Global Packaging Films Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

107.97 Billion

USD

165.57 Billion

2024

2032

USD

107.97 Billion

USD

165.57 Billion

2024

2032

| 2025 –2032 | |

| USD 107.97 Billion | |

| USD 165.57 Billion | |

|

|

|

|

Global Packaging Films Market, By Type (Polyethylene (PE), Polypropylene (PP), Polyethylene Terephthalate (PET), Polyvinyl Chloride (PVC), Polylactic Acid (PLA) , Cellulose, Ethylene Vinyl Alcohol (EVOH), and Others), Flexibility (Flexible and Rigid), Nature (Synthetic and Bio-Based), Application (Food & Beverage, Pharmaceuticals, Personal Care & Cosmetics, Electrical and Electronics, Household and Home Décor, Pet Food, and Others) - Industry Trends and Forecast to 2031.

Packaging Films Market Analysis and Size

The global packaging films market report provides details of market share, new developments, and the impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, products approvals, strategic decisions, product launches, geographic expansions, and technological innovations in the market. To understand the analysis and the market scenario, contact us for an analyst brief. Our team will help you create a revenue-impact solution to achieve your desired goal.

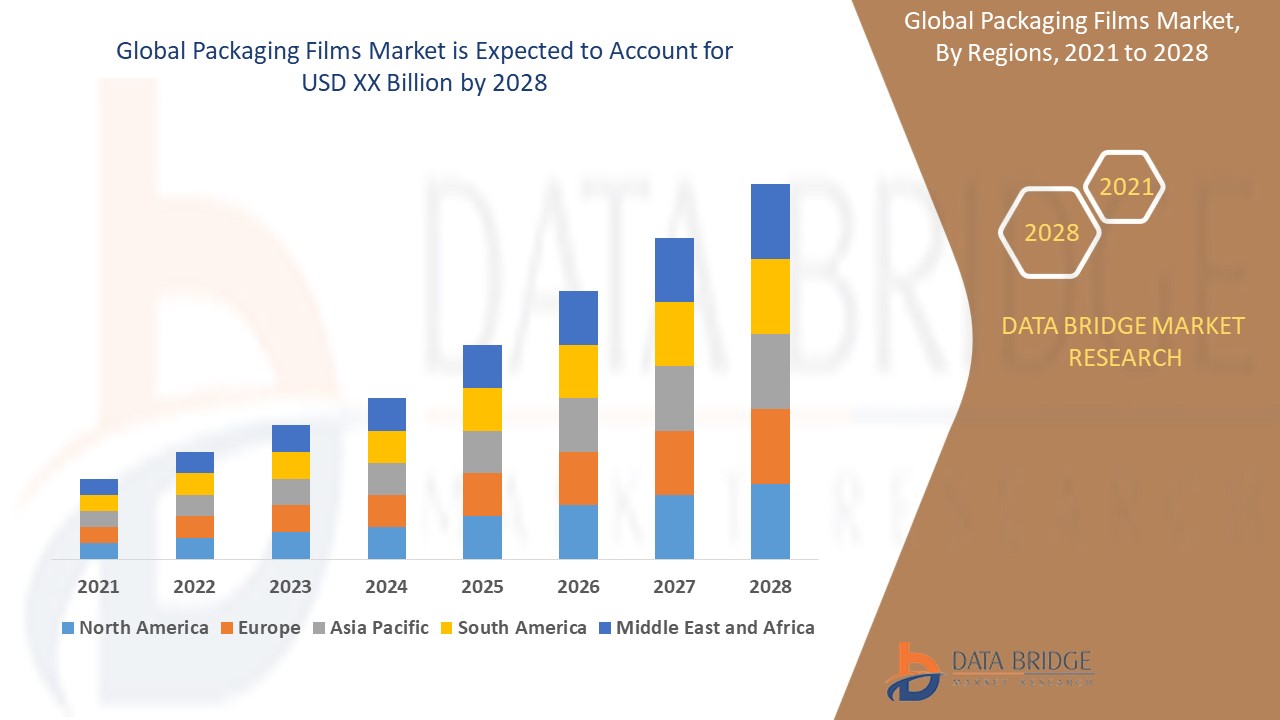

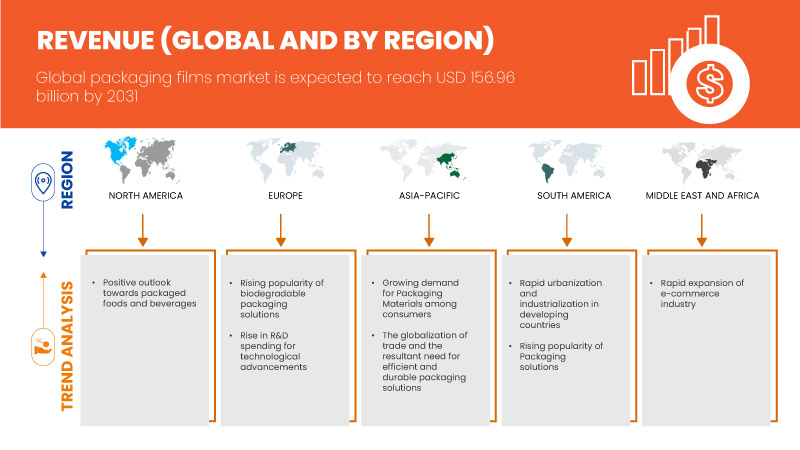

Data Bridge Market Research analyzes that the global packaging films market is expected to reach USD 156.96 billion by 2031 from USD 102.74 billion in 2023, growing with a CAGR of 5.49% in the forecast period of 2024 to 2031.

|

Report Metric |

Details |

|

Forecast Period |

2024 to 2031 |

|

Base Year |

2023 |

|

Historic Years |

2022 (Customizable to 2016-2021) |

|

Quantitative Units |

Revenue in USD Billion |

|

Segments Covered |

