Global Polyurethane Processing Machine Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

4.26 Billion

USD

5.88 Billion

2024

2032

USD

4.26 Billion

USD

5.88 Billion

2024

2032

| 2025 –2032 | |

| USD 4.26 Billion | |

| USD 5.88 Billion | |

|

|

|

|

Segmentação do mercado global de máquinas de processamento de poliuretano, por produto (sistemas de dosagem, cabeçote de mistura, equipamento de medição, equipamento de formação de espuma e outros), tipo (alta pressão e baixa pressão), uso final (construção, automotivo, médico, produtos de consumo e outros) - Tendências do setor e previsão até 2032

Qual é o tamanho e a taxa de crescimento do mercado global de máquinas de processamento de poliuretano?

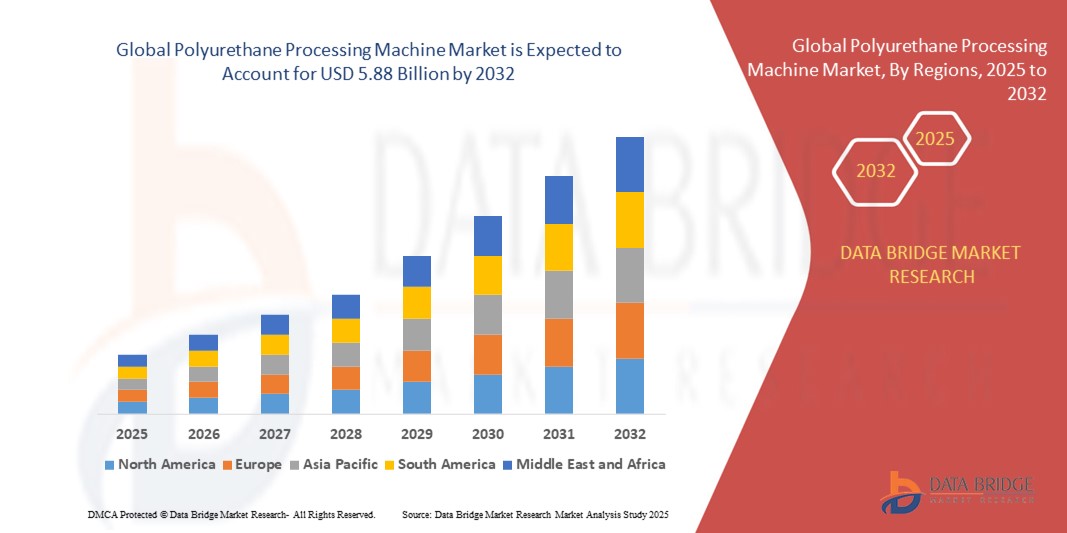

- O tamanho do mercado global de máquinas de processamento de poliuretano foi avaliado em US$ 4,26 bilhões em 2024 e deve atingir US$ 5,88 bilhões até 2032 , com um CAGR de 4,10% durante o período previsto.

- O mercado global de máquinas para processamento de poliuretano apresenta crescimento constante, impulsionado pela demanda dos setores automotivo, de construção e moveleiro. A preferência do setor automotivo por veículos leves e materiais isolantes eficientes, aliada à expansão da indústria da construção em economias emergentes, impulsiona a demanda.

- Além disso, a adoção da espuma de poliuretano pela indústria moveleira contribui para o crescimento do mercado. Avanços tecnológicos, como a automação, aumentam a eficiência da produção, atraindo investimentos e criando oportunidades de crescimento para o mercado.

Quais são os principais destaques do mercado de máquinas de processamento de poliuretano?

- O crescente setor da construção civil, especialmente em economias emergentes, é um fator-chave para o mercado de máquinas de processamento de poliuretano . A espuma de poliuretano é amplamente utilizada na construção civil para isolamento, vedação e aplicações estruturais, impulsionando a demanda por máquinas de processamento para a fabricação de produtos de espuma.

- À medida que os projetos de desenvolvimento de infraestrutura continuam a crescer globalmente, há um aumento correspondente na adoção de máquinas de processamento de poliuretano para atender às necessidades do setor de construção.

- A Ásia-Pacífico dominou o mercado de máquinas de processamento de poliuretano com a maior participação na receita de 41,5% em 2024, impulsionada pela forte base de fabricação da região, rápida industrialização e crescente demanda por aplicações de poliuretano nos setores de construção, automotivo e bens de consumo

- O mercado europeu de máquinas de processamento de poliuretano deverá crescer a uma taxa composta de crescimento anual (CAGR) mais rápida, de 21,9%, de 2025 a 2032, impulsionado por regulamentações rigorosas de eficiência energética, metas de sustentabilidade e crescente demanda por materiais ecológicos.

