Global Building Management System Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

88,841,536.28 Thousand

USD

200,517,985.93 Thousand

2023

2031

USD

88,841,536.28 Thousand

USD

200,517,985.93 Thousand

2023

2031

| 2024 –2031 | |

| USD 88,841,536.28 Thousand | |

| USD 200,517,985.93 Thousand | |

|

|

|

|

Mercado global de sistemas de gestão de edifícios, por tipo de sistema (sistemas de gestão de instalações (FMS), sistemas de segurança e controlo de acessos, sistemas de gestão de energia, software de gestão de edifícios (BMS), sistemas de proteção contra incêndios e outros), tecnologia (tecnologias sem fios e tecnologias com fios) , Aplicação (Residencial, Comercial e Industrial) - Tendências do Sector e Previsão para 2031.

Análise e tamanho do mercado do sistema de gestão de edifícios

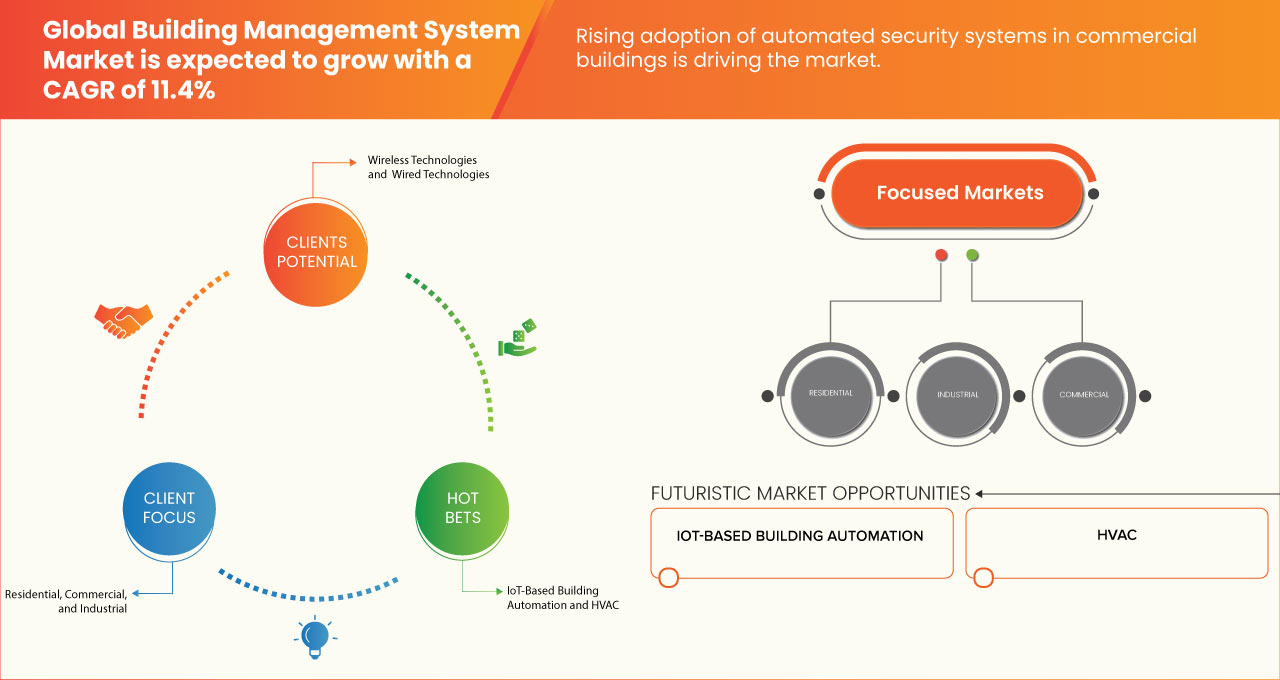

The upsurge in the focus on designing energy-efficient and eco-friendly buildings, the rising adoption of automated security systems in commercial buildings, and the growing popularity of IoT-based Building Automation Systems (BASs) are some of the major factors driving the market crescimento.

No entanto, o surgimento de questões de segurança e o elevado custo de manutenção dos BASs como um problema para os fabricantes no fabrico de produtos inovadores são alguns dos principais fatores que restringem o crescimento do mercado.

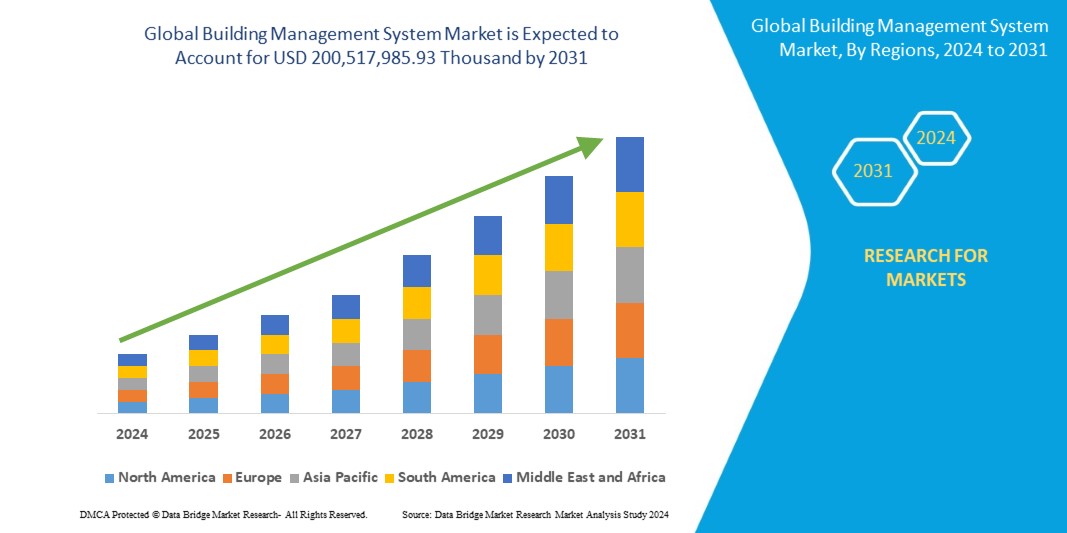

A Data Bridge Market Research analisa que o mercado global de sistemas de gestão de edifícios deverá atingir os 200.517.985,93 mil dólares até 2031, face aos 88.841.536,28 mil dólares em 2023, crescendo com um CAGR de 11,4% durante o período de previsão de 2024 a 2031.

