Global Gyroscope Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

4.06 Billion

USD

6.09 Billion

2024

2032

USD

4.06 Billion

USD

6.09 Billion

2024

2032

| 2025 –2032 | |

| USD 4.06 Billion | |

| USD 6.09 Billion | |

|

|

|

|

Segmentação do mercado global de giroscópios, por tipo de tecnologia (giroscópio MEMS, giroscópio de fibra óptica (FOG), giroscópio de laser de anel (RLG), giroscópio ressonador hemisférico (HRG), giroscópio com ajuste dinâmico (DTG) e outros), tipo de produto (smartphones, tablets, câmeras, consoles de jogos, laptops, dispositivos de navegação e outros), usuário final (eletrônicos de consumo, automotivo, aeroespacial e defesa, industrial, marítimo e outros) - Tendências do setor e previsão até 2032

Tamanho do mercado de giroscópios

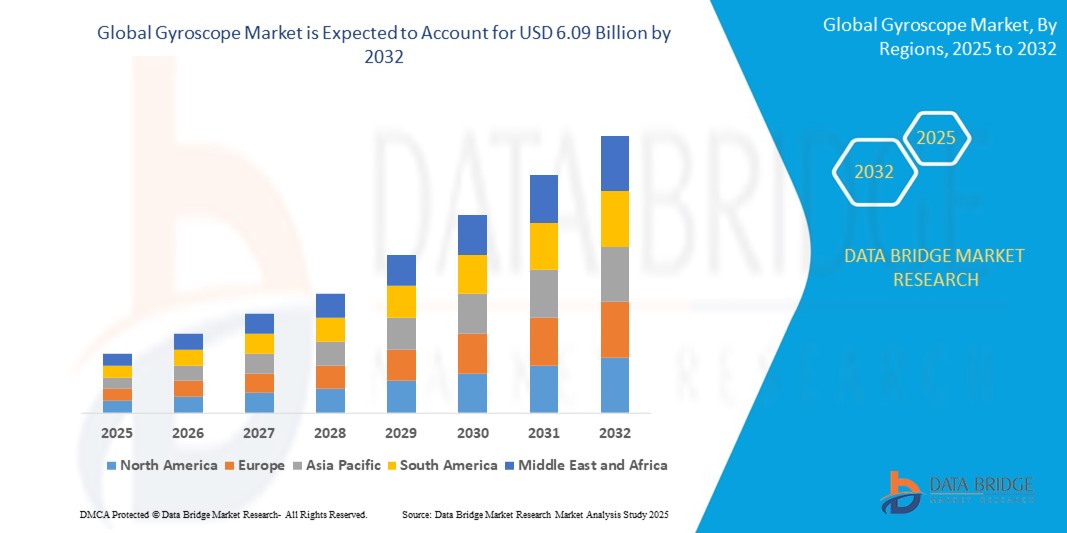

- O tamanho do mercado global de giroscópios foi avaliado em US$ 4,06 bilhões em 2024 e deve atingir US$ 6,09 bilhões até 2032 , com um CAGR de 5,20% durante o período previsto.

- O crescimento do mercado é amplamente impulsionado pela crescente adoção de giroscópios em smartphones, veículos autônomos, drones e sistemas de defesa, impulsionado por avanços tecnológicos em MEMS e tecnologias de giroscópio de fibra óptica, permitindo maior precisão, miniaturização e eficiência de custos.

- Além disso, a crescente demanda por navegação precisa, detecção de movimento e controle de estabilidade nos setores de eletrônicos de consumo, automotivo, aeroespacial e industrial está consolidando os giroscópios como componentes essenciais para melhor desempenho, confiabilidade e automação. Esses fatores convergentes estão acelerando a integração de giroscópios em diversas aplicações, impulsionando significativamente o crescimento do mercado.

Análise de Mercado de Giroscópios

- Giroscópios são dispositivos que medem a velocidade angular e a orientação, permitindo a detecção precisa de movimento, navegação e estabilização em uma ampla gama de aplicações, incluindo smartphones, veículos, plataformas aeroespaciais, máquinas industriais e sistemas de defesa.

- A crescente demanda por giroscópios é alimentada principalmente pela crescente implantação de veículos autônomos, sistemas não tripulados, dispositivos inteligentes de consumo e tecnologias de defesa avançadas, bem como pela necessidade de soluções precisas de orientação e navegação em tempo real em ambientes comerciais e militares.

