Global Core Banking Solutions Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

16.71 Billion

USD

37.42 Billion

2024

2032

USD

16.71 Billion

USD

37.42 Billion

2024

2032

| 2025 –2032 | |

| USD 16.71 Billion | |

| USD 37.42 Billion | |

|

|

|

|

Mercado global de soluções bancárias essenciais, por tipo (soluções para clientes corporativos, depósitos, empréstimos, hipotecas, transferências, pagamentos e saques, câmbio e outros), oferta (software e serviços), modo de implantação (nuvem e local), tamanho da empresa (grandes empresas e pequenas e médias empresas (PMEs)), canal (caixas eletrônicos, internet banking, mobile banking, agências bancárias e outros), função (gerenciamento de contas, processamento de transações, gerenciamento de riscos, gerenciamento de relacionamento com o cliente, relatórios e análises, gerenciamento de produtos, gerenciamento de empréstimos, gerenciamento de conformidade e outros) e usuário final (bancos, cooperativas de crédito e bancos comunitários e outras instituições financeiras) - Tendências do setor e previsão até 2032.

Tamanho do mercado de soluções bancárias essenciais

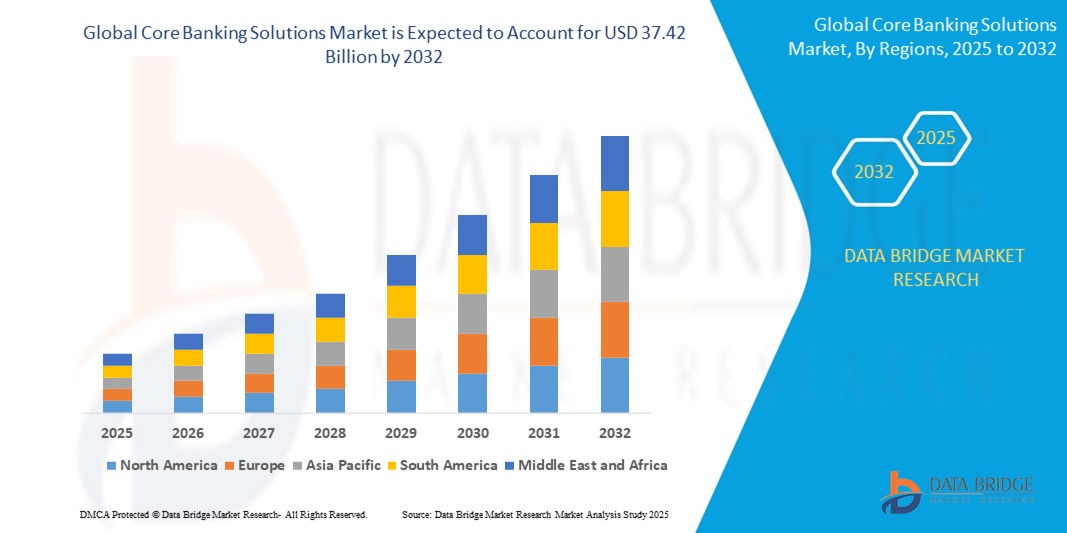

- O tamanho do mercado global de soluções bancárias básicas foi avaliado em US$ 16,71 bilhões em 2024 e deve atingir US$ 37,42 bilhões até 2032 , com um CAGR de 10,6% durante o período previsto.

- O crescimento do mercado é impulsionado pela crescente adoção de serviços bancários digitais, pelos avanços em tecnologias baseadas em nuvem e pela necessidade de infraestrutura bancária modernizada para melhorar a eficiência operacional e a experiência do cliente.

- A crescente demanda por soluções bancárias integradas, seguras e contínuas, aliada aos requisitos regulatórios de conformidade e gerenciamento de riscos, está posicionando as principais soluções bancárias como componentes essenciais das estratégias de transformação digital das instituições financeiras.

Análise de Mercado de Soluções Bancárias Essenciais

- As soluções bancárias essenciais, que abrangem software e serviços que gerenciam operações bancárias críticas, como depósitos, empréstimos e pagamentos, são essenciais para a modernização das instituições financeiras, permitindo o processamento de transações em tempo real, melhor atendimento ao cliente e integração com canais bancários digitais.

