020-2029 (KILO TONNE)

TABLE 90 THAILAND RICE HUSK ASH MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 91 THAILAND RICE HUSK ASH MARKET, BY FORM, 2020-2029 (KILO TONNE)

TABLE 92 THAILAND RICE HUSK ASH MARKET, BY SILICON CONTENT, 2020-2029 (USD THOUSAND)

TABLE 93 THAILAND RICE HUSK ASH MARKET, BY SILICON CONTENT, 2020-2029 (KILO TONNE)

TABLE 94 THAILAND RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 95 THAILAND RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION, 2020-2029 (KILO TONNE)

TABLE 96 THAILAND CONCRETE MIXES IN RICE HUSK ASH MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 97 THAILAND CONCRETE MIXES IN RICE HUSK ASH MARKET, BY TYPE, 2020-2029 (KILO TONNE)

TABLE 98 INDONESIA RICE HUSK ASH MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 99 INDONESIA RICE HUSK ASH MARKET, BY FORM, 2020-2029 (KILO TONNE)

TABLE 100 INDONESIA RICE HUSK ASH MARKET, BY SILICON CONTENT, 2020-2029 (USD THOUSAND)

TABLE 101 INDONESIA RICE HUSK ASH MARKET, BY SILICON CONTENT, 2020-2029 (KILO TONNE)

TABLE 102 INDONESIA RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 103 INDONESIA RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION, 2020-2029 (KILO TONNE)

TABLE 104 INDONESIA CONCRETE MIXES IN RICE HUSK ASH MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 105 INDONESIA CONCRETE MIXES IN RICE HUSK ASH MARKET, BY TYPE, 2020-2029 (KILO TONNE)

TABLE 106 AUSTRALIA & NEW ZEALAND RICE HUSK ASH MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 107 AUSTRALIA & NEW ZEALAND RICE HUSK ASH MARKET, BY FORM, 2020-2029 (KILO TONNE)

TABLE 108 AUSTRALIA & NEW ZEALAND RICE HUSK ASH MARKET, BY SILICON CONTENT, 2020-2029 (USD THOUSAND)

TABLE 109 AUSTRALIA & NEW ZEALAND RICE HUSK ASH MARKET, BY SILICON CONTENT, 2020-2029 (KILO TONNE)

TABLE 110 AUSTRALIA & NEW ZEALAND RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 111 AUSTRALIA & NEW ZEALAND RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION, 2020-2029 (KILO TONNE)

TABLE 112 AUSTRALIA & NEW ZEALAND CONCRETE MIXES IN RICE HUSK ASH MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 113 AUSTRALIA & NEW ZEALAND CONCRETE MIXES IN RICE HUSK ASH MARKET, BY TYPE, 2020-2029 (KILO TONNE)

TABLE 114 PHILIPPINES RICE HUSK ASH MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 115 PHILIPPINES RICE HUSK ASH MARKET, BY FORM, 2020-2029 (KILO TONNE)

TABLE 116 PHILIPPINES RICE HUSK ASH MARKET, BY SILICON CONTENT, 2020-2029 (USD THOUSAND)

TABLE 117 PHILIPPINES RICE HUSK ASH MARKET, BY SILICON CONTENT, 2020-2029 (KILO TONNE)

TABLE 118 PHILIPPINES RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 119 PHILIPPINES RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION, 2020-2029 (KILO TONNE)

TABLE 120 PHILIPPINES CONCRETE MIXES IN RICE HUSK ASH MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 121 PHILIPPINES CONCRETE MIXES IN RICE HUSK ASH MARKET, BY TYPE, 2020-2029 (KILO TONNE)

TABLE 122 MALAYSIA RICE HUSK ASH MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 123 MALAYSIA RICE HUSK ASH MARKET, BY FORM, 2020-2029 (KILO TONNE)

TABLE 124 MALAYSIA RICE HUSK ASH MARKET, BY SILICON CONTENT, 2020-2029 (USD THOUSAND)

TABLE 125 MALAYSIA RICE HUSK ASH MARKET, BY SILICON CONTENT, 2020-2029 (KILO TONNE)

TABLE 126 MALAYSIA RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 127 MALAYSIA RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION, 2020-2029 (KILO TONNE)

TABLE 128 MALAYSIA CONCRETE MIXES IN RICE HUSK ASH MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 129 MALAYSIA CONCRETE MIXES IN RICE HUSK ASH MARKET, BY TYPE, 2020-2029 (KILO TONNE)

