Mercado global de embalagens de retorta, por tipo de produto (sacos, tabuleiros, caixas e outros), material (PET, polipropileno, folha de alumínio, poliamida (PA), papel e cartão, EVOH e outros), canal de distribuição (off -line e on-line), fim -Utilização (Alimentos, Bebidas, Produtos Farmacêuticos e Outros) – Tendências e Previsão da Indústria até 2029.

Análise de Mercado e Tamanho

A industrialização e a urbanização alteraram as técnicas de processamento e as formas de envio de meios ou fluidos, o que levou à necessidade de embalagens de retort em quase todos os setores onde os fluidos desempenham um papel importante. Portanto, o mercado de embalagens retort foi impulsionado pela necessidade de uma produção mais segura e de uma infraestrutura adequada .

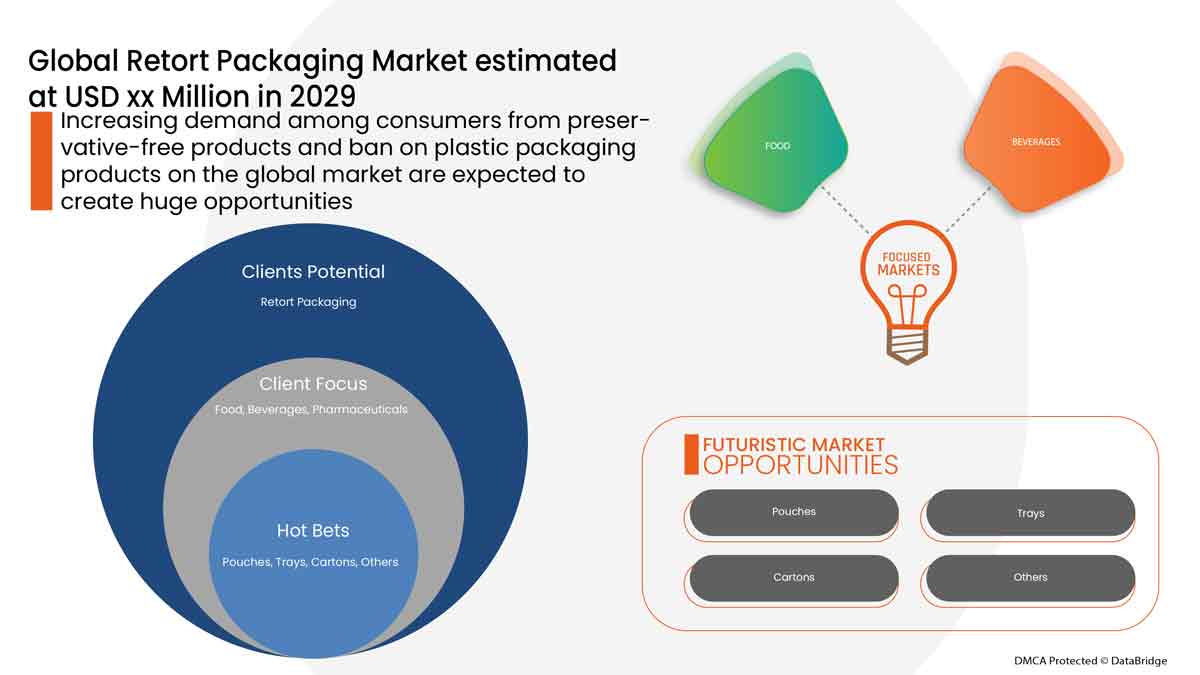

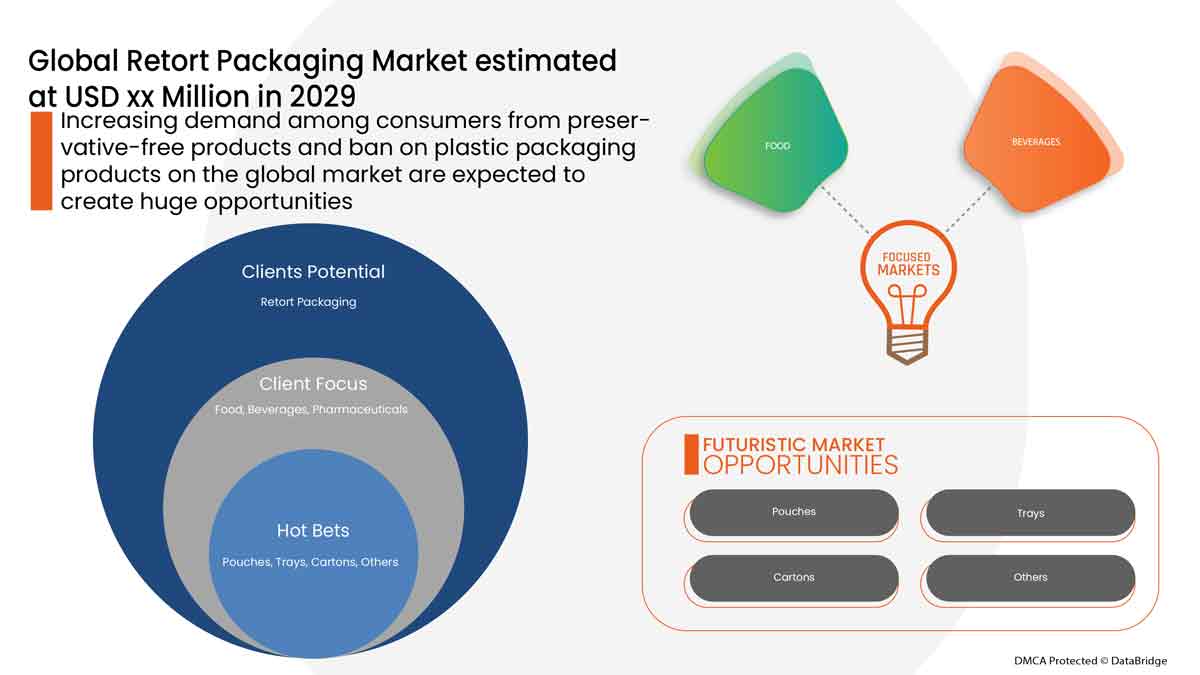

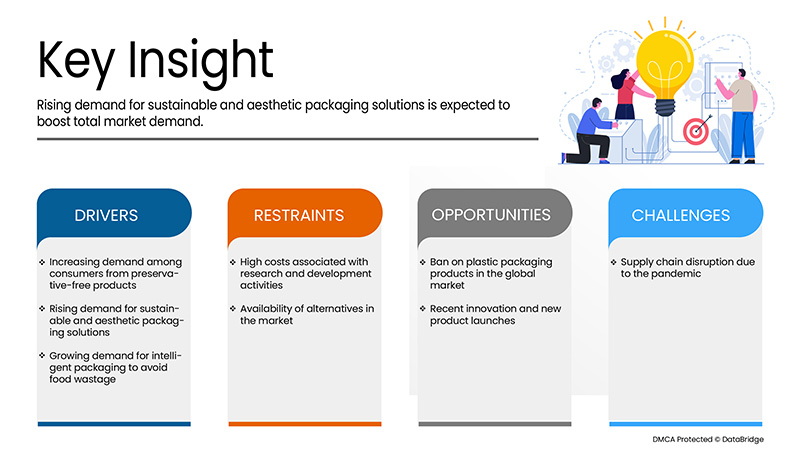

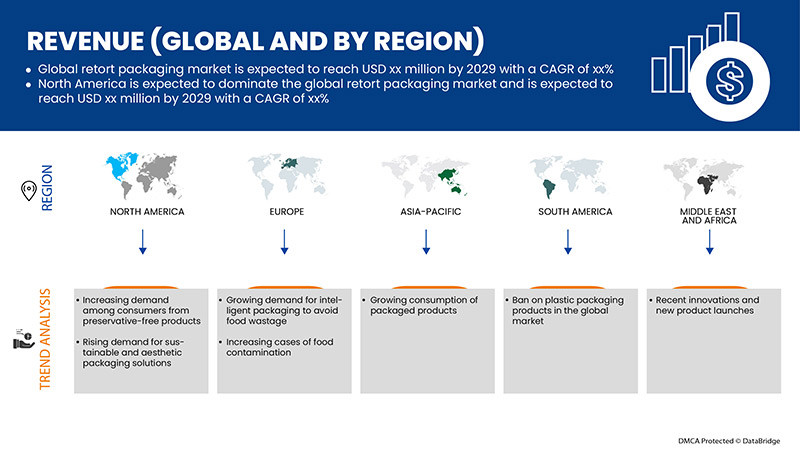

Alguns dos fatores que estão a impulsionar o mercado são a crescente procura dos consumidores por produtos sem conservantes, a crescente procura por soluções de embalagens sustentáveis e estéticas e a crescente procura por embalagens inteligentes para evitar o desperdício alimentar. No entanto, o elevado custo associado às atividades de investigação e desenvolvimento é a restrição que impede o crescimento do mercado.

