Global Commercial Turf Utility Vehicle Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

452.40 Million

USD

812.88 Million

2024

2032

USD

452.40 Million

USD

812.88 Million

2024

2032

| 2025 –2032 | |

| USD 452.40 Million | |

| USD 812.88 Million | |

|

|

|

|

Mercado global de veículos utilitários de grama sintética comercial, por tipo de propulsão (elétrica, gasolina e diesel), potência de saída ( 8 kW e 8 kW–15 kW), assinatura (nova compra e aluguel), capacidade de assentos (2 lugares e mais de 2 lugares), tipo de grama sintética (grama natural e artificial), capacidade de reboque (menos de 680 kg e mais de 680 kg) e aplicação (campos de golfe, hotéis e resorts, aeroportos, faculdades e universidades, zoológicos e outros) - Tendências do setor e previsão até 2032

Tamanho do mercado de veículos utilitários de grama sintética comercial

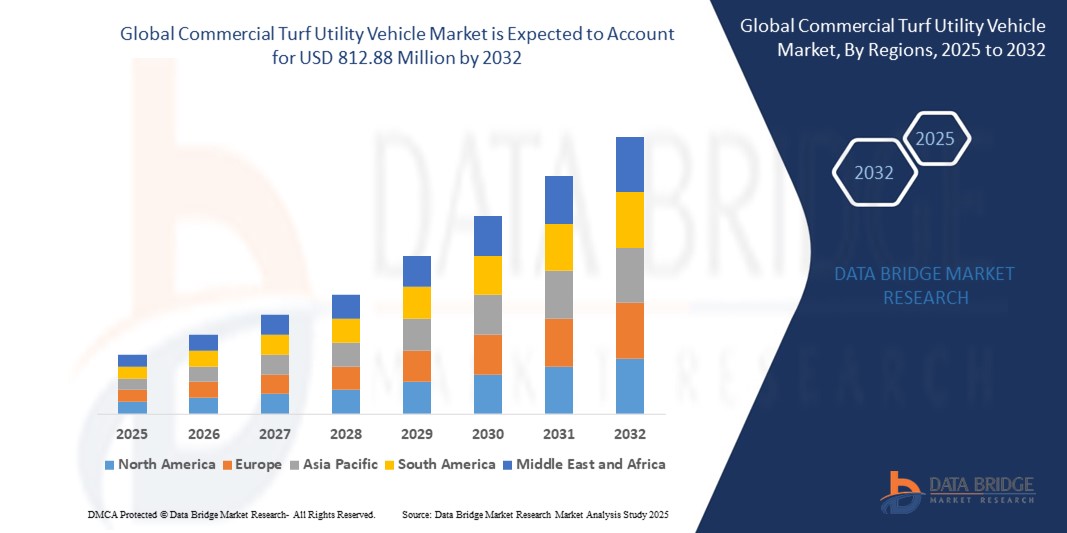

- O tamanho do mercado global de veículos utilitários para grama comercial foi avaliado em US$ 452,40 milhões em 2024 e deve atingir US$ 812,88 milhões até 2032 , com um CAGR de 7,60% durante o período previsto.

- O crescimento do mercado é impulsionado principalmente pela crescente demanda por soluções eficientes de manutenção de gramados, pela crescente adoção de veículos elétricos para sustentabilidade e pelos avanços tecnológicos em automação e conectividade de veículos.

- Os crescentes investimentos em instalações recreativas, como campos de golfe e resorts, juntamente com o foco maior em soluções de paisagismo ecológicas, estão acelerando a adoção de veículos utilitários comerciais de grama, impulsionando significativamente o crescimento do setor.

Análise do mercado de veículos utilitários de grama sintética comercial

- Veículos utilitários comerciais para gramados, projetados para manutenção e transporte de gramados em diversas aplicações, são essenciais para operações eficientes em ambientes como campos de golfe, resorts e terrenos institucionais, oferecendo maior manobrabilidade, durabilidade e capacidade de transporte de carga.

