Global Compressed Natural Gas Cng Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

92.21 Billion

USD

121.42 Billion

2024

2032

USD

92.21 Billion

USD

121.42 Billion

2024

2032

| 2025 –2032 | |

| USD 92.21 Billion | |

| USD 121.42 Billion | |

|

|

|

|

Segmentação do mercado global de gás natural comprimido (GNC), por fonte (gás associado e gás não associado), kits (sequenciais e Venturi), tipo de distribuição (cilindros/tanques, acumuladores, coletores compostos e outros) e uso final (veículos leves, médios e pesados) – Tendências e previsões do setor até 2032

Tamanho do mercado de gás natural comprimido (GNC)

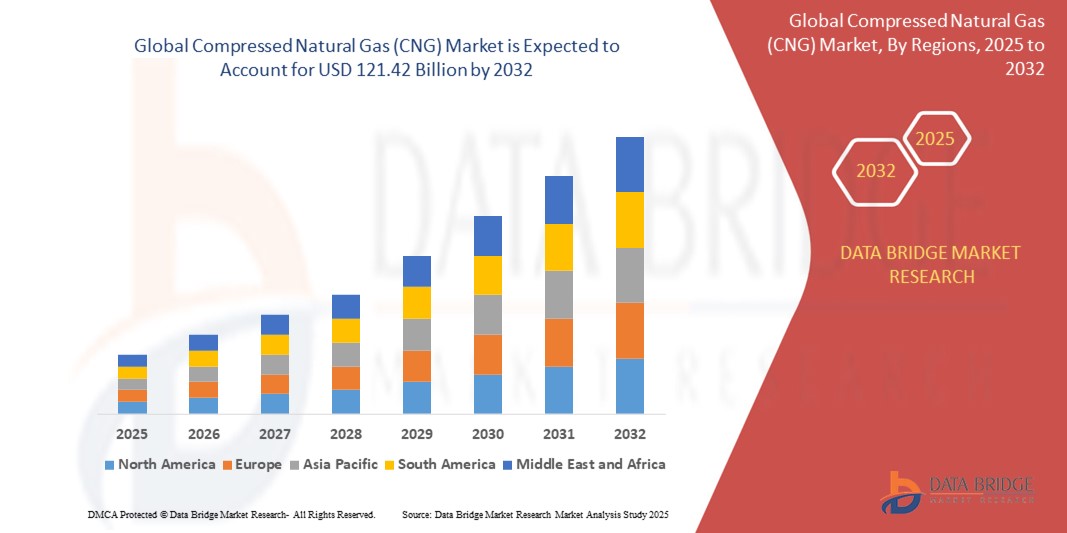

- O tamanho do mercado global de gás natural comprimido (GNC) foi avaliado em US$ 92,21 bilhões em 2024 e deve atingir US$ 121,42 bilhões até 2032 , com um CAGR de 3,50% durante o período previsto.

- O crescimento do mercado é impulsionado principalmente pela crescente demanda por alternativas de combustível mais limpas e sustentáveis, políticas governamentais de apoio à promoção de veículos de baixa emissão e avanços na infraestrutura de GNC e tecnologias de reabastecimento.

- As crescentes preocupações ambientais, aliadas à relação custo-eficácia do GNC em comparação com os combustíveis tradicionais, estão a acelerar a sua adopção em vários segmentos de veículos, especialmente nas economias emergentes.

Análise de Mercado de Gás Natural Comprimido (GNC)

- O gás natural comprimido (GNC) é um combustível alternativo mais limpo, usado principalmente no transporte, oferecendo emissões mais baixas em comparação à gasolina e ao diesel, o que o torna uma escolha preferencial para mercados ecologicamente conscientes.

- A crescente adoção do GNC é impulsionada pelo aumento das regulamentações ambientais, pelo aumento dos custos dos combustíveis e pela expansão da infraestrutura de reabastecimento de GNC em todo o mundo.

- A Ásia-Pacífico dominou o mercado de gás natural comprimido (GNC) com a maior participação na receita de 45,3% em 2024, impulsionada pela ampla adoção em países como China, Índia e Paquistão, apoiada por incentivos governamentais, combustível GNC de baixo custo e extensas redes de reabastecimento.