Type (Polyethylene (PE), Polypropylene (PP), Polyethylene Terephthalate (PET), Polyvinyl Chloride (PVC), Polylactic Acid (PLA) , Cellulose, Ethylene Vinyl Alcohol (EVOH), and Others), Flexibility (Flexible and Rigid), Nature (Synthetic and Bio-Based), Application (Food & Beverage, Pharmaceuticals, Personal Care & Cosmetics, Electrical and Electronics, Household and Home Décor, Pet Food, and Others) |

|

Countries Covered |

U.S., Canada, Mexico, Germany, France, U.K., Italy, Russia, Spain, Sweden, Finland, Netherlands, Switzerland, Poland, Belgium, Turkey, Norway, Denmark, Rest of Europe, China, Japan, India, South Korea, Indonesia, Thailand, Malaysia, Philippines, Singapore, Australia, New Zealand, Rest of Asia-Pacific, Brazil, Argentina Rest of South America, Saudi Arabia, South Africa, United Arab Emirates, Egypt, Israel, Rest of Middle East and Africa |

|

Market Players Covered |

Novolex, Amcor plc, Sigma Plastics Group, Interplast Group, Papier-Mettler, Berry Global Group, Inc., Mondi, Uflex Limited, ProAmpac, Taghleef Industries, Parkside, DACO Corporation, Klöckner Pentaplast, AEP GROUP, and TIPA LTD., among others |

Packaging films are manly thin plastic or polymer-based film used to wrap, protect, and preserve products, providing barrier protection against moisture, gases, and contaminants, along with mechanical strength, flexibility, and transparency. Made from different material like polyethylene, polypropylene, PVC, and PET, these films are used in food, beverage, pharmaceutical, and consumer goods packaging. They extend shelf life, ensure product safety, and enhance product appearance, with functionalities such as heat sealability, printability, and puncture resistance. Advanced packaging films may also include smart technologies like anti-microbial coatings, oxygen scavengers, and biodegradable properties to meet market demands and sustainability goals.

