Global Fdm Composite Large Size Tooling Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

345.77 Billion

USD

457.79 Billion

2025

2032

USD

345.77 Billion

USD

457.79 Billion

2025

2032

| 2026 –2032 | |

| USD 345.77 Billion | |

| USD 457.79 Billion | |

|

|

|

|

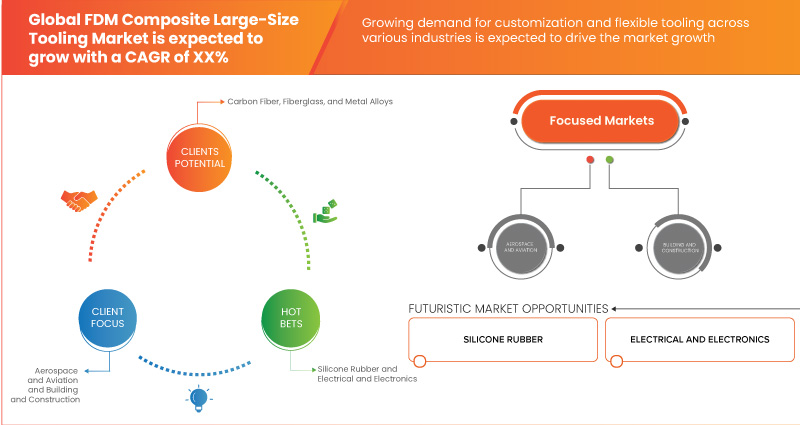

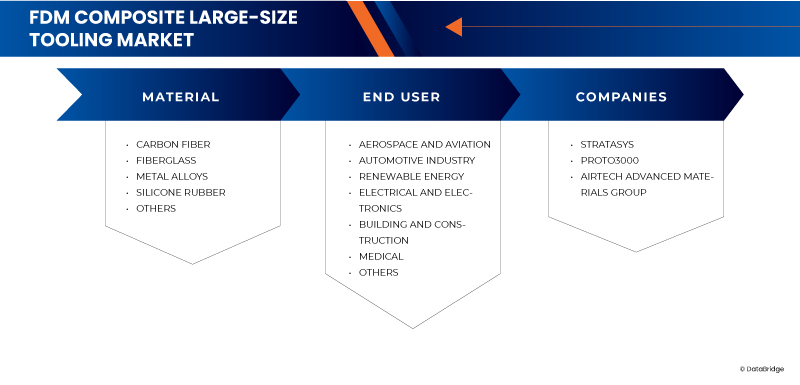

Segmentação do mercado global de ferramentas compostas de grande porte FDM , por material fibra de carbono , fibra de vidro, ligas metálicas, borracha de silicone e outros), utilizador final ( aeroespacial e aviação, indústria automóvel , energia renovável, elétrica e eletrónica, construção civil, Médico e outros) – Tendências e previsões do sector até 2031.

Análise do mercado global de ferramentas de grande dimensão compostas FDM

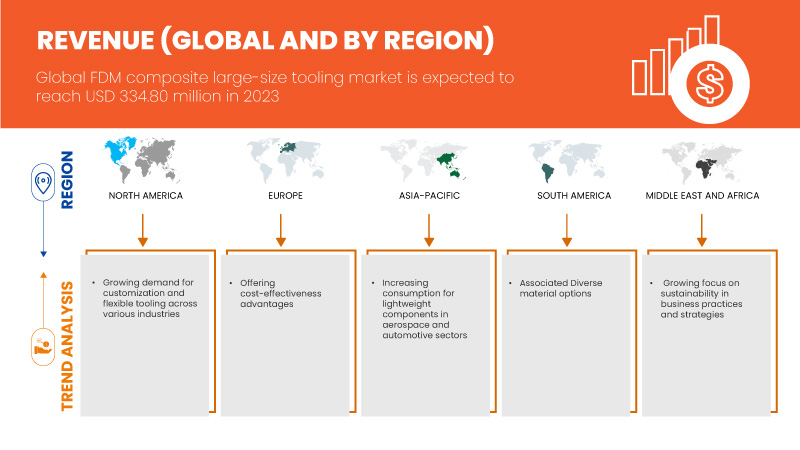

O aumento do consumo de componentes leves nos setores aeroespacial e automóvel está a impulsionar o crescimento do mercado. O crescente foco na sustentabilidade nas práticas e estratégias de negócio oferece oportunidades no mercado. Além disso, as diversas opções de materiais associados estão a impulsionar o crescimento do mercado.