- A América do Norte dominou o mercado de giroscópios com uma participação de 39,2% em 2024, devido à crescente demanda por sistemas avançados de navegação, veículos autônomos e integração de eletrônicos de consumo

- Espera-se que a Ásia-Pacífico seja a região de crescimento mais rápido no mercado de giroscópios durante o período previsto devido à rápida industrialização, urbanização e avanços tecnológicos na China, Japão, Índia e Coreia do Sul.

- O segmento de giroscópios MEMS dominou o mercado, com uma participação de mercado de 48,8% em 2024, devido ao seu tamanho compacto, baixo custo e alta integração com dispositivos eletrônicos modernos. Os giroscópios MEMS são amplamente utilizados em smartphones, tablets, dispositivos vestíveis e sistemas de segurança automotiva, impulsionados pelos avanços na miniaturização e pela crescente demanda por recursos de detecção de movimento em aplicações industriais e de consumo. Sua capacidade de oferecer medições confiáveis de velocidade angular, mantendo baixo consumo de energia, os torna a escolha preferida em eletrônicos portáteis e dispositivos de IoT.

Escopo do Relatório e Segmentação do Mercado de Giroscópios

|

Atributos |

Principais insights de mercado do giroscópio |

|

Segmentos abrangidos |

|

|

Países abrangidos |

América do Norte

Europa

Ásia-Pacífico

Oriente Médio e África

Ámérica do Sul

|

|

Principais participantes do mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor agregado |

Além dos insights sobre cenários de mercado, como valor de mercado, taxa de crescimento, segmentação, cobertura geográfica e principais participantes, os relatórios de mercado selecionados pela Data Bridge Market Research também incluem análises aprofundadas de especialistas, produção e capacidade de empresas representadas geograficamente, layouts de rede de distribuidores e parceiros, análises detalhadas e atualizadas de tendências de preços e análises de déficit da cadeia de suprimentos e demanda. |

Tendências do mercado de giroscópios

“Adoção crescente de giroscópios MEMS”

- Uma tendência significativa e crescente no mercado global de giroscópios é a crescente adoção de giroscópios MEMS (Sistemas Microeletromecânicos) em aplicações eletrônicas de consumo, automotivas e aeroespaciais, como smartphones, drones e sistemas avançados de assistência ao motorista.

- Por exemplo, empresas como a STMicroelectronics e a Bosch Sensortec estão a lançar giroscópios MEMS de alto desempenho que oferecem tamanho compacto, baixo consumo de energia e alta sensibilidade para integração em dispositivos portáteis e sistemas autónomos.

- O desenvolvimento de giroscópios MEMS multieixos permite recursos avançados de detecção de movimento e estabilização em produtos como fones de ouvido de realidade virtual, rastreadores de condicionamento físico vestíveis e robótica

- Os giroscópios MEMS oferecem vantagens como tamanho reduzido, menor custo e confiabilidade aprimorada em comparação aos giroscópios mecânicos e de fibra óptica tradicionais, apoiando a ampla adoção em diversos setores

- Essa tendência de miniaturização e funcionalidade aprimorada está remodelando fundamentalmente o design e a inovação de produtos em setores como eletrônicos de consumo e segurança automotiva. Empresas como a Analog Devices e a InvenSense estão investindo em pesquisa e desenvolvimento para aprimorar a precisão e a robustez dos giroscópios para aplicações exigentes.

- A demanda por giroscópios MEMS está crescendo rapidamente em mercados estabelecidos e emergentes, à medida que os fabricantes priorizam cada vez mais a compactação, o desempenho e a eficiência de custos em soluções de navegação e detecção de movimento.

Dinâmica do Mercado de Giroscópios

Motorista

“Aumento da demanda por sistemas de navegação”

- A crescente necessidade de sistemas de navegação precisos e confiáveis nos setores automotivo, aeroespacial, marítimo e de eletrônicos de consumo é um importante impulsionador do mercado global de giroscópios

- Por exemplo, a Honeywell e a Northrop Grumman estão a fornecer soluções avançadas de giroscópio para utilização em navegação inercial de aeronaves, orientação de mísseis e controlo de atitude de naves espaciais.

- À medida que as indústrias buscam melhorar a segurança dos veículos, a automação e a operação autônoma, os giroscópios oferecem recursos essenciais, como detecção de orientação, rastreamento de movimento e estabilização.