- O segmento de Sistemas de Dosagem dominou o mercado em 2024 com a maior participação na receita, impulsionado por seu papel crítico em garantir proporções químicas precisas e minimizar o desperdício de matéria-prima

Escopo do relatório e segmentação do mercado de máquinas de processamento de poliuretano

|

Atributos |

Principais insights de mercado sobre máquinas de processamento de poliuretano |

|

Segmentos abrangidos |

|

|

Países abrangidos |

América do Norte

Europa

Ásia-Pacífico

Oriente Médio e África

Ámérica do Sul

|

|

Principais participantes do mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor agregado |

Além dos insights sobre cenários de mercado, como valor de mercado, taxa de crescimento, segmentação, cobertura geográfica e principais participantes, os relatórios de mercado selecionados pela Data Bridge Market Research também incluem análises aprofundadas de especialistas, análises de preços, análises de participação de marca, pesquisas com consumidores, análises demográficas, análises da cadeia de suprimentos, análises da cadeia de valor, visão geral de matérias-primas/consumíveis, critérios de seleção de fornecedores, análise PESTLE, análise de Porter e estrutura regulatória. |

Qual é a principal tendência no mercado de máquinas de processamento de poliuretano?

Automação e Digitalização para Processamento de Precisão

- Uma tendência importante e crescente no mercado global de máquinas de processamento de poliuretano é a integração de tecnologias de automação, robótica e controle digital para aumentar a eficiência, a precisão e a consistência da produção no processamento de espuma

- Por exemplo, as modernas máquinas de dosagem e mistura estão cada vez mais equipadas com sensores habilitados para IoT e sistemas PLC, permitindo o monitoramento em tempo real das taxas de fluxo, temperatura e proporções de mistura para reduzir o desperdício de material e melhorar a qualidade.

- A adoção da tecnologia de gêmeos digitais no processamento de poliuretano permite que os fabricantes simulem o desempenho das máquinas, prevejam as necessidades de manutenção e otimizem a produtividade antes mesmo da produção real. A KraussMaffei e a Hennecke GmbH estão investindo fortemente nessas inovações.

- Além disso, os fabricantes estão incorporando ferramentas de otimização de processos orientadas por IA em máquinas de poliuretano, permitindo o controle adaptativo de parâmetros como pressão de injeção e tempo de cura para maximizar a produtividade

- A tendência para fábricas inteligentes e a Indústria 4.0 tornou as soluções automatizadas de processamento de poliuretano uma parte essencial das linhas de produção de móveis, automóveis e materiais de isolamento

- Este foco crescente na automação e digitalização está a remodelar a indústria, levando as empresas a investir em máquinas de última geração que proporcionam maior produção, menores taxas de desperdício e melhor eficiência energética.

Quais são os principais impulsionadores do mercado de máquinas de processamento de poliuretano?

- A crescente demanda dos setores automotivo, moveleiro e de construção por espumas, revestimentos, adesivos e selantes à base de poliuretano está impulsionando o crescimento do mercado. Esses setores exigem máquinas de processamento de alta precisão para garantir a durabilidade e o desempenho dos produtos.

- Por exemplo, em março de 2024, a Linde plc anunciou avanços em suas soluções à base de gás para a fabricação de espuma de poliuretano, destacando a crescente importância de tecnologias de processamento eficientes para atender à crescente demanda por isolamento e peças automotivas leves.

- A crescente necessidade de materiais de isolamento com eficiência energética em edifícios e aparelhos está impulsionando a demanda por máquinas avançadas de poliuretano de alta pressão que podem produzir espumas rígidas com desempenho térmico superior

- A tendência para veículos leves e melhor eficiência de combustível está impulsionando as aplicações de poliuretano em assentos, painéis internos e compostos leves, aumentando diretamente a utilização da máquina

- Além disso, a mudança para uma produção sustentável levou as empresas a desenvolver máquinas compatíveis com polióis de base biológica e formulações de baixa emissão, aumentando a demanda por substituição de sistemas mais antigos.

- Coletivamente, esses fatores estão posicionando as máquinas de processamento de poliuretano como um facilitador essencial da inovação em vários setores subsequentes.

Qual fator está desafiando o crescimento do mercado de máquinas de processamento de poliuretano?

- Um grande desafio para o mercado é o alto investimento de capital e o custo de manutenção associados às máquinas avançadas de processamento de poliuretano, o que pode ser uma barreira significativa para pequenas e médias empresas (PMEs)

- Por exemplo, muitas PME na Ásia-Pacífico hesitam em atualizar para sistemas de processamento totalmente automatizados ou digitalizados devido a restrições orçamentais, embora estas soluções aumentem a eficiência

- Outra questão urgente é a volatilidade dos preços das matérias-primas, especialmente polióis e isocianatos, que impactam diretamente as taxas de utilização das máquinas e as decisões de investimento dos fabricantes.