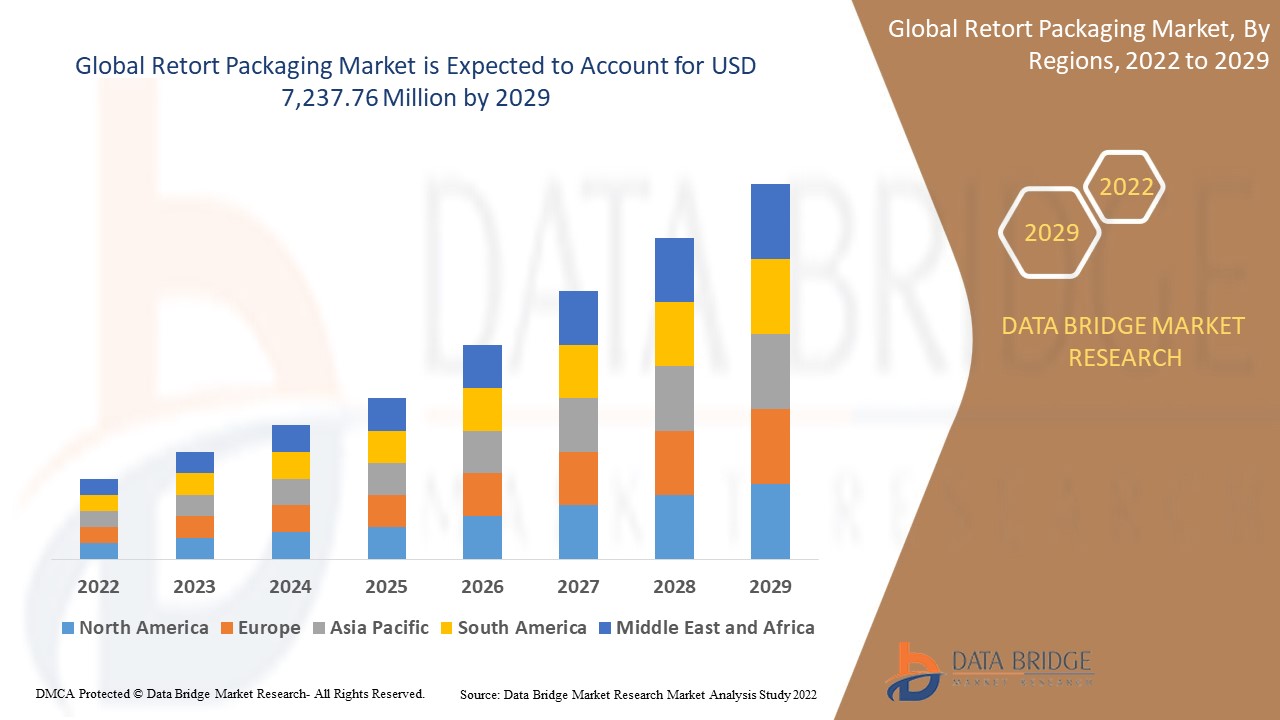

A Data Bridge Market Research analisa que o mercado de embalagens Retort deverá atingir o valor de 7.237,76 milhões de dólares até 2029, com um CAGR de 5,9% durante o período previsto. Os “pouches” representam o maior segmento de tipo de produto no mercado de embalagens Retort devido aos rápidos desenvolvimentos nos caminhos tecnológicos para comercializar a utilização de embalagens alternativas. em profundidade.

|

Métrica de Reporte |

Detalhes |

|

Período de previsão |

2022 a 2029 |

|

Ano base |

2021 |

|

Anos históricos |

2020 |

|

Unidades quantitativas |

Receita em milhões de dólares americanos, volumes em unidades, preços em dólares americanos |

|

Segmentos abrangidos |

Por tipo de produto (sacos, tabuleiros, caixas e outros), por material (PET, polipropileno, folha de alumínio, poliamida (PA), papel e cartão, EVOH e outros), por canal de distribuição (off-line e on- line), por utilização final (Alimentos, Bebidas, Produtos Farmacêuticos e Outros) |

|

Países abrangidos |

EUA, Canadá e México na América do Norte, Reino Unido, Alemanha, França, Espanha, Itália, Holanda, Suíça, Rússia, Bélgica, Turquia, Luxemburgo e restante Europa, China, Coreia do Sul, Japão, Índia, Austrália, Singapura, Malásia , Indonésia, Tailândia, Filipinas e o resto da Ásia-Pacífico na Ásia-Pacífico (APAC), África do Sul, Arábia Saudita, Emirados Árabes Unidos, Israel, Egito e o resto do Médio Oriente e África (MEA) como parte do Médio Oriente e África (MEA), Brasil, Argentina e Resto da América do Sul como parte da América do Sul. |

|

Atores do mercado abrangidos |

ProAmpac, Coveris, Berry Global Inc., FLAIR Flexible Packaging Corporation, IMPAK CORPORATION, PORTCO PACKAGING, Constantia Flexibles, Mondi, Tetra Pak, Clifton Packaging Group Limited, DNP America, LLC., Sonoco Products Company, Amcor plc, Sealed Air, WINPAK LTD., Huhtamaki, LD PACKAGING CO.,LTD, Paharpur 3P, Printpack e Floeter India Retort Pouches (P) Ltd, entre outros. |

Definição de Mercado

A embalagem retort é um tipo de embalagem para alimentos feita de um laminado de plástico flexível e folhas metálicas. Permite a embalagem estéril de uma grande variedade de alimentos e bebidas manipulados por processamento asséptico e é utilizada como alternativa aos métodos tradicionais de enlatamento industrial. Os alimentos embalados variam desde a água a refeições totalmente cozinhadas, termoestabilizadas (tratadas termicamente) e altamente calóricas (1.300 kcal em média), como as refeições prontas a consumir (MREs), que podem ser consumidas frias ou aquecidas por imersão em água. aquecido com um aquecedor de ração sem chama, um componente de refeição introduzido pela primeira vez pelos militares em 1992. Rações de campo, comida espacial, produtos de peixe, refeições de acampamento, noodles rápidos e empresas como Capri Sun e Tasty Bite, todos empregam embalagens de retorta.

Inicialmente, as embalagens de retorta foram desenvolvidas para aplicações industriais e de órgãos de tubos. Gradualmente, o design foi adaptado na indústria biofarmacêutica para métodos de esterilização utilizando materiais compatíveis. E agora está a ser utilizado em quase todos os setores para uma produção segura e infraestruturas adequadas, como alimentos e bebidas e processamento químico, entre outros setores.

Dinâmica do mercado de embalagens para retorta

Esta secção trata da compreensão dos impulsionadores, vantagens, oportunidades, restrições e desafios do mercado. Tudo isto é discutido em detalhe abaixo:

- Aumento da procura dos consumidores por produtos sem conservantes

A retorta ocorre quando os produtos não estéreis são hermeticamente fechados, o que significa literalmente embalagens não estéreis. A embalagem é carregada num recipiente de pressão de retorta e submetida a vapor pressurizado. O produto é também exposto a altas temperaturas durante um período muito mais longo do que no enchimento a quente. O tempo adicional pode deteriorar significativamente a qualidade global e o conteúdo nutricional do produto.

A crescente procura entre os consumidores de todo o mundo por produtos isentos de conservantes é um fator-chave para o mercado global de embalagens de retort. À medida que os consumidores estão mais preocupados com os efeitos nocivos dos conservantes nas suas bebidas, a procura por produtos sem conservantes está no seu auge.

- Aumento da procura de embalagens de retorta por parte das companhias aéreas

Recentemente, tem havido uma mudança crescente de consumidores em direção a opções de embalagens sustentáveis e amigas do ambiente, o que levou à introdução de embalagens totalmente recicláveis e sacos verticais de vários designs. Além de proporcionarem vantagens ambientais, as embalagens sustentáveis podem também ajudar as empresas a aumentar os lucros e a eliminar peças de substituição desnecessárias, melhorando assim a segurança das linhas de produção e minimizando os custos de eliminação. O principal objetivo da embalagem não é apenas proteger o produto contra danos durante o transporte, mas proteger o armazém e as lojas de retalho antes de vender o produto. Diferentes tipos de embalagem são utilizados para diferentes tipos de produtos. Além disso, a embalagem retort é utilizada para produtos alimentares pesados e volumosos e também para outros produtos.