- O aumento da procura é alimentado pela crescente adopção de serviços bancários móveis e pela Internet, pelas crescentes pressões regulamentares e pela necessidade de sistemas escaláveis e flexíveis para responder às expectativas em evolução dos clientes.

- A América do Norte dominou o mercado de soluções bancárias essenciais com a maior participação na receita de 42,5% em 2024, impulsionada pela adoção antecipada de tecnologias bancárias digitais, alto investimento em infraestrutura de TI e presença de grandes participantes do mercado

- Espera-se que a região da Ásia-Pacífico seja a de crescimento mais rápido durante o período previsto, impulsionada pela rápida digitalização, pelo aumento da inclusão financeira e pela crescente adoção de serviços bancários móveis em países como a Índia e a China.

- O segmento de soluções para clientes empresariais dominou a maior fatia de receita de mercado de 38% em 2024, impulsionado pela crescente demanda por plataformas integradas que otimizam o gerenciamento de clientes, serviços de conta e experiências bancárias personalizadas para grandes instituições financeiras.

Escopo do Relatório e Segmentação do Mercado de Soluções Bancárias Essenciais

|

Atributos |

Insights importantes do mercado de soluções bancárias essenciais |

|

Segmentos abrangidos |

|

|

Países abrangidos |

América do Norte

Europa

Ásia-Pacífico

Oriente Médio e África

Ámérica do Sul

|

|

Principais participantes do mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor agregado |

Além dos insights sobre cenários de mercado, como valor de mercado, taxa de crescimento, segmentação, cobertura geográfica e principais participantes, os relatórios de mercado selecionados pela Data Bridge Market Research também incluem análises aprofundadas de especialistas, produção e capacidade de empresas representadas geograficamente, layouts de rede de distribuidores e parceiros, análises detalhadas e atualizadas de tendências de preços e análises de déficit da cadeia de suprimentos e demanda. |

Tendências de mercado de soluções bancárias essenciais

“Aumento da integração de IA e análise avançada”

- O mercado global de soluções bancárias essenciais está vivenciando uma tendência significativa em direção à integração de Inteligência Artificial (IA) e análises avançadas

- Essas tecnologias permitem um processamento de dados sofisticado, oferecendo insights mais profundos sobre o comportamento do cliente, padrões de transação e eficiência operacional

- As soluções bancárias básicas baseadas em IA facilitam a tomada de decisões proativas, como a identificação de possíveis fraudes, a otimização das aprovações de empréstimos e a previsão das necessidades dos clientes.

- Por exemplo, vários provedores estão desenvolvendo plataformas baseadas em IA que personalizam produtos financeiros, otimizam processos de conformidade e melhoram a gestão de riscos com base na análise de dados em tempo real.

- Esta tendência está aumentando o apelo das soluções bancárias principais para instituições financeiras, melhorando a satisfação do cliente e a agilidade operacional

- Os algoritmos de IA analisam vastos conjuntos de dados, incluindo históricos de transações, interações com clientes e tendências de mercado, para fornecer serviços personalizados e insights preditivos

Dinâmica do mercado de soluções bancárias essenciais

Motorista

“Crescente demanda por serviços bancários digitais e melhor experiência do cliente”

- A crescente demanda do consumidor por serviços bancários digitais integrados, como serviços bancários móveis, pagamentos em tempo real e produtos financeiros personalizados, é um fator-chave para o mercado global de soluções bancárias essenciais.

- Os principais sistemas bancários melhoram a experiência do cliente ao oferecer recursos como processamento instantâneo de transações, acesso à conta 24 horas por dia, 7 dias por semana e ferramentas integradas de gestão financeira

- Os mandatos regulatórios em regiões como a América do Norte, que domina o mercado, estão a pressionar os bancos a adotar soluções bancárias avançadas para cumprir os padrões de transparência e segurança.

- A proliferação da computação em nuvem e da tecnologia 5G está permitindo um processamento de dados mais rápido e menor latência, apoiando serviços bancários inovadores, como câmbio de moeda em tempo real e serviços bancários que priorizam dispositivos móveis.