Tamanho do mercado global de ferramentas de grande dimensão compostas FDM

Prevê-se que o mercado global de ferramentas compostas de FDM de grande dimensão atinja os 442,01 milhões de dólares até 2031, face aos 334,80 milhões de dólares em 2023, crescendo com um CAGR substancial de 3,6% no período previsto de 2024 a 2031.

Tendências do mercado global de ferramentas de grande dimensão compostas FDM

“Crescente procura por personalização e ferramentas flexíveis em vários setores”

A crescente procura por personalização e ferramentas flexíveis em vários setores, como a saúde, automóvel e aeroespacial, impacta o mercado global de ferramentas compostas FDM de grande escala. Indústrias como a aeroespacial, automóvel, bens de consumo e de saúde, entre outras, estão a registar uma procura crescente por peças personalizadas e complexas. Estes setores exigem soluções de ferramentas que possam lidar com geometrias complexas e requisitos de design específicos. Os métodos de fabrico tradicionais deixam muitas vezes a desejar em termos de flexibilidade e rapidez, levando empresas automóveis como a Briggs Automotive Company, Tesla, Cadillac, entre outras, a procurar alternativas que ofereçam maior adaptabilidade. A tecnologia FDM, com a sua capacidade de criar formas e estruturas complexas camada a camada, oferece uma solução atrativa. Permite a rápida prototipagem e produção de ferramentas personalizadas, o que é crucial para satisfazer as várias exigências das aplicações de fabrico modernas para ferramentas de pequena dimensão, como marcas de face de dispositivos de saúde, bem como ferramentas de grande dimensão, como várias peças de aviões e consolas de posicionamento. Esta agilidade é particularmente benéfica para indústrias que exigem mudanças frequentes nos projetos de ferramentas ou para aquelas envolvidas em produção de baixo volume e alta diversidade.

Além disso, a tendência de personalização em massa, em que os produtos são adaptados às especificações individuais do cliente, está a alargar o âmbito a ferramentas compostas FDM de grande dimensão. À medida que as empresas se esforçam para oferecer produtos personalizados, a procura por soluções de ferramentas adaptáveis e reconfiguráveis aumenta. A tecnologia FDM vai ao encontro desta necessidade permitindo a produção de moldes e ferramentas personalizadas com elevada precisão e eficiência. A capacidade de iterar rapidamente em projetos e produzir pequenos lotes de ferramentas personalizadas reforça a tendência para produtos de consumo mais personalizados.

Âmbito do relatório e segmentação do mercado global de ferramentas de grande dimensão compostas FDM

|

Métrica de Reporte |

Detalhes |

|

Segmentação |

Por material - Fibra de carbono , fibra de vidro, ligas metálicas, borracha de silicone e outros Por utilizador final - Aeroespacial e aviação, indústria automóvel, energia renovável, elétrica e eletrónica, construção civil, médica e outros |

|

Países abrangidos |

EUA, Canadá, México, China, Japão, Índia, Coreia do Sul, Singapura, Indonésia, Tailândia, Filipinas, Austrália e Nova Zelândia, Malásia, resto da Ásia-Pacífico, Alemanha, Itália, Reino Unido, França, Espanha, Turquia, Rússia, Suíça, Bélgica, Holanda, resto da Europa, Brasil, Argentina, resto da América do Sul, Emirados Árabes Unidos, Arábia Saudita, África do Sul, Kuwait e resto do Médio Oriente e África |

|

Principais participantes do mercado |

Startasys (EUA), Airtech Advanced Materials Group (EUA) e Proto3000 (Canadá) |

|

Oportunidades de Mercado |

|

|

Conjuntos de informações de dados de valor acrescentado |

Para além dos insights sobre os cenários de mercado, tais como o valor de mercado, a taxa de crescimento, a segmentação, a cobertura geográfica e os principais participantes, os relatórios de mercado selecionados pela Data Bridge Market Research incluem também análises aprofundadas de especialistas, produção e análise de empresas representadas geograficamente. capacidade, layouts de rede de distribuidores e parceiros, análise detalhada e atualizada das tendências de preços e análise do défice da cadeia de abastecimento e da procura. |

Definição do mercado global de ferramentas de grande dimensão compostas FDM

As ferramentas compostas de FDM de grande dimensão referem-se a ferramentas fabricadas através da tecnologia de modelação por deposição fundida (FDM) com materiais compósitos para produzir peças em grande escala. O FDM é um processo de fabrico aditivo em que o material é extrudido camada a camada para construir uma peça. Quando combinado com materiais compósitos, como polímeros reforçados com fibra de carbono ou fibra de vidro, aumenta a resistência e a durabilidade das ferramentas. Esta abordagem permite a criação de geometrias e estruturas complexas que são geralmente leves, mas robustas. As ferramentas compostas de FDM de grande porte são comummente utilizadas em indústrias como a aeroespacial, automóvel e de fabrico, onde o alto desempenho e a precisão são essenciais.

