Global Glass Substrate Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

7.01 Billion

USD

12.33 Billion

2024

2032

USD

7.01 Billion

USD

12.33 Billion

2024

2032

| 2025 –2032 | |

| USD 7.01 Billion | |

| USD 12.33 Billion | |

|

|

|

|

Segmentação do mercado global de substratos de vidro, por tipo (à base de borossilicato, à base de sílica fundida/quartzo, silício e outros), diâmetro do wafer (300 mm, 200 mm, 150 mm, 125 mm, acima de 300 mm e até 100 mm), aplicação (embalagem de wafer, suporte de substrato e interposer TGV), uso final (eletrônicos, aplicações ópticas, aeroespacial e defesa, automotivo e solar e médico) - tendências do setor e previsão até 2032

Tamanho do mercado de substratos de vidro

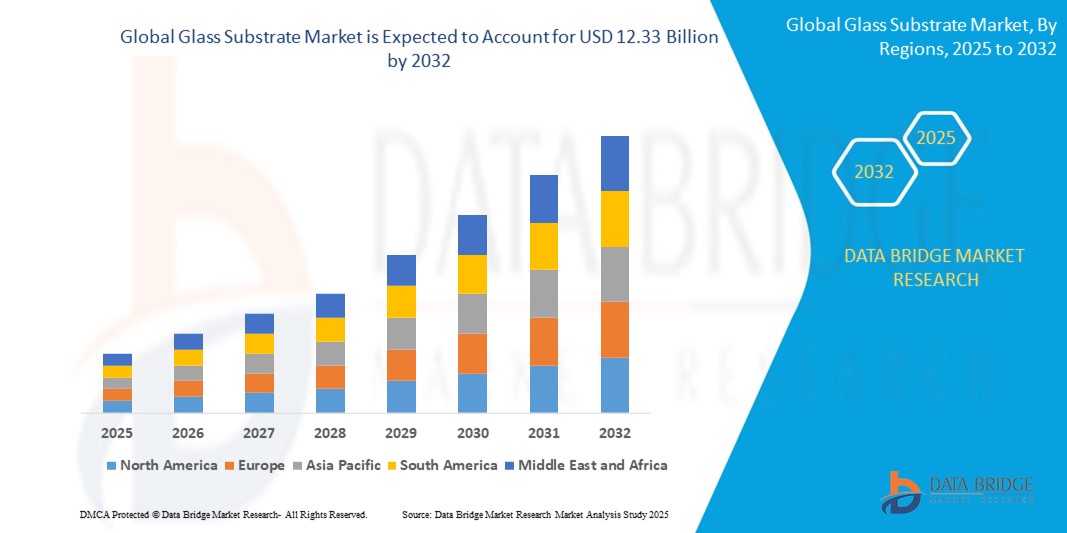

- O tamanho do mercado global de substratos de vidro foi avaliado em US$ 7,01 bilhões em 2024 e deve atingir US$ 12,33 bilhões até 2032 , com um CAGR de 7,30% durante o período previsto.

- O crescimento do mercado é amplamente impulsionado pela crescente demanda por tecnologias avançadas de exibição em eletrônicos de consumo, como smartphones, tablets e televisores, bem como pelas aplicações em expansão em painéis solares e eletrônicos flexíveis.

- Além disso, a crescente adoção de telas OLED e AMOLED, que exigem substratos de vidro de alta qualidade para melhor desempenho e durabilidade, está impulsionando ainda mais a expansão do mercado globalmente.

Análise de Mercado de Substratos de Vidro

- O mercado de substratos de vidro está se expandindo devido à crescente demanda por telas de alto desempenho em eletrônicos de consumo, oferecendo maior durabilidade e clareza para dispositivos como smartphones e televisores

- Os fabricantes estão se concentrando no desenvolvimento de substratos de vidro mais finos e flexíveis para atender às necessidades em evolução das tecnologias de telas flexíveis e dobráveis

- A América do Norte dominou o mercado de substratos de vidro com a maior participação na receita em 2024, impulsionada por uma indústria eletrônica robusta, crescente demanda por tecnologias de exibição avançadas e a presença de fabricantes líderes de semicondutores

- Espera-se que a região da Ásia-Pacífico testemunhe a maior taxa de crescimento no mercado global de substratos de vidro, impulsionada pela rápida industrialização, expansão da fabricação de eletrônicos e aumento da demanda por semicondutores e painéis de exibição em países como China, Japão, Coreia do Sul e Índia.