- O aumento da procura é impulsionado pela expansão das instalações desportivas e recreativas, pelo aumento das regulamentações ambientais que promovem os veículos elétricos e pela necessidade de equipamentos de manutenção versáteis e económicos.

- A América do Norte dominou o mercado de veículos utilitários para gramados comerciais com a maior participação na receita de 42,5% em 2024, impulsionada pelo amplo desenvolvimento de campos de golfe, alta adoção de tecnologias avançadas de manutenção de gramados e presença de grandes fabricantes

- Espera-se que a Ásia-Pacífico seja a região com crescimento mais rápido durante o período previsto, impulsionada pela rápida urbanização, pelos crescentes investimentos em turismo e hospitalidade e pelo aumento dos rendimentos disponíveis.

- O segmento elétrico dominou a maior fatia de mercado, com 48,7% da receita em 2024, impulsionado por crescentes preocupações ambientais, regulamentações de emissões mais rigorosas e crescente demanda por soluções ecológicas. Veículos utilitários elétricos para gramados oferecem vantagens de emissão zero, tornando-os ideais para paisagismo sustentável e tarefas de manutenção.

Escopo do relatório e segmentação do mercado de veículos utilitários para gramados comerciais

|

Atributos |

Principais insights do mercado de veículos utilitários de grama sintética comercial |

|

Segmentos abrangidos |

|

|

Países abrangidos |

América do Norte

Europa

Ásia-Pacífico

Oriente Médio e África

Ámérica do Sul

|

|

Principais participantes do mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor agregado |

Além de insights de mercado, como valor de mercado, taxa de crescimento, segmentos de mercado, cobertura geográfica, participantes do mercado e cenário de mercado, o relatório de mercado selecionado pela equipe de pesquisa de mercado da Data Bridge inclui análise aprofundada de especialistas, análise de importação/exportação, análise de preços, análise de consumo de produção e análise pilão. |

Tendências do mercado de veículos utilitários para grama sintética comercial

“Aumento da integração da IoT e da conectividade avançada”

- O mercado global de veículos utilitários de grama sintética comercial está vivenciando uma tendência significativa em direção à integração da Internet das Coisas (IoT) e soluções avançadas de conectividade, como GPS e telemática

- Essas tecnologias permitem o monitoramento em tempo real do desempenho do veículo, das condições do gramado e da eficiência do operador, fornecendo insights práticos para manutenção e otimização operacional.

- Os veículos utilitários para gramados habilitados para IoT permitem manutenção preditiva, identificando potenciais problemas mecânicos antes que eles resultem em tempo de inatividade, reduzindo assim os custos de reparo e melhorando a eficiência operacional

- Por exemplo, fabricantes como a Club Car e a John Deere estão a desenvolver plataformas conectadas que se integram com aplicações móveis para monitorizar a utilização dos veículos, otimizar rotas para manutenção do relvado e fornecer informações baseadas em dados para a gestão de frotas.

- Esta tendência melhora a proposta de valor dos veículos utilitários para gramados, tornando-os mais atraentes para campos de golfe, resorts e outras instalações de grande porte que exigem um gerenciamento eficiente do gramado.

- A conectividade avançada também oferece suporte a recursos como geofencing e diagnóstico remoto, permitindo que os operadores rastreiem a localização dos veículos e garantam o uso ideal em grandes áreas, como campos de golfe ou aeroportos.

Dinâmica do mercado de veículos utilitários de grama sintética comercial

Motorista

“Crescente demanda por gestão eficiente e sustentabilidade de gramados”

- A crescente demanda por soluções eficientes de manutenção de gramados, impulsionada pela expansão de campos de golfe, resorts e espaços verdes urbanos, é um fator-chave para o mercado global de veículos utilitários de gramado comercial.

- Os veículos utilitários para gramados melhoram a eficiência operacional ao fornecer soluções versáteis para corte, transporte, pulverização e semeadura, adaptadas tanto para grama natural quanto para superfícies de grama artificial.

- As iniciativas governamentais que promovem o paisagismo sustentável e a conservação ambiental, especialmente na América do Norte e na Europa, estão a impulsionar a adopção de veículos utilitários elétricos para relva, que oferecem benefícios de emissão zero.