Dinâmica do mercado global de ferramentas compostas de grande dimensão FDM

Motoristas

- Oferecendo vantagens de custo-efetividade

A relação custo-benefício da tecnologia de modelação por deposição fundida (FDM) é um fator significativo que impulsiona o mercado global de ferramentas compostas de FDM de grande escala. As vantagens do FDM em termos de acessibilidade e eficiência fazem dele uma escolha convincente para a produção de ferramentas em grande escala, o que, por sua vez, está a influenciar a sua ampla adoção em vários setores, como o aeroespacial, automóvel, saúde, bens de consumo e outros. Um dos principais benefícios de custo da tecnologia FDM é a sua capacidade de reduzir os custos de produção através da redução do desperdício de material. Ao contrário dos métodos de fabrico tradicionais, que geralmente envolvem processos subtrativos, a FDM é uma técnica de fabrico aditivo em que o material é depositado camada a camada. Esta abordagem minimiza o desperdício, uma vez que o material é utilizado apenas onde é necessário para construir a peça. Oferece redução de custos através da sua capacidade de produzir protótipos e ferramentas rapidamente. Os métodos tradicionais de ferramentas podem ser demorados e dispendiosos, especialmente quando são necessárias várias iterações ou projetos personalizados. Os tempos de resposta rápidos da FDM para criar e modificar ferramentas permitem iterações de design mais rápidas e ciclos de desenvolvimento mais curtos. Esta capacidade de prototipagem rápida reduz o prazo de entrega e os custos associados aos processos de ferramentas tradicionais, tornando-a uma opção adequada para empresas que procuram agilizar os seus horários de produção.

- Aumento do consumo de componentes leves nos setores aeroespacial e automóvel

Os setores aeroespacial e automóvel estão a dar cada vez mais prioridade aos componentes leves para melhorar o desempenho, a eficiência de combustível e a funcionalidade geral. Esta crescente procura por peças leves está a influenciar significativamente o mercado global de ferramentas compostas de FDM de grande porte, impulsionando a inovação e a adoção de técnicas de fabrico avançadas. Na indústria aeroespacial, os componentes leves são cruciais para melhorar a eficiência do combustível e reduzir os custos operacionais. Os fabricantes de aeronaves procuram materiais que ofereçam elevadas relações resistência-peso para diminuir o peso total da aeronave, o que se traduz diretamente num menor consumo de combustível e numa maior capacidade de carga útil. Os materiais compósitos, como a fibra de carbono e a fibra de vidro, são normalmente utilizados devido à sua resistência superior e propriedades leves. A tecnologia de modelação por deposição fundida (FDM), que suporta a utilização de filamentos compostos, está a ser cada vez mais aproveitada para produzir ferramentas de grandes dimensões que podem acomodar estes materiais avançados. A capacidade da FDM de criar ferramentas complexas e de grande escala com materiais compósitos está perfeitamente alinhada com a necessidade da indústria aeroespacial de características de precisão e leveza nos seus componentes. Da mesma forma, a indústria automóvel está a passar por uma mudança para veículos mais leves para melhorar a eficiência do combustível e reduzir as emissões. Os componentes leves, como os feitos de compósitos avançados, desempenham um papel fundamental para atingir estes objetivos. A capacidade de incorporar estes materiais em peças e conjuntos automóveis requer ferramentas especializadas. A tecnologia FDM oferece uma solução económica e flexível para a produção de ferramentas de grandes dimensões que podem lidar com as complexidades dos materiais compósitos. Esta tecnologia permite a prototipagem rápida e as mudanças iterativas de design, que são essenciais no acelerado setor automóvel, onde a inovação e o tempo de colocação no mercado são essenciais.

Por exemplo, em junho de 2024, de acordo com um blogue publicado na AIP Precision, a tecnologia FDM será fundamental na indústria aeroespacial para o fabrico de peças complexas devido à sua liberdade de design e capacidade de reduzir o peso. Esta vantagem permite a produção de componentes leves e complexos.

