Global Hemostats Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

3.34 Billion

USD

5.67 Billion

2024

2032

USD

3.34 Billion

USD

5.67 Billion

2024

2032

| 2025 –2032 | |

| USD 3.34 Billion | |

| USD 5.67 Billion | |

|

|

|

|

Segmentação do mercado global de hemostáticos, por tipo de produto (hemostato à base de trombina, combinado, à base de celulose oxidada regenerada, à base de gelatina e à base de colágeno), formulação (hemostatos de matriz e gel, hemostáticos em folha e almofada, hemostáticos de esponja e hemostáticos em pó), aplicação (ortopédica, cirurgia geral, cirurgia neurológica, cirurgia cardiovascular, cirurgia reconstrutiva e cirurgia ginecológica), indicação (fechamento de feridas e cirurgia), usuário final (hospitais, clínicas, centros ambulatoriais, assistência médica comunitária e outros) - tendências do setor e previsão para 2032

Tamanho do mercado de hemostáticos

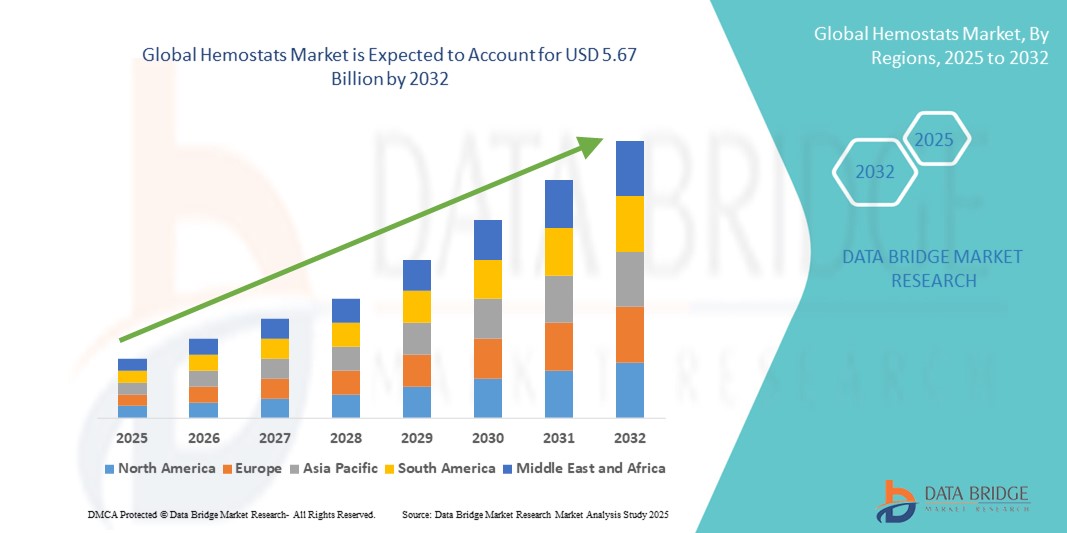

- O tamanho do mercado global de hemostáticos foi avaliado em US$ 3,34 bilhões em 2024 e deve atingir US$ 5,67 bilhões até 2032 , com um CAGR de 6,85% durante o período previsto.

- O crescimento do mercado é amplamente impulsionado pela crescente incidência de procedimentos cirúrgicos em todo o mundo e pela crescente necessidade de gerenciamento eficaz da perda de sangue, especialmente em ambientes de trauma e atendimento de emergência. Os hemostáticos estão desempenhando um papel crítico no aumento da eficiência cirúrgica, oferecendo controle rápido e localizado do sangramento, reduzindo assim as complicações intraoperatórias e melhorando os resultados dos pacientes.

- Além disso, os avanços nas tecnologias hemostáticas — incluindo materiais bioabsorvíveis, agentes à base de trombina e produtos combinados — estão acelerando a adoção de hemostáticos em cirurgia geral, procedimentos cardiovasculares e intervenções ortopédicas. Essas inovações não apenas aumentam a eficácia, mas também permitem uma aplicação mais ampla em cirurgias minimamente invasivas e laparoscópicas, impulsionando significativamente o crescimento do mercado.