- As instituições financeiras estão adotando cada vez mais plataformas bancárias centrais modernas como ofertas padrão para atender às expectativas dos clientes e permanecerem competitivas

Restrição/Desafio

“Altos custos de implementação e preocupações com a segurança de dados”

- O investimento inicial significativo necessário para a implementação do sistema bancário central, incluindo hardware, software e integração, representa uma barreira à adoção, especialmente para pequenas e médias empresas (PMEs) e instituições em mercados emergentes.

- A integração de soluções bancárias básicas modernas com sistemas legados pode ser complexa e dispendiosa, exigindo ampla personalização e testes

- As preocupações com a segurança e a privacidade dos dados são grandes desafios, uma vez que os principais sistemas bancários lidam com dados sensíveis de clientes e transações, aumentando os riscos de violações, uso indevido ou não conformidade com regulamentações como GDPR e CCPA.

- O cenário regulatório fragmentado entre os países, particularmente na região da Ásia-Pacífico em rápido crescimento, complica a conformidade para os provedores globais, adicionando desafios operacionais

- Esses fatores podem impedir a adoção, especialmente em regiões com alta sensibilidade de custo ou conscientização rigorosa sobre privacidade de dados.

Escopo de mercado de soluções bancárias essenciais

O mercado é segmentado com base no tipo, oferta, modo de implantação, tamanho da empresa, canal, função e usuário final.

- Por tipo

Com base no tipo, o mercado global de soluções bancárias básicas é segmentado em soluções para clientes corporativos, depósitos, empréstimos, hipotecas, transferências, pagamentos e saques, câmbio, entre outros. O segmento de soluções para clientes corporativos dominou a maior fatia de receita de mercado, com 38% em 2024, impulsionado pela crescente demanda por plataformas integradas que simplifiquem a gestão de clientes, os serviços de conta e as experiências bancárias personalizadas para grandes instituições financeiras.

Espera-se que o segmento de pagamentos e saques apresente a maior taxa de crescimento entre 2025 e 2032, impulsionado pela crescente adoção de sistemas de pagamento digitais, processamento de transações em tempo real e pela demanda do consumidor por soluções de pagamento integradas, seguras e instantâneas. Os avanços em fintechs e tecnologias de mobile banking aceleram ainda mais esse crescimento.

- Ao oferecer

Com base na oferta, o mercado global de soluções de core banking é segmentado em software e serviços. Espera-se que o segmento de software detenha a maior fatia da receita de mercado, de 62%, em 2024, impulsionado pelo papel fundamental do software de core banking em permitir o processamento eficiente de transações, a gestão de contas e a conformidade com os requisitos regulatórios. As instituições financeiras dependem cada vez mais de soluções de software escaláveis para modernizar sistemas legados.

Prevê-se que o segmento de serviços apresente a taxa de crescimento mais rápida, de 18,5%, entre 2025 e 2032, impulsionado pela crescente necessidade de serviços de implementação, consultoria e manutenção para dar suporte a implantações complexas de software bancário básico. A demanda por soluções personalizadas e suporte contínuo está impulsionando a adoção.

- Por modo de implantação

Com base no modo de implantação, o mercado global de soluções bancárias básicas é segmentado em nuvem e on-premises. Espera-se que o segmento de nuvem detenha a maior fatia da receita de mercado, de 58%, em 2024, devido à sua flexibilidade, escalabilidade e custo-benefício, que permitem às instituições financeiras se adaptarem às mudanças nas demandas do mercado e reduzir os custos de infraestrutura.

O segmento de nuvem também deverá testemunhar o crescimento mais rápido de 2025 a 2032, impulsionado pela crescente adoção de soluções baseadas em nuvem na Ásia-Pacífico e outras regiões, onde os bancos buscam alavancar tecnologias avançadas, como IA e aprendizado de máquina, para melhorar a eficiência operacional e a experiência do cliente.