Oportunidades

- Foco crescente na sustentabilidade nas práticas e estratégias empresariais

Atualmente, com a consciencialização ambiental global a aumentar, assiste-se a uma mudança crescente no sentido da adoção de práticas de fabrico amigas do ambiente que visam reduzir o desperdício, diminuir as emissões de carbono e incentivar a utilização de materiais reciclados, o que oferece uma oportunidade significativa para o setor global de compósitos FDM de grande dimensão.

A tecnologia FDM, que constrói peças camada a camada utilizando polímeros termoplásticos, está bem posicionada para alavancar esta tendência para a sustentabilidade. A utilização de materiais termoplásticos reciclados, como o Polietileno de Alta Densidade (PEAD), Ácido Polilático (PLA), Polietileno Tereftalato. (PET), O polipropileno (PP) e o acrilonitrilo butadieno estireno (ABS) na tecnologia FDM criam oportunidades notáveis para a sustentabilidade. A conversão destes materiais residuais em filamentos de impressão 3D permite aos fabricantes reduzir significativamente a sua dependência de recursos virgens e diminuir o desperdício em aterros sanitários. Esta estratégia de reciclagem não só apoia metas globais de sustentabilidade, como também proporciona benefícios económicos, incluindo a redução de despesas com matérias-primas e uma maior eficiência global de custos.

Os avanços na tecnologia FDM aumentam esta oportunidade ao integrar vários aditivos e cargas em filamentos reciclados. Estas melhorias aumentam as propriedades mecânicas e o desempenho dos componentes impressos em 3D, facilitando a produção de peças duráveis e de alta qualidade e promovendo a sustentabilidade e a eficiência dos recursos no processo de fabrico.

Por exemplo, de acordo com um artigo publicado pela Elsevier BV, a incorporação de fibras naturais, biochar e outros materiais avançados pode melhorar significativamente as propriedades mecânicas dos componentes impressos em 3D, abordando eficazmente questões relacionadas com a durabilidade e o desempenho. Estas inovações permitem a criação de peças estruturalmente robustas e de alta qualidade que cumprem os rigorosos requisitos de diversas aplicações de engenharia.

- Integração com Smart Industry 4.o para aplicações de tecnologia inteligente melhoradas

A digitalização de impressoras de modelação por deposição fundida (FDM) apresenta uma grande oportunidade para fazer avançar ferramentas compostas através da fabricação aditiva inteligente. A integração de tecnologias inteligentes em processos FDM aumenta a eficiência, a precisão e a qualidade da produção de componentes de ferramentas complexas. As tecnologias inteligentes em FDM permitem a monitorização contínua dos processos de impressão e a correção automática de defeitos, o que é especialmente importante para ferramentas compostas, onde a precisão é essencial. Os sistemas de monitorização avançados podem detetar e resolver problemas de forma proativa, reduzindo o desperdício de material e melhorando a qualidade geral dos componentes das ferramentas. Além disso, podem ser empregues ferramentas de Inteligência Artificial (IA) para processar estes dados e fazer ajustes em tempo real no processo de impressão, garantindo propriedades consistentes do material e união de camadas. Este sistema de circuito fechado pode melhorar significativamente a qualidade e a fiabilidade de grandes ferramentas compostas produzidas pela tecnologia FDM, minimizando defeitos como vazios internos e garantindo a uniformidade entre lotes. As empresas que produzem grandes componentes aeroespaciais utilizando tecnologia FDM podem implementar esta abordagem de fabrico inteligente. A integração de sistemas de manutenção preditiva orientados por IA também pode prever possíveis falhas de equipamento antes que estas ocorram, reduzindo o tempo de inatividade e mantendo uma elevada eficiência de produção. Ao evoluir para um processo de produção em massa de circuito fechado e uma maior rentabilidade, a tecnologia FDM pode alcançar a precisão e a fiabilidade necessárias para aplicações de ferramentas em larga escala em setores de fabrico avançados.

Além disso, a integração de controlos digitais e mecanismos de feedback nas impressoras FDM permite a produção de peças compostas complexas com designs e especificações detalhados. Isto está alinhado com a mudança mais ampla em direção à fabricação e indústria inteligentes, posicionando a tecnologia FDM como um participante crucial no avanço de ferramentas compostas de alto desempenho.