TABLE 130 SINGAPORE RICE HUSK ASH MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 131 SINGAPORE RICE HUSK ASH MARKET, BY FORM, 2020-2029 (KILO TONNE)

TABLE 132 SINGAPORE RICE HUSK ASH MARKET, BY SILICON CONTENT, 2020-2029 (USD THOUSAND)

TABLE 133 SINGAPORE RICE HUSK ASH MARKET, BY SILICON CONTENT, 2020-2029 (KILO TONNE)

TABLE 134 SINGAPORE RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 135 SINGAPORE RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION, 2020-2029 (KILO TONNE)

TABLE 136 SINGAPORE CONCRETE MIXES IN RICE HUSK ASH MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 137 SINGAPORE CONCRETE MIXES IN RICE HUSK ASH MARKET, BY TYPE, 2020-2029 (KILO TONNE)

TABLE 138 REST OF ASIA-PACIFIC RICE HUSK ASH, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 139 REST OF ASIA-PACIFIC RICE ASH MARKET, BY FORM, 2020-2029 (KILO TONNE)

TABLE 140 EUROPE RICE HUSK ASH MARKET, BY COUNTRY, 2020-2029 (USD THOUSAND)

TABLE 141 EUROPE RICE HUSK ASH MARKET, BY COUNTRY, 2020-2029 (KILO TONNE)

TABLE 142 EUROPE RICE HUSK ASH MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 143 EUROPE RICE HUSK ASH MARKET, BY FORM, 2020-2029 (KILO TONNE)

TABLE 144 EUROPE RICE HUSK ASH MARKET, BY SILICON CONTENT, 2020-2029 (USD THOUSAND)

TABLE 145 EUROPE RICE HUSK ASH MARKET, BY SILICON CONTENT, 2020-2029 (KILO TONNE)

TABLE 146 EUROPE RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 147 EUROPE RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION, 2020-2029 (KILO TONNE)

TABLE 148 EUROPE CONCRETE MIXES IN RICE HUSK ASH MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 149 EUROPE CONCRETE MIXES IN RICE HUSK ASH MARKET, BY TYPE, 2020-2029 (KILO TONNE)

TABLE 150 GERMANY RICE HUSK ASH MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 151 GERMANY RICE HUSK ASH MARKET, BY FORM, 2020-2029 (KILO TONNE)

TABLE 152 GERMANY RICE HUSK ASH MARKET, BY SILICON CONTENT, 2020-2029 (USD THOUSAND)

TABLE 153 GERMANY RICE HUSK ASH MARKET, BY SILICON CONTENT, 2020-2029 (KILO TONNE)

TABLE 154 GERMANY RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 155 GERMANY RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION, 2020-2029 (KILO TONNE)

TABLE 156 GERMANY CONCRETE MIXES IN RICE HUSK ASH MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 157 GERMANY CONCRETE MIXES IN RICE HUSK ASH MARKET, BY TYPE, 2020-2029 (KILO TONNE)

TABLE 158 U.K. RICE HUSK ASH MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 159 U.K. RICE HUSK ASH MARKET, BY FORM, 2020-2029 (KILO TONNE)

TABLE 160 U.K. RICE HUSK ASH MARKET, BY SILICON CONTENT, 2020-2029 (USD THOUSAND)

TABLE 161 U.K. RICE HUSK ASH MARKET, BY SILICON CONTENT, 2020-2029 (KILO TONNE)

TABLE 162 U.K. RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 163 U.K. RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION, 2020-2029 (KILO TONNE)

TABLE 164 U.K. CONCRETE MIXES IN RICE HUSK ASH MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 165 U.K. CONCRETE MIXES IN RICE HUSK ASH MARKET, BY TYPE, 2020-2029 (KILO TONNE)

TABLE 166 FRANCE RICE HUSK ASH MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 167 FRANCE RICE HUSK ASH MARKET, BY FORM, 2020-2029 (KILO TONNE)

TABLE 168 FRANCE RICE HUSK ASH MARKET, BY SILICON CONTENT, 2020-2029 (USD THOUSAND)

TABLE 169 FRANCE RICE HUSK ASH MARKET, BY SILICON CONTENT, 2020-2029 (KILO TONNE)

TABLE 170 FRANCE RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 171 FRANCE RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION, 2020-2029 (KILO TONNE)