Análise de Mercado de Hemostatos

- Hemostatos, agentes cirúrgicos vitais projetados para controlar sangramentos e facilitar a coagulação durante cirurgias, são cada vez mais indispensáveis em cuidados de trauma, procedimentos ortopédicos, cirurgias cardiovasculares e intervenções minimamente invasivas devido à sua capacidade de garantir hemostasia rápida e melhorar os resultados cirúrgicos.

- A crescente demanda por hemostáticos é impulsionada principalmente pelo crescente volume de procedimentos cirúrgicos em todo o mundo, pelo aumento da incidência de traumas e acidentes e pela expansão da população idosa propensa a doenças crônicas que exigem cuidados cirúrgicos.

- A América do Norte dominou o mercado de hemostáticos, com a maior participação na receita, de 39,8% em 2024, devido à sua infraestrutura avançada de saúde, aos altos gastos per capita com saúde e à forte presença de importantes players do mercado. Os EUA, em particular, testemunharam uma alta adoção de agentes hemostáticos passivos e ativos em hospitais e centros cirúrgicos ambulatoriais.

- A Ásia-Pacífico deverá ser a região de crescimento mais rápido no mercado de hemostáticos durante o período previsto de 2025 a 2032, impulsionada pela rápida urbanização, pelo aumento dos investimentos em saúde, pela melhoria do acesso a cuidados cirúrgicos em países como China e Índia e pela conscientização crescente sobre o gerenciamento eficaz da perda de sangue durante os procedimentos.

- O segmento de Cirurgia dominou o mercado de hemostáticos com uma participação de mercado de 65,4% em 2024, devido ao crescente número de intervenções cirúrgicas complexas que exigem controle imediato e eficiente do sangramento para minimizar complicações

Escopo do Relatório e Segmentação do Mercado de Hemostatos

|

Atributos |

Principais insights de mercado da Hemostats |

|

Segmentos abrangidos |

|

|

Países abrangidos |

América do Norte

Europa

Ásia-Pacífico

Oriente Médio e África

Ámérica do Sul

|

|

Principais participantes do mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor agregado |

Além dos insights sobre cenários de mercado, como valor de mercado, taxa de crescimento, segmentação, cobertura geográfica e principais participantes, os relatórios de mercado selecionados pela Data Bridge Market Research também incluem análises aprofundadas de especialistas, análises de preços, análises de participação de marca, pesquisas com consumidores, análises demográficas, análises da cadeia de suprimentos, análises da cadeia de valor, visão geral de matérias-primas/consumíveis, critérios de seleção de fornecedores, análise PESTLE, análise de Porter e estrutura regulatória. |

Tendências do mercado de hemostáticos

Crescente demanda por agentes hemostáticos avançados em cirurgia moderna

- Uma tendência significativa e crescente no mercado global de hemostáticos é a crescente adoção de agentes hemostáticos avançados em diversas áreas cirúrgicas, incluindo ortopedia, cirurgia cardiovascular, traumatologia e neurocirurgia. A evolução das técnicas cirúrgicas levou ao aumento da demanda por soluções confiáveis e de ação rápida para o manejo eficiente do sangramento intraoperatório.

- Os hemostáticos modernos, incluindo agentes ativos como selantes de trombina e fibrina, estão ganhando popularidade devido à sua eficácia superior, especialmente em procedimentos complexos ou minimamente invasivos, onde os métodos mecânicos tradicionais (como suturas ou ligaduras) não são suficientes

- Hospitais e centros cirúrgicos ambulatoriais estão cada vez mais privilegiando hemostáticos combinados que oferecem mecanismos duplos — físico e bioquímico — para controlar o sangramento. Essa mudança reflete uma preferência mais ampla por agentes versáteis que podem ser usados em uma variedade de cenários cirúrgicos e tipos de feridas.

- Além disso, o aumento da população geriátrica em todo o mundo — que é mais propensa a doenças crônicas que requerem cirurgia — influenciou diretamente o aumento do consumo de produtos hemostáticos em cuidados operatórios e na recuperação pós-cirúrgica.