|

Métrica de reporte |

Detalhes |

|

Período de previsão |

2024 a 2031 |

|

Ano base |

2023 |

|

Anos históricos |

2022 (personalizável para 2016-2021) |

|

Unidades Quantitativas |

Receita em mil dólares |

|

Segmentos cobertos |

Tipo de sistema (sistemas de gestão de instalações (FMS), sistemas de segurança e controlo de acessos, sistemas de gestão de energia, software de gestão de edifícios (BMS), sistemas de proteção contra incêndios e outros), tecnologia (tecnologias sem fios e tecnologias com fios), aplicação (residencial, comercial, e Industriais) |

|

Países abrangidos |

EUA, Canadá, México, Alemanha, França, Reino Unido, Itália, Turquia, Espanha, Holanda, Rússia, Bélgica, Suíça, Resto da Europa, China, Japão, Coreia do Sul, Índia, Austrália, Singapura, Malásia, Tailândia, Filipinas , Indonésia , Resto da Ásia-Pacífico, Arábia Saudita, Emirados Árabes Unidos, África do Sul, Israel, Egito, Resto do Médio Oriente e África, Brasil, Argentina e Resto da América do Sul |

|

Participantes do mercado abrangidos |

Johnson Controls, Schneider Electric, Siemens, Hangzhou Hikvision Digital Technology Co., Ltd., Honeywell International Inc., Trane Technologies plc, IBM, Convergint Technologies LLC, Veolia, Delta Controls, ACUITY BRANDS, INC., Snap One, LLC, Virtusa Corp., Crestron Electronics, Beckhoff Automation GmbH & Co. KG, Bajaj Electricals Ltd, GridPoint, UNIPOWER, Novius Services, Elipse Software, BuildingIQ e Axonator Inc, entre outros |

Definição do mercado global de sistemas de gestão de edifícios

Building Management System (BMS) é um sistema baseado em computador que gere e monitoriza vários sistemas prediais, tais como aquecimento, ventilação, ar condicionado, iluminação, segurança, prevenção de incêndios e fornecimento de energia. Pode reduzir o consumo de energia, os custos de manutenção e o impacto ambiental, ajustando as configurações dos sistemas prediais de acordo com os dados recolhidos pelos sensores e contadores. Um BMS pode também fornecer informações e alertas em tempo real aos operadores e gestores do edifício, permitindo-lhes controlar e otimizar o desempenho do edifício.

Dinâmica global do mercado de sistemas de gestão de edifícios

Esta secção trata da compreensão dos impulsionadores, oportunidades, restrições e desafios do mercado. Tudo isto é discutido em detalhe abaixo:

Motoristas

- Aumento do foco no projeto de edifícios energeticamente eficientes e ecológicos

A conservação de energia através da eficiência energética no edifício adquiriu uma importância primordial em todo o mundo. Os principais aspectos da eficiência energética num edifício incluem a concepção de edifícios energeticamente passivos antes da construção propriamente dita e materiais de construção de baixo consumo energético durante a construção. O foco principal da construção de edifícios verdes é a integração de tecnologias de energia renovável e a utilização de equipamentos eficientes com baixos requisitos operacionais de energia.

O consumo de energia nos edifícios e infraestruturas aumenta exponencialmente, sugerindo a necessidade de desenvolver alternativas para poupar energia e operar os edifícios de forma sustentável. A eficiência energética pode ser alcançada com isolamento, técnicas de construção melhoradas e métodos de construção modificados para edifícios, aumentando a procura de sistemas de automação sustentáveis. Como resultado, isto aumenta a procura por sistemas de gestão de edifícios, o que está a impulsionar o crescimento do mercado.

- Crescente adoção de sistemas de segurança automatizados em edifícios comerciais

Os sistemas de segurança são essenciais para todos os edifícios, especialmente para edifícios comerciais. Garante a consistência das operações comerciais e a segurança da propriedade física e intelectual. As propriedades comerciais, como empresas industriais, instituições financeiras e governamentais, escolas, instalações médicas e empresas de petróleo e gás, exigem um conjunto único de medidas de segurança e proteção, uma vez que cada tipo de propriedade é vulnerável a perigos diferentes.

Um sistema de segurança para edifícios comerciais apresenta uma solução mais abrangente do que os sistemas de segurança típicos dos edifícios de apartamentos e é composto por diferentes sistemas de automatização. Isto inclui o controlo de acessos comercial em várias camadas, vários sensores e detetores, como sensores infravermelhos, micro-ondas ou laser , e segurança perimetral (CCTV). Todos os sistemas de segurança empresarial podem ser integrados numa solução de segurança complexa com maior flexibilidade e escalabilidade e, assim, impulsionando o crescimento do mercado.

Oportunidade

- Iniciativas e incentivos governamentais favoráveis para as cidades inteligentes emergentes

Os edifícios inteligentes incluem tecnologia avançada de automação e gestão de edifícios que melhora a forma como os governos monitorizam e controlam máquinas, sistemas de aquecimento, refrigeração e iluminação em edifícios federais em todos os países, aumentando a eficiência destes sistemas. A tecnologia do sistema de gestão de edifícios recolhe dados brutos de sistemas mecânicos ou elétricos, analisa-os e utiliza os resultados para identificar ineficiências que podem ser corrigidas imediatamente.

A iniciativa dos edifícios inteligentes permite aos governos fazer uma diferença real através da implementação de tecnologias inovadoras e da identificação de oportunidades para poupar energia. Através da iniciativa edifícios inteligentes, o governo está a intensificar os esforços para melhorar a gestão do desempenho energético nos edifícios federais. Isto levará a uma redução da pegada ambiental e dos custos de energia através da implementação de BMS inteligentes. Através da iniciativa de construção inteligente, o governo de todos os países está a melhorar a gestão do desempenho energético dos edifícios federais, o que resulta numa redução das emissões de gases com efeito de estufa e na redução dos custos de energia. Assim, projeta-se criar uma oportunidade significativa de crescimento do mercado.

Restrição/Desafio

- Emergência de problemas de segurança

Nos últimos anos, muitos edifícios foram instalados com sistemas de comunicação bidirecionais para monitorização avançada e controlo de recursos do data center, o que estimula a necessidade de sistemas de automação. Por conseguinte, a propagação de BMS também aumentou a prevalência de ataques cibernéticos a empresas, instituições governamentais e outros edifícios recém-construídos, devido aos quais é provável que surjam preocupações genuínas nos sistemas de segurança dos edifícios.