TABLE 172 FRANCE CONCRETE MIXES IN RICE HUSK ASH MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 173 FRANCE CONCRETE MIXES IN RICE HUSK ASH MARKET, BY TYPE, 2020-2029 (KILO TONNE)

TABLE 174 ITALY RICE HUSK ASH MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 175 ITALY RICE HUSK ASH MARKET, BY FORM, 2020-2029 (KILO TONNE)

TABLE 176 ITALY RICE HUSK ASH MARKET, BY SILICON CONTENT, 2020-2029 (USD THOUSAND)

TABLE 177 ITALY RICE HUSK ASH MARKET, BY SILICON CONTENT, 2020-2029 (KILO TONNE)

TABLE 178 ITALY RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 179 ITALY RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION, 2020-2029 (KILO TONNE)

TABLE 180 ITALY CONCRETE MIXES IN RICE HUSK ASH MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 181 ITALY CONCRETE MIXES IN RICE HUSK ASH MARKET, BY TYPE, 2020-2029 (KILO TONNE)

TABLE 182 SPAIN RICE HUSK ASH MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 183 SPAIN RICE HUSK ASH MARKET, BY FORM, 2020-2029 (KILO TONNE)

TABLE 184 SPAIN RICE HUSK ASH MARKET, BY SILICON CONTENT, 2020-2029 (USD THOUSAND)

TABLE 185 SPAIN RICE HUSK ASH MARKET, BY SILICON CONTENT, 2020-2029 (KILO TONNE)

TABLE 186 SPAIN RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 187 SPAIN RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION, 2020-2029 (KILO TONNE)

TABLE 188 SPAIN CONCRETE MIXES IN RICE HUSK ASH MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 189 SPAIN CONCRETE MIXES IN RICE HUSK ASH MARKET, BY TYPE, 2020-2029 (KILO TONNE)

TABLE 190 RUSSIA RICE HUSK ASH MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 191 RUSSIA RICE HUSK ASH MARKET, BY FORM, 2020-2029 (KILO TONNE)

TABLE 192 RUSSIA RICE HUSK ASH MARKET, BY SILICON CONTENT, 2020-2029 (USD THOUSAND)

TABLE 193 RUSSIA RICE HUSK ASH MARKET, BY SILICON CONTENT, 2020-2029 (KILO TONNE)

TABLE 194 RUSSIA RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 195 RUSSIA RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION, 2020-2029 (KILO TONNE)

TABLE 196 RUSSIA CONCRETE MIXES IN RICE HUSK ASH MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 197 RUSSIA CONCRETE MIXES IN RICE HUSK ASH MARKET, BY TYPE, 2020-2029 (KILO TONNE)

TABLE 198 SWITZERLAND RICE HUSK ASH MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 199 SWITZERLAND RICE HUSK ASH MARKET, BY FORM, 2020-2029 (KILO TONNE)

TABLE 200 SWITZERLAND RICE HUSK ASH MARKET, BY SILICON CONTENT, 2020-2029 (USD THOUSAND)

TABLE 201 SWITZERLAND RICE HUSK ASH MARKET, BY SILICON CONTENT, 2020-2029 (KILO TONNE)

TABLE 202 SWITZERLAND RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 203 SWITZERLAND RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION, 2020-2029 (KILO TONNE)

TABLE 204 SWITZERLAND CONCRETE MIXES IN RICE HUSK ASH MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 205 SWITZERLAND CONCRETE MIXES IN RICE HUSK ASH MARKET, BY TYPE, 2020-2029 (KILO TONNE)

TABLE 206 TURKEY RICE HUSK ASH MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 207 TURKEY RICE HUSK ASH MARKET, BY FORM, 2020-2029 (KILO TONNE)

TABLE 208 TURKEY RICE HUSK ASH MARKET, BY SILICON CONTENT, 2020-2029 (USD THOUSAND)

TABLE 209 TURKEY RICE HUSK ASH MARKET, BY SILICON CONTENT, 2020-2029 (KILO TONNE)

TABLE 210 TURKEY RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 211 TURKEY RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION, 2020-2029 (KILO TONNE)

TABLE 212 TURKEY CONCRETE MIXES IN RICE HUSK ASH MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 213 TURKEY CONCRETE MIXES IN RICE HUSK ASH MARKET, BY TYPE, 2020-2029 (KILO TONNE)

TABLE 214 BELGIUM RICE HUSK ASH MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 215 BELGIUM RICE HUSK ASH MARKET, BY FORM, 2020-2029 (KILO TONNE)