- O segmento à base de borossilicato dominou o mercado, com a maior participação na receita em 2024, impulsionado por sua alta resistência térmica e química, tornando-o adequado para uma variedade de aplicações em microeletrônica e fotônica. A demanda por substratos de borossilicato é forte em encapsulamentos de semicondutores devido à sua estabilidade dimensional e custo-benefício.

Escopo do Relatório e Segmentação do Mercado de Substrato de Vidro

|

Atributos |

Principais insights de mercado sobre substratos de vidro |

|

Segmentos abrangidos |

|

|

Países abrangidos |

América do Norte

Europa

Ásia-Pacífico

Oriente Médio e África

Ámérica do Sul

|

|

Principais participantes do mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor agregado |

Além dos insights sobre cenários de mercado, como valor de mercado, taxa de crescimento, segmentação, cobertura geográfica e principais participantes, os relatórios de mercado selecionados pela Data Bridge Market Research também incluem análises aprofundadas de especialistas, produção e capacidade de empresas representadas geograficamente, layouts de rede de distribuidores e parceiros, análises detalhadas e atualizadas de tendências de preços e análises de déficit da cadeia de suprimentos e demanda. |

Tendências do mercado de substratos de vidro

“Ascensão dos substratos de vidro flexíveis e dobráveis para displays”

- O mercado de substratos de vidro está testemunhando uma tendência significativa em direção ao desenvolvimento e adoção de substratos de vidro flexíveis e dobráveis, impulsionado pela crescente popularidade de smartphones dobráveis e dispositivos vestíveis

- Os fabricantes estão inovando em materiais de vidro ultrafinos e dobráveis que podem suportar dobras repetidas sem comprometer a durabilidade ou a nitidez da tela.

- Por exemplo, os smartphones dobráveis da Samsung e o Surface Duo da Microsoft utilizam substratos de vidro flexíveis, destacando a viabilidade comercial e a demanda do consumidor por tais tecnologias

- Esta tendência está a levar os produtores de vidro a melhorar a tenacidade e a elasticidade do vidro através de técnicas avançadas de reforço químico e revestimento.

- Além disso, a tendência apoia o crescimento de novas categorias de produtos em eletrônicos de consumo, como displays roláveis e tablets flexíveis, abrindo novas oportunidades para aplicações de substrato de vidro além dos displays rígidos tradicionais.

Dinâmica do mercado de substratos de vidro

Motorista

“Crescente demanda por tecnologias avançadas de exibição”

- A crescente demanda por tecnologias avançadas de exibição está impulsionando o mercado de substratos de vidro, à medida que os consumidores buscam dispositivos de alta resolução, duráveis e fáceis de usar.

- Os substratos de vidro são essenciais para displays como displays de cristal líquido, diodos orgânicos emissores de luz e telas flexíveis e dobráveis emergentes, fornecendo uma superfície lisa e plana para camadas eletrônicas uniformes.

- Inovações como vidro ultrafino e quimicamente reforçado permitem telas mais leves e robustas, atendendo às necessidades do consumidor por dispositivos elegantes e duráveis.

- A ampla adoção de smartphones, tablets, laptops e televisores com telas avançadas está acelerando o crescimento do mercado; por exemplo, as principais marcas de smartphones usam vidro quimicamente reforçado para aumentar a resistência a arranhões e a durabilidade.

- Novos formatos de exibição, incluindo telas flexíveis e roláveis, dependem de substratos de vidro especializados que mantêm a flexibilidade sem sacrificar a transparência ou a resistência, expandindo o uso em painéis automotivos e dispositivos vestíveis.