- Os principais fabricantes estão focados no desenvolvimento de hemostáticos de última geração com biocompatibilidade aprimorada, resposta imunogênica mínima e tempos de aplicação mais rápidos, o que está alinhado com a tendência crescente de redução da duração cirúrgica e melhoria dos resultados para os pacientes.

- Com o aumento dos investimentos em infraestrutura de saúde e inovação cirúrgica, especialmente em economias emergentes, o mercado global de hemostáticos está pronto para um crescimento sustentado, impulsionado pela eficácia clínica, segurança do paciente e pelo escopo crescente de procedimentos cirúrgicos que exigem controle preciso da perda de sangue.

Dinâmica do mercado de hemostáticos

Motorista

Crescente demanda por gerenciamento de perda de sangue em especialidades cirúrgicas

- O crescente volume cirúrgico global — particularmente em procedimentos cardiovasculares, ortopédicos, de trauma e neurocirurgia — está aumentando significativamente a demanda por agentes hemostáticos eficientes

- Hospitais e centros cirúrgicos estão priorizando o uso de hemostatos avançados para gerenciar o sangramento intraoperatório e pós-operatório de forma mais eficaz, reduzindo assim as taxas de complicações e melhorando os resultados dos pacientes

- Por exemplo, a crescente adopção de técnicas cirúrgicas minimamente invasivas, onde a visibilidade e a precisão são primordiais, reforçou a necessidade de agentes hemostáticos tópicos de acção rápida.

- Isso está incentivando os fabricantes a desenvolver soluções inovadoras que proporcionem coagulação rápida sem interferir no campo operatório

- Condições crônicas como diabetes, doenças hepáticas e coagulopatias, que aumentam o risco de sangramento durante a cirurgia, estão impulsionando ainda mais a demanda por soluções hemostáticas confiáveis em procedimentos eletivos e de emergência.

- O uso de hemostáticos adjuvantes está se tornando uma prática padrão em muitas cirurgias de alto risco

Restrição/Desafio

Altos custos e restrições regulatórias

- Apesar de sua eficácia clínica, o alto custo associado a hemostáticos biológicos e ativos avançados, como produtos à base de trombina ou fibrina, continua sendo uma barreira fundamental em ambientes de saúde com recursos limitados. Muitos hospitais públicos e pequenos centros cirúrgicos, especialmente em economias em desenvolvimento, ainda dependem de métodos mecânicos básicos devido a restrições de custo.

- Além disso, o rigoroso arcabouço regulatório que rege a aprovação de produtos hemostáticos de origem biológica aumenta a complexidade e o custo da entrada no mercado. Os fabricantes devem investir pesadamente em validação clínica e cumprir rigorosos requisitos de conformidade, o que pode atrasar a inovação e a acessibilidade.

- Outro desafio reside na compatibilidade e na facilidade de uso dos produtos. Alguns agentes hemostáticos exigem armazenamento ou preparação especializados, o que os torna menos convenientes em situações de emergência ou em áreas rurais. Como resultado, há uma demanda crescente por produtos prontos para uso, com longa vida útil e ampla aplicabilidade em diferentes tipos de procedimentos.

- A falta de conscientização generalizada sobre os benefícios dos hemostatos avançados em certos mercados em desenvolvimento limita sua adoção. Cirurgiões e departamentos de compras podem continuar dependentes de técnicas tradicionais devido à formação limitada ou à exposição a novas tecnologias.

- Os desafios de reembolso em diversas regiões também restringem o crescimento do mercado. Muitos sistemas de saúde não oferecem reembolso integral para produtos hemostáticos caros, criando um ônus financeiro tanto para os provedores quanto para os pacientes.

- Interrupções na cadeia de suprimentos, especialmente durante eventos globais como a pandemia de COVID-19, podem prejudicar a disponibilidade consistente de hemostáticos essenciais em hospitais e centros cirúrgicos, afetando protocolos de tratamento e decisões de estoque.