- Espera-se que a América do Norte seja a região de crescimento mais rápido durante o período previsto, atribuído ao aumento dos investimentos em infraestrutura de GNC, à crescente demanda por soluções de transporte sustentáveis e às políticas de apoio que promovem energia limpa nos EUA e no Canadá.

- O segmento de gás associado dominou o mercado com uma participação de mercado de 89,91% em 2024, impulsionado por sua oferta abundante, eficiência econômica e benefícios ambientais, pois é produzido junto com o petróleo bruto, reduzindo o desperdício e as emissões.

Escopo do Relatório e Segmentação do Mercado de Gás Natural Comprimido (GNC)

|

Atributos |

Principais insights do mercado de gás natural comprimido (GNC) |

|

Segmentos abrangidos |

|

|

Países abrangidos |

América do Norte

Europa

Ásia-Pacífico

Oriente Médio e África

Ámérica do Sul

|

|

Principais participantes do mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor agregado |

Além dos insights sobre cenários de mercado, como valor de mercado, taxa de crescimento, segmentação, cobertura geográfica e principais participantes, os relatórios de mercado selecionados pela Data Bridge Market Research também incluem análise de importação e exportação, visão geral da capacidade de produção, análise de consumo de produção, análise de tendência de preço, cenário de mudança climática, análise da cadeia de suprimentos, análise da cadeia de valor, visão geral de matéria-prima/consumíveis, critérios de seleção de fornecedores, análise PESTLE, análise de Porter e estrutura regulatória. |

Tendências do mercado de gás natural comprimido (GNC)

“Aumento da integração de tecnologias avançadas de armazenamento e IoT”

- O mercado global de Gás Natural Comprimido (GNC) está vivenciando uma tendência significativa em direção à integração de tecnologias avançadas de armazenamento e soluções de Internet das Coisas (IoT)

- Inovações em materiais compostos leves, como fibra de carbono e fibra de vidro para tanques de GNC Tipo IV, aumentam a eficiência de armazenamento e o desempenho do veículo, reduzindo o peso e melhorando a segurança

- Os sistemas de GNC habilitados para IoT permitem o monitoramento em tempo real da pressão do tanque, dos níveis de combustível e da integridade do sistema, fornecendo insights úteis para operadores de frotas e proprietários de veículos

- Por exemplo, as empresas estão a desenvolver plataformas de IoT que monitorizam os padrões de consumo de GNC para otimizar os horários de reabastecimento e prever as necessidades de manutenção dos sistemas de combustível.

- Esta tendência aumenta a eficiência e a fiabilidade dos sistemas de GNC, tornando-os mais apelativos tanto para os operadores de frotas comerciais como para os consumidores individuais.

- A integração da IoT também oferece suporte ao gerenciamento inteligente de frotas, analisando dados sobre rotas de veículos, eficiência de combustível e emissões, contribuindo para a economia de custos e conformidade ambiental.

Dinâmica do mercado de gás natural comprimido (GNC)

Motorista

“Crescente demanda por combustíveis mais limpos e regulamentações rigorosas de emissões”

- A crescente demanda do consumidor e da indústria por alternativas de combustível ecologicamente corretas, impulsionada pelo aumento dos custos do combustível e pelas preocupações ambientais, é um importante impulsionador do mercado global de GNC

- Os veículos movidos a GNC produzem emissões significativamente menores em comparação com a gasolina ou o diesel, com estudos mostrando uma redução de até 25% nas emissões de CO2 por quilômetro percorrido

- Os mandatos governamentais, particularmente em regiões como a Ásia-Pacífico com políticas que promovem energia limpa, estão acelerando a adoção do GNC por meio de subsídios, incentivos fiscais e investimentos em infraestrutura.

- A expansão das tecnologias 5G e IoT melhora as aplicações de GNC ao permitir uma transmissão de dados mais rápida para monitoramento de combustível em tempo real e gerenciamento de frotas

- As montadoras estão cada vez mais integrando sistemas de GNC como recursos padrão ou opcionais em veículos para atender aos requisitos regulatórios e à demanda do consumidor por transporte sustentável

Restrição/Desafio

“Custos iniciais elevados e infraestrutura de reabastecimento limitada”

- Os altos custos iniciais para conversões de veículos a GNC, fabricação avançada de tanques (por exemplo, tanques compostos Tipo IV) e desenvolvimento de postos de abastecimento representam uma barreira significativa, especialmente em mercados emergentes