- Além disso, a complexidade da operação e manutenção das máquinas exige operadores qualificados, e a escassez de técnicos treinados nas economias emergentes constitui um obstáculo à adopção mais ampla.

- Embora empresas líderes como a Hennecke GmbH e a Graco Inc. ofereçam programas de treinamento e sistemas de suporte remoto, a adoção ainda está atrasada nas regiões em desenvolvimento

- A menos que sejam abordados por meio de soluções econômicas, modelos de financiamento e iniciativas de treinamento de operadores, esses desafios podem retardar a implantação generalizada de máquinas avançadas de processamento de poliuretano.

Como o mercado de máquinas de processamento de poliuretano é segmentado?

O mercado é segmentado com base no tipo, produto e uso final.

- Por tipo

Com base no tipo, o mercado de máquinas para processamento de poliuretano é segmentado em Sistemas de Dosagem, Cabeças de Mistura, Equipamentos de Dosagem, Equipamentos de Espuma e Outros. O segmento de Sistemas de Dosagem dominou o mercado em 2024, com a maior participação na receita, 54,87%, impulsionado por seu papel fundamental em garantir proporções químicas precisas e minimizar o desperdício de matéria-prima. Indústrias como a da construção civil e a automotiva preferem cada vez mais unidades de dosagem avançadas integradas com sensores e automação para alcançar maior consistência e produtividade.

Prevê-se que o segmento de Cabeças de Mistura apresentará a maior taxa de crescimento entre 2025 e 2032, devido à crescente demanda por mistura de precisão na produção de espumas flexíveis, revestimentos e adesivos. Suas inovações em design, incluindo mecanismos de autolimpeza e operação de alta velocidade, tornam-nas essenciais para fabricantes que buscam aumentar a eficiência e reduzir o tempo de inatividade.

- Por produto

Com base no produto, o mercado é segmentado em máquinas de alta pressão e baixa pressão. O segmento de alta pressão detinha a maior participação de mercado em 2024, principalmente devido à sua ampla utilização em aplicações que exigem produção em alta velocidade e qualidade de mistura superior, como assentos automotivos e espumas rígidas de isolamento. Essas máquinas são favorecidas por proporcionar tempos de ciclo reduzidos e maior produtividade.

Espera-se que o segmento de Baixa Pressão registre o CAGR mais rápido entre 2025 e 2032, impulsionado por sua adequação à produção em menor escala e a aplicações que exigem maior flexibilidade, como prototipagem, produtos médicos e bens de consumo especializados. Seu custo de investimento relativamente menor e a facilidade de operação os tornam particularmente atraentes para PMEs e fabricantes de nicho.

- Por uso final

Com base no uso final, o mercado de máquinas para processamento de poliuretano é segmentado em Construção, Automotivo, Médico, Produtos de Consumo e Outros. O segmento de Construção foi responsável pela maior fatia da receita de mercado em 2024, impulsionado pela crescente demanda por espumas isolantes, selantes e adesivos com eficiência energética. A crescente ênfase em construções sustentáveis e regulamentações energéticas mais rigorosas estão impulsionando ainda mais a adoção de máquinas neste setor.

O segmento automotivo deverá crescer com a CAGR mais rápida entre 2025 e 2032, impulsionado pelo uso crescente de poliuretano em componentes leves, sistemas de assentos e peças internas. A busca pela eficiência de combustível e pelo desenvolvimento de veículos elétricos pela indústria está acelerando a demanda por máquinas de processamento de precisão.

Qual região detém a maior fatia do mercado de máquinas de processamento de poliuretano?

- A Ásia-Pacífico dominou o mercado de máquinas de processamento de poliuretano com a maior participação na receita de 41,5% em 2024, impulsionada pela forte base de fabricação da região, rápida industrialização e crescente demanda por aplicações de poliuretano nos setores de construção, automotivo e bens de consumo

- O uso generalizado de espumas de poliuretano para isolamento, assentos e embalagens, juntamente com iniciativas governamentais de apoio ao desenvolvimento de infraestrutura, está acelerando a adoção de tecnologias avançadas de processamento de poliuretano.

- Além disso, a disponibilidade de mão de obra com boa relação custo-benefício, fabricantes locais de máquinas e políticas favoráveis que promovem a automação industrial fortalecem ainda mais a posição de liderança da Ásia-Pacífico no mercado global.

Visão geral do mercado de máquinas de processamento de poliuretano da China

O mercado chinês de máquinas para processamento de poliuretano obteve a maior fatia da receita, 64%, na região Ásia-Pacífico em 2024, impulsionado pelo domínio do país nos setores de construção, produção automotiva e fabricação de eletrônicos. O impulso para cidades inteligentes, a demanda por materiais leves e projetos de isolamento em larga escala estão impulsionando a capacidade de processamento de poliuretano. Fortes fornecedores nacionais de máquinas e uma sólida base de exportação também contribuem para a posição de liderança da China na região.