- A proliferação da tecnologia 5G e da IoT está permitindo uma transmissão de dados mais rápida e comunicação em tempo real, suportando aplicações avançadas como manutenção automatizada de gramados e gerenciamento inteligente de frotas

- Os fabricantes estão cada vez mais oferecendo modelos elétricos e híbridos de fábrica para atender à demanda por soluções ecológicas, especialmente em aplicações como campos de golfe, hotéis, resorts e universidades.

Restrição/Desafio

“Altos custos iniciais e limitações de infraestrutura”

Altos custos iniciais e limitações de infraestrutura

- Os altos custos iniciais de compra e integração de veículos utilitários avançados para gramados, especialmente modelos elétricos com recursos de IoT e telemática, representam uma barreira significativa à adoção, especialmente em mercados sensíveis a custos, como partes da Ásia-Pacífico e América Latina.

- A modernização de veículos existentes com conectividade avançada ou sistemas de propulsão elétrica pode ser complexa e cara, limitando a adoção entre operadores menores

- As limitações de infraestrutura, como redes de carregamento inadequadas para veículos utilitários elétricos de grama, especialmente em mercados emergentes, dificultam o crescimento e a escalabilidade do mercado.

- Preocupações com a segurança e privacidade de dados relacionadas a veículos habilitados para IoT, que coletam e transmitem dados operacionais e de localização, levantam desafios em relação a possíveis violações e à conformidade com diferentes regulamentações regionais de proteção de dados.

- O cenário regulatório fragmentado entre os países, especialmente no que diz respeito aos padrões de emissões e ao uso de dados, complica as operações para fabricantes e prestadores de serviços, potencialmente impedindo a expansão do mercado em regiões com regulamentações rigorosas ou pouco claras.

Escopo do mercado de veículos utilitários de grama comercial

O mercado é segmentado com base no tipo de propulsão, potência de saída, assinatura, capacidade de assentos, tipo de grama, capacidade de reboque e aplicação.

- Por tipo de propulsão

Com base no tipo de propulsão, o mercado global de veículos utilitários para gramados comerciais é segmentado em tipos de propulsão elétrica, a gasolina e a diesel. O segmento elétrico dominou a maior fatia da receita de mercado, com 48,7% em 2024, impulsionado por crescentes preocupações ambientais, regulamentações de emissões mais rigorosas e crescente demanda por soluções ecológicas. Os veículos utilitários para gramados elétricos oferecem vantagens de emissão zero, tornando-os ideais para paisagismo sustentável e tarefas de manutenção.

O segmento elétrico também deverá apresentar a maior taxa de crescimento entre 2025 e 2032, impulsionado pelos avanços na tecnologia de baterias, pela redução dos custos das baterias e pelos incentivos governamentais que promovem veículos com emissão zero. A mudança para a sustentabilidade em setores como campos de golfe e resorts acelera ainda mais a adoção.

- Por potência de saída

Com base na potência de saída, o mercado global de veículos utilitários comerciais para gramados é segmentado em > 8 kW e 8 kW–15 kW. O segmento de 8 kW–15 kW dominou, com uma participação de mercado de 66,4% na receita em 2024, devido ao seu equilíbrio entre desempenho e custo-benefício, atendendo a diversas aplicações, como corte de grama, transporte e manutenção de gramados.

Espera-se que o segmento de 8 kW–15 kW mantenha um forte crescimento de 2025 a 2032, impulsionado por sua versatilidade e adequação para tarefas leves e pesadas em ambientes comerciais, como campos de golfe e universidades.

- Por assinatura

Com base na assinatura, o mercado global de veículos utilitários comerciais para grama sintética é segmentado em compra nova e aluguel. O segmento de compra nova deteve a maior participação de mercado na receita, 54,2% em 2024, impulsionado pela preferência por propriedade de longo prazo entre operadores de grande porte, como campos de golfe e resorts, garantindo desempenho e personalização consistentes.