O software malicioso pode penetrar num sistema de edifícios através de redes inseguras e causar interrupções. Os problemas técnicos e outras ameaças virais podem muitas vezes levar à perda de comunicação e de acesso a dados sensíveis, afetando o funcionamento de dispositivos como a videovigilância em edifícios.

Embora o mercado continue a crescer, o surgimento de questões de segurança restringe consideravelmente o seu progresso. Por conseguinte, as vulnerabilidades de cibersegurança , se não forem devidamente abordadas, podem comprometer a segurança, a privacidade e a funcionalidade dos edifícios. Para sustentar o crescimento do mercado e garantir a segurança das infraestruturas críticas, as partes interessadas devem priorizar e investir em medidas robustas de cibersegurança. Além disso, quando um edifício liga todos os dispositivos do sistema a uma única rede de controlo, existe o risco de um utilizador mal-intencionado ou estranho poder efetivamente invadir o edifício, diminuindo a procura de sistemas de gestão predial e restringindo o crescimento do mercado .

Desenvolvimentos recentes

- Em outubro de 2023, a Hangzhou Hikvision Digital Technology Co., Ltd. estabeleceu uma parceria com a eficiência da construção verde utilizando 'gémeos digitais'. A Hikvision desenvolveu uma solução avançada de gémeos digitais para satisfazer a crescente procura por construção inteligente e ecológica. A solução cria uma réplica digital de edifícios, permitindo a monitorização em tempo real de indicadores-chave como a eficiência energética e a segurança. Isto permite intervenções rápidas durante incidentes ou problemas técnicos, melhorando a eficácia operacional global

- Em junho de 2023, a Atrius, uma divisão da ACUITY BRANDS, INC., revelou o Atrius DataLab, a sua mais recente plataforma de automação de edifícios. O produto, lançado ontem, revoluciona as operações em espaços construídos ao oferecer um controlo centralizado. O Atrius DataLab facilita a automatização rápida de aplicações para um controlo escalável. A plataforma, construída no Microsoft Azure, fornece uma arquitetura independente de dados. Capacita os utilizadores para criar aplicações personalizadas, auxiliando os gestores de instalações, energia e sustentabilidade no rastreamento e relatórios do consumo de recursos

- Em maio de 2023, a ACUITY BRANDS, INC. concluiu a aquisição da KE2 Therm Solutions, Inc. A empresa de tecnologia industrial integrou a KE2 Therm, conhecida pelas soluções inteligentes de controlo de refrigeração, na Distech Controls dentro do segmento de negócio do Intelligent Spaces Group. Esta alteração visa aumentar a eficiência do sistema e reduzir os custos operacionais e de serviços, contribuindo para uma maior rentabilidade. Esta aquisição ajudou a empresa a aumentar a oferta de produtos e a alcançar novos clientes no mercado comercial

- Em março de 2022, a GridPoint, um importante player na tecnologia de gestão de energia, concluiu com sucesso um aumento de capital de 75,00 milhões de dólares. O Grupo de Investimento Sustentável da Goldman Sachs Asset Management liderou o financiamento estratégico, acompanhado pela Shell Ventures. O investimento impulsionará os esforços da GridPoint na descarbonização de edifícios comerciais e no avanço da modernização da rede

- Em dezembro de 2021, a ACUITY BRANDS, INC. A plataforma lançada hoje concentra-se inicialmente no controlo da iluminação para reduzir as despesas operacionais e aumentar a satisfação dos ocupantes. O Atrius Building Manager oferece recursos escaláveis integrados para uma melhor visibilidade e automatização em vários tipos de edifícios comerciais. Este lançamento ajudou a empresa a satisfazer a procura dos consumidores, fornecendo opções comparativamente mais baratas para gerir sistemas de iluminação e poupando custos de mão-de-obra

Âmbito global do mercado de sistemas de gestão de edifícios

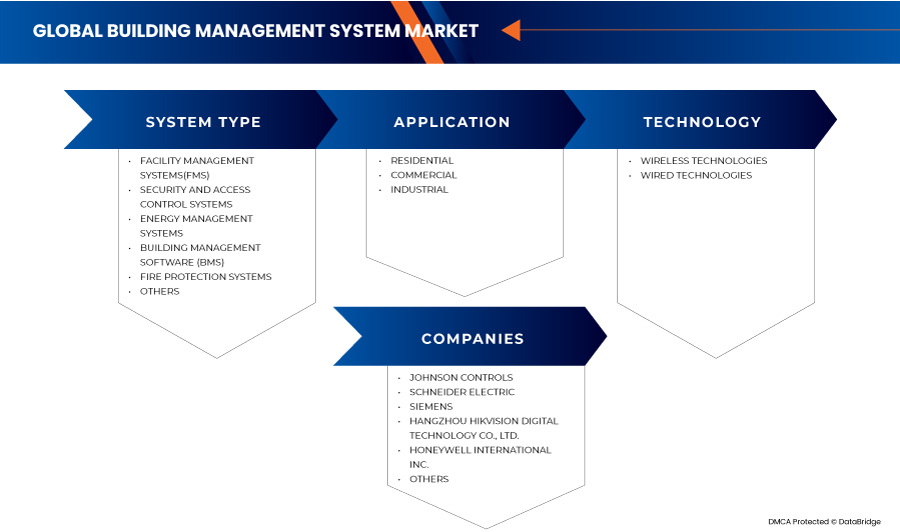

O mercado global de sistemas de gestão de edifícios está segmentado em três segmentos notáveis com base no tipo de sistema, tecnologia e aplicação. O crescimento entre estes segmentos irá ajudá-lo a analisar os escassos segmentos de crescimento nas indústrias e fornecer aos utilizadores uma valiosa visão geral do mercado e insights de mercado para os ajudar a tomar decisões estratégicas para identificar as principais aplicações do mercado.

Tipo de sistema

- Sistemas de gestão de instalações (FMS)

- Sistemas de Segurança e Controlo de Acessos

- Sistemas de gestão de energia

- Software de gestão de edifícios (BMS)

- Sistemas de proteção contra incêndio

- Outros

Com base no tipo de sistema, o mercado global de sistemas de gestão de edifícios está segmentado em Sistemas de Gestão de Instalações (FMS), sistemas de proteção contra incêndio, sistemas de segurança e controlo de acessos, sistemas de gestão de energia, Software de Gestão Predial (BMS), entre outros.