Visão geral do mercado de máquinas de processamento de poliuretano no Japão

O mercado japonês apresenta crescimento constante, impulsionado por seu avançado setor de manufatura, altos padrões de qualidade dos produtos e inovação contínua. A adoção de máquinas de processamento de poliuretano é particularmente forte em assentos automotivos, dispositivos médicos e eletrônicos de consumo. O foco do Japão em engenharia de precisão e sustentabilidade está estimulando a demanda por máquinas de poliuretano de alta pressão e controle digital.

Visão geral do mercado de máquinas de processamento de poliuretano na Índia

O mercado indiano deverá crescer a uma CAGR robusta durante o período previsto, impulsionado pela rápida urbanização, projetos de desenvolvimento habitacional e pela expansão do setor automotivo. O aumento dos investimentos na manufatura industrial e a iniciativa governamental "Make in India" estão impulsionando a demanda por espumas de poliuretano nos setores de construção, colchões e transporte, impulsionando assim a adoção de máquinas.

Qual região tem o crescimento mais rápido no mercado de máquinas de processamento de poliuretano?

O mercado europeu de máquinas para processamento de poliuretano deverá crescer à taxa composta de crescimento anual (CAGR) mais rápida, de 21,9%, entre 2025 e 2032, impulsionado por rigorosas regulamentações de eficiência energética, metas de sustentabilidade e crescente demanda por materiais ecológicos. O foco da região em construções sustentáveis, reciclagem e produção de baixa emissão está incentivando as empresas a adotar máquinas avançadas para processamento de poliuretano compatíveis com polióis de origem biológica e agentes de expansão alternativos.

Visão geral do mercado de máquinas de processamento de poliuretano na Alemanha

Espera-se que o mercado alemão detenha a maior fatia da Europa em 2024, impulsionado por sua forte indústria automotiva, foco em materiais leves e infraestrutura avançada. Os fabricantes estão investindo cada vez mais em máquinas de alta pressão e soluções de automação para aumentar a produtividade e, ao mesmo tempo, cumprir os rigorosos padrões de sustentabilidade da UE.

Visão geral do mercado de máquinas de processamento de poliuretano no Reino Unido

Prevê-se que o mercado do Reino Unido se expanda a um CAGR saudável, impulsionado pelo crescimento dos setores de habitação e construção, bem como pela demanda por espumas isolantes para atender aos requisitos de economia de energia. A crescente ênfase em projetos de infraestrutura modernos e a adoção de soluções ecologicamente corretas são os principais impulsionadores do país.

Visão geral do mercado de máquinas de processamento de poliuretano na França

O mercado francês deverá crescer de forma constante durante o período previsto, devido ao seu foco em projetos de modernização residencial e comercial. Espera-se que os incentivos governamentais para materiais de construção sustentáveis e construções com eficiência energética impulsionem a demanda por espumas de poliuretano e, consequentemente, por máquinas de processamento.

Quais são as principais empresas no mercado de máquinas de processamento de poliuretano?

A indústria de máquinas de processamento de poliuretano é liderada principalmente por empresas bem estabelecidas, incluindo:

- Linde plc (Irlanda)

- Frimo Group GmbH (Alemanha)

- Rim Polymer Industries Pte. Ltd. (Singapura)

- LEWA GmbH (Alemanha)

- Grupo Haitiano (China)

- Grupo KraussMaffei (Alemanha)

- Hennecke GmbH (Alemanha)

- Grupo Wittmann (Áustria)

- Engel Austria GmbH (Áustria)

- Graco Inc. (EUA)

Quais são os desenvolvimentos recentes no mercado global de máquinas de processamento de poliuretano?

- Em abril de 2022, a Mitsubishi Chemical firmou uma parceria com a Origin Materials para desenvolver conjuntamente produtos carbono-negativos para a fabricação de pneus, um passo que visa impulsionar a inovação sustentável na indústria automotiva. Espera-se que essa colaboração acelere a adoção de materiais ecológicos na produção de pneus.

- Em janeiro de 2022, a Eastman Chemical anunciou um investimento de US$ 1 bilhão para estabelecer a maior unidade de reciclagem molecular de plásticos do mundo na França, com o objetivo de promover soluções de economia circular. Esta iniciativa visa aprimorar significativamente as capacidades globais de reciclagem e reduzir o desperdício de plástico.

- Em fevereiro de 2020, a Hennecke GmbH e o Frimo Group anunciaram uma parceria estratégica na área de poliuretano e outras aplicações de plásticos reativos, projetada para agregar valor aos clientes da indústria automotiva. Espera-se que essa aliança fortaleça a presença de ambas as empresas no mercado de processamento de poliuretano.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.