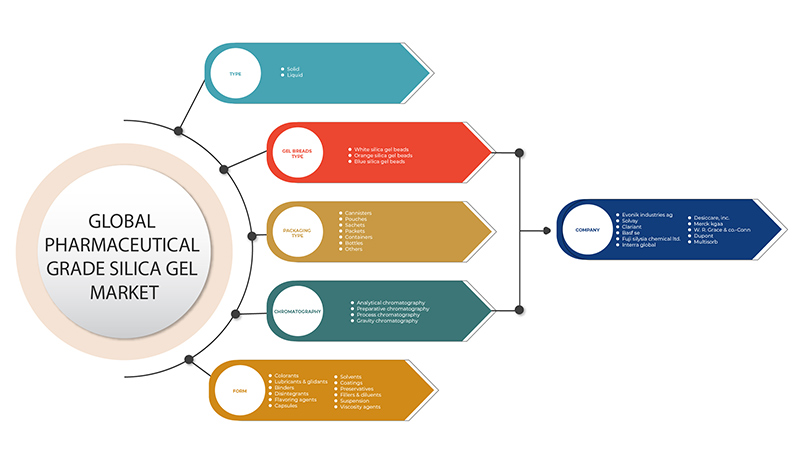

Global Pharmaceutical Grade Silica Gel Market, By Type (Liquid, and Solid), Gel Breads Type (White Silica Gel Breads, Orange Silica Gel Breads, and Blue Silica Gel Breads), Form (Colorants, Lubricants & Glidants, Binders, Disintegrants, Flavoring Agents, Capsules, Solvents, Coatings, Preservatives, Fillers & Diluents, Suspension, Viscosity Agents, and Others), Packaging Type (Canisters, Pouches, Sachets, Packets, Containers, Bottles, and Others), Chromatography (Analytical Chromatography, Preparative Chromatography, Process Chromatography, and Gravity Chromatography) Industry Trends and Forecast to 2029.

Market Analysis and Insights

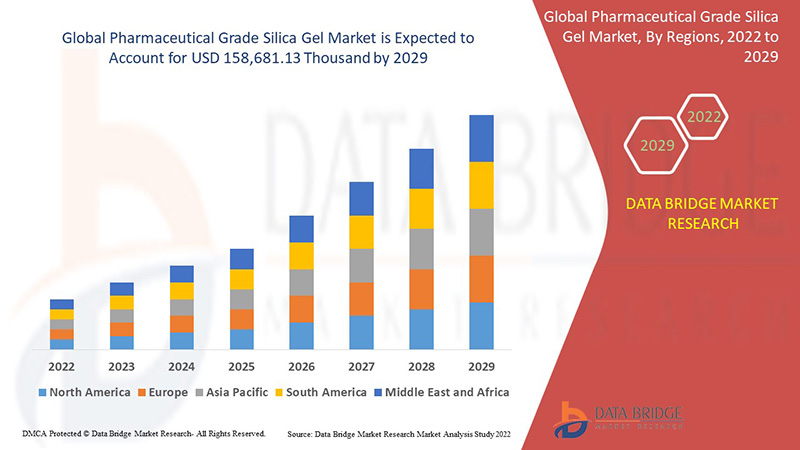

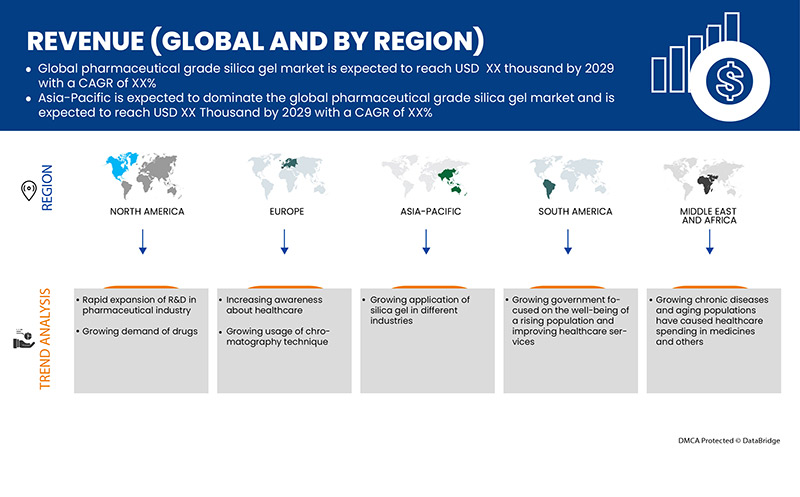

Global pharmaceutical grade silica gel market is expected to gain significant growth in the forecast period of 2022 to 2029. Data Bridge Market Research analyses that the market is growing with a CAGR of 3.1% in the forecast period of 2022 to 2029 and is expected to reach USD 158,681.13 thousand by 2029. The major factor driving the growth of the pharmaceutical grade silica gel market are growing demand for medicinal drugs, Extensive deployment or R&D in the Pharma sector, and rising spending on biotechnology using chromatography for detecting molecular components.

Silica gel as a stationary phase is largely accepted as one of the top adsorbents used in column chromatography as well as other separation techniques. One of the major advantages is its tremendous affinity for adsorption. Additionally, it is commercially very readily available in several different sizes and types. The major significant reason for silica gel used as a stationary phase in column chromatography is that it has feasible to obtain the extract essential size of the particle size for a particular method.

Silica gel is a polar adsorbent that is slightly acidic and has a strong capacity to adsorb the basic substance. The silica gel is most widely used in reversed-phase partition chromatography and it has broad applications that consist of the separation of steroids, amino acids, lipids, alkaloids, and several pharmaceutical processes.

Global pharmaceutical grade silica gel market report provides details of market share, new developments, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, products approvals, strategic decisions, product launches, geographic expansions, and technological innovations in the market. To understand the analysis and the market scenario contact us for an Analyst Brief, our team will help you create a revenue impact solution to achieve your desired goal.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2019 - 2014) |

|

Quantitative Units |

Receita em USD Mil, Volumes em Quilo Toneladas, Preços em USD |

|

Segmentos abrangidos |

Por tipo (líquido e sólido), tipo de pão de gel (pães de gel de sílica branca, pães de gel de sílica laranja e pães de gel de sílica azul), forma (corantes, lubrificantes e deslizantes, aglutinantes, desintegrantes, agentes aromatizantes , cápsulas, solventes, revestimentos, Conservantes, Enchimentos e Diluentes, Suspensão, Agentes de Viscosidade e Outros), Tipo de Embalagem (Latas, Sacos, Saquetas, Pacotes, Recipientes, Frascos e Outros), Cromatografia (Cromatografia Analítica, Cromatografia Preparativa, Cromatografia de Processo e Cromatografia de Gravidade) |

|

Países abrangidos |

EUA, Canadá e México, Reino Unido, Itália, França, Espanha, Rússia, Suíça, Turquia, Bélgica, Holanda, Alemanha, Resto da Europa, Japão, China, Coreia do Sul, Índia, Singapura, Tailândia, Indonésia, Malásia, Filipinas , Austrália e Nova Zelândia, Resto da Ásia-Pacífico, Brasil, Argentina, Resto da América do Sul, África do Sul, Egito, Arábia Saudita, Emirados Árabes Unidos, Israel e Resto do Médio Oriente e África. |

|

Atores do mercado abrangidos |

BASF SE, DuPont, Solvay, Merck KGAA, WR Grace & Co.-Conn, Evonik Industries AG, Multisorb Technologies, Clariant AG, Fuji Silysia Chemical |

Dinâmica do mercado de sílica gel de grau farmacêutico

Esta secção trata da compreensão dos impulsionadores, vantagens, oportunidades, restrições e desafios do mercado. Tudo isto é discutido em detalhe abaixo:

Motoristas

- Crescente procura por medicamentos

A crescente indústria farmacêutica impulsionou o crescimento da produção de medicamentos, o que aumentou o consumo de sílica gel ao longo dos anos. Espera-se que a procura de sílica gel aumente ainda mais, uma vez que a cromatografia pode ser realizada utilizando sílica gel. A cromatografia em coluna de sílica gel é amplamente utilizada na indústria farmacêutica para recolher ou separar diferentes componentes de medicamentos.