Restrições/Desafios

- Integridade estrutural insuficiente comprometendo o desempenho e a segurança

A falta de integridade estrutural em ferramentas compostas de grande dimensão de modelação por deposição fundida (FDM) representa uma restrição significativa ao mercado global de ferramentas compostas de grande dimensão de FDM. Este problema afeta a eficácia e a fiabilidade das soluções de ferramentas, impactando a sua adoção e desempenho em vários setores, como a saúde, os bens de consumo e outros. Outro aspeto que contribui para os problemas de integridade estrutural é o potencial de vazios ou lacunas nas ferramentas impressas. A tecnologia FDM, principalmente na produção de peças de grandes dimensões, pode por vezes resultar em vazios internos ou em enchimento incompleto da ferramenta, o que pode prejudicar a sua resistência e estabilidade. Estes defeitos podem levar à redução da capacidade de carga e ao aumento da suscetibilidade à deformação ou à quebra. Além disso, a baixa resolução no FDM pode levar à colagem inadequada das camadas, resultando em pontos fracos nas ferramentas. Defeitos superficiais, como texturas ásperas e linhas de camadas visíveis, podem comprometer a funcionalidade e a estética, enquanto as imprecisões nas dimensões afetam o ajuste e o desempenho das ferramentas.

Além disso, o pós-processamento de ferramentas impressas em FDM também pode afetar a sua integridade estrutural. Técnicas como o lixamento, a maquinação ou o revestimento são frequentemente necessárias para atingir as especificações finais e o acabamento da superfície. O pós-processamento inadequado pode deixar tensões residuais ou imperfeições que afetam a resistência global e a funcionalidade da ferramenta.

- Os requisitos de pós-processamento são essenciais para finalizar o produto

No mercado global de ferramentas compostas de FDM de grande dimensão, os requisitos de pós-processamento representam um desafio significativo. Embora a tecnologia FDM ofereça inúmeras vantagens, incluindo a prototipagem rápida e o fabrico económico, a necessidade de um pós-processamento extensivo pode prejudicar alguns destes benefícios, particularmente em aplicações de ferramentas de grande dimensão.

A tecnologia FDM constrói peças através de camadas de materiais, o que pode resultar em imperfeições da superfície, linhas de camadas visíveis e tensões residuais que devem ser corrigidas para cumprir os padrões de qualidade. Isto é particularmente crucial para ferramentas compostas, onde a elevada precisão e durabilidade são essenciais. As etapas de pós-processamento, incluindo lixagem, maquinação e acabamento de superfícies, são geralmente necessárias para refinar o produto final, melhorar a sua aparência e melhorar as suas propriedades mecânicas. Estes processos adicionais são essenciais para resolver os defeitos do processo de impressão FDM, garantindo que os componentes da ferramenta são funcionais e compatíveis com especificações rigorosas.

Para ferramentas de grande dimensão, o pós-processamento torna-se cada vez mais complexo e utiliza uma vasta gama de recursos. As dimensões destas peças requerem frequentemente trabalho manual extra e equipamento especializado, o que pode levar a maiores tempos de produção e custos. Além disso, garantir uma qualidade consistente em componentes de grandes dimensões pode ser difícil, uma vez que as inconsistências no pós-processamento podem afetar o desempenho global e a fiabilidade das ferramentas.

Além disso, a exigência de um pós-processamento preciso complica a tarefa de manter os ganhos de eficiência normalmente associados à tecnologia FDM. O tempo e as despesas envolvidas no pós-processamento podem diminuir algumas das vantagens da produção rápida, especialmente para componentes de ferramentas grandes e complexos, onde o acabamento é crucial.

Este relatório de mercado fornece detalhes de novos desenvolvimentos recentes, regulamentos comerciais, análise de importação e exportação, análise de produção, otimização da cadeia de valor, quota de mercado, impacto dos participantes do mercado doméstico e localizado, analisa as oportunidades em termos de bolsas de receitas emergentes, alterações nas regulamentações do mercado, análise estratégica do crescimento do mercado, tamanho do mercado, crescimento do mercado das categorias, nichos de aplicação e dominância, aprovações de produtos, lançamentos de produtos, expansões geográficas, inovações tecnológicas no mercado. Para mais informações sobre o mercado, contacte a Data Bridge Market Research para obter um briefing de analista.

Impacto e cenário atual do mercado de escassez de matéria-prima e atrasos no envio

A Data Bridge Market Research oferece uma análise de alto nível do mercado e fornece informações tendo em conta o impacto e o ambiente atual do mercado de escassez de matérias-primas e atrasos nas remessas. Isto traduz-se em avaliar possibilidades estratégicas, criar planos de ação eficazes e auxiliar as empresas na tomada de decisões importantes.