- A adaptação de veículos existentes com kits de GNC, como sistemas sequenciais ou venturi, envolve processos de integração complexos e dispendiosos

- A disponibilidade limitada de postos de abastecimento de GNC, especialmente em regiões rurais ou menos desenvolvidas, restringe o crescimento do mercado e desencoraja a adoção entre operadores de veículos de longa distância

- Preocupações com a segurança de dados relacionadas a sistemas de GNC habilitados para IoT, incluindo riscos de ataques cibernéticos em sistemas de combustível conectados, aumentam os desafios de privacidade e conformidade com regulamentações globais variadas

- Esses fatores podem desencorajar potenciais adotantes e retardar a expansão do mercado, especialmente em regiões com sensibilidade a custos ou infraestrutura subdesenvolvida.

Escopo do mercado de gás natural comprimido (GNC)

O mercado é segmentado com base na origem, kits, tipo de distribuição e uso final.

- Por fonte

Com base na fonte, o mercado global de gás natural comprimido (GNC) é segmentado em gás associado e gás não associado. O segmento de gás associado dominou o mercado, com uma participação de mercado de 89,91% em 2024, impulsionado por sua oferta abundante, eficiência econômica e benefícios ambientais, visto que é produzido juntamente com o petróleo bruto, reduzindo o desperdício e as emissões.

Espera-se que o segmento de gás não associado testemunhe a taxa de crescimento mais rápida de 12,5% entre 2025 e 2032, impulsionado pelo declínio na produção global de petróleo bruto e pela mudança em direção às reservas de gás não associado, particularmente em regiões como Oriente Médio e Rússia, para atender à crescente demanda por GNC.

- Por Kits

Com base em kits, o mercado global de gás natural comprimido (GNC) é segmentado em sequencial e Venturi. Espera-se que o segmento sequencial domine o mercado com uma participação de 59,41% em 2024, devido ao seu melhor desempenho do motor, eficiência, emissões reduzidas, custo-benefício e longevidade, tornando-o a escolha preferencial para conversões de veículos a GNC.

A projeção é de que o segmento venturi experimente um crescimento robusto de 2025 a 2032, impulsionado por sua simplicidade e acessibilidade, que atraem mercados preocupados com custos, especialmente em regiões em desenvolvimento que adotam veículos movidos a GNC.

- Por tipo de distribuição

Com base no tipo de distribuição, o mercado global de gás natural comprimido (GNC) é segmentado em cilindros/tanques, acumuladores, coletores compostos e outros. Espera-se que o segmento de cilindros/tanques domine o mercado com uma participação de 80,14% em 2024, impulsionado pelo papel crítico dos tanques de GNC no armazenamento de gás comprimido em altas pressões (até 250 bar) para a operação segura e eficiente dos veículos. Os tanques Tipo 4, feitos de materiais compostos avançados, são particularmente populares por suas características de leveza e alta capacidade.

Espera-se que o segmento de acumuladores testemunhe um crescimento significativo entre 2025 e 2032, à medida que eles aumentam a eficiência do armazenamento e dão suporte aos sistemas de gasodutos virtuais em expansão, melhorando a acessibilidade ao GNC em áreas sem acesso direto ao gasoduto.

- Por uso final

Com base no uso final, o mercado global de gás natural comprimido (GNC) é segmentado em veículos leves, médios e pesados. Espera-se que o segmento de veículos leves domine o mercado, com uma participação de 63,28% em 2024, impulsionado pelo alto volume de veículos de passeio globalmente, pela crescente demanda do consumidor por opções de combustível econômicas e ecologicamente corretas e pela crescente adoção do GNC em áreas urbanas para combater a poluição do ar.

O segmento de veículos pesados deverá testemunhar a taxa de crescimento mais rápida de 19,6% entre 2025 e 2032, impulsionado pela crescente adoção de GNC em caminhões e ônibus de longa distância para economia de custos, redução de emissões e conformidade com regulamentações ambientais rigorosas, apoiada pela expansão da infraestrutura de reabastecimento.

Análise regional do mercado de gás natural comprimido (GNC)

- A Ásia-Pacífico dominou o mercado de gás natural comprimido (GNC) com a maior participação na receita de 45,3% em 2024, impulsionada pela ampla adoção em países como China, Índia e Paquistão, apoiada por incentivos governamentais, combustível GNC de baixo custo e extensas redes de reabastecimento.