- Ampla implementação de I&D no setor farmacêutico

A crescente necessidade de integridade e automatização de dados levou à integração de software sofisticado com sistemas de cromatografia contemporâneos. Estes avanços na tecnologia para o desenvolvimento de sistemas melhorados, colunas inovadoras e descartáveis, resinas de melhor desempenho e outros acessórios podem ajudar o mercado a crescer significativamente.

- Aumento dos gastos em biotecnologia com recurso à cromatografia para deteção de componentes moleculares

A bioencapsulação envolve o envolvimento de tecidos ou substâncias biologicamente ativas numa membrana semipermeável para proteger as estruturas biológicas envolvidas, como células, enzimas, fármacos e materiais magnéticos, entre outros. A investigação e o desenvolvimento contínuos de técnicas baseadas em sílica gel, como a cromatografia, no setor biotecnológico conduzirão ao crescimento do mercado global de sílica gel de grau farmacêutico.

Oportunidades

- Perspetiva lucrativa para I&D interno

A cromatografia é uma técnica em constante evolução e o aumento da procura de instrumentos e reagentes cromatográficos para investigação e desenvolvimento é um fator importante que impulsiona o crescimento e a procura do mercado global de sílica gel de grau farmacêutico.

- Fácil disponibilidade de matérias-primas através de parceiros estratégicos bem estabelecidos

A forma amorfa do dióxido de silício é utilizada para fabricar gel de sílica de base farmacêutica. A enorme disponibilidade de diferentes matérias-primas à superfície da Terra, bem como a capacidade de produzir sinteticamente estas matérias-primas, juntamente com as empresas que produzem sílica gel de grau farmacêutico, estabeleceram parcerias bem estabelecidas com vários fornecedores e parceiros, que fornecem continuamente matérias-primas de alta qualidade para estes players para a produção de gel de sílica.

Restrições/Desafios

- Regulamentos rigorosos do governo

Os padrões de medicamentos da USP são aplicáveis nos EUA pela Food and Drug Administration (FDA) e são também utilizados em mais de 140 países em todo o mundo. Na Lei das Farmácias de 1948 da Índia, existem várias regulamentações rigorosas relacionadas com a composição dos medicamentos, o que exige que os farmacêuticos sigam vários procedimentos e rastreios para serem aprovados pelo governo. Estas regras e regulamentos rigorosos podem ser uma das maiores restrições enfrentadas pelo mercado global de sílica gel de grau farmacêutico.

- A disponibilidade de substitutos

Os silanóis livres na superfície da sílica são responsáveis por interações prejudiciais destes compostos e da fase estacionária. Apresentam mau formato de pico e baixa eficiência. Isto levou também os fabricantes a optar por substitutos presentes no mercado. Por estas razões, estão a ser introduzidas no mercado diversas novas fases estacionárias, como as fases estacionárias sem sílica, que possuem silanóis reduzidos e/ou blindados.

- Os artigos farmacêuticos atendem a rigorosos padrões de controlo de qualidade e desempenho

Em todo o mundo, todos os governos atribuem uma proporção substancial do seu orçamento total de cuidados de saúde a medicamentos e produtos farmacêuticos. Nos países em desenvolvimento, esforços administrativos e técnicos consideráveis são direcionados para garantir que os doentes e os consumidores recebem medicamentos eficazes e de boa qualidade, sem comprometer a qualidade.

- Âmbito de aplicação limitado aos compostos não voláteis

A temperatura do sistema que utiliza sílica gel para compostos voláteis necessita de ser mantida a níveis mais baixos para que o composto não vaporize demasiado rápido e haja uma perda total da amostra antes de esta ser utilizada e separada pela placa de sílica gel. Por conseguinte, o âmbito de aplicação do gel de sílica é limitado aos compostos não voláteis, o que pode desafiar o crescimento do mercado global de gel de sílica de grau farmacêutico.

Desenvolvimento recente

- Em fevereiro, a DuPont lançou um novo portal de vendas online para satisfazer as necessidades dos compradores da indústria de bioprocessamento. O bioprocessamento da DuPont permite separações e purificações sofisticadas para produtos terapêuticos, com diferentes marcas da DuPont, como a AmberChrom e a AmberLite, muito bem estabelecidas na indústria biofarmacêutica.

Âmbito do mercado global de sílica gel de grau farmacêutico

O mercado global de sílica gel de grau farmacêutico é categorizado com base no tipo, tipo de gel, forma, tipo de embalagem e cromatografia. O crescimento entre estes segmentos irá ajudá-lo a analisar os principais segmentos de crescimento nos setores e fornecerá aos utilizadores uma visão geral valiosa do mercado e informações de mercado para tomar decisões estratégicas para identificar as principais aplicações de mercado.

Tipo

- Sólido

- Líquido

Com base no tipo, o mercado global de sílica gel de grau farmacêutico está segmentado em sólido e líquido.

Tipo de Pão de Gel

- Pães de sílica gel branco

- Pães de Sílica Gel Laranja

- Pães de gel de sílica azul

Com base no tipo de pão de gel, o mercado global de sílica gel de grau farmacêutico está segmentado em pães de sílica gel brancos, pães de sílica gel laranja e pães de sílica gel azuis.

Forma

- Enchimentos e diluentes

- Ligantes

- Desintegrantes

- Lubrificantes e Deslizantes

- Corantes

- Agentes aromatizantes

- Conservantes

- Solventes

- Cápsulas

- Agentes de Viscosidade

- Suspensão

- Revestimentos

Com base na forma, o mercado global de sílica gel de grau farmacêutico está segmentado em corantes, lubrificantes e deslizantes, aglutinantes, desintegrantes, agentes aromatizantes, cápsulas, solventes, revestimentos, conservantes, enchimentos e diluentes, suspensões, agentes de viscosidade e outros hospitais e clínicas, centros de diagnóstico, institutos académicos e outros.

Tipo de embalagem

- Bolsas

- Sachês

- Pacotes

- Latas

- Recipientes

- Garrafas

- Outros

Com base no tipo de embalagem, o mercado global de sílica gel de grau farmacêutico está segmentado em latas, bolsas, saquetas, pacotes, recipientes, garrafas e outros.

Cromatografia

- Cromatografia Analítica

- Cromatografia Preparativa

- Cromatografia de Processo

Com base na cromatografia, o mercado global de sílica gel de grau farmacêutico está segmentado em cromatografia analítica, cromatografia preparativa, cromatografia de processo e cromatografia de gravidade.

Análise regional/perspetivas do mercado de gel de sílica de grau farmacêutico

O mercado de sílica gel de grau farmacêutico é analisado e são fornecidos insights e tendências sobre o tamanho do mercado por país, tipo, tipo de pão de gel, formato, tipo de embalagem e cromatografia, conforme referenciado acima.