Tecnologia

- Tecnologias sem fios

- Tecnologias com fios

Com base na tecnologia, o mercado global de sistemas de gestão de edifícios está segmentado em tecnologias sem fios e tecnologias com fios.

Aplicação

- residencial

- Comercial

- Industrial

Com base na aplicação, o mercado global de sistemas de gestão de edifícios está segmentado em residencial, comercial e industrial.

Análise/perspetivas regionais do mercado global de sistemas de gestão de edifícios

O mercado global de sistemas de gestão de edifícios está segmentado em três segmentos notáveis com base no tipo de sistema, tecnologia e aplicação.

Os países abrangidos neste relatório de mercado são os EUA, Canadá, México, Alemanha, França, Reino Unido, Itália, Turquia, Espanha, Países Baixos, Rússia, Bélgica, Suíça, resto da Europa, China, Japão, Coreia do Sul, Índia, Austrália , Singapura , Malásia, Tailândia, Filipinas, Indonésia, resto da Ásia-Pacífico, Arábia Saudita, Emirados Árabes Unidos, África do Sul, Israel, Egito, resto do Médio Oriente e África, Brasil, Argentina e resto da América do Sul.

Prevê-se que a Europa domine o mercado global de sistemas de gestão de edifícios, uma vez que tem grandes fabricantes e uma elevada procura de BMS. Prevê-se que a Alemanha domine na região da Europa devido ao aumento da incidência de violações de segurança e ao aumento da necessidade de soluções inovadoras de segurança e proteção. Espera-se que os EUA dominem a região da América do Norte devido ao aumento da capacidade de gastos dos consumidores para a digitalização das instalações de construção, o que está a aumentar a procura do mercado. Espera-se que a China domine a região Ásia-Pacífico devido à crescente procura de edifícios ecológicos.

A secção de países do relatório também fornece fatores individuais que impactam o mercado e alterações na regulamentação do mercado interno que impactam as tendências atuais e futuras do mercado. Pontos de dados como a análise da cadeia de valor a jusante e a montante, tendências técnicas, análise das cinco forças de Porter e estudos de caso são alguns dos indicadores utilizados para prever o cenário de mercado para países individuais. Além disso, são considerados a presença e disponibilidade de marcas globais e os desafios enfrentados devido à concorrência grande ou escassa de marcas locais e nacionais, e o impacto das tarifas nacionais e das rotas comerciais, ao mesmo tempo que se fornece uma análise de previsão dos dados do país.

Cenário competitivo do mercado global de sistemas de gestão de edifícios e análise da quota de mercado

O panorama competitivo do mercado global de sistemas de gestão de edifícios fornece detalhes dos concorrentes. Os detalhes incluídos são a visão geral da empresa, finanças da empresa, receitas geradas, potencial de mercado, investimento em investigação e desenvolvimento, novas iniciativas de mercado, presença global, localizações e instalações de produção, capacidades de produção, pontos fortes e fracos da empresa , lançamento de produto, largura e amplitude do produto, e domínio da aplicação. Os dados acima fornecidos estão apenas relacionados com o foco das empresas no mercado.

Alguns dos principais players do mercado que operam neste mercado global de sistemas de gestão de edifícios são a Johnson Controls, Schneider Electric, Siemens, Hangzhou Hikvision Digital Technology Co., Ltd., Honeywell International Inc., Trane Technologies plc, IBM, Convergint Technologies LLC, Veolia, Delta Controls, ACUITY BRANDS, INC., Snap One, LLC, Virtusa Corp., Crestron Electronics, Beckhoff Automation GmbH & Co. KG, Bajaj Electricals Ltd, GridPoint, UNIPOWER, Novius Services, Elipse Software, BuildingIQ e Axonator Inc entre outros .

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Índice

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL BUILDING MANAGEMENT SYSTEM MARKET

1.4 LIMITATION

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 SYSTEM TYPE TIMELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES ANALYSIS

4.2 REGULATIONS

4.3 BUILDING AUTOMATION SYSTEM REGULATIONS

4.4 TRADE AND TARIFF ANALYSIS

4.5 AVERAGE SELLING PRICE ANALYSIS

4.6 MARKET LANDSCAPE OF AUSTRALIAN MANUFACTURES AND THEIR COMPETENCIES

4.7 BUILDING AUTOMATION SYSTEM ECOSYSTEM

4.8 ATTRACTIVE OPPORTUNITIES IN THE BUILDING AUTOMATION SYSTEM MARKET

4.9 VALUE CHAIN ANALYSIS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 UPSURGE IN THE FOCUS ON DESIGNING ENERGY-EFFICIENT AND ECO-FRIENDLY BUILDINGS