Global Packaging Films Market Dynamics

Drivers

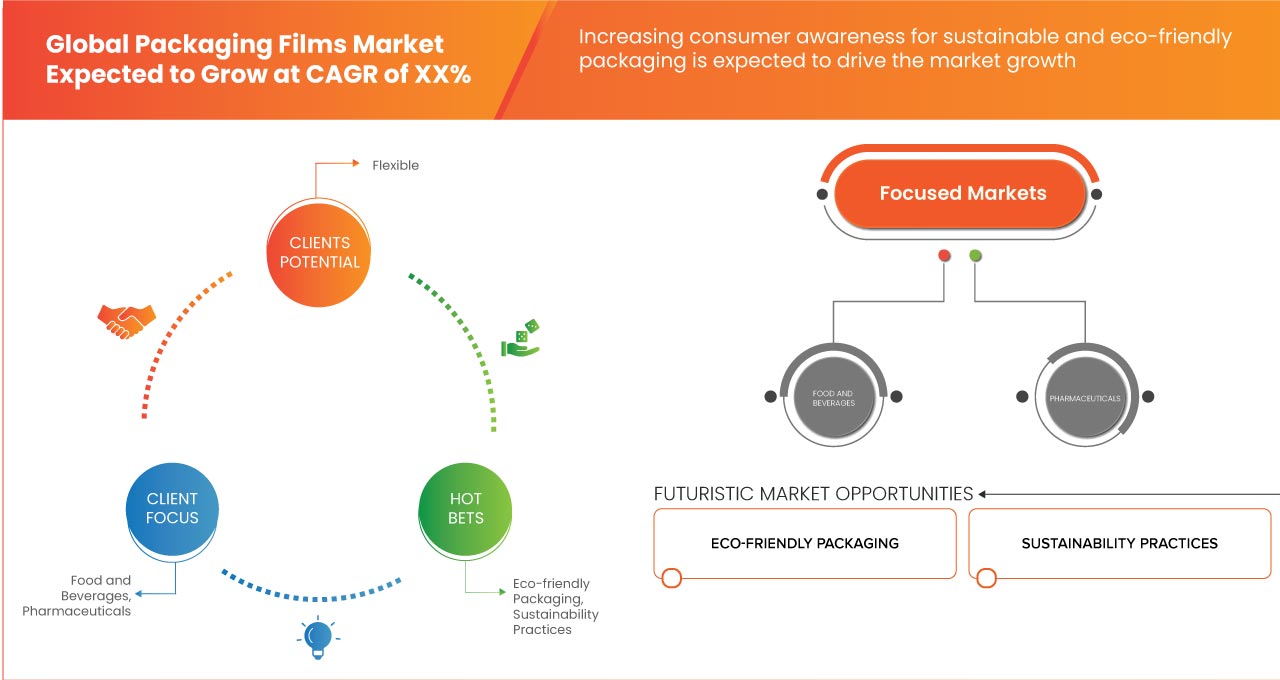

- Increasing Consumer Awareness for Sustainable and Eco-Friendly Packaging

An increasing trend toward environmentally, friendly and sustainable packaging options drive the market expansion for film packaging globally. With growing concern of the effects of plastic waste and the significance of sustainability, environmental issues are becoming more and more important on a global scale. Consumers are becoming more aware of the environmental impact of plastic waste and pollution. This awareness is driven by media coverage, educational campaigns, and increased visibility of environmental issues. Demand for packaging solutions that are not just efficient but also ecologically friendly is being driven by this increased awareness. Sustainable packaging is seen as a means of preserving natural resources, cutting waste, and lowering carbon emissions all of which are in line with the more general objectives of sustainability and environmental preservation.

- Rise in Adoption of Packaging Films in Pharmaceutical and Agriculture Industry

The increasing use of packaging films in the agriculture and pharmaceutical industries is fueling a significant demand rise for the product in the worldwide packaging films market. This trend reflects an increasing awareness among a wide range of industries of the many advantages packaging films provide in terms of product protection, preservation, and convenience. In the pharmaceutical industry, the adoption of packaging films has witnessed a significant upswing due to several key factors. Firstly, stringent regulatory requirements necessitate packaging solutions that ensure the safety, integrity, and efficacy of pharmaceutical products throughout their lifecycle. Packaging films play a crucial role in meeting these requirements by providing barrier properties that protect drugs from moisture, oxygen, light, and other environmental factors that could compromise their stability and shelf life. Additionally, advancements in film technology have led to the development of specialized pharmaceutical films with features such as tamper-evident seals, child-resistant closures, and anti-counterfeiting measures, which are essential for ensuring product safety and regulatory compliance. In addition, as the world's population ages and chronic diseases become more common, there is an increased need for pharmaceutical items, which in turn raises the requirement for dependable and effective packaging solutions. Packaging films are ideal for a variety of pharmaceutical applications, such as blister packs, sachets, pouches, and strip packs, since they are flexible, adaptable, and reasonably priced.