O mercado global de sílica gel de grau farmacêutico está ainda mais segmentado na América do Norte, América do Sul, Ásia-Pacífico, Europa, Médio Oriente e África. A América do Norte está segmentada em EUA, Canadá e México. A Europa está segmentada em Alemanha, Reino Unido, Itália, França, Espanha, Rússia, Suíça, Turquia, Bélgica, Holanda e restante Europa. A Ásia-Pacífico está segmentada em Japão, China, Coreia do Sul, Índia, Singapura, Tailândia, Indonésia, Malásia, Filipinas, Austrália, Nova Zelândia e restante Ásia-Pacífico. A América do Sul está segmentada em Brasil, Argentina e restante América do Sul. O Médio Oriente e África estão segmentados em África do Sul, Egito, Arábia Saudita, Emirados Árabes Unidos, Israel e o resto do Médio Oriente e África.

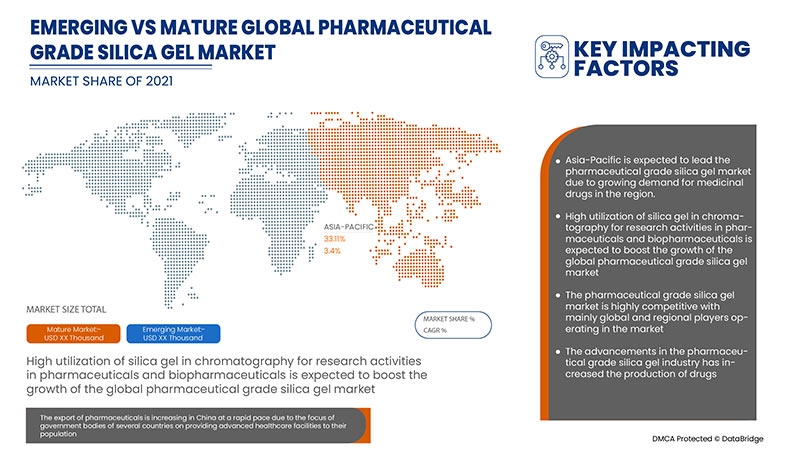

A região Ásia-Pacífico domina o mercado de sílica gel de grau farmacêutico em termos de quota de mercado e receitas de mercado e continuará a aumentar o seu domínio durante o período previsto. Isto deve-se à presença de grandes players e à infraestrutura de saúde bem desenvolvida no país.

A secção de países do relatório também fornece fatores individuais que impactam o mercado e alterações nas regulamentações do mercado que impactam as tendências atuais e futuras do mercado. Os pontos de dados, como as vendas de produtos novos e de substituição, a demografia dos países e as tarifas de importação e exportação, são alguns dos principais indicadores utilizados para prever o cenário de mercado para países individuais. Além disso, a presença e disponibilidade de marcas globais e os seus desafios enfrentados devido à elevada concorrência de marcas locais e nacionais, e o impacto dos canais de vendas são considerados ao fornecer uma análise de previsão dos dados do país.

Análise do panorama competitivo e da quota de mercado global de sílica gel de grau farmacêutico

O panorama competitivo do mercado global de sílica gel de grau farmacêutico fornece detalhes por concorrentes. Os detalhes incluídos são a visão geral da empresa, finanças da empresa, receitas geradas, potencial de mercado, investimento em investigação e desenvolvimento, novas iniciativas de mercado, localizações e instalações de produção, pontos fortes e fracos da empresa, lançamento de produtos, pipelines de testes de produto, aprovações de produto, patentes, largura e amplitude do produto, domínio da aplicação, curva de vida da tecnologia. Os pontos de dados fornecidos acima estão apenas relacionados com o foco das empresas no mercado de sílica gel de grau farmacêutico.

Alguns dos principais participantes que operam no mercado global de sílica gel de grau farmacêutico são a BASF SE, DuPont, Solvay, Merck KGAA, WR Grace & Co.-Conn, Evonik Industries AG, Multisorb Technologies, Clariant AG, Fuji Silysia Chemical.

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com grandes tamanhos de amostra. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados, que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Além disso, os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha do tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise da quota de mercado da empresa, padrões de medição, análise global versus regional e análise da participação dos fornecedores. Solicite a chamada de um analista em caso de dúvidas adicionais.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Índice

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL PHARMACEUTICAL GRADE SILICA GEL MARKET

1.4 LIMITATION

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 TYPE LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 DBMR MARKET CHALLENGE MATRIX

2.11 DBMR VENDOR SHARE ANALYSIS

2.12 IMPORT-EXPORT DATA

2.13 SECONDARY SOURCES

2.14 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTLE ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 LEGAL FACTORS

4.1.6 ENVIRONMENTAL FACTORS

4.2 PORTER’S FIVE FORCES:

4.2.1 THREAT OF NEW ENTRANTS

4.2.2 THREAT OF SUBSTITUTES

4.2.3 CUSTOMER BARGAINING POWER

4.2.4 SUPPLIER BARGAINING POWER

4.2.5 INTERNAL COMPETITION (RIVALRY)

4.3 CLIMATE CHANGE SCENARIO

4.4 RAW MATERIAL PRODUCTION COVERAGE

4.5 TECHNOLOGY ADVANCEMENTS

4.6 REGULATORY COVERAGE

4.7 SUPPLY CHAIN ANALYSIS

4.7.1 OVERVIEW

4.7.2 RAW MATERIAL PROCUREMENT

4.7.2.1 MANUFACTURING AND PACKING

4.7.2.2 MARKETING AND DISTRIBUTION

4.7.2.3 END USERS

4.7.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.8 VENDOR SELECTION CRITERIA

5 REGIONAL SUMMARY

5.1 GLOBAL

5.2 ASIA-PACIFIC

5.3 EUROPE

5.4 NORTH AMERICA

5.5 MIDDLE EAST AND AFRICA

5.6 SOUTH AMERICA

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 GROWING DEMAND FOR MEDICINAL DRUGS