- A tendência para veículos conectados, veículos aéreos não tripulados e infraestrutura de transporte inteligente está tornando os giroscópios um componente essencial para navegação e controle em tempo real

- A conveniência de integrar giroscópios com GPS, acelerômetros e outros sensores em sistemas de fusão multissensor está impulsionando a adoção em aplicações comerciais e de defesa. A expansão de veículos autônomos e soluções de mobilidade inteligente contribui ainda mais para o crescimento do mercado.

Restrição/Desafio

“Altos custos de fabricação”

- As preocupações em torno dos altos custos de fabricação de giroscópios de precisão, especialmente aqueles necessários para aplicações aeroespaciais e de defesa, representam um desafio significativo para uma adoção mais ampla no mercado

- Por exemplo, a produção de giroscópios de fibra óptica e de laser de anel de alta precisão por empresas como a KVH Industries e a Safran Electronics & Defense envolve processos de fabricação complexos e rigorosos controlos de qualidade.

- Enfrentar esses desafios por meio de avanços na tecnologia MEMS, economias de escala e fabricação simplificada é crucial para reduzir custos e expandir o acesso ao mercado. Empresas como a Bosch Sensortec e a Analog Devices estão se concentrando em métodos de produção econômicos e projetos escaláveis.

- A necessidade de materiais especializados, instalações de salas limpas e pessoal qualificado pode ser uma barreira para novos participantes e fabricantes menores, impactando a competitividade geral da indústria

- Superar esses desafios por meio da colaboração da indústria, do aumento da automação e do investimento contínuo em pesquisa e desenvolvimento será vital para o crescimento sustentado do mercado e a acessibilidade.

Escopo de mercado de giroscópios

O mercado é segmentado com base no tipo de tecnologia, tipo de produto e usuário final.

• Por tipo de tecnologia

Com base no tipo de tecnologia, o mercado de giroscópios é segmentado em giroscópio MEMS, giroscópio de fibra óptica (FOG), giroscópio de laser de anel (RLG), giroscópio ressonador hemisférico (HRG), giroscópio de ajuste dinâmico (DTG) e outros. O segmento de giroscópio MEMS dominou a maior fatia de receita de mercado de 48,8% em 2024, atribuída ao seu tamanho compacto, baixo custo e alta integração com dispositivos eletrônicos modernos. Os giroscópios MEMS são amplamente utilizados em smartphones, tablets, dispositivos vestíveis e sistemas de segurança automotiva, impulsionados pelos avanços na miniaturização e pela crescente demanda por recursos de detecção de movimento em aplicações industriais e de consumo. Sua capacidade de oferecer medição confiável de velocidade angular, mantendo baixo consumo de energia, os torna a escolha preferida em eletrônicos portáteis e dispositivos de IoT.

Prevê-se que o segmento de giroscópios de fibra óptica (FOG) apresentará a maior taxa de crescimento entre 2025 e 2032, impulsionado pela crescente adoção em sistemas aeroespaciais, de defesa e de navegação autônoma. Os FOGs oferecem precisão e resistência superiores à interferência eletromagnética, tornando-os ideais para aplicações que exigem navegação inercial de alta precisão, como submarinos, naves espaciais e veículos não tripulados. A crescente ênfase em tecnologias autônomas, modernização militar e programas de exploração espacial impulsiona ainda mais a demanda por giroscópios de fibra óptica avançados.

• Por tipo de produto

Com base no tipo de produto, o mercado de giroscópios é segmentado em smartphones, tablets, câmeras, consoles de jogos, laptops, dispositivos de navegação e outros. O segmento de smartphones foi responsável pela maior fatia da receita de mercado em 2024, impulsionado pela ampla integração de giroscópios para aprimorar a experiência do usuário em aplicativos como jogos, realidade aumentada (RA), navegação e rastreamento de movimento. Os giroscópios em smartphones contribuem para a melhor orientação da tela, estabilização de imagem e funcionalidades imersivas de aplicativos, tornando-os indispensáveis no ecossistema global de smartphones.

Espera-se que o segmento de dispositivos de navegação registre o CAGR mais rápido entre 2025 e 2032, impulsionado pela crescente demanda por posicionamento e orientação precisos em veículos, drones e embarcações marítimas. Dispositivos de navegação equipados com giroscópios avançados permitem desempenho confiável em ambientes sem GPS, essenciais para aplicações críticas de defesa, aviação e marítimas. A crescente implantação de veículos autônomos e drones amplia ainda mais o potencial de crescimento de sistemas de navegação de alto desempenho habilitados por giroscópio.