- Por tamanho da empresa

Com base no porte da empresa, o mercado global de soluções bancárias básicas é segmentado em grandes empresas e pequenas e médias empresas (PMEs). O segmento de grandes empresas dominou a participação de mercado de 70% na receita em 2024, impulsionado pela necessidade de sistemas bancários básicos robustos, escaláveis e seguros para gerenciar altos volumes de transações e operações complexas em grandes instituições financeiras.

Espera-se que o segmento de PMEs testemunhe um rápido crescimento de 20,2% entre 2025 e 2032, impulsionado pela crescente digitalização e pela adoção de soluções bancárias básicas baseadas em nuvem e com boa relação custo-benefício, adaptadas às necessidades de instituições menores, principalmente em mercados emergentes como a Ásia-Pacífico.

- Por canal

Com base no canal, o mercado global de soluções bancárias básicas é segmentado em caixas eletrônicos, internet banking, mobile banking, agências bancárias e outros. Espera-se que o segmento de mobile banking detenha a maior fatia da receita de mercado, chegando a 45% em 2024, impulsionado pela ampla adoção de smartphones e pela preferência do consumidor por serviços bancários práticos e móveis.

Espera-se que o segmento de serviços bancários pela Internet experimente um crescimento significativo entre 2025 e 2032, à medida que as instituições financeiras investem em plataformas on-line fáceis de usar para melhorar o envolvimento do cliente e fornecer acesso direto aos serviços bancários, principalmente em regiões com grande conhecimento tecnológico, como América do Norte e Ásia-Pacífico.

- Por função

Com base na função, o mercado global de soluções bancárias básicas é segmentado em gestão de contas, processamento de transações, gestão de riscos, gestão de relacionamento com clientes, relatórios e análises, gestão de produtos, gestão de empréstimos, gestão de conformidade, entre outros. Espera-se que o segmento de processamento de transações detenha a maior fatia da receita de mercado, chegando a 40% em 2024, impulsionado por seu papel fundamental em permitir o processamento seguro, eficiente e em tempo real de transações financeiras em múltiplos canais.

Espera-se que o segmento de relatórios e análises testemunhe o crescimento mais rápido entre 2025 e 2032, impulsionado pela crescente demanda por insights baseados em dados para aprimorar a tomada de decisões, otimizar operações e atender aos requisitos regulatórios de relatórios. A integração de IA e análises avançadas impulsiona ainda mais a adoção.

- Por usuário final

Com base no usuário final, o mercado global de soluções bancárias básicas é segmentado em bancos, cooperativas de crédito, bancos comunitários e outras instituições financeiras. O segmento bancário dominou a participação de mercado de 73% na receita em 2024, devido ao alto volume de transações, à extensa rede de agências e à necessidade de sistemas bancários básicos avançados para oferecer suporte a diversos serviços.

Espera-se que o segmento de cooperativas de crédito e bancos comunitários testemunhe um rápido crescimento de 19,8% entre 2025 e 2032, impulsionado pela crescente adoção de soluções bancárias modernas para aumentar a eficiência operacional, melhorar a experiência do cliente e competir com instituições financeiras maiores, principalmente em regiões como a Ásia-Pacífico.

Análise regional do mercado de soluções bancárias essenciais

- A América do Norte dominou o mercado de soluções bancárias essenciais com a maior participação na receita de 42,5% em 2024, impulsionada pela adoção antecipada de tecnologias bancárias digitais, alto investimento em infraestrutura de TI e presença de grandes participantes do mercado

- As instituições financeiras priorizam soluções bancárias essenciais para aumentar a eficiência operacional, melhorar a experiência do cliente e garantir a conformidade com os requisitos regulatórios, especialmente em regiões com condições econômicas diversas.

- O crescimento é apoiado por avanços em software bancário, incluindo plataformas baseadas em nuvem e análises orientadas por IA, juntamente com a crescente adoção em grandes empresas e pequenas e médias empresas (PMEs).

Visão do mercado de soluções bancárias essenciais dos EUA

O mercado de soluções bancárias core dos EUA capturou a maior fatia da receita, de 84,8%, em 2024, na América do Norte, impulsionado pela forte demanda por transformação digital no setor bancário e pela crescente conscientização sobre os benefícios das plataformas bancárias integradas. A tendência por serviços bancários personalizados e padrões regulatórios rigorosos impulsiona ainda mais a expansão do mercado. A crescente adoção de soluções baseadas em nuvem por instituições financeiras complementa as implantações tradicionais on-premises, criando um ecossistema de produtos diversificado.

