Global Pharmaceutical Excipients Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

8.85 Billion

USD

14.77 Billion

2024

2032

USD

8.85 Billion

USD

14.77 Billion

2024

2032

| 2025 –2032 | |

| USD 8.85 Billion | |

| USD 14.77 Billion | |

|

|

|

|

Segmentação do mercado global de excipientes farmacêuticos por funcionalidade (aglutinantes e adesivos, desintegrantes, material de revestimento, corantes, solubilizantes, aromatizantes, adoçantes, diluentes, lubrificantes, tampões, emulsificantes, conservantes, antioxidantes, sorventes, solventes, emolientes, deslizantes, quelantes, antiespumantes e outros), forma de dosagem (sólida, semissólida e líquida), via de administração (excipientes orais, excipientes tópicos, excipientes parenterais e outros excipientes), usuário final (empresas farmacêuticas e biofarmacêuticas, formuladores contratados, organizações de pesquisa e acadêmicos e outros), canal de distribuição (licitação direta, vendas no varejo e outros) - tendências do setor e previsão para 2032

Tamanho do mercado de excipientes farmacêuticos

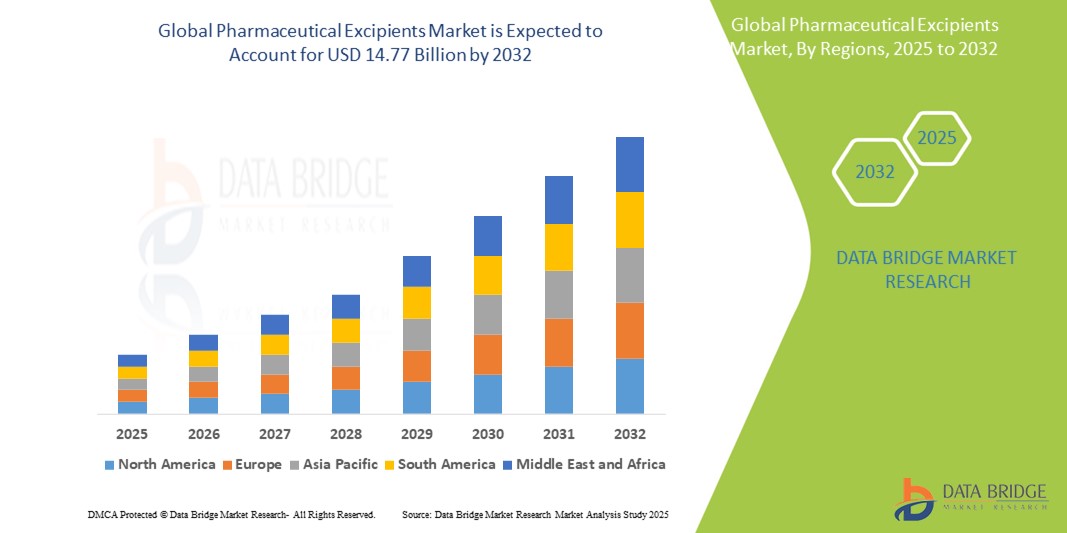

- O tamanho do mercado global de excipientes farmacêuticos foi avaliado em US$ 8,85 bilhões em 2024 e deve atingir US$ 14,77 bilhões até 2032 , com um CAGR de 6,60% durante o período previsto.

- Este crescimento é impulsionado por fatores como a expansão da indústria farmacêutica, o aumento do desenvolvimento de medicamentos genéricos e os avanços tecnológicos nos sistemas de distribuição de medicamentos.

Análise de Mercado de Excipientes Farmacêuticos

- Excipientes farmacêuticos são substâncias essenciais e não ativas utilizadas em formulações de medicamentos para melhorar a estabilidade, a biodisponibilidade e a adesão do paciente. Eles desempenham um papel crucial na fabricação de medicamentos, atuando como aglutinantes, enchimentos, revestimentos e estabilizantes.

- A demanda por excipientes farmacêuticos é significativamente impulsionada pela crescente prevalência de doenças crônicas, aumento da produção de medicamentos genéricos e avanços nas tecnologias de administração de medicamentos.

- A América do Norte domina o mercado de excipientes farmacêuticos , com uma participação de 39,8% no mercado global de excipientes farmacêuticos, impulsionada por suas capacidades avançadas de fabricação farmacêutica, altos gastos com assistência médica e forte presença de importantes participantes do mercado.