Além do relatório padrão, também oferecemos uma análise aprofundada do nível de aquisição, desde atrasos previstos de expedição, mapeamento de distribuidores por região, análise de commodities, análise de produção, tendências de mapeamento de preços, sourcing, análise de desempenho de categoria, soluções avançadas de gestão de risco da cadeia de abastecimento.

Impacto esperado da desaceleração económica nos preços e na disponibilidade dos produtos

Quando a atividade económica abranda, as indústrias começam a sofrer. Os efeitos previstos da crise económica nos preços e na acessibilidade dos produtos são tidos em conta nos relatórios de informação de mercado e nos serviços de informações fornecidos pelo DBMR. Com isto, os nossos clientes conseguem geralmente manter-se um passo à frente dos seus concorrentes, projetar as suas vendas e receitas e estimar as suas despesas com lucros e perdas.

Âmbito do mercado global de ferramentas de grande dimensão compostas FDM

O mercado está segmentado em dois segmentos notáveis com base no material e no utilizador final. O crescimento entre estes segmentos irá ajudá-lo a analisar segmentos de baixo crescimento nos setores e fornecerá aos utilizadores uma visão geral e informações valiosas do mercado para os ajudar a tomar decisões estratégicas para identificar as principais aplicações do mercado.

Material

- Fibra de carbono

- Fibra de vidro

- Ligas metálicas

- Borracha de silicone

- Outros

Utilizador final

- Aeroespacial e Aviação

- Indústria Automóvel

- Energia Renovável

- Elétrica e Eletrónica

- Construção e Edificação

- Médico

- Outros

Análise regional do mercado global de ferramentas de grande dimensão compostas FDM

The market is analyzed and market size insights and trends are provided by material and end-user as referenced above.

The countries covered in the market are U.S., Canada, Mexico, China, Japan, India, South Korea, Singapore, Indonesia, Thailand, Philippines, Australia & New Zealand, Malaysia, rest of Asia-Pacific, Germany, Italy, U.K., France, Spain, Turkey, Russia, Switzerland, Belgium, Netherlands, rest of Europe, Brazil, Argentina, rest of South America, U.A.E., Saudi Arabia, South Africa, Kuwait, and rest of Middle East and Africa.

Asia-Pacific will dominate and the fastest growing region in the global FDM composite large-size tooling market due to its well-established infrastructure, advanced processing technology, and higher levels of investment in the sector compared to other regions are expected to further fuel the market's growth.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Global FDM Composite Large-Size Tooling Market Share

The market competitive landscape provides details by competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Global FDM Composite Large-Size Tooling Market Leaders Operating in the Market Are:

- Startasys. (U.S.)

- Airtech Advanced Materials Group (U.S.)

- Proto3000 (Canada)

Latest Developments in Global FDM Composite Large Size Tooling Market

- In July 2024, Stratasys received four Sustainability Recognition Awards at the AMGTA 2024 Annual Summit for its leadership in environmental sustainability. The awards honored Stratasys for maintaining ISO 14001 EMS certification, excellence in sustainability reporting, environmental sustainability research, and advancing sustainable manufacturing practices globally, showcasing its commitment to the Mindful Manufacturing approach

- Em junho de 2024, a Stratasys e a AM Craft anunciaram uma parceria para expandir a utilização de peças impressas em 3D com certificação de voo na aviação. A Stratasys fez um investimento estratégico na AM Craft, que possui a Aprovação de Organização de Produção EASA Parte 21G, permitindo a produção económica de peças certificadas. A colaboração visa melhorar as soluções da cadeia de abastecimento e atender à crescente procura da indústria

- Em dezembro de 2023, a Stratasys ganhou o Prémio da Indústria de Impressão 3D na categoria de Aplicação Médica, Dentária ou de Saúde pelas suas impressoras 3D J5 DentaJet, J5 MediJet e J850 Digital Anatomy baseadas em PolyJet. Além disso, a Stratasys recebeu menções honrosas de Empresa do Ano (Enterprise) e a série Neo450 de Impressora 3D Empresarial do Ano (Polímeros) na cerimónia de entrega de prémios de 2023

- Em dezembro de 2023, a Stratasys Ltd. e a NOCTI estabeleceram uma parceria para apresentar a primeira Certificação de Processo de Modelação de Deposição Fundida (FDM), validada pela NOCTI. Esta certificação garante que os estudantes e profissionais adquiram competências aprovadas pela indústria em fabrico aditivo. Ajuda também as escolas a garantir financiamento para expandir os seus cursos de fabrico aditivo, capacitando a próxima geração de especialistas neste campo em rápida evolução.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.