Visão do mercado de soluções bancárias essenciais na Europa

Espera-se que o mercado de soluções bancárias core da Europa testemunhe um crescimento significativo, apoiado pela ênfase regulatória na transparência financeira e em serviços bancários centrados no cliente. Bancos e instituições financeiras buscam soluções que aprimorem o processamento de transações, a gestão de riscos e a gestão do relacionamento com o cliente. O crescimento é proeminente tanto na implementação de novos sistemas quanto na atualização de sistemas legados, com países como Alemanha e França apresentando adoção significativa devido às crescentes tendências de bancos digitais e à estabilidade econômica.

Visão do mercado de soluções bancárias essenciais do Reino Unido

Espera-se que o mercado britânico de soluções bancárias essenciais testemunhe um rápido crescimento, impulsionado pela demanda por experiências aprimoradas para o cliente e serviços bancários digitais integrados em ambientes urbanos e suburbanos. O crescente interesse em serviços bancários móveis e pela internet, aliado à crescente conscientização sobre os benefícios da segurança de dados e da conformidade, incentiva a adoção. A evolução das regulamentações financeiras influencia as escolhas bancárias, equilibrando a inovação com a conformidade regulatória.

Visão do mercado de soluções bancárias essenciais na Alemanha

Espera-se que a Alemanha testemunhe um rápido crescimento no mercado de soluções bancárias essenciais, devido ao seu avançado setor de serviços financeiros e ao alto foco em eficiência operacional e satisfação do cliente. Os bancos alemães preferem soluções tecnologicamente avançadas que agilizem a gestão de contas, o processamento de transações e a gestão de conformidade. A integração dessas soluções em grandes empresas e PMEs apoia o crescimento sustentado do mercado.

Visão do mercado de soluções bancárias essenciais da Ásia-Pacífico

A região da Ásia-Pacífico deverá apresentar a maior taxa de crescimento, impulsionada pela expansão dos setores de serviços financeiros e pela crescente adoção do digital em países como China, Índia e Japão. A crescente conscientização sobre soluções de gestão de relacionamento com o cliente, gestão de riscos e processamento de transações está impulsionando a demanda. Iniciativas governamentais que promovem a inclusão financeira e o banco digital incentivam ainda mais a adoção de soluções avançadas de core banking.

Visão do mercado de soluções bancárias essenciais do Japão

Espera-se que o mercado de soluções bancárias core do Japão testemunhe um rápido crescimento devido à forte preferência do consumidor por plataformas bancárias de alta qualidade e tecnologicamente avançadas que aprimorem a eficiência operacional e a satisfação do cliente. A presença de grandes instituições financeiras e a integração de soluções bancárias core em sistemas corporativos aceleram a penetração no mercado. O crescente interesse em serviços bancários móveis e pela internet também contribui para o crescimento.

Visão do mercado de soluções bancárias essenciais da China

A China detém a maior fatia do mercado de soluções bancárias básicas na Ásia-Pacífico, impulsionada pela rápida urbanização, pela crescente presença de instituições financeiras e pela crescente demanda por soluções bancárias digitais. A crescente classe média do país e o foco em serviços financeiros inteligentes impulsionam a adoção de plataformas bancárias básicas avançadas. A forte capacidade nacional de desenvolvimento de software e os preços competitivos aumentam a acessibilidade ao mercado.

Participação de mercado em soluções bancárias essenciais

O setor de soluções bancárias básicas é liderado principalmente por empresas bem estabelecidas, incluindo:

- FIS (Fidelity National Information Services, Inc.) (EUA)

- Bricknode (Suécia)

- Soluções Jayam (Índia)

- Forbis (Lituânia)

- NCR VOYIX Corporation (EUA)

- HCL Technologies Limited (Índia)

- Unisys (EUA)

- Infosys Limited (Índia)

- TATA Consultancy Services Limited (Índia)

- Jack Henry & Associates, Inc. (EUA)

- SAP (Alemanha)

- Oracle (EUA)

- Capgemini (França)

- nCino (EUA)

- Finastra (Reino Unido)

Quais são os desenvolvimentos recentes no mercado global de soluções bancárias essenciais?