6.1.2 EXTENSIVE DEPLOYMENT OF R&D IN THE PHARMA SECTOR

6.1.3 RISING EXPENSES ON BIOTECHNOLOGY USING CHROMATOGRAPHY FOR DETECTING MOLECULAR COMPONENTS

6.2 RESTRAINTS

6.2.1 STRINGENT REGULATIONS BY THE GOVERNMENT

6.2.2 AVAILABILITY OF SUBSTITUTES

6.2.3 RESTRICTIONS ON DERMAL AND ORAL EXPOSURE TO PHARMACEUTICAL GRADE SILICA GEL

6.2.4 HIGH PRICE OF SILICA GEL

6.3 OPPORTUNITIES

6.3.1 LUCRATIVE OUTLOOK TOWARDS IN-HOUSE R&D

6.3.2 EASY AVAILABILITY OF RAW MATERIALS THROUGH WELL-ESTABLISHED STRATEGIC PARTNERS

6.4 CHALLENGES

6.4.1 PHARMACEUTICAL ITEMS MEET STRINGENT QUALITY CONTROL AND PERFORMANCE STANDARDS

6.4.2 LIMITED APPLICATION SCOPE TO NON-VOLATILE COMPOUNDS

7 GLOBAL PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE

7.1 OVERVIEW

7.2 SOLID

7.3 LIQUID

8 GLOBAL PHARMACEUTICAL GRADE SILICA GEL MARKET, BY GEL BEADS TYPE

8.1 OVERVIEW

8.2 WHITE SILICA GEL BEADS

8.3 ORANGE SILICA GEL BEADS

8.4 BLUE SILICA GEL BEADS

9 GLOBAL PHARMACEUTICAL GRADE SILICA GEL MARKET, BY FORM

9.1 OVERVIEW

9.2 FILLERS & DILUENTS

9.3 BINDERS

9.4 DISINTEGRANTS

9.5 LUBRICANTS & GLIDANTS

9.6 COLORANTS

9.7 FLAVORING AGENTS

9.8 PRESERVATIVES

9.9 SOLVENTS

9.1 CAPSULES

9.11 VISCOSITY AGENTS

9.12 SUSPENSION

9.13 COATINGS

10 GLOBAL PHARMACEUTICAL GRADE SILICA GEL MARKET, BY PACKAGING TYPE

10.1 OVERVIEW

10.2 POUCHES

10.3 SACHETS

10.4 PACKETS

10.5 CANISTERS

10.6 CONTAINERS

10.7 BOTTLES

10.8 OTHERS

11 GLOBAL PHARMACEUTICAL GRADE SILICA GEL MARKET, BY CHROMATOGRAPHY

11.1 OVERVIEW

11.2 ANALYTICAL CHROMATOGRAPHY

11.3 PREPARATIVE CHROMATOGRAPHY

11.4 PROCESS CHROMATOGRAPHY

11.5 GRAVITY CHROMATOGRAPHY

12 GLOBAL PHARMACEUTICAL GRADE SILICA GEL MARKET, BY REGION

12.1 OVERVIEW

12.2 EUROPE

12.2.1 GERMANY

12.2.2 U.K.

12.2.3 FRANCE

12.2.4 ITALY

12.2.5 SPAIN

12.2.6 RUSSIA

12.2.7 SWITZERLAND

12.2.8 TURKEY

12.2.9 BELGIUM

12.2.10 NETHERLANDS

12.2.11 REST OF EUROPE

12.3 ASIA-PACIFIC

12.3.1 CHINA

12.3.2 INDIA

12.3.3 JAPAN

12.3.4 SOUTH KOREA

12.3.5 SINGAPORE

12.3.6 AUSTRALIA & NEW ZEALAND

12.3.7 THAILAND

12.3.8 MALAYSIA

12.3.9 INDONESIA

12.3.10 PHILIPPINES

12.3.11 REST OF ASIA-PACIFIC

12.4 MIDDLE EAST AND AFRICA

12.4.1 U.A.E.

12.4.2 SAUDI ARABIA

12.4.3 EGYPT

12.4.4 SOUTH AFRICA

12.4.5 ISRAEL

12.4.6 REST OF MIDDLE EAST AND AFRICA

12.5 NORTH AMERICA

12.5.1 U.S.

12.5.2 CANADA

12.5.3 MEXICO

12.6 SOUTH AMERICA

12.6.1 BRAZIL

12.6.2 ARGENTINA

12.6.3 REST OF SOUTH AMERICA

13 GLOBAL PHARMACEUTICAL GRADE SILICA GEL MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: GLOBAL

13.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

13.3 COMPANY SHARE ANALYSIS: EUROPE

13.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

13.4.1 COLLABORATIONS

13.4.2 EXPANSIONS

13.4.3 NEW PRODUCT DEVELOPMENTS

14 SWOT ANALYSIS

15 COMPANY PROFILES

15.1 BASF SE

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT UPDATE

15.2 DUPONT

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT UPDATES

15.3 SOLVAY

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 COMPANY SHARE ANALYSIS

15.3.4 PRODUCT PORTFOLIO

15.3.5 RECENT UPDATES

15.4 MERCK KGAA

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 COMPANY SHARE ANALYSIS

15.4.4 PRODUCT PORTFOLIO

15.4.5 RECENT UPDATE

15.5 W. R. GRACE & CO.-CONN

15.5.1 COMPANY SNAPSHOT

15.5.2 COMPANY SHARE ANALYSIS

15.5.3 PRODUCT PORTFOLIO

15.5.4 RECENT UPDATE

15.6 EVONIK INDUSTRIES AG

15.6.1 COMPANY SNAPSHOT

15.6.2 REVENUE ANALYSIS

15.6.3 PRODUCT PORTFOLIO

15.6.4 RECENT UPDATES

15.7 CLARIANT

15.7.1 COMPANY SNAPSHOT

15.7.2 REVENUE ANALYSIS

15.7.3 PRODUCT PORTFOLIO

15.7.4 RECENT UPDATES

15.8 DESICCARE, INC

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT UPDATE

15.9 FUJI SILYSIA CHEMICAL LTD

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT UPDATE

15.1 INTERRA GLOBAL

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT UPDATE

15.11 MULTISORB

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT UPDATE

16 QUESTIONNAIRE

17 RELATED REPORTS

Lista de Tabela

TABLE 1 IMPORT DATA OF SILICON DIOXIDE; HS CODE - PRODUCT: 281122 (USD THOUSAND)

TABLE 2 EXPORT DATA OF SILICON DIOXIDE; HS CODE - PRODUCT: 281122 (USD THOUSAND)

TABLE 3 REGULATORY FRAMEWORK

TABLE 4 GLOBAL PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 5 GLOBAL PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 6 GLOBAL SOLID IN PHARMACEUTICAL GRADE SILICA GEL MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 7 GLOBAL SOLID IN PHARMACEUTICAL GRADE SILICA GEL MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 8 GLOBAL LIQUID IN GLOBAL PHARMACEUTICAL GRADE SILICA GEL MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 9 GLOBAL LIQUID IN GLOBAL PHARMACEUTICAL GRADE SILICA GEL MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 10 GLOBAL PHARMACEUTICAL GRADE SILICA GEL MARKET, BY GEL BEADS TYPE, 2020-2029 (USD THOUSAND)

TABLE 11 GLOBAL WHITE SILICA GEL BEADS IN PHARMACEUTICAL GRADE SILICA GEL MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 12 GLOBAL ORANGE SILICA GEL BEADS IN GLOBAL PHARMACEUTICAL GRADE SILICA GEL MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 13 GLOBAL BLUE SILICA GEL BEADS IN PHARMACEUTICAL GRADE SILICA GEL MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 14 GLOBAL PHARMACEUTICAL GRADE SILICA GEL MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 15 GLOBAL FILLERS & DILUENTS IN PHARMACEUTICAL GRADE SILICA GEL MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 16 GLOBAL BINDERS IN GLOBAL PHARMACEUTICAL GRADE SILICA GEL MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 17 GLOBAL DISINTEGRANTS IN PHARMACEUTICAL GRADE SILICA GEL MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 18 GLOBAL LUBRICANTS & GLIDANTS IN PHARMACEUTICAL GRADE SILICA GEL MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 19 GLOBAL COLORANTS IN GLOBAL PHARMACEUTICAL GRADE SILICA GEL MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 20 GLOBAL FLAVORING AGENTS IN PHARMACEUTICAL GRADE SILICA GEL MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 21 GLOBAL PRESERVATIVES IN PHARMACEUTICAL GRADE SILICA GEL MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 22 GLOBAL SOLVENTS IN GLOBAL PHARMACEUTICAL GRADE SILICA GEL MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 23 GLOBAL CAPSULES IN PHARMACEUTICAL GRADE SILICA GEL MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 24 GLOBAL VISCOSITY AGENTS IN PHARMACEUTICAL GRADE SILICA GEL MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 25 GLOBAL SUSPENSION IN GLOBAL PHARMACEUTICAL GRADE SILICA GEL MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 26 GLOBAL COATINGS IN PHARMACEUTICAL GRADE SILICA GEL MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 27 GLOBAL PHARMACEUTICAL GRADE SILICA GEL MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 28 GLOBAL POUCHES IN PHARMACEUTICAL GRADE SILICA GEL MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 29 GLOBAL SACHETS IN GLOBAL PHARMACEUTICAL GRADE SILICA GEL MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 30 GLOBAL PACKETS IN PHARMACEUTICAL GRADE SILICA GEL MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 31 GLOBAL CANISTERS IN PHARMACEUTICAL GRADE SILICA GEL MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 32 GLOBAL CONTAINERS IN GLOBAL PHARMACEUTICAL GRADE SILICA GEL MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 33 GLOBAL BOTTLES IN PHARMACEUTICAL GRADE SILICA GEL MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 34 GLOBAL OTHERS IN PHARMACEUTICAL GRADE SILICA GEL MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 35 GLOBAL PHARMACEUTICAL GRADE SILICA GEL MARKET, BY CHROMATOGRAPHY, 2020-2029 (USD THOUSAND)