Opportunities

- Innovations in Technologies that Enhance the Protective Qualities of Packaging Films

The global packaging films market is witnessing a transformative phase driven by technological innovations aimed at enhancing the protective qualities of packaging materials. These innovations address the critical need to ensure product integrity, safety, and extended shelf life across diverse industries. New technologies are leading to the development of films with superior oxygen and moisture barrier properties such as advanced barrier technologies. As one of the most critical aspects of packaging films is their ability to protect products from external factors such as moisture, oxygen, light, and contaminants. High-performance films with exceptional protective qualities have been developed as a result of recent advancements in barrier technology. For example, multi-layer films provide improved barrier protection without sacrificing strength or flexibility since they blend several materials into a single structure. For delicate food and pharmaceutical products that need a long shelf life and strong protection, these films are especially helpful.

- Innovations in Packaging Materials, Such as Biodegradable and Sustainable Films

The global packaging films market is undergoing a significant transformation driven by the surge in demand for biodegradable and sustainable alternatives. Consumers and regulatory bodies alike are increasingly prioritizing environmentally friendly solutions, creating a vast opportunity for manufacturers who can innovate and adapt the need for ecofriendly film packaging. Now a day’s consumer awareness regarding environmental issues has reached unprecedented levels, with many individuals actively seeking products that minimize their ecological footprint. This shift in consumer behavior is propelling the demand for packaging films made from biodegradable and sustainable materials. These films offer an eco-friendly alternative to traditional plastics, which are known for their harmful impact on the environment. On the other hand biodegradable films, typically made from renewable resources such as polylactic acid (PLA), polyhydroxyalkanoates (PHA), and starch-based materials, decompose naturally over time, reducing the accumulation of plastic waste in landfills and oceans. Sustainable films, on the other hand, are designed for recyclability and reuse, promoting a circular economy that minimizes resource depletion and waste generation. In addition advancements in bioplastics and biopolymer research are also leading to the development of high-performance biodegradable films.

Restraints/Challenges

- Availability of Alternative Packaging Materials

The global packaging films market, while experiencing growth in some sectors, faces a significant challenge in the form of the increasing availability and popularity of alternative packaging materials. These alternatives, including paper bags and paper packaging, are gaining traction due to environmental concerns and consumer preferences, potentially impacting the demand for plastic films. One of the primary reason behind the shift to paper packaging is the growing consumer awareness and concern over plastic pollution. Plastics, particularly single-use plastics, have come under scrutiny for their environmental impact, primarily due to their persistence in the environment and the resultant micro plastic pollution. In contrast, paper is perceived as a more eco-friendly material, being biodegradable and recyclable. This perception has led to an increased preference for paper-based packaging among environmentally conscious consumers. Today's consumers are increasingly making environmentally conscious choices when purchasing products. The availability of paper bags and packaging allows them to choose options that align with their values and contribute to a more sustainable future. Again paper is a renewable resource and can be recycled multiple times, minimizing its environmental footprint compared to plastic films. Additionally, paper packaging often biodegrades readily when composted correctly. Which attracts the environmentally aware customers towards recyclable paper packaging instead of film packaging.

- Fluctuation in Prices of Raw Material

Various packaging films are manufactured using a variety of raw materials. These raw materials are plastic materials like polyethylene and polypropylene which are derived from petroleum crude oi. These materials are non-biodegradable, hard to recycle, and harmful to the environment, including water and land. Selection of the raw material is primarily based on the end-usage of the barrier films and normal packaging films. Some of the key raw materials used in packaging films include PE, PP, EVOH, PLA, PVDC, and PP.

Most of the raw materials used in the production of these materials are non-renewable resources, and therefore, there are high fluctuations in the price of these raw materials. Moreover, increased demand and an availability of the insufficient amount of available raw materials, and thus the unusual price increase, cause volatility in the packaging film market. Also price volatility of traditional raw materials such as polyethylene and polypropylene, which are derived from petroleum, often leads to increased production costs and unpredictable profit margins. This instability incentivizes packaging film manufacturers to diversify their raw material sources. In addition, with the advent of the COVID-19 pandemic, the prices of these raw materials saw an upward trend due to restrictions on transport and shortage of raw materials.

