Mercado global de sensores de nível e caudal, por tipo (sensor de caudal e sensor de nível), tecnologia (sensor de nível e caudal sem contacto e sensor de nível e caudal de contacto), suportes de aplicação (sólidos, líquidos e gases) , utilizador final (fabrico industrial , Petróleo e Gás, Química , Bens de Consumo, Automóvel, Energia e Electricidade, Governo e Defesa, Águas Residuais, Saúde e Outros) – Tendências e Previsões do Sector até 2030.

Análise e tamanhos de mercado de sensores de nível e de caudal

O mercado global de sensores de nível e de fluxo refere-se ao setor da economia que serve o fornecimento de soluções de energia elétrica personalizadas para instalações e operações industriais. Este mercado abrange uma vasta gama de produtos e serviços focados na geração, distribuição e controlo de energia para satisfazer as exigências específicas de fábricas, armazéns e outros locais industriais. Os principais componentes do mercado incluem equipamentos de geração de energia, tais como turbinas a gás , geradores a diesel e fontes de energia renováveis, sistemas de distribuição de energia, tais como transformadores e aparelhagens de manobra, equipamentos de controlo e monitorização de energia, centros de controlo de motores e controladores lógicos programáveis e soluções de armazenamento de energia, como baterias . Além disso, o mercado inclui serviços de instalação, manutenção e gestão de projetos relacionados com sistemas globais de sensores de nível e de caudal. Os fatores que influenciam este mercado incluem o crescimento industrial, as políticas energéticas, os avanços tecnológicos e as preocupações com a sustentabilidade ambiental.