Espera-se que o segmento de aluguel testemunhe a maior taxa de crescimento entre 2025 e 2032, impulsionado pela crescente demanda por soluções flexíveis e econômicas entre operadores menores e usuários sazonais, como locais de eventos e zoológicos.

- Por capacidade de assentos

Com base no tipo de capacidade de assentos, o mercado global de veículos utilitários comerciais de grama sintética é segmentado em veículos de 2 e mais de 2 lugares. O segmento de 2 lugares representou a maior fatia da receita de mercado, 62,3% em 2024, devido à sua versatilidade, custo-benefício e adequação para tarefas que exigem veículos compactos, como manutenção em espaços confinados.

O segmento de mais de 2 lugares deverá apresentar um crescimento robusto entre 2025 e 2032, impulsionado pela crescente demanda por veículos que acomodam vários passageiros em aplicações como resorts, aeroportos e faculdades, onde o transporte em grupo é essencial.

- Por tipo de grama

Com base no tipo de grama, o mercado global de veículos utilitários de grama comercial é segmentado em grama natural e artificial. O segmento de grama natural dominou, com uma participação de mercado de 71,3% na receita em 2024, pois continua sendo a superfície predominante em aplicações como campos de golfe, campos esportivos e parques, exigindo veículos especializados para manutenção.

Espera-se que o segmento artificial testemunhe um crescimento significativo entre 2025 e 2032, impulsionado pela crescente adoção de grama artificial em instalações esportivas e paisagismo urbano, necessitando de veículos adaptados às suas necessidades específicas de manutenção.

- Por capacidade de reboque

Com base na capacidade de reboque, o mercado global de veículos utilitários comerciais de grama é segmentado em menos de 680 kg e mais de 680 kg. O segmento de menos de 680 kg deteve a maior participação de receita de mercado de 63,8% em 2024, devido à sua versatilidade, custo-benefício e adequação para várias aplicações, incluindo tarefas leves em zoológicos e universidades.

Espera-se que o segmento com mais de 680 kg cresça rapidamente de 2025 a 2032, impulsionado pela necessidade de reboque pesado em aplicações como manutenção de campos de golfe e operações de resorts, onde cargas maiores são comuns.

- Por aplicação

Com base na aplicação, o mercado global de veículos utilitários para grama sintética comercial é segmentado em campos de golfe, hotéis e resorts, aeroportos, faculdades e universidades, zoológicos e outros. O segmento de campos de golfe dominou, com uma participação de mercado de 38,9% na receita em 2024, devido ao amplo uso de veículos utilitários para grama sintética para manutenção, transporte e outras tarefas críticas às operações dos campos de golfe.

Espera-se que o segmento de hotéis e resorts testemunhe o crescimento mais rápido entre 2025 e 2032, impulsionado pela crescente indústria do turismo de luxo e pela necessidade de soluções de transporte eficientes e ecológicas dentro de grandes instalações de resorts.

Análise regional do mercado de veículos utilitários de grama sintética comercial

- A América do Norte dominou o mercado de veículos utilitários para gramados comerciais com a maior participação na receita de 42,5% em 2024, impulsionada pelo amplo desenvolvimento de campos de golfe, alta adoção de tecnologias avançadas de manutenção de gramados e presença de grandes fabricantes

- Os consumidores priorizam os veículos por sua versatilidade, manobrabilidade e capacidade de executar tarefas como cortar a grama, transportar e pulverizar, principalmente em regiões com amplos espaços verdes e diversos tipos de grama.

- O crescimento é apoiado pelos avanços na tecnologia de veículos, incluindo sistemas de propulsão elétricos e híbridos, juntamente com a crescente adoção em novos mercados de compra e aluguel.

Visão geral do mercado de veículos utilitários de grama sintética comercial dos EUA

O mercado de veículos utilitários para gramados comerciais dos EUA capturou a maior fatia da receita, de 87,2%, em 2024, na América do Norte, impulsionado pela forte demanda em campos de golfe, faculdades e projetos de paisagismo urbano. A tendência para o manejo sustentável de gramados e o aumento das regulamentações que promovem veículos com emissão zero impulsionam a expansão do mercado. A integração de tecnologias avançadas, como GPS e IoT, em veículos complementa os novos segmentos de compra e locação, criando um ecossistema de mercado diversificado.