5.1.2 RISING ADOPTION OF AUTOMATED SECURITY SYSTEMS IN COMMERCIAL BUILDINGS

5.1.3 GROWING POPULARITY OF IOT BUILDING AUTOMATION SYSTEMS

5.1.4 INCREASING DEMAND FOR WIRELESS SENSOR NETWORK TECHNOLOGY

5.2 RESTRAINTS

5.2.1 EMERGENCE OF SECURITY ISSUES

5.2.2 HIGH MAINTENANCE COST OF BUILDING AUTOMATION SYSTEMS

5.3 OPPORTUNITIES

5.3.1 FAVORABLE GOVERNMENT INITIATIVES AND INCENTIVES FOR EMERGING SMART CITIES

5.3.2 SHIFTING CONSUMER’S PREFERENCE TOWARDS HVAC CONTROL SYSTEMS

5.3.3 INCREASING COLLABORATION AND PARTNERSHIPS FOR BUILDING MANAGEMENT SYSTEMS

5.4 CHALLENGES

5.4.1 INVOLVEMENT OF VARIOUS LENGTHY COMMUNICATION PROTOCOLS DURING THE INSTALLATION PROCESS

5.4.2 FALSE NOTION ABOUT HIGH INSTALLATION COSTS OF BUILDING MANAGEMENT SYSTEMS

6 GLOBAL BUILDING MANAGEMENT SYSTEM MARKET, BY SYSTEM TYPE

6.1 OVERVIEW

6.2 FACILITY MANAGEMENT SYSTEMS (FMS)

6.2.1 FACILITY MANAGEMENT SYSTEMS(FMS), BY TYPE

6.2.1.1 HVAC CONTROL SYSTEMS

6.2.1.1.1 HVAC CONTROL SYSTEMS, BY TYPE

6.2.1.1.1.1 SENSORS

6.2.1.1.1.2 ACTUATORS

6.2.1.1.1.3 ACTUATORS, BY TYPE

6.2.1.1.1.4 ELECTRIC

6.2.1.1.1.5 HYDRAULIC

6.2.1.1.1.6 PNEUMATIC

6.2.1.1.1.7 CONTROL VALVES

6.2.1.1.1.8 HEATING AND COOLING COILS

6.2.1.1.1.9 SMART THERMOSTATS

6.2.1.1.1.10 PUMPS AND FANS

6.2.1.1.1.11 DAMPERS

6.2.1.1.1.12 DAMPERS, BY TYPE

6.2.1.1.1.13 PARALLEL AND OPPOSED BLADE DAMPERS

6.2.1.1.1.14 LOW-LEAKAGE DAMPERS

6.2.1.1.1.15 ROUND DAMPERS

6.2.1.1.1.16 OTHERS

6.2.1.2 SMART DEVICES

6.2.1.2.1 SMART DEVICES, BY TYPE

6.2.1.2.1.1 SMART APPLIANCES

6.2.1.2.1.2 ENVIRONMENT AND AIR QUALITY MONITORING SYSTEMS

6.2.1.2.1.3 SMART METER

6.2.1.3 LIGHTING CONTROL SYSTEMS

6.2.1.3.1 LIGHTING CONTROL SYSTEMS, BY SYSTEM

6.2.1.3.1.1 HARDWARE

6.2.1.3.1.2 HARDWARE, BY TYPE

6.2.1.3.1.3 RECEIVERS

6.2.1.3.1.4 ACTUATORS

6.2.1.3.1.5 TRANSMITTERS

6.2.1.3.1.6 SENSORS

6.2.1.3.1.7 TIMERS

6.2.1.3.1.8 RELAY

6.2.1.3.1.9 SOFTWARE

6.2.1.3.1.10 SERVICES

6.2.1.3.1.11 SERVICES, BY TYPE

6.2.1.3.1.12 INSTALLATION

6.2.1.3.1.13 SUPPORT AND MAINTENANCE

6.3 SECURITY AND ACCESS CONTROL SYSTEMS

6.3.1 SECURITY AND ACCESS CONTROL SYSTEMS, BY TYPE

6.3.1.1 BIOMETRIC SYSTEMS AND ACCESS CONTROL SYSTEMS

6.3.1.1.1 BIOMETRIC SYSTEMS AND ACCESS CONTROL SYSTEM, BY SYSTEM

6.3.1.1.1.1 HARDWARE

6.3.1.1.1.2 HARDWARE, BY TYPE

6.3.1.1.1.3 MULTI FACTOR AUTHENTICATION

6.3.1.1.1.4 SINGLE FACTOR AUTHENTICATION

6.3.1.1.1.5 SOFTWARE

6.3.1.1.1.6 SERVICES

6.3.1.1.1.7 SERVICES, BY TYPE

6.3.1.1.1.8 INSTALLATION

6.3.1.1.1.9 SUPPORT & MAINTENANCE

6.3.1.1.1.10 ACCESS CONTROL AS A SERVICE (ACAAS)

6.3.1.2 VIDEO SURVEILLANCE SYSTEMS

6.3.1.2.1 VIDEO SURVEILLANCE SYSTEMS, BY TYPE

6.3.1.2.1.1 HARDWARE

6.3.1.2.1.2 HARDWARE, BY TYPE

6.3.1.2.1.3 CAMERAS

6.3.1.2.1.4 STORAGE SYSTEMS

6.3.1.2.1.5 ACCESSORIES

6.3.1.2.1.6 MONITORS

6.3.1.2.1.7 SOFTWARE

6.3.1.2.1.8 SERVICES

6.3.1.2.1.9 SERVICES, BY TYPE

6.3.1.2.1.10 INSTALLATION

6.3.1.2.1.11 SUPPORT & MAINTENANCE

6.3.1.2.1.12 VIDEO SURVEILLANCE AS A SERVICE (VSAAS)

6.4 ENERGY MANAGEMENT SYSTEMS

6.5 BUILDING MANAGEMENT SOFTWARE (BMS)

6.6 FIRE PROTECTION SYSTEMS

6.6.1 FIRE PROTECTION SYSTEMS BY TYPE

6.6.1.1 SENSORS AND DETECTORS

6.6.1.1.1 SENSORS AND DETECTORS, BY TYPE

6.6.1.1.1.1 SMOKE DETECTORS

6.6.1.1.1.2 SMOKE DETECTORS, BY TYPE

6.6.1.1.1.3 DUAL-SENSOR SMOKE DETECTORS

6.6.1.1.1.4 IONIZATION

6.6.1.1.1.5 PHOTOELECTRIC

6.6.1.1.1.6 FLAME DETECTORS

6.6.1.1.1.7 FLAME DETECTORS, BY TYPE

6.6.1.1.1.8 SINGLE IR /SINGLE UV

6.6.1.1.1.9 DUAL IR /SINGLE UV

6.6.1.1.1.10 MULTI IR /SINGLE UV

6.7 OTHERS

7 GLOBAL BUILDING MANAGEMENT SYSTEM MARKET, BY TECHNOLOGY

7.1 OVERVIEW

7.2 WIRELESS TECHNOLOGIES

7.2.1 ZIGBEE

7.2.2 Z–WAVE

7.2.3 ENOCEAN

7.2.4 WI-FI

7.2.5 THREAD

7.2.6 BLUETOOTH

7.2.7 INFRARED

7.3 WIRED TECHNOLOGIES

7.3.1 KNX

7.3.2 DIGITAL ADDRESSABLE LIGHTING INTERFACE (DALI)

7.3.3 BUILDING AUTOMATION AND CONTROL NETWORK (BACNET)

7.3.4 LONWORKS

7.3.5 MODBUS

8 GLOBAL BUILDING MANAGEMENT SYSTEM MARKET, BY APPLICATION

8.1 OVERVIEW

8.2 RESIDENTIAL

8.2.1 FACILITY MANAGEMENT SYSTEMS (FMS)

8.2.1.1 HVAC CONTROL SYSTEMS

8.2.1.2 SMART DEVICES

