Global Pharmaceutical Processing Equipment Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

16.42 Billion

USD

33.72 Billion

2024

2032

USD

16.42 Billion

USD

33.72 Billion

2024

2032

| 2025 –2032 | |

| USD 16.42 Billion | |

| USD 33.72 Billion | |

|

|

|

|

Mercado global de equipamentos de processamento farmacêutico, por equipamento (misturadores, liquidificadores, granuladores, bombas, permutadores de calor e outros), tipo de dosagem (equipamento de processamento de dosagem sólida, equipamento de processamento de dosagem líquida e equipamento de dosagem semi-sólida), tipo de processamento (processamento upstream e Processamento Downstream), Aplicação (Mistura e Combinação, Granulação, Secagem, Compressão de Comprimidos, Enchimento de Cápsulas e Outros), Utilizador Final (Empresas Farmacêuticas e Biofarmacêuticas, Organização de Investigação Contratada, Laboratórios de I&D e Outros ), Canal de Distribuição (Licitação Direta, Vendas a retalho e outros) - Tendências e previsões do setor até 2031.

Análise e dimensão do mercado de equipamentos de processamento farmacêutico

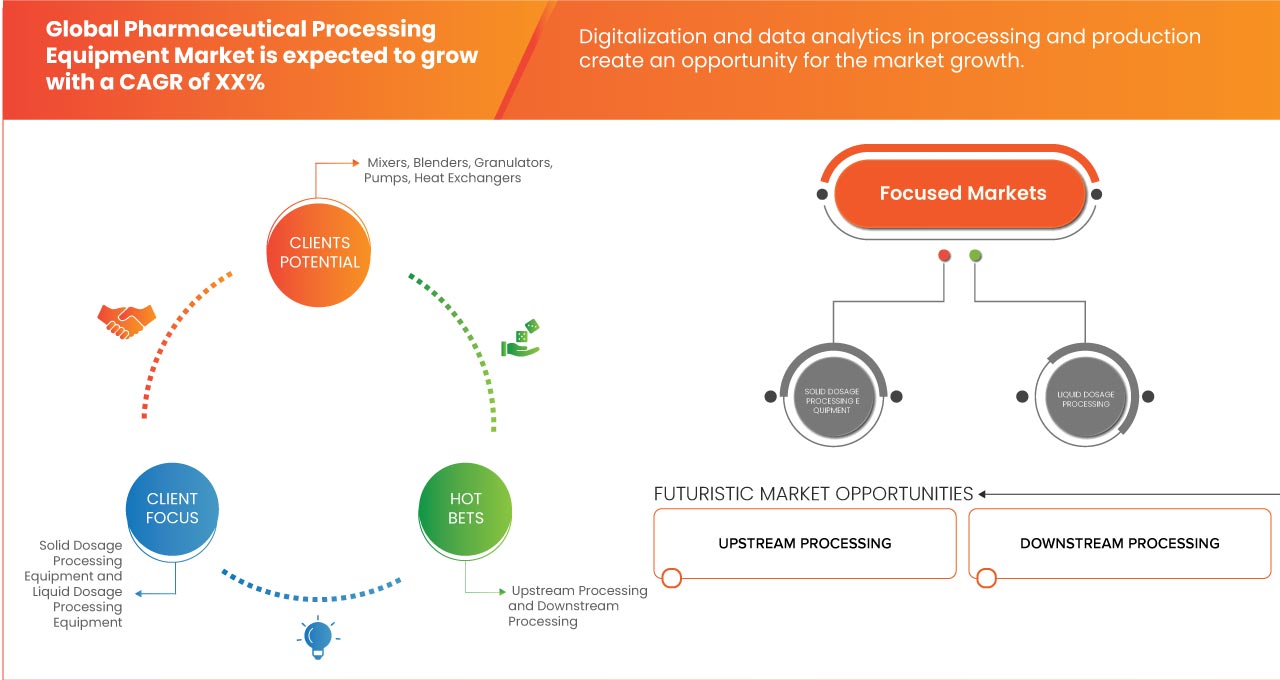

O mercado global de equipamentos de processamento farmacêutico é impulsionado pelo aumento global de doenças crónicas, como doenças cardiovasculares, cancro e doenças respiratórias, o que aumenta ainda mais a procura de produtos farmacêuticos. No entanto, uma restrição ao crescimento do mercado é que a escassez de matéria-prima é uma grande preocupação no fabrico de equipamentos de processamento farmacêutico, uma vez que os materiais especializados podem ser escassos ou difíceis de obter, levando a atrasos na produção e a custos mais elevados. Uma oportunidade neste mercado está nas tecnologias modernas, como a automação, robótica, PAT e fabrico contínuo, que aumentam a eficiência operacional, reduzem os custos de produção e aumentam a qualidade do produto, apresentando um crescimento significativo do mercado. Um desafio é que a elevada procura de conhecimentos especializados torna difícil para as empresas recrutar e reter profissionais qualificados, resultando numa maior concorrência e em maiores custos de mão-de-obra.