TABLE 216 BELGIUM RICE HUSK ASH MARKET, BY SILICON CONTENT, 2020-2029 (USD THOUSAND)

TABLE 217 BELGIUM RICE HUSK ASH MARKET, BY SILICON CONTENT, 2020-2029 (KILO TONNE)

TABLE 218 BELGIUM RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 219 BELGIUM RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION, 2020-2029 (KILO TONNE)

TABLE 220 BELGIUM CONCRETE MIXES IN RICE HUSK ASH MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 221 BELGIUM CONCRETE MIXES IN RICE HUSK ASH MARKET, BY TYPE, 2020-2029 (KILO TONNE)

TABLE 222 NETHERLANDS RICE HUSK ASH MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 223 NETHERLANDS RICE HUSK ASH MARKET, BY FORM, 2020-2029 (KILO TONNE)

TABLE 224 NETHERLANDS RICE HUSK ASH MARKET, BY SILICON CONTENT, 2020-2029 (USD THOUSAND)

TABLE 225 NETHERLANDS RICE HUSK ASH MARKET, BY SILICON CONTENT, 2020-2029 (KILO TONNE)

TABLE 226 NETHERLANDS RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 227 NETHERLANDS RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION, 2020-2029 (KILO TONNE)

TABLE 228 NETHERLANDS CONCRETE MIXES IN RICE HUSK ASH MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 229 NETHERLANDS CONCRETE MIXES IN RICE HUSK ASH MARKET, BY TYPE, 2020-2029 (KILO TONNE)

TABLE 230 LUXEMBURG RICE HUSK ASH MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 231 LUXEMBURG RICE HUSK ASH MARKET, BY FORM, 2020-2029 (KILO TONNE)

TABLE 232 LUXEMBURG RICE HUSK ASH MARKET, BY SILICON CONTENT, 2020-2029 (USD THOUSAND)

TABLE 233 LUXEMBURG RICE HUSK ASH MARKET, BY SILICON CONTENT, 2020-2029 (KILO TONNE)

TABLE 234 LUXEMBURG RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 235 LUXEMBURG RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION, 2020-2029 (KILO TONNE)

TABLE 236 LUXEMBURG CONCRETE MIXES IN RICE HUSK ASH MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 237 LUXEMBURG CONCRETE MIXES IN RICE HUSK ASH MARKET, BY TYPE, 2020-2029 (KILO TONNE)

TABLE 238 REST OF EUROPE IN RICE HUSK ASH MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 239 REST OF EUROPE RICE HUSK ASH MARKET, BY FORM, 2020-2029 (KILO TONNE)

TABLE 240 NORTH AMERICA RICE HUSK ASH MARKET, BY COUNTRY, 2020-2029 (USD THOUSAND)

TABLE 241 NORTH AMERICA RICE HUSK ASH MARKET, BY COUNTRY, 2020-2029 (KILO TONNE)

TABLE 242 NORTH AMERICA RICE HUSK ASH MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 243 NORTH AMERICA RICE HUSK ASH MARKET, BY FORM, 2020-2029 (KILO TONNE)

TABLE 244 NORTH AMERICA RICE HUSK ASH MARKET, BY SILICON CONTENT, 2020-2029 (USD THOUSAND)

TABLE 245 NORTH AMERICA RICE HUSK ASH MARKET, BY SILICON CONTENT, 2020-2029 (KILO TONNE)

TABLE 246 NORTH AMERICA RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 247 NORTH AMERICA RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION, 2020-2029 (KILO TONNE)

TABLE 248 NORTH AMERICA CONCRETE MIXES IN RICE HUSK ASH MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 249 NORTH AMERICA CONCRETE MIXES IN RICE HUSK ASH MARKET, BY TYPE, 2020-2029 (KILO TONNE)

TABLE 250 U.S. RICE HUSK ASH MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 251 U.S. RICE HUSK ASH MARKET, BY FORM, 2020-2029 (KILO TONNE)

TABLE 252 U.S. RICE HUSK ASH MARKET, BY SILICON CONTENT, 2020-2029 (USD THOUSAND)

TABLE 253 U.S. RICE HUSK ASH MARKET, BY SILICON CONTENT, 2020-2029 (KILO TONNE)

TABLE 254 U.S. RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 255 U.S. RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION, 2020-2029 (KILO TONNE)