8.2.1.3 LIGHTING CONTROL SYSTEMS

8.2.2 SECURITY AND ACCESS CONTROL SYSTEMS

8.2.2.1 BIOMETRIC SYSTEMS AND ACCESS CONTROL SYSTEMS

8.2.2.2 VIDEO SURVEILLANCE SYSTEMS

8.2.3 ENERGY MANAGEMENT SYSTEMS

8.2.4 BUILDING MANAGEMENT SOFTWARE (BMS)

8.2.5 FIRE PROTECTION SYSTEMS

8.2.6 OTHERS

8.3 COMMERCIAL

8.3.1.1 AIRPORTS AND RAILWAY STATIONS

8.3.1.2 GOVERNMENT

8.3.1.3 HOSPITALS AND HEALTHCARE FACILITIES

8.3.1.4 HOSPITALITY

8.3.1.5 OFFICE BUILDINGS

8.3.1.6 RETAIL AND PUBLIC ASSEMBLY BUILDINGS

8.3.1.7 EDUCATION

8.3.1.8 OTHERS

8.3.1.9 FACILITY MANAGEMENT SYSTEMS (FMS)

8.3.1.9.1 HVAC CONTROL SYSTEMS

8.3.1.9.2 SMART DEVICES

8.3.1.9.3 LIGHTING CONTROL SYSTEMS

8.3.1.10 SECURITY AND ACCESS CONTROL SYSTEMS

8.3.1.10.1 BIOMETRIC SYSTEMS AND ACCESS CONTROL SYSTEMS

8.3.1.10.2 VIDEO SURVEILLANCE SYSTEMS

8.3.1.11 ENERGY MANAGEMENT SYSTEMS

8.3.1.12 BUILDING MANAGEMENT SOFTWARE (BMS)

8.3.1.13 FIRE PROTECTION SYSTEMS

8.3.1.14 OTHERS

8.4 INDUSTRIAL

8.4.1 FACILITY MANAGEMENT SYSTEMS (FMS)

8.4.1.1 HVAC CONTROL SYSTEMS

8.4.1.2 SMART DEVICES

8.4.1.3 LIGHTING CONTROL SYSTEMS

8.4.2 SECURITY AND ACCESS CONTROL SYSTEMS

8.4.2.1 BIOMETRIC SYSTEMS AND ACCESS CONTROL SYSTEMS

8.4.2.2 VIDEO SURVEILLANCE SYSTEMS

8.4.3 ENERGY MANAGEMENT SYSTEMS

8.4.4 BUILDING MANAGEMENT SOFTWARE (BMS)

8.4.5 FIRE PROTECTION SYSTEMS

8.4.6 OTHERS

9 GLOBAL BUILDING MANAGEMENT SYSTEM MARKET, BY REGION

9.1 OVERVIEW

10 GLOBAL BUILDING MANAGEMENT SYSTEM MARKET, COMPANY LANDSCAPE

10.1 COMPANY SHARE ANALYSIS: GLOBAL

10.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

10.3 COMPANY SHARE ANALYSIS: EUROPE

10.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

10.5 COMPANY SHARE ANALYSIS: MIDDLE EAST AND AFRICA

10.6 COMPANY SHARE ANALYSIS: SOUTH AMERICA

11 SWOT ANALYSIS

12 COMPANY PROFILE

12.1 JOHNSON CONTROLS

12.1.1 COMPANY SNAPSHOT

12.1.2 REVENUE ANALYSIS

12.1.3 COMPANY SHARE ANALYSIS

12.1.4 PRODUCT PORTFOLIO

12.1.5 RECENT DEVELOPMENTS

12.2 SCHNEIDER ELECTRIC

12.2.1 COMPANY SNAPSHOT

12.2.2 REVENUE ANALYSIS

12.2.3 COMPANY SHARE ANALYSIS

12.2.4 PRODUCT PORTFOLIO

12.2.5 RECENT DEVELOPMENTS

12.3 SIEMENS

12.3.1 COMPANY SNAPSHOT

12.3.2 REVENUE ANALYSIS

12.3.3 COMPANY SHARE ANALYSIS

12.3.4 PRODUCT PORTFOLIO

12.3.5 RECENT DEVELOPMENTS

12.4 HANGZHOU HIKVISION DIGITAL TECHNOLOGY CO., LTD.

12.4.1 COMPANY SNAPSHOT

12.4.2 REVENUE ANALYSIS

12.4.3 COMPANY SHARE ANALYSIS

12.4.4 PRODUCT PORTFOLIO

12.4.5 RECENT DEVELOPMENTS

12.5 HONEYWELL INTERNATIONAL INC.

12.5.1 COMPANY SNAPSHOT

12.5.2 REVENUE ANALYSIS

12.5.3 COMPANY SHARE ANALYSIS

12.5.4 PRODUCT PORTFOLIO

12.5.5 RECENT DEVELOPMENTS

12.6 ACUITY BRANDS, INC.

12.6.1 COMPANY SNAPSHOT

12.6.2 REVENUE ANALYSIS

12.6.3 PRODUCT PORTFOLIO

12.6.4 RECENT DEVELOPMENTS

12.7 AXONATOR INC

12.7.1 COMPANY SNAPSHOT

12.7.2 PRODUCT PORTFOLIO

12.7.3 RECENT DEVELOPMENT

12.8 BECKHOFF AUTOMATION GMBH & CO. KG

12.8.1 COMPANY SNAPSHOT

12.8.2 PRODUCT PORTFOLIO

12.8.3 RECENT DEVELOPMENTS

12.9 BAJAJ ELECTRICALS LTD

12.9.1 COMPANY SNAPSHOT

12.9.2 REVENUE ANALYSIS

12.9.3 PRODUCT PORTFOLIO

12.9.4 RECENT DEVELOPMENTS

12.1 BUILDINGIQ

12.10.1 COMPANY SNAPSHOT

12.10.2 PRODUCT PORTFOLIO

12.10.3 RECENT DEVELOPMENTS

12.11 CONVERGINT TECHNOLOGIES LLC

12.11.1 COMPANY SNAPSHOT

12.11.2 PRODUCT PORTFOLIO

12.11.3 RECENT DEVELOPMENTS

12.12 CRESTON ELECTRONICS

12.12.1 COMPANY SNAPSHOT

12.12.2 PRODUCT PORTFOLIO

12.12.3 RECENT DEVELOPMENT

12.13 DELTA CONTROLS

12.13.1 COMPANY SNAPSHOT

12.13.2 PRODUCT PORTFOLIO

12.13.3 RECENT DEVELOPMENTS

12.14 ELIPSE SOFTWARE

12.14.1 COMPANY SNAPSHOT

12.14.2 SOLUTION PORTFOLIO

12.14.3 RECENT DEVELOPMENTS

12.15 GRIDPOINT

12.15.1 COMPANY SNAPSHOT

12.15.2 PRODUCT PORTFOLIO

12.15.3 RECENT DEVELOPMENTS

12.16 IBM

12.16.1 COMPANY SNAPSHOT

12.16.2 REVENUE ANALYSIS

12.16.3 PRODUCT PORTFOLIO

12.16.4 RECENT DEVELOPMENT

12.17 NOVIUS SERVICES

12.17.1 COMPANY SNAPSHOT

12.17.2 PRODUCT PORTFOLIO

12.17.3 RECENT DEVELOPMENT

12.18 SNAP ONE, LLC

12.18.1 COMPANY SNAPSHOT

12.18.2 REVENUE ANALYSIS

12.18.3 SOLUTION PORTFOLIO

12.18.4 RECENT DEVELOPMENT