- Por exemplo, os smartphones dobráveis mais recentes da Samsung usam substratos de vidro ultrafinos e quimicamente reforçados que permitem que a tela se dobre suavemente, mantendo a durabilidade e a clareza.

Restrição/Desafio

“Altos custos de produção e complexidades de fabricação”

- O mercado de substratos de vidro enfrenta desafios devido aos altos custos envolvidos na produção de materiais de vidro avançados, especialmente aqueles que são ultrafinos ou tratados quimicamente

- A fabricação requer várias etapas precisas, como fusão, conformação, recozimento e reforço químico, cada uma delas exigindo verificações de qualidade rigorosas e equipamentos especializados.

- A produção de substratos de vidro flexíveis envolve a manutenção da flexibilidade e da clareza óptica, o que é tecnicamente exigente e aumenta os custos operacionais

- Por exemplo, o desenvolvimento de vidro flexível ultrafino para displays dobráveis requer controle de espessura em nível nano para evitar quebras e, ao mesmo tempo, garantir o desempenho visual.

- Materiais alternativos, como substratos plásticos, embora menos duráveis, estão ganhando popularidade para displays flexíveis devido aos menores custos de produção e processamento mais fácil

Escopo de mercado de substrato de vidro

O mercado é segmentado com base no tipo, diâmetro do wafer, aplicação e uso final.

- Por tipo

Com base no tipo, o mercado de substratos de alta resistência ao vidro é segmentado em à base de borossilicato, à base de sílica/quartzo fundido, silício e outros. O segmento à base de borossilicato dominou o mercado, com a maior participação na receita em 2024, impulsionado por sua alta resistência térmica e química, tornando-o adequado para uma variedade de aplicações em microeletrônica e fotônica. A demanda por substratos de borossilicato é forte em encapsulamentos de semicondutores devido à sua estabilidade dimensional e custo-benefício.

Prevê-se que o segmento à base de sílica fundida/quartzo apresentará a maior taxa de crescimento entre 2025 e 2032, impulsionado por sua excepcional transparência óptica e baixo coeficiente de expansão térmica. Essas propriedades o tornam ideal para eletrônica de alta frequência, componentes ópticos e litografia avançada, particularmente em aplicações semicondutoras e aeroespaciais.

- Por diâmetro da bolacha

Com base no diâmetro do wafer, o mercado de substratos de vidro de alta densidade é segmentado em 300 mm, 200 mm, 150 mm, 125 mm, acima de 300 mm e até 100 mm. O segmento de 200 mm deteve a maior fatia de mercado em 2024, impulsionado por seu amplo uso em instalações de fabricação de semicondutores tradicionais e sua relação custo-benefício na produção de MEMS e dispositivos analógicos.

Prevê-se que o segmento de 300 mm apresentará a maior taxa de crescimento entre 2025 e 2032, impulsionado pelos avanços contínuos na fabricação de semicondutores, incluindo encapsulamento 3D e produção em larga escala de circuitos integrados. À medida que as fundições migram para wafers maiores para melhorar o rendimento e reduzir o custo por chip, a demanda por substratos de vidro de 300 mm está aumentando rapidamente.

- Por aplicação

Com base na aplicação, o mercado de substratos de alta densidade de vidro é segmentado em encapsulamento de wafer, substrato de suporte e interposer TGV. O segmento de encapsulamento de wafer foi responsável pela maior fatia da receita de mercado em 2024, impulsionado pela crescente demanda por soluções de encapsulamento miniaturizadas e de alta densidade em eletrônicos de consumo e dispositivos de comunicação. Os substratos de vidro proporcionam excelentes superfícies planas e desempenho térmico, ideais para encapsulamento em nível de wafer.

Prevê-se que o segmento de interposers TGV apresentará a maior taxa de crescimento entre 2025 e 2032, devido à crescente adoção da tecnologia Through Glass Via em integração avançada de chips e encapsulamento heterogêneo. Suas características de alta precisão e baixa perda dielétrica são atraentes para computação de alto desempenho e aplicações de RF.