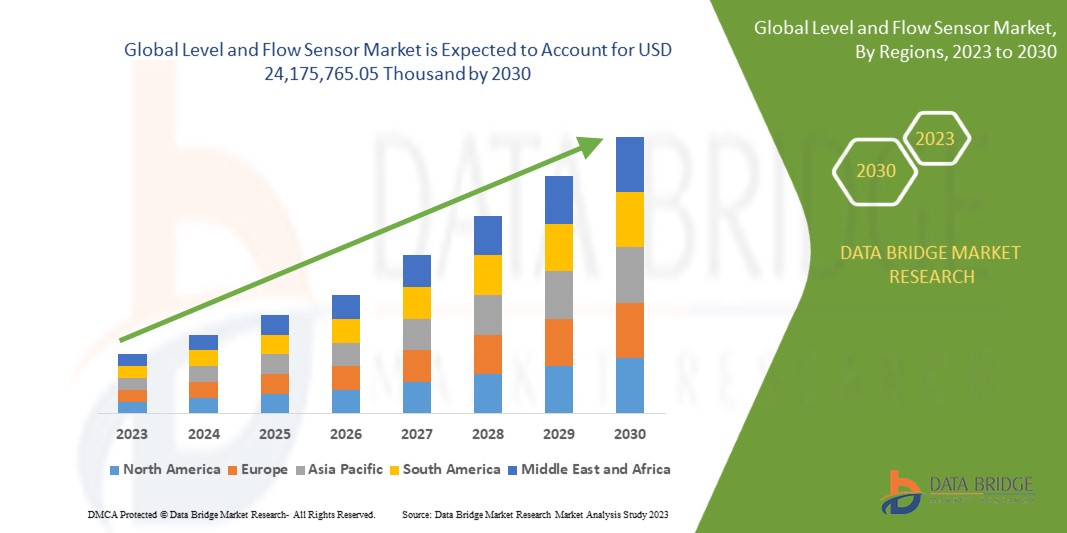

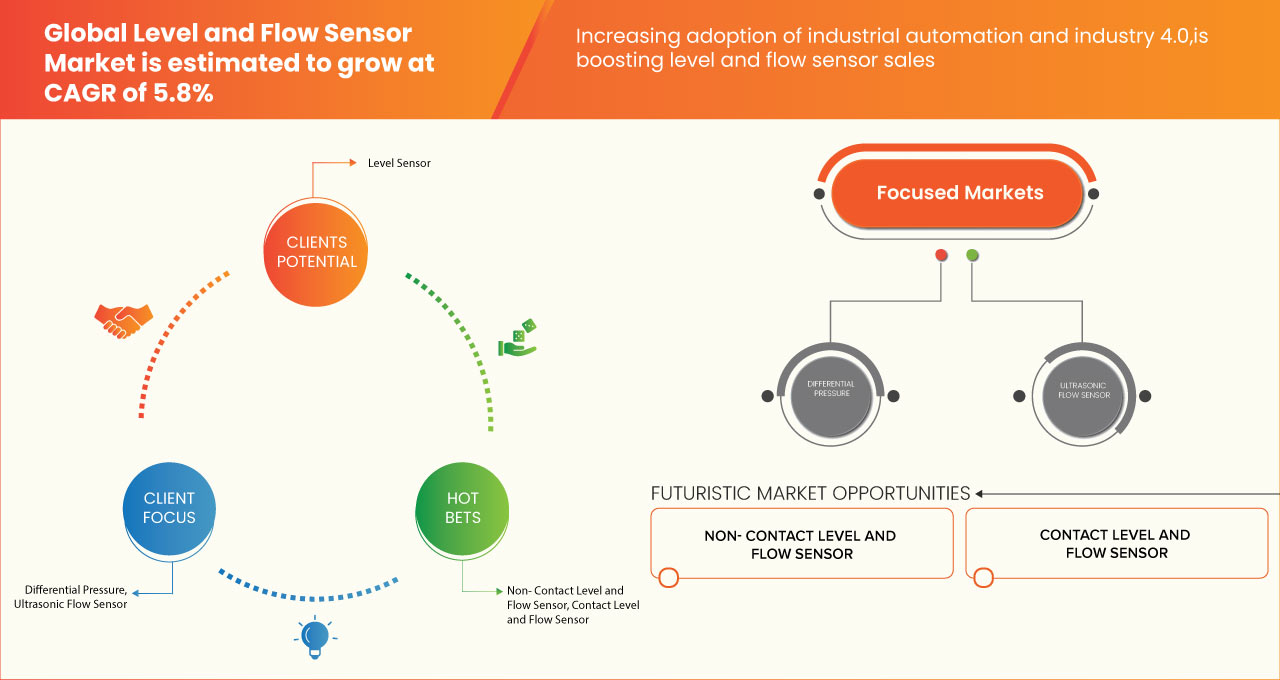

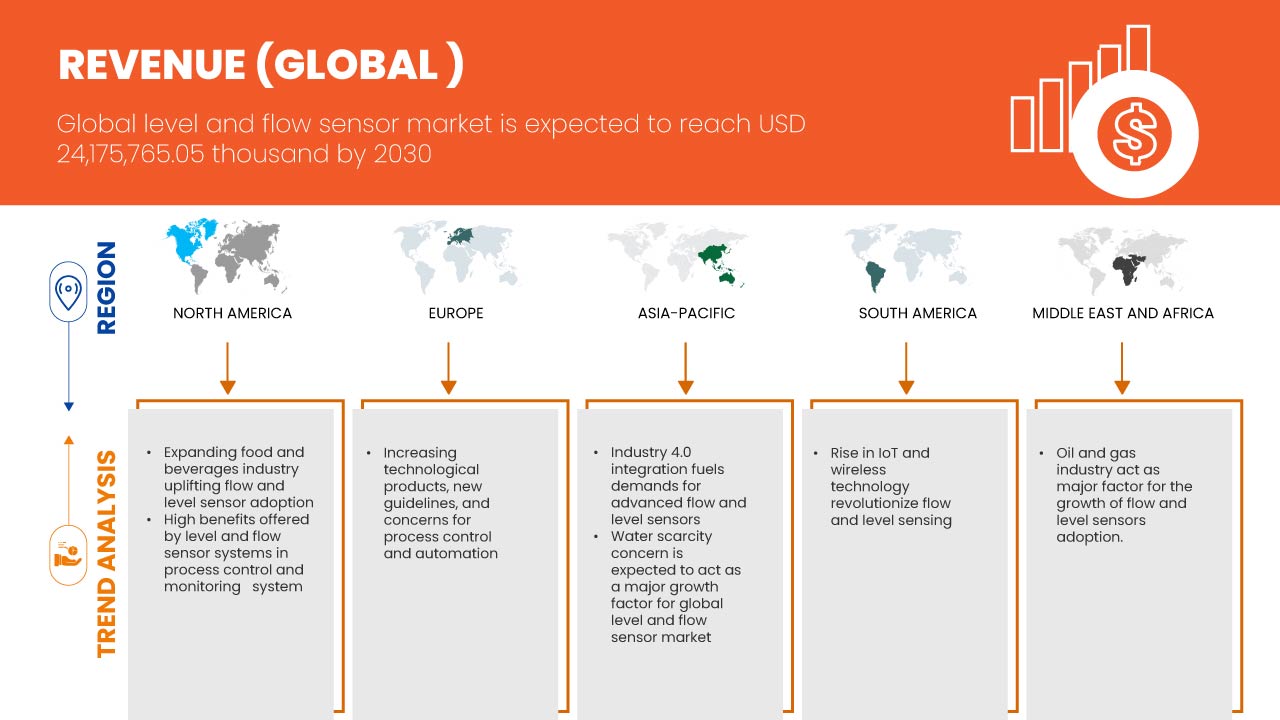

A Data Bridge Market Research analisa que o mercado global de sensores de nível e de fluxo deverá crescer a um CAGR de 5,8% no período previsto de 2023 a 2030 e deverá atingir os 24.175.765,05 mil dólares até 2030. O relatório de mercado de sensores de nível e de fluxo abrange também a análise de preços, a análise de patentes e os avanços tecnológicos em profundidade.

|

Métrica de Reporte |

Detalhes |

|

Período de previsão |

2023 a 2030 |

|

Ano base |

2022 |

|

Anos históricos |

2021 (Personalizável para 2015-2020) |

|

Unidades quantitativas |

Receita em USD mil |

|

Segmentos abrangidos |

Tipo (sensor de caudal e sensor de nível), Tecnologia (sensor de nível e caudal sem contacto e sensor de nível e caudal de contacto), Meio de aplicação (sólidos, líquidos e gases), Utilizador final (fabrico industrial, petróleo e gás , produtos químicos, Bens de consumo, Automóvel, Energia e Eletricidade, Governo e Defesa, Águas Residuais, Saúde e Outros) |

|

Países abrangidos |

EUA, Canadá, México, Alemanha, Reino Unido, França, Itália, Espanha, Rússia, Polónia, Países Baixos, Bélgica, Suíça, Dinamarca, Finlândia, Suécia, Noruega, Turquia, Resto da Europa, China, Japão, Coreia do Sul, Índia , Taiwan , Austrália, Tailândia, Indonésia, Malásia, Singapura, Nova Zelândia, Filipinas, Vietname, Resto da Ásia-Pacífico, Brasil, Argentina e restante América do Sul, Arábia Saudita, Emirados Árabes Unidos, África do Sul, Kuwait, Qatar, Egito, Israel , Omã, Bahrein e resto do Médio Oriente e África |

|

Atores do mercado abrangidos |

TE Connectivity, Temposonics (uma subsidiária da Amphenol Corporation), AMETEK Inc., Emerson Electric Co., KEYENCE CORPORATION, ABB, Fortive, SICK AG, OMRON Corporation, Azbil Corporation, Honeywell International Inc., Endress+Hauser Group Services AG, SSI Technologies, LLC, Balluff Automation India Pvt. Ltd, KROHNE, Siemens, Schneider Electric, Omega Engineering Inc., Yokogawa Electric Corporation, ifm electronic GmbH, Baumer, Nanjing AH Electronic Science & Technology Co., Ltd., UWT GmbH, NOHKEN INC., FAFNIR GmbH, Sapcon Instruments Pvt Ltd , Anderson-Negele, Senix Ultrasonic Distance and Ultrasonic Level Sensors, GF Piping Systems, Fuelics PC, Aplus Finetek Sensor, Inc (uma subsidiária da Finetek CO, LTD.), Pulsar Measurement and Flowline, entre outros |

Definição de Mercado

O mercado global de sensores de nível e caudal é a procura, oferta e comércio coletivos de dispositivos concebidos para medir e monitorizar os níveis de fluidos e as taxas de caudal em diversas aplicações industriais, comerciais e residenciais. Estes sensores desempenham um papel crucial para garantir a gestão eficiente e precisa de líquidos e gases em sistemas, processos e equipamentos. O mercado abrange uma vasta gama de tipos de sensores, tecnologias e aplicações, servindo setores como o da indústria transformadora, processamento químico, gestão de águas e esgotos e energia, entre outros.