- Em julho de 2025, o 10x Banking lançou o Meta Core, uma plataforma bancária inovadora e nativa em nuvem, projetada para acelerar a transformação digital de instituições financeiras. O Meta Core simplifica o desenvolvimento de aplicativos bancários, abstraindo elementos comuns do produto e o livro-razão principal, permitindo que os bancos criem produtos personalizados com apenas 2.000 linhas de código. Isso reduz drasticamente a complexidade e o risco em comparação com sistemas legados. A plataforma oferece segurança de nível empresarial, arquitetura de dados pronta para IA e escalabilidade ilimitada, capacitando os bancos a inovar com mais rapidez e atender os clientes com mais eficácia. O Meta Core marca um grande salto em direção à modernização nativa em nuvem no setor bancário.

- Em maio de 2025, a Temenos lançou uma solução de IA Generativa de ponta, projetada para revolucionar a forma como os bancos interagem com seus dados e impulsionar a eficiência operacional. Integrada às plataformas Temenos Core e Financial Crime Mitigation (FCM), a solução permite que os usuários interajam com dados bancários complexos por meio de consultas em linguagem natural, fornecendo insights instantâneos e agilizando a tomada de decisões. Ela oferece suporte a práticas de IA seguras, explicáveis e auditáveis, ajudando os bancos a aumentar a produtividade, a conformidade e a lucratividade. Essa inovação reflete o compromisso da Temenos com uma IA responsável e capacita as instituições financeiras a criar serviços hiperpersonalizados e otimizar o desempenho em todas as operações.

- Em abril de 2025, o Zand Bank, o primeiro banco exclusivamente digital dos Emirados Árabes Unidos, anunciou a adoção do pacote Infosys Finacle Solutions para aprimorar seus serviços bancários corporativos. Hospedada no Microsoft Azure, a plataforma nativa em nuvem capacita a Zand a oferecer uma experiência bancária centrada no cliente e preparada para o futuro, com recursos avançados em IA, análise preditiva e integração com blockchain. A arquitetura modular e as APIs abertas do Finacle aceleram a inovação, melhoram a escalabilidade e otimizam as operações. Essa mudança estratégica posiciona a Zand na vanguarda das finanças digitais, permitindo-lhe oferecer serviços seguros, personalizados e eficientes para clientes corporativos.

- Em janeiro de 2025, o 10x Banking e a DLT Apps firmaram uma parceria estratégica para revolucionar a migração de dados para instituições financeiras. Ao combinar a plataforma de meta core banking nativa em nuvem do 10x com as ferramentas TerraAi e MigratIO, alimentadas por IA, da DLT Apps, a colaboração oferece um caminho de migração rápido, seguro e auditável de sistemas legados e não legados. A solução conjunta permite que os bancos carreguem dados em qualquer sequência, os validem em um ambiente controlado e mantenham trilhas de auditoria completas, garantindo a integridade, a qualidade dos dados e o mínimo de tempo de inatividade. Essa parceria capacita as instituições a se modernizarem com confiança e acelerarem suas jornadas de transformação digital.

- Em janeiro de 2025, a Temenos e a Deloitte anunciaram uma parceria estratégica para ajudar instituições financeiras dos EUA a modernizar seus principais sistemas bancários e de pagamentos por meio de soluções baseadas em nuvem. Ao combinar a profunda expertise em consultoria da Deloitte com a plataforma bancária SaaS componível da Temenos, a colaboração visa acelerar a entrega de experiências digitais modernas, reduzindo custos e riscos de implantação. A parceria também apoia modelos de negócios emergentes, como Banking-as-a-Service (BaaS) e Pagamentos Instantâneos, permitindo que os bancos aumentem a resiliência operacional e o engajamento do cliente. Essa estratégia conjunta de entrada no mercado fortalece a presença da Temenos nos EUA e capacita os bancos a adotar a transformação digital.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.