TABLE 256 U.S. CONCRETE MIXES IN RICE HUSK ASH MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 257 U.S. CONCRETE MIXES IN RICE HUSK ASH MARKET, BY TYPE, 2020-2029 (KILO TONNE)

TABLE 258 CANADA RICE HUSK ASH MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 259 CANADA RICE HUSK ASH MARKET, BY FORM, 2020-2029 (KILO TONNE)

TABLE 260 CANADA RICE HUSK ASH MARKET, BY SILICON CONTENT, 2020-2029 (USD THOUSAND)

TABLE 261 CANADA RICE HUSK ASH MARKET, BY SILICON CONTENT, 2020-2029 (KILO TONNE)

TABLE 262 CANADA RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 263 CANADA RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION, 2020-2029 (KILO TONNE)

TABLE 264 CANADA CONCRETE MIXES IN RICE HUSK ASH MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 265 CANADA CONCRETE MIXES IN RICE HUSK ASH MARKET, BY TYPE, 2020-2029 (KILO TONNE)

TABLE 266 MEXICO RICE HUSK ASH MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 267 MEXICO RICE HUSK ASH MARKET, BY FORM, 2020-2029 (KILO TONNE)

TABLE 268 MEXICO RICE HUSK ASH MARKET, BY SILICON CONTENT, 2020-2029 (USD THOUSAND)

TABLE 269 MEXICO RICE HUSK ASH MARKET, BY SILICON CONTENT, 2020-2029 (KILO TONNE)

TABLE 270 MEXICO RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 271 MEXICO RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION, 2020-2029 (KILO TONNE)

TABLE 272 MEXICO CONCRETE MIXES IN RICE HUSK ASH MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 273 MEXICO CONCRETE MIXES IN RICE HUSK ASH MARKET, BY TYPE, 2020-2029 (KILO TONNE)

TABLE 274 MIDDLE EAST AND AFRICA RICE HUSK ASH MARKET, BY COUNTRY, 2020-2029 (USD THOUSAND)

TABLE 275 MIDDLE EAST AND AFRICA RICE HUSK ASH MARKET, BY COUNTRY, 2020-2029 (KILO TONNE)

TABLE 276 MIDDLE EAST AND AFRICA RICE HUSK ASH MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 277 MIDDLE EAST AND AFRICA RICE HUSK ASH MARKET, BY FORM, 2020-2029 (KILO TONNE)

TABLE 278 MIDDLE EAST AND AFRICA RICE HUSK ASH MARKET, BY SILICON CONTENT, 2020-2029 (USD THOUSAND)

TABLE 279 MIDDLE EAST AND AFRICA RICE HUSK ASH MARKET, BY SILICON CONTENT, 2020-2029 (KILO TONNE)

TABLE 280 MIDDLE EAST AND AFRICA RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 281 MIDDLE EAST AND AFRICA RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION, 2020-2029 (KILO TONNE)

TABLE 282 MIDDLE EAST AND AFRICA CONCRETE MIXES IN RICE HUSK ASH MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 283 MIDDLE EAST AND AFRICA CONCRETE MIXES IN RICE HUSK ASH MARKET, BY TYPE, 2020-2029 (KILO TONNE)

TABLE 284 EGYPT RICE HUSK ASH MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 285 EGYPT RICE HUSK ASH MARKET, BY FORM, 2020-2029 (KILO TONNE)

TABLE 286 EGYPT RICE HUSK ASH MARKET, BY SILICON CONTENT, 2020-2029 (USD THOUSAND)

TABLE 287 EGYPT RICE HUSK ASH MARKET, BY SILICON CONTENT, 2020-2029 (KILO TONNE)

TABLE 288 EGYPT RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 289 EGYPT RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION, 2020-2029 (KILO TONNE)

TABLE 290 EGYPT CONCRETE MIXES IN RICE HUSK ASH MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 291 EGYPT CONCRETE MIXES IN RICE HUSK ASH MARKET, BY TYPE, 2020-2029 (KILO TONNE)

TABLE 292 SAUDI ARABIA RICE HUSK ASH MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 293 SAUDI ARABIA RICE HUSK ASH MARKET, BY FORM, 2020-2029 (KILO TONNE)

TABLE 294 SAUDI ARABIA RICE HUSK ASH MARKET, BY SILICON CONTENT, 2020-2029 (USD THOUSAND)