Dinâmica do mercado global de sensores de nível e de fluxo

Esta secção trata da compreensão dos impulsionadores, vantagens, oportunidades, restrições e desafios do mercado. Tudo isto é discutido em detalhe abaixo:

Motoristas

- Aumento da adoção da automação industrial e da indústria 4.0

A crescente adoção da automação industrial em setores como a indústria transformadora, os produtos químicos e farmacêuticos levou a uma maior procura por sensores precisos e fiáveis. Os sensores de nível e de fluxo fornecem dados em tempo real, ajudando as indústrias a otimizar os seus processos, a reduzir a intervenção manual e a aumentar a produtividade global.

- Amplas aplicações de sensores de nível e de caudal na indústria de petróleo e gás

Os sensores de fluxo são utilizados no fabrico para medir o fluxo de líquidos e gases. Esta informação é utilizada para controlar o processo de produção e garantir que os produtos são fabricados de acordo com as especificações. A automação está a ser cada vez mais utilizada em diversos setores, como a indústria transformadora, a energia e os transportes. Os sensores de fluxo são utilizados em sistemas de automação para medir o fluxo de fluidos e controlar o funcionamento de máquinas e equipamentos.

Oportunidade

- Necessidade crescente de precisão em vários setores

A crescente necessidade de precisão em vários setores está a criar oportunidades para o mercado global de sensores de nível e caudal. Os fabricantes de sensores de caudal estão a desenvolver tecnologias novas e inovadoras para satisfazer os exigentes requisitos destes setores. Como resultado, espera-se que o mercado global de sensores de nível e de fluxo cresça significativamente nos próximos anos.

Restrição/Desafio

- Elevado custo inicial de sensores de nível e de caudal

Muitos setores e aplicações que dependem de sensores de nível e de fluxo, como a indústria transformadora, o tratamento de água e o petróleo e gás, são geralmente sensíveis ao custo. Gastos iniciais elevados podem impedir que os potenciais clientes adotem estes sensores, especialmente nos casos em que é necessário um grande número de sensores.

Desenvolvimentos recentes

- Em maio de 2023, a Murata Manufacturing Co., Ltd lançou a série EVA de condensadores cerâmicos multicamadas (MLCCs) com capacidades avançadas de moldagem de resina, concebidas para aplicações em veículos elétricos (VE), tais como carregadores de bordo, inversores, sistemas de gestão de bateria e transferência de energia sem fios. Estes MLCCs de classe Y2 com certificação de segurança apresentam classificações de tensão de 305 VCA/1500 VCC, distâncias de fuga de 10 mm e valores de capacitância que variam de 0,1 nF a 4,7 nF, atendendo às exigências de migração para sistemas de transmissão de 800 V, mantendo a miniaturização nos sistemas automóveis modernos. A utilização de moldagem de resina permite que estes componentes compactos alcancem tanto a fuga prolongada como a compactação, garantindo fiabilidade a longo prazo em motores de veículos elétricos com tensões mais elevadas.

- Em março de 2023, a Delta Electronics, Inc. apresentou as suas fontes de alimentação industriais e soluções de carregamento sem fios para robôs móveis autónomos (AMRs) no Fórum de Fabrico do Futuro do Taipei International Machine Tool Show (TIMTOS). Apresentaram a fonte de alimentação de montagem em painel de baixo perfil da série PMT2 e a série LYTE II do tipo calha DIN ultrafina para as necessidades de energia industrial. Além disso, a Delta apresentou o sistema de carregamento sem fios M∞Vair de 1 kW para AMRs e AGVs, destacando o seu compromisso com operações de fábrica inteligentes e soluções eficientes.

- Em agosto de 2022, a UWT Gmbh recebeu o prestigiado "Supplier Performance Award" da Siemens em reconhecimento da sua colaboração excecional e desempenho extraordinário ao longo do ano anterior, refletindo a forte parceria entre as duas empresas.

- Em abril de 2021, a Temposonics tornou-se oficialmente parte da conceituada Amphenol Corporation. A Amphenol, reconhecida como um dos maiores fabricantes mundiais de produtos de interligação, é especializada em conectores elétricos, eletrónicos e de fibra ótica de última geração, sistemas de interligação e muito mais.

- Em julho de 2020, a Yokogawa Electric Corporation anunciou a expansão da sua solução de IoT industrial sem fios (IIoT) Sushi Sensor com a introdução de novos sensores de pressão e temperatura.