TABLE 36 GLOBAL ANALYTICAL CHROMATOGRAPHY IN PHARMACEUTICAL GRADE SILICA GEL MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 37 GLOBAL PREPARATIVE CHROMATOGRAPHY IN GLOBAL PHARMACEUTICAL GRADE SILICA GEL MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 38 GLOBAL PROCESS CHROMATOGRAPHY IN PHARMACEUTICAL GRADE SILICA GEL MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 39 GLOBAL GRAVITY CHROMATOGRAPHY IN PHARMACEUTICAL GRADE SILICA GEL MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 40 GLOBAL PHARMACEUTICAL GRADE SILICA GEL MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 41 GLOBAL PHARMACEUTICAL GRADE SILICA GEL MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 42 EUROPE PHARMACEUTICAL GRADE SILICA GEL MARKET, BY COUNTRY, 2020-2029 (USD THOUSAND)

TABLE 43 EUROPE PHARMACEUTICAL GRADE SILICA GEL MARKET, BY COUNTRY, 2020-2029 (KILO TONS)

TABLE 44 EUROPE PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 45 EUROPE PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 46 EUROPE PHARMACEUTICAL GRADE SILICA GEL MARKET, BY GEL BEADS TYPE, 2020-2029 (USD THOUSAND)

TABLE 47 EUROPE PHARMACEUTICAL GRADE SILICA GEL MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 48 EUROPE PHARMACEUTICAL GRADE SILICA GEL MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 49 EUROPE PHARMACEUTICAL GRADE SILICA GEL MARKET, BY CHROMATOGRAPHY, 2020-2029 (USD THOUSAND)

TABLE 50 GERMANY PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 51 GERMANY PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 52 GERMANY PHARMACEUTICAL GRADE SILICA GEL MARKET, BY GEL BEADS TYPE, 2020-2029 (USD THOUSAND)

TABLE 53 GERMANY PHARMACEUTICAL GRADE SILICA GEL MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 54 GERMANY PHARMACEUTICAL GRADE SILICA GEL MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 55 GERMANY PHARMACEUTICAL GRADE SILICA GEL MARKET, BY CHROMATOGRAPHY, 2020-2029 (USD THOUSAND)

TABLE 56 U.K. PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 57 U.K. PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 58 U.K. PHARMACEUTICAL GRADE SILICA GEL MARKET, BY GEL BEADS TYPE, 2020-2029 (USD THOUSAND)

TABLE 59 U.K. PHARMACEUTICAL GRADE SILICA GEL MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 60 U.K. PHARMACEUTICAL GRADE SILICA GEL MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 61 U.K. PHARMACEUTICAL GRADE SILICA GEL MARKET, BY CHROMATOGRAPHY, 2020-2029 (USD THOUSAND)

TABLE 62 FRANCE PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 63 FRANCE PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 64 FRANCE PHARMACEUTICAL GRADE SILICA GEL MARKET, BY GEL BEADS TYPE, 2020-2029 (USD THOUSAND)

TABLE 65 FRANCE PHARMACEUTICAL GRADE SILICA GEL MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 66 FRANCE PHARMACEUTICAL GRADE SILICA GEL MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 67 FRANCE PHARMACEUTICAL GRADE SILICA GEL MARKET, BY CHROMATOGRAPHY, 2020-2029 (USD THOUSAND)

TABLE 68 ITALY PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 69 ITALY PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 70 ITALY PHARMACEUTICAL GRADE SILICA GEL MARKET, BY GEL BEADS TYPE, 2020-2029 (USD THOUSAND)

TABLE 71 ITALY PHARMACEUTICAL GRADE SILICA GEL MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 72 ITALY PHARMACEUTICAL GRADE SILICA GEL MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 73 ITALY PHARMACEUTICAL GRADE SILICA GEL MARKET, BY CHROMATOGRAPHY, 2020-2029 (USD THOUSAND)

TABLE 74 SPAIN PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 75 SPAIN PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 76 SPAIN PHARMACEUTICAL GRADE SILICA GEL MARKET, BY GEL BEADS TYPE, 2020-2029 (USD THOUSAND)

TABLE 77 SPAIN PHARMACEUTICAL GRADE SILICA GEL MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 78 SPAIN PHARMACEUTICAL GRADE SILICA GEL MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 79 SPAIN PHARMACEUTICAL GRADE SILICA GEL MARKET, BY CHROMATOGRAPHY, 2020-2029 (USD THOUSAND)

TABLE 80 RUSSIA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 81 RUSSIA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 82 RUSSIA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY GEL BEADS TYPE, 2020-2029 (USD THOUSAND)

TABLE 83 RUSSIA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 84 RUSSIA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 85 RUSSIA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY CHROMATOGRAPHY, 2020-2029 (USD THOUSAND)

TABLE 86 SWITZERLAND PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 87 SWITZERLAND PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 88 SWITZERLAND PHARMACEUTICAL GRADE SILICA GEL MARKET, BY GEL BEADS TYPE, 2020-2029 (USD THOUSAND)

TABLE 89 SWITZERLAND PHARMACEUTICAL GRADE SILICA GEL MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 90 SWITZERLAND PHARMACEUTICAL GRADE SILICA GEL MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 91 SWITZERLAND PHARMACEUTICAL GRADE SILICA GEL MARKET, BY CHROMATOGRAPHY, 2020-2029 (USD THOUSAND)

TABLE 92 TURKEY PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 93 TURKEY PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 94 TURKEY PHARMACEUTICAL GRADE SILICA GEL MARKET, BY GEL BEADS TYPE, 2020-2029 (USD THOUSAND)

TABLE 95 TURKEY PHARMACEUTICAL GRADE SILICA GEL MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 96 TURKEY PHARMACEUTICAL GRADE SILICA GEL MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 97 TURKEY PHARMACEUTICAL GRADE SILICA GEL MARKET, BY CHROMATOGRAPHY, 2020-2029 (USD THOUSAND)

TABLE 98 BELGIUM PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 99 BELGIUM PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 100 BELGIUM PHARMACEUTICAL GRADE SILICA GEL MARKET, BY GEL BEADS TYPE, 2020-2029 (USD THOUSAND)