- Por uso final

Com base no uso final, o mercado de substratos de vidro de alta densidade é segmentado em eletrônicos, aplicações ópticas, aeroespacial e defesa, automotivo e solar e médico. O segmento de eletrônicos dominou o mercado em 2024, impulsionado pela crescente demanda por smartphones, wearables e dispositivos semicondutores que exigem soluções de substrato compactas e eficientes.

Espera-se que o segmento médico testemunhe a maior taxa de crescimento entre 2025 e 2032, devido à crescente adoção de biossensores, chips microfluídicos e tecnologias de laboratório em chip que utilizam substratos de vidro por sua biocompatibilidade, estabilidade química e transparência.

Análise regional do mercado de substratos de vidro

- A América do Norte dominou o mercado de substratos de vidro com a maior participação na receita em 2024, impulsionada por uma indústria eletrônica robusta, crescente demanda por tecnologias de exibição avançadas e a presença de fabricantes líderes de semicondutores

- A região beneficia do aumento dos investimentos em I&D para aplicações microelectrónicas e optoelectrónicas, o que está a reforçar a procura de substratos de vidro de alto desempenho

- Além disso, iniciativas governamentais de apoio e a expansão de instalações de fabricação nos EUA e Canadá estão acelerando a adoção pelo mercado em setores de uso final, como automotivo, aeroespacial e saúde.

Visão do mercado de substratos de vidro dos EUA

O mercado de substratos de vidro dos EUA conquistou a maior fatia da receita da América do Norte em 2024, impulsionado pela forte presença de empresas líderes em eletrônicos e semicondutores. O ecossistema tecnológico avançado do país, aliado à alta demanda por componentes miniaturizados e de alta precisão em eletrônicos de consumo, impulsiona o mercado. O aumento das aplicações em dispositivos de imagem médica e módulos fotovoltaicos também contribui para o crescimento. A inovação contínua em técnicas de fabricação de vidro e ciência dos materiais aprimora ainda mais as perspectivas do mercado.

Visão geral do mercado de substratos de vidro na Europa

Espera-se que o mercado europeu de substratos de vidro apresente a maior taxa de crescimento entre 2025 e 2032, impulsionado pelo aumento dos investimentos em fotônica, MEMS e tecnologias de display. A forte presença da região no setor de eletrônica automotiva, aliada à crescente adoção de displays inteligentes e componentes ópticos, sustenta a demanda sustentada do mercado. Regulamentações ambientais e de qualidade rigorosas também estão fomentando o uso de substratos de vidro sustentáveis e de alta pureza em diversas aplicações na Alemanha, França e Reino Unido.

Visão geral do mercado de substratos de vidro do Reino Unido

Espera-se que o mercado de substratos de vidro do Reino Unido apresente a maior taxa de crescimento entre 2025 e 2032, impulsionado pela crescente demanda por materiais avançados nas indústrias médica, aeroespacial e optoeletrônica. Inovações em eletrônica flexível e sensores ópticos, bem como o apoio governamental à fabricação nacional, estão melhorando as perspectivas do mercado. Além disso, a ênfase do país em sustentabilidade e fabricação de precisão está incentivando a adoção em setores emergentes de alta tecnologia.

Visão do mercado de substratos de vidro na Alemanha

Espera-se que o mercado alemão de substratos de vidro apresente a maior taxa de crescimento entre 2025 e 2032, impulsionado pela liderança do país em tecnologia automotiva, óptica e automação industrial. Com forte foco em engenharia de precisão e materiais de alto desempenho, a Alemanha está investindo fortemente em microfabricação e materiais de substrato avançados. A ascensão da Indústria 4.0 e das fábricas inteligentes está aumentando ainda mais a demanda por substratos de vidro para integração de sensores e displays.

Visão do mercado de substratos de vidro da Ásia-Pacífico

Espera-se que o mercado de substratos de vidro da Ásia-Pacífico apresente a maior taxa de crescimento entre 2025 e 2032, devido à crescente produção de eletrônicos de consumo, políticas governamentais favoráveis e rápida industrialização. Países como China, Japão, Coreia do Sul e Taiwan estão na vanguarda da inovação em painéis de exibição, semicondutores e tecnologia solar. A disponibilidade de fabricação de baixo custo, mão de obra qualificada e investimentos estratégicos em instalações de salas limpas estão acelerando significativamente o crescimento regional.