TABLE 295 SAUDI ARABIA RICE HUSK ASH MARKET, BY SILICON CONTENT, 2020-2029 (KILO TONNE)

TABLE 296 SAUDI ARABIA RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 297 SAUDI ARABIA RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION, 2020-2029 (KILO TONNE)

TABLE 298 SAUDI ARABIA CONCRETE MIXES IN RICE HUSK ASH MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 299 SAUDI ARABIA CONCRETE MIXES IN RICE HUSK ASH MARKET, BY TYPE, 2020-2029 (KILO TONNE)

TABLE 300 ISRAEL RICE HUSK ASH MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 301 ISRAEL RICE HUSK ASH MARKET, BY FORM, 2020-2029 (KILO TONNE)

TABLE 302 ISRAEL RICE HUSK ASH MARKET, BY SILICON CONTENT, 2020-2029 (USD THOUSAND)

TABLE 303 ISRAEL RICE HUSK ASH MARKET, BY SILICON CONTENT, 2020-2029 (KILO TONNE)

TABLE 304 ISRAEL RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 305 ISRAEL RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION, 2020-2029 (KILO TONNE)

TABLE 306 ISRAEL CONCRETE MIXES IN RICE HUSK ASH MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 307 ISRAEL CONCRETE MIXES IN RICE HUSK ASH MARKET, BY TYPE, 2020-2029 (KILO TONNE)

TABLE 308 SOUTH AFRICA RICE HUSK ASH MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 309 SOUTH AFRICA RICE HUSK ASH MARKET, BY FORM, 2020-2029 (KILO TONNE)

TABLE 310 SOUTH AFRICA RICE HUSK ASH MARKET, BY SILICON CONTENT, 2020-2029 (USD THOUSAND)

TABLE 311 SOUTH AFRICA RICE HUSK ASH MARKET, BY SILICON CONTENT, 2020-2029 (KILO TONNE)

TABLE 312 SOUTH AFRICA RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 313 SOUTH AFRICA RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION, 2020-2029 (KILO TONNE)

TABLE 314 SOUTH AFRICA CONCRETE MIXES IN RICE HUSK ASH MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 315 SOUTH AFRICA CONCRETE MIXES IN RICE HUSK ASH MARKET, BY TYPE, 2020-2029 (KILO TONNE)

TABLE 316 UNITED ARAB EMIRATES RICE HUSK ASH MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 317 UNITED ARAB EMIRATES RICE HUSK ASH MARKET, BY FORM, 2020-2029 (KILO TONNE)

TABLE 318 UNITED ARAB EMIRATES RICE HUSK ASH MARKET, BY SILICON CONTENT, 2020-2029 (USD THOUSAND)

TABLE 319 UNITED ARAB EMIRATES RICE HUSK ASH MARKET, BY SILICON CONTENT, 2020-2029 (KILO TONNE)

TABLE 320 UNITED ARAB EMIRATES RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 321 UNITED ARAB EMIRATES RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION, 2020-2029 (KILO TONNE)

TABLE 322 UNITED ARAB EMIRATES CONCRETE MIXES IN RICE HUSK ASH MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 323 UNITED ARAB EMIRATES CONCRETE MIXES IN RICE HUSK ASH MARKET, BY TYPE, 2020-2029 (KILO TONNE)

TABLE 324 REST OF MIDDLE EAST AND AFRICA RICE HUSK ASH MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 325 REST OF MIDDLE EAST AND AFRICA RICE HUSK ASH MARKET, BY FORM, 2020-2029 (KILO TONNE)

TABLE 326 SOUTH AMERICA RICE HUSK ASH MARKET, BY COUNTRY, 2020-2029 (USD THOUSAND)

TABLE 327 SOUTH AMERICA RICE HUSK ASH MARKET, BY COUNTRY, 2020-2029 (KILO TONNE)

TABLE 328 SOUTH AMERICA RICE HUSK ASH MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 329 SOUTH AMERICA RICE HUSK ASH MARKET, BY FORM, 2020-2029 (KILO TONNE)

TABLE 330 SOUTH AMERICA RICE HUSK ASH MARKET, BY SILICON CONTENT, 2020-2029 (USD THOUSAND)

TABLE 331 SOUTH AMERICA RICE HUSK ASH MARKET, BY SILICON CONTENT, 2020-2029 (KILO TONNE)

TABLE 332 SOUTH AMERICA RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 333 SOUTH AMERICA RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION, 2020-2029 (KILO TONNE)