• Por Usuário Final

Com base no usuário final, o mercado de giroscópios é segmentado em eletrônicos de consumo, automotivo, aeroespacial e defesa, industrial, marítimo e outros. O segmento de eletrônicos de consumo dominou a participação de mercado em 2024, devido ao amplo uso de giroscópios em smartphones, dispositivos de jogos, headsets de realidade virtual (RV) e wearables inteligentes. A integração de giroscópios nesses dispositivos aprimora a detecção de movimento, as experiências em jogos, o reconhecimento de gestos e as funcionalidades de realidade aumentada, em linha com as crescentes expectativas dos consumidores por tecnologias interativas e responsivas.

O segmento aeroespacial e de defesa deverá apresentar a taxa composta de crescimento anual (CAGR) mais rápida entre 2025 e 2032, impulsionada pelo papel crucial dos giroscópios em sistemas de navegação inercial, estabilização de voo e direcionamento. A demanda por giroscópios duráveis e de alta precisão está se intensificando com a crescente adoção de veículos aéreos não tripulados (VANTs), missões de exploração espacial e plataformas militares avançadas. Além disso, os investimentos contínuos em modernização da defesa e programas espaciais em todo o mundo estão contribuindo significativamente para o crescimento robusto dos giroscópios em aplicações aeroespaciais e de defesa.

Análise regional do mercado de giroscópios

- A América do Norte dominou o mercado de giroscópios com a maior participação de receita de 39,2% em 2024, impulsionada pela crescente demanda por sistemas avançados de navegação, veículos autônomos e integração de eletrônicos de consumo

- A maturidade tecnológica da região e a forte presença das indústrias aeroespacial, de defesa e automotiva são os principais contribuintes para o uso generalizado de giroscópios em várias aplicações

- Os crescentes investimentos em modernização da defesa, exploração espacial e desenvolvimento de veículos autônomos continuam a fortalecer a demanda por giroscópios de alto desempenho na América do Norte

Visão do mercado de giroscópios dos EUA

O mercado de giroscópios dos EUA conquistou a maior fatia da receita da América do Norte em 2024, impulsionado pela liderança do país nos setores aeroespacial, de defesa e de eletrônicos de consumo. O crescente foco em tecnologias de veículos autônomos, missões espaciais e modernização militar está impulsionando significativamente a demanda por giroscópios. Além disso, a alta penetração de smartphones, dispositivos de jogos e eletrônicos vestíveis está impulsionando a adoção de giroscópios MEMS para detecção de movimento e experiências aprimoradas do usuário.

Visão do mercado de giroscópios na Europa

O mercado europeu de giroscópios deverá crescer a um CAGR substancial durante o período previsto, impulsionado pelo aumento dos investimentos em defesa, aeroespacial e automação industrial. Padrões rigorosos de segurança e a crescente necessidade de navegação precisa nos setores militar e comercial estão fomentando a adoção de giroscópios. A região também está testemunhando uma demanda notável por giroscópios em eletrônicos de consumo, especialmente em smartphones, tablets e dispositivos de jogos.

Visão geral do mercado de giroscópios do Reino Unido

Prevê-se que o mercado de giroscópios do Reino Unido cresça a uma CAGR considerável durante o período previsto, impulsionado pela crescente ênfase em capacidades de defesa, transporte autônomo e tecnologias inteligentes. A crescente integração de giroscópios em sistemas de navegação para veículos, plataformas de defesa e equipamentos industriais está contribuindo para o crescimento do mercado. Além disso, a crescente demanda por eletrônicos de consumo com recursos de detecção de movimento está impulsionando a adoção de giroscópios MEMS.

Visão do mercado de giroscópios da Alemanha

Espera-se que o mercado alemão de giroscópios se expanda a um CAGR considerável durante o período previsto, impulsionado pelos fortes setores automotivo e industrial do país. Sendo a Alemanha um polo de inovação automotiva e iniciativas da Indústria 4.0, a necessidade de giroscópios para estabilidade veicular, navegação e automação robótica está aumentando. Além disso, os avanços nas tecnologias aeroespaciais e a crescente adoção de giroscópios de fibra óptica de alta precisão e de laser em anel estão impulsionando o crescimento do mercado.