Âmbito do mercado global de sensores de nível e de fluxo

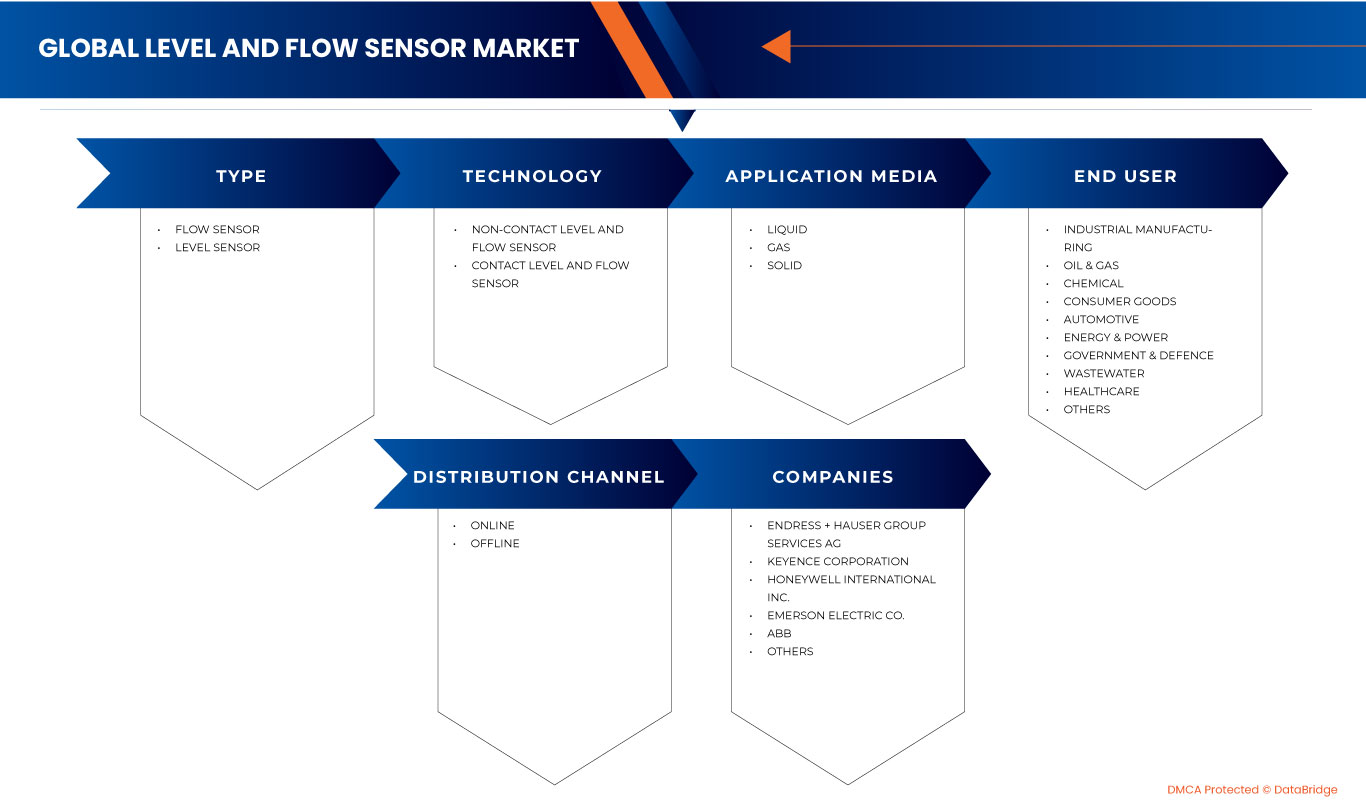

O mercado global de sensores de nível e de caudal está segmentado com base no tipo, tecnologia, meio de aplicação, utilizador final e canal de distribuição. O crescimento entre estes segmentos irá ajudá-lo a analisar segmentos de baixo crescimento nos setores e fornecerá aos utilizadores uma visão geral e informações valiosas do mercado para os ajudar a tomar decisões estratégicas para identificar as principais aplicações do mercado.

Tipo

- Sensor de fluxo

- Sensor de nível

Com base no tipo, o mercado global de sensores de nível e de caudal está segmentado em sensores de caudal e sensores de nível.

Tecnologia

- Sensor de nível e caudal sem contacto

- Sensor de nível e fluxo de contacto

Com base na tecnologia, o mercado global de sensores de nível e caudal está segmentado em sensores de nível e caudal sem contacto e sensores de nível e caudal com contacto.

Mídia de aplicação

- Sólido

- Líquido

- Gás

Com base no meio de aplicação, o mercado global de sensores de nível e de caudal está segmentado em sólido, líquido e gasoso.

Utilizador final

- Fabricação Industrial

- Petróleo e Gás

- Químico

- Bens de consumo

- Automotivo

- Energia e Poder

- Governo e Defesa

- Águas residuais

- Assistência médica

- Outros

Com base no utilizador final, o mercado global de sensores de nível e de fluxo está segmentado em fabrico industrial, petróleo e gás, produtos químicos, bens de consumo, automóvel, energia e eletricidade, governo e defesa, águas residuais, saúde e outros.

Canal de Distribuição

- Desligado

- Online

Com base no canal de distribuição, o mercado global de sensores de nível e de fluxo está segmentado em offline e online.

Análise/Insights Regionais do Mercado Global de Sensores de Nível e de Fluxo

O mercado global de sensores de nível e de fluxo é analisado e são fornecidos insights e tendências sobre o tamanho do mercado por região, tipo, tecnologia, meios de aplicação, utilizador final e canal de distribuição, conforme referenciado acima.

Os países abrangidos no relatório do mercado global de sensores de nível e de fluxo são os EUA, Canadá, México, Alemanha, Reino Unido, França, Itália, Espanha, Rússia, Polónia, Países Baixos, Bélgica, Suíça, Dinamarca, Finlândia, Suécia, Noruega, Turquia, Resto do mundo. da América do Sul, Arábia Saudita , Emirados Árabes Unidos, África do Sul, Kuwait, Qatar, Egito, Israel, Omã, Bahrein e resto do Médio Oriente e África.

Espera-se que a Ásia-Pacífico domine o mercado global de sensores de nível e de fluxo devido aos muitos lançamentos de produtos nos principais mercados da região e à crescente consciencialização dos consumidores. Na região Ásia-Pacífico, espera-se que a China domine a região, uma vez que esta cresceu rapidamente e tornou-se um centro global de fabrico e tecnologia. Na América do Norte, espera-se que os EUA dominem, pois têm uma das maiores e mais desenvolvidas economias do mundo. Na Europa, espera-se que a Alemanha domine, pois é conhecida pela sua forte tradição em engenharia e força de trabalho qualificada.

A secção de países do relatório também fornece fatores individuais que impactam o mercado e alterações na regulamentação do mercado que impactam as tendências atuais e futuras do mercado. Pontos de dados como a análise da cadeia de valor a montante e a jusante, tendências técnicas e análise das cinco forças de Porter, estudos de caso são alguns dos indicadores utilizados para prever o cenário de mercado para países individuais. Além disso, a presença e a disponibilidade de marcas globais e os seus desafios enfrentados devido à grande ou escassa concorrência de marcas locais e nacionais, ao impacto de tarifas domésticas e rotas comerciais são considerados ao fornecer uma análise de previsão dos dados do país.