Recent Developments

- In October 2022, Novolex earned a benchmark BPI compostable certification, namely dual How2Compost and How2Recycle labels for paper bags and sacks products, namely "Dubl Life". This certification will help the company to gain recognition from the customers and improve its market scope

- In March 2024, Amcor plc, a global leader in developing and producing responsible packaging solutions, has been awarded with eight Flexible Packaging Achievement Awards for innovative and sustainable contributions to the industry. Among all the awards, McCoy Dunnage Free IBC Liners for bulk aseptic products has received three awards: Gold for Sustainability, and Silver for Expanding the Use of Flexible Packaging, and Technical Innovation. This will strengthen the company’s aim towards achieving its sustainability goals and achieving more innovative solutions

- In March 2021, AEP Group has successfully obtained ISCC PLUS certification. This certification underscores dedication to the circular economy and adherence to global sustainability standards. It validates the company’s fulfillment of ecological and social criteria and their efforts in reducing greenhouse gas emissions, and our commitment to supply chain traceability

- In October 2023, Berry Global Inc. (NYSE: BERY) was recognized as one of America’s top employers within Indiana by Forbes. This acknowledgment was based on feedback from employees, including direct input and recommendations. It helped in building the employer-employee trust and given a positive impact for its customers

Global Packaging Films Market Scope

The global packaging films market is segmented into four notable segments based on type, flexibility, nature, and application. The growth amongst these segments will help you analyze major growth segments in the industries and provide the users with a valuable market overview and market insights to make strategic decisions to identify core market applications.

Type

- Polyethylene (PE)

- Polypropylene (PP)

- Polyethylene Terephthalate (PET)

- Polyvinyl Chloride (PVC)

- Polylactic Acid (PLA)

- Cellulose

- Ethylene Vinyl Alcohol (EVOH)

- Others

On the basis of type, the market is segmented into Polyethylene (PE), Polypropylene (PP) Polyethylene Terephthalate (PET), Polyvinyl Chloride (PVC), Polylactic Acid (PLA), Cellulose, Ethylene Vinyl Alcohol (EVOH), and others.

Flexibility

- Flexible

- Rigid

On the basis of flexibility, the market is segmented into flexible and rigid.

Nature

- Synthetic

- Bio-Based

On the basis of nature, the market is segmented into synthetic and bio-based.

Application

- Food & Beverage

- Pharmaceuticals

- Personal Care & Cosmetics

- Electrical and Electronics

- Household and Home Décor

- Pet Food

- Others

On the basis of application, the market is segmented into food & beverage, pharmaceuticals, personal care & cosmetics, electrical and electronics, household and home décor, pet food, and others.

Global Packaging Films Market Regi.

The global packaging films market is segmented into four notable segments based on type, flexibility, nature, and application.

The countries in the global packaging films market are U.S., Canada, Mexico, Germany, France, U.K., Italy, Russia, Spain, Sweden, Finland, Netherlands, Switzerland, Poland, Belgium, Turkey, Norway, Denmark, rest of Europe, China, Japan, India, South Korea, Indonesia, Thailand, Malaysia, Philippines, Singapore, Australia, New Zealand, rest of Asia-Pacific, Brazil, Argentina rest of South America, Saudi Arabia, South Africa, United Arab Emirates, Egypt, Israel, and rest of Middle East And Africa.

Asia-Pacific segment is expected to dominate the global packaging films market. China is expected to dominate in Asia-Pacific due to rising demand for frozen and chilled foods. U.S. is expected to dominate in North America due to growth of e-commerce, courier, and delivery service. Germany is expected to dominate in Europe due to rise in adoption of packaging films in pharmaceutical and agriculture industry.

The country section of the report also provides individual market-impacting factors and changes in market regulation that impact the current and future trends of the market. Data point downstream and upstream value chain analysis, technical trends porter's five forces analysis, and case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs, and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Global Packaging Films Market Share Analysis

The global packaging films market competitive landscape provides details by competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width and breadth, application dominance, technology lifeline curve. The above data points provided are only related to the companies’ focus related to the Global Packaging Films market.

Some of the prominent participants operating in the global packaging films market are Novolex, Amcor plc, Sigma Plastics Group, Interplast Group, Papier-Mettler, Berry Global Group, Inc., Mondi, Uflex Limited, ProAmpac, Taghleef Industries, Parkside, DACO Corporation, Klöckner Pentaplast, AEP GROUP, and TIPA LTD., among others.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.