- O mercado da Ásia-Pacífico detém uma participação de 30,4% do mercado global de excipientes farmacêuticos, impulsionado pela rápida expansão na fabricação de produtos farmacêuticos, pelo aumento dos gastos com saúde e pela crescente demanda por formulações de medicamentos com boa relação custo-benefício.

- Espera-se que ligantes e adesivos dominem o mercado de excipientes farmacêuticos, com a maior participação de 56,72% em 2023, impulsionados por seu papel crítico em formulações de comprimidos e cápsulas. Esses excipientes proporcionam integridade estrutural e garantem uniformidade na composição do fármaco, contribuindo para resultados terapêuticos consistentes.

Escopo do Relatório e Segmentação do Mercado de Excipientes Farmacêuticos

|

Atributos |

Principais insights de mercado sobre excipientes farmacêuticos |

|

Segmentos abrangidos |

|

|

Países abrangidos |

América do Norte

Europa

Ásia-Pacífico

Oriente Médio e África

Ámérica do Sul

|

|

Principais participantes do mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor agregado |

Além dos insights sobre cenários de mercado, como valor de mercado, taxa de crescimento, segmentação, cobertura geográfica e principais participantes, os relatórios de mercado selecionados pela Data Bridge Market Research também incluem análise de importação e exportação, visão geral da capacidade de produção, análise de consumo de produção, análise de tendência de preço, cenário de mudança climática, análise da cadeia de suprimentos, análise da cadeia de valor, visão geral de matéria-prima/consumíveis, critérios de seleção de fornecedores, análise PESTLE, análise de Porter e estrutura regulatória. |

Tendências do mercado de excipientes farmacêuticos

“Inovações em Excipientes Farmacêuticos para Administração Avançada de Medicamentos”

- Uma tendência proeminente no mercado de excipientes farmacêuticos é o foco crescente em excipientes multifuncionais que suportam sistemas avançados de administração de medicamentos, incluindo formulações de liberação controlada, administração direcionada e desintegração oral.

- Esses excipientes inovadores aumentam a estabilidade do medicamento, a biodisponibilidade e a adesão do paciente, desempenhando um papel crucial na formulação de medicamentos complexos, biológicos e medicamentos personalizados.

- Por exemplo, excipientes como as ciclodextrinas melhoram a solubilidade e a estabilidade de medicamentos pouco solúveis em água, enquanto os excipientes à base de lipídios auxiliam na administração de compostos altamente lipofílicos, facilitando a absorção eficiente e o impacto terapêutico.

- Esses avanços estão transformando o desenvolvimento de medicamentos, permitindo que as empresas farmacêuticas superem os desafios de formulação, melhorem os resultados terapêuticos e impulsionem a demanda por excipientes novos e de alto desempenho.

Dinâmica do Mercado de Excipientes Farmacêuticos

Motorista

“Crescente demanda por sistemas inovadores de administração de medicamentos”

- O foco crescente em terapias centradas no paciente e na medicina personalizada está impulsionando significativamente a demanda por excipientes farmacêuticos avançados que suportem sistemas inovadores de administração de medicamentos, como liberação controlada, administração direcionada e comprimidos de desintegração oral.

- À medida que as empresas farmacêuticas se esforçam para melhorar os resultados terapêuticos e a adesão dos pacientes, a necessidade de excipientes que possam aumentar a biodisponibilidade, a estabilidade e a solubilidade dos ingredientes farmacêuticos ativos (IFAs) está aumentando.

- Além disso, a tendência para produtos biológicos e formulações complexas de medicamentos, que muitas vezes requerem excipientes especializados, está a impulsionar ainda mais o crescimento do mercado

Por exemplo,

- De acordo com um relatório de 2024 da Pharmaceutical Research and Manufacturers of America (PhRMA), o número de medicamentos biológicos em desenvolvimento mais que dobrou na última década, criando uma demanda substancial por novos excipientes que podem enfrentar os desafios únicos das formulações biológicas.

- À medida que a indústria farmacêutica continua a inovar, espera-se que a procura por excipientes avançados que possam suportar estas terapias de ponta cresça significativamente.

Oportunidade

“Expansão para mercados emergentes com rápido crescimento farmacêutico”

- As economias emergentes, particularmente nas regiões da Ásia-Pacífico e América Latina, representam uma oportunidade significativa para os fabricantes de excipientes farmacêuticos, impulsionadas pelo rápido crescimento econômico, pelo aumento dos gastos com saúde e pela expansão das capacidades de fabricação farmacêutica.

- Essas regiões estão vivenciando um aumento na demanda por medicamentos genéricos de baixo custo, medicamentos de venda livre (OTC) e produtos biológicos, criando um mercado favorável para excipientes que podem atender a diversas necessidades de formulação.