TABLE 101 BELGIUM PHARMACEUTICAL GRADE SILICA GEL MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 102 BELGIUM PHARMACEUTICAL GRADE SILICA GEL MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 103 BELGIUM PHARMACEUTICAL GRADE SILICA GEL MARKET, BY CHROMATOGRAPHY, 2020-2029 (USD THOUSAND)

TABLE 104 NETHERLANDS PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 105 NETHERLANDS PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 106 NETHERLANDS PHARMACEUTICAL GRADE SILICA GEL MARKET, BY GEL BEADS TYPE, 2020-2029 (USD THOUSAND)

TABLE 107 NETHERLANDS PHARMACEUTICAL GRADE SILICA GEL MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 108 NETHERLANDS PHARMACEUTICAL GRADE SILICA GEL MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 109 NETHERLANDS PHARMACEUTICAL GRADE SILICA GEL MARKET, BY CHROMATOGRAPHY, 2020-2029 (USD THOUSAND)

TABLE 110 REST OF EUROPE PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 111 REST OF EUROPE PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 112 ASIA-PACIFIC PHARMACEUTICAL GRADE SILICA GEL MARKET, BY COUNTRY, 2020-2029 (USD THOUSAND)

TABLE 113 ASIA-PACIFIC PHARMACEUTICAL GRADE SILICA GEL MARKET, BY COUNTRY, 2020-2029 (KILO TONS)

TABLE 114 ASIA-PACIFIC PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 115 ASIA-PACIFIC PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 116 ASIA-PACIFIC PHARMACEUTICAL GRADE SILICA GEL MARKET, BY GEL BEADS TYPE, 2020-2029 (USD THOUSAND)

TABLE 117 ASIA-PACIFIC PHARMACEUTICAL GRADE SILICA GEL MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 118 ASIA-PACIFIC PHARMACEUTICAL GRADE SILICA GEL MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 119 ASIA-PACIFIC PHARMACEUTICAL GRADE SILICA GEL MARKET, BY CHROMATOGRAPHY, 2020-2029 (USD THOUSAND)

TABLE 120 CHINA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 121 CHINA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 122 CHINA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY GEL BEADS TYPE, 2020-2029 (USD THOUSAND)

TABLE 123 CHINA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 124 CHINA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 125 CHINA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY CHROMATOGRAPHY, 2020-2029 (USD THOUSAND)

TABLE 126 INDIA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 127 INDIA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 128 INDIA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY GEL BEADS TYPE, 2020-2029 (USD THOUSAND)

TABLE 129 INDIA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 130 INDIA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 131 INDIA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY CHROMATOGRAPHY, 2020-2029 (USD THOUSAND)

TABLE 132 JAPAN PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 133 JAPAN PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 134 JAPAN PHARMACEUTICAL GRADE SILICA GEL MARKET, BY GEL BEADS TYPE, 2020-2029 (USD THOUSAND)

TABLE 135 JAPAN PHARMACEUTICAL GRADE SILICA GEL MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 136 JAPAN PHARMACEUTICAL GRADE SILICA GEL MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 137 JAPAN PHARMACEUTICAL GRADE SILICA GEL MARKET, BY CHROMATOGRAPHY, 2020-2029 (USD THOUSAND)

TABLE 138 SOUTH KOREA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 139 SOUTH KOREA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 140 SOUTH KOREA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY GEL BEADS TYPE, 2020-2029 (USD THOUSAND)

TABLE 141 SOUTH KOREA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 142 SOUTH KOREA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 143 SOUTH KOREA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY CHROMATOGRAPHY, 2020-2029 (USD THOUSAND)

TABLE 144 SINGAPORE PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 145 SINGAPORE PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 146 SINGAPORE PHARMACEUTICAL GRADE SILICA GEL MARKET, BY GEL BEADS TYPE, 2020-2029 (USD THOUSAND)

TABLE 147 SINGAPORE PHARMACEUTICAL GRADE SILICA GEL MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 148 SINGAPORE PHARMACEUTICAL GRADE SILICA GEL MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 149 SINGAPORE PHARMACEUTICAL GRADE SILICA GEL MARKET, BY CHROMATOGRAPHY, 2020-2029 (USD THOUSAND)

TABLE 150 AUSTRALIA & NEW ZEALAND PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 151 AUSTRALIA & NEW ZEALAND PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 152 AUSTRALIA & NEW ZEALAND PHARMACEUTICAL GRADE SILICA GEL MARKET, BY GEL BEADS TYPE, 2020-2029 (USD THOUSAND)

TABLE 153 AUSTRALIA & NEW ZEALAND PHARMACEUTICAL GRADE SILICA GEL MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 154 AUSTRALIA & NEW ZEALAND PHARMACEUTICAL GRADE SILICA GEL MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 155 AUSTRALIA & NEW ZEALAND PHARMACEUTICAL GRADE SILICA GEL MARKET, BY CHROMATOGRAPHY, 2020-2029 (USD THOUSAND)

TABLE 156 THAILAND PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 157 THAILAND PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 158 THAILAND PHARMACEUTICAL GRADE SILICA GEL MARKET, BY GEL BEADS TYPE, 2020-2029 (USD THOUSAND)

TABLE 159 THAILAND PHARMACEUTICAL GRADE SILICA GEL MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 160 THAILAND PHARMACEUTICAL GRADE SILICA GEL MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 161 THAILAND PHARMACEUTICAL GRADE SILICA GEL MARKET, BY CHROMATOGRAPHY, 2020-2029 (USD THOUSAND)

TABLE 162 MALAYSIA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 163 MALAYSIA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 164 MALAYSIA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY GEL BEADS TYPE, 2020-2029 (USD THOUSAND)

TABLE 165 MALAYSIA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 166 MALAYSIA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 167 MALAYSIA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY CHROMATOGRAPHY, 2020-2029 (USD THOUSAND)

TABLE 168 INDONESIA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 169 INDONESIA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 170 INDONESIA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY GEL BEADS TYPE, 2020-2029 (USD THOUSAND)

TABLE 171 INDONESIA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 172 INDONESIA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 173 INDONESIA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY CHROMATOGRAPHY, 2020-2029 (USD THOUSAND)

TABLE 174 PHILIPPINES PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 175 PHILIPPINES PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 176 PHILIPPINES PHARMACEUTICAL GRADE SILICA GEL MARKET, BY GEL BEADS TYPE, 2020-2029 (USD THOUSAND)

TABLE 177 PHILIPPINES PHARMACEUTICAL GRADE SILICA GEL MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 178 PHILIPPINES PHARMACEUTICAL GRADE SILICA GEL MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 179 PHILIPPINES PHARMACEUTICAL GRADE SILICA GEL MARKET, BY CHROMATOGRAPHY, 2020-2029 (USD THOUSAND)

TABLE 180 REST OF ASIA-PACIFIC PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 181 REST OF ASIA-PACIFIC PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 182 MIDDLE EAST AND AFRICA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY COUNTRY, 2020-2029 (USD THOUSAND)

TABLE 183 MIDDLE EAST AND AFRICA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY COUNTRY, 2020-2029 (KILO TONS)

TABLE 184 MIDDLE EAST AND AFRICA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 185 MIDDLE EAST AND AFRICA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 186 MIDDLE EAST AND AFRICA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY GEL BEADS TYPE, 2020-2029 (USD THOUSAND)