- Crescente procura por embalagens inteligentes para evitar desperdício alimentar

A embalagem inteligente oferece diversas soluções para reduzir o desperdício alimentar, uma vez que fornece diferentes indicadores para evitar a deterioração dos alimentos. Desta forma, o crescente desperdício alimentar está a atrair os consumidores para comprar alimentos com embalagens inteligentes.

A embalagem inteligente inclui indicadores (indicadores de tempo e temperatura; indicadores de integridade ou de gás; indicadores de frescura); códigos de barras e etiquetas de identificação por radiofrequência (RFID); sensores (biossensores; sensores de gás; sensores de oxigénio baseados em fluorescência), entre outros. Por conseguinte, as embalagens inteligentes ajudam os fabricantes de alimentos a monitorizar o estado dos seus produtos alimentares em tempo real, contribuindo assim para a redução do desperdício alimentar.

Além disso, a embalagem inteligente pode também atuar como a principal ferramenta para os consumidores escolherem os seus produtos no retalho, uma vez que os conceitos de embalagem inteligente podem permitir aos consumidores avaliar a qualidade dos produtos. Como resultado, espera-se que as embalagens inteligentes desempenhem um papel importante na atração de consumidores.

- Elevado custo associado às atividades de investigação e desenvolvimento

As despesas com investigação e desenvolvimento estão diretamente associadas à investigação e desenvolvimento de bens ou serviços de uma empresa e de qualquer propriedade intelectual gerada no processo. Uma empresa incorre frequentemente em despesas de I&D no processo de descoberta e criação de novos produtos ou serviços.

As empresas de embalagens dependem muito das suas capacidades de investigação e desenvolvimento; para que possam superar relativamente as despesas com I&D. Por exemplo, mudar as preferências dos consumidores de embalagens comuns para embalagens inteligentes e ativas, aumentando a sensibilização dos consumidores para a segurança alimentar, entre outros. Desta forma, as empresas precisam de investir em atividades de investigação e desenvolvimento para diversificar os seus negócios e encontrar novas oportunidades de crescimento à medida que a tecnologia continua a evoluir.

- Proibição de produtos de embalagem plástica no mercado global

Com o aumento das preocupações ambientais em várias regiões, o governo tomou medidas rigorosas para proibir os produtos plásticos de utilização única e as embalagens não biodegradáveis no mercado. Isto porque os produtos plásticos demoram mais tempo a decompor-se e são perigosos para os animais aquáticos e terrestres.

Por exemplo,

A Natural Environment estima que aproximadamente 100.000 tartarugas marinhas e outros animais marinhos morrem todos os anos porque ficam estrangulados em sacos ou os confundem com comida.

Na América do Norte, os sacos de plástico descartáveis utilizados para embalagens de produtos alimentares e bens de consumo são proibidos. Como resultado, a procura por embalagens de cartão e retortas está a aumentar na região.

São utilizados vários tipos de embalagens em diferentes aplicações, resultando na produção de resíduos e são muito prejudiciais para o ambiente. As embalagens de plástico são utilizadas para embalar bens de consumo, o que produz resíduos plásticos não biodegradáveis, libertando gases tóxicos para o solo, o que é perigoso para os animais e para as águas subterrâneas. Por isso, foram tomadas medidas para proibir as embalagens de sacos de plástico, pois são prejudiciais para o ambiente.

- Interrupção da cadeia de abastecimento devido à pandemia

A COVID-19 interrompeu a cadeia de abastecimento e reduziu os mercados de embalagens retort em todo o mundo. As interrupções levaram ao atraso no stock dos produtos, bem como à redução do acesso e do fornecimento de alimentos e bebidas. Com a persistência da COVID-19, verificaram-se restrições ao transporte, importação e exportação de materiais. Além disso, com a restrição de circulação dos trabalhadores, o fabrico de embalagens retort foi afetado, o que fez com que a procura dos consumidores não fosse satisfeita. Além disso, com as restrições de importação e exportação, tornou-se difícil para os fabricantes fornecerem matérias-primas e os seus produtos finais em todos os países do mundo, o que também teve impacto nos preços das embalagens retort. Desta forma, com as atuais restrições devido à COVID-19, a cadeia de fornecimento de embalagens retort foi interrompida, o que está a criar um grande desafio para os fabricantes.

Com a persistência da COVID-19 e as restrições de circulação, existe uma disrupção na cadeia de abastecimento a nível global, o que representa um grande desafio para o mercado global de embalagens de retort.

Impacto pós-COVID-19 no mercado de embalagens de retorta

A COVID-19 causou um grande impacto no mercado de embalagens retort, uma vez que quase todos os países optaram pelo encerramento de todas as unidades de produção, exceto as que estão envolvidas na produção de produtos essenciais. O governo tomou algumas medidas rigorosas, como a paragem da produção e venda de bens não essenciais, bloqueou o comércio internacional e muitas outras para impedir a propagação da COVID-19. Os únicos negócios que estão a lidar com esta situação de pandemia são os serviços essenciais que estão autorizados a abrir e executar os processos.

Devido ao surto da pandemia provocada pelo vírus, muitos pequenos sectores foram encerrados e, por outro lado, alguns sectores decidiram cortar alguns funcionários, o que resultou num grande desemprego. As embalagens retort são também utilizadas na embalagem de produtos e também nas indústrias. Devido ao surto de uma pandemia, a procura por tais produtos aumentou bastante, especialmente nos sectores médico, da saúde, farmacêutico, alimentar, do comércio electrónico e de vários outros sectores. Mas a procura inesperada, juntamente com capacidades de produção limitadas e perturbações na cadeia de abastecimento, continua a causar dificuldades em todos estes sectores.

Os fabricantes estão a tomar várias decisões estratégicas para recuperar após a COVID-19. Os jogadores estão a conduzir diversas atividades de investigação e desenvolvimento para melhorar a tecnologia envolvida na embalagem da retorta. Com isto, as empresas levarão para o mercado controladores avançados e precisos. Além disso, a utilização de embalagens retort pelas autoridades governamentais em alimentos e bebidas levou ao crescimento do mercado.

Desenvolvimento recente

- Em fevereiro de 2021, a SEE anunciou a aquisição da Foxpak Flexibles Ltd. (Foxpak) pela SEE Ventures, a sua iniciativa de investimento em tecnologias e modelos de negócio disruptivos para acelerar o crescimento. A Foxpak aproveitou as capacidades de impressão digital para imprimir diretamente nos seus materiais de embalagem flexíveis para fortalecer as marcas dos seus clientes. As suas soluções podem ser rapidamente ampliadas ou reduzidas para satisfazer os requisitos de produção de clientes de qualquer dimensão. Esta aquisição ajudará a fortalecer os fluxos de caixa e os lucros. Expande ainda mais o portefólio de embalagens da empresa.

- Em dezembro de 2021, a Sonoco adquiriu a Ball Metalpack. Aquisição complementa o maior franchising de embalagens de consumo da Sonoco. Ball Metalpack, fabricante líder de embalagens metálicas sustentáveis para alimentos e produtos domésticos e o maior produtor de aerossóis da América do Norte. Esta aquisição ajudará a fortalecer os fluxos de caixa e os lucros. Expande ainda mais o portefólio de embalagens da empresa.

Âmbito do mercado global de embalagens de retorta

O mercado de embalagens para retortas está segmentado com base no tipo de produto, material, canal de distribuição e utilização final. O crescimento entre estes segmentos irá ajudá-lo a analisar segmentos de baixo crescimento nos setores e fornecerá aos utilizadores uma visão geral e informações valiosas do mercado para os ajudar a tomar decisões estratégicas para identificar as principais aplicações do mercado.

Tipo de produto

- Bandejas

- Bolsas

- Caixas

- Outros

Com base no tipo de produto, o mercado global de embalagens para retorta está segmentado em tabuleiros, bolsas, caixas e outros.

Material

- ANIMAL DE ESTIMAÇÃO

- Polipropileno

- Folha de alumínio

- Poliamida (PA)

- Papel e cartão

- EVOH

- Outros

Com base no material, o mercado global de embalagens para retortas foi segmentado em PET, polipropileno, folha de alumínio, poliamida (PA), papel e cartão, EVOH e outros.

Canal de Distribuição

- Desligado

- Online

Com base no canal de distribuição, o mercado global de embalagens para retortas foi segmentado em offline e online.