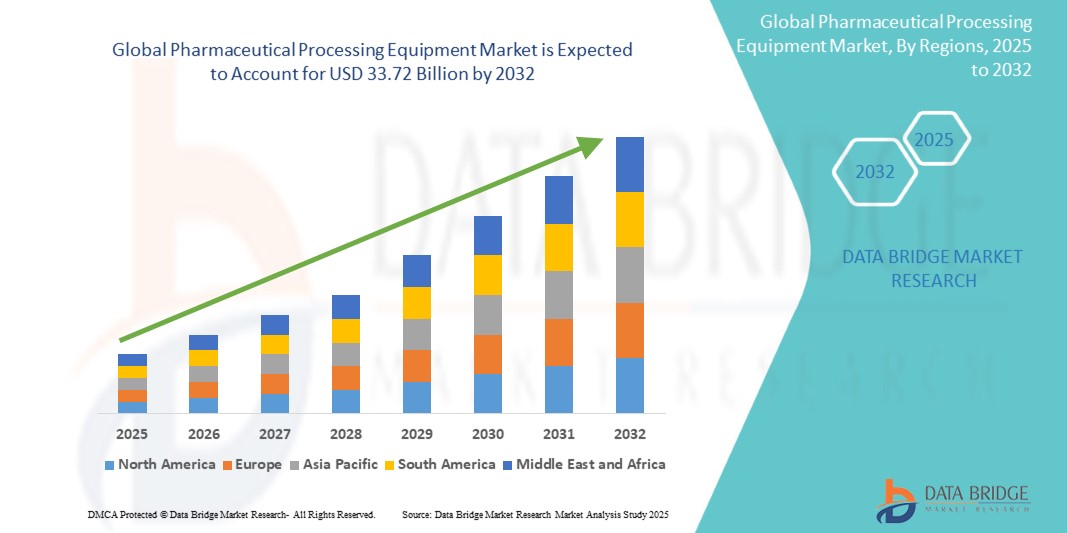

A Data Bridge Market Research analisa que o mercado global de equipamentos de processamento farmacêutico está a crescer com um CAGR de 9,41% no período previsto de 2024 a 2031 e deverá atingir os 30.821,11 milhões de dólares até 2031, face aos 15.354,28 dólares milhões em 2023.

|

Métrica de Reporte |

Detalhes |

|

Período de previsão |

2024 a 2031 |

|

Ano base |

2023 |

|

Anos históricos |

2022 (Personalizável 2016-2021) |

|

Unidades quantitativas |

Receita em milhões de dólares americanos |

|

Segmentos abrangidos |

Equipamento (misturadores, liquidificadores, granuladores, bombas, permutadores de calor e outros), Tipo de dosagem (equipamento de processamento de dosagem sólida, equipamento de processamento de dosagem líquida e equipamento de dosagem semi-sólida), Tipo de processamento (processamento a montante e processamento a jusante), Aplicação ( Mistura e unificação, granulação, secagem, compressão de comprimidos, enchimento de cápsulas e outros), utilizador final (empresas farmacêuticas e biofarmacêuticas, organização de investigação contratada, laboratórios de I&D e outros), canal de distribuição (licitação direta, vendas a retalho e outros) |

|

Países abrangidos |

EUA, Canadá, México, Reino Unido, Alemanha, França, Espanha, Itália, Bélgica, Rússia, Suíça, Holanda, Turquia, resto da Europa, China, Austrália, Japão, Índia, Singapura, Coreia do Sul, Malásia, Tailândia, Indonésia , Filipinas , resto da Ásia-Pacífico, Brasil, Argentina e resto da América do Sul, África do Sul, Egito, Arábia Saudita, Emirados Árabes Unidos, Israel e resto do Médio Oriente e África |

|

Atores do mercado abrangidos |

Thermo Fisher Scientific Inc., ALFA LAVAL, GEA Group Aktiengsellschaft, SPX FLOW, Inc., IMA INDUSTRIA MACCHINE AUTOMATICHE SPA, ACG, Syntegon Technology GmbH, Paul Mueller Company, FREUND Corp., Gansons, Alexanderwerk AG, B&P Littleford, Chamunda Pharma Machinery , Prism Pharma Machinery, SaintyCo Nicomac Srl, United Pharmatek USA, ADINATH INTERNATIONAL, NU PHARMA ENGINEERS & CONSULTANT e Senieer entre outros |