- Recolhimentos de produtos e preocupações relacionadas à segurança ou contaminação podem impactar significativamente a confiança e a adoção da marca. Por exemplo, produtos biológicos podem apresentar risco de reação imunogênica ou transmissão viral se não forem manuseados ou processados adequadamente.

- Há também uma preocupação crescente com o impacto ambiental e a geração de resíduos de produtos hemostáticos de uso único, levando os órgãos reguladores e os hospitais a buscar alternativas mais sustentáveis - algo que nem todas as empresas estão atualmente equipadas para oferecer.

Escopo de mercado de hemostatos

O mercado é segmentado com base no tipo de produto, formulação, aplicação, indicação e usuário final.

- Por tipo de produto

Com base no tipo de produto, o mercado de hemostáticos é segmentado em hemostáticos à base de trombina, combinados, à base de celulose oxidada regenerada, à base de gelatina e à base de colágeno. O segmento de hemostáticos à base de trombina dominou o mercado, com uma participação de receita de 31,8% em 2024, devido à sua rápida capacidade de coagulação e compatibilidade com diversos procedimentos cirúrgicos. Esses produtos são altamente eficazes no controle de sangramentos leves e graves, tornando-os amplamente preferidos por cirurgiões em todo o mundo.

Enquanto isso, o segmento de hemostáticos combinados deverá crescer na taxa composta de crescimento anual (CAGR) mais rápida, de 6,9%, de 2025 a 2032, devido aos seus mecanismos de dupla ação e maior eficácia em ambientes cirúrgicos complexos, como procedimentos cardíacos e ortopédicos.

- Por Formulação

Com base na formulação, o mercado de hemostáticos é segmentado em hemostáticos de matriz e gel, hemostáticos de folhas e almofadas, hemostáticos de esponja e hemostáticos em pó. O segmento de hemostáticos de matriz e gel representou a maior participação na receita, 34,2% em 2024, devido à sua excelente adaptabilidade a superfícies irregulares de feridas e à sua rápida ação em cirurgias minimamente invasivas. Sua fácil aplicação e reduzido dano tecidual os tornaram a escolha dos cirurgiões em cirurgias de alta precisão.

Espera-se que o segmento de hemostáticos em pó testemunhe o CAGR mais rápido de 7,3% entre 2025 e 2032, impulsionado por sua versatilidade, facilidade de armazenamento e uso crescente em traumas de emergência e procedimentos laparoscópicos.

- Por aplicação

Com base na aplicação, o mercado de hemostáticos é segmentado em ortopedia, cirurgia geral, neurologia, cirurgia cardiovascular, cirurgia reconstrutiva e cirurgia ginecológica. A Cirurgia Geral liderou o segmento, com uma participação de receita de 28,6% em 2024, atribuída ao amplo uso de agentes hemostáticos em cirurgias abdominais, de trauma e de hérnia, onde o controle eficaz da perda sanguínea é fundamental.

Espera-se que o segmento de cirurgia neurológica cresça a uma taxa composta de crescimento anual (CAGR) mais rápida, de 7,5%, entre 2025 e 2032, pois esses procedimentos exigem ferramentas hemostáticas de alta precisão para controlar sangramentos delicados próximos aos tecidos cerebrais e espinhais.

- Por Indicação

Com base na indicação, o mercado de hemostáticos é segmentado em fechamento de feridas e cirurgia. O segmento cirúrgico conquistou a maior fatia de mercado, com 65,4% em 2024, devido ao crescente número de intervenções cirúrgicas complexas que exigem controle imediato e eficiente do sangramento para minimizar complicações.

Espera-se que o segmento de fechamento de feridas cresça na CAGR mais rápida de 2025 a 2032, devido ao uso crescente de hemostáticos tópicos em atendimento de emergência e recuperação pós-operatória para reduzir o tempo de cicatrização e o risco de infecção.

- Por usuário final

Com base no usuário final, o mercado de hemostatos é segmentado em hospitais, clínicas, centros ambulatoriais, serviços de saúde comunitários e outros. Os hospitais detinham a maior participação de mercado, com 58,1% em 2024, impulsionados pelo alto volume cirúrgico e pela disponibilidade de equipes cirúrgicas especializadas e infraestrutura. Os hospitais são os principais locais para procedimentos complexos que exigem controle avançado de sangramento.