Uso final

- Comida

- Bebidas

- Produtos farmacêuticos

- Outros

Com base na utilização final, o mercado global de embalagens para retortas foi segmentado em alimentos, bebidas, produtos farmacêuticos e outros.

Análise regional/perspetivas do mercado de embalagens de retorta

O mercado de embalagens de retorta é analisado e são fornecidos insights e tendências sobre o tamanho do mercado por tipo de produto, material, canal de distribuição e setor de utilização final, conforme referenciado acima.

Os países abrangidos pelo relatório de mercado de embalagens Retort são os EUA, Canadá e México na América do Norte, Reino Unido, Alemanha, França, Espanha, Itália, Países Baixos, Suíça, Rússia, Bélgica, Turquia, Luxemburgo e o resto da Europa, China , Coreia do Sul , Japão, Índia, Austrália, Singapura, Malásia, Indonésia, Tailândia, Filipinas e o resto da Ásia-Pacífico na Ásia-Pacífico (APAC), África do Sul, Arábia Saudita, Emirados Árabes Unidos, Israel, Egito e o resto do Médio Oriente e África (MEA) como parte do Médio Oriente e África (MEA), Brasil, Argentina e Resto da América do Sul como parte da América do Sul.

Espera-se que o mercado norte-americano de embalagens para retortas seja o que mais rapidamente cresce no mundo. O crescente desenvolvimento da infraestrutura, do comércio e da indústria de embalagens em países emergentes como os EUA, o Canadá e o México é creditado ao domínio do mercado. Os EUA dominam a região da América do Norte devido às principais alternativas de substituição das embalagens convencionais. A Alemanha domina o mercado europeu de embalagens para retortas, devido ao aumento dos investimentos para o crescimento das embalagens para retortas. A China domina o mercado de embalagens Retort da Ásia-Pacífico. A procura nesta região deverá ser impulsionada pelo aumento da procura de embalagens retort para alimentos e bebidas.

A secção de países do relatório também fornece fatores individuais que impactam o mercado e alterações na regulamentação do mercado que impactam as tendências atuais e futuras do mercado. Pontos de dados como a análise da cadeia de valor a montante e a jusante, tendências técnicas e análise das cinco forças de Porter, estudos de caso são alguns dos indicadores utilizados para prever o cenário de mercado para países individuais. Além disso, a presença e a disponibilidade de marcas globais e os seus desafios enfrentados devido à grande ou escassa concorrência de marcas locais e nacionais, ao impacto de tarifas domésticas e rotas comerciais são considerados ao fornecer uma análise de previsão dos dados do país.

Análise do cenário competitivo e da quota de mercado das embalagens de retorta

O panorama competitivo do mercado de embalagens para retortas fornece detalhes por concorrente. Os detalhes incluídos são a visão geral da empresa, finanças da empresa, receitas geradas, potencial de mercado, investimento em investigação e desenvolvimento, novas iniciativas de mercado, presença global, localizações e instalações de produção, capacidades de produção, pontos fortes e fracos da empresa , lançamento do produto, amplitude e abrangência do produto, aplicação domínio. Os pontos de dados fornecidos acima estão apenas relacionados com o foco das empresas relacionadas com o mercado de embalagens de retort.

Alguns dos principais participantes do mercado de embalagens para retortas são a ProAmpac, Coveris, Berry Global Inc., FLAIR Flexible Packaging Corporation, IMPAK CORPORATION, PORTCO PACKAGING, Constantia Flexibles, Mondi, Tetra Pak, Clifton Packaging Group Limited, DNP America, LLC. Sonoco Products Company, Amcor plc, Sealed Air, WINPAK LTD., Huhtamaki, LD PACKAGING CO., LTD, Paharpur 3P, Printpack e Floeter India Retort Pouches (P) Ltd, entre outras

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Índice

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL RETORT PACKAGING MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 PRODUCT TYPE TIMELINE CURVE