TABLE 334 SOUTH AMERICA CONCRETE MIXES IN RICE HUSK ASH MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 335 SOUTH AMERICA CONCRETE MIXES IN RICE HUSK ASH MARKET, BY TYPE, 2020-2029 (KILO TONNE)

TABLE 336 BRAZIL RICE HUSK ASH MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 337 BRAZIL RICE HUSK ASH MARKET, BY FORM, 2020-2029 (KILO TONNE)

TABLE 338 BRAZIL RICE HUSK ASH MARKET, BY SILICON CONTENT, 2020-2029 (USD THOUSAND)

TABLE 339 BRAZIL RICE HUSK ASH MARKET, BY SILICON CONTENT, 2020-2029 (KILO TONNE)

TABLE 340 BRAZIL RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 341 BRAZIL RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION, 2020-2029 (KILO TONNE)

TABLE 342 BRAZIL CONCRETE MIXES IN RICE HUSK ASH MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 343 BRAZIL CONCRETE MIXES IN RICE HUSK ASH MARKET, BY TYPE, 2020-2029 (KILO TONNE)

TABLE 344 ARGENTINA RICE HUSK ASH MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 345 ARGENTINA RICE HUSK ASH MARKET, BY FORM, 2020-2029 (KILO TONNE)

TABLE 346 ARGENTINA RICE HUSK ASH MARKET, BY SILICON CONTENT, 2020-2029 (USD THOUSAND)

TABLE 347 ARGENTINA RICE HUSK ASH MARKET, BY SILICON CONTENT, 2020-2029 (KILO TONNE)

TABLE 348 ARGENTINA RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 349 ARGENTINA RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION, 2020-2029 (KILO TONNE)

TABLE 350 ARGENTINA CONCRETE MIXES IN RICE HUSK ASH MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 351 ARGENTINA CONCRETE MIXES IN RICE HUSK ASH MARKET, BY TYPE, 2020-2029 (KILO TONNE)

TABLE 352 REST OF SOUTH AMERICA RICE HUSK ASH MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 353 REST OF SOUTH AMERICA RICE HUSK ASH MARKET, BY FORM, 2020-2029 (KILO TONNE)

Lista de Figura

FIGURE 1 GLOBAL RICE HUSK ASH MARKET: SEGMENTATION

FIGURE 2 GLOBAL RICE HUSK ASH MARKET: DATA TRIANGULATION

FIGURE 3 GLOBAL RICE HUSK ASH MARKET: DROC ANALYSIS

FIGURE 4 GLOBAL RICE HUSK ASH MARKET: GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 5 GLOBAL RICE HUSK ASH MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 GLOBAL RICE HUSK ASH MARKET: THE FORM LIFE LINE CURVE

FIGURE 7 GLOBAL RICE HUSK ASH MARKET: MULTIVARIATE MODELLING

FIGURE 8 GLOBAL RICE HUSK ASH MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 GLOBAL RICE RUSK ASH MARKET: DBMR MARKET POSITION GRID

FIGURE 10 GLOBAL RICE HUSK ASH MARKET: DOWNSTREAM APPLICATION COVERAGE GRID

FIGURE 11 GLOBAL RICE HUSK ASH MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 GLOBAL RICE HUSK ASH MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 GLOBAL RICE HUSK ASH MARKET: SEGMENTATION

FIGURE 14 ASIA-PACIFIC IS EXPECTED TO DOMINATE THE GLOBAL RICE HUSK ASH MARKET, WHILE NORTH AMERICA IS EXPECTED TO GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD

FIGURE 15 EXTENSIVE PRODUCT SCOPE IN CONSTRUCTION INDUSTRY DUE TO HIGH SILICA CONTENT IS EXPECTED TO DRIVE GLOBAL RICE HUSK ASH MARKET IN THE FORECAST PERIOD

FIGURE 16 PALLETS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF GLOBAL RICE HUSK ASH MARKET IN 2022 & 2029

FIGURE 17 ASIA-PACIFIC IS THE FASTEST-GROWING MARKET FOR GLOBAL RICE HUSK ASH MARKET MANUFACTURERS IN THE FORECAST PERIOD

FIGURE 18 IMPORT-EXPORT SCENARIO (USD THOUSAND)

FIGURE 19 SUPPLY CHAIN ANALYSIS- GLOBAL RICE HUSK ASH MARKET

FIGURE 20 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE GLOBAL RICE HUSK ASH MARKET