- Além disso, espera-se que políticas governamentais favoráveis, conscientização crescente sobre saúde e investimentos crescentes na produção farmacêutica local aumentem ainda mais a demanda por excipientes.

Por exemplo,

- Em janeiro de 2025, de acordo com um relatório da Aliança Farmacêutica Indiana, a Índia deverá se tornar o terceiro maior mercado farmacêutico do mundo até 2030, impulsionada pela forte demanda interna e pela expansão das oportunidades de exportação. Esse crescimento aumentará significativamente a demanda por excipientes farmacêuticos necessários para a formulação e fabricação de medicamentos.

- Como resultado, os fabricantes de excipientes que se expandem estrategicamente para esses mercados de rápido crescimento podem se beneficiar do aumento das vendas e da participação de mercado.

Restrição/Desafio

“Requisitos regulatórios rigorosos e altos custos de conformidade”

- O mercado de excipientes farmacêuticos enfrenta desafios significativos relacionados aos rigorosos requisitos regulatórios que regem a segurança, a qualidade e o desempenho dos excipientes usados em formulações de medicamentos

- Essas regulamentações, que variam significativamente entre regiões, muitas vezes exigem testes, documentação e validação extensivos, aumentando o custo geral e o tempo necessários para o desenvolvimento e a comercialização do produto.

- Além disso, a necessidade de conformidade com as Boas Práticas de Fabricação (BPF), padrões farmacopeicos e outras certificações de qualidade aumenta o ônus financeiro para os fabricantes de excipientes.

Por exemplo,

- De acordo com um relatório de 2024 do Conselho Internacional de Excipientes Farmacêuticos (IPEC), o custo da conformidade regulatória para os fabricantes de excipientes aumentou em mais de 30% nos últimos cinco anos, à medida que as agências reguladoras em todo o mundo reforçam sua supervisão para garantir a segurança do paciente e a eficácia do produto.

- Essas pressões regulatórias podem limitar a entrada no mercado de participantes menores e aumentar o custo geral da produção de excipientes, impactando a lucratividade e o crescimento do mercado.

Escopo de mercado de excipientes farmacêuticos

O mercado é segmentado com base na funcionalidade, forma farmacêutica, via de administração, usuário final e canal de distribuição.

|

Segmentação |

Sub-segmentação |

|

Por funcionalidade |

|

|

Por forma de dosagem |

|

|

Por via de administração |

|

|

Por usuário final |

|

|

Por canal de distribuição |

|

Em 2025, projeta-se que os ligantes e adesivos dominem o mercado com a maior participação no segmento de funcionalidade

Espera-se que o segmento de aglutinantes e adesivos domine o mercado de excipientes farmacêuticos, com a maior participação, de 56,72%, impulsionado por seu papel crítico em formulações de comprimidos e cápsulas. Esses excipientes proporcionam integridade estrutural e garantem uniformidade na composição do fármaco, contribuindo para resultados terapêuticos consistentes. Seu amplo uso é ainda impulsionado pela alta demanda por formas farmacêuticas orais sólidas, preferidas por sua conveniência, estabilidade e adesão do paciente, reforçando seu domínio de mercado.

Espera-se que os excipientes orais representem a maior fatia durante o período previsto no mercado de vias de administração

Em 2025, o segmento de excipientes orais dominou o mercado de excipientes farmacêuticos, com a maior participação de mercado, de 55,49%, impulsionado por seu amplo uso e pela preferência dos pacientes pela administração oral de medicamentos. Essas formulações são favorecidas devido à sua facilidade de administração, custo-efetividade e alta adesão dos pacientes. Os excipientes dessa categoria são essenciais para aumentar a biodisponibilidade, a estabilidade e o sabor dos medicamentos orais, reforçando sua dominância no mercado.

Análise regional do mercado de excipientes farmacêuticos

“A América do Norte detém a maior fatia do mercado de excipientes farmacêuticos”

- A América do Norte domina o mercado de excipientes farmacêuticos , com uma participação de 39,8% no mercado global de excipientes farmacêuticos, impulsionada por suas capacidades avançadas de fabricação farmacêutica, altos gastos com assistência médica e forte presença de importantes participantes do mercado.

- Os EUA detêm uma participação significativa de 39% devido à sua indústria farmacêutica bem estabelecida, às extensas atividades de pesquisa e desenvolvimento e à crescente demanda por sistemas inovadores de administração de medicamentos, incluindo formulações de liberação controlada e direcionadas.