TABLE 187 MIDDLE EAST AND AFRICA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 188 MIDDLE EAST AND AFRICA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 189 MIDDLE EAST AND AFRICA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY CHROMATOGRAPHY, 2020-2029 (USD THOUSAND)

TABLE 190 U.A.E. PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 191 U.A.E. PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 192 U.A.E. PHARMACEUTICAL GRADE SILICA GEL MARKET, BY GEL BEADS TYPE, 2020-2029 (USD THOUSAND)

TABLE 193 U.A.E. PHARMACEUTICAL GRADE SILICA GEL MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 194 U.A.E. PHARMACEUTICAL GRADE SILICA GEL MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 195 U.A.E. PHARMACEUTICAL GRADE SILICA GEL MARKET, BY CHROMATOGRAPHY, 2020-2029 (USD THOUSAND)

TABLE 196 SAUDI ARABIA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 197 SAUDI ARABIA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 198 SAUDI ARABIA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY GEL BEADS TYPE, 2020-2029 (USD THOUSAND)

TABLE 199 SAUDI ARABIA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 200 SAUDI ARABIA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 201 SAUDI ARABIA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY CHROMATOGRAPHY, 2020-2029 (USD THOUSAND)

TABLE 202 EGYPT PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 203 EGYPT PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 204 EGYPT PHARMACEUTICAL GRADE SILICA GEL MARKET, BY GEL BEADS TYPE, 2020-2029 (USD THOUSAND)

TABLE 205 EGYPT PHARMACEUTICAL GRADE SILICA GEL MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 206 EGYPT PHARMACEUTICAL GRADE SILICA GEL MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 207 EGYPT PHARMACEUTICAL GRADE SILICA GEL MARKET, BY CHROMATOGRAPHY, 2020-2029 (USD THOUSAND)

TABLE 208 SOUTH AFRICA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 209 SOUTH AFRICA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 210 SOUTH AFRICA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY GEL BEADS TYPE, 2020-2029 (USD THOUSAND)

TABLE 211 SOUTH AFRICA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 212 SOUTH AFRICA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 213 SOUTH AFRICA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY CHROMATOGRAPHY, 2020-2029 (USD THOUSAND)

TABLE 214 ISRAEL PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 215 ISRAEL PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 216 ISRAEL PHARMACEUTICAL GRADE SILICA GEL MARKET, BY GEL BEADS TYPE, 2020-2029 (USD THOUSAND)

TABLE 217 ISRAEL PHARMACEUTICAL GRADE SILICA GEL MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 218 ISRAEL PHARMACEUTICAL GRADE SILICA GEL MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 219 ISRAEL PHARMACEUTICAL GRADE SILICA GEL MARKET, BY CHROMATOGRAPHY, 2020-2029 (USD THOUSAND)

TABLE 220 REST OF MIDDLE EAST AND AFRICA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 221 REST OF MIDDLE EAST AND AFRICA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 222 NORTH AMERICA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY COUNTRY, 2020-2029 (USD THOUSAND)

TABLE 223 NORTH AMERICA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY COUNTRY, 2020-2029 (KILO TONS)

TABLE 224 NORTH AMERICA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 225 NORTH AMERICA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 226 NORTH AMERICA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY GEL BEADS TYPE, 2020-2029 (USD THOUSAND)

TABLE 227 NORTH AMERICA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 228 NORTH AMERICA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 229 NORTH AMERICA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY CHROMATOGRAPHY, 2020-2029 (USD THOUSAND)

TABLE 230 U.S. PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 231 U.S. PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 232 U.S. PHARMACEUTICAL GRADE SILICA GEL MARKET, BY GEL BEADS TYPE, 2020-2029 (USD THOUSAND)

TABLE 233 U.S. PHARMACEUTICAL GRADE SILICA GEL MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 234 U.S. PHARMACEUTICAL GRADE SILICA GEL MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 235 U.S. PHARMACEUTICAL GRADE SILICA GEL MARKET, BY CHROMATOGRAPHY, 2020-2029 (USD THOUSAND)

TABLE 236 CANADA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 237 CANADA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 238 CANADA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY GEL BEADS TYPE, 2020-2029 (USD THOUSAND)

TABLE 239 CANADA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 240 CANADA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 241 CANADA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY CHROMATOGRAPHY, 2020-2029 (USD THOUSAND)

TABLE 242 MEXICO PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 243 MEXICO PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 244 MEXICO PHARMACEUTICAL GRADE SILICA GEL MARKET, BY GEL BEADS TYPE, 2020-2029 (USD THOUSAND)

TABLE 245 MEXICO PHARMACEUTICAL GRADE SILICA GEL MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 246 MEXICO PHARMACEUTICAL GRADE SILICA GEL MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 247 MEXICO PHARMACEUTICAL GRADE SILICA GEL MARKET, BY CHROMATOGRAPHY, 2020-2029 (USD THOUSAND)

TABLE 248 SOUTH AMERICA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY COUNTRY, 2020-2029 (USD THOUSAND)

TABLE 249 SOUTH AMERICA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY COUNTRY, 2020-2029 (KILO TONS)

TABLE 250 SOUTH AMERICA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 251 SOUTH AMERICA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 252 SOUTH AMERICA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY GEL BEADS TYPE, 2020-2029 (USD THOUSAND)

TABLE 253 SOUTH AMERICA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 254 SOUTH AMERICA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 255 SOUTH AMERICA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY CHROMATOGRAPHY, 2020-2029 (USD THOUSAND)

TABLE 256 BRAZIL PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 257 BRAZIL PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 258 BRAZIL PHARMACEUTICAL GRADE SILICA GEL MARKET, BY GEL BEADS TYPE, 2020-2029 (USD THOUSAND)

TABLE 259 BRAZIL PHARMACEUTICAL GRADE SILICA GEL MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 260 BRAZIL PHARMACEUTICAL GRADE SILICA GEL MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 261 BRAZIL PHARMACEUTICAL GRADE SILICA GEL MARKET, BY CHROMATOGRAPHY, 2020-2029 (USD THOUSAND)

TABLE 262 ARGENTINA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 263 ARGENTINA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 264 ARGENTINA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY GEL BEADS TYPE, 2020-2029 (USD THOUSAND)

TABLE 265 ARGENTINA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 266 ARGENTINA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 267 ARGENTINA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY CHROMATOGRAPHY, 2020-2029 (USD THOUSAND)

TABLE 268 REST OF SOUTH AMERICA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 269 REST OF SOUTH AMERICA PHARMACEUTICAL GRADE SILICA GEL MARKET, TYPE, 2020-2029 (KILO TONS)

Lista de Figura

FIGURE 1 GLOBAL PHARMACEUTICAL GRADE SILICA GEL MARKET: SEGMENTATION

FIGURE 2 GLOBAL PHARMACEUTICAL GRADE SILICA GEL MARKET: DATA TRIANGULATION

FIGURE 3 GLOBAL PHARMACEUTICAL GRADE SILICA GEL MARKET: DROC ANALYSIS

FIGURE 4 GLOBAL PHARMACEUTICAL GRADE SILICA GEL MARKET: GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 5 GLOBAL PHARMACEUTICAL GRADE SILICA GEL MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 GLOBAL PHARMACEUTICAL GRADE SILICA GEL MARKET: TYPE LIFE LINE CURVE

FIGURE 7 GLOBAL PHARMACEUTICAL GRADE SILICA GEL MARKET: MULTIVARIATE MODELLING

FIGURE 8 GLOBAL PHARMACEUTICAL GRADE SILICA GEL MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 GLOBAL PHARMACEUTICAL GRADE SILICA GEL MARKET: DBMR MARKET POSITION GRID