12.19 TRANE TECHNOLOGIES PLC

12.19.1 COMPANY SNAPSHOT

12.19.2 REVENUE ANALYSIS

12.19.3 PRODUCT PORTFOLIO

12.19.4 RECENT DEVELOPMENT

12.2 UNIPOWER

12.20.1 COMPANY SNAPSHOT

12.20.2 PRODUCT PORTFOLIO

12.20.3 RECENT DEVELOPMENT

12.21 VEOLIA

12.21.1 COMPANY SNAPSHOT

12.21.2 REVENUE ANALYSIS

12.21.3 SOLUTION PORTFOLIO

12.21.4 RECENT DEVELOPMENTS

12.22 VIRTUSA CORP.

12.22.1 COMPANY SNAPSHOT

12.22.2 SERVICE PORTFOLIO

12.22.3 RECENT DEVELOPMENT

13 QUESTIONNAIRES

14 RELATED REPORTS

Lista de Tabela

TABLE 1 BUILDING AUTOMATION SYSTEM REGULATIONS

TABLE 2 VIDEO SURVEILLANCE PRIVACY AND WIRETAPPING REGULATIONS

TABLE 3 GOVERNMENT REGULATIONS FOR BIOMETRIC SYSTEM

TABLE 4 COMPREHENSIVE IMPORT DATA OF THE BUILDING MANAGEMENT SYSTEM

TABLE 5 COMPREHENSIVE EXPORT DATA OF THE BUILDING MANAGEMENT SYSTEM

TABLE 6 GLOBAL BUILDING MANAGEMENT SYSTEM MARKET, BY SYSTEM TYPE, 2022-2031 (USD THOUSAND)

TABLE 7 GLOBAL FACILITY MANAGEMENT SYSTEMS(FMS) IN BUILDING MANAGEMENT SYSTEM MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 8 GLOBAL FACILITY MANAGEMENT SYSTEMS (FMS) IN BUILDING MANAGEMENT SYSTEM MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 9 GLOBAL HVAC CONTROL SYSTEMS IN BUILDING MANAGEMENT SYSTEM MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 10 GLOBAL ACTUATORS IN BUILDING MANAGEMENT SYSTEM MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 11 GLOBAL DAMPERS IN BUILDING MANAGEMENT SYSTEM MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 12 GLOBAL SMART DEVICES IN BUILDING MANAGEMENT SYSTEM MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 13 GLOBAL LIGHTING CONTROL SYSTEMS IN BUILDING MANAGEMENT SYSTEM MARKET, BY SYSTEM, 2022-2031 (USD THOUSAND)

TABLE 14 GLOBAL HARDWARE IN BUILDING MANAGEMENT SYSTEM MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 15 GLOBAL SERVICES IN BUILDING MANAGEMENT SYSTEM MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 16 GLOBAL SECURITY AND ACCESS CONTROL SYSTEMS IN BUILDING MANAGEMENT SYSTEM MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 17 GLOBAL SECURITY AND ACCESS CONTROL SYSTEMS IN BUILDING MANAGEMENT SYSTEM MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 18 GLOBAL BIOMETRIC SYSTEMS AND ACCESS CONTROL SYSTEMS IN BUILDING MANAGEMENT SYSTEM MARKET, BY SYSTEM, 2022-2031 (USD THOUSAND)

TABLE 19 GLOBAL HARDWARE IN BUILDING MANAGEMENT SYSTEM MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 20 GLOBAL SERVICES IN BUILDING MANAGEMENT SYSTEM MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 21 GLOBAL VIDEO SURVEILLANCE SYSTEMS IN BUILDING MANAGEMENT SYSTEM MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 22 GLOBAL HARDWARE IN BUILDING MANAGEMENT SYSTEM MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 23 GLOBAL SERVICES IN BUILDING MANAGEMENT SYSTEM MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 24 GLOBAL ENERGY MANAGEMENT SYSTEMS IN BUILDING MANAGEMENT SYSTEM MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 25 GLOBAL BUILDING MANAGEMENT SOFTWARE (BMS) IN BUILDING MANAGEMENT SYSTEM MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 26 GLOBAL FIRE PROTECTION SYSTEMS IN BUILDING MANAGEMENT SYSTEM MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 27 GLOBAL FIRE PROTECTION SYSTEMS IN BUILDING MANAGEMENT SYSTEM MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 28 GLOBAL SENSORS AND DETECTORS IN BUILDING MANAGEMENT SYSTEM MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 29 GOBAL SMOKE DETECTORS IN BUILDING MANAGEMENT SYSTEM MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 30 GLOBAL FLAME DETECTORS IN BUILDING MANAGEMENT SYSTEM MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 31 GLOBAL OTHERS IN BUILDING MANAGEMENT SYSTEM MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 32 GLOBAL BUILDING MANAGEMENT SYSTEM MARKET, BY TECHNOLOGY, 2022-2031 (USD THOUSAND)

TABLE 33 GLOBAL WIRELESS TECHNOLOGIES IN BUILDING MANAGEMENT SYSTEM MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 34 GLOBAL WIRELESS TECHNOLOGIES IN BUILDING MANAGEMENT SYSTEM MARKET, BY TECHNOLOGY, 2022-2031 (USD THOUSAND)