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 TECHNOLOGICAL ADVANCEMENTS BY MANUFACTURERS

4.1.1 OVERVIEW

4.1.2 DEVELOPMENT OF ADVANCED SMART PACKAGING PRODUCTS

4.1.3 TEMPERATURE BALANCING SMART PACKAGING

4.1.4 SMART PACKAGING TO IMPROVE CONSUMER SAFETY

4.2 REGULATIONS

4.2.1 OVERVIEW

4.2.2 FOOD AND DRUG ADMINISTRATION

4.2.3 EUROPEAN FOOD PACKAGING REGULATIONS

4.2.4 FOOD SAFETY AND STANDARDS AUTHORITY OF INDIA (FSSAI)

4.3 EMERGING TREND

4.4 PRICE TREND ANALYSIS

4.5 PRODUCTION CONSUMPTION ANALYSIS

4.6 IMPORT-EXPORT SCENARIO

4.7 PORTER’S FIVE FORCE ANALYSIS

4.8 SUPPLIER OVERVIEW

4.9 SUPPLY CHAIN ANALYSIS

4.9.1 OVERVIEW

4.9.2 LOGISTIC COST SCENARIO

4.9.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASING DEMAND AMONG CONSUMERS FOR PRESERVATIVE-FREE PRODUCTS

5.1.2 RISING DEMAND FOR SUSTAINABLE AND AESTHETIC PACKAGING SOLUTIONS

5.1.3 GROWING DEMAND FOR INTELLIGENT PACKAGING TO AVOID FOOD WASTAGE

5.1.4 GROWING CONSUMPTION OF PACKAGED PRODUCTS

5.2 RESTRAINTS

5.2.1 HIGH COSTS ASSOCIATED WITH RESEARCH AND DEVELOPMENT ACTIVITIES

5.2.2 AVAILABILITY OF ALTERNATIVES IN THE MARKET

5.3 OPPORTUNITIES

5.3.1 BAN ON PLASTIC PACKAGING PRODUCTS IN THE GLOBAL MARKET

5.3.2 RECENT INNOVATION AND NEW PRODUCT LAUNCHES

5.3.3 INCREASING CASES OF FOOD CONTAMINATION

5.4 CHALLENGE

5.4.1 SUPPLY CHAIN DISRUPTION DUE TO PANDEMIC

6 GLOBAL RETORT PACKAGING MARKET, BY PRODUCT TYPE

6.1 OVERVIEW

6.2 POUCHES

6.2.1 STAND-UP-POUCHES

6.2.2 GUSSETED POUCHES

6.2.3 BACK-SEAL QUAD

6.2.4 SPOUTED POUCHES

6.3 TRAYS

6.4 CARTONS

6.5 OTHERS

7 GLOBAL RETORT PACKAGING MARKET, BY MATERIAL

7.1 OVERVIEW

7.2 PET

7.3 POLYPROPYLENE

7.4 ALUMINIUM FOIL

7.5 POLYAMIDE (PA)

7.6 PAPER & PAPERBOARD

7.7 EVOH

7.8 OTHERS

8 GLOBAL RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL

8.1 OVERVIEW

8.2 OFFLINE

8.3 ONLINE

9 GLOBAL RETORT PACKAGING MARKET, BY END-USE

9.1 OVERVIEW

9.2 FOOD

9.2.1 READY TO EAT MEALS

9.2.2 MEAT, POULTRY, & SEA FOOD

9.2.3 PET FOOD

9.2.4 BABY FOOD

9.2.5 SOUPS & SAUCES

9.2.6 SPICES & CONDIMENTS

9.2.7 OTHERS

9.3 BEVERAGES

9.3.1 NON-ALCOHOLIC

9.3.2 ALCOHOLIC

9.4 PHARMACEUTICALS

9.5 OTHERS

10 GLOBAL RETORT PACKAGING MARKET, BY REGION

10.1 OVERVIEW

10.2 NORTH AMERICA

10.2.1 U.S.

10.2.2 CANADA

10.2.3 MEXICO

10.3 EUROPE

10.3.1 GERMANY

10.3.2 ITALY

10.3.3 FRANCE

10.3.4 SPAIN

10.3.5 U.K.

10.3.6 RUSSIA

10.3.7 BELGIUM

10.3.8 SWITZERLAND

10.3.9 NETHERLANDS

10.3.10 TURKEY

10.3.11 LUXEMBURG

10.3.12 REST OF EUROPE

10.4 ASIA-PACIFIC

10.4.1 CHINA

10.4.2 JAPAN

10.4.3 SOUTH KOREA

10.4.4 INDIA

10.4.5 AUSTRALIA & NEW ZEALAND

10.4.6 SINGAPORE

10.4.7 INDONESIA

10.4.8 THAILAND

10.4.9 MALAYSIA

10.4.10 PHILIPPINES

10.4.11 REST OF ASIA-PACIFIC

10.5 MIDDLE EAST AND AFRICA

10.5.1 SOUTH AFRICA

10.5.2 SAUDI ARABIA

10.5.3 EGYPT

10.5.4 U.A.E.

10.5.5 ISRAEL

10.5.6 REST OF MIDDLE EAST AND AFRICA

10.6 SOUTH AMERICA

10.6.1 BRAZIL

10.6.2 ARGENTINA

10.6.3 REST OF SOUTH AMERICA

11 GLOBAL RETORT PACKAGING MARKET: COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: GLOBAL

11.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

11.3 COMPANY SHARE ANALYSIS: EUROPE

11.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

12 SWOT ANALYSIS

13 COMPANY PROFILE

13.1 TETRA PAK

13.1.1 COMPANY SNAPSHOT

13.1.2 COMPANY SHARE ANALYSIS

13.1.3 PRODUCT PORTFOLIO

13.1.4 RECENT DEVELOPMENT

13.2 SEALED AIR

13.2.1 COMPANY SNAPSHOT

13.2.2 REVENUE ANALYSIS

13.2.3 COMPANY SHARE ANALYSIS

13.2.4 PRODUCT PORTFOLIO

13.2.5 RECENT DEVELOPMENT

13.3 SONOCO PRODUCTS COMPANY

13.3.1 COMPANY SNAPSHOT

13.3.2 REVENUE ANALYSIS

13.3.3 COMPANY SHARE ANALYSIS

13.3.4 PRODUCT PORTFOLIO

13.3.5 RECENT DEVELOPMENTS

13.4 PROAMPAC

13.4.1 COMPANY SNAPSHOT

13.4.2 COMPANY SHARE ANALYSIS

13.4.3 PRODUCT PORTFOLIO

13.4.4 RECENT DEVELOPMENTS

13.5 AMCOR PLC

13.5.1 COMPANY SNAPSHOT

13.5.2 REVENUE ANALYSIS

13.5.3 COMPANY SHARE ANALYSIS

13.5.4 PRODUCT PORTFOLIO

13.5.5 RECENT DEVELOPMENTS

13.6 BERRY GLOBAL INC.

13.6.1 COMPANY SNAPSHOT

13.6.2 COMPANY SNAPSHOT

13.6.3 PRODUCT PORTFOLIO

13.6.4 RECENT DEVELOPMENT

13.7 CLIFTON PACKAGING GROUP LIMITED

13.7.1 COMPANY SNAPSHOT

13.7.2 PRODUCT PORTFOLIO

13.7.3 RECENT DEVELOPMENT

13.8 CONSTANTIA FLEXIBLES

13.8.1 COMPANY SNAPSHOT

13.8.2 PRODUCT PORTFOLIO

13.8.3 RECENT DEVELOPMENT

13.9 COVERIS

13.9.1 COMPANY SNAPSHOT

13.9.2 RODUCT PORTFOLIO

13.9.3 RECENT DEVELOPMENT

13.1 DNP AMERICA, LLC.

13.10.1 COMPANY SNAPSHOT

13.10.2 PRODUCT PORTFOLIO

13.10.3 RECENT DEVELOPMENT

13.11 FLAIR FLEXIBLE PACKAGING CORPORATION

13.11.1 COMPANY SNAPSHOT

13.11.2 PRODUCT PORTFOLIO

13.11.3 RECENT DEVELOPMENT

13.12 FLOETER INDIA RETORT POUCHES (P) LTD

13.12.1 COMPANY SNAPSHOT

13.12.2 PRODUCT PORTFOLIO

13.12.3 RECENT DEVELOPMENT

13.13 HUHTAMAKI

13.13.1 COMPANY SNAPSHOT

13.13.2 REVENUE ANALYSIS

13.13.3 PRODUCT PORTFOLIO

13.13.4 RECENT DEVELOPMENT

13.14 IMPAK CORPORATION

13.14.1 COMPANY SNAPSHOT

13.14.2 PRODUCT PORTFOLIO

13.14.3 RECENT DEVELOPMENT

13.15 LD PACKAGING CO .,LTD

13.15.1 COMPANY SNAPSHOT

13.15.2 PRODUCT PORTFOLIO

13.15.3 RECENT DEVELOPMENT

13.16 MONDI

13.16.1 COMPANY SNAPSHOT

13.16.2 REVENUE ANALYSIS

13.16.3 PRODUCT PORTFOLIO

13.16.4 RECENT DEVELOPMENTS

13.17 PAHARPUR 3P

13.17.1 COMPANY SNAPSHOT

13.17.2 PRODUCT PORTFOLIO

13.17.3 RECENT DEVELOPMENT

13.18 PORTCO PACKAGING

13.18.1 COMPANY SNAPSHOT

13.18.2 PRODUCT PORTFOLIO

13.18.3 RECENT DEVELOPMENTS

13.19 PRINTPACK

13.19.1 COMPANY SNAPSHOT

13.19.2 PRODUCT PORTFOLIO

13.19.3 RECENT DEVELOPMENT

13.2 WINPAK LTD.

13.20.1 COMPANY SNAPSHOT

13.20.2 REVENUE ANALYSIS

13.20.3 PRODUCT PORTFOLIO

13.20.4 RECENT DEVELOPMENT

14 QUESTIONNAIRE

15 RELATED REPORTS

Lista de Tabela

TABLE 1 GLOBAL RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 2 GLOBAL RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION UNITS)

TABLE 3 GLOBAL POUCHES IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 4 GLOBAL POUCHES IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (MILLION UNITS)

TABLE 5 GLOBAL POUCHES IN RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 6 GLOBAL TRAYS IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 GLOBAL TRAYS IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (MILLION UNITS)

TABLE 8 GLOBAL CARTONS IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 GLOBAL CARTONS IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (MILLION UNITS)

TABLE 10 GLOBAL OTHERS IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 GLOBAL OTHERS IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (MILLION UNITS)

TABLE 12 GLOBAL RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 13 GLOBAL RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (MILLION UNITS)

TABLE 14 GLOBAL PET IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 GLOBAL PET IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (MILLION UNITS)

TABLE 16 GLOBAL POLYPROPYLENE IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 GLOBAL POLYPROPYLENE IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (MILLION UNITS)

TABLE 18 GLOBAL ALUMINUM FOIL IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 GLOBAL ALUMINUM FOIL IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (MILLION UNITS)

TABLE 20 GLOBAL POLYAMIDE (PA) IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 GLOBAL POLYAMIDE (PA) IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (MILLION UNITS)

TABLE 22 GLOBAL PAPER & PAPERBOARD IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 GLOBAL PAPER & PAPERBOARD IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (MILLION UNITS)

TABLE 24 GLOBAL EVOH IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 GLOBAL EVOH IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (MILLION UNITS)

TABLE 26 GLOBAL OTHERS IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 GLOBAL OTHERS IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (MILLION UNITS)

TABLE 28 GLOBAL RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 29 GLOBAL RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (MILLION UNITS)

TABLE 30 GLOBAL OFFLINE IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 GLOBAL OFFLINE IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (MILLION UNITS)

TABLE 32 GLOBAL ONLINE IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 GLOBAL ONLINE IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (MILLION UNITS)

TABLE 34 GLOBAL RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 35 GLOBAL RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (MILLION UNITS)

TABLE 36 GLOBAL FOOD IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 37 GLOBAL FOOD IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (MILLION UNITS)

TABLE 38 GLOBAL FOOD IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 39 GLOBAL BEVERAGES IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 40 GLOBAL BEVERAGES IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (MILLION UNITS)

TABLE 41 GLOBAL BEVERAGES IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 42 GLOBAL PHARMACEUTICAL IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 43 GLOBAL PHARMACEUTICAL IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (MILLION UNITS)

TABLE 44 GLOBAL OTHERS IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 45 GLOBAL OTHERS IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (MILLION UNITS)

TABLE 46 GLOBAL RETORT PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 47 GLOBAL RETORT PACKAGING MARKET, BY REGION, 2020-2029 (MILLION UNITS)

TABLE 48 NORTH AMERICA RETORT PACKAGING MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 49 NORTH AMERICA RETORT PACKAGING MARKET, BY COUNTRY, 2020-2029 (MILLION UNITS)

TABLE 50 NORTH AMERICA RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 51 NORTH AMERICA RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION UNITS)

TABLE 52 NORTH AMERICA POUCHES IN RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 53 NORTH AMERICA RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 54 NORTH AMERICA RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (MILLION UNITS)