A previsão é que os centros ambulatoriais registrem o CAGR mais rápido de 8,1% entre 2025 e 2032, devido ao aumento nas cirurgias ambulatoriais e à crescente adoção de procedimentos econômicos e realizados no mesmo dia, que exigem pinças hemostáticas confiáveis e de ação rápida.

Análise regional do mercado de hemostáticos

- A América do Norte dominou o mercado de hemostáticos com a maior participação na receita de 39,8% em 2024, impulsionada pelo aumento de procedimentos cirúrgicos, alta adoção de agentes hemostáticos avançados e forte infraestrutura de saúde.

- A presença de grandes intervenientes no mercado, juntamente com políticas de reembolso favoráveis e um foco crescente na minimização de complicações cirúrgicas, contribuiu ainda mais para o domínio da região

- A demanda por hemostáticos na América do Norte também é impulsionada pelo aumento da população geriátrica da região, pela alta prevalência de doenças crônicas e pelo aumento do número de cirurgias cardiovasculares e de trauma. Hospitais e centros cirúrgicos estão investindo cada vez mais em soluções hemostáticas modernas e eficientes para reduzir o sangramento intraoperatório e melhorar os resultados dos pacientes.

Visão do mercado de hemostatos dos EUA

O mercado de hemostáticos dos EUA capturou a maior fatia da receita, de 64%, em 2024, na América do Norte, impulsionado pela crescente preferência por cirurgias minimamente invasivas, pela crescente conscientização sobre o gerenciamento de perdas sanguíneas e pelos avanços tecnológicos em produtos hemostáticos. O país também se beneficia de uma estrutura regulatória bem estabelecida, da ampla adoção clínica de hemostáticos combinados e de colaborações estratégicas entre hospitais e empresas de dispositivos médicos. Além disso, o financiamento governamental e a presença de instituições acadêmicas de ponta conduzindo pesquisas em hemostasia cirúrgica impulsionam ainda mais o crescimento do mercado.

Visão geral do mercado de hemostáticos na Europa

O mercado europeu de hemostáticos deverá crescer a um CAGR substancial ao longo do período previsto, principalmente devido ao aumento do volume de procedimentos cirúrgicos eletivos e de emergência, ao foco crescente em resultados pós-operatórios e ao financiamento favorável da saúde pública. Países como Alemanha, França e Reino Unido estão observando um uso crescente de hemostáticos biológicos e ativos avançados em cirurgias ortopédicas, cardiovasculares e de trauma. Além disso, os crescentes esforços para aprimorar o treinamento de cirurgiões, a inovação em dispositivos médicos e a segurança cirúrgica estão fomentando a adoção em instituições de saúde públicas e privadas.

Visão geral do mercado de hemostatos do Reino Unido

Prevê-se que o mercado de hemostáticos do Reino Unido cresça a um CAGR considerável durante o período previsto, impulsionado pela crescente prevalência de doenças crônicas que exigem intervenção cirúrgica e pela forte ênfase na melhoria dos resultados cirúrgicos por meio de ferramentas intraoperatórias avançadas. Os investimentos do Serviço Nacional de Saúde (NHS) em equipamentos cirúrgicos modernos e a crescente importância dos centros cirúrgicos ambulatoriais (ASCs) estão contribuindo para o aumento da demanda. Além disso, o aumento de cirurgias ambulatoriais e procedimentos laparoscópicos está aumentando a necessidade de agentes hemostáticos absorvíveis de ação rápida.

Visão do mercado de hemostatos na Alemanha

Espera-se que o mercado alemão de hemostáticos se expanda a uma CAGR considerável durante o período previsto, impulsionado por um sistema de saúde tecnologicamente avançado, ênfase na qualidade do atendimento e um número crescente de pacientes idosos submetidos a tratamentos cirúrgicos. Hospitais em toda a Alemanha estão incorporando hemostáticos combinados e à base de selante de fibrina por sua eficácia em cirurgias complexas. Incentivos regulatórios e inovação local em materiais cirúrgicos estão impulsionando ainda mais a expansão do mercado na Alemanha.