Visão do mercado de giroscópios da Ásia-Pacífico

O mercado de giroscópios da Ásia-Pacífico deverá crescer com a CAGR mais rápida durante o período previsto de 2025 a 2032, impulsionado pela rápida industrialização, urbanização e avanços tecnológicos na China, Japão, Índia e Coreia do Sul. O aumento da produção e do consumo de smartphones, tablets e dispositivos de navegação está impulsionando a demanda por giroscópios MEMS. Além disso, o aumento dos investimentos em defesa, aeroespacial e desenvolvimento de veículos autônomos na região está contribuindo para uma expansão significativa do mercado.

Visão do mercado de giroscópios do Japão

O mercado japonês de giroscópios está ganhando força devido à liderança do país nos setores de robótica, automotivo e eletrônicos de consumo. A crescente demanda por sistemas avançados de navegação em veículos autônomos e giroscópios de alta precisão para aplicações aeroespaciais e de defesa está impulsionando o crescimento do mercado. O forte foco do Japão em inovação, aliado à sua sólida base de fabricação de eletrônicos, apoia a ampla adoção de giroscópios MEMS e de fibra óptica.

Visão do mercado de giroscópios da China

O mercado chinês de giroscópios representou a maior fatia da receita de mercado na região Ásia-Pacífico em 2024, impulsionado pela crescente indústria de eletrônicos de consumo do país, pelos rápidos avanços em veículos autônomos e por investimentos significativos em programas de defesa e espaço. A China é um importante polo de fabricação de giroscópios MEMS usados em smartphones, dispositivos de jogos e wearables. Além disso, a crescente implantação de drones, robótica e sistemas de navegação no país está acelerando a demanda por tecnologias de giroscópios de alto desempenho.

Participação no mercado de giroscópios

A indústria de giroscópios é liderada principalmente por empresas bem estabelecidas, incluindo:

- Honeywell International Inc. (EUA)

- Bosch Sensortec GmbH (Alemanha)

- Analog Devices, Inc. (EUA)

- Trimble Inc. (EUA)

- Murata Manufacturing Co., Ltd (Japão)

- Silicon Sensing Systems Limited (Reino Unido)

- Parker Hannifin Corp (EUA)

- MEMSIC Semiconductor Co., Ltd. (China)

- Northrop Grumman (EUA)

- EMCORE Corporation (EUA)

- KVH Industries, Inc (EUA)

- Safran (França)

- TDK Corporation (Japão)

- GEM elettronica (Itália)

- Optolink (Itália)

- STMicroelectronics (Suíça)

- ROHM Co., Ltd. (EUA)

- VectorNav Technologies, LLC (EUA)

- NXP Semiconductors (Holanda)

- Epson America, Inc (EUA)

- Ina Labs (EUA)

Últimos desenvolvimentos no mercado global de giroscópios

- Em julho de 2024, a Honeywell colaborou com a Odys Aviation para criar estações de controle em solo de última geração, a fim de facilitar a implantação das aeronaves VTOL híbridas da Odys Aviation nas regiões do Oriente Médio e Pacífico. Essa parceria visa aumentar a eficiência operacional e atender à crescente demanda por soluções avançadas de mobilidade aérea nessas áreas.

- Em julho de 2024, a Moog firmou uma parceria estratégica com o Serviço Técnico da Finnair, com o objetivo de fornecer à Finnair acesso global ao pool de componentes da Moog e suporte abrangente de reparo para vários números de peças usados na frota da companhia aérea.

- Em março de 2024, a Honeywell adquiriu a Civitanavi Systems, uma empresa especializada em tecnologia de posicionamento, navegação e cronometragem para os setores aeroespacial e de defesa

- Em outubro de 2023, a Honeywell expandiu seu portfólio de navegação industrial HGuide com o lançamento da Unidade de Medição Inercial (IMU) HGuide i400. Esta nova IMU foi projetada para uma variedade de aplicações de defesa, industriais e autônomas em veículos aéreos, terrestres e marítimos. Com uma repetibilidade de polarização do giroscópio de menos de um grau por hora, o HGuide i400 estabelece um novo padrão de precisão compacta, medindo apenas 28 mm x 25 mm sem comprometer o desempenho.

- Em setembro de 2023, a EMCORE Corporation lançou a Unidade de Medição Inercial (IMU) MEMS TAC-440, a menor IMU de 1°/hora do mundo. Esta unidade ultracompacta, com menos de cinco polegadas cúbicas, oferece desempenho superior como uma substituição compatível em forma, ajuste e função para as IMUs Honeywell 1930 e 4930.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.