Visão geral do mercado de veículos utilitários de grama sintética comercial na Europa

Espera-se que o mercado europeu de veículos utilitários para gramados comerciais testemunhe um crescimento significativo, impulsionado pela ênfase regulatória na sustentabilidade ambiental e na manutenção eficiente dos gramados. Os consumidores buscam veículos que ofereçam baixas emissões e alto desempenho para aplicações em gramados naturais e artificiais. O crescimento é expressivo em países como Alemanha e Reino Unido, impulsionado pelo aumento dos investimentos em instalações esportivas e espaços verdes públicos.

Visão geral do mercado de veículos utilitários de grama sintética comercial do Reino Unido

Espera-se que o mercado britânico de veículos utilitários para gramados comerciais testemunhe um rápido crescimento, impulsionado pela demanda por soluções de manutenção eficientes em parques urbanos e instalações recreativas. O foco crescente em veículos ecológicos, especialmente modelos elétricos, e a crescente conscientização sobre eficiência operacional incentivam a adoção. A evolução das regulamentações ambientais influencia as escolhas do consumidor, equilibrando desempenho e conformidade.

Visão geral do mercado de veículos utilitários de grama sintética comercial na Alemanha

Espera-se que a Alemanha testemunhe um rápido crescimento no mercado de veículos utilitários para gramados comerciais, devido ao seu avançado setor de paisagismo e ao alto foco do consumidor em sustentabilidade e eficiência. Os consumidores alemães preferem veículos tecnologicamente avançados com propulsão elétrica ou híbrida, que reduzem o impacto ambiental e os custos operacionais. A integração desses veículos em campos de golfe e projetos municipais contribui para o crescimento sustentado do mercado.

Visão do mercado de veículos utilitários de grama sintética comercial da Ásia-Pacífico

Espera-se que a região Ásia-Pacífico registre a maior taxa de crescimento, impulsionada pela expansão de atividades de paisagismo e lazer em países como China, Índia e Japão. A crescente conscientização sobre o manejo sustentável de gramados, aliada ao aumento da renda disponível, impulsiona a demanda por veículos elétricos e movidos a gasolina. Iniciativas governamentais que promovem espaços verdes e eficiência energética incentivam ainda mais a adoção de veículos utilitários avançados.

Visão geral do mercado de veículos utilitários de grama sintética comercial do Japão

Espera-se que o mercado japonês de veículos utilitários esportivos comerciais para grama testemunhe um rápido crescimento devido à forte preferência do consumidor por veículos de alta qualidade e tecnologicamente avançados que aprimorem a eficiência operacional e a sustentabilidade. A presença de grandes fabricantes e a integração de veículos elétricos em campos de golfe e resorts aceleram a penetração no mercado. O crescente interesse em assinaturas de aluguel também contribui para o crescimento.

Visão geral do mercado de veículos utilitários de grama sintética comercial da China

A China detém a maior fatia do mercado de veículos utilitários para gramados comerciais da Ásia-Pacífico, impulsionada pela rápida urbanização, pelo crescente desenvolvimento de espaços verdes e pela crescente demanda por soluções eficientes para a manutenção de gramados. A expansão da classe média do país e o foco em paisagismo sustentável impulsionam a adoção de veículos elétricos e híbridos. A forte capacidade de fabricação nacional e os preços competitivos aumentam a acessibilidade ao mercado.

Participação no mercado de veículos utilitários de grama sintética comercial

O setor de veículos utilitários para grama comercial é liderado principalmente por empresas bem estabelecidas, incluindo:

- Textron Inc. (EUA)

- Deere & Company (EUA)

- Suzhou Eagle Electric Vehicle Manufacturing Co. Ltd (China)

- The Toro Company (EUA)

- Polaris Inc. (EUA)

- Yamaha Motor Co. Ltd. (Japão)

- KUBOTA Corporation (Japão)

- Columbia Vehicle Group Inc. (EUA)

- SPEEDWAYS (Índia)

- VEÍCULO ELÉTRICO HDK (EUA)

- Marshell Green Power (China)

- STAR EV CORPORATION (EUA)

- Tropos Motors (EUA)

- Landmaster americano (EUA)

- Garia A/S (Dinamarca)

- Ingersoll Rand (EUA)

- Veículos elétricos Bintelli (EUA)

- Veículos elétricos moto (EUA)

Quais são os desenvolvimentos recentes no mercado global de veículos utilitários para gramados comerciais?