Análise do panorama competitivo e da quota de mercado global de sensores de nível e de fluxo

O panorama competitivo do mercado global de sensores de nível e de fluxo fornece detalhes dos concorrentes. Os detalhes incluídos são a visão geral da empresa, finanças da empresa, receitas geradas, potencial de mercado, investimento em investigação e desenvolvimento, novas iniciativas de mercado, presença global, localizações e instalações de produção, capacidades de produção, pontos fortes e fracos da empresa , lançamento do produto, amplitude e abrangência do produto, aplicação domínio. Os pontos de dados fornecidos acima estão apenas relacionados com o foco das empresas em relação ao mercado.

Alguns dos principais participantes que operam no mercado global de sensores de nível e de fluxo são a TE Connectivity, Temposonics (uma subsidiária da Amphenol Corporation), AMETEK Inc., Emerson Electric Co., KEYENCE CORPORATION, ABB, Fortive, SICK AG, OMRON Corporation, Azbil Corporation, Honeywell International Inc., Endress+Hauser Group Services AG, SSI Technologies, LLC, Balluff Automation India Pvt. Ltd, KROHNE, Siemens, Schneider Electric, Omega Engineering Inc., Yokogawa Electric Corporation, ifm electronic GmbH, Baumer, Nanjing AH Electronic Science & Technology Co., Ltd., UWT GmbH, NOHKEN INC., FAFNIR GmbH, Sapcon Instruments Pvt Ltd , Anderson-Negele, Senix Ultrasonic Distance and Ultrasonic Level Sensors, GF Piping Systems, Fuelics PC, Aplus Finetek Sensor, Inc (uma subsidiária da Finetek CO, LTD.) e Pulsar Measurement and Flowline, entre outros.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Índice

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE GLOBAL LEVEL AND FLOW SENSOR MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 YEARS CONSIDERED FOR THE STUDY

2.3 GEOGRAPHIC SCOPE

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MARKET END-USER COVERAGE GRID

2.9 MULTIVARIATE MODELLING

2.1 TYPE TIMELINE CURVE

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 UPCOMING PROJECTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASING ADOPTION OF INDUSTRIAL AUTOMATION AND INDUSTRY 4.0