Visão do mercado de hemostáticos da Ásia-Pacífico

O mercado de hemostáticos da Ásia-Pacífico deverá crescer com a CAGR mais rápida durante o período previsto de 2025 a 2032, impulsionado pelo crescimento dos investimentos em saúde, pela crescente adoção de práticas cirúrgicas modernas e por um forte aumento nos volumes cirúrgicos em economias emergentes. Países como China, Japão e Índia estão testemunhando uma rápida expansão em sua infraestrutura hospitalar, aliada a esforços apoiados pelo governo para melhorar os resultados cirúrgicos. Espera-se que a crescente demanda por soluções hemostáticas econômicas e eficientes em hospitais públicos e privados impulsione significativamente o crescimento na região.

Visão do mercado de hemostatos do Japão

O mercado japonês de hemostáticos está ganhando força, impulsionado pelo alto volume de cirurgias, pelo aumento da população geriátrica e pelo foco crescente na prevenção de infecções e na melhora da cicatrização pós-cirúrgica. As instituições de saúde japonesas priorizam produtos hemostáticos de alta qualidade com segurança e eficácia clínicas comprovadas. Hospitais avançados estão adotando hemostáticos combinados e sintéticos para reduzir o tempo cirúrgico e a necessidade de transfusão de sangue. Além disso, a inovação nacional e as fortes diretrizes regulatórias estão acelerando o lançamento de novos produtos.

Visão do mercado de hemostatos da China

O mercado chinês de hemostáticos foi responsável pela maior fatia da receita de mercado na Ásia-Pacífico em 2024, devido à rápida modernização da infraestrutura de saúde do país, à expansão de hospitais terciários e ao crescente número de procedimentos cirúrgicos realizados anualmente. A forte capacidade de fabricação local e o apoio governamental às empresas nacionais de dispositivos médicos estão aumentando ainda mais a disponibilidade e o preço acessível dos hemostáticos no país. O crescimento da população de classe média, aliado ao aumento da penetração de planos de saúde, está melhorando o acesso a cuidados cirúrgicos e impulsionando a demanda por agentes hemostáticos eficazes.

Participação de mercado de hemostáticos

O setor de hemostáticos é liderado principalmente por empresas bem estabelecidas, incluindo:

- CR Bard, Inc. (EUA)

- B. Braun SE (Alemanha)

- Baxter International, Inc. (EUA)

- Integra LifeSciences (EUA)

- Marine Polymer Technologies, Inc. (EUA)

- Teleflex (EUA)

- Ethicon, Inc. (EUA)

- Pfizer, Inc. (EUA)

- Z-Medica LLC (EUA)

- Gelita Medical GmbH (Alemanha)

- Anika Therapeutics, Inc. (EUA)

- Stryker (EUA)

- Integra LifeSciences Corporation (EUA)

Últimos desenvolvimentos no mercado global de hemostáticos

- Em abril de 2023, a Olympus lançou um trio de novos produtos hemostáticos — o Adesivo EndoClot (ECA), o Spray Hemostático Polissacarídeo EndoClot (PHS) e a Injeção Submucosa EndoClot — projetados para o controle rápido do sangramento durante procedimentos endoscópicos. Essas inovações refletem o crescimento contínuo em ferramentas de suporte cirúrgico minimamente invasivas.

- Em março de 2023, a Axio Biosolutions recebeu a aprovação 510(k) da FDA dos EUA para seu Hemostato Cirúrgico Ax-Surgi, um produto à base de quitosana desenvolvido para o tratamento de sangramentos cirúrgicos graves. Esta aprovação destaca o impulso regulatório no desenvolvimento de agentes hemostáticos.

- Em janeiro de 2024, a Baxter International Inc. adquiriu a PerClot, uma hemostática em pó à base de amido vegetal, expandindo sua oferta no segmento de hemostasia adjuvante e destacando a consolidação estratégica na indústria

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.