TABLE 55 NORTH AMERICA RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 56 NORTH AMERICA RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (MILLION UNITS)

TABLE 57 NORTH AMERICA RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 58 NORTH AMERICA RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (MILLION UNITS)

TABLE 59 NORTH AMERICA FOOD IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 60 NORTH AMERICA BEVERAGES IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 61 U.S. RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 62 U.S. RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION UNITS)

TABLE 63 U.S. POUCHES IN RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 64 U.S. RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 65 U.S. RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (MILLION UNITS)

TABLE 66 U.S. RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 67 U.S. RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (MILLION UNITS)

TABLE 68 U.S. RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 69 U.S. RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (MILLION UNITS)

TABLE 70 U.S. FOOD IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 71 U.S. BEVERAGES IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 72 CANADA RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 73 CANADA RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION UNITS)

TABLE 74 CANADA POUCHES IN RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 75 CANADA RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 76 CANADA RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (MILLION UNITS)

TABLE 77 CANADA RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 78 CANADA RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (MILLION UNITS)

TABLE 79 CANADA RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 80 CANADA RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (MILLION UNITS)

TABLE 81 CANADA FOOD IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 82 CANADA BEVERAGES IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 83 MEXICO RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 84 MEXICO RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION UNITS)

TABLE 85 MEXICO POUCHES IN RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 86 MEXICO RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 87 MEXICO RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (MILLION UNITS)

TABLE 88 MEXICO RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 89 MEXICO RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (MILLION UNITS)

TABLE 90 MEXICO RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 91 MEXICO RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (MILLION UNITS)

TABLE 92 MEXICO FOOD IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 93 MEXICO BEVERAGES IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 94 EUROPE RETORT PACKAGING MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 95 EUROPE RETORT PACKAGING MARKET, BY COUNTRY, 2020-2029 (MILLION UNITS)

TABLE 96 EUROPE RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 97 EUROPE RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION UNITS)

TABLE 98 EUROPE POUCHES IN RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 99 EUROPE RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 100 EUROPE RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (MILLION UNITS)

TABLE 101 EUROPE RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 102 EUROPE RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (MILLION UNITS)

TABLE 103 EUROPE RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 104 EUROPE RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (MILLION UNITS)

TABLE 105 EUROPE FOOD IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 106 EUROPE BEVERAGES IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 107 GERMANY RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 108 GERMANY RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION UNITS)

TABLE 109 GERMANY POUCHES IN RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 110 GERMANY RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 111 GERMANY RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (MILLION UNITS)

TABLE 112 GERMANY RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 113 GERMANY RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (MILLION UNITS)

TABLE 114 GERMANY RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 115 GERMANY RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (MILLION UNITS)

TABLE 116 GERMANY FOOD IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 117 GERMANY BEVERAGES IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 118 ITALY RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 119 ITALY RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION UNITS)

TABLE 120 ITALY POUCHES IN RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 121 ITALY RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 122 ITALY RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (MILLION UNITS)

TABLE 123 ITALY RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 124 ITALY RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (MILLION UNITS)

TABLE 125 ITALY RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 126 ITALY RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (MILLION UNITS)

TABLE 127 ITALY FOOD IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 128 ITALY BEVERAGES IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 129 FRANCE RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 130 FRANCE RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION UNITS)

TABLE 131 FRANCE POUCHES IN RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 132 FRANCE RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 133 FRANCE RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (MILLION UNITS)

TABLE 134 FRANCE RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 135 FRANCE RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (MILLION UNITS)

TABLE 136 FRANCE RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 137 FRANCE RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (MILLION UNITS)

TABLE 138 FRANCE FOOD IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 139 FRANCE BEVERAGES IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 140 SPAIN RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 141 SPAIN RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION UNITS)

TABLE 142 SPAIN POUCHES IN RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 143 SPAIN RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 144 SPAIN RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (MILLION UNITS)

TABLE 145 SPAIN RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 146 SPAIN RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (MILLION UNITS)

TABLE 147 SPAIN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 148 SPAIN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (MILLION UNITS)

TABLE 149 SPAIN FOOD IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 150 SPAIN BEVERAGES IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 151 U.K. RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 152 U.K. RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION UNITS)

TABLE 153 U.K. POUCHES IN RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 154 U.K. RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 155 U.K. RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (MILLION UNITS)

TABLE 156 U.K. RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 157 U.K. RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (MILLION UNITS)

TABLE 158 U.K. RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 159 U.K. RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (MILLION UNITS)

TABLE 160 U.K. FOOD IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 161 U.K. BEVERAGES IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 162 RUSSIA RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 163 RUSSIA RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION UNITS)

TABLE 164 RUSSIA POUCHES IN RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 165 RUSSIA RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 166 RUSSIA RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (MILLION UNITS)

TABLE 167 RUSSIA RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 168 RUSSIA RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (MILLION UNITS)

TABLE 169 RUSSIA RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 170 RUSSIA RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (MILLION UNITS)

TABLE 171 RUSSIA FOOD IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 172 RUSSIA BEVERAGES IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 173 BELGIUM RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 174 BELGIUM RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION UNITS)

TABLE 175 BELGIUM POUCHES IN RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 176 BELGIUM RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 177 BELGIUM RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (MILLION UNITS)

TABLE 178 BELGIUM RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 179 BELGIUM RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (MILLION UNITS)

TABLE 180 BELGIUM RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 181 BELGIUM RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (MILLION UNITS)

TABLE 182 BELGIUM FOOD IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 183 BELGIUM BEVERAGES IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 184 SWITZERLAND RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 185 SWITZERLAND RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION UNITS)

TABLE 186 SWITZERLAND POUCHES IN RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 187 SWITZERLAND RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 188 SWITZERLAND RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (MILLION UNITS)

TABLE 189 SWITZERLAND RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 190 SWITZERLAND RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (MILLION UNITS)

TABLE 191 SWITZERLAND RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 192 SWITZERLAND RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (MILLION UNITS)

TABLE 193 SWITZERLAND FOOD IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 194 SWITZERLAND BEVERAGES IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 195 NETHERLANDS RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 196 NETHERLANDS RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION UNITS)

TABLE 197 NETHERLANDS POUCHES IN RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 198 NETHERLANDS RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 199 NETHERLANDS RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (MILLION UNITS)

TABLE 200 NETHERLANDS RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 201 NETHERLANDS RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (MILLION UNITS)

TABLE 202 NETHERLANDS RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 203 NETHERLANDS RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (MILLION UNITS)

TABLE 204 NETHERLANDS FOOD IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 205 NETHERLANDS BEVERAGES IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 206 TURKEY RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 207 TURKEY RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION UNITS)

TABLE 208 TURKEY POUCHES IN RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 209 TURKEY RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 210 TURKEY RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (MILLION UNITS)

TABLE 211 TURKEY RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 212 TURKEY RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (MILLION UNITS)

TABLE 213 TURKEY RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 214 TURKEY RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (MILLION UNITS)

TABLE 215 TURKEY FOOD IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 216 TURKEY BEVERAGES IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 217 LUXEMBURG RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 218 LUXEMBURG RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION UNITS)

TABLE 219 LUXEMBURG POUCHES IN RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 220 LUXEMBURG RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 221 LUXEMBURG RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (MILLION UNITS)

TABLE 222 LUXEMBURG RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 223 LUXEMBURG RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (MILLION UNITS)

TABLE 224 LUXEMBURG RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 225 LUXEMBURG RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (MILLION UNITS)

TABLE 226 LUXEMBURG FOOD IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 227 LUXEMBURG BEVERAGES IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 228 REST OF EUROPE RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 229 REST OF EUROPE RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION UNITS)

TABLE 230 ASIA-PACIFIC RETORT PACKAGING MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 231 ASIA-PACIFIC RETORT PACKAGING MARKET, BY COUNTRY, 2020-2029 (MILLION UNITS)

TABLE 232 ASIA-PACIFIC RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 233 ASIA-PACIFIC RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION UNITS)

TABLE 234 ASIA-PACIFIC POUCHES IN RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 235 ASIA-PACIFIC RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 236 ASIA-PACIFIC RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (MILLION UNITS)

TABLE 237 ASIA-PACIFIC RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 238 ASIA-PACIFIC RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (MILLION UNITS)

TABLE 239 ASIA-PACIFIC RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 240 ASIA-PACIFIC RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (MILLION UNITS)

TABLE 241 ASIA-PACIFIC FOOD IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 242 ASIA-PACIFIC BEVERAGES IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 243 CHINA RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 244 CHINA RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION UNITS)