5.1.2 CONTINUOUS ADVANCEMENTS IN SENSOR TECHNOLOGY

5.1.3 RISING AWARENESS OF SAFETY IN PROCESS CONTROL

5.1.4 WIDE APPLICATIONS OF LEVEL AND FLOW SENSORS IN THE OIL AND GAS INDUSTRY

5.2 RESTRAINTS

5.2.1 HIGH INITIAL COST OF LEVEL AND FLOW SENSORS

5.2.2 STRICT REGULATORY COMPLIANCES RELATED TO SENSOR TECHNOLOGY

5.3 OPPORTUNITIES

5.3.1 INCREASING COLLABORATION AND PARTNERSHIPS AMONG MARKET PLAYERS

5.3.2 GROWING NEED FOR ACCURACY IN VARIOUS INDUSTRIES

5.3.3 EMERGING TECHNOLOGIES, SUCH AS IIOT, ASSET MANAGEMENT, AND ADVANCED DIAGNOSTICS

5.4 CHALLENGES

5.4.1 REQUIREMENT OF TIMELY CALIBRATION AND MAINTENANCE

5.4.2 LESS AVAILABILITY OF SKILLED LABOR

5.4.3 TECHNICAL LIMITATIONS RELATED TO LEVEL AND FLOW SENSORS

6 GLOBAL LEVEL AND FLOW SENSOR MARKET, BY TYPE

6.1 OVERVIEW

6.2 FLOW SENSOR

6.2.1 DIFFERENTIAL PRESSURE

6.2.2 ULTRASONIC FLOW SENSOR

6.2.3 MAGNETIC INDUCTION FLOW SENSOR

6.2.4 VORTEX FLOW SENSOR

6.2.5 THERMAL FLOW SENSOR

6.2.6 TURBINE FLOW SENSOR

6.2.7 CURIOUS SENSOR

6.2.8 POSITIVE DISPLACEMENT FLOW SENSOR

6.2.9 OTHERS

6.3 LEVEL SENSOR

6.3.1 ULTRASONIC LEVEL SENSOR

6.3.2 CAPACITANCE LEVEL SENSOR

6.3.3 OPTICAL LEVEL SENSOR

6.3.4 CONDUCTIVITY OR RESISTANCE LEVEL SENSOR

6.3.5 VIBRATING OR TUNING FORK LEVEL SENSOR

6.3.6 FLOAT LEVEL SENSOR

6.3.7 OTHERS

7 GLOBAL LEVEL AND FLOW SENSOR MARKET, BY TECHNOLOGY

7.1 OVERVIEW

7.2 NON- CONTACT LEVEL AND FLOW SENSOR

7.3 CONTACT LEVEL AND FLOW SENSOR

8 GLOBAL LEVEL AND FLOW SENSOR MARKET, BY APPLICATION MEDIA

8.1 OVERVIEW

8.2 LIQUID

8.3 GAS

8.4 SOLID

9 GLOBAL LEVEL AND FLOW SENSOR MARKET, BY END USER

9.1 OVERVIEW

9.2 INDUSTRIAL MANUFACTURING

9.2.1 FLOW SENSOR

9.2.2 LEVEL SENSOR

9.3 OIL & GAS

9.3.1 FLOW SENSOR

9.3.2 LEVEL SENSOR

9.4 CHEMICAL

9.4.1 FLOW SENSOR

9.4.2 LEVEL SENSOR

9.5 CONSUMER GOODS

9.5.1 FLOW SENSOR

9.5.2 LEVEL SENSOR

9.6 AUTOMOTIVE

9.6.1 FLOW SENSOR

9.6.2 LEVEL SENSOR

9.7 ENERGY & POWER

9.7.1 FLOW SENSOR

9.7.2 LEVEL SENSOR

9.8 GOVERNMENT & DEFENSE

9.8.1 FLOW SENSOR

9.8.2 LEVEL SENSOR

9.9 WASTEWATER

9.9.1 FLOW SENSOR

9.9.2 LEVEL SENSOR

9.1 HEALTHCARE

9.10.1 FLOW SENSOR

9.10.2 LEVEL SENSOR

9.11 OTHERS

9.11.1 FLOW SENSOR

9.11.2 LEVEL SENSOR

10 GLOBAL LEVEL AND FLOW SENSOR MARKET, BY DISTRIBUTION CHANNEL

10.1 OVERVIEW

10.2 OFFLINE

10.2.1 SPECIALITY STORES

10.2.2 RETAIL STORES

10.2.3 OTHERS

10.3 ONLINE

10.3.1 COMPANY WEBSITE

10.3.2 THIRD PARTY E-COMMERCE WEBSITE

11 GLOBAL LEVEL AND FLOW SENSOR MARKET, BY REGION

11.1 OVERVIEW

11.2 NORTH AMERICA

11.2.1 U.S.

11.2.2 CANADA

11.2.3 MEXICO

11.3 EUROPE

11.3.1 GERMANY

11.3.2 U.K.

11.3.3 FRANCE

11.3.4 ITALY

11.3.5 SPAIN

11.3.6 RUSSIA

11.3.7 POLAND

11.3.8 NETHERLANDS

11.3.9 BELGIUM

11.3.10 SWITZERLAND

11.3.11 DENMARK

11.3.12 FINLAND

11.3.13 SWEDEN

11.3.14 NORWAY

11.3.15 TURKEY

11.3.16 REST OF EUROPE

11.4 ASIA-PACIFIC

11.4.1 CHINA

11.4.2 JAPAN

11.4.3 SOUTH KOREA

11.4.4 INDIA

11.4.5 TAIWAN

11.4.6 AUSTRALIA

11.4.7 THAILAND

11.4.8 INDONESIA

11.4.9 MALAYSIA

11.4.10 SINGAPORE

11.4.11 NEWZEALAND

11.4.12 PHILIPPINES

11.4.13 VIETNAM

11.4.14 REST OF ASIA-PACIFIC

11.5 MIDDLE EAST AND AFRICA

11.5.1 SAUDI ARABIA

11.5.2 U.A.E.

11.5.3 SOUTH AFRICA

11.5.4 KUWAIT

11.5.5 QATAR

11.5.6 EGYPT

11.5.7 ISRAEL

11.5.8 OMAN

11.5.9 BAHRAIN

11.5.10 REST OF MIDDLE EAST AND AFRICA

11.6 SOUTH AMERICA

11.6.1 BRAZIL

11.6.2 ARGENTINA

11.6.3 REST OF SOUTH AMERICA

12 GLOBAL LEVEL AND FLOW SENSOR MARKET: COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: GLOBAL FLOW SENSOR MARKET