Definição de Mercado

Os equipamentos de processamento farmacêutico compreendem uma gama diversificada de máquinas e ferramentas especializadas essenciais para o fabrico, manuseamento e preparação de produtos farmacêuticos. Este equipamento foi concebido para cumprir as rigorosas normas regulamentares e garantir a segurança, eficácia e qualidade das formulações farmacêuticas. As principais categorias de equipamentos de processamento farmacêutico incluem máquinas de mistura e combinação, que combinam ingredientes farmacêuticos ativos (IFAs) com excipientes para criar misturas homogéneas. Os equipamentos de moagem e redução de tamanho reduzem o tamanho das partículas de matérias-primas para atingir as características desejadas para processamento ou formulação posterior. As máquinas de compressão de comprimidos e enchimento de cápsulas automatizam a produção de comprimidos e cápsulas, garantindo uma dosagem precisa e uniformidade.

Este equipamento é essencial para cumprir as Boas Práticas de Fabrico (BPF) e os requisitos regulamentares, aumentando a eficiência e garantindo a consistência e a segurança dos produtos farmacêuticos entregues aos doentes e aos prestadores de cuidados de saúde.

Dinâmica do mercado global de equipamentos de processamento farmacêutico

Esta secção trata da compreensão dos impulsionadores, vantagens, oportunidades, restrições e desafios do mercado. Tudo isto é discutido em detalhe abaixo:

Motoristas

- Aumento da procura por produtos farmacêuticos

A crescente procura de produtos farmacêuticos é motivada por vários factores, incluindo o aumento da população global que exige mais serviços de saúde e medicamentos, levando a uma maior necessidade de produção farmacêutica para tratar uma série de problemas de saúde.

O envelhecimento da população, principalmente nos países desenvolvidos, está a aumentar a procura de produtos farmacêuticos. Os indivíduos idosos necessitam frequentemente de mais medicamentos para controlar doenças relacionadas com a idade, como a hipertensão, a diabetes e a artrite. Consequentemente, esta mudança demográfica está a impulsionar a necessidade de produtos farmacêuticos e, consequentemente, de equipamento de processamento farmacêutico.

- Crescente procura por equipamentos de alta contenção

Os equipamentos de alta contenção são essenciais para garantir o manuseamento e a produção seguros de Ingredientes Farmacêuticos Ativos Altamente Potentes (HPAPIs) e outras substâncias perigosas. Esta procura é impulsionada principalmente por vários fatores-chave.

Há um foco crescente no desenvolvimento e na fabricação de medicamentos especializados, incluindo aqueles utilizados em oncologia, imunoterapia e outros tratamentos que envolvem HPAPIs. Estes medicamentos exigem medidas de segurança rigorosas para proteger os trabalhadores e o ambiente da exposição a substâncias perigosas durante o processo de fabrico. Os equipamentos de alta contenção, como os isoladores e os sistemas de barreira, proporcionam o nível necessário de proteção e controlo da contaminação, tornando-os indispensáveis nas modernas instalações de produção farmacêutica.

Oportunidade

- Integração de Tecnologias Avançadas de Fabrico

As tecnologias avançadas de fabrico oferecem uma oportunidade transformadora no mercado global de equipamentos de processamento farmacêutico. Tecnologias modernas como a automação, robôs, Tecnologia Analítica de Processos (PAT) e fabrico contínuo podem ser integradas para melhorar a eficácia operacional, reduzir os custos de produção e melhorar a qualidade do produto. As empresas farmacêuticas podem acompanhar as mudanças nas exigências do mercado, manter-se competitivas e incentivar a inovação do setor, adotando estas tecnologias de IoT, robótica e PAT.

Restrição/Desafio

- Interrupções na cadeia de abastecimento

As interrupções na cadeia de abastecimento representam uma restrição significativa para o mercado global de equipamentos de processamento farmacêutico. Estas interrupções podem ter várias origens, incluindo escassez de matéria-prima, desafios logísticos e questões geopolíticas, todas as quais podem impedir a disponibilidade e a entrega atempada de equipamento essencial.

A escassez de matéria-prima é uma preocupação primordial. O fabrico de equipamentos de processamento farmacêutico depende geralmente de materiais especializados, que podem ser escassos ou difíceis de obter. Quando o fornecimento destes materiais é interrompido, podem ocorrer atrasos na produção e aumento dos custos. Por exemplo, a disponibilidade de aço inoxidável de alta qualidade, essencial para a sua resistência à corrosão e durabilidade em ambientes farmacêuticos, pode ser afetada pelas restrições globais de fornecimento.