TABLE 245 CHINA POUCHES IN RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 246 CHINA RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 247 CHINA RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (MILLION UNITS)

TABLE 248 CHINA RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 249 CHINA RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (MILLION UNITS)

TABLE 250 CHINA RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 251 CHINA RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (MILLION UNITS)

TABLE 252 CHINA FOOD IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 253 CHINA BEVERAGES IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 254 JAPAN RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 255 JAPAN RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION UNITS)

TABLE 256 JAPAN POUCHES IN RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 257 JAPAN RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 258 JAPAN RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (MILLION UNITS)

TABLE 259 JAPAN RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 260 JAPAN RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (MILLION UNITS)

TABLE 261 JAPAN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 262 JAPAN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (MILLION UNITS)

TABLE 263 JAPAN FOOD IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 264 JAPAN BEVERAGES IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 265 SOUTH KOREA RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 266 SOUTH KOREA RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION UNITS)

TABLE 267 SOUTH KOREA POUCHES IN RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 268 SOUTH KOREA RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 269 SOUTH KOREA RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (MILLION UNITS)

TABLE 270 SOUTH KOREA RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 271 SOUTH KOREA RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (MILLION UNITS)

TABLE 272 SOUTH KOREA RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 273 SOUTH KOREA RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (MILLION UNITS)

TABLE 274 SOUTH KOREA FOOD IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 275 SOUTH KOREA BEVERAGES IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 276 INDIA RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 277 INDIA RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION UNITS)

TABLE 278 INDIA POUCHES IN RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 279 INDIA RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 280 INDIA RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (MILLION UNITS)

TABLE 281 INDIA RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 282 INDIA RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (MILLION UNITS)

TABLE 283 INDIA RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 284 INDIA RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (MILLION UNITS)

TABLE 285 INDIA FOOD IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 286 INDIA BEVERAGES IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 287 AUSTRALIA & NEW ZEALAND RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 288 AUSTRALIA & NEW ZEALAND RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION UNITS)

TABLE 289 AUSTRALIA & NEW ZEALAND POUCHES IN RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 290 AUSTRALIA & NEW ZEALAND RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 291 AUSTRALIA & NEW ZEALAND RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (MILLION UNITS)

TABLE 292 AUSTRALIA & NEW ZEALAND RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 293 AUSTRALIA & NEW ZEALAND RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (MILLION UNITS)

TABLE 294 AUSTRALIA & NEW ZEALAND RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 295 AUSTRALIA & NEW ZEALAND RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (MILLION UNITS)

TABLE 296 AUSTRALIA & NEW ZEALAND FOOD IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 297 AUSTRALIA & NEW ZEALAND BEVERAGES IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 298 SINGAPORE RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 299 SINGAPORE RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION UNITS)

TABLE 300 SINGAPORE POUCHES IN RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 301 SINGAPORE RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 302 SINGAPORE RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (MILLION UNITS)

TABLE 303 SINGAPORE RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 304 SINGAPORE RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (MILLION UNITS)

TABLE 305 SINGAPORE RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 306 SINGAPORE RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (MILLION UNITS)

TABLE 307 SINGAPORE FOOD IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 308 SINGAPORE BEVERAGES IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 309 INDONESIA RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 310 INDONESIA RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION UNITS)

TABLE 311 INDONESIA POUCHES IN RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 312 INDONESIA RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 313 INDONESIA RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (MILLION UNITS)

TABLE 314 INDONESIA RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 315 INDONESIA RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (MILLION UNITS)

TABLE 316 INDONESIA RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 317 INDONESIA RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (MILLION UNITS)

TABLE 318 INDONESIA FOOD IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 319 INDONESIA BEVERAGES IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 320 THAILAND RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 321 THAILAND RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION UNITS)

TABLE 322 THAILAND POUCHES IN RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 323 THAILAND RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 324 THAILAND RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (MILLION UNITS)

TABLE 325 THAILAND RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 326 THAILAND RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (MILLION UNITS)

TABLE 327 THAILAND RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 328 THAILAND RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (MILLION UNITS)

TABLE 329 THAILAND FOOD IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 330 THAILAND BEVERAGES IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 331 MALAYSIA RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 332 MALAYSIA RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION UNITS)

TABLE 333 MALAYSIA POUCHES IN RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 334 MALAYSIA RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 335 MALAYSIA RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (MILLION UNITS)

TABLE 336 MALAYSIA RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 337 MALAYSIA RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (MILLION UNITS)

TABLE 338 MALAYSIA RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 339 MALAYSIA RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (MILLION UNITS)

TABLE 340 MALAYSIA FOOD IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 341 MALAYSIA BEVERAGES IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 342 PHILIPPINES RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 343 PHILIPPINES RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION UNITS)

TABLE 344 PHILIPPINES POUCHES IN RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 345 PHILIPPINES RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 346 PHILIPPINES RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (MILLION UNITS)

TABLE 347 PHILIPPINES RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 348 PHILIPPINES RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (MILLION UNITS)

TABLE 349 PHILIPPINES RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 350 PHILIPPINES RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (MILLION UNITS)

TABLE 351 PHILIPPINES FOOD IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 352 PHILIPPINES BEVERAGES IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 353 REST OF ASIA-PACIFIC RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 354 REST OF ASIA-PACIFIC RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION UNITS)

TABLE 355 MIDDLE EAST AND AFRICA RETORT PACKAGING MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 356 MIDDLE EAST AND AFRICA RETORT PACKAGING MARKET, BY COUNTRY, 2020-2029 (MILLION UNITS)

TABLE 357 MIDDLE EAST AND AFRICA RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 358 MIDDLE EAST AND AFRICA RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION UNITS)

TABLE 359 MIDDLE EAST AND AFRICA POUCHES IN RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 360 MIDDLE EAST AND AFRICA RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 361 MIDDLE EAST AND AFRICA RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (MILLION UNITS)

TABLE 362 MIDDLE EAST AND AFRICA RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 363 MIDDLE EAST AND AFRICA RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (MILLION UNITS)

TABLE 364 MIDDLE EAST AND AFRICA RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 365 MIDDLE EAST AND AFRICA RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (MILLION UNITS)

TABLE 366 MIDDLE EAST AND AFRICA FOOD IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 367 MIDDLE EAST AND AFRICA BEVERAGES IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 368 SOUTH AFRICA RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 369 SOUTH AFRICA RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION UNITS)

TABLE 370 SOUTH AFRICA POUCHES IN RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 371 SOUTH AFRICA RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 372 SOUTH AFRICA RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (MILLION UNITS)

TABLE 373 SOUTH AFRICA RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 374 SOUTH AFRICA RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (MILLION UNITS)

TABLE 375 SOUTH AFRICA RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 376 SOUTH AFRICA RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (MILLION UNITS)

TABLE 377 SOUTH AFRICA FOOD IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 378 SOUTH AFRICA BEVERAGES IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 379 SAUDI ARABIA RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 380 SAUDI ARABIA RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION UNITS)

TABLE 381 SAUDI ARABIA POUCHES IN RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 382 SAUDI ARABIA RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 383 SAUDI ARABIA RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (MILLION UNITS)

TABLE 384 SAUDI ARABIA RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 385 SAUDI ARABIA RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (MILLION UNITS)

TABLE 386 SAUDI ARABIA RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 387 SAUDI ARABIA RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (MILLION UNITS)

TABLE 388 SAUDI ARABIA FOOD IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 389 SAUDI ARABIA BEVERAGES IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 390 EGYPT RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 391 EGYPT RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION UNITS)

TABLE 392 EGYPT POUCHES IN RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 393 EGYPT RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 394 EGYPT RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (MILLION UNITS)

TABLE 395 EGYPT RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 396 EGYPT RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (MILLION UNITS)

TABLE 397 EGYPT RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 398 EGYPT RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (MILLION UNITS)

TABLE 399 EGYPT FOOD IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 400 EGYPT BEVERAGES IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 401 U.A.E. RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 402 U.A.E. RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION UNITS)

TABLE 403 U.A.E. POUCHES IN RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 404 U.A.E. RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 405 U.A.E. RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (MILLION UNITS)

TABLE 406 U.A.E. RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 407 U.A.E. RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (MILLION UNITS)

TABLE 408 U.A.E. RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 409 U.A.E. RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (MILLION UNITS)

TABLE 410 U.A.E. FOOD IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 411 U.A.E. BEVERAGES IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 412 ISRAEL RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 413 ISRAEL RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION UNITS)

TABLE 414 ISRAEL POUCHES IN RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 415 ISRAEL RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 416 ISRAEL RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (MILLION UNITS)