12.2 COMPANY SHARE ANALYSIS: GLOBAL LEVEL SENSOR MARKET

12.3 COMPANY SHARE ANALYSIS: NORTH AMERICA FLOW SENSOR MARKET

12.4 COMPANY SHARE ANALYSIS: NORTH AMERICA LEVEL SENSOR MARKET

12.5 COMPANY SHARE ANALYSIS: EUROPE FLOW SENSOR MARKET

12.6 COMPANY SHARE ANALYSIS: EUROPE LEVEL SENSOR MARKET

12.7 COMPANY SHARE ANALYSIS: ASIA-PACIFIC FLOW SENSOR MARKET

12.8 COMPANY SHARE ANALYSIS: ASIA-PACIFIC LEVEL SENSOR MARKET

13 SWOT ANALYSIS

14 COMPANY PROFILE

14.1 ENDRESS + HAUSER GROUP SERVICES AG

14.1.1 COMPANY SNAPSHOT

14.1.2 COMPANY SHARE ANALYSIS

14.1.3 PRODUCT PORTFOLIO

14.1.4 RECENT DEVELOPMENTS

14.2 KEYENCE CORPORATION

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 COMPANY SHARE ANALYSIS

14.2.4 PRODUCT PORTFOLIO

14.2.5 RECENT DEVELOPMENT

14.3 HONEYWELL INTERNATIONAL INC.

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 COMPANY SHARE ANALYSIS

14.3.4 PRODUCT PORTFOLIO

14.3.5 RECENT DEVELOPMENT

14.4 EMERSON ELECTRIC CO.

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 PRODUCT PORTFOLIO

14.4.4 RECENT DEVELOPMENT

14.5 ABB

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 PRODUCT PORTFOLIO

14.5.4 RECENT DEVELOPMENTS

14.6 AMETEK INC.

14.6.1 COMPANY SNAPSHOT

14.6.2 REVENUE ANALYSIS

14.6.3 PRODUCT PORTFOLIO

14.6.4 RECENT DEVELOPMENT

14.7 ANDERSON-NEGELE

14.7.1 COMPANY SNAPSHOT

14.7.2 PRODUCT PORTFOLIO

14.7.3 RECENT DEVELOPMENTS

14.8 APLUS FINETEK SENSOR, INC

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCT PORTFOLIO

14.8.3 RECENT DEVELOPMENT

14.9 AZBIL CORPORATION

14.9.1 COMPANY SNAPSHOT

14.9.2 REVENUE ANALYSIS

14.9.3 PRODUCT PORTFOLIO

14.9.4 RECENT DEVELOPMENTS

14.1 BALLUFF AUTOMATION INDIA PVT. LTD.

14.10.1 COMPANY SNAPSHOT

14.10.2 PRODUCT PORTFOLIO

14.10.3 RECENT DEVELOPMENTS

14.11 BAUMER

14.11.1 COMPANY SNAPSHOT

14.11.2 PRODUCT PORTFOLIO

14.11.3 RECENT DEVELOPMENTS

14.12 FAFNIR GMBH

14.12.1 COMPANY SNAPSHOT

14.12.2 PRODUCT PORTFOLIO

14.12.3 RECENT DEVELOPMENTS

14.13 FLOWLINE

14.13.1 COMPANY SNAPSHOT

14.13.2 PRODUCT PORTFOLIO

14.13.3 RECENT DEVELOPMENTS

14.14 FORTIVE

14.14.1 COMPANY SNAPSHOT

14.14.2 REVENUE ANALYSIS

14.14.3 PRODUCT PORTFOLIO

14.14.4 RECENT DEVELOPMENTS

14.15 FUELICS PC

14.15.1 COMPANY SNAPSHOT

14.15.2 PRODUCT PORTFOLIO

14.15.3 RECENT DEVELOPMENTS

14.16 GF PIPING SYSTEMS

14.16.1 COMPANY SNAPSHOT

14.16.2 PRODUCT PORTFOLIO

14.16.3 RECENT DEVELOPMENTS

14.17 IFM ELECTRONIC GMBH

14.17.1 COMPANY SNAPSHOT

14.17.2 PRODUCT PORTFOLIO

14.17.3 RECENT DEVELOPMENTS

14.18 KROHNE

14.18.1 COMPANY SNAPSHOT

14.18.2 PRODUCT PORTFOLIO

14.18.3 RECENT DEVELOPMENTS

14.19 NANJING AH ELECTRONIC SCIENCE & TECHNOLOGY CO., LTD.

14.19.1 COMPANY SNAPSHOT

14.19.2 PRODUCT PORTFOLIO

14.19.3 RECENT DEVELOPMENT

14.2 NOHKEN INC.

14.20.1 COMPANY SNAPSHOT

14.20.2 PRODUCT PORTFOLIO

14.20.3 RECENT DEVELOPMENTS

14.21 OMEGA ENGINEERING, INC.

14.21.1 COMPANY SNAPSHOT

14.21.2 PRODUCT PORTFOLIO

14.21.3 RECENT DEVELOPMENTS

14.22 OMRON CORPORATION

14.22.1 COMPANY SNAPSHOT

14.22.2 REVENUE ANALYSIS

14.22.3 PRODUCT PORTFOLIO

14.22.4 RECENT DEVELOPMENT

14.23 PULSAR MEASUREMENT

14.23.1 COMPANY SNAPSHOT

14.23.2 PRODUCT PORTFOLIO

14.23.3 RECENT DEVELOPMENTS

14.24 SAPCON INSTRUMENTS PVT LTD

14.24.1 COMPANY SNAPSHOT

14.24.2 PRODUCT PORTFOLIO

14.24.3 RECENT DEVELOPMENTS

14.25 SCHNEIDER ELECTRIC

14.25.1 COMPANY SNAPSHOT

14.25.2 REVENUE ANALYSIS

14.25.3 PRODUCT PORTFOLIO

14.25.4 RECENT DEVELOPMENTS

14.26 SENIX ULTRASONIC DISTANCE AND ULTRASONIC LEVEL SENSORS

14.26.1 COMPANY SNAPSHOT

14.26.2 PRODUCT PORTFOLIO

14.26.3 RECENT DEVELOPMENTS

14.27 SICK AG

14.27.1 COMPANY SNAPSHOT

14.27.2 PRODUCT PORTFOLIO

14.27.3 RECENT DEVELOPMENTS

14.28 SIEMENS (2022)

14.28.1 COMPANY SNAPSHOT

14.28.2 REVENUE ANALYSIS

14.28.3 PRODUCT PORTFOLIO

14.28.4 RECENT DEVELOPMENTS

14.29 SSI TECHNOLOGIESM, LLC

14.29.1 COMPANY SNAPSHOT

14.29.2 PRODUCT PORTFOLIO

14.29.3 RECENT DEVELOPMENTS

14.3 TE CONNECTIVITY

14.30.1 COMPANY SNAPSHOT

14.30.2 REVENUE ANALYSIS

14.30.3 PRODUCT PORTFOLIO

14.30.4 RECENT DEVELOPMENTS

14.31 TEMPOSONICS (A SUBSIDIARITY OF AMPHENOL CORPORATION)

14.31.1 COMPANY SNAPSHOT

14.31.2 PRODUCT PORTFOLIO

14.31.3 RECENT DEVELOPMENTS

14.32 UWT GMBH

14.32.1 COMPANY SNAPSHOT

14.32.2 PRODUCT PORTFOLIO

14.32.3 RECENT DEVELOPMENTS

14.33 YOKOGAWA ELECTRIC CORPORATION

14.33.1 COMPANY SNAPSHOT

14.33.2 REVENUE ANALYSIS

14.33.3 PRODUCT PORTFOLIO

14.33.4 RECENT DEVELOPMENTS

15 QUESTIONNAIRE

16 RELATED REPORTS

Lista de Tabela

TABLE 1 OPTICAL MEASUREMENT SYSTEMS AND COST ASSOCIATED (USD)

TABLE 2 GLOBAL LEVEL AND FLOW SENSOR MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 3 GLOBAL FLOW SENSOR IN LEVEL AND FLOW SENSOR MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 4 GLOBAL FLOW SENSOR IN LEVEL AND FLOW SENSOR MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 5 GLOBAL LEVEL SENSOR IN LEVEL AND FLOW SENSOR MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 6 GLOBAL LEVEL SENSOR IN LEVEL AND FLOW SENSOR MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 7 GLOBAL LEVEL AND FLOW SENSOR MARKET, BY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 8 GLOBAL NON-CONTACT LEVEL AND FLOW SENSOR IN LEVEL AND FLOW SENSOR MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 9 GLOBAL CONTACT LEVEL AND FLOW SENSOR IN LEVEL AND FLOW SENSOR MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 10 GLOBAL LEVEL AND FLOW SENSOR MARKET, BY APPLICATION MEDIA, 2021-2030 (USD THOUSAND)