- Além disso, a presença de grandes empresas farmacêuticas e os rigorosos padrões regulatórios de segurança e eficácia dos medicamentos fortalecem ainda mais o mercado na região.

- O foco crescente em produtos biológicos, medicina personalizada e medicamentos especiais também contribui para a alta demanda por excipientes de alta qualidade, reforçando a liderança da América do Norte no mercado.

“A região Ásia-Pacífico deverá registrar o maior CAGR no mercado de excipientes farmacêuticos”

- Espera-se que a região Ásia-Pacífico testemunhe a maior taxa de crescimento no mercado de excipientes farmacêuticos, com uma participação de mercado de 30,4%, impulsionada pela rápida expansão na fabricação de produtos farmacêuticos, aumento dos gastos com saúde e crescente demanda por formulações de medicamentos com boa relação custo-benefício.

- Países como a China, a Índia e o Japão estão a emergir como mercados-chave, apoiados por políticas governamentais favoráveis, uma grande população de pacientes e uma prevalência crescente de doenças crónicas que exigem medicação a longo prazo.

- O Japão, conhecido por sua pesquisa farmacêutica de ponta e tecnologias avançadas de fabricação de medicamentos, continua sendo um mercado crucial para excipientes premium que dão suporte a formulações inovadoras de medicamentos.

- A Índia deverá registrar o maior crescimento em participação de mercado com CAGR de 5,1%, impulsionada pelo rápido crescimento de sua indústria de medicamentos genéricos, expansão da infraestrutura de saúde e aumento dos investimentos em P&D farmacêutico, tornando-se um participante importante no mercado global de excipientes.

Participação de mercado de excipientes farmacêuticos

O cenário competitivo do mercado fornece detalhes por concorrente. Os detalhes incluem visão geral da empresa, finanças da empresa, receita gerada, potencial de mercado, investimento em pesquisa e desenvolvimento, novas iniciativas de mercado, presença global, locais e instalações de produção, capacidades de produção, pontos fortes e fracos da empresa, lançamento de produto, abrangência e amplitude do produto e domínio da aplicação. Os pontos de dados fornecidos acima referem-se apenas ao foco das empresas em relação ao mercado.

Os principais líderes de mercado que operam no mercado são:

- Kerry Group plc (Irlanda)

- DFE Pharma (Alemanha)

- Cargill, Incorporated (EUA)

- Pfanstiehl Inc. (EUA)

- Colorcon Inc. (EUA)

- MEGGLE Group GmbH (Alemanha)

- Omya International AG (Suíça)

- Peter Greven GmbH & Co. KG (Alemanha)

- Ashland (EUA)

- Evonik Industries AG (Alemanha)

- Dow (EUA)

- Croda International Plc (Reino Unido)

- Roquette Frères (França)

- A Lubrizol Corporation (EUA)

- BASF (Alemanha)

- Avantor, Inc. (EUA)

- BENEO GmbH (Alemanha)

- Comércio de produtos químicos (Índia)

Últimos desenvolvimentos no mercado global de excipientes farmacêuticos

- Em novembro de 2024, a Clariant apresentou oito novos excipientes farmacêuticos de alto desempenho na feira CPHI Índia 2024. Esses excipientes foram desenvolvidos para auxiliar o desenvolvimento de medicamentos seguros e eficazes, atendendo a aplicações como APIs sensíveis, formulações parenterais e formulações que exigem soluções incolores.

- Em janeiro de 2025, a Roquette lançou três novos graus de excipientes projetados especificamente para ingredientes farmacêuticos ativos (APIs) sensíveis à umidade, aumentando a estabilidade e a eficácia em formulações desafiadoras

- Em janeiro de 2025, a Evonik expandiu seu portfólio de excipientes farmacêuticos à base de lipídios por meio de aquisições estratégicas, atendendo à crescente demanda por novos sistemas de administração de medicamentos e excipientes de alta qualidade que melhoram a biodisponibilidade e a estabilidade.

- Em janeiro de 2025, a Akums Drugs and Pharmaceuticals anunciou o desenvolvimento de uma nova unidade dedicada à fabricação de dosagens liofilizadas e estéreis, com foco em injetáveis e biológicos, para atender à crescente demanda por medicamentos estéreis e biológicos.

- Em setembro de 2024, a Glenmark Pharmaceuticals lançou uma variante biossimilar do medicamento antidiabético Liraglutida, marcando um esforço pioneiro no cenário farmacêutico indiano e expandindo seu portfólio de produtos biológicos.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.