TABLE 35 GLOBAL WIRED TECHNOLOGIES IN BUILDING MANAGEMENT SYSTEM MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 36 GLOBAL MANAGED NETWORK SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 37 GLOBAL BUILDING MANAGEMENT SYSTEM MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 38 GLOBAL RESIDENTIAL IN BUILDING MANAGEMENT SYSTEM MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 39 GLOBAL RESIDENTIAL IN BUILDING MANAGEMENT SYSTEM MARKET, BY SYSTEM TYPE, 2022-2031 (USD THOUSAND)

TABLE 40 GLOBAL FACILITY MANAGEMENT SYSTEMS (FMS) IN BUILDING MANAGEMENT SYSTEM MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 41 GLOBAL SECURITY AND ACCESS CONTROL SYSTEMS IN BUILDING MANAGEMENT SYSTEM MARKET, BY SYSTEM TYPE, 2022-2031 (USD THOUSAND)

TABLE 42 GLOBAL COMMERCIAL IN BUILDING MANAGEMENT SYSTEM MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 43 GLOBAL COMMERCIAL IN BUILDING MANAGEMENT SYSTEM MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 44 GLOBAL COMMERCIAL IN BUILDING MANAGEMENT SYSTEM MARKET, BY SYSTEM TYPE, 2022-2031 (USD THOUSAND)

TABLE 45 GLOBAL FACILITY MANAGEMENT SYSTEMS (FMS) IN BUILDING MANAGEMENT SYSTEM MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 46 GLOBAL SECURITY AND ACCESS CONTROL SYSTEMS IN BUILDING MANAGEMENT SYSTEM MARKET, BY SYSTEM TYPE, 2022-2031 (USD THOUSAND)

TABLE 47 GLOBAL INDUSTRIAL IN BUILDING MANAGEMENT SYSTEM MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 48 GLOBAL INDUSTRIAL IN BUILDING MANAGEMENT SYSTEM MARKET, BY SYSTEM TYPE, 2022-2031 (USD THOUSAND)

TABLE 49 GLOBAL FACILITY MANAGEMENT SYSTEMS (FMS) IN BUILDING MANAGEMENT SYSTEM MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 50 GLOBAL SECURITY AND ACCESS CONTROL SYSTEMS IN BUILDING MANAGEMENT SYSTEM MARKET, BY SYSTEM TYPE, 2022-2031 (USD THOUSAND)

Lista de Figura

FIGURE 1 GLOBAL BUILDING MANAGEMENT SYSTEM MARKET: SEGMENTATION

FIGURE 2 GLOBAL BUILDING MANAGEMENT SYSTEM MARKET: DATA TRIANGULATION

FIGURE 3 GLOBAL BUILDING MANAGEMENT SYSTEM MARKET: DROC ANALYSIS

FIGURE 4 GLOBAL BUILDING MANAGEMENT SYSTEM MARKET: GLOBAL VS. REGIONAL MARKET ANALYSIS

FIGURE 5 GLOBAL BUILDING MANAGEMENT SYSTEM MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 GLOBAL BUILDING MANAGEMENT SYSTEM MARKET: MULTIVARIATE MODELLING

FIGURE 7 GLOBAL BUILDING MANAGEMENT SYSTEM MARKET: SYSTEM TYPE TIMELINE CURVE

FIGURE 8 GLOBAL BUILDING MANAGEMENT SYSTEM MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 GLOBAL BUILDING MANAGEMENT SYSTEM MARKET: DBMR MARKET POSITION GRID

FIGURE 10 GLOBAL BUILDING MANAGEMENT SYSTEM MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 11 GLOBAL BUILDING MANAGEMENT SYSTEM MARKET: SEGMENTATION

FIGURE 12 EUROPE IS EXPECTED TO DOMINATE THE GLOBAL BUILDING MANAGEMENT SYSTEM MARKET, AND ASIA-PACIFIC IS EXPECTED TO GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2024 TO 2031

FIGURE 13 UPSURGE IN THE FOCUS ON DESIGNING ENERGY-EFFICIENT AND ECO-FRIENDLY BUILDINGS IS DRIVING THE GROWTH OF THE GLOBAL BUILDING MANAGEMENT SYSTEM MARKET IN THE FORECAST PERIOD OF 2024 TO 2031

FIGURE 14 FACILITY MANAGEMENT SYSTEMS (FMS) IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE GLOBAL BUILDING MANAGEMENT SYSTEM MARKET IN 2024 AND 2031

FIGURE 15 ASIA-PACIFIC IS THE FASTEST GROWING MARKET FOR BUILDING MANAGEMENT SYSTEM MARKET MANUFACTURERS IN THE FORECAST PERIOD OF 2024 TO 2031

FIGURE 16 AUSTRALIAN MANUFACTURES AND THEIR COMPETENCIES

FIGURE 17 VALUE CHAIN ANALYSIS FOR GLOBAL BUILDING MANAGEMENT SYSTEM MARKET

FIGURE 18 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE GLOBAL BUILDING MANAGEMENT SYSTEM MARKET

FIGURE 19 GLOBAL BUILDING MANAGEMENT SYSTEM MARKET: BY SYSTEM TYPE, 2023

FIGURE 20 GLOBAL BUILDING MANAGEMENT SYSTEM MARKET: BY TECHNOLOGY, 2023

FIGURE 21 GLOBAL BUILDING MANAGEMENT SYSTEM MARKET: BY APPLICATION, 2023

FIGURE 22 GLOBAL BUILDING MANAGEMENT SYSTEM MARKET: SNAPSHOT (2023)

FIGURE 23 GLOBAL BUILDING MANAGEMENT SYSTEM MARKET: COMPANY SHARE 2023 (%)

FIGURE 24 NORTH AMERICA BUILDING MANAGEMENT SYSTEM MARKET: COMPANY SHARE 2023 (%)

FIGURE 25 EUROPE BUILDING MANAGEMENT SYSTEM MARKET: COMPANY SHARE 2023 (%)

FIGURE 26 ASIA-PACIFIC BUILDING MANAGEMENT SYSTEM MARKET: COMPANY SHARE 2023 (%)

FIGURE 27 MIDDLE EAST AND AFRICA BUILDING MANAGEMENT SYSTEM MARKET: COMPANY SHARE 2023 (%)

FIGURE 28 SOUTH AMERICA BUILDING MANAGEMENT SYSTEM MARKET: COMPANY SHARE 2023 (%)

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.