FIGURE 21 GLOBAL RICE HUSK ASH MARKET, BY FORM, 2021

FIGURE 22 GLOBAL RICE HUSK ASH MARKET, BY SILICON CONTENT, 2021

FIGURE 23 GLOBAL RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION, 2021

FIGURE 24 GLOBAL RICE HUSK ASH MARKET: SNAPSHOT (2021)

FIGURE 25 GLOBAL RICE HUSK ASH MARKET: BY GEOGRAPHY (2021)

FIGURE 26 GLOBAL RICE HUSK ASH MARKET: BY GEOGRAPHY (2022 & 2029)

FIGURE 27 GLOBAL RICE HUSK ASH MARKET: BY GEOGRAPHY (2021 & 2029)

FIGURE 28 GLOBAL RICE HUSK ASH MARKET: BY FORM (2022-2029)

FIGURE 29 ASIA-PACIFIC RICE HUSK ASH MARKET: SNAPSHOT (2021)

FIGURE 30 ASIA-PACIFIC RICE HUSK ASH MARKET: BY COUNTRY (2021)

FIGURE 31 ASIA-PACIFIC RICE HUSK ASH MARKET: BY COUNTRY (2022 & 2029)

FIGURE 32 ASIA-PACIFIC RICE HUSK ASH MARKET: BY COUNTRY (2021 & 2029)

FIGURE 33 ASIA-PACIFIC RICE HUSK ASH MARKET: BY FORM (2022 - 2029)

FIGURE 34 EUROPE RICE HUSK ASH MARKET: SNAPSHOT (2021)

FIGURE 35 EUROPE RICE HUSK ASH MARKET: BY COUNTRY (2021)

FIGURE 36 EUROPE RICE HUSK ASH MARKET: BY COUNTRY (2022 & 2029)

FIGURE 37 EUROPE RICE HUSK ASH MARKET: BY COUNTRY (2021 & 2029)

FIGURE 38 EUROPE RICE HUSK ASH MARKET: BY FORM (2022 - 2029)

FIGURE 39 NORTH AMERICA RICE HUSK ASH MARKET: SNAPSHOT (2021)

FIGURE 40 NORTH AMERICA RICE HUSK ASH MARKET: BY COUNTRY (2021)

FIGURE 41 NORTH AMERICA RICE HUSK ASH MARKET: BY COUNTRY (2022 & 2029)

FIGURE 42 NORTH AMERICA RICE HUSK ASH MARKET: BY COUNTRY (2021 & 2029)

FIGURE 43 NORTH AMERICA RICE HUSK ASH MARKET: BY FORM (2022 & 2029)

FIGURE 44 MIDDLE EAST AND AFRICA RICE HUSK ASH MARKET: SNAPSHOT (2021)

FIGURE 45 MIDDLE EAST AND AFRICA RICE HUSK ASH MARKET: BY COUNTRY (2021)

FIGURE 46 MIDDLE EAST AND AFRICA RICE HUSK ASH MARKET: BY COUNTRY (2022 & 2029)

FIGURE 47 MIDDLE EAST AND AFRICA RICE HUSK ASH MARKET: BY COUNTRY (2021 & 2029)

FIGURE 48 MIDDLE EAST AND AFRICA RICE HUSK ASH MARKET: BY FORM (2022 & 2029)

FIGURE 49 SOUTH AMERICA RICE HUSK ASH MARKET: SNAPSHOT (2021)

FIGURE 50 SOUTH AMERICA RICE HUSK ASH MARKET: BY COUNTRY (2021)

FIGURE 51 SOUTH AMERICA RICE HUSK ASH MARKET: BY COUNTRY (2022 & 2029)

FIGURE 52 SOUTH AMERICA RICE HUSK ASH MARKET: BY COUNTRY (2021 & 2029)

FIGURE 53 SOUTH AMERICA RICE HUSK ASH MARKET: BY FORM (2022 & 2029)

FIGURE 54 GLOBAL RICE HUSK ASH MARKET: COMPANY SHARE 2021 (%)

FIGURE 55 NORTH AMERICA RICE HUSK ASH MARKET: COMPANY SHARE 2021 (%)

FIGURE 56 EUROPE RICE HUSK ASH MARKET: COMPANY SHARE 2021 (%)

FIGURE 57 ASIA-PACIFIC RICE HUSK ASH MARKET: COMPANY SHARE 2021 (%)

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.