TABLE 417 ISRAEL RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 418 ISRAEL RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (MILLION UNITS)

TABLE 419 ISRAEL RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 420 ISRAEL RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (MILLION UNITS)

TABLE 421 ISRAEL FOOD IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 422 ISRAEL BEVERAGES IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 423 REST OF MIDDLE EAST AND AFRICA RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 424 REST OF MIDDLE EAST AND AFRICA RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION UNITS)

TABLE 425 SOUTH AMERICA RETORT PACKAGING MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 426 SOUTH AMERICA RETORT PACKAGING MARKET, BY COUNTRY, 2020-2029 (MILLION UNITS)

TABLE 427 SOUTH AMERICA RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 428 SOUTH AMERICA RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION UNITS)

TABLE 429 SOUTH AMERICA POUCHES IN RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 430 SOUTH AMERICA RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 431 SOUTH AMERICA RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (MILLION UNITS)

TABLE 432 SOUTH AMERICA RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 433 SOUTH AMERICA RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (MILLION UNITS)

TABLE 434 SOUTH AMERICA RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 435 SOUTH AMERICA RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (MILLION UNITS)

TABLE 436 SOUTH AMERICA FOOD IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 437 SOUTH AMERICA BEVERAGES IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 438 BRAZIL RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 439 BRAZIL RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION UNITS)

TABLE 440 BRAZIL POUCHES IN RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 441 BRAZIL RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 442 BRAZIL RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (MILLION UNITS)

TABLE 443 BRAZIL RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 444 BRAZIL RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (MILLION UNITS)

TABLE 445 BRAZIL RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 446 BRAZIL RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (MILLION UNITS)

TABLE 447 BRAZIL FOOD IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 448 BRAZIL BEVERAGES IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 449 ARGENTINA RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 450 ARGENTINA RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION UNITS)

TABLE 451 ARGENTINA POUCHES IN RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 452 ARGENTINA RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 453 ARGENTINA RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (MILLION UNITS)

TABLE 454 ARGENTINA RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 455 ARGENTINA RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (MILLION UNITS)

TABLE 456 ARGENTINA RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 457 ARGENTINA RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (MILLION UNITS)

TABLE 458 ARGENTINA FOOD IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 459 ARGENTINA BEVERAGES IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 460 REST OF SOUTH AMERICA RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 461 REST OF SOUTH AMERICA RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION UNITS)

Lista de Figura

FIGURE 1 GLOBAL RETORT PACKAGING MARKET: SEGMENTATION

FIGURE 2 GLOBAL RETORT PACKAGING MARKET: DATA TRIANGULATION

FIGURE 3 GLOBAL RETORT PACKAGING MARKET: DROC ANALYSIS

FIGURE 4 GLOBAL RETORT PACKAGING MARKET: GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 5 GLOBAL RETORT PACKAGING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 GLOBAL RETORT PACKAGING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 GLOBAL RETORT PACKAGING MARKET: DBMR MARKET POSITION GRID

FIGURE 8 GLOBAL RETORT PACKAGING MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 GLOBAL RETORT PACKAGING MARKET: END-USE COVERAGE GRID

FIGURE 10 GLOBAL RETORT PACKAGING MARKET: SEGMENTATION

FIGURE 11 INCREASING DEMAND AMONG CONSUMERS FOR PRESERVATIVE-FREE PRODUCTS IS EXPECTED TO DRIVE THE GLOBAL RETORT PACKAGING MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 POUCHES SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE GLOBAL RETORT PACKAGING MARKET IN 2022 & 2029

FIGURE 13 NORTH AMERICA IS EXPECTED TO DOMINATE AND ASIA-PACIFIC IS THE FASTEST-GROWING REGION IN THE GLOBAL RETORT PACKAGING MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 14 ASIA-PACIFIC IS THE FASTEST GROWING MARKET FOR RETORT PACKAGING MANUFACTURERS IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGE OF GLOBAL RETROT PACKAGING MARKET

FIGURE 16 THE BELOW PIE CHART SHOWS THE RESULT OF FOODBORNE OUTBREAKS IN 2018

FIGURE 17 GLOBAL RETORT PACKAGING MARKET: BY PRODUCT TYPE, 2021

FIGURE 18 GLOBAL RETORT PACKAGING MARKET: BY MATERIAL, 2021

FIGURE 19 GLOBAL RETORT PACKAGING MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 20 GLOBAL RETORT PACKAGING MARKET: BY END-USE, 2021

FIGURE 21 GLOBAL RETORT PACKAGING MARKET: SNAPSHOT (2021)

FIGURE 22 GLOBAL RETORT PACKAGING MARKET: BY REGION (2021)

FIGURE 23 GLOBAL RETORT PACKAGING MARKET: BY REGION (2022 & 2029)

FIGURE 24 GLOBAL RETORT PACKAGING MARKET: BY REGION (2021 & 2029)

FIGURE 25 GLOBAL RETORT PACKAGING MARKET: BY PRODUCT TYPE (2022-2029)

FIGURE 26 NORTH AMERICA RETORT PACKAGING MARKET: SNAPSHOT (2021)

FIGURE 27 NORTH AMERICA RETORT PACKAGING MARKET: BY COUNTRY (2021)

FIGURE 28 NORTH AMERICA RETORT PACKAGING MARKET: BY COUNTRY (2022 & 2029)

FIGURE 29 NORTH AMERICA RETORT PACKAGING MARKET: BY COUNTRY (2021 & 2029)

FIGURE 30 NORTH AMERICA RETORT PACKAGING MARKET: BY PRODUCT TYPE (2022 & 2029)

FIGURE 31 EUROPE RETORT PACKAGING MARKET: SNAPSHOT (2021)

FIGURE 32 EUROPE RETORT PACKAGING MARKET: BY COUNTRY (2021)

FIGURE 33 EUROPE RETORT PACKAGING MARKET: BY COUNTRY (2022 & 2029)

FIGURE 34 EUROPE RETORT PACKAGING MARKET: BY COUNTRY (2021 & 2029)

FIGURE 35 EUROPE RETORT PACKAGING MARKET: BY PRODUCT TYPE (2022 & 2029)

FIGURE 36 ASIA-PACIFIC RETORT PACKAGING MARKET: SNAPSHOT (2021)

FIGURE 37 ASIA-PACIFIC RETORT PACKAGING MARKET: BY COUNTRY (2021)

FIGURE 38 ASIA-PACIFIC RETORT PACKAGING MARKET: BY COUNTRY (2022 & 2029)

FIGURE 39 ASIA-PACIFIC RETORT PACKAGING MARKET: BY COUNTRY (2021 & 2029)

FIGURE 40 ASIA-PACIFIC RETORT PACKAGING MARKET: BY PRODUCT TYPE (2022 & 2029)

FIGURE 41 MIDDLE EAST AND AFRICA RETORT PACKAGING MARKET: SNAPSHOT (2021)

FIGURE 42 MIDDLE EAST AND AFRICA RETORT PACKAGING MARKET: BY COUNTRY (2021)

FIGURE 43 MIDDLE EAST AND AFRICA RETORT PACKAGING MARKET: BY COUNTRY (2022 & 2029)

FIGURE 44 MIDDLE EAST AND AFRICA RETORT PACKAGING MARKET: BY COUNTRY (2021 & 2029)

FIGURE 45 MIDDLE EAST AND AFRICA RETORT PACKAGING MARKET: BY PRODUCT TYPE (2022 & 2029)

FIGURE 46 SOUTH AMERICA RETORT PACKAGING MARKET: SNAPSHOT (2021)

FIGURE 47 SOUTH AMERICA RETORT PACKAGING MARKET: BY COUNTRY (2021)

FIGURE 48 SOUTH AMERICA RETORT PACKAGING MARKET: BY COUNTRY (2022 & 2029)

FIGURE 49 SOUTH AMERICA RETORT PACKAGING MARKET: BY COUNTRY (2021 & 2029)

FIGURE 50 SOUTH AMERICA RETORT PACKAGING MARKET: BY PRODUCT TYPE (2022 & 2029)

FIGURE 51 GLOBAL RETORT PACKAGING MARKET: COMPANY SHARE 2021 (%)

FIGURE 52 NORTH AMERICA RETORT PACKAGING MARKET: COMPANY SHARE 2021 (%)

FIGURE 53 EUROPE RETORT PACKAGING MARKET: COMPANY SHARE 2021 (%)

FIGURE 54 ASIA-PACIFIC RETORT PACKAGING MARKET: COMPANY SHARE 2021 (%)

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.