Desenvolvimentos recentes

- Em novembro de 2023, a Thermo Fisher Scientific e a Flagship Pioneering estabeleceram uma parceria para desenvolver e escalar rapidamente plataformas multiproduto. Esta colaboração visa criar novas empresas com foco em ferramentas inovadoras para a indústria da biotecnologia, aproveitando a experiência de ambas as organizações para acelerar o desenvolvimento de terapias

- Em agosto de 2023, a Thermo Fisher Scientific adquiriu a CorEvitas, um fornecedor de provas do mundo real, para melhorar o seu segmento de Produtos de Laboratório e Serviços Biofarmacêuticos. Esta aquisição reforça a posição da Thermo Fisher no fornecimento de dados de nível regulamentar para tratamentos médicos, contribuindo para o seu crescimento e inovação no setor da saúde

- Em janeiro de 2024, o EcoDataCenter alcança o primeiro lugar no setor ao implementar permutadores de calor Alfa Laval feitos de aço reciclado, produzidos sem novas emissões de CO2 da SSAB, marcando um marco significativo na redução das emissões de carbono e destacando a importância da colaboração nos esforços de sustentabilidade. Este avanço irá melhorar a reputação ambiental da empresa, reduzir a sua pegada de carbono e definir um novo padrão para práticas sustentáveis na indústria

- Em maio de 2024, a GEA continua a expandir o seu portefólio de secadores de pulverização farmacêuticos. Na ACHEMA em Frankfurt (10 a 14 de junho de 2024, Pavilhão 4.0, Stand G66), a GEA irá apresentar os novos secadores de pulverização GEA ASEPTICSD. São especialmente concebidos para aplicações de secagem por pulverização farmacêutica. Desde antibióticos, vacinas, hormonas e alergénios a anticorpos monoclonais, peptídeos e proteínas terapêuticas, hemoderivados e pós para infusões parenterais, os secadores por pulverização oferecem soluções versáteis. Os secadores por pulverização também podem ser concebidos para lidar com solventes orgânicos, permitindo a utilização de uma variedade de veículos dentro da formulação

- Em janeiro de 2024, a marca Anhydro da SPX FLOW lançou o Sistema SmartDry, utilizando tecnologia avançada para um controlo preciso em ambientes de produção variáveis. Este sistema "Plug-and-Produce" melhora a automatização, poupando custos e otimizando a eficiência da produção. Este lançamento reforça a reputação da SPX FLOW em soluções inovadoras, atraindo clientes que procuram sistemas avançados e automatizados para melhorar os seus processos de secagem por pulverização, aumentando assim a quota de mercado e a receita da empresa.

Âmbito do mercado global de equipamentos de processamento farmacêutico

O mercado global de equipamentos de processamento farmacêutico está segmentado em seis segmentos notáveis com base no equipamento, tipo de dosagem, tipo de processamento, aplicação, utilizador final e canal de distribuição. O crescimento entre segmentos ajuda-o a analisar os nichos de crescimento e as estratégias para abordar o mercado e determinar as suas principais áreas de aplicação e as diferenças nos seus mercados-alvo.

Equipamento

- Misturadores

- Liquidificadores

- Granuladores

- Bombas

- Permutadores de calor

- Outros

Com base no equipamento, o mercado global de equipamentos de processamento farmacêutico está segmentado em misturadores, liquidificadores, granuladores, bombas, permutadores de calor e outros.

Tipo de dosagem

- Equipamento de processamento de dosagem sólida

- Equipamento de processamento de dosagem de líquidos

- Equipamento de processamento de dosagem semi-sólida

Com base no tipo de dosagem, o mercado global de equipamentos de processamento farmacêutico está segmentado em equipamentos de processamento de dosagem sólida, equipamentos de processamento de dosagem líquida e equipamentos de processamento de dosagem semi-sólida.

Tipo de processamento

- Processamento Upstream

- Processamento a jusante

Com base no tipo de processamento, o mercado global de equipamentos de processamento farmacêutico está segmentado em processamento a montante e processamento a jusante.

Aplicação

- Mistura e combinação

- Granulação

- Secagem

- Compressão de tablet

- Enchimento de cápsulas

- Outros

On the basis of application, the global pharmaceutical processing equipment market is segmented into mixing & blending, granulation, drying, tablet compression, capsule filling, and others.

End User

- Pharmaceutical & Biopharmaceutical Companies

- Contract Research Organization

- R&D Laboratories

- Others

On the basis of end user, the global pharmaceutical processing equipment market is segmented into pharmaceutical & biopharmaceutical companies, contract research organization, R&D laboratories, and others.

Distribution Channel

- Direct Tenders

- Retail Sales

- Others

On the basis of distribution channel, the global pharmaceutical processing equipment market is segmented into direct tenders, retail sales, and others.

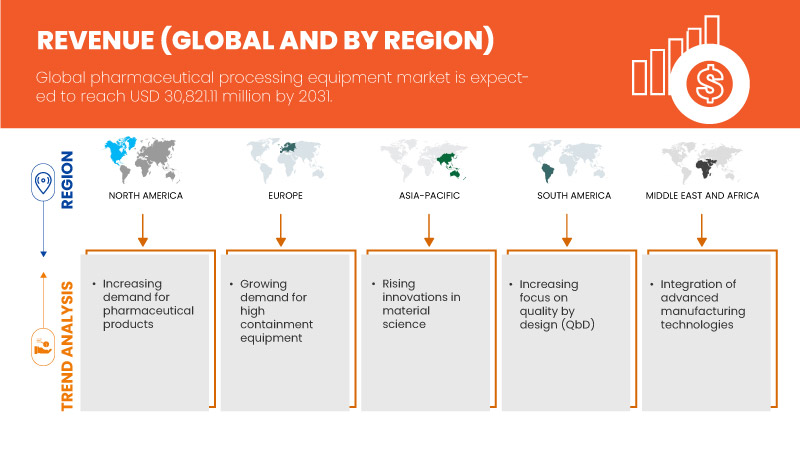

Global Pharmaceutical Processing Equipment Market Regional Analysis/Insights

Global pharmaceutical processing equipment market is analyzed, and market size insights and trends are provided by based on equipment, dosage type, processing type, application, end user, and distribution channel.

The countries covered in this global pharmaceutical processing equipment market report are U.S., Canada, Mexico, U.K., Germany, France, Spain, Italy, Belgium, Russia, Switzerland, Netherlands, Turkey, rest of Europe, China, Australia, Japan, India, Singapore, South Korea, Malaysia, Thailand, Indonesia, Philippines, rest of Asia-Pacific, Brazil, Argentina, and rest of South America, South Africa, Egypt, Saudi Arabia, U.A.E., Israel, and rest of Middle East and Africa.

North America is expected to dominate the market due to its advanced infrastructure, strong R&D capabilities, stringent regulatory standards, and significant investment in innovation and technology. U.S. is expected to dominate in the North America market due to advanced infrastructure, robust regulatory framework, extensive R&D investment, and significant market size.

U.K. is expected to dominate in the Europe market due to its strong regulatory standards, cutting-edge research institutions, strategic geographic location, and a history of innovation in pharmaceutical development.

China is expected to dominate in the Asia-Pacific market due to its lower manufacturing costs, expansive production capabilities, a large domestic market, and government support for industry growth.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Análise do panorama competitivo e da quota de mercado global de equipamentos de processamento farmacêutico

O mercado global de equipamentos de processamento farmacêutico está segmentado em seis segmentos notáveis com base no equipamento, tipo de dosagem, tipo de processamento, aplicação, utilizador final e canal de distribuição.

O panorama competitivo do mercado global de equipamentos de processamento farmacêutico fornece detalhes por concorrente. Os detalhes incluídos são a visão geral da empresa, finanças da empresa, receitas geradas, potencial de mercado, investimento em investigação e desenvolvimento, novas iniciativas de mercado, presença global, localizações e instalações de produção, capacidades de produção, pontos fortes e fracos da empresa , lançamento do produto, amplitude e abrangência do produto e domínio da aplicação. Os pontos de dados fornecidos acima estão apenas relacionados com o foco das empresas no mercado global de equipamentos de processamento farmacêutico.

Alguns dos principais participantes que operam no mercado global de equipamentos de processamento farmacêutico são a Thermo Fisher Scientific Inc., ALFA LAVAL, GEA Group Aktiengsellschaft, SPX FLOW, Inc., IMA INDUSTRIA MACCHINE AUTOMATICHE SPA, ACG, Syntegon Technology GmbH, Paul Mueller Company, FREUND Corp., Gansons, Alexanderwerk AG, B&P Littleford, Chamunda Pharma Machinery, Prism Pharma Machinery, SaintyCo Nicomac Srl, United Pharmatek USA, ADINATH INTERNATIONAL, NU PHARMA ENGINEERS & CONSULTANT e Senieer, entre outros.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.