- Em fevereiro de 2024, a Polaris Inc. lançou uma versão elétrica de seu utilitário pesado Pro XD, voltado especificamente para aplicações na construção, aluguel de equipamentos e indústria. Batizado de Pro XD Kinetic, este veículo oferece recursos aprimorados para reboque e transporte, com autonomia de até 72,4 km com uma única carga. Este lançamento reforça o compromisso da Polaris em expandir sua oferta de veículos elétricos para ambientes de trabalho exigentes.

- Em março de 2023, a Club Car, líder global em veículos elétricos de rodas pequenas e zero emissões, revelou seus mais recentes modelos utilitários elétricos homologados para as ruas: o Club Car Urban LSV e o Urban XR. Esses veículos apresentam estilo inspirado no setor automotivo, design ergonômico e são adequados para aplicações comerciais, municipais e de entrega de última milha. O Urban LSV é homologado para as ruas, com velocidade máxima de 40 km/h, enquanto a versão XR não é homologada para as ruas, atingindo 30 km/h. Ambos os modelos oferecem configurações flexíveis, incluindo caçambas para caminhonetes e vans, e agora estão disponíveis na rede de distribuidores comerciais norte-americana da Club Car, apoiando soluções de transporte sustentáveis e econômicas.

- Em outubro de 2023, a Metalcraft de Mayville, fabricante americana conhecida por sua marca Scag Power Equipment, adquiriu a Bluebird Turf Products, localizada em Auburn Hills, Michigan. A aquisição, efetivada em 9 de outubro de 2023, fortalece a posição da Metalcraft no mercado de equipamentos para tratamento de gramados, expandindo seu portfólio de produtos e ampliando seu alcance nos setores de aluguel e paisagismo comercial. Como parte do acordo, todos os 21 funcionários da Bluebird foram mantidos. A mudança permite que os revendedores da Scag ofereçam produtos complementares para renovação de gramados, enquanto a rede de aluguel da Bluebird ganha acesso à linha mais ampla da Scag.

- A aquisição da Excel Industries pela Stanley Black & Decker ocorreu antes de setembro de 2023 — e foi anunciada oficialmente em 13 de setembro de 2021. Nesta transação de US$ 375 milhões em dinheiro, a Stanley Black & Decker adquiriu a Excel, fabricante americana de equipamentos premium para tratamento de gramados comerciais e residenciais, sob as marcas Hustler Turf Equipment e BigDog Mower Co. A aquisição marcou a entrada estratégica da Stanley Black & Decker no mercado de equipamentos para tratamento de gramados, expandindo sua oferta de produtos para áreas externas e alavancando suas capacidades de fabricação e distribuição para diversificar sua atuação em um novo setor.

- Em julho de 2023, a Target Specialty Products lançou o Turf Fuel Infinite no Canadá após seu registro na CFIA. O Turf Fuel Infinite é um surfactante avançado para solos e solução para a saúde das plantas, desenvolvido para melhorar o gerenciamento da umidade, a tolerância das plantas ao estresse e a vitalidade geral do gramado. O produto combina Diuturon, uma tecnologia de polímero com patente pendente, com Templar™, um intensificador de defesa contra o estresse das plantas, juntamente com quatro polímeros surfactantes adicionais. Esta formulação garante hidratação consistente do solo e maior resistência à seca, tornando-a ideal para campos de golfe, campos esportivos e áreas comerciais. Embora não seja um veículo, complementa o uso de veículos utilitários para gramados comerciais, otimizando as condições do gramado para manutenção e desempenho.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.