- Os consumidores priorizam o GNC pela sua relação custo-eficácia, menores emissões e menores custos de manutenção em comparação com os combustíveis tradicionais, especialmente em regiões com altos preços de combustível e preocupações ambientais.

- O crescimento é apoiado pelos avanços na tecnologia de GNC, incluindo tanques leves Tipo 4 e kits sequenciais, juntamente com a crescente adoção nos segmentos OEM e de reposição para vários tipos de veículos.

Visão do mercado de gás natural comprimido (GNC) do Japão

Espera-se que o mercado de GNC do Japão testemunhe um crescimento significativo devido à forte preferência do consumidor por sistemas de GNC de alta qualidade e tecnologicamente avançados que aprimorem a eficiência e a segurança dos veículos. A presença de grandes fabricantes automotivos e a integração de sistemas de GNC em veículos originais (OEM) aceleram a penetração no mercado. O crescente interesse em conversões de GNC para o mercado de reposição também contribui para o crescimento.

Visão do mercado de gás natural comprimido (GNC) da China

A China detém a maior fatia do mercado de GNC da Ásia-Pacífico, impulsionada pela rápida urbanização, pelo aumento da propriedade de veículos e pela forte demanda por soluções de combustível econômicas e ecologicamente corretas. A crescente classe média do país e o foco na mobilidade sustentável impulsionam a adoção de tecnologias avançadas de GNC. A forte capacidade de fabricação nacional e os preços competitivos aumentam a acessibilidade ao mercado.

Mercado de gás natural comprimido (GNC) da América do Norte

Espera-se que o mercado de gás natural comprimido (GNC) da América do Norte apresente a maior taxa de crescimento. Esse crescimento é impulsionado por uma forte ênfase na redução das emissões de carbono, pela abundância de recursos de gás natural e pela crescente adoção de alternativas de combustível mais limpas por consumidores e empresas. A região se beneficia do crescente apoio governamental por meio de incentivos e regulamentações que promovem o uso do GNC em diversos setores, especialmente no transporte.

Visão do mercado de gás natural comprimido (GNC) dos EUA

Espera-se que o mercado de gás natural comprimido (GNC) dos EUA apresente um crescimento significativo, impulsionado pela forte demanda do mercado de reposição e pela crescente conscientização do consumidor sobre os benefícios ambientais e de redução de custos do GNC. A tendência por soluções de transporte mais limpas e a expansão da infraestrutura de reabastecimento impulsionam ainda mais a expansão do mercado. A integração de sistemas de GNC pelas montadoras em veículos de fábrica complementa as vendas no mercado de reposição, criando um ecossistema de mercado robusto.

Visão geral do mercado de gás natural comprimido (GNC) na Europa

Espera-se que o mercado europeu de GNC testemunhe um crescimento significativo, apoiado por regulamentações ambientais rigorosas e foco na redução das emissões de carbono. Os consumidores buscam soluções de GNC que ofereçam menores emissões e eficiência de combustível, além de atender aos padrões de segurança. O crescimento é proeminente tanto em instalações de veículos novos quanto em projetos de retrofit, com países como Alemanha e Itália apresentando uma adesão significativa devido a preocupações com a qualidade do ar urbano e políticas de apoio.

Visão geral do mercado de gás natural comprimido (GNC) do Reino Unido

Espera-se que o mercado de GNC do Reino Unido testemunhe um rápido crescimento, impulsionado pela demanda por alternativas de combustível mais limpas e transporte econômico em áreas urbanas e suburbanas. A maior conscientização sobre os benefícios ambientais do GNC e a redução dos custos operacionais incentivam a adoção. A evolução das regulamentações que equilibram a redução de emissões com os padrões de segurança veicular influencia as escolhas do consumidor, promovendo sistemas de GNC compatíveis.

Visão do mercado de gás natural comprimido (GNC) na Alemanha

Espera-se que a Alemanha testemunhe um rápido crescimento no mercado de GNC, atribuído ao seu avançado setor de fabricação automotiva e ao grande foco do consumidor em eficiência de combustível e sustentabilidade. Os consumidores alemães preferem tecnologias avançadas de GNC, como tanques Tipo 4 e kits sequenciais, que reduzem as emissões e contribuem para um menor consumo de combustível. A integração de sistemas de GNC em veículos premium e opções de reposição sustenta o crescimento sustentado do mercado.