TABLE 11 GLOBAL LIQUID IN LEVEL AND FLOW SENSOR MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 12 GLOBAL GAS IN LEVEL AND FLOW SENSOR MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 13 GLOBAL SOLID IN LEVEL AND FLOW SENSOR MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 14 GLOBAL LEVEL AND FLOW SENSOR MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 15 GLOBAL INDUSTRIAL MANUFACTURING IN LEVEL AND FLOW SENSOR MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 16 GLOBAL INDUSTRIAL MANUFACTURING IN LEVEL AND FLOW SENSOR MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 17 GLOBAL OIL & GAS IN LEVEL AND FLOW SENSOR MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 18 GLOBAL OIL & GAS IN LEVEL AND FLOW SENSOR MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 19 GLOBAL CHEMICAL IN LEVEL AND FLOW SENSOR MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 20 GLOBAL CHEMICAL IN LEVEL AND FLOW SENSOR MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 21 GLOBAL CONSUMER GOODS IN LEVEL AND FLOW SENSOR MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 22 GLOBAL CONSUMER GOODS IN LEVEL AND FLOW SENSOR MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 23 GLOBAL AUTOMOTIVE IN LEVEL AND FLOW SENSOR MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 24 GLOBAL AUTOMOTIVE IN LEVEL AND FLOW SENSOR MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 25 GLOBAL ENERGY & POWER IN LEVEL AND FLOW SENSOR MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 26 GLOBAL ENERGY & POWER IN LEVEL AND FLOW SENSOR MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 27 GLOBAL GOVERNMENT & DEFENSE IN LEVEL AND FLOW SENSOR MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 28 GLOBAL GOVERNMENT & DEFENSE IN LEVEL AND FLOW SENSOR MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 29 GLOBAL WASTEWATER IN LEVEL AND FLOW SENSOR MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 30 GLOBAL WASTEWATER IN LEVEL AND FLOW SENSOR MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 31 GLOBAL HEALTHCARE IN LEVEL AND FLOW SENSOR MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 32 GLOBAL HEALTHCARE IN LEVEL AND FLOW SENSOR MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 33 GLOBAL OTHERS IN LEVEL AND FLOW SENSOR MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 34 GLOBAL OTHERS IN LEVEL AND FLOW SENSOR MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 35 GLOBAL LEVEL AND FLOW SENSOR MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 36 GLOBAL OFFLINE IN LEVEL AND FLOW SENSOR MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 37 GLOBAL OFFLINE IN LEVEL AND FLOW SENSOR MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 38 GLOBAL ONLINE IN LEVEL AND FLOW SENSOR MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 39 GLOBAL ONLINE IN LEVEL AND FLOW SENSOR MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 40 MARKET SHARE OF TOP 15 COMPANIES IN GLOBAL FLOW AND LEVEL SENSOR MARKET

TABLE 41 MARKET SHARE OF TOP 15 COMPANIES IN NORTH AMERICA FLOW AND LEVEL SENSOR MARKET

TABLE 42 MARKET SHARE OF TOP 15 COMPANIES IN EUROPE FLOW AND LEVEL SENSOR MARKET

TABLE 43 MARKET SHARE OF TOP 15 COMPANIES IN ASIA-PACIFIC FLOW AND LEVEL SENSORS MARKET

Lista de Figura

FIGURE 1 GLOBAL LEVEL AND FLOW SENSOR MARKET: SEGMENTATION

FIGURE 2 GLOBAL LEVEL AND FLOW SENSOR MARKET: DATA TRIANGULATION

FIGURE 3 GLOBAL LEVEL AND FLOW SENSOR MARKET: DROC ANALYSIS

FIGURE 4 GLOBAL LEVEL AND FLOW SENSOR MARKET: GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 5 GLOBAL LEVEL AND FLOW SENSOR MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 GLOBAL LEVEL AND FLOW SENSOR MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 GLOBAL LEVEL AND FLOW SENSOR MARKET: DBMR MARKET POSITION GRID

FIGURE 8 GLOBAL LEVEL SENSOR MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 GLOBAL FLOW SENSOR MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 GLOBAL LEVEL AND FLOW SENSOR MARKET: MARKET END-USER COVERAGE GRID

FIGURE 11 GLOBAL LEVEL AND FLOW SENSOR MARKET: MULTIVARIATE MODELLING

FIGURE 12 GLOBAL LEVEL AND FLOW SENSOR MARKET: TYPE TIMELINE CURVE

FIGURE 13 GLOBAL LEVEL AND FLOW SENSOR MARKET: SEGMENTATION

FIGURE 14 THE INCREASING ADOPTION OF INDUSTRIAL AUTOMATION AND INDUSTRY 4.0 IS EXPECTED TO BE KEY DRIVERS FOR THE GLOBAL LEVEL AND FLOW SENSOR MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 15 FLOW SENSOR IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF GLOBAL LEVEL AND FLOW SENSOR MARKET IN 2023 TO 2030

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE GLOBAL LEVEL AND FLOW SENSOR MARKET

FIGURE 17 INCREASING AUTOMATION IN INDIA (IN %)

FIGURE 18 ADVANCEMENTS IN SENSOR TECHNOLOGY

FIGURE 19 VARIOUS STRATEGIC INITIATIVES

FIGURE 20 GROWING NEED FOR ACCURACY IN VARIOUS INDUSTRIES

FIGURE 21 TOP IOT CATEGORIES BASED ON 2020 MARKET SHARE

FIGURE 22 GLOBAL LEVEL AND FLOW SENSOR MARKET: BY TYPE, 2022

FIGURE 23 GLOBAL LEVEL AND FLOW SENSOR MARKET: BY TECHNOLOGY, 2022

FIGURE 24 GLOBAL LEVEL AND FLOW SENSOR MARKET: BY APPLICATION MEDIA, 2022

FIGURE 25 GLOBAL LEVEL AND FLOW SENSOR MARKET: BY END USER, 2022

FIGURE 26 GLOBAL LEVEL AND FLOW SENSOR MARKET: BY DISTRIBUTION CHANNEL, 2022

FIGURE 27 GOBAL LEVEL AND FLOW SENSOR MARKET: SNAPSHOT (2022)

FIGURE 28 GLOBAL FLOW SENSOR MARKET: COMPANY SHARE 2022 (%)

FIGURE 29 GLOBAL LEVEL SENSOR MARKET: COMPANY SHARE 2022 (%)

FIGURE 30 NORTH AMERICA FLOW SENSOR MARKET: COMPANY SHARE 2022 (%)

FIGURE 31 NORTH AMERICA LEVEL SENSOR MARKET: COMPANY SHARE 2022 (%)

FIGURE 32 EUROPE FLOW SENSOR MARKET: COMPANY SHARE 2022 (%)

FIGURE 33 EUROPE LEVEL SENSOR MARKET: COMPANY SHARE 2022 (%)

FIGURE 34 ASIA-PACIFIC FLOW SENSOR MARKET: COMPANY SHARE 2022 (%)

FIGURE 35 ASIA-PACIFIC LEVEL SENSOR MARKET: COMPANY SHARE 2022 (%)

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.