Visão do mercado de substratos de vidro do Japão

Espera-se que o mercado japonês de substratos de vidro apresente a maior taxa de crescimento entre 2025 e 2032, devido à sua sólida expertise em materiais de precisão, microeletrônica e tecnologias ópticas de ponta. Os setores maduros de eletrônicos de consumo e painéis de exibição do Japão são os principais impulsionadores da demanda. Além disso, aplicações em HUDs automotivos, fotomáscaras e equipamentos médicos avançados estão impulsionando a adoção. A ênfase na miniaturização e durabilidade dos produtos fortalece ainda mais a posição do mercado em aplicações de alto valor agregado.

Visão do mercado de substratos de vidro da China

O mercado chinês de substratos de vidro foi responsável pela maior fatia da receita na região Ásia-Pacífico em 2024, impulsionado pela produção em massa de smartphones, tablets e dispositivos de exibição. A busca agressiva do país pela autossuficiência em semicondutores e a expansão da fabricação de energia fotovoltaica estão impulsionando a necessidade de substratos de vidro de qualidade. Com fortes fornecedores nacionais e incentivos governamentais apoiando o desenvolvimento tecnológico, a China continua liderando o crescimento regional, tanto em volume quanto em expansão de capacidade.

Participação de mercado de substratos de vidro

O setor de substratos de vidro é liderado principalmente por empresas bem estabelecidas, incluindo:

- AGC Inc. (Japão)

- SCHOTT (Alemanha)

- AvanStrate Inc. (Japão)

- Dongxu Group Co., Ltd. (China)

- Irico Group New Energy Company Limited (China)

- TECNISCO, LTD. (Japão)

- Corning Incorporated (EUA)

- Nippon Electric Glass Co., Ltd. (Japão)

- HOYA Corporation (Japão)

- Plan Optik AG (Alemanha)

- Ohara Inc. (Japão)

Últimos desenvolvimentos no mercado global de substratos de vidro

- Em abril de 2024, a AGC Inc. obteve uma Declaração Ambiental de Produto (EPD) para seu vidro float arquitetônico da fábrica de Kashima, validada pela SuMPO. Esta iniciativa visa ajudar os compradores a avaliar os impactos ambientais de forma mais transparente e apoia a conformidade com os padrões de construção sustentável, como o LEED. Ao se alinhar à sua meta de médio prazo de redução do impacto ambiental, a AGC fortalece sua estratégia de sourcing sustentável, ampliando as oportunidades de crescimento no setor da construção.

- Em janeiro de 2024, a SCHOTT expandiu sua colaboração com a Lumus para atender à crescente demanda por óculos de realidade aumentada (RA). A expansão da fábrica da SCHOTT na Malásia dará suporte à produção da tecnologia de guia de onda Z-Lens da Lumus. Esta parceria visa agilizar o desenvolvimento de RA, desde a prototipagem até a produção em massa, tornando os óculos de RA mais acessíveis e reforçando a presença da SCHOTT no mercado de eletrônicos de consumo.

- Em maio de 2023, a Corning Incorporated implementou um aumento de 20% no preço de substratos de vidro para telas em todo o mundo para lidar com o aumento dos custos de energia e matéria-prima. Essa mudança estratégica de preço visa manter a lucratividade em meio à inflação, capitalizando a crescente demanda por vidro para telas. O ajuste posiciona a Corning para a liderança contínua do mercado e o crescimento da receita em uma indústria eletrônica em recuperação.

- Em abril de 2023, a SCHOTT apresentou soluções inovadoras para cozinhas na AWE 2023, em Xangai, apresentando recursos como o revestimento CleanPlus para fácil manutenção e o CERAN Luminoir para designs avançados de cooktops. Esses produtos, que receberam reconhecimento da indústria, refletem a dedicação da SCHOTT à inovação em cozinhas inteligentes e fortalecem sua competitividade no mercado de eletrodomésticos.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.