Participação de mercado do gás natural comprimido (GNC)

O setor de gás natural comprimido (GNC) é liderado principalmente por empresas bem estabelecidas, incluindo:

- NIS (Sérvia)

- KryoGas (Sérvia)

- TotalEnergies SE (França)

- Chevron Corporation (EUA)

- Shell PLC (Reino Unido)

- Grupo Adani (Índia)

- JW Power Company (EUA)

- INDIAN OIL CORPORATION LIMITED (Índia)

- JIO-BP (Índia)

- ENGIE GROUP (Reino Unido)

- INDRAPRASTHA GAS LIMITED (Índia)

- TRILLIUM ENERGY (EUA)

Quais são os desenvolvimentos recentes no mercado global de gás natural comprimido (GNC)?

- Em fevereiro de 2025, o Irã inaugurou 12 novos postos de gás natural comprimido (GNC) em seis províncias, marcando um passo significativo em seus esforços contínuos para expandir a infraestrutura de combustíveis limpos. O lançamento coincidiu com o 46º aniversário da Revolução Islâmica e foi liderado pela Companhia Nacional Iraniana de Distribuição de Produtos Petrolíferos (NIOPDC). Essa expansão eleva o número total de postos de GNC em operação no país para mais de 2.600, apoiando o objetivo do Irã de reduzir o consumo de gasolina e promover o gás natural como uma alternativa mais limpa e econômica.

- Em fevereiro de 2025, o Aeroporto Internacional de Noida (NIA) anunciou uma parceria estratégica com a Indraprastha Gas Limited (IGL) para desenvolver a infraestrutura de Gás Natural Comprimido (GNC) no aeroporto. Como parte da iniciativa, serão construídos dois postos de GNC — um na área oeste e outro na área de embarque — para atender viajantes, funcionários do aeroporto e parceiros de logística. A IGL também construirá uma rede de Distribuição de Gás Urbano (CGD) e fornecerá gás natural canalizado (GNC) para praças de alimentação, lounges e cozinhas. Esta colaboração destaca a integração de soluções de energia limpa na infraestrutura da aviação.

- Em fevereiro de 2024, a Shell PLC finalizou a aquisição da Nature Energy Biogas A/S, a maior produtora de gás natural renovável (GNR) da Europa. A empresa dinamarquesa, que opera 14 usinas de biometano em escala industrial, agora opera como subsidiária integral da Shell. Este movimento estratégico aprimora significativamente o portfólio de combustíveis de baixo carbono da Shell e apoia sua ambição de construir uma cadeia de valor global e integrada de GNR. A aquisição também inclui um pipeline de 30 novos projetos de usinas na Europa e América do Norte, reforçando o compromisso da Shell com alternativas energéticas sustentáveis.

- Em julho de 2023, a Time Technoplast anunciou uma expansão significativa em sua capacidade de fabricação de GNC em cascata para atender à crescente demanda por soluções de armazenamento e transporte de combustível limpo. Na Fase 1, a empresa aumentou a capacidade para 300 cascatas anualmente. Com base nesse impulso, a Fase 2 visa aumentar a capacidade anual total para 480 cascatas, com planos futuros de expansão para 1.080 cascatas por ano até o final do ano fiscal de 2023-24. Essa expansão reflete a crescente adoção da infraestrutura de GNC e a liderança da empresa na tecnologia de cilindros compostos Tipo IV.

- Em outubro de 2022, a Advik Hi-Tech Private Limited, fabricante indiana líder em componentes automotivos, firmou uma colaboração tecnológica com a NIKKI Co. Ltd., renomada empresa japonesa de sistemas de combustível, para produzir reguladores de gás natural comprimido (GNC) na Índia. Esta aliança estratégica visa localizar a produção, fortalecer a cadeia de suprimentos doméstica e apoiar o avanço da Índia em soluções de mobilidade mais limpas. A parceria combina a comprovada tecnologia de reguladores da Nikki com a expertise em fabricação da Advik para atender à crescente demanda por automóveis de passeio, veículos comerciais e aplicações industriais.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.