FIGURE 10 GLOBAL PHARMACEUTICAL GRADE SILICA GEL MARKET: CHALLENGE MATRIX

FIGURE 11 GLOBAL PHARMACEUTICAL GRADE SILICA GEL MARKET: VENDOR SHARE ANALYSIS

FIGURE 12 GLOBAL PHARMACEUTICAL GRADE SILICA GEL MARKET: SEGMENTATION

FIGURE 13 ASIA-PACIFIC IS EXPECTED TO DOMINATE GLOBAL PHARMACEUTICAL GRADE SILICA GEL MARKET AND IS EXPECTED TO GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD

FIGURE 14 GROWING DEMAND FOR MEDICINAL DRUGS IS EXPECTED TO DRIVE GLOBAL PHARMACEUTICAL GRADE SILICA GEL MARKET IN THE FORECAST PERIOD

FIGURE 15 SOLID SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE GLOBAL PHARMACEUTICAL GRADE SILICA GEL MARKET IN 2022 & 2029

FIGURE 16 ASIA-PACIFIC IS THE FASTEST-GROWING MARKET FOR PHARMACEUTICAL GRADE SILICA GEL MARKET MANUFACTURERS IN THE FORECAST PERIOD

FIGURE 17 SUPPLY CHAIN ANALYSIS- GLOBAL PHARMACEUTICAL GRADE SILICA GEL MARKET

FIGURE 18 VENDOR SELECTION CRITERIA

FIGURE 19 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF GLOBAL PHARMACEUTICAL GRADE SILICA GEL MARKET

FIGURE 20 GLOBAL PHARMACEUTICAL GRADE SILICA GEL MARKET: BY TYPE, 2021

FIGURE 21 GLOBAL PHARMACEUTICAL GRADE SILICA GEL MARKET: BY GEL BEADS TYPE, 2021

FIGURE 22 GLOBAL PHARMACEUTICAL GRADE SILICA GEL MARKET: BY FORM, 2021

FIGURE 23 GLOBAL PHARMACEUTICAL GRADE SILICA GEL MARKET: BY PACKAGING TYPE, 2021

FIGURE 24 GLOBAL PHARMACEUTICAL GRADE SILICA GEL MARKET: BY CHROMATOGRAPHY, 2021

FIGURE 25 GLOBAL PHARMACEUTICAL GRADE SILICA GEL MARKET: SNAPSHOT (2021)

FIGURE 26 GLOBAL PHARMACEUTICAL GRADE SILICA GEL MARKET : BY REGION (2021)

FIGURE 27 GLOBAL PHARMACEUTICAL GRADE SILICA GEL MARKET: BY REGION (2022 & 2029)

FIGURE 28 GLOBAL PHARMACEUTICAL GRADE SILICA GEL MARKET: BY REGION (2021 & 2029)

FIGURE 29 GLOBAL PHARMACEUTICAL GRADE SILICA GEL MARKET: BY TYPE (2022-2029)

FIGURE 30 EUROPE PHARMACEUTICAL GRADE SILICA GEL MARKET : SNAPSHOT (2021)

FIGURE 31 EUROPE PHARMACEUTICAL GRADE SILICA GEL MARKET: BY COUNTRY (2021)

FIGURE 32 EUROPE PHARMACEUTICAL GRADE SILICA GEL MARKET: BY COUNTRY (2022 & 2029)

FIGURE 33 EUROPE PHARMACEUTICAL GRADE SILICA GEL MARKET: BY COUNTRY (2021 & 2029)

FIGURE 34 EUROPE PHARMACEUTICAL GRADE SILICA GEL MARKET: BY TYPE (2022-2029)

FIGURE 35 ASIA-PACIFIC PHARMACEUTICAL GRADE SILICA GEL MARKET : SNAPSHOT (2021)

FIGURE 36 ASIA-PACIFIC PHARMACEUTICAL GRADE SILICA GEL MARKET: BY COUNTRY (2021)

FIGURE 37 ASIA-PACIFIC PHARMACEUTICAL GRADE SILICA GEL MARKET: BY COUNTRY (2022 & 2029)

FIGURE 38 ASIA-PACIFIC PHARMACEUTICAL GRADE SILICA GEL MARKET: BY COUNTRY (2021 & 2029)

FIGURE 39 ASIA-PACIFIC PHARMACEUTICAL GRADE SILICA GEL MARKET: BY TYPE (2022-2029)

FIGURE 40 MIDDLE EAST AND AFRICA PHARMACEUTICAL GRADE SILICA GEL MARKET : SNAPSHOT (2021)

FIGURE 41 MIDDLE EAST AND AFRICA PHARMACEUTICAL GRADE SILICA GEL MARKET: BY COUNTRY (2021)

FIGURE 42 MIDDLE EAST AND AFRICA PHARMACEUTICAL GRADE SILICA GEL MARKET: BY COUNTRY (2022 & 2029)

FIGURE 43 MIDDLE EAST AND AFRICA PHARMACEUTICAL GRADE SILICA GEL MARKET: BY COUNTRY (2021 & 2029)

FIGURE 44 MIDDLE EAST AND AFRICA PHARMACEUTICAL GRADE SILICA GEL MARKET: BY TYPE (2022-2029)

FIGURE 45 NORTH AMERICA PHARMACEUTICAL GRADE SILICA GEL MARKET: SNAPSHOT (2021)

FIGURE 46 NORTH AMERICA PHARMACEUTICAL GRADE SILICA GEL MARKET: BY COUNTRY (2021)

FIGURE 47 NORTH AMERICA PHARMACEUTICAL GRADE SILICA GEL MARKET: BY COUNTRY (2022 & 2029)

FIGURE 48 NORTH AMERICA PHARMACEUTICAL GRADE SILICA GEL MARKET: BY COUNTRY (2021 & 2029)

FIGURE 49 NORTH AMERICA PHARMACEUTICAL GRADE SILICA GEL MARKET: BY TYPE (2022-2029)

FIGURE 50 SOUTH AMERICA PHARMACEUTICAL GRADE SILICA GEL MARKET : SNAPSHOT (2021)

FIGURE 51 SOUTH AMERICA PHARMACEUTICAL GRADE SILICA GEL MARKET: BY COUNTRY (2021)

FIGURE 52 SOUTH AMERICA PHARMACEUTICAL GRADE SILICA GEL MARKET: BY COUNTRY (2022 & 2029)

FIGURE 53 SOUTH AMERICA PHARMACEUTICAL GRADE SILICA GEL MARKET: BY COUNTRY (2021 & 2029)

FIGURE 54 SOUTH AMERICA PHARMACEUTICAL GRADE SILICA GEL MARKET: BY TYPE (2022-2029)

FIGURE 55 GLOBAL PHARMACEUTICAL GRADE SILICA GEL MARKET: COMPANY SHARE 2021 (%)

FIGURE 56 NORTH AMERICA PHARMACEUTICAL GRADE SILICA GEL MARKET: COMPANY SHARE 2021 (%)

FIGURE 57 EUROPE PHARMACEUTICAL GRADE SILICA GEL MARKET: COMPANY SHARE 2021 (%)

FIGURE 58 ASIA-PACIFIC PHARMACEUTICAL GRADE SILICA GEL MARKET: COMPANY